This article takes us to explore the current situation of the NFT market and looks forward to the factors that can drive the new narrative of NFT.

Author: FRANCESCO

Translation: Deep Tide TechFlow

In the world of digital assets, non-fungible tokens (NFTs) have always been a topic of intense debate. They were once hailed as the next big revolution in the art and collectibles market, but public perception of NFTs has undergone a dramatic shift.

This article delves into the current status of NFTs and analyzes the current market trends.

While the crypto market seems to have rebounded recently, largely due to the expectation of Bitcoin ETFs and Bitcoin halving, the NFT market appears to be struggling to rebound, as it currently lacks strong catalysts.

This article explores the current state of the NFT market and looks forward to the factors that can drive the new narrative of NFT.

NFT Market Downturn

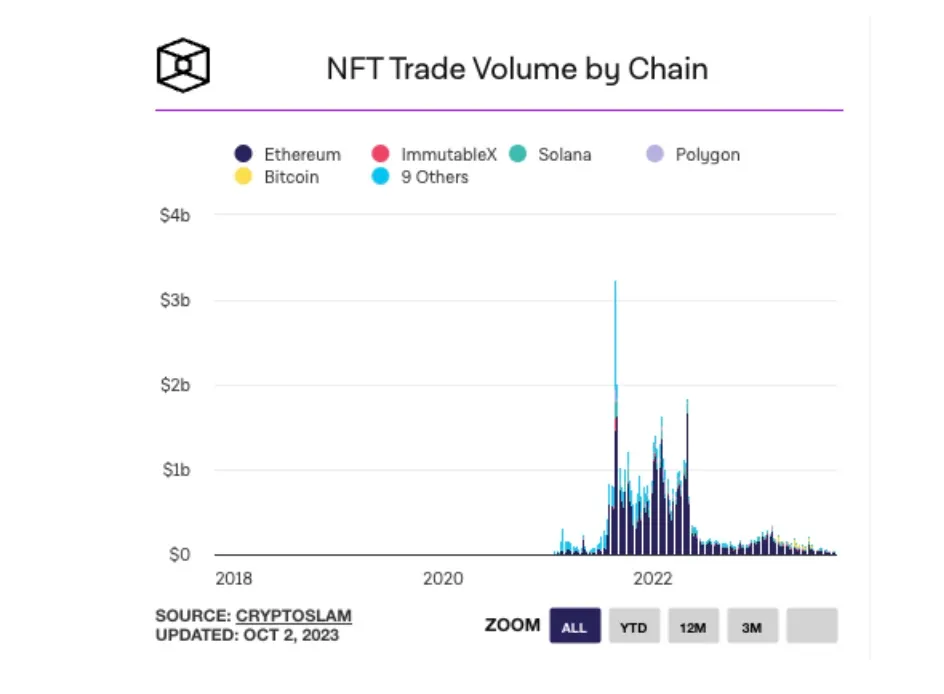

The trading volume of NFTs has dropped significantly in 2022, but it may be an exaggeration to say that NFTs have disappeared.

By definition, NFTs exist on the chain and therefore will never disappear, so NFTs will not disappear.

However, we must admit that we are far from the heyday of NFTs, and we must also acknowledge the significant decline in sales and public interest over the past year.

The decline of NFTs is undeniable: during this period, sales of NFTs have decreased, and market saturation (the deployment of countless new NFT projects) has led to consumer fatigue.

What are the main problems with NFTs?

There are two core issues contributing to the downturn of the NFT market:

Hype of new projects: 99% of the new projects deployed in the market are trying to capture the NFT craze. Like the "shitcoin" craze of 2018, many NFT projects are built on hype, lacking substantive content or long-term vision, leading to their inevitable decline.

Blue-chip projects struggling to reshape themselves as global brands: After the success of NFT collections, several blue-chip projects are now struggling to reshape themselves and provide value to holders.

Comparing NFTs to the "shitcoin craze" of 2018 is not without basis. Many NFT projects lack clear use cases or practicality, resembling speculative assets rather than sustainable digital goods.

This has led to an NFT bubble, which, when it bursts, leaves many investors holding worthless assets.

NFT Community vs. Crypto Community

Although the boundaries are blurred, the NFT community differs from the crypto community. They have different spirits and different reasons for joining the industry.

Generally, the NFT community is less involved in the ideological aspects of the industry and focuses more on art and economics.

In addition, many scammers have found NFTs to be a hot topic and have joined in.

This has been confirmed by numerous influencers who have started promoting scams (or creating their own scams) just to make quick money, especially celebrities like Kim Kardashian, Floyd Mayweather, and Logan Paul.

Therefore, our position is that we cannot consider the NFT community as part of the crypto community, but rather as an external subset with different reasons for joining the industry.

Nevertheless, we must also acknowledge that NFTs have indeed empowered global artists, which is a positive thing.

Challenges for Blue-Chip Projects

Even the so-called "blue-chip" NFT projects are currently struggling. These projects were once at the forefront of the NFT boom and are now facing an uncertain future.

The challenges they face are multifaceted:

Unknown territory: Many projects are in uncharted territory, which is a constantly evolving and unpredictable market.

Development challenges: It has been proven that evolving from a simple NFT project to a more substantive project (such as integrating games or other practical applications) is very difficult. Where should their focus be?

Complexity and loss of interest: Some projects, such as Otherside and DeGods, are overly complex, leading to a waning public interest.

