Authors: Matthew Sigel, Patrick Bush

Compiled by: Luffy, Foresight News

1. The US Economic Recession is Coming, and Spot Bitcoin ETF Makes Its Debut

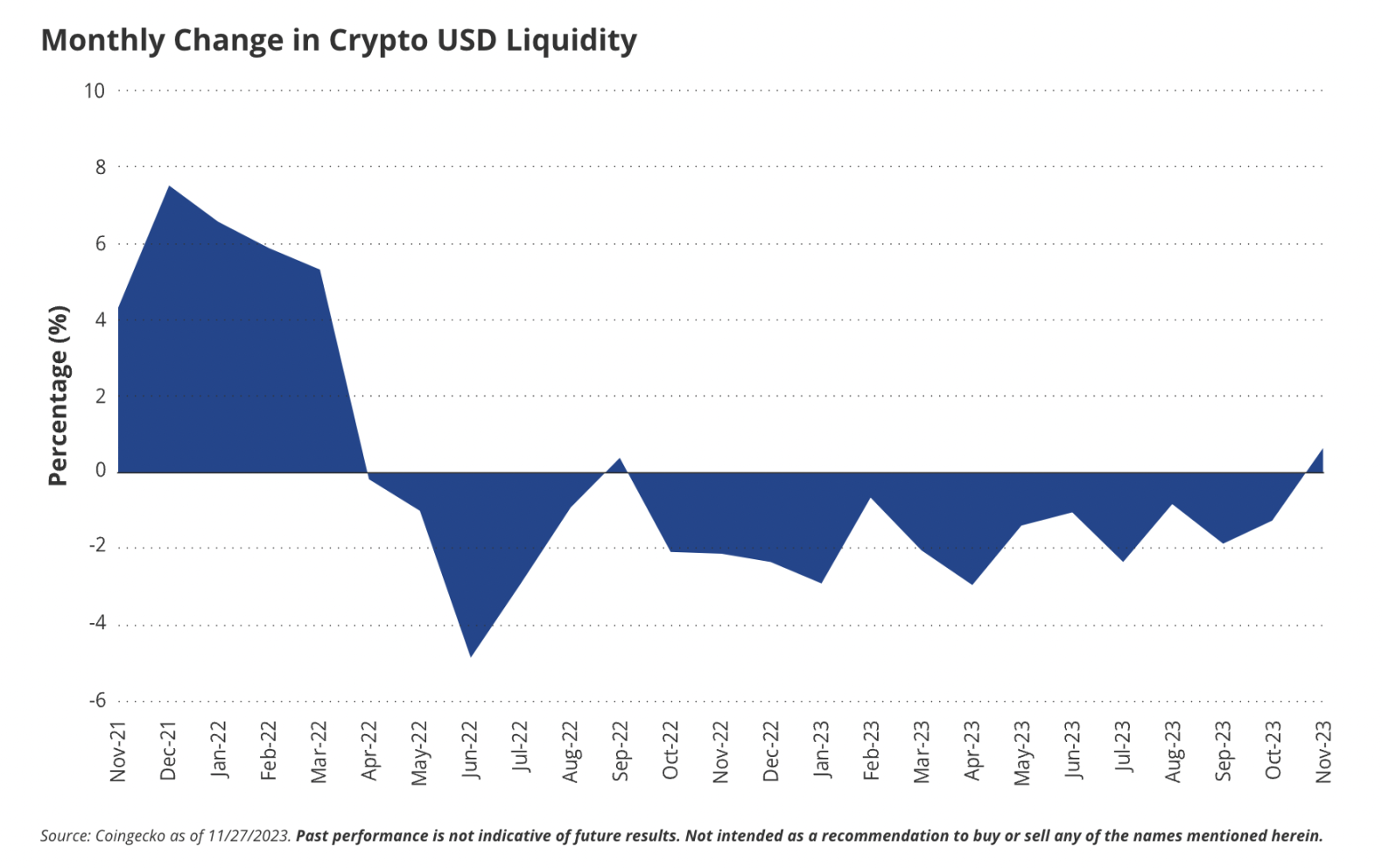

The US economy is expected to finally enter a recession in the first half of 2024. Economic growth has been slowing for several months, and inflation has cooled, making the economy more vulnerable to shocks. After 19 consecutive months of decline, leading indicators in the US have now entered the recession phase, approaching historic lows. Stock prices are struggling, commodities are weak, employment is weak, corporate bankruptcy filings have returned to early levels of the COVID-19 pandemic, and the yield curve has inverted but has become steeper in recent weeks — all signs of the late stage of the economic cycle. The media frequently mentions a "soft landing," which usually occurs before the formal announcement of an economic recession. Bitcoin has only experienced one official US economic recession, from January to April 2020, during which the price of Bitcoin plummeted by 60% from its peak and then rebounded significantly after the Federal Reserve provided ample liquidity. Gold also tends to decline in the early stages of an economic recession: it dropped by 12% in two weeks in March 2020. However, the recent breakthrough of gold confirms the strong demand for hard currency by US authorities, a characteristic shared with Bitcoin. Due to concerns about debt levels at the national level being more worrisome than at the corporate or household level, we expect over $24 billion to flow into the newly approved US spot Bitcoin ETF in the first quarter of 2024, driving up the price of Bitcoin. Despite the possibility of significant volatility, it is unlikely that the price of Bitcoin will fall below $30,000 in the first quarter of 2024.

We estimated the inflow of the Bitcoin ETF by referencing the SPDR Gold Shares (GLD) ETF. The GLD ETF was launched on November 18, 2004, and attracted approximately $1 billion in inflows in its first few days. By the end of the first quarter of 2005, GLD had attracted approximately $2.26 billion in inflows. At that time, the total supply of physical gold was