The core upgrade content includes the migration from Polygon to the Solana ecosystem, the upgrade from the old token to the new token RENDER, and the introduction of the Burn and Mint Equilibrium token economic model.

Authors: Feng & Carol, DFG

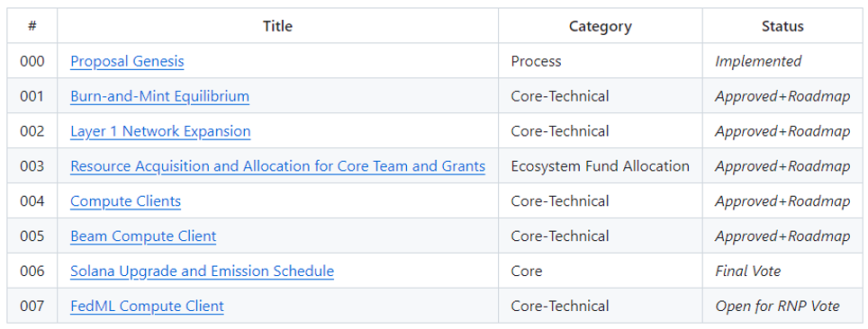

On November 2, Render Network officially announced the successful completion of the upgrade to Solana, which means that the leading enterprise in the decentralized rendering field has officially migrated from the Polygon ecosystem to the Solana ecosystem. This migration will involve the implementation of multiple RNP proposals (Render Network Proposals) approved by the Render community over the past year, which not only includes the migration of the Layer1 ecosystem but also the issuance of the new token (RENDER) and the implementation of the new Burn and Mint Equilibrium (BME) token economic model, which will have a profound impact on the entire Render ecosystem and all stakeholders of RNDR (soon to be upgraded and renamed as the SPL token RENDER).

Recent secondary market data also shows that the community has given positive feedback on Render's recent actions. Coingecko data shows that the token RNDR has surged to over $4, reaching a new high in nearly 21 months.

What are the core upgrade areas?

Render is undergoing a series of major technical upgrades, with these upgrade proposals mutually supportive and empowering. The core upgrade content includes the migration from Polygon to the Solana ecosystem, the upgrade from the old token to the new token RENDER, the introduction of the Burn and Mint Equilibrium token economic model, and the token incentive and ecological resource reallocation mechanism designed around the BME model implementation.

Introduction of the BME model

The innovation of the token economic model is the core of this series of upgrades. As early as June 2022, the Render community created Proposal 001, proposing the introduction of the Burn and Mint Equilibrium (BME) token economic model, a model that has been successfully used by the Helium Network (HNT).

Render Network is preparing to switch to a BME model with a net emission limit. By adopting the new token model, a long-term supply-demand balance or even deflation of RENDER can be achieved. According to the plan of RNP-001, the new model is expected to be deployed in the coming weeks and will launch the emission plan on Solana.

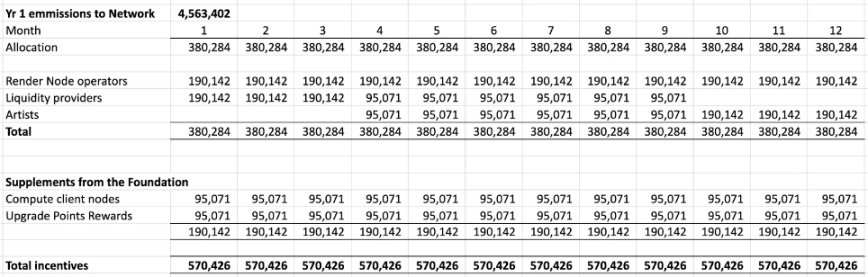

The recently approved RNP-006 details part of the emission and distribution of BME, explaining in detail how emissions are distributed among different network participants, including: node operators, computing client partners, artists, and liquidity providers.

Settling in the Solana ecosystem

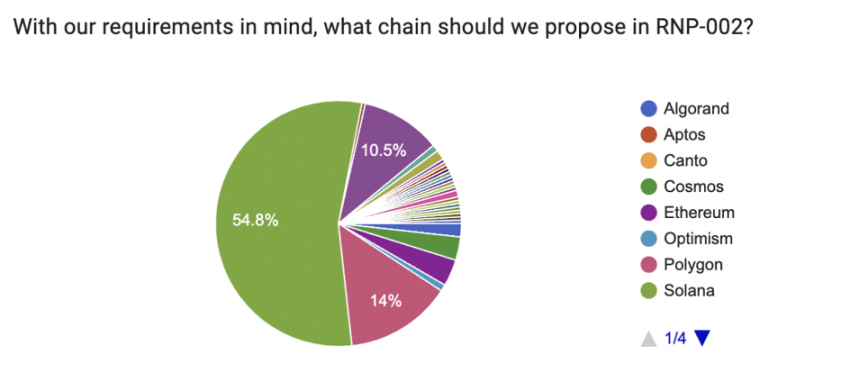

In order to better implement the BME proposal and meet the needs of network development, the Render community has made a major decision to migrate from Polygon to the Solana ecosystem (RNP-002). In a recent community sentiment survey on selecting a new L1, nearly 55% of community members supported Solana, citing its faster, cheaper, and more capable handling of Render Network's broad vision.

A significant change in the Solana blockchain upgrade is the introduction of "RENDER" to replace RNDR. RNDR is an ERC-20 token, while RENDER is a new token built on the Solana blockchain. All work on the Render network (3D and AI) will be paid in $RENDER, and users can transfer and upgrade their current RNDR (ERC-20) tokens to RENDER (SPL).

Another change in the Solana blockchain upgrade is the introduction of a new Solana-compatible voting system. Community members upgrading to the RENDER SPL token will participate in Render's network governance through Nation.io, a voting system similar to Snapshot. During the upgrade, both Nation voting on RNP and Snapshot voting will be open, and the votes on both platforms will be cumulative.

Ecological resource reallocation

The new BME economic model sets a balanced emission plan to ensure that emissions are flexible enough to reward the four main stakeholders of the network (node operators, artists, liquidity providers, and computing clients) in proportion to their contributions.

Creators will receive a certain percentage of RENDER tokens as a reward for the epoch's expenditure. The reward percentage may be as high as 100% of the initial expenditure of RENDER and may gradually decrease over time. Node operators will be rewarded for performing work or providing value, and the Render Foundation has announced the distribution of 1.14 million RENDER tokens as an incentive to attract new node operators to participate in AI computing tasks. Liquidity providers will receive rewards for staking tokens in liquidity pools on partner exchanges. Early migration from RNDR (ETH) to RENDER (ETH) will also be incentivized for regular token holders. In addition, given the network's growth goals, the allocation of rewards between specific stakeholders or new stakeholders appearing in network operations will remain adjustable to ensure that the work of value-adding participants is compensated. Overall, the implementation of the new model will bring incentives to all parties participating in the ecosystem.

Impact of Render's Solana upgrade on the ecosystem

Elastic and sustainable token economic model

After the introduction of the BME model, the RENDER token will gain more value support and will effectively transition into a deflation mechanism. Compared to the old payment token model, the BME model has two main advantages:

- RENDER will be considered a commodity asset, more in line with the long-term goal of establishing tokenized computing standards for the network.

- When the network utilization reaches a certain load condition, RENDER will effectively enter a deflation mechanism, and the value of the token will significantly increase.

Specifically, under the new model, when there is insufficient demand for rendering tasks, miners can earn more income than before. However, when the total task price corresponding to the rendering task demand exceeds the total RENDER reward released, miners will earn less income compared to the original model (burned tokens > newly minted tokens), and the RENDER token will enter a deflationary state.

Looking back at the operation of the Render network, over the past 3 months, the rendering workload of the Render Network has increased by about 20-30%. According to a report released by Insight Partners, the revenue of the visualization and 3D rendering software market is expected to reach $11.83 billion by 2030, with a compound annual growth rate of 20.3% from 2022 to 2030. In the coming years, with the further stimulation of user and traffic growth by various computing clients, it is expected to achieve the same scale as the current rendering market. The surge in business demand will trigger the destruction mechanism of the RENDER token and accelerate the deflation of the RENDER token.

Faster and More Scalable Network

Render is already a mature project that processes millions of frames per year, and the requirements for the underlying L1 network are increasing. Migrating from Polygon to Solana will greatly assist in the expansion of Render's business in the underlying infrastructure, mainly in the following aspects:

In terms of transaction performance, the most intuitive data is TPS. The Ethereum mainnet has approximately 14 TPS, while the Polygon mainnet shows real-time data of approximately 130 TPS. In contrast, the average TPS of Solana over the past month is more than 30 times that of Polygon, at approximately 4000 TPS. Distributed rendering services require real-time networks, high hardware requirements for rendering, and an interactive information transmission mechanism, and they need to synchronize node states on-chain to maintain a decentralized network. Therefore, L1 needs to have the capacity to withstand pressure under large-scale, high-load conditions and meet on-chain and off-chain liquidity requirements.

In terms of transaction costs, the Solana network has higher transaction throughput and lower transaction fees compared to Polygon. If we use the current data for estimation, the rendering costs (i.e., transaction fees) for running the same number of frames on Solana are approximately a thousand times lower than on Polygon. Since the on-chain state synchronization of the Render network requires significant network traffic, transaction costs are also a core consideration.

Overall, compared to Polygon, Solana is faster, cheaper, and more capable of handling Render Network's broad vision. The goal of the Render network is to provide real-time, rendering, interactive holographic streams. This will require real-time dynamic updates of the state on-chain. Therefore, the network needs to be able to write high-performance code on-chain and on GPUs. Rust can provide Render Network with higher speed and flexibility than Solidity, ultimately allowing the use of the same code for GPU rendering work and smart contracts.

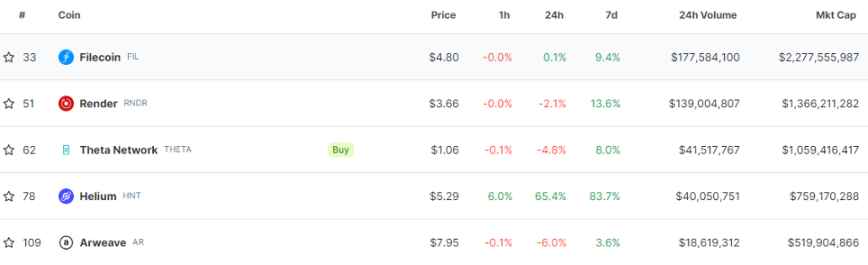

More Promising DePin, AI, and Digital Rights Management (DRM) Rising Stars

Render is one of the benchmarks in the DePIN (Distributed Physical Infrastructure Network) track in the Web3 field, providing hardware infrastructure for rendering, AI, and other tracks, and is currently considered the "NVIDIA of Web3". From the market capitalization data on Coingecko, it can be seen that Render is currently second only to the decentralized storage leader Filecoin in the DePin track, surpassing many established projects such as Arweave and Helium. Against the backdrop of the current AI application explosion, Render is one of the few projects that can continue to innovate and achieve AI narratives. Digital Rights Management (DRM) is another cutting-edge field that Render focuses on, and DRM enables fast, low-cost multi-party royalty flows, which is crucial for the monetization of next-generation media applications. In addition, by migrating to Solana, Render can also introduce DRM and royalties for complex 3D assets, IP, and AI works on-chain, with corresponding rewards for contributions to the training set.

Currently, in terms of both business scenarios and economic models, Render has more significant growth potential and room for imagination compared to Filecoin, and is expected to catch up with Filecoin in the DePIN, AI, and DRM tracks, becoming a leader.

Looking Forward to Explosive Growth

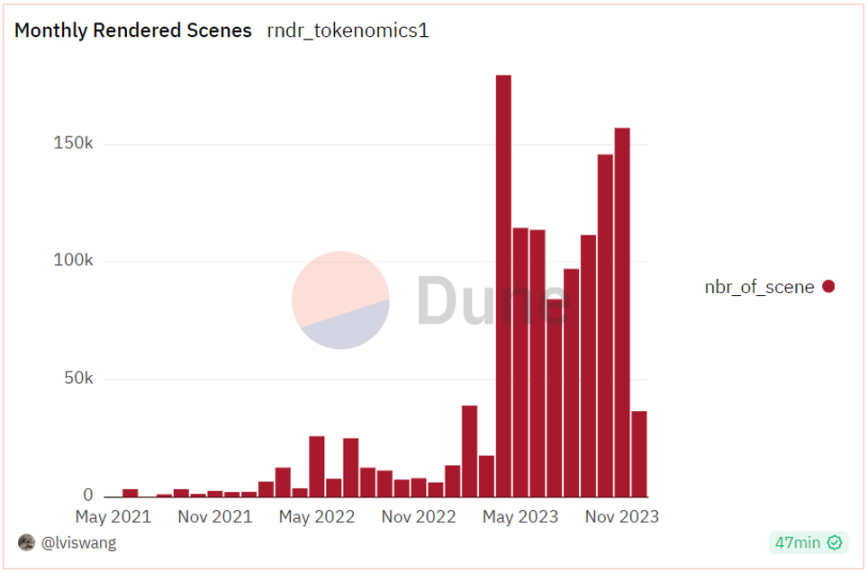

Since April of this year, Render's business has entered a period of rapid growth, with the rendering tasks in April reaching a historical high of 179,500, a tenfold exponential growth compared to the previous months. As of now, the average number of rendering tasks per month has exceeded 120,000, and the number is still growing, demonstrating the explosive growth of Render's rendering business. The main reasons are as follows:

- The parent company OTOY (a leading cloud rendering company in the United States) has a partnership with Apple, and the Render network logo has appeared multiple times in Apple's official promotional videos. Octane X supports Mac and iPad equipped with the M1, M2, and the latest M3 high-performance chips, and in the future, Render may become the built-in rendering component of Apple's software.

- A recent partnership with Stable Diffusion has been established, and rendering scenarios for generating 3D images and videos using large language models can be completed by Render.

Leveraging the strong rendering technology of its parent company OTOY, Render has long occupied a leading position in the decentralized rendering field, but Render itself has been continuously pursuing product and technological innovation and iteration. The innovation of the token economic model and the migration to Solana are both aimed at providing better cloud rendering services in the future.

In addition, Render is also undergoing more innovative upgrades, such as the latest Proposal 007, which plans to introduce the FEDML cloud platform, with the aim of bringing AI community demands into Render's computing network. The GPU market of FEDML can include Render, allowing AI developers to seamlessly access Render's powerful distributed GPU resources. In addition to FEDML, Render is actively introducing various other computing clients, such as Beam, io.net, and other cloud platforms. Furthermore, at the recent Solana Breakpoint 2023 conference, Render also announced the provision of multiple renderers for users, adding Maxon's Redshift, Physical, and Standard renderers.

These series of effective actions ensure that Render will maintain a high narrative continuity in the future. The commercialization of AI has just begun, and fields related to AI such as AR and VR are also poised for growth, which will undoubtedly generate sustained high demand for distributed GPU computing networks like Render; DFG is one of the early investors in Render Network and continues to be optimistic about the project's product and technological progress. We believe that Render Network is well-prepared to lead a large-scale decentralized rendering revolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。