We can use Bored Ape Yacht Club (BAYC) and DeGods as examples to illustrate this predicament.

Bored Ape Yacht Club (BAYC)

No introduction is needed; like Cryptopunks, BAYC is one of the most representative and iconic NFT collections.

BAYC was initially a collection of 10,000 bored apes.

Then, the project airdropped variant apes (MAYC) and a puppy companion to BAYC holders—effectively airdropping thousands of dollars in value to holders.

However, airdrop strategies are not sustainable in the long run. In fact, by introducing new collections, you are effectively diluting the total supply of the entire collection.

While BAYC originally had only 10,000 NFTs, there are now 10,000 dogs and 20,000 MAYCs. Additionally, each of them has now been airdropped an Otherside plot (with a total supply of over 100,000). Each Otherside plot also generates shards. Not to mention the HV-MTL series (30,000 units).

This NFT series has become too complex!

The direction BAYC has taken after NFTs is focused on two main verticals:

Gaming

Lifestyle (as a global lifestyle brand, similar to BAPE, Supreme)

However, with the emergence of this division, holders need more time and effort to keep up with and track everything.

For example, users are expected by the project to develop their Otherside plots through daily efforts—I, personally as a holder, have given up and have not followed through with this at all.

BAYC, originally a simple community, is now evolving into an increasingly complex and fragmented ecosystem.

Furthermore, the games created by BAYC have raised a question: if they expect us to only hire professional players to win these internal competitions, is this really community-centric? What about ordinary people who have not achieved success through NFTs and are living normal lives? Will they be permanently excluded from victory?

It feels like this project is moving away from its origins and ignoring its core community.

Another example is "The Legend of Mara," which is another standalone experience connected to other gaming worlds.

In addition, users have been waiting for over a year to get news about The Legend of Mara, and many have eventually given up and left the community.

When will this situation stop?

On one hand, expanding their series of products is a good tool to attract a wider audience. However, this may also have the opposite effect, weakening the core value of BAYC's original and primary collection, thereby threatening the project's community foundation.

With the project unclear on how to move forward and with significant investments from VCs (such as A16z investing $1 billion in BAYC), many are expressing concerns that BAYC will no longer be the same and will eventually become a Web2 giant.

DeGods

The situation with DeGods is worse, to some extent not due to the expansion of the ecosystem, but due to the strategic decisions of the team.

Once one of the best and most promising projects on Solana, DeGods has now become synonymous with chaos and incompetence.

Here is a summary of what roughly happened:

DeGods released their second series y00ts, promising a revolutionary scoring system, quoting Steve Jobs, and positioning themselves as the new Apple of the NFT world.

After the collapse of FTX, DeGods eventually left Solana and migrated DeGods to Ethereum, and y00t to Polygon (as they received funding).

Honestly, this was a huge betrayal for the community that supported them from the beginning, causing their prices to rise from 3 SOL to over 10 ETH.

That was the peak of DeGods, everyone was talking about them being the new BAYC, and how valuable their token DUST (and the company behind it) would be in the future.

But a few months later, Dust Labs did not produce anything truly valuable, and the price of DUST reflected that.

