This wave of Solana opportunities was missed, and people often look for the next Solana.

Author: Deep Tide TechFlow

Recently, the Solana ecosystem has performed extraordinarily well, with the entire ecosystem experiencing a general uptrend. Especially with the recent airdrop of Jito, many users have begun to pay attention to Solana's interactions again. Previously, we shared an article about potential airdrop opportunities in the Solana ecosystem. Interested readers can refer to the previous article: "Jito is fierce, don't miss the other 5 projects that may airdrop in the Solana ecosystem"

When this "Solana" opportunity is missed, people often start looking for the next "Solana".

Just like when BRC inscriptions are missed, people will go for Eth\Solana inscriptions. Whether it makes sense is not important, just rush in and figure it out later.

In the previous bull market, Solana led the way in Alt Layer1, followed by tokens from public chains such as Avalanche and Polygon breaking new highs.

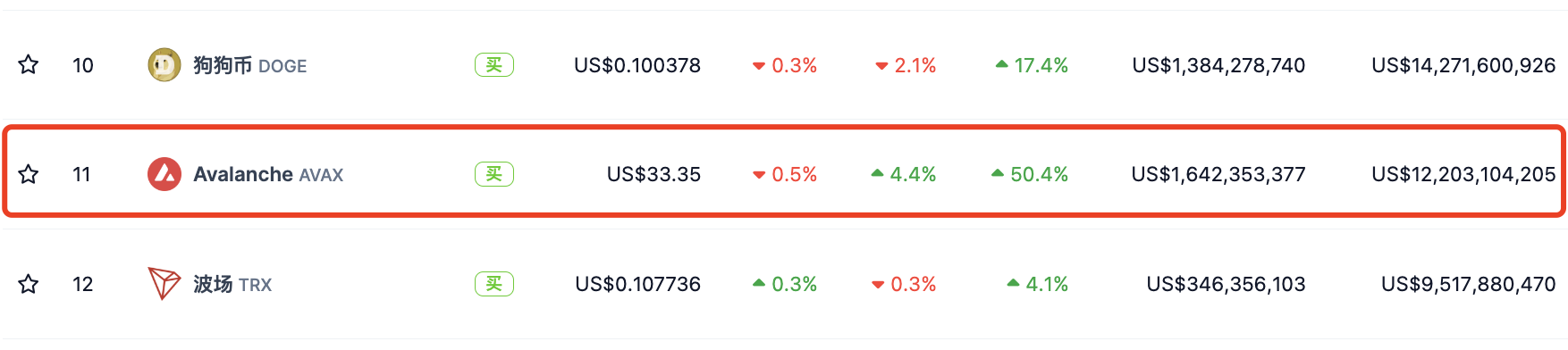

After this wave of Solana market, similarly, more and more users are starting to pay attention to the Avalanche ecosystem. AVAX also broke through $30 recently, rising to 11th place. This article will take stock of the latest developments and project situations in the Avalanche ecosystem, hoping to be helpful to friends who are interested in the Avalanche ecosystem.

1. Avalanche Catalyst

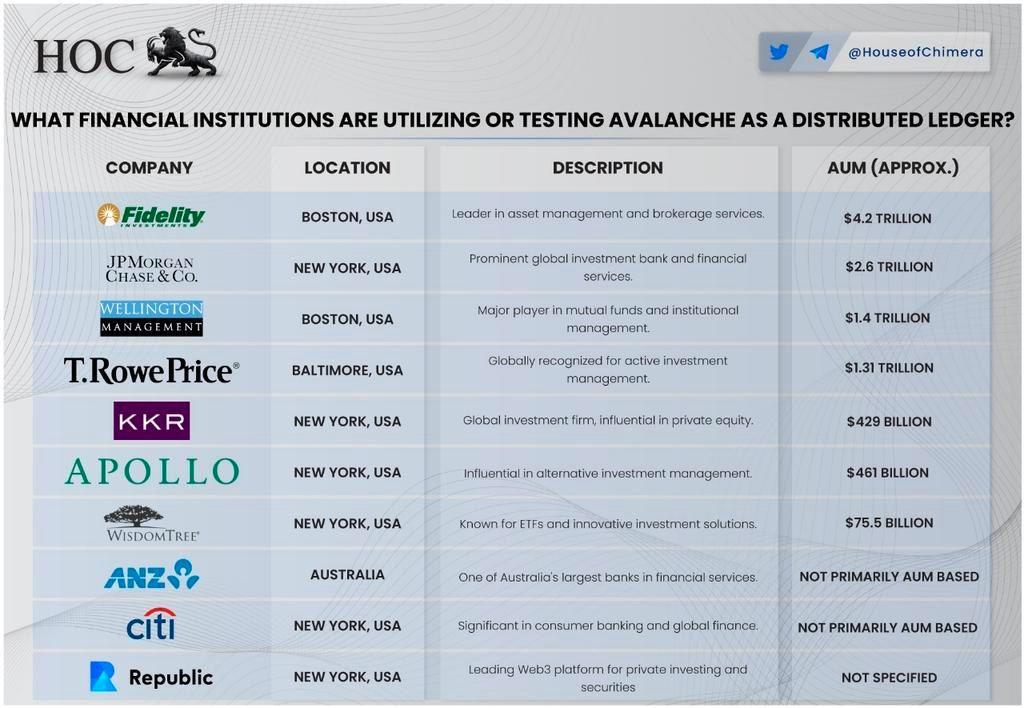

From the perspective of the development of the public chain itself, the biggest progress of Avalanche is in the direction of RWA and cooperation with enterprises. The following figure lists financial institutions that are currently using or testing Avalanche, including:

1-Fidelity: Located in Boston, it is a leader in asset management and brokerage services, managing assets of about $4.2 trillion. 2-JPMorgan Chase & Co.: Located in New York, it is a well-known global investment bank and financial services provider, managing assets of about $2.6 trillion. 3-Wellington Management: Located in Boston, it is a major participant in mutual funds and institutional management, managing assets of about $1.4 trillion. 4-T.Rowe Price: Located in Baltimore, it is a globally recognized active investment management company, managing assets of about $1.31 trillion. 5-KKR: Located in New York, it is a global investment firm with influence in private equity, managing assets of about $429 billion. 6-Apollo: Located in New York, it is a highly regarded alternative investment management company, managing assets of about $461 billion. 7-WisdomTree: Located in New York, known for ETFs and innovative investment solutions, managing assets of about $75.5 billion. 8-ANZ: Located in Australia, it is one of the largest banks in the country, with a significant position in the financial services sector, not primarily based on assets under management (AUM). 9-Citi: Located in New York, it holds an important position in consumer banking and global finance, not primarily based on assets under management (AUM). 10-Republic: Located in New York, it is a leading Web3 platform, focusing on private investment and securities, with unspecified assets under management.

