Original Title: "Can the Cosmos Hub be saved? The fight to rescue the heart of a visionary Crypto Ecosystem"

Author: Lukasinho, GCR Research Team Member

Translation: Elvin, ChainCatcher

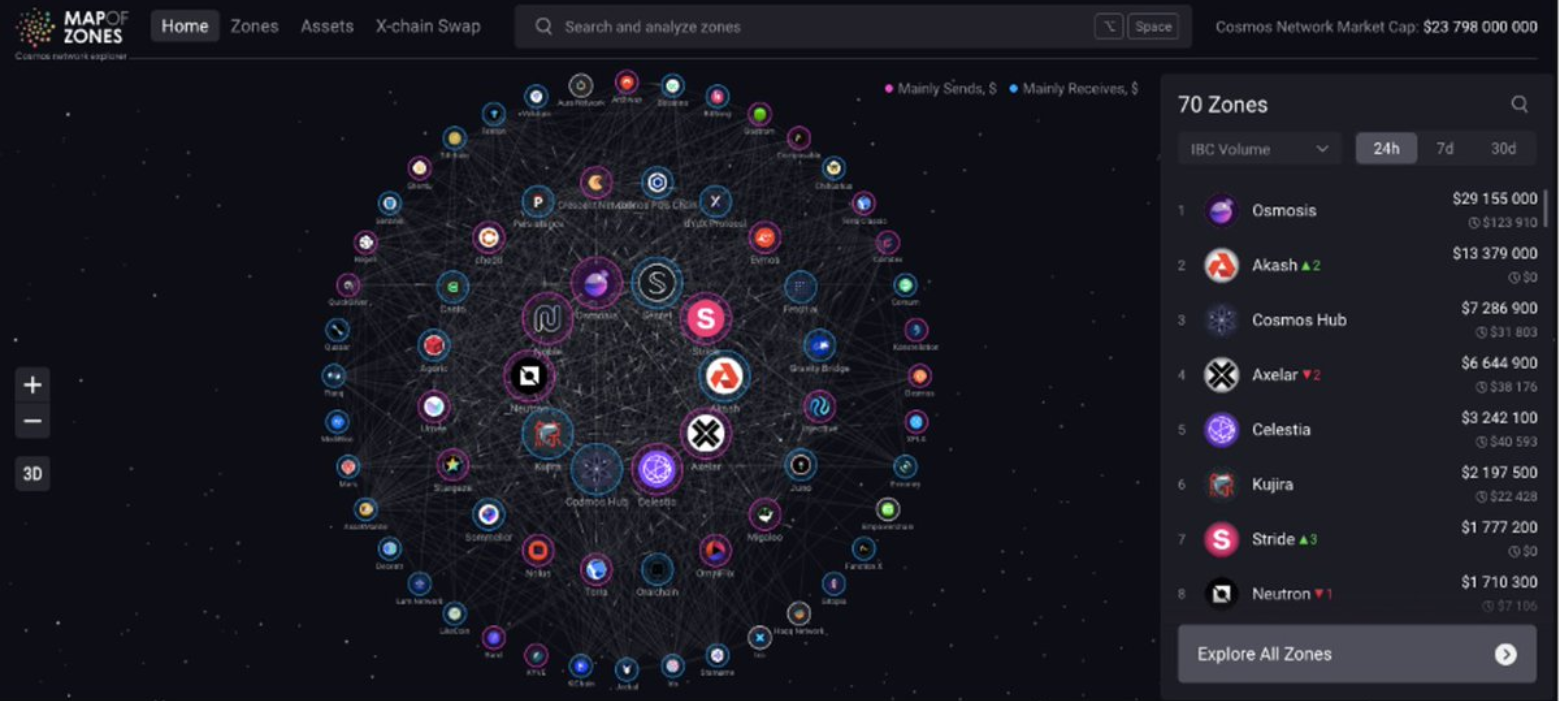

The Cosmos Hub is a renowned center for cryptocurrency innovation, pioneering many technologies that are now widely adopted. It is worth noting that the founder of Cosmos is the inventor of the proof-of-stake consensus mechanism, which fully embodies the ecosystem's knack for pioneering new technologies. However, despite Cosmos's strong technological originality, it has lost momentum. The market value of the Atom token has declined. Cosmos lags behind competitors' ecosystems in metrics such as total locked value, active users, and revenue. Confidence in the ecosystem has waned, which is concerning for a network acclaimed for its innovative spirit.