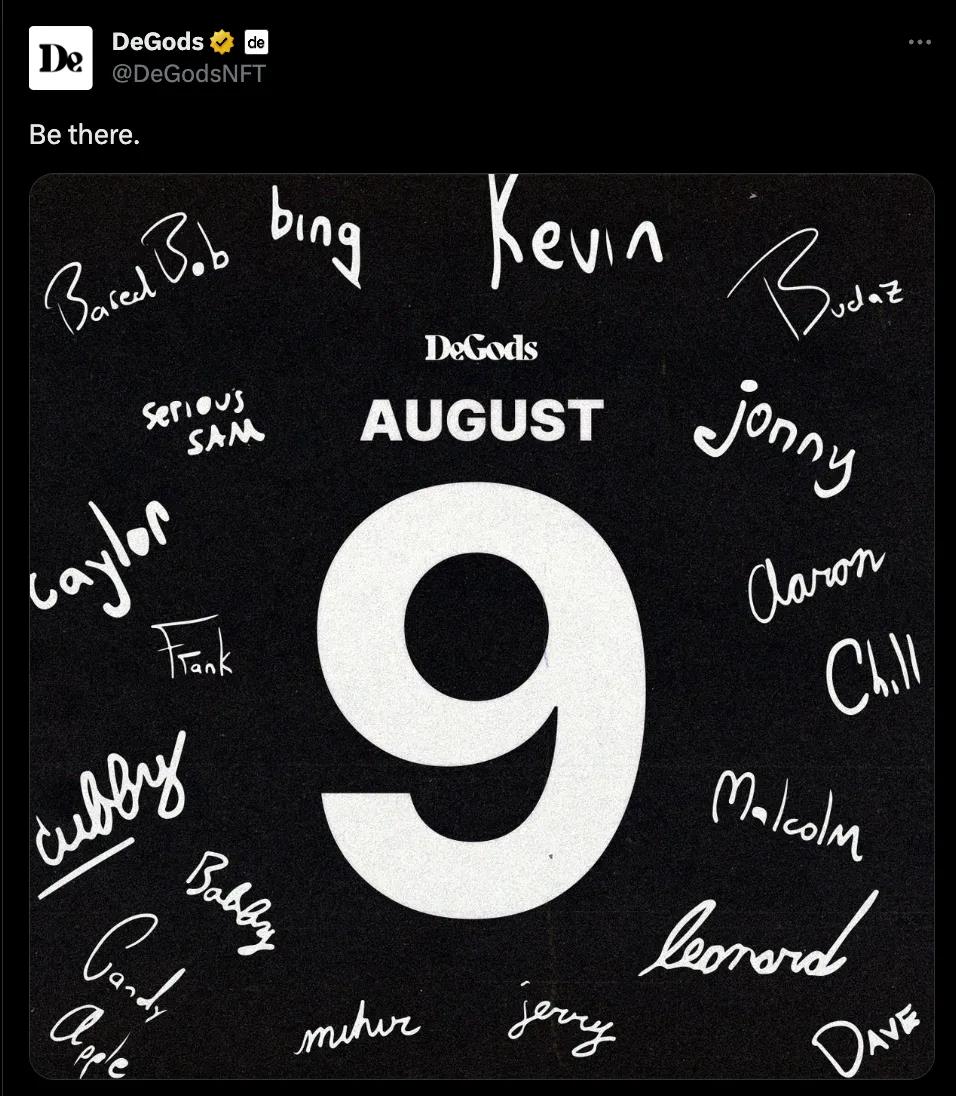

- DeGods announced a plan: DeGods Season 3, scheduled for August 9, 2023.

As part of their marketing, DeGods utilized their preferred strategy: overpromise, underdeliver.

The third season was highly anticipated and would push DeGods' trading volume to new highs.

However, things quickly turned sour.

What will DeGods Season 3 include?

- y00ts migrating back from Polygon to Ethereum (it must be acknowledged that this was a wrong choice: aside from being funded, who would host their NFTs on Polygon?).

- DeGods' art downgrading: This brought a turning point, where users had to pay 333 DUST (about $450 at the time) to downgrade their DeGods (some might say, finally some use for the DUST token).

However, in reality, this is like saying "this is our third attempt to get DeGods' art on the right track, as our previous attempts did not convince our community."

They also launched a scoring pool, where users can stake their Season 3 DeGods to earn points and win rewards and prizes.

Here are some prizes from the scoring pool: while these are all nice, I don't think DeGods whales would be excited about a few dozen prizes.

Like many other collections, DeGods' holders elevated their founder Frank to a mysterious figure with a business mind and potential similar to Jobs.

This can also be seen from Frank's statements.

Nevertheless, we have seen that over-reliance on god-like founders does not bring much benefit.

DeGods Season 3 sparked a lot of controversy.

The team's promises were never truly realized, creating a huge gap between promise and execution.

As a result, their value dropped by over 50% in just one week.

In any case, the example of DeGods tells us the importance of underpromising and overdelivering, not the other way around.

If you act like a savior and then fail to deliver on promises, the situation will eventually turn. The DeGods team has repeatedly shown that their roadmap and plans are very well thought out. But they have never truly executed on them.

Every new update from DeGods in some way touches on the art or dynamics of the collection. Additionally, they have failed to fully utilize Dust Labs and DUST - a huge missed opportunity.

Finally, I think this is largely exacerbated by the behavior of their founder, who is rarely willing to admit their mistakes.

While my words may sound biased, they are not; I had high expectations for DeGods and even hold some DUST, and I am very disappointed with what has happened during the execution process.

These two blue-chip cases highlight that sometimes, the simple way is the best.

View on NFT Trading Volume

After discussing how blue-chip projects are striving to create the next wave of development for their projects, let's delve into the market data.

Is the trading volume of NFTs declining?

Are people still buying NFTs?

We will do this by analyzing the NFT markets of Ethereum and Solana.

Starting from the monopoly of OpenSea, Ethereum, as the leading NFT platform, is facing its own challenges and developments in the NFT space.

The Ethereum market is adapting to changing consumer preferences and the evolution of NFT nature. These platforms are working to address accessibility, scalability, and environmental issues.

The market involves two major trends:

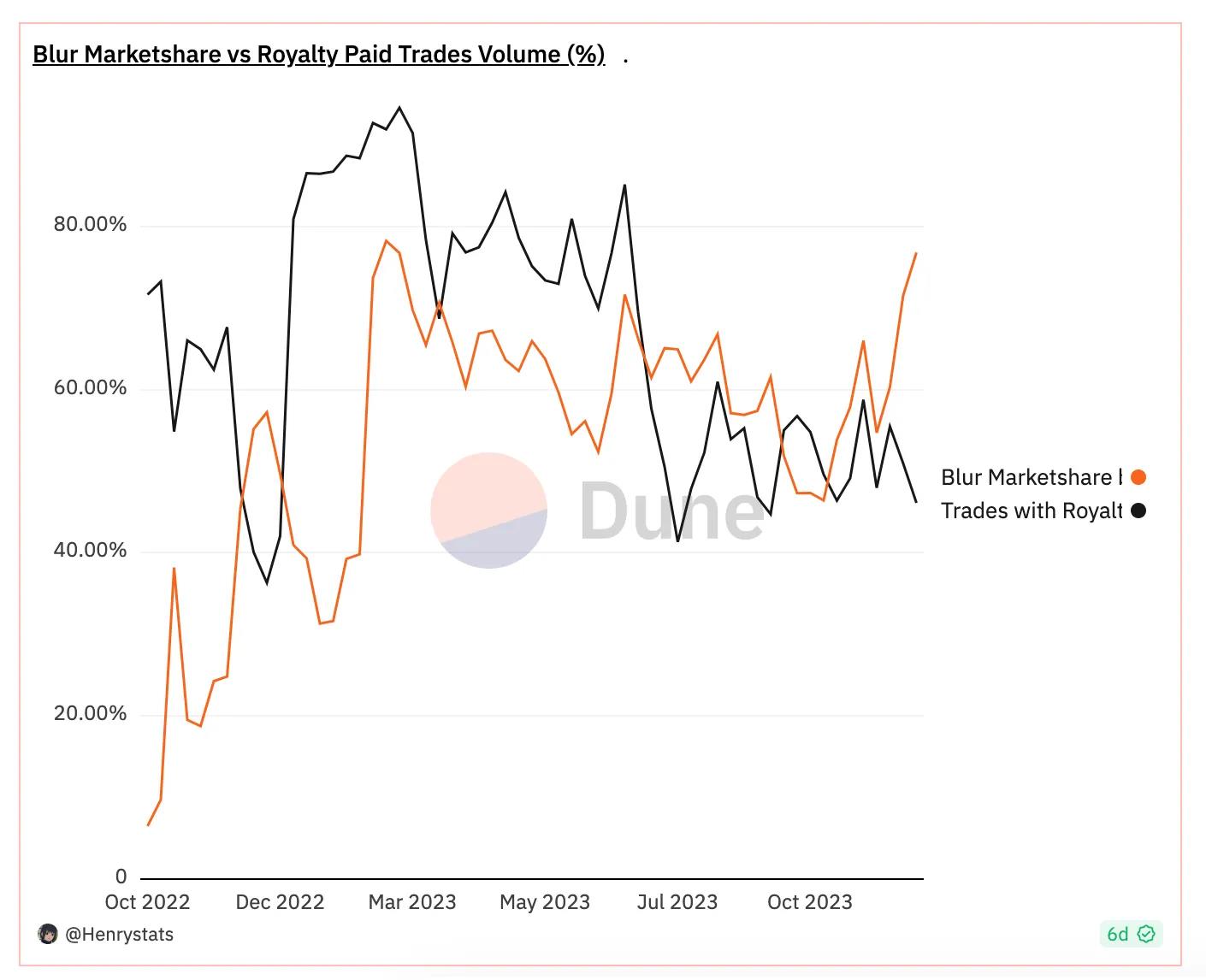

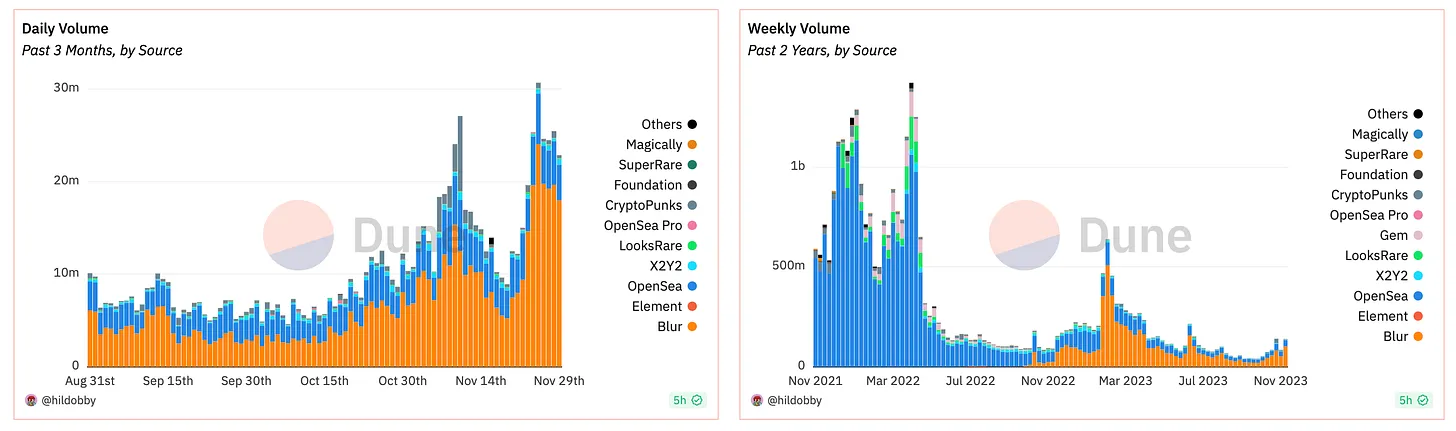

From the monopoly of OpenSea to the dominance of Blur

Controversy over royalties: Should users buying and selling NFTs pay royalties to artists or NFT markets? More and more markets are ultimately moving towards not paying royalties.

This post will provide a brief overview.

Since Blur announced its launch and airdrop, NFTs have never been the same. Many have accused the platform of unilaterally causing the decline of the NFT market, as large holders acquired Blur points in large quantities by providing and listing NFTs.

Currently, over 78% of the total NFT trading volume occurs on Blur, while OpenSea's share is less than 18% of the total volume.

However, while it may be somewhat far-fetched to attribute the decline of NFTs to Blur, they have introduced new incentives that affect buyers and sellers.

View on NFT Royalties

Initially, the NFT market enforced royalties, either compensating artists or the teams behind the NFTs. This sparked an industry-wide debate.