In addition, Avalanche also collaborates with top global enterprises such as IEEE, TSM, and ST.

The above collaborations are closely related to Avalanche's strong emphasis on compliance. Not long ago, the SEC released a list of tokens defined as securities, including SOL, MATIC, and many other leading public chain projects, but AVAX was not included.

The above collaborations are closely related to Avalanche's strong emphasis on compliance. Not long ago, the SEC released a list of tokens defined as securities, including SOL, MATIC, and many other leading public chain projects, but AVAX was not included.

Combined with Avalanche's feature of customizable subnets, we can still expect more enterprises to cooperate with it in the future.

2. DeFi

Traderjoe: The largest DEX on Avalanche

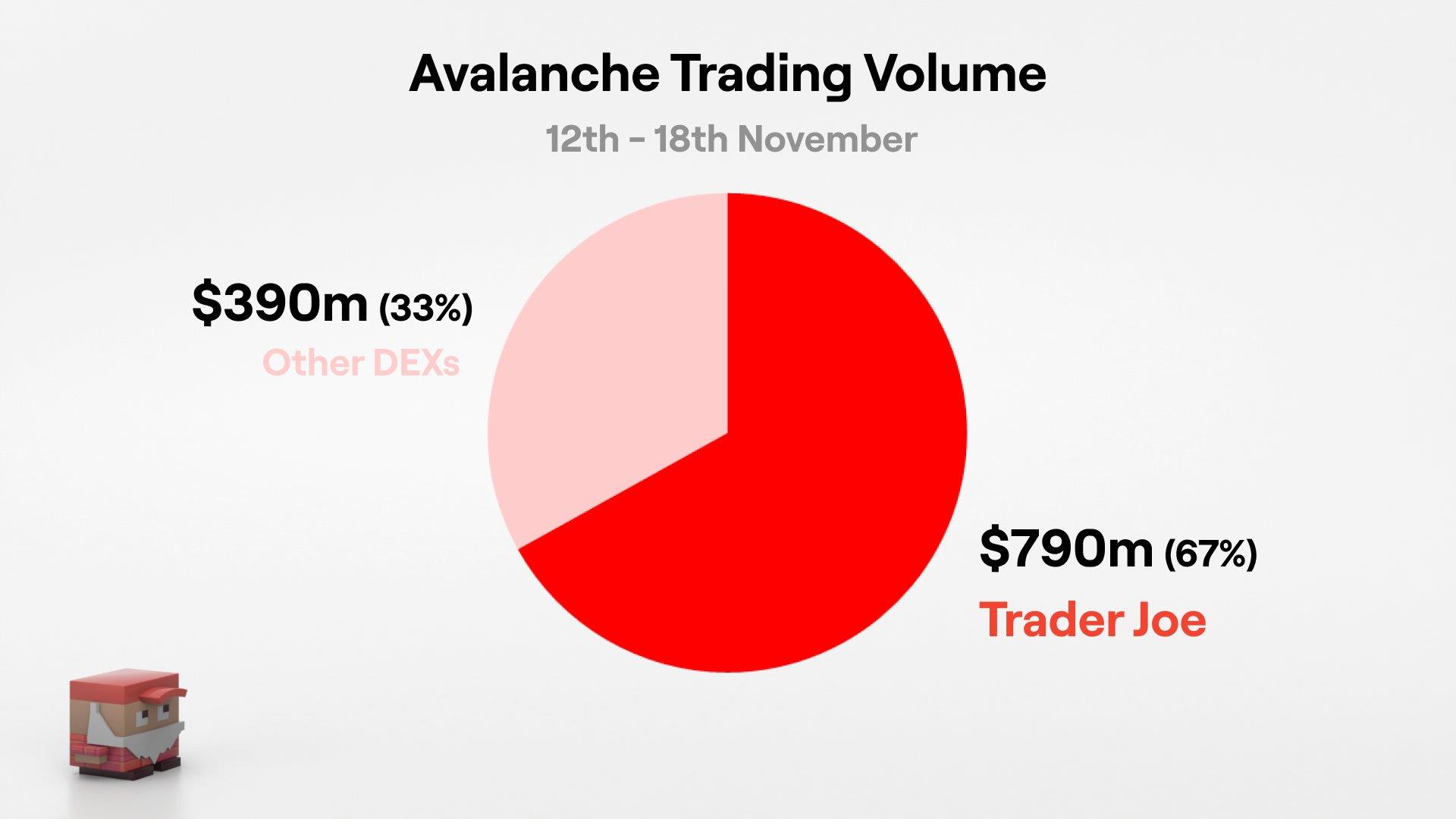

When it comes to DeFi, most of the trading volume on Avalanche occurs on Traderjoe. According to data from November 12th to November 18th, Traderjoe's volume on Avalanche accounted for 67%, making it the undisputed Top DEX.

TraderJoe was born in 2021 and underwent a comprehensive rebranding earlier this year, while also launching the Liquity book on its product, which performed well during the arbitrum airdrop period. For a detailed introduction to Liquity book, refer to the article: "Compared with Uniswap V3, what problems does Trader Joe's Liquidity Book solve?"

