This article will focus on the perspective of virtual currency regulation in China, to outline the compliance operation path for Web3 practitioners in the crypto world.

Authors:

Will Awang, Master of International Law, investment and financing lawyer, seasoned entrepreneur, and independent researcher

Chris Chuyan, crypto lawyer, former senior product manager at a cryptocurrency exchange, and on-chain data researcher

Web3 projects built on public blockchains are inherently global, able to cover a wider global market. However, from a legal compliance perspective, this also brings about regulatory challenges from different jurisdictions around the world. For example, the regulatory clashes between the United States and crypto giants are typical challenges under globalized operations.

For Web3 practitioners in the Chinese-speaking region, there are inevitably many connection points with China, a jurisdiction with strong regulation. Therefore, it is very important to understand China's regulatory positioning and red lines for virtual currencies. Previously, a sharing session titled "How Web3 Practitioners Protect Themselves in the Crypto World" was conducted at LXDAO with crypto lawyer Chris, which received enthusiastic feedback, just as Sanzhi said, "I think this is a sharing session that any Web3 practitioner needs to listen to."

We believe it is very important to organize the content of the sharing session into an article, with the "conscience" trait, hoping to help a wide range of Web3 practitioners protect themselves while managing the overall risks of their projects in the crypto world.

I. Positioning and Regulatory Red Lines of Virtual Currency in China

1.1 Positioning of Virtual Currency in China

Since Bitcoin entered the regulatory spotlight, China has adopted a strict and cautious regulatory attitude. On December 3, 2013, the People's Bank of China and four other ministries issued the "Notice on Preventing Bitcoin Risks," directly denying the currency attributes of Bitcoin—stating that it is not issued by a monetary authority, does not have the attributes of legal tender, and does not have the mandatory and enforceable attributes of real currency.

In terms of its nature, Bitcoin should be considered a specific virtual commodity, without the legal status equivalent to currency, and should not and cannot be used as a medium of exchange in the market. This can be considered as the basic principle of China's regulation of virtual currencies, which has been upheld to this day.

Related article: Brief Introduction to China's Regulatory Attitude Towards Virtual Currencies

1.2 Regulatory Red Lines of Virtual Currency

China's regulatory red lines for virtual currencies can be based on the "Notice on Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Trading" ("924 Notice") issued by the People's Bank of China and ten other ministries on September 15, 2021. The core content includes:

(1) Virtual currencies do not have the legal status equivalent to legal tender, such as Bitcoin, Ethereum, Tether, and other virtual currencies, which are unofficial currencies and do not have legal tender, and cannot be used as a medium of exchange in the market.

Interpretation: This has been the regulatory red line since 2013.

(2) Virtual currency-related business activities are considered illegal financial activities and are strictly prohibited. Those who engage in legal tender-to-virtual currency exchange, virtual currency-to-virtual currency exchange, buying and selling virtual currency as a central counterparty, providing information intermediary and pricing services for virtual currency trading, token issuance financing, and virtual currency derivative trading, are all considered illegal financial activities.

Interpretation: This further clarifies that virtual currency-related business activities are illegal financial activities, strictly prohibited within China, involving services such as providing fiat currency trading, spot trading, derivative trading, exchanges, token financing (ICO), token trading intermediaries, and promoting the issuance and circulation of virtual currencies.

(3) Providing services to Chinese residents by overseas exchanges is considered illegal financial activities.

Interpretation: This has led many exchanges and Web3 projects to reorganize their structures and shift their operations overseas, completely ceasing operations in China, and no longer providing services to users with IP addresses from China or holding Chinese passports, in order to avoid regulatory risks from China.

(4) Chinese residents investing in virtual currencies do so at their own risk. If investment activities are suspected of disrupting financial order and endangering financial security, legal responsibilities must be borne. Any legal person, unincorporated organization, or individual investing in virtual currencies and related derivatives, in violation of public order and good customs, will have their relevant civil legal actions invalidated, and any resulting losses will be borne by themselves; if suspected of disrupting financial order and endangering financial security, relevant departments will handle it according to law.

Interpretation: Investing in virtual currencies by citizens within China is not considered illegal or criminal behavior, but the regulatory attitude is that individuals bear the risk themselves. In judicial practice, many civil legal actions involving virtual currency transactions between individuals or between legal persons and individuals have been deemed to violate the financial security and market order protected by the 924 Notice, resulting in the invalidity of contracts. In the case of invalid civil legal actions, many judgments will allocate responsibility based on the fault of both parties.