As shown in the image below, March 2023 marked a turning point in the market's introduction of optional royalties.

Currently, just over 45% of NFT transactions pay royalties.

Solana NFT Market Overview

Solana has emerged as a notable contender in the NFT space, praised for its high transaction speed and low costs. NFT projects based on Solana offer an alternative to the high gas fees of Ethereum, but they also face the universal challenge of maintaining relevance and public interest.

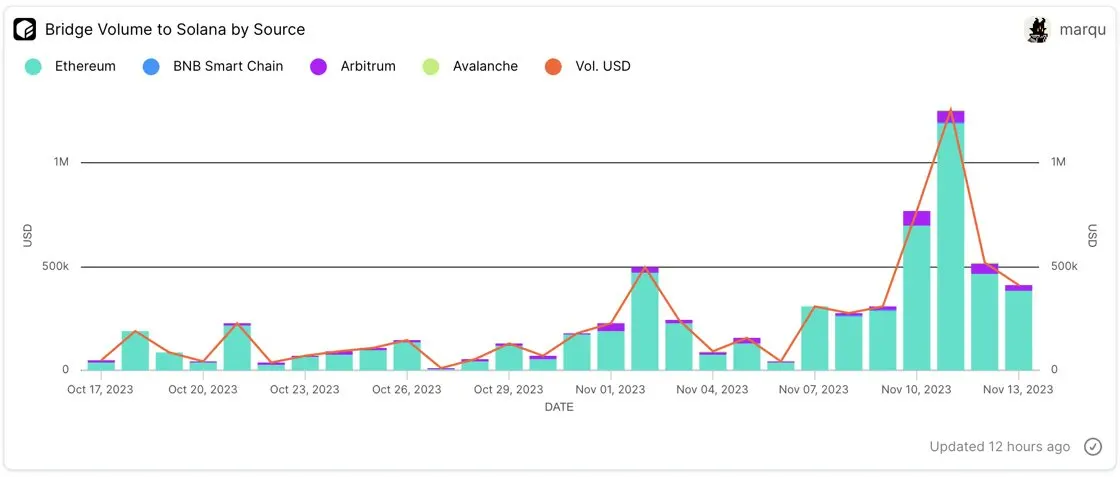

In particular, over the past few weeks, as Solana surged to $60, on-chain NFT activity has increased, especially with the volume of transactions from Ethereum and Arbitrum to Solana.