Regarding future development, the co-founder recently publicly shared some of his plans on Twitter. However, for users, the most direct space to participate in the near future is the Layerzero airdrop.

Currently, $JOE has been deployed on Avalanche, arbitrum, and BNB Chain. Users can use the Bridge button on the official website's homepage to cross their $JOE to different chains, and Layerzero provides cross-chain solutions for $JOE.

Steakhut: Liquidity management solution based on Trader Joe

SteakHut provides an automated liquidity management solution for LPs, initially serving TraderJoe. Thanks to TraderJoe's recent gains, SteakHut's token $STEAK also saw a 400% to 500% increase within a month.

Recently, SteakHut has completed its seed round of financing and will expand its vision to provide better liquidity management solutions for the entire Avalanche ecosystem. For a more detailed introduction to SteakHut, refer to the article: "Detailed explanation of SteakHut: Liquidity management solution based on Trader Joe"

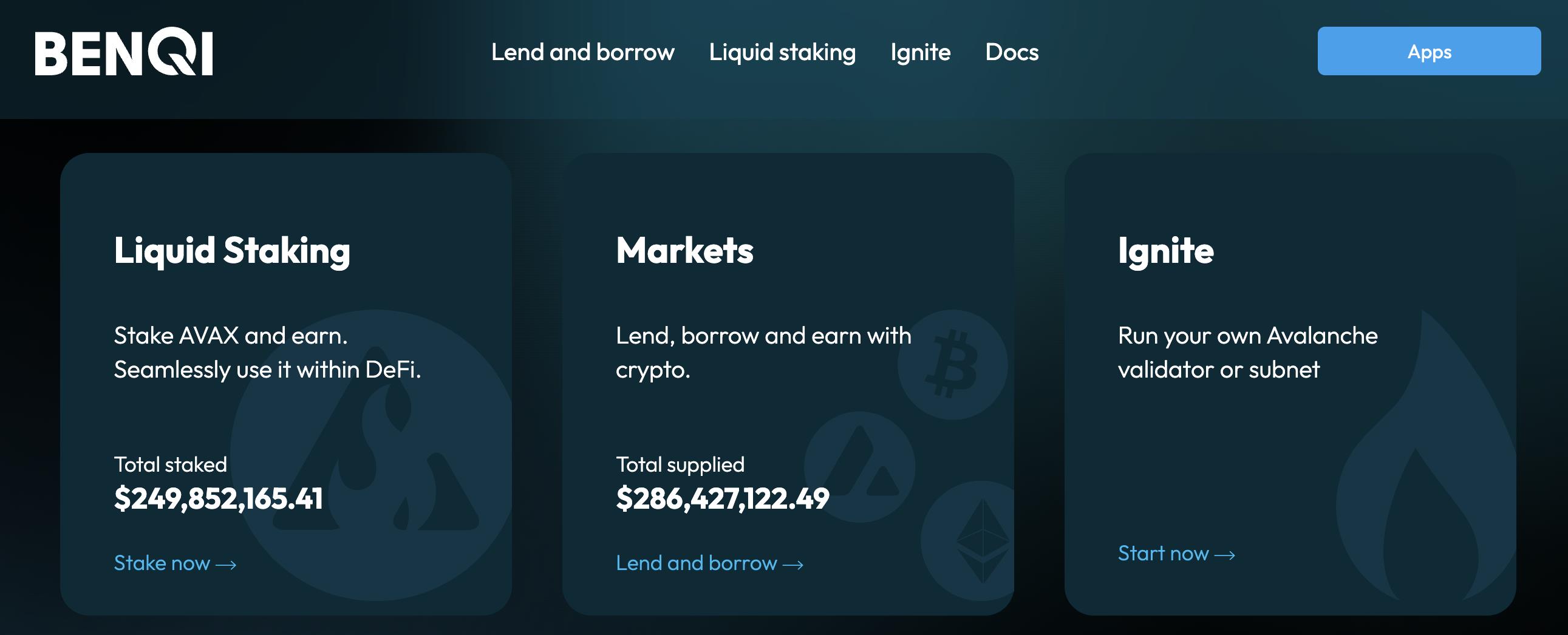

Benqi: The largest lending and liquidity staking protocol on Avalanche

Benqi is one of the most important protocols in the Avalanche ecosystem, providing lending and liquidity staking services for Avalanche, and currently has the highest TVL in the Avalanche ecosystem.

Benqi has a long history in the Avalanche ecosystem, and whenever $AVAX performs well, its token $QI often receives more attention. Additionally, $QI is the only token in the Avalanche ecosystem listed on Coinbase.

