If you insist on comparing cryptocurrency to stocks, then the current NFTs are stronger than the stamp craze 30 years ago.

Author: Wang Jun, founding partner of inpower

Almost the entire coin circle is "collecting NFTs"!

Last night, the Fil NFT was released, and it was sold out by the morning.

People outside the circle are anxious, not knowing how to buy.

1. What is an NFT?

For the technical details of NFTs, those interested can search for them on their own.

If Bitcoin's earliest definition is a peer-to-peer payment system, then NFTs are more like payment notes.

And because of some updates, the data size of these notes can become very large, large enough to hold relatively small images.

It even sparked some controversy with core developers.

But all of this has not affected the crazy rise in NFT prices.

Hegel said "existence is rational," but I believe more in what the Bible says, "there is nothing new under the sun."

Finding similar things is more helpful for us to seize opportunities (or avoid pitfalls).

If you insist on comparing cryptocurrency to stocks (stop comparing cryptocurrency and stocks, this is too insulting to cryptocurrency), then the current NFTs are stronger than the stamp craze 30 years ago.

If we follow this analogy, we can probably understand it like this:

Bitcoin ecosystem - Market of a certain country

Ordinals protocol - Postal service of a certain country

Various NFTs on Brc20 - Various series of stamps in a certain country

NFTs on other public chains - Series of stamps in other countries

2. There are also countries that make issuing stamps their main business

I don't know if NFTs can support a public chain, but the stamp issuing business can support a country.

Liechtenstein is a legitimate European country, and it speaks German.

Stamps are one of the important economic sources of this country, and during good times, they can account for 10% of the national economy's total income.

According to the experience of stamp issuance in Liechtenstein, a few key points must be mastered in stamp issuance:

First, the stamp design must be fresh, with coordinated colors and exquisite printing. (Design must be top-notch)

Second, the printing quantity is small, with each stamp basically stable at less than 1 million, of which 80% are collected by stamp collectors. In other countries, the printing quantity of stamps ranges from 20-100 million, with most used for postage. (Small quantity of NFTs)

Third, the number of stamp sets issued each year is very small, with only about 12-25 stamps issued, each with a print run of over 500,000, of which only 20% are used for mailing, so most stamp enthusiasts can afford to buy and collect them. (Few types of NFTs)

3. The stamp market was hot and NFTs were sold out in seconds

Of course, there are also countries that do not adhere to the above second/third points, but can still issue good stamps.

This generally requires mastering another unique skill:

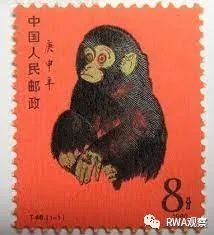

In 1980, the "Monkey Stamp" was issued, which was the first zodiac stamp issued by the People's Republic of China.

This type of stamp can be considered for collecting purposes, and this year can also be considered the first year of NFTs.

The face value of the Monkey Stamp soared from 0.08 yuan to over 2000 yuan, an increase of over 20,000 times.

At that time, the stamp scene was like this:

In April 1985, when the "Plum Blossom" miniature sheet was issued, people rushed to buy stamps. A queue a meter wide and several kilometers long stretched from the China Stamp Company's branch office at Ping'anmen in Beijing to Xuanwumen, with about 30,000 people. The public security department was afraid of trouble, so more than 100 police officers were deployed to maintain order. In Shanghai, Nanjing, and other places, the doors and windows of stamp companies were broken, and counters were overturned. (High gas fees for NFTs)

Subsequently, the State Post Bureau gradually increased the issuance quantity of stamps, with issuance quantities of 30-50 million being quite common, and some even issuing over 100 million. For example, the "Panda" miniature sheet issued in 1985 had a print run of over 12 million, which was an "enormous quantity" compared to the previous miniature sheets with print runs of only several hundred thousand to several million. Compared with the "Return of Hong Kong" miniature sheet issued in 1997 with a print run of over 50 million, it was even more insignificant. (Various NFTs being mass-produced)

At the same time, the number of stamp collectors rapidly expanded. One set of data shows that in 1980, there were only over 100,000 members of the national stamp association, which had increased to 5 million by 1985, reached 8 million in 1990, and surged to 15 million in 1994. (Participation increased by 100 times)

The stamp market at its peak was like this: it was difficult to buy early Republic of China stamps and actual mailing envelopes. Professional stamp collectors likened this form of stamp market to a "wholesale market," where the main feature of this market was "wholesale" transactions dominated by new stamps, and stamps could be sold in large quantities like selling cabbages, which was unique in the world! (Just get used to it)

At the same time, the State Post Office also implemented four measures to destroy stamps. In 1996, the China Post destroyed stamps for the first time. The big stamp market emerged in 1997; in 2001, the Post Office once again raised the flag of destruction, but the quantity and types of destruction were still not made public; in the first half of 2003, the Post Office raised the flag of destruction for the third time, reportedly destroying stamps with a total face value of 1.19 billion yuan; in 2004, stamps with a face value of up to 3 billion yuan were destroyed, becoming the largest-scale destruction measure in the history of China Post. (Destruction mechanism has been in place for a long time)

However, stamp collectors found that although the scale of destruction of stamps by the postal service continued to increase, the market stimulation after each destruction was weaker each time. Some stamp collectors pointed out that the so-called destruction of stamps was not made from the perspective of the stamp collecting business, and the postal management department was only repairing this broken "ATM" for itself. (Investors awakening)

The stamp market still exists today, but the stamp market of a certain country has almost disappeared.

4. How do NFTs compare to stamps?

From the above, the main pain points of the stamp market of a certain country are:

- Too large issuance quantity

- Unable to buy high-quality stamps (early Republic of China/actual mailing envelopes)

- Lack of transparency in destruction/inventory situation

- The management department only shears the sheep, without considering the stamp collecting business

For NFTs, the situation is better in some aspects:

- High-quality NFTs are public (various top-tier ones), so they are not unavailable

- Destruction/inventory situation is transparent and publicly available

- Various NFTs compete freely, without a governing body. (Similar to being able to buy stamps from various countries in the market)

5. What stage are we at now?

Let's talk business, and CX talks CX

The most important thing in the speculation of the stamp market is to mobilize the masses. Initially, stamp collecting was a niche activity with only tens of thousands of participants nationwide, but it has become a public cause with tens of millions of participants nationwide, or using the trendy term, a social experiment.

Although the NFT market is currently booming, the holders of mainstream NFTs are only around 10,000, so there is still a lot of room for growth.

Perhaps the number of holders needs to increase at least tenfold to be considered a successful speculation. Otherwise, it's just self-indulgence within the circle.

Referring to the stamp market, we are at most in the early 1980s.

It's still a bit difficult to get into NFTs now, and buying NFTs is not easy either.

The establishment of a trading market is a necessary condition for a bull market.

P.S. Some people might ask, why not use NFT for comparison instead of NFTs?

Um…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。