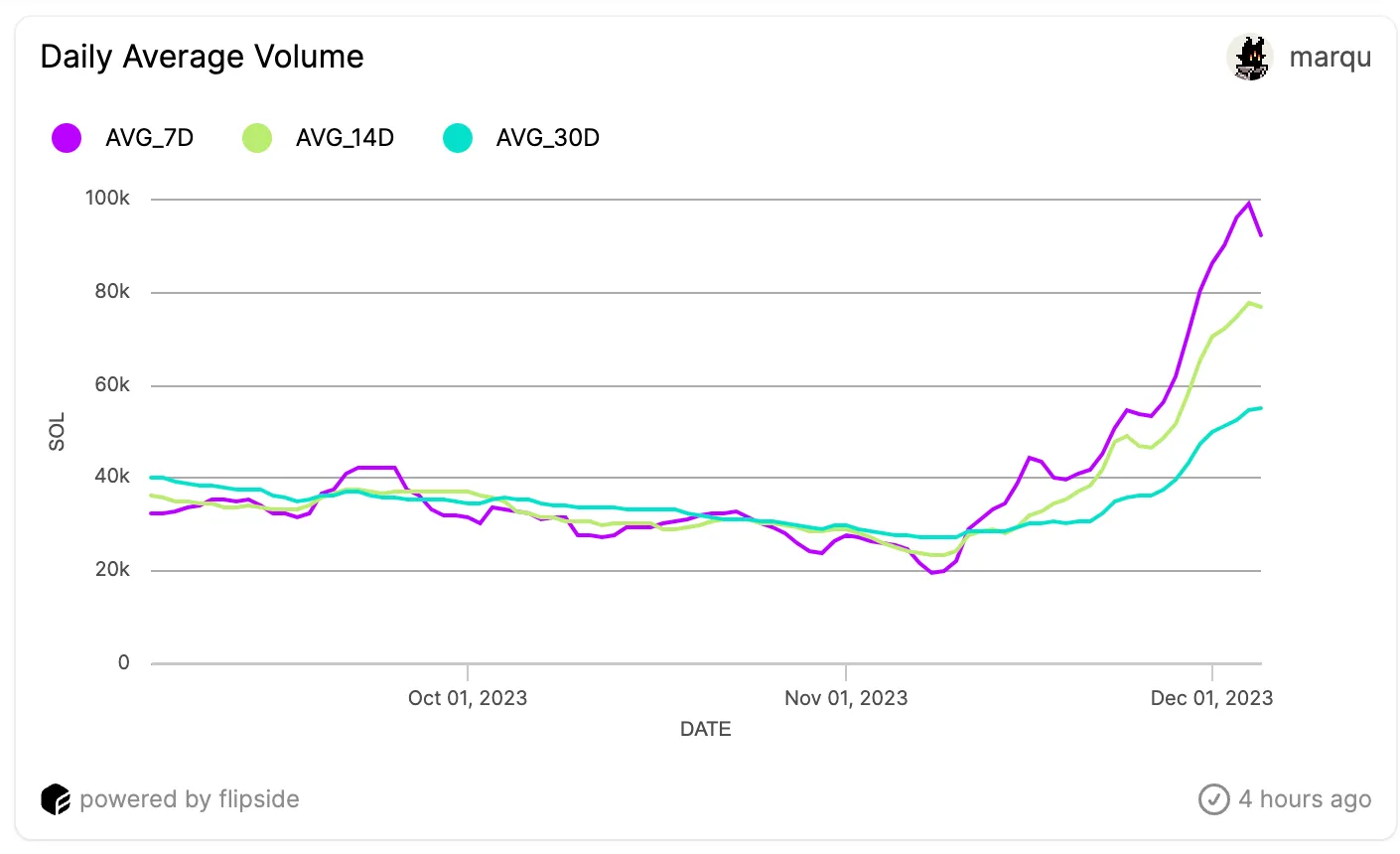

As seen in the chart above, Solana's daily trading volume has been increasing since early November 2023.

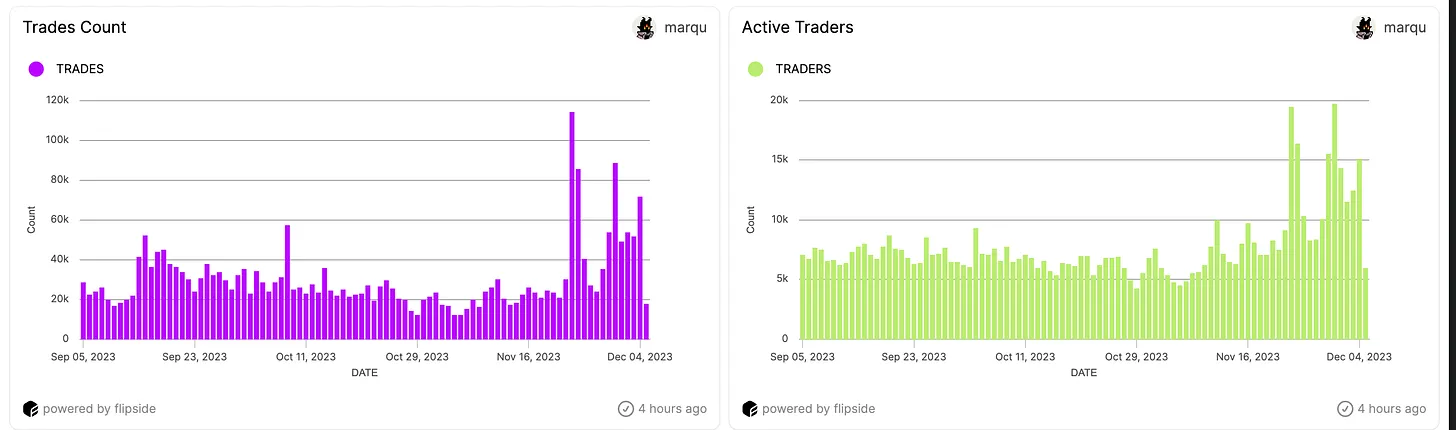

But not only that, NFT trading and active traders have increased by 300% since September.

But is this trend limited to Solana only?