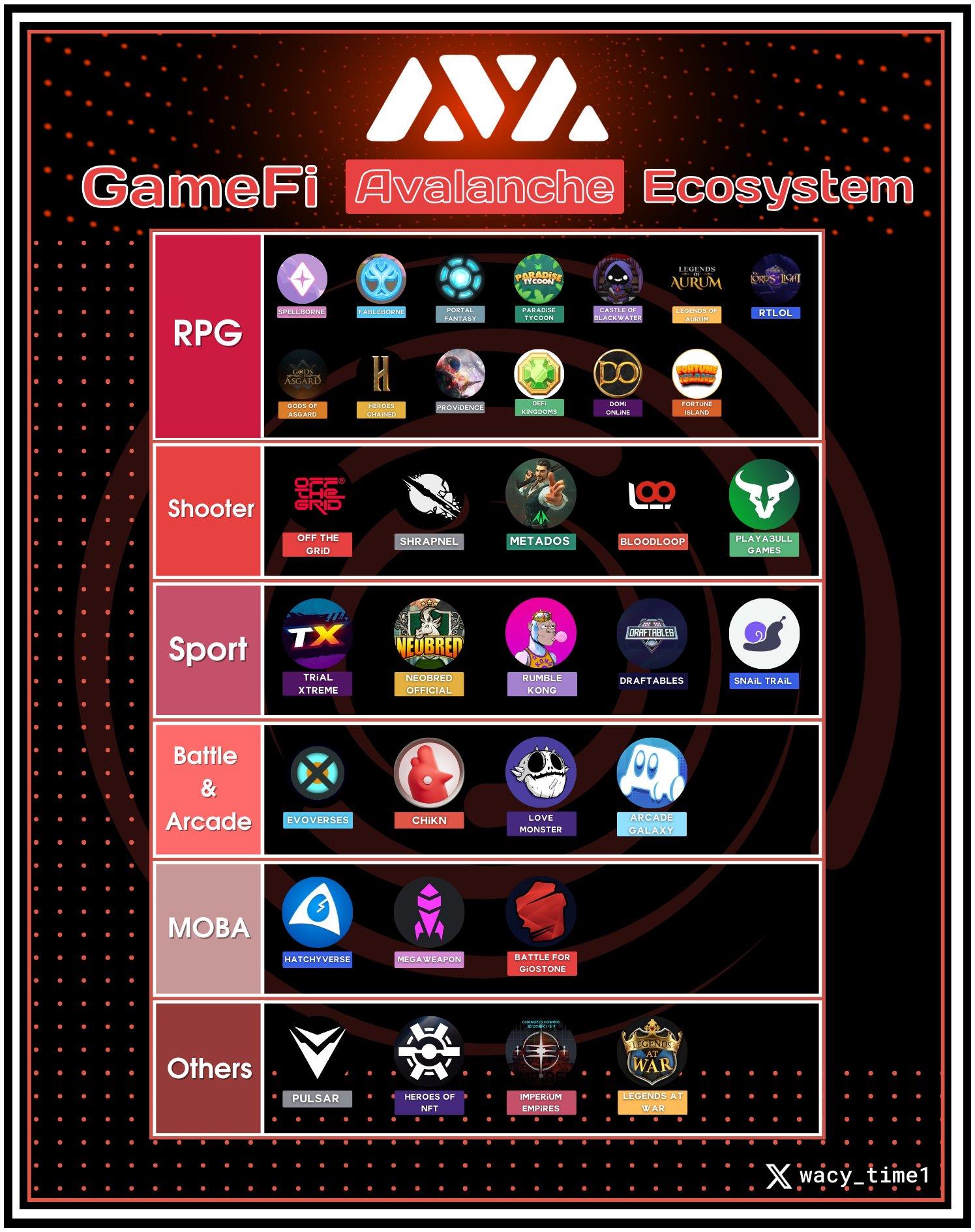

3. GameFi

Shrapnel: The hottest AAA chain game on Avalanche

Shrapnel is a project launched in early 2022. We previously did a detailed video explaining its whitepaper and prospects, which interested friends can watch for more information: SHRAP|Shrapnel Avalanche's 3A shooting chain game, encouraging independent creation

This game has recently gained popularity mainly because its token $SHRAP has been on an upward trend, with the current FDV exceeding 1 billion.

Shrapnel has released some promotional videos in the past and has conducted offline testing at many Avalanche events, with generally positive feedback. Additionally, two months ago, the project received another $20 million in financing led by Polychain.

Due to Shrapnel's influence, more and more users are starting to pay attention to the gaming ecosystem on Avalanche. However, overall, apart from Shrapnel, there are currently no particularly outstanding games. Previously, the highly anticipated Defikingdoms and Ascenders experienced situations such as online bugs and soft rugs.

However, based on the current community's enthusiasm, games such as Off The Grid (launched by Gunzilla Games), BloodLoop, and Defikingdoms are more discussed within the community.

4. NFT

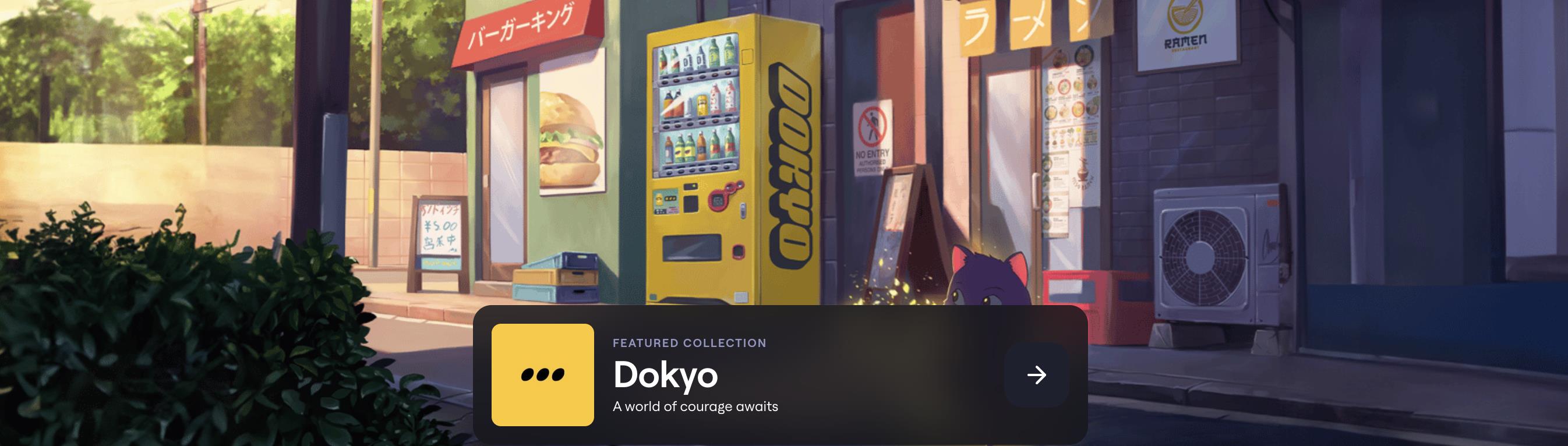

Dokyo: Currently the hottest NFT in the Avalanche ecosystem

If you pay attention to the Avalanche ecosystem, you will see many people using Dokyo avatars. The NFT has a total of 5,555, with a current floor price of 37.5 $AVAX. The known founding team member is 0xBrando.