II. Cross-Border Structure Under Strong Regulation

2.1 Development in China, Operations and Promotion Overseas

Under the strong regulatory background in China, Web3 projects have shifted their organizational structure and operations overseas, completely ceasing operations in China and no longer providing any services to users with IP addresses from China or holding Chinese passports, in order to avoid regulatory risks from China.

In general, project teams will place management and marketing personnel overseas (such as in Hong Kong, Singapore) to target overseas markets. At the same time, due to cost and practical considerations, project teams will leave developers in China to provide technical support for the project, or engage in business through overseas outsourcing partnerships.

Although the above measures can to some extent avoid regulatory risks from China, Chinese criminal law has established a comprehensive extraterritorial application mechanism. In cases involving illegal activities, cross-border structures are also difficult to completely avoid.

2.2 Strong Jurisdiction from Chinese Regulation

The 924 Notice specifies that for domestic employees of related overseas virtual currency exchanges, and legal persons, unincorporated organizations, and individuals who knowingly or should have known that they are engaged in virtual currency-related business, but still provide them with marketing, payment settlement, technical support, and other services, relevant responsibilities will be pursued according to law.

Although the above provision only clearly defines the nature of illegal financial activities by overseas exchanges, we believe the same applies to other entities providing illegal financial activities, such as those involved in providing fiat currency transactions (deposits and withdrawals, crypto payments), spot trading (CEX/DEX), derivative trading (Prep DEX), token financing (ICO), and other services. In addition, we believe it also applies to some projects involving gambling and fundraising fraud.

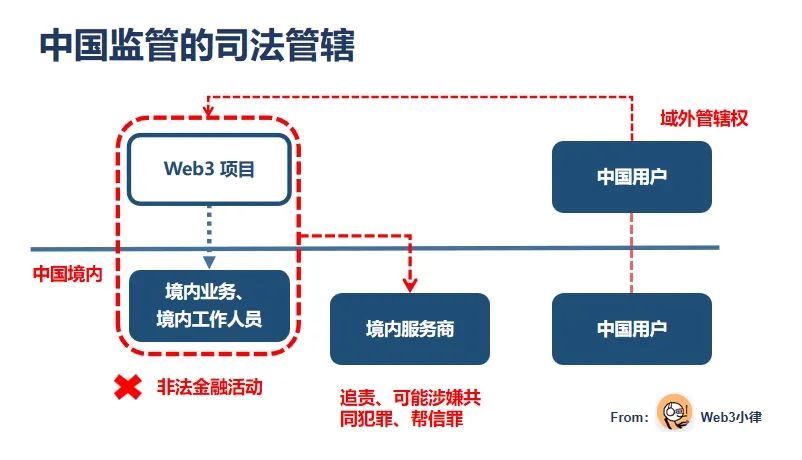

Once these illegal financial activities constitute a crime, they will face the "strong" intervention of Chinese regulators based on criminal jurisdiction. Here, we understand this from three perspectives:

First, for domestic employees of entities engaged in illegal financial activities in China, depending on the nature of the specific illegal activities and the specific functions performed, they may be suspected of crimes such as illegal business operations, illegal absorption of public deposits, fundraising fraud, and organizing and leading pyramid schemes.

Second, for service providers in China for entities engaged in illegal financial activities (such as third-party technical outsourcing, media public relations, payment settlement), service providers may be pursued for relevant responsibilities according to law. In severe cases, they may be suspected of complicity in crimes or aiding and abetting crimes.

Finally, if the entity engaged in illegal financial activities outside the Chinese jurisdiction provides virtual currency services to Chinese citizens via the internet and engages in actions that violate Chinese laws, it is still subject to Chinese legal constraints. As long as the location of the information network system used by the victim, the location of the victim at the time of the infringement, and the location of the victim's property loss are in China, Chinese regulators have extraterritorial jurisdiction.

III. Compliance Paths and Protection Measures for Web3 Practitioners

Although the red lines are clear, the regulation is strong, and the jurisdiction is broad, the intention of discussing all this is not to spread a sense of crisis, but to outline some compliance paths for Web3 practitioners to reference, and thereby enable everyone to legally and compliantly "buidl" in the sunshine. We still have a bright future ahead.

3.1 Compliance Paths from the Individual Perspective

3.1.1 Holding and Trading Virtual Currencies

Regarding holding, although relevant regulatory documents deny the legal tender attributes of virtual currencies, they do not deny the commodity attributes of virtual currencies. Therefore, holders still have property rights in virtual commodities, which are protected by law. Therefore, holding virtual currencies as virtual commodities is not a problem.