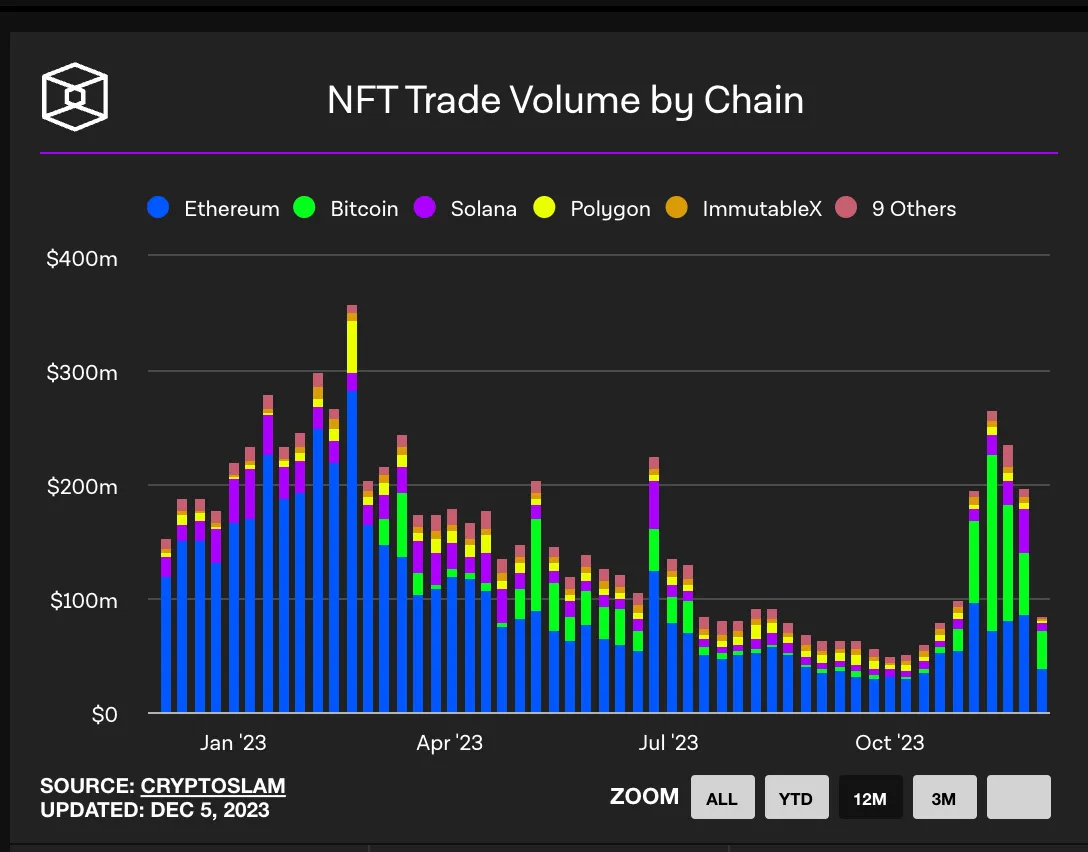

State of the NFT Market

Overall, the numbers for NFTs are on the rise.

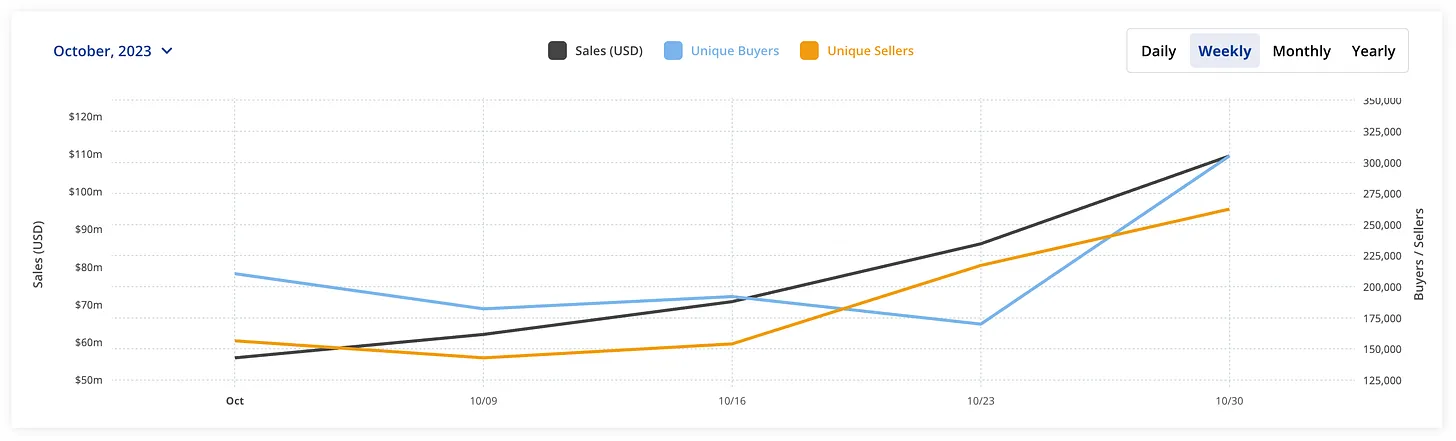

In fact, since October, the NFT space has experienced a slight recovery in trading volume.

Of course, if we put this development in a longer time frame, more evidence is needed to argue that the NFT bull market has returned. Nevertheless, we can observe that sales volume is slowly increasing, and both buyers and sellers are happy to see some demand for NFTs that were almost worthless in the bull market.