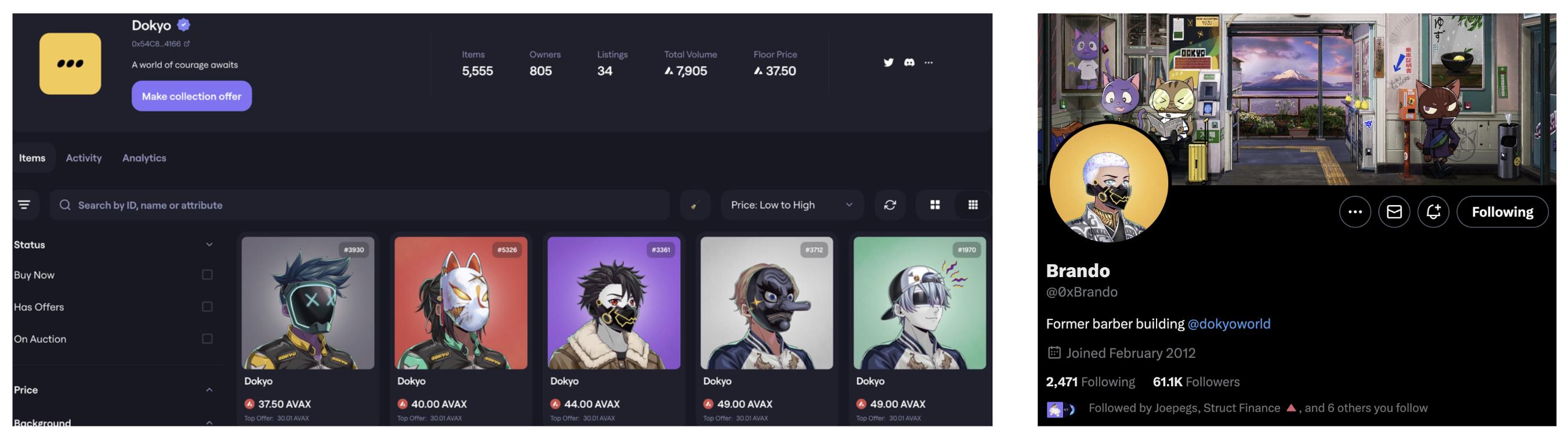

Smol joes/Joe Hat: NFT project launched by the TraderJoe team

Smol joes/Joe Hat: NFT project launched by the TraderJoe team

The TraderJoe team also launched their NFT platform Joepegs and secured several million dollars in financing from FTX and Avalanche. They later launched multiple NFT projects, but currently, the core developments are only the Smol Joes and Peon projects.

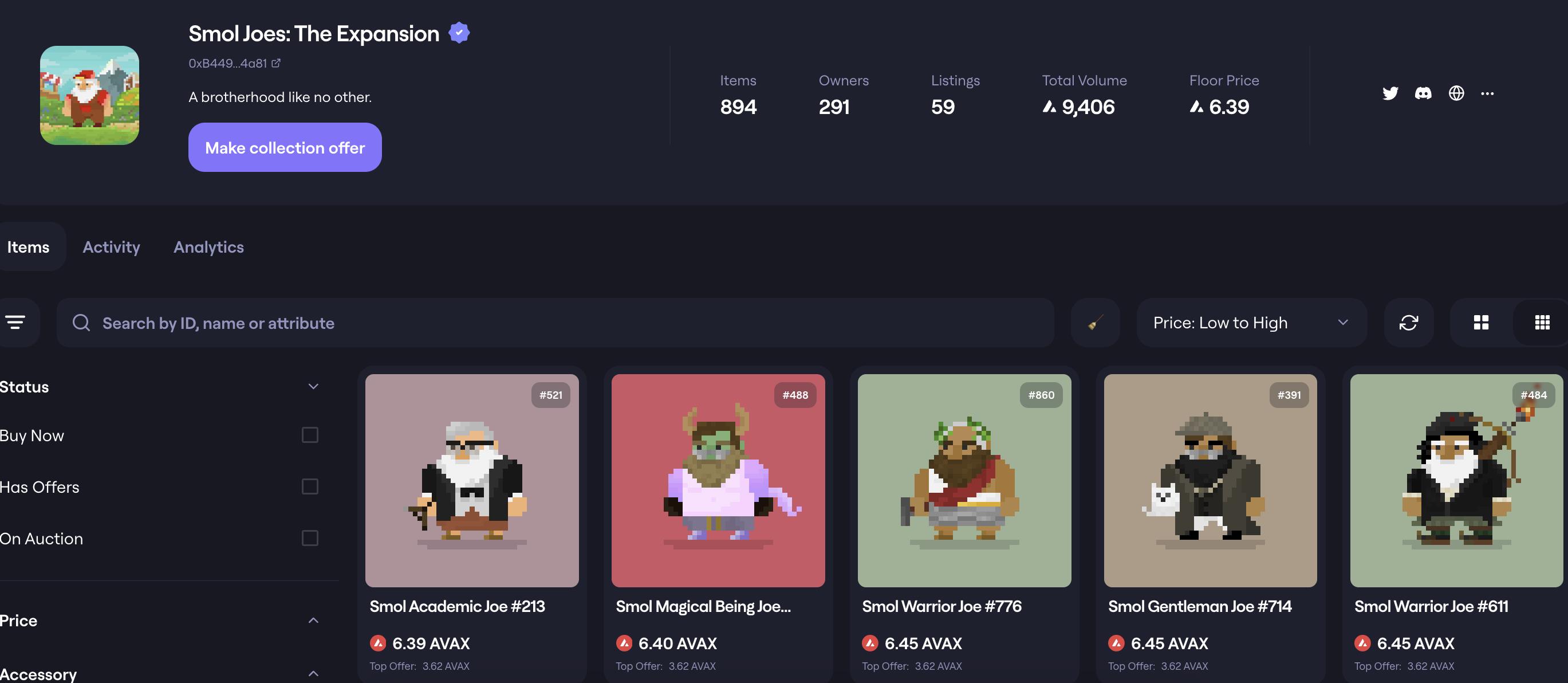

In addition, back in 2021, the TraderJoe team launched the Joe Hat project, similar to Uniswap's unisocks, with a total of 150 tokens. Owning $HAT allows the exchange for a real-world hat.