As for trading, the 924 Notice clearly states that "any legal person, unincorporated organization, and individual investing in virtual currencies and related derivatives, in violation of public order and good customs, will have their relevant civil legal actions invalidated, and any resulting losses will be borne by themselves." However, in judicial practice, court judgments vary.

Previously, the Shanghai First Intermediate People's Court made a civil judgment (2021) Hu 01 Min Zhong 11624 after the 924 Notice, stating that "Chinese laws and regulations do not prohibit the holding and legal circulation of virtual currencies or tokens, nor do they prohibit normal transactions of virtual currencies between private individuals."

Unfortunately, this year, many courts have been more inclined to invalidate contracts related to virtual currency trading and financial management, and have allocated responsibility based on the fault of both parties, reflecting the regulatory attitude of individuals bearing the risk of virtual currency-related civil actions.

3.1.2 Fiat-to-Virtual Currency Transactions

Web3 practitioners and investors are most likely to engage in criminal risk activities through OTC fiat-to-virtual currency transactions, where investors exchange fiat currency for BTC, ETH, and other virtual currencies, and then convert virtual currencies back into fiat currency after making a profit, which are all personal investment decisions.

However, with the rampant telecommunications fraud both domestically and internationally, many criminal groups use OTC transactions to convert fraudulent funds into virtual currencies, such as BTC, ETH, USDT, due to the anonymity and decentralization of virtual assets, making them the preferred choice for money laundering by telecommunications criminals. This has led to many investors receiving "black money" from fraudulent funds during this process and having their bank accounts frozen.

In addition, some investors have had their exchange accounts frozen, often due to involvement with related gambling platforms. Both of these situations are currently the focus of China's regulatory authorities, so relevant practitioners and investors must be aware of the risks their actions may bring.

During fiat-to-virtual currency transactions, it is recommended that individuals carefully verify the identity and source of funds of their trading partners. For any suspicious trading partners or funds, transactions should be terminated promptly to avoid involvement in related criminal cases. If frozen inadvertently, individuals should promptly contact banks, public security agencies, and other relevant departments to explain the situation. In the process of communicating with relevant departments, the key point is to prove that one's actions are not related to the suspected criminal activities of the trading partners, and if necessary, it is advisable to engage professional lawyers.

3.2 Compliance Paths from the Developer Perspective

Building on the clear compliance paths for holding, trading, and fiat-to-virtual currency transactions, developers have the additional role of "buidler" for Web3 projects, which exposes them to risks from the project, especially for entities defined by regulators as engaging in illegal financial activities.

In a cross-border structure, developers who remain in China are exposed to virtual currency regulation in China. Therefore, developers need to constantly monitor risks from the following perspectives and take appropriate measures to protect themselves.

3.2.1 Identification of Illegal Financial Activity Projects

The 924 Notice has already listed most illegal financial activity projects, including entities providing fiat currency transactions, spot trading, token financing (ICO), derivative trading, and exchanges, with exchanges being the primary focus. Therefore, developers building in these projects need to understand that the high salaries offered by the projects are, in part, a hedge against the regulatory risks in China.

It is essential to focus on the risk control and compliance measures taken by these entities in the Chinese jurisdiction, such as blocking Chinese user IP/VPN, strict customer identification (KYC)/anti-money laundering (AML)/counter-terrorism financing (CTF) measures. These measures effectively avoid judicial jurisdiction from Chinese regulators.

Although most developers may find it difficult to assess the overall risks of a project from a "Whole Picture" perspective, they should still pay attention and engage in discussions.

3.2.2 Positioning of Work Nature

The risks for Web3 practitioners are mainly influenced by the nature of their work and their level of involvement in the project. In some public judicial cases, individuals with deeper involvement in the project, such as in marketing, business, technical, and financial roles, have faced greater crackdowns, as these individuals play a decisive role in the project's operation. Once a project is suspected of criminal risk, the decision-making layer of the project is inevitably at risk of imprisonment.

Therefore, practitioners should thoroughly evaluate their work and the project's development during recruitment and in their daily work, and should promptly disengage from projects that may involve illegal activities to avoid getting deeper involved.

3.2.3 Risks of Receiving Salary Compensation

Currently, the salaries or labor compensation of many practitioners are paid in stablecoins or project tokens. However, it should be noted that Article 50 of the Labor Law and Article 5 of the Interim Regulations on Wage Payment clearly stipulate that wages should be paid in the form of legal tender and cannot be replaced by physical objects or other valuable securities. Virtual currencies are not legal tender in China, so paying wages in virtual currencies is illegal if a labor contract is signed and a labor relationship is established between the company and the worker.