In this article, we will analyze the factors behind Cosmos's stagnation. What are the issues? More importantly, how can Cosmos regain its position as a leader in the cryptocurrency field?

Competitive Advantage

From the outset, Cosmos foresaw that no single blockchain could solve the "impossible trilemma" of decentralization, security, and scalability. This arises from inherent trade-offs between these characteristics. For example, increasing transaction throughput typically requires larger block sizes, leading to centralization as only fewer nodes can process and store larger blocks.

Several years before the entire crypto industry arrived at the same conclusion, Cosmos realized that only a multi-chain architecture could overcome these trilemmas. Thus, they pioneered a vision focused on horizontal scalability, with each app being powered by its own decentralized but seamlessly interoperable blockchain.

To realize the vision of a multi-chain structure, Cosmos developed the groundbreaking Inter-Blockchain Communication (IBC) protocol. IBC enables seamless operability between chains, allowing for fund transfers between different chains to be completed in seconds at minimal cost. This far surpasses the bridging experience of Ethereum, layer 2, and other crypto ecosystems.

Compared to the challenges faced by Ethereum, Cosmos has already established and prepared for seamless interoperability. This is Cosmos's greatest competitive advantage and the best interoperability solution in the industry to date.

Cosmos Facing Many Challenges

Unfortunately, as the originator of this exciting key technology, Cosmos has not reached the heights that many envisioned. Why is this the case? The reasons for Cosmos's struggles are both internal and external. So let's delve into the various issues that Cosmos faces and attempt to propose potentially effective solutions.

1. Expensive Reality of App Chains

As mentioned earlier, Cosmos is designed around the theory of app chains, envisioning that each app runs on its own sovereign blockchain. Unfortunately, this theory of app chains faces some challenges. Whether in terms of engineering resources or ongoing operational costs, the expense of establishing and maintaining app chains is very high. This creates a significant financial burden, especially for early-stage startups.

To address this challenge, most Cosmos chains have turned to using inflation as a means to pay for validation costs. While this method has been effective in bull markets, it has exposed its shortcomings in bear markets. As validators continuously sell inflation rewards to sustain operations, it leads to a sharp decline in token prices. Even after the recent market recovery, many projects, including Osmosis and other prominent projects, have still dropped by 90% or more.

For many developers, launching an app chain may be a poor business decision. With the advent of layer 2 solutions making Ethereum scalable and the emergence of various alternative fast layer 1 solutions, launching an app chain is becoming increasingly impractical for many developers.

Exception: Benefits of App Chains

However, there are exceptions. Mature projects with strong user bases and tangible products can benefit from launching their own app chains. These projects can internalize the benefits of MEV (Maximum Extractable Value), achieve higher throughput, and have complete control over the blockchain. Once a solid user base is established, the product can generate sustainable revenue, making the transition to an app chain meaningful if the revenue from a particular business model outweighs the additional costs.

dYdX is one of the projects that has recently embarked on this journey. Its success or failure will significantly impact the future of the app chain theory. If dYdX proves that its app chain can create outstanding products that surpass competitors such as Gains Network or GMX, it will have a significant driving force for the app chain concept. Conversely, if dYdX's performance is unsatisfactory, it will cast doubt on the legitimacy of ecosystems like Cosmos and others centered around app chains.

Intense Competition Faced by Cosmos

To alleviate the cost pressure faced by app chains, various solutions have been developed. Thanks to solutions such as Eigenlayer, Optimism Superchain, and Polygon 2.0, app chains will be able to launch their own roll-ups or chains on Ethereum, benefiting from a larger community, more liquidity, and lower setup and maintenance costs. Within the Cosmos ecosystem, Celestia provides a solution for building tailored roll-ups, offering a level of customization almost identical to app chains based on Cosmos.