Recently, Joe Hat has been hyped by "mysterious forces," and its price has reached an all-time high. It has also gained high discussion on Avalanche. However, the market fluctuates greatly, so cautious attention is advised.

5. meme

5. meme

Husky: Bonk on Avalanche

Husky is the first "dog" on Avalanche, almost a universally known meme project.

The project has been launched for over two years, but it's only recently that it has seen a very exaggerated increase in discussions about Avalanche memes.

Coq: The newest meme launched only 3 days ago

$COQ is a meme project launched on December 8th by @WojakSatoshi. After the project went live, the community's enthusiasm surged, and it has been on an upward trend, with the current FDV at 18 million, surpassing Husky.

However, it's important to note that Coq has declared on its official website that it has no relation to the previous "Avalanche chicken" chikn, which was a well-known Ponzi game on Avalanche.

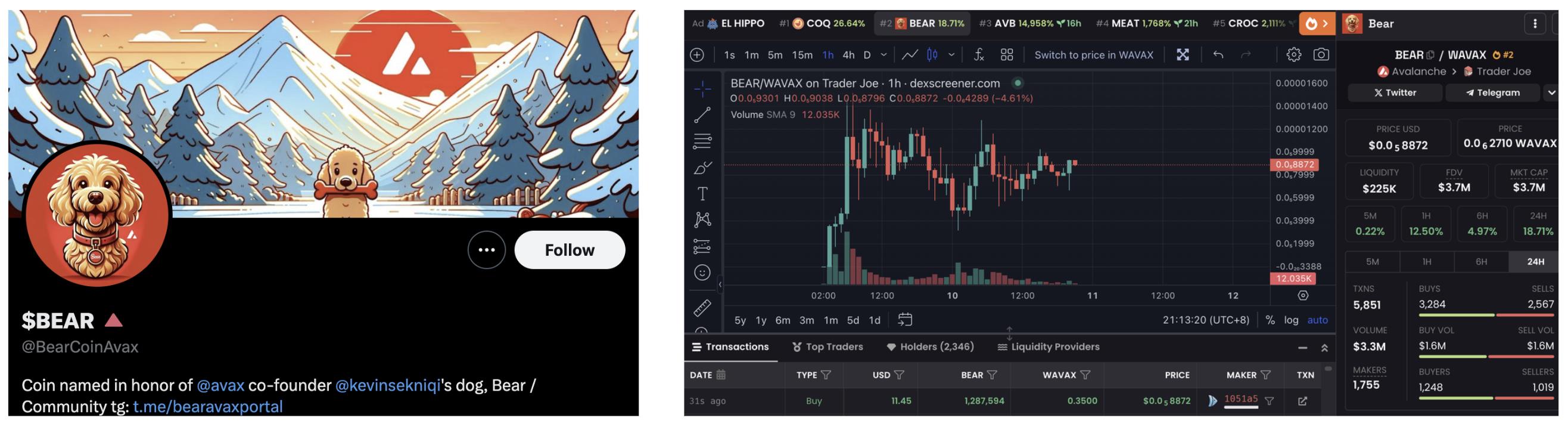

Bear: "Dog" of Avalanche Co-founder

$BEAR was launched on December 9th, originating from Avalanche co-founder Kevin posting his dog on social media, which led to users creating memes with the name "BEAR."

The project has only been live for one day and has experienced significant market fluctuations. This information is shared for informational purposes only and should not be considered as investment advice.