3.3 Compliance Paths from the Project Perspective

3.3.1 Effective Internal Control Measures and Risk Identification

Currently, many overseas exchanges and project entities need to implement effective risk control and compliance measures in the Chinese jurisdiction, such as blocking Chinese user IP/VPN, strict customer identification (KYC)/anti-money laundering (AML)/counter-terrorism financing (CTF) measures. These measures effectively avoid judicial jurisdiction from Chinese regulators.

In addition, active cooperation and response to judicial assistance from Chinese regulatory authorities are also necessary for overseas exchanges and project entities after going overseas.

3.3.2 Reasonable Construction of Cross-Border Legal Organizational Structure

In fact, there is no need to limit projects due to regulatory reasons. We are actively helping project entities explore and evaluate compliant paths for cross-border structures. Once the tasks of the project are reasonably divided and allocated, the advantages of a cross-border structure can be unleashed. On one hand, it fully taps into the "big market" of China and gains related policy dividends, and on the other hand, it captures global value through the economic model of Web3. However, this operation is difficult and requires careful evaluation, for example:

Establishing a blockchain technology company in China to empower domestic entities with blockchain technology (such as DID, ZK, payment, etc.) is highly popular in some domestic innovation industrial parks and can be used to apply for policy support, park subsidies, and other preferential policies. It also enables compliant operations and "technology going global."

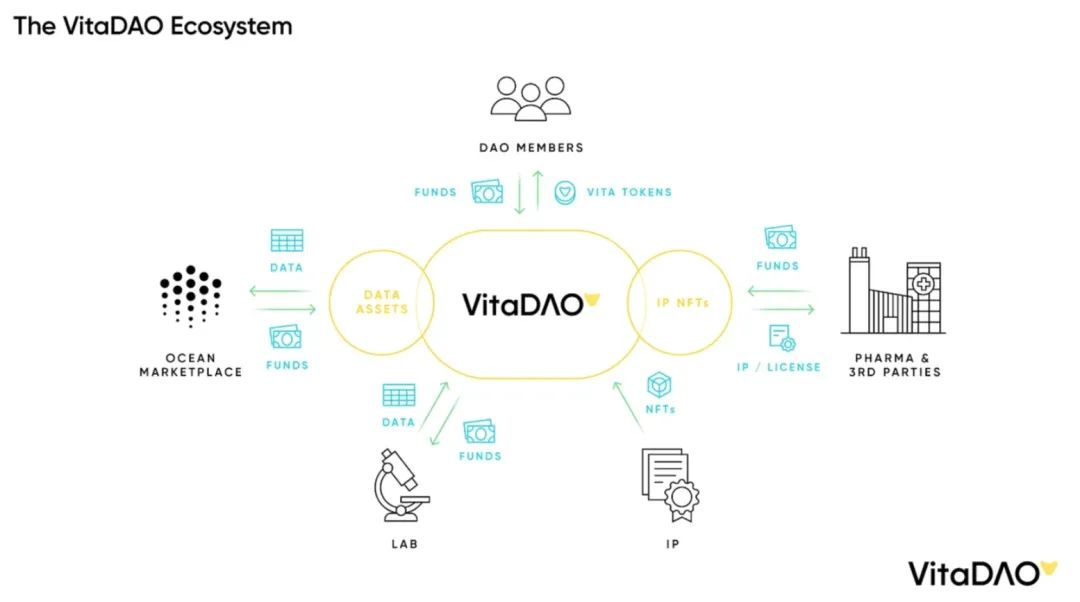

Overseas companies can fully utilize the characteristics of Web3 to capture global value (such as related data, community participation, global collaboration, etc.). For example, VitaDAO, a decentralized autonomous organization focused on extending human lifespan through biomedical research, uses blockchain technology to collectively own and manage scientific intellectual property (IP), greatly reducing the threshold for projects to obtain IP data and empowering multiple entities through multiple authorizations, coordinating global resource collaboration, and providing economic incentives through Web3.

IV. Legal Challenges for Decentralized Projects - Who Bears Responsibility

Unlike traditional projects, the most significant feature of Web3 projects is decentralization, which can unleash the unlimited potential of projects, such as DAO organizations enabling global-scale collaboration through innovative incentive models. However, Web3 projects cannot blindly pursue decentralization without considering the new regulatory compliance challenges, which can directly hinder the operation of projects. These obstacles not only bring trouble to the project, but may also affect developers.

The most immediate regulatory challenge is: who bears responsibility after the decentralization of the project?

4.1 CFTC Administrative Enforcement - Developer Admissions

It is often said that "the decentralized world on the blockchain is beyond the reach of the law, and no one will be held responsible for it." However, the U.S. Commodity Futures Trading Commission (CFTC) disagrees, as it believes that developers still have to bear responsibility.

In the judicial ruling of CFTC v. Ooki DAO, Ooki DAO, as a DAO organization managing on-chain protocols, was required to bear legal responsibility for violating CFTC regulations on commodity futures. What's even more frightening is that since Ooki DAO is on-chain and has no legal entity, the responsibility is shifted to the members participating in the governance of the DAO organization.

In addition, in the administrative enforcement and settlement cases of three DeFi protocols in September, the CFTC also targeted protocol developers. Despite the decentralized nature of the protocols, accessible to anyone, the CFTC still directly attributes the responsibility for malicious third-party actions to the developers, as developers cannot control the occurrence of malicious third-party behavior.

4.2 Uniswap Judicial Ruling - Developer Innocence, Technology Innocence

However, in the case of Uniswap, the result was completely different. The court ruled that DEX (Uniswap protocol) would not be held responsible for users' losses due to investing in tokens issued by malicious third parties, indicating that the technology itself is innocent, and the guilt lies with the individuals using the technology. This is a significant positive for decentralized projects.

Of course, this is related to Uniswap's establishment in the United States, active cooperation with regulators, and the single governance function of its token. Nevertheless, this does not prevent Uniswap from providing a good example for other decentralized projects to deal with regulation.

4.3 Regulatory-Friendly Decentralized Path - Uniswap Playbook

As the most successful decentralized exchange, Uniswap's growth path is highly worth emulating, especially in sensitive cryptocurrency trading businesses and in the context of opaque regulation in the United States. A previous article titled "Uniswap, the Most Successful U.S. Internet Fintech Company Under the Web3 Dividend" provided a good summary, emphasizing the importance of compliance for Fintech companies.

We have outlined the compliance path for Uniswap Labs after separating from the protocol, providing a regulatory-friendly example for Web3 decentralized projects. The purpose of this separation is to achieve progressive decentralization and to gain more flexibility in regulatory compliance.

Decentralization + Non-Security Tokens: The Uniswap protocol operates autonomously on-chain, governed by the Uniswap DAO, achieving decentralization, with the UNI token serving as its governance token. This model avoids SEC securities classification and has led to successful court rulings.

DAO Legal Structure + Limited Liability for Members: Uniswap DAO establishes the Uniswap Foundation as a legal entity, serving as the legal wrapper for the DAO. This not only ensures limited liability for DAO members but also allows interaction with the Web2 world, expanding influence.

Labs Independent Operation + Flexible Front-end Development: The Uniswap Labs team, previously responsible for developing and maintaining the protocol, now operates as a separate legal entity and is the main contributor to the protocol. This allows them to avoid restrictions from the protocol and to build and maintain front-end products by calling the backend protocol, ensuring sustainability, such as the previously introduced fee model for the Uniswap DApp.

Regulatory Application Rather Than Protocol: As advocated by a16z, decentralized on-chain protocols are difficult to reconcile with regulation, while front-end applications can fully comply with regulatory requirements, enabling the team and the product itself to avoid potential regulatory risks. Similar to any app, front-end applications can incorporate KYC/AML/CTF verification as per regulatory requirements, delist tokens flagged by regulators, and apply for licensing qualifications.

In contrast, Tornado Cash, due to the protocol's incompatibility with regulation and the lack of KYC/AML/CTF measures, faced severe sanctions for non-compliance with regulation, leading to developers being sued by the Department of Justice for decentralized projects without legal wrapping.

V. Conclusion

We believe that for legal practitioners in the field of virtual currencies, we should not only focus on "criminal" and "non-criminal." While these are important, we should also support the development of Fin and Tech in the encrypted world from a FinTech perspective.

In line with the "conscience" characteristic of LXDAO, we share the above content with everyone, not to bring negative effects to the vast number of Web3 practitioners, but to make this content a sustainable "Public Good" for the industry, creating positive externalities. From a long-term perspective, we aim to help Web3 practitioners operate legally and compliantly, protecting themselves while better "buidling" the ideal world in our hearts.

Feel free to contact us at any time to "buidl" together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。