In addition to cheaper, updated app chain solutions, Cosmos also faces competition from Layer-2 and rapidly evolving Layer-1 blockchains. These solutions offer fast transactions, low fees, and good scalability, nullifying the advantages of app chains. For many developers, launching on such blockchains is a more cost-effective solution, at least in the initial stages, with almost no drawbacks.

This can be seen from recent developments. The current trend indicates that the future of blockchains will likely involve several powerful Layer-1 chains, with their Layer-2 networks hosting most apps. Therefore, for the Cosmos ecosystem to thrive, it needs strong Layer-1 smart contract platforms to launch apps. These platforms should utilize Inter-Blockchain Communication (IBC) to facilitate communication between them and large-scale apps running on their own blockchains.

Several efforts are currently underway to connect Cosmos with other ecosystems. For example, Composable is connecting Polkadot and Cosmos through IBC. Landslide is developing an IBC-integrated subnetwork on Avalanche, and TOKI is bringing IBC to Binance Smart Chain. On the surface, these chains should bring a significant amount of funds and users to the ecosystem. However, this remains to be observed in practice.

Only establishing contact is not enough. To truly realize the vision of these new chains becoming leading layer-1 chains based on Cosmos, these new chains need to actively integrate and collaborate with various native Cosmos projects. Companies like Avalanche and Binance Smart Chain may not currently have the motivation to do so.

Therefore, native layer-1 chains of Cosmos (such as Neutron, Injective, Archway, or Juno) becoming significant competitors with a large user base and capital would be a crucial step forward for the entire ecosystem. Injective has already worked wonders in this regard, and for the benefit of the entire ecosystem, it would be ideal if it can maintain its rapid growth trajectory.

2. Interchain Services Failed to Provide the Needed Value Proposition for the Hub

When designing Cosmos, its founders made a deliberate choice: to provide Inter-Blockchain Communication (IBC) as a public good. They decided not to route all IBC transactions through the Hub or levy small taxes on IBC transactions, but to stimulate innovation and growth by providing open access to this powerful tool. Cosmos would play the role of a trusted neutral service provider in this ecosystem.

In May 2023, the highly anticipated Interchain Security (ICS) was launched. It aimed to ultimately provide an income model for the Cosmos Hub and make app chains economically viable. However, about five months later, people began to feel disappointed. The adoption rate has been low, with only two ICS chains live: Neutron and Stride, and Noble is still in the planning stages. Stride even hinted at the possibility of being acquired by the Cosmos Hub.

This situation highlights a fundamental issue—when launching in the Cosmos ecosystem, there are four options: on their own app chain (with no revenue for the Cosmos Hub), on another L1 (with no revenue for the Hub), on an ICS chain (with the Hub earning a certain percentage of gas fees), and finally on the Hub itself (with the Hub earning 100% of gas fees). Many projects have found that launching on a layer-1 chain rather than on an ICS chain or on the Hub is wiser. If this trend continues, the Cosmos Hub could become a bystander in its own ecosystem. It would be most beneficial for the Hub to use permissioned CosmWASM to host these apps and earn 100% of transaction fees.

If running apps on the Cosmos Hub is the best financial outcome for the Hub, then running apps on ICS chains is the next best option, but even then, the Cosmos Hub cannot significantly win. ICS chains actually present financial challenges for the Cosmos Hub. Hub validators must validate all transactions, limiting scalability. Chains like Stride or Noble, while valuable to the ecosystem, do not generate high-frequency transactions. Low transaction volume means low revenue for the Hub. Unpermissioned first-layer ICS chains like Neutron can bring substantial transaction volume, but they also consume most of the Hub's bandwidth while only paying the Hub 25% of transaction fees. Therefore, whether it's high or low transaction volume ICS chains, they are not attractive to the Hub, indicating that the Hub's business model itself has not been well thought out.

Fundamentally, Neutron could potentially diminish the Hub's revenue potential. It may be wiser for the Hub to choose CosmWASM and earn 100% of gas income. While the Hub and its ICS model have their advantages, they are not economically favorable. In a world where many blockchains struggle to be profitable, especially those promising low transaction fees, further reducing revenue does not seem like a wise decision.