6. Others

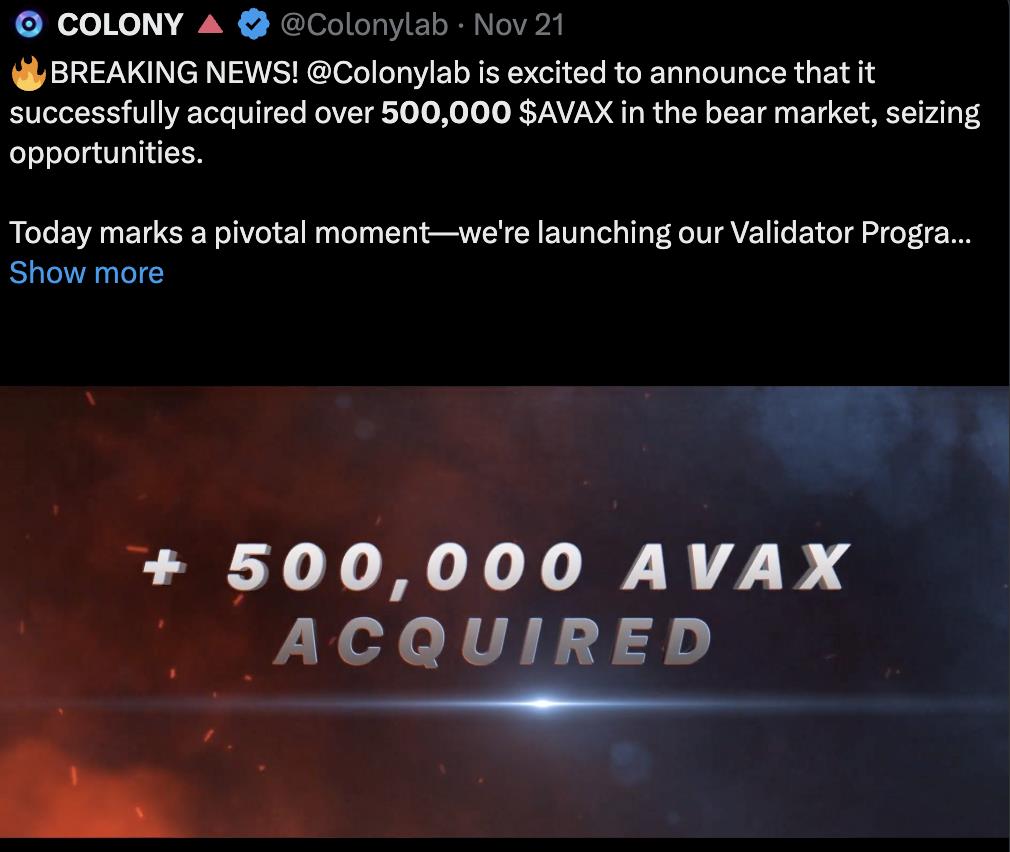

Colony: Aggregation platform supporting early projects on Avalanche

Colony, launched in 2021, has recently gained widespread attention primarily because it introduced a fund of over $10 million for the development of Avalanche ecosystem projects. This is due to Colony accumulating $AVAX tokens during the bear market, with the treasury currently holding over 500,000 $AVAX, valued at approximately $15 million.

The Colony token $CLY has also seen a recent increase of 385.5%, with a current market value of $24 million and FDV of $38 million. Holding and staking $CLY tokens will provide opportunities for:

1- Participating in early investments in projects supported by Colony

2- Airdrops for investing in Colony projects

3- Receiving Avalanche validator incentives

4- Receiving $CAI airdrops (Avalanche index fund launched by Colony)

5- Receiving $CLY airdrops (from Colony's protocol income, such as unstake fees)

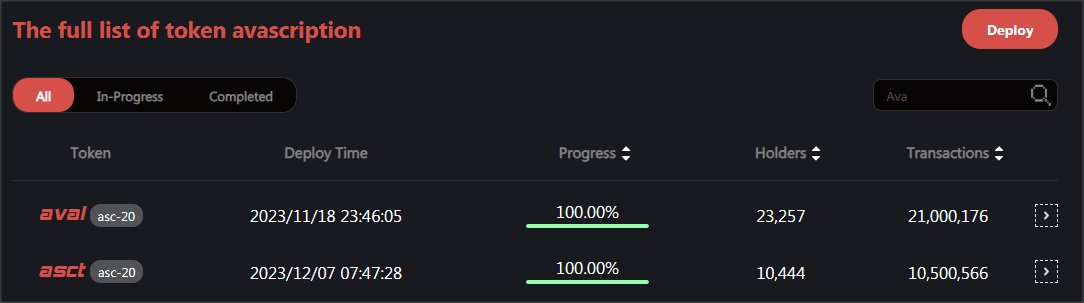

Aval: The most well-known inscription on Avalanche

Following the trend of inscriptions on other public chains, Avalanche has also introduced the asc-20 token, with aval being the most discussed in the community. Currently, the OTC price is 0.2u, with moderate popularity.