approximately 152,000 tons, with a value of approximately $15.6 million per ton, resulting in a total market value of $2.36 trillion. In the first few days after the launch of GLD, the inflow of US dollars into GLD accounted for approximately 0.04% of the total market value of the gold market. Approximately a quarter later, on March 31, 2005, the inflow into GLD reached $2.26 billion, accounting for approximately 0.1% of the global gold supply, taking into account supply growth and changes in gold prices. If we apply this data to the Bitcoin spot market, we estimate that the initial inflow of the Bitcoin spot ETF will be around $310 million, and the inflow over a quarter will be approximately $750 million.

However, that was a time of higher interest rates and much lower money supply. In 2023, we are no longer in the "Dead Ball" era of finance, but are entering the HGH/Steroid era. According to data from the Federal Reserve Bank of New York, the M2 money supply in November 2004 was $6.4 trillion, while in October 2023, it was $20.7 trillion. Therefore, we believe that it is reasonable to expand the inflow of funds into the Bitcoin spot ETF by 3.23 times. Thus, the initial inflow of funds into the spot Bitcoin ETF will be around $1 billion, and the inflow over a quarter will reach $2.4 billion. Extending our logic further, the more mature state of the Bitcoin ETF may account for approximately 1.7% of the total supply of the Bitcoin spot market (approximately $125 billion), a proportion similar to the total supply of gold held by the gold ETF. We assume that Bitcoin is taking away significant market share from gold and expect that voters in 2024 will have a better understanding of the drawbacks of debt-driven money printing. Therefore, we apply the 3.23 times multiple of M2 to estimate that the mid-term inflow of the Bitcoin ETF in the two years before trading will be $40.4 billion.

Finally, we note that Coinbase charges retail traders approximately 2.5% in fees. We believe that the trading spread of the spot Bitcoin ETF may be around 10 basis points, with zero commission for many brokerage firms. This means that the spot ETF can provide users with significant cost advantages.

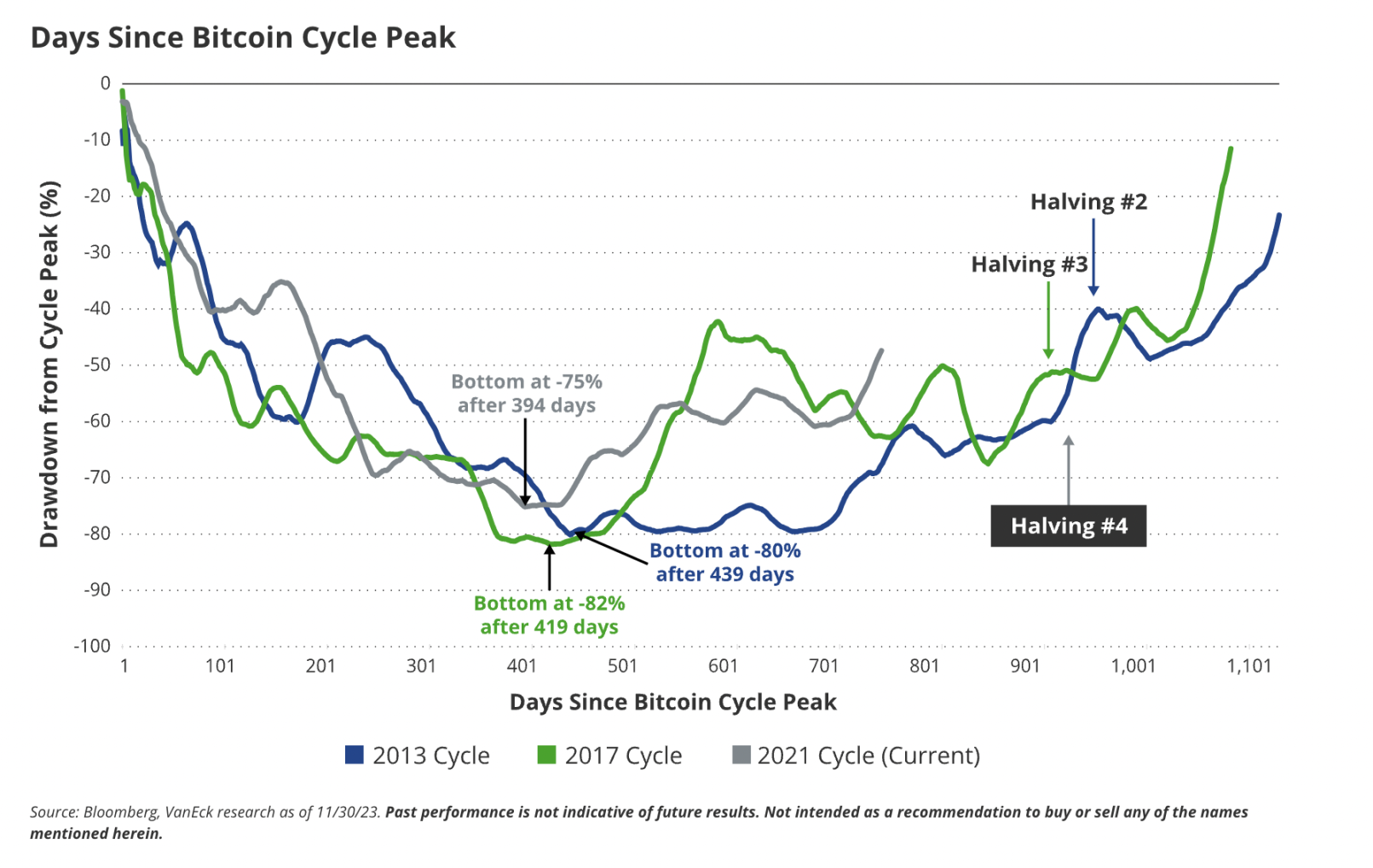

2. The Calm Fourth Bitcoin Halving

The fourth Bitcoin halving will take place in April 2024 without any major forks. With the new coin issuance halved, unprofitable miners will exit, giving market share to those with low-cost electricity. Nevertheless, due to the significantly improved balance sheets of listed miners, the public market will not be greatly affected, as these miners currently control a record percentage of global hash rate (approximately 25%). After a brief period of consolidation (from a few days to a few weeks) following the halving, the additional selling pressure from unprofitable miners will be absorbed by the market, and Bitcoin will rise to over $48,000, the neckline position completed in April 2022. Overall, the performance of Bitcoin miners will be lower after the halving, but low-cost miners CLSK and RIOT will stand out. After the halving, we expect that at least one publicly listed miner will achieve a tenfold increase by the end of 2024.

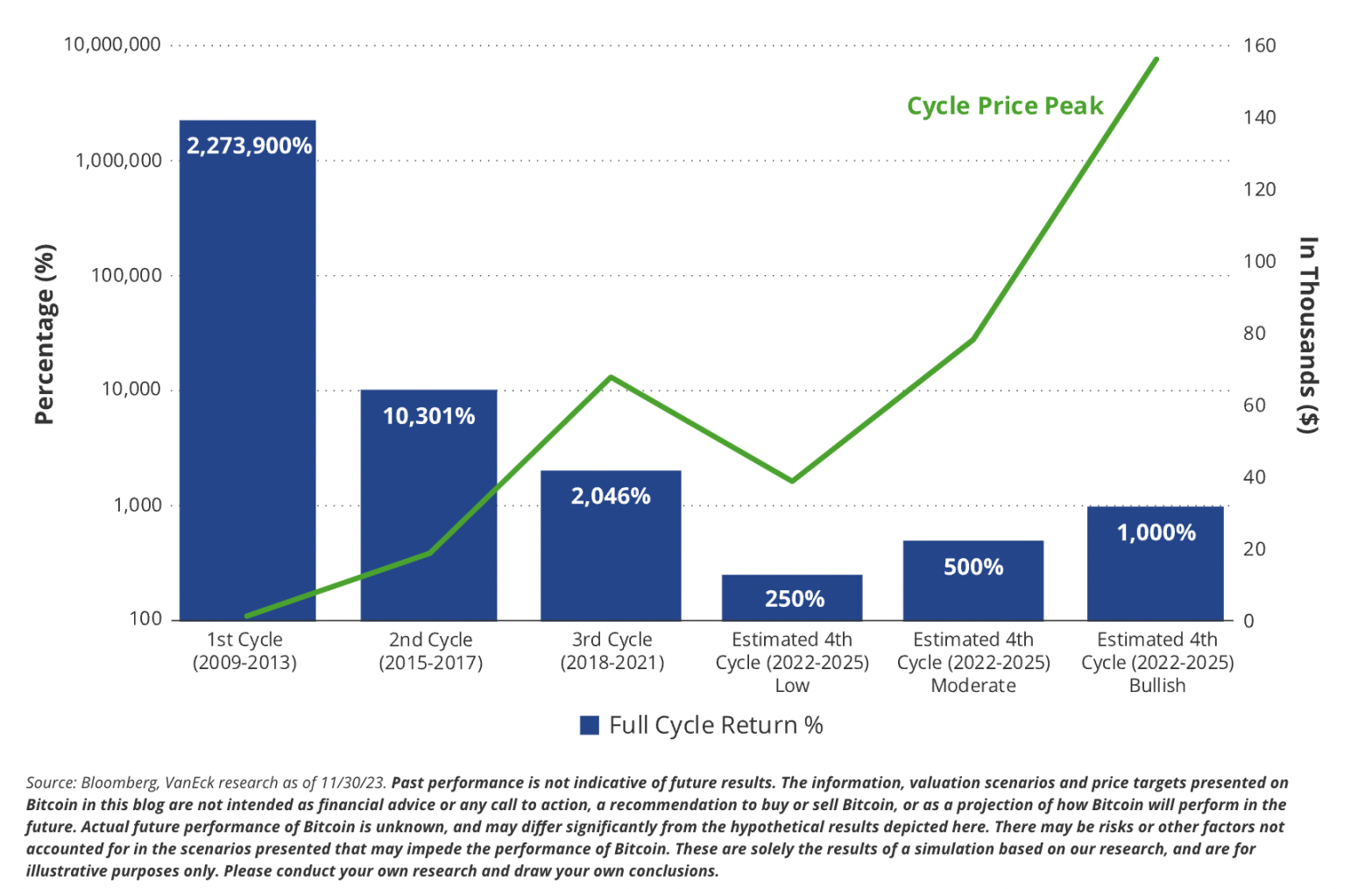

3. Bitcoin Will Hit a Historic High in the Fourth Quarter

In the second half of 2024, Bitcoin will break through the wall of worries. By 2024, the percentage of the global population voting in legislative and presidential elections will reach a historic high of over 45%. Such a high level of important elections indicates high volatility and significant changes in prospects. More specifically, there is increasing evidence that voters and courts are rejecting the anti-growth agenda of green lobbying groups. Therefore, after Donald Trump wins 290 electoral votes and is re-elected as president, people will be optimistic about the abolition of the SEC's hostile regulatory approach. We believe that the price of Bitcoin will reach a historic high on November 9, three years since the last historic high. (Recall that Bitcoin's breakthrough in November 2020 also occurred exactly three years after the peak in November 2017). If Bitcoin reaches $100,000 by December, we predict that Satoshi Nakamoto will be named "Person of the Year" by Time magazine.

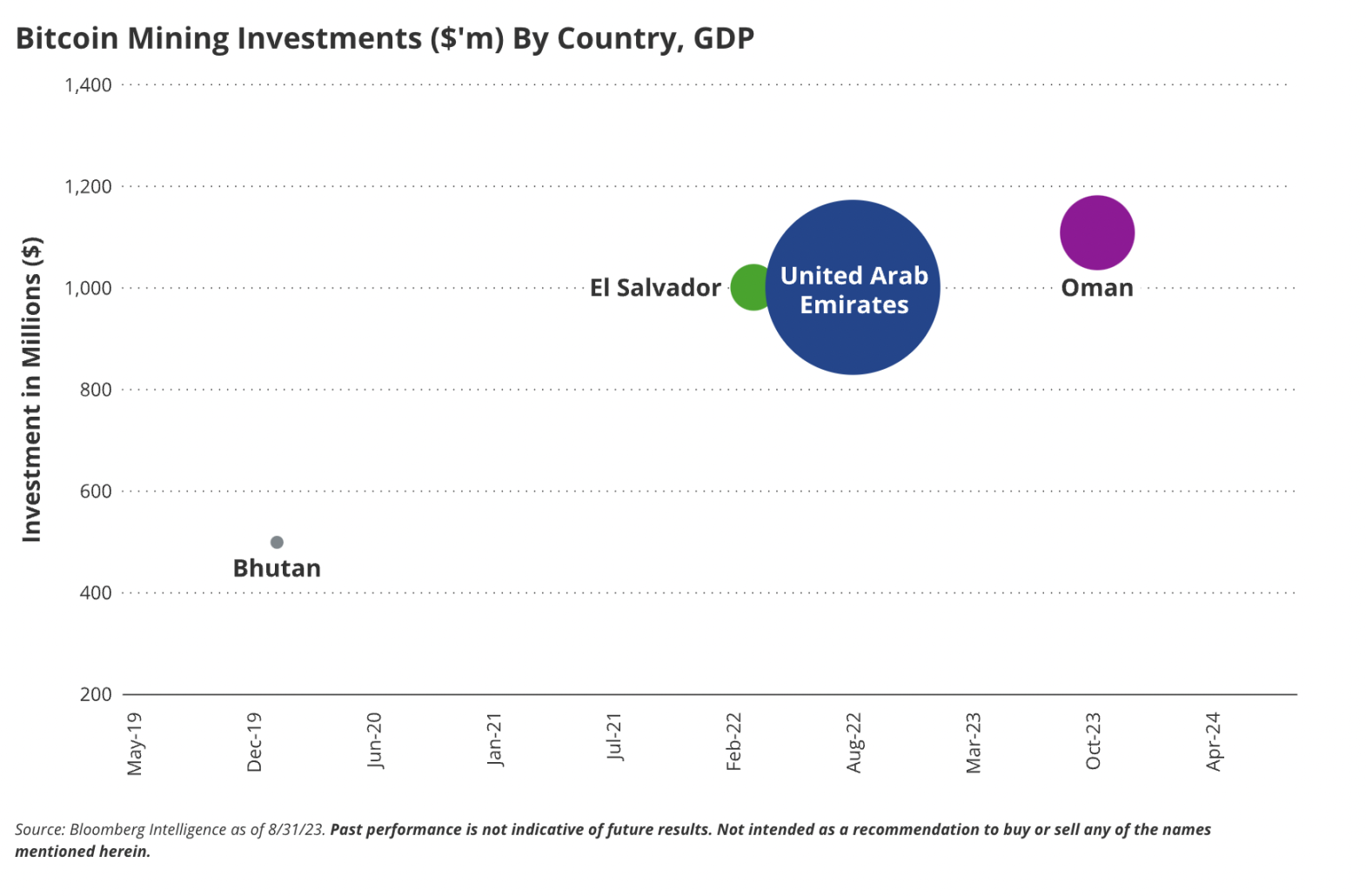

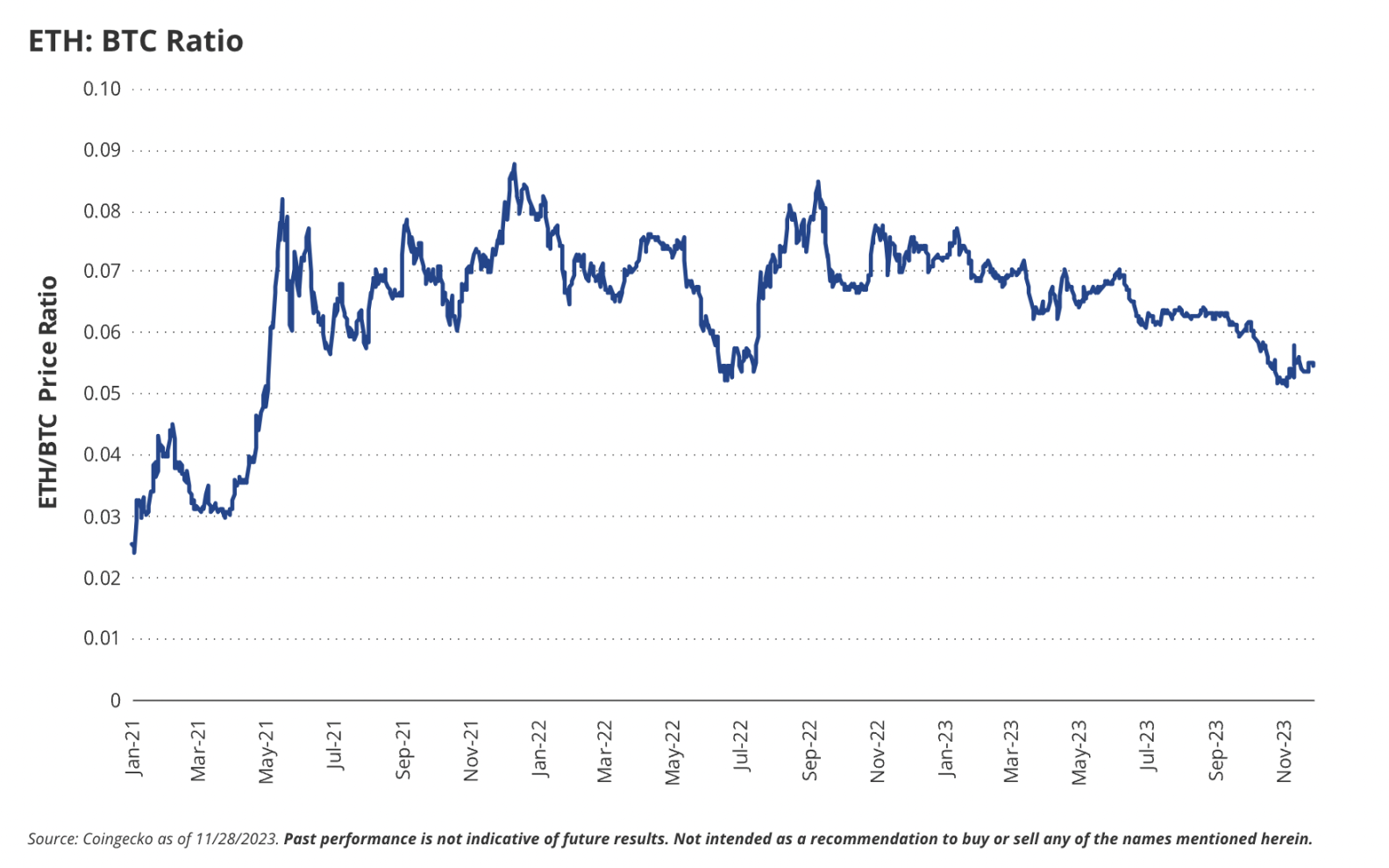

4. Ethereum Will Not Surpass Bitcoin

Ethereum will not be able to surpass Bitcoin in 2024, but it will outperform all major tech stocks. The more obvious regulatory status and energy intensity of Bitcoin will attract interest from entities in Latin America, the Middle East, and Asia. Argentina will join the ranks of El Salvador, the United Arab Emirates, Oman, and Bhutan as the fifth country to sponsor Bitcoin mining, as the Argentine state-owned energy giant YPF may express interest in using surplus methane and natural gas to mine digital assets. As in past cycles, Bitcoin will lead the market, and value will flow into smaller tokens after the halving. Ethereum's performance will begin to surpass Bitcoin's, and it may perform better overall than Bitcoin in 2024, but it will not surpass it. Although Ethereum will perform strongly in 2024, its market share will still be taken over by other smart contract platforms with more stable scalability roadmaps (such as Solana).

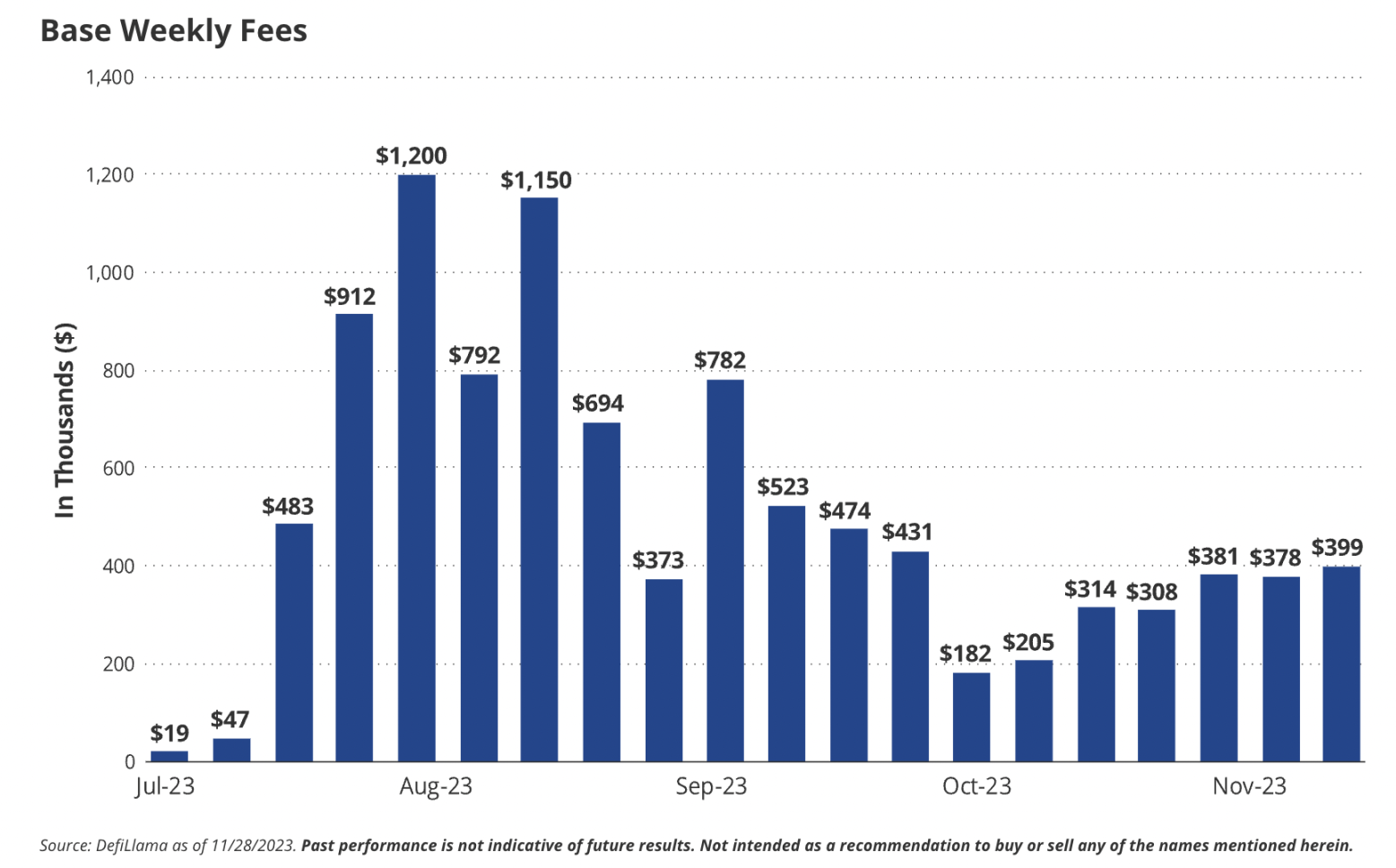

5. After EIP-4844, L2 Will Dominate the Ethereum Ecosystem

6. NFT Activity Will Rebound to Historic Highs