3. Unsustainable Atom Token Economics

Inflation in the Cosmos ecosystem is not just a small app chain issue; it also affects the Cosmos Hub. The continuous selling of block rewards puts downward pressure on the price of the Atom token. Without substantial sources of income, Atom faces the same predicament as its smaller competitors.

We are working to address these token economic challenges. While the launch of a new Cosmos Hub token economics was expected at this year's Cosmoverse, it has not materialized. However, the EffortCapital presentation by Blockworks Research at Cosmoverse 2023 has shown planned changes.

To strengthen the token economic value of Atom and transform it into a true interchain currency, we have proposed two specific measures:

First: Accelerate the rate of inflation reduction to reach the 7% final target faster. To further expedite this process, Cosmos core contributor Zaki Manian proposed a "halving" proposal aimed at immediately halving the Atom inflation rate. This proposal has passed the governance process and should be implemented soon. The governance process is a very rigorous decision, and it was not without controversy. Most large validators, who benefit the most from high inflation, voted against it. On the last day, the proposal seemed to be narrowly rejected until several prominent Cosmos community members (including Osmosis founder Sunny Aggarwal) purchased a large amount of Atom, adding more favorable votes on the last day, and the proposal was passed.

Second: Introduce a liquidity staking tax. Once a specific threshold is reached (Blockworks suggests 25% of all circulating Atom), liquidity stakers must pay a tax to the Cosmos Hub. If the liquidity staking rate exceeds the specified target rate (Blockworks suggests 33% of all issued Atom), the tax rate for liquidity stakers will significantly increase. The purpose of this approach is to maintain a balanced ideal liquidity staking ratio, prevent uncontrolled growth, which has been a problem recently in the Ethereum ecosystem, and has sparked intense debate.

This additional income can be used to reduce Atom's inflation through a burning mechanism and can also serve as the protocol's overall liquidity, stimulating economic activity in the Atom economic zone, generating more revenue. This creates a virtuous cycle: increasing income, reinvesting to stimulate more activity, which in turn generates more income.

These proposals are expected to create a sustainable token economy for Atom. While details are still evolving, and BinaryBuilders and the Royal Melbourne Institute of Technology Blockchain Innovation Center are developing other aspects, the initial impression suggests that Atom is moving in a hopeful direction to address these challenges.

4. Liquidity Fragmentation, Poor User Experience, Low Adoption

App chain infrastructure brings two major challenges: poor user experience and liquidity fragmentation.

Compared to more streamlined single-chain blockchains like Solana, conducting simple token transactions on Cosmos requires additional steps. Users must initiate an IBC transfer, trade the token on the exchange's chain, and then execute another IBC transfer to bring the token back to the app's chain. While Cosmos apps and wallets provide user-friendly interfaces for these transfers, these additional steps can cause confusion, hindering the adoption of new users.

Another major challenge is liquidity fragmentation. In the Cosmos ecosystem, liquidity is fragmented across different chains, leading to reduced liquidity on each chain. As a result, users, especially large traders, encounter higher slippage when trading within the Cosmos ecosystem, reducing its attractiveness to this segment of users. This fragmentation also complicates arbitrage activities, which play a crucial role in maintaining price stability across different chains.

These challenges are evident in the adoption metrics of the Cosmos ecosystem. Total Value Locked (TVL) and daily active user numbers are still significantly lower compared to similar ecosystems.

5. Lack of Organization, Guidance, and Capital Efficiency

A major issue facing the Cosmos ecosystem is the lack of a clear unified vision. In fact, the situation is quite the opposite. Core contributors often hold conflicting views, with no unified goal that everyone is working towards. Earlier in this article, we discussed issues such as product-market mismatch, token economic problems, and a lack of compelling value propositions. Due to its decentralized structure, Cosmos lacks a clear plan or roadmap to address these issues and make the Cosmos Hub and ATOM more attractive products.

Cosmos has been built by many small companies, each developing features that align with their own interests and preferences. There is no higher coordinating organization to determine task priorities, develop comprehensive plans, and ensure that all work is geared towards achieving a common goal. The lack of a central coordinating body that can take responsibility, seek solutions, and guide the ecosystem in the right direction has led to stagnation.

As a result, progress in the ecosystem is hindered by disputes among major participants and their organizations, each advocating for different approaches and solutions. This lack of cohesion has left the ecosystem in a state of paralysis. In the innovative Web3 space, success often depends on experimentation, hypothesis testing, and agile adaptability, which require a clear vision and a willingness to change strategies.

The governance process in Cosmos is slow, and influential participants are following their own interests, contrasting sharply with the agile leadership required for success in the rapidly evolving Web3 environment. The result is a lack of coordination and widespread inaction. Additionally, each independent company in the Cosmos ecosystem must manage administrative expenses related to legal, accounting, management, and other administrative functions. This creates redundancy and inefficiency compared to single organizational entities like PolygonLabs or SolanaLabs, which only need to pay management fees for their respective ecosystems. To cover these expenses, these companies charge additional fees to the Interchain Foundation and community pool, increasing the overall cost of ecosystem development and maintenance.

Measures to be Taken

Despite significant technological advantages, particularly through its unparalleled interoperability solution IBC, Cosmos is under pressure from its competitors. Ethereum has long recognized the inevitability of a multi-chain future. Great projects like the actively developing Superchain and Polygon 2.0, which can match or even surpass the functionality of IBC, are already in development. While these solutions are still in development, their ecosystems are far ahead in user adoption and total value locked.

This puts pressure on Cosmos. It may have about a year to launch applications that can successfully attract users and capital to the interchain. If this effort fails and competitors introduce interoperability solutions, Cosmos will lag significantly behind in adoption, potentially spelling doom for its future.

Therefore, what Cosmos needs most is proactive business development. Instead of focusing on infrastructure construction, the Interchain Foundation (ICF) should take the initiative to enable serious developers to build on Cosmos. Together with the ATOM community pool, the focus should be on providing funding incentives for killer applications. Our idea is not to cast a wide net and pray for a large number of small projects, but to provide substantial funding to organizations with successful product release experience that have not yet participated in the Cosmos ecosystem. Our goal is to replicate the successful experiences of projects like Friends.tech within the Cosmos network.

These products should not be launched as standalone industry chains. They need to directly bring value, users, and transaction volume to the Cosmos Hub. Ideally, they can be launched directly on the Cosmos Hub through permissioned CosmWASM. However, given the direction chosen by the Cosmos Hub, this may not be achievable. Therefore, creating ICS chains or launching them onto the Cosmos Hub and aligning with Layer-1 Neutron is the next best option. Ideally, they should launch without a token and instead utilize ATOM. Just one or two killer applications that match the Cosmos Hub can drive the development of ATOM.

Economically, the Cosmos Hub needs a significant redesign. We have been making promising efforts, especially in token economics. Support from the broader ecosystem is crucial, even if the proposed changes are not perfect and may not fully align with everyone's interests. In the current situation, standing still is the worst choice, and these efforts are a positive step forward.

The ultimate desire should be for the Cosmos Hub to become the core of the Cosmos ecosystem, just as Ethereum is the core of its ecosystem—making the ecosystem operational and positioning ATOM as a cross-chain token. This positioning can create excitement, attracting the necessary users and capital, transforming the ecosystem into a thriving Web3 activity center.

With strengthened centralization and successful cross-chain projects like Kujira and Injective gaining traction as first-layer blockchains and DeFi hubs, the Cosmos ecosystem will attract more attention from developers seeking to launch projects. This will benefit the Atom community as well as first-layer blockchains like Injective and Neutron. A virtuous cycle of adoption driving further adoption can be initiated, and the vision of interconnecting first-layer chains through IBC, flagship apps on their own chains, and a vibrant hub centered around ATOM can become a reality.

To achieve this vision, all participants in the Cosmos ecosystem must collaborate, enact necessary changes, and provide support for those driving change. While some challenges stemming from its decentralized structure may persist, the results can be improved. The Cosmos ecosystem has outstanding and creative talent, and bold decisions that go beyond the status quo are clearly needed. Underestimating Cosmos, despite significant challenges, would be unwise, and a brilliant resurgence is certainly possible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。