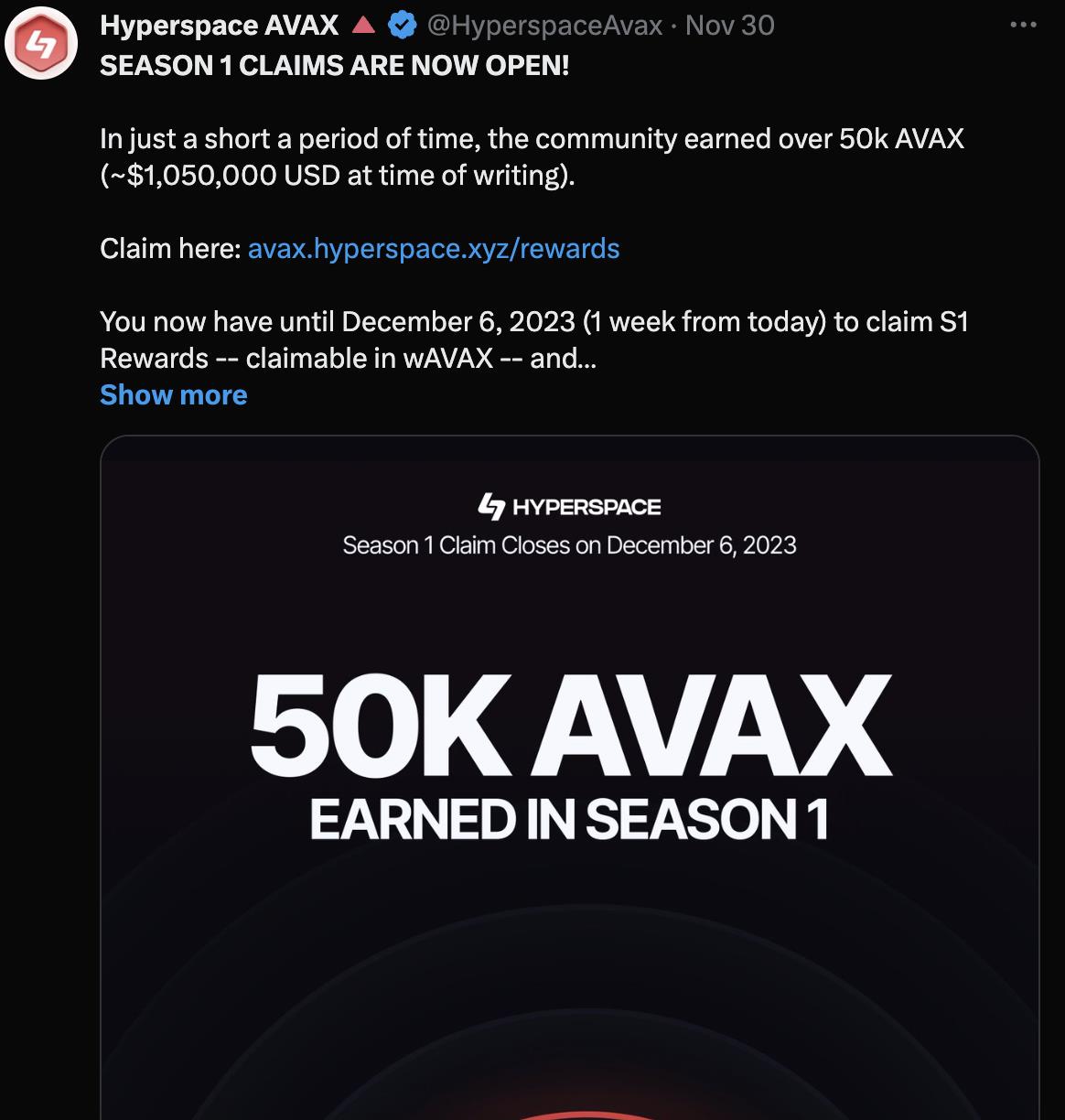

Hyperspace: New NFT platform, can earn points by completing tasks

Hyperspace is a well-known cross-chain NFT platform that has launched a task-based points earning activity on Avalanche, with rewards in $AVAX. In the recently concluded Season 1, over one million dollars in incentives were distributed.

However, there were previous announcements of over one million $AVAX rewards, which significantly differs from the current incentive amount, leading to some FUD in the community. Season 2 has also begun.

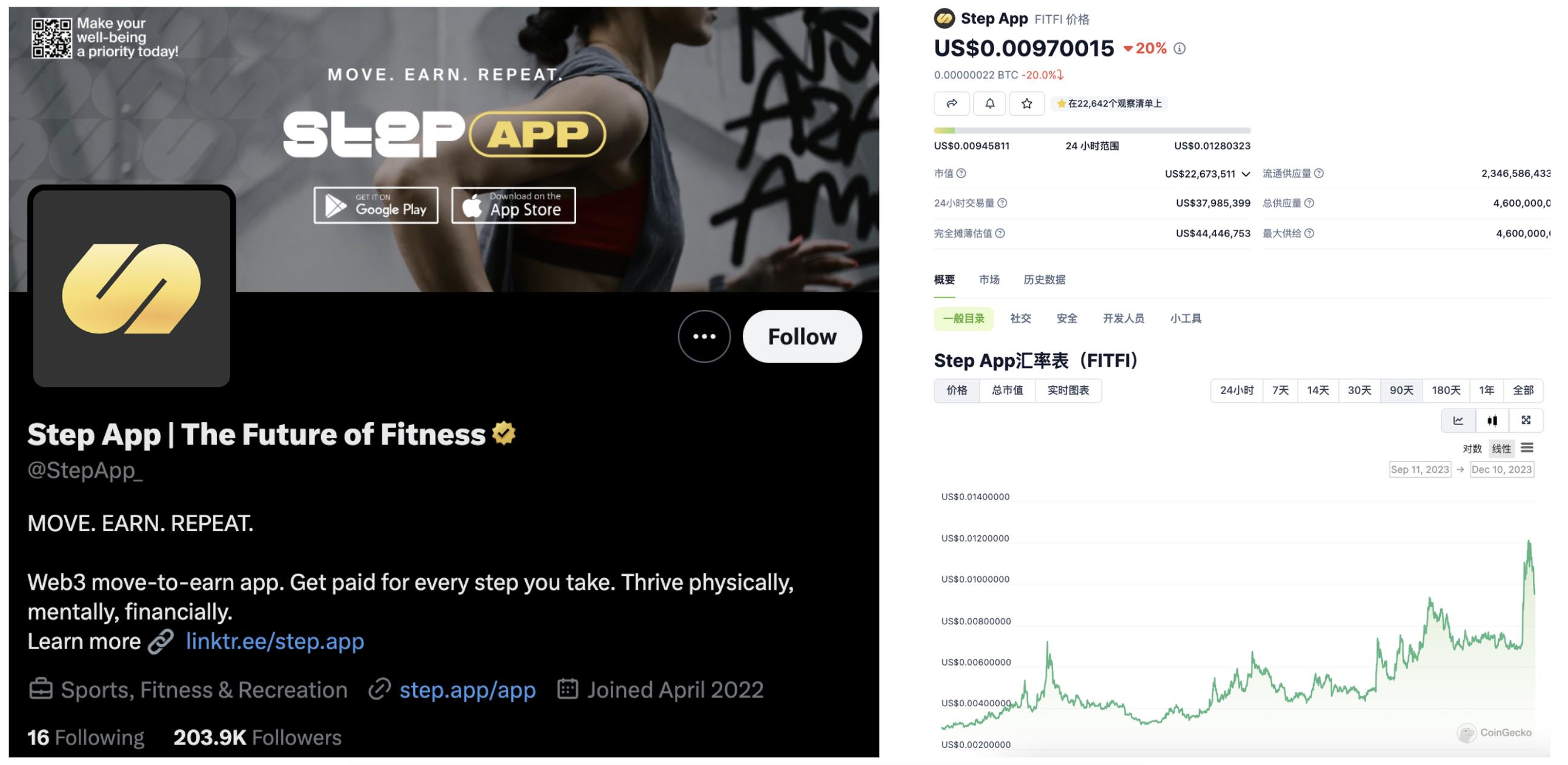

Fitfi: StepN on Avalanche

StepApp is a running shoe simulation on Avalanche, and recently, due to a rebranding plan, some Avalanche users have started discussing it, leading to a 95% increase in the $FITFI token within 30 days.

After several years of development, the Avalanche ecosystem currently has over 350 protocols and applications. Additionally, many projects have gradually ceased operations or experienced soft rugs. The following provides a relatively comprehensive overview of the Avalanche ecosystem projects.

Please note that this article is only a compilation of key information and does not constitute investment advice. Interested individuals are welcome to join the Avalanche community group (link) to share and discuss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。