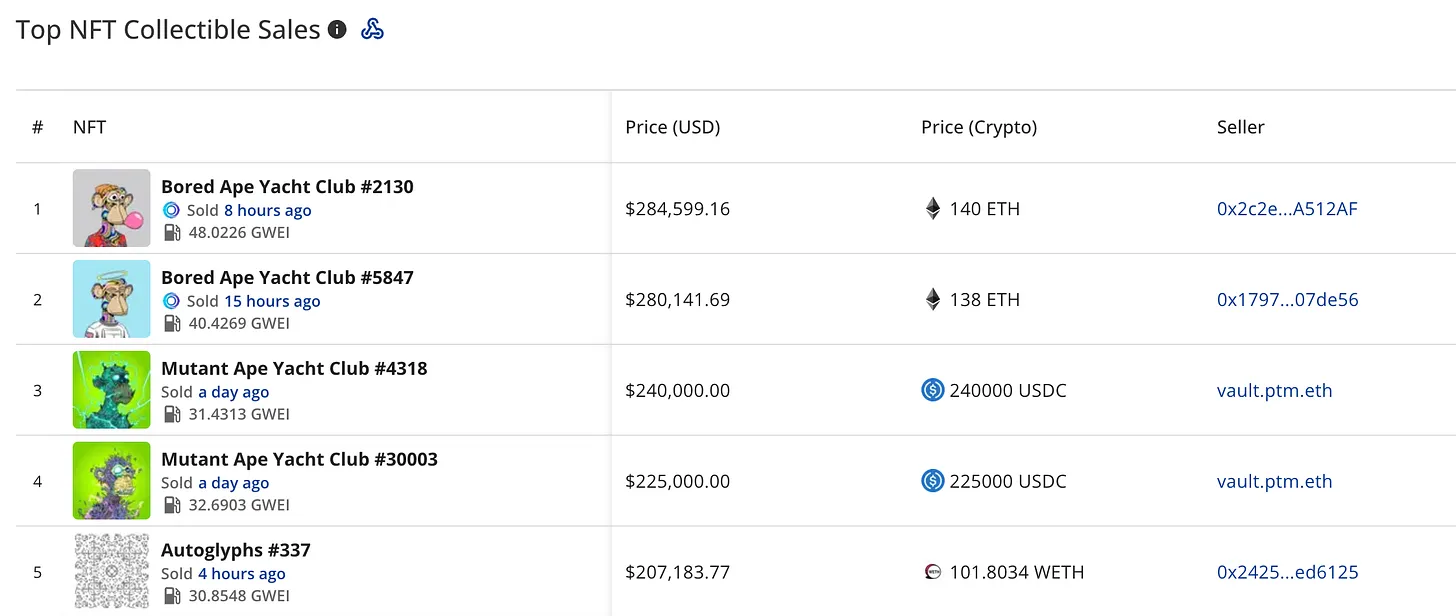

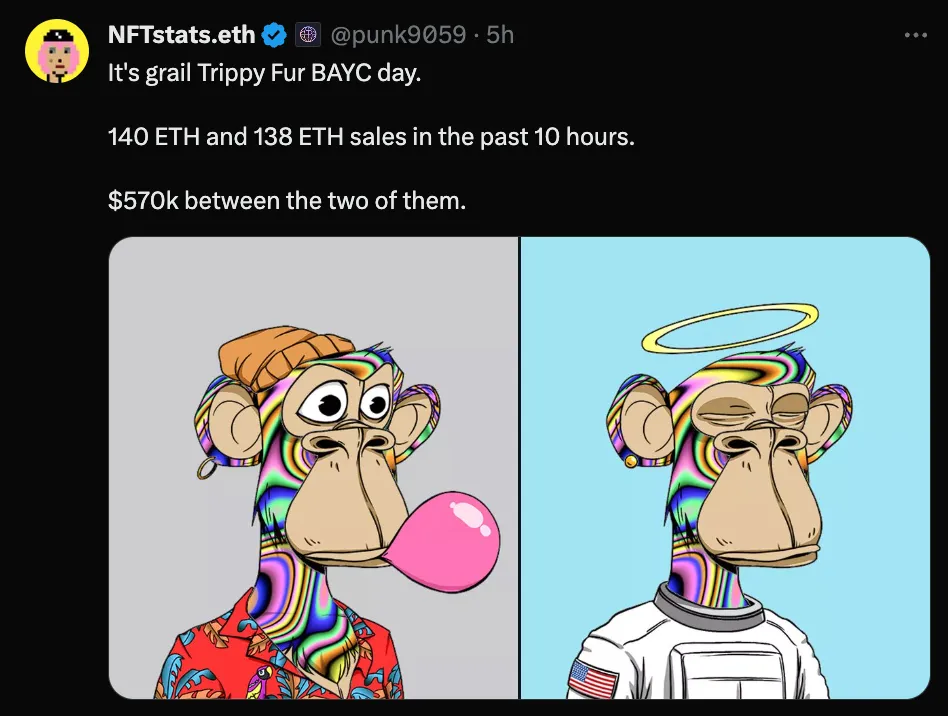

Here are the top NFT sales from last week:

And here are the top 11 NFT series by sales volume:

Interestingly, Mad Lads from Solana has suddenly risen in value, now worth over 4 ETH (170 SOL).

Finally, we are seeing some large bids again (perhaps from some people who got rich through meme coins?).

Expectations for the New Narrative: NFT Perpetual Contracts

Another very important development that will drive the next step for NFTs (if any) is the development of more narrative-based NFTs. In 2021, NFTs seemed to have little use beyond collecting. That is about to change, such as with NFTperp V2, which allows users to long or short their favorite NFTs.

If you are interested in learning more about NFTperp, please click here to read the article.

Looking to the Future

NFTs are at a crossroads. While the current state may seem bleak, the potential for innovation and adaptation still exists.

The future of NFTs will depend on whether creators and platforms can evolve to provide real value and utility beyond mere speculation. Whether NFTs will make a glorious comeback or fade into the background of digital history, only time will tell.

In particular, we expect the most successful companies to eventually clearly indicate the way forward from PFP collections.

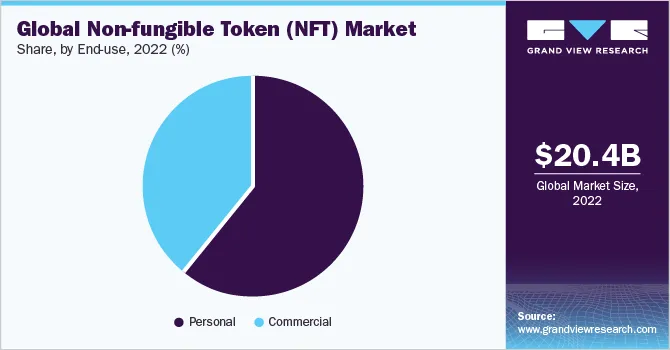

Despite being in a bear market for three years, the scale of the NFT market is expected to grow by an average of 30% from 2023 to 2030.

Especially, there will be an opportunity to decentralize the industry geographically when the next wave arrives, as the United States (plus Canada and Mexico) currently accounts for over 30% of the total revenue share.

Another foreseeable trend in the future is the development of more NFTs for commercial use rather than personal use.

Unfortunately, due to the scope of this article, I cannot delve into the content of Ordinals and xNFTs, two very interesting developments in the NFT space, especially considering the recent increase in Bitcoin NFT trading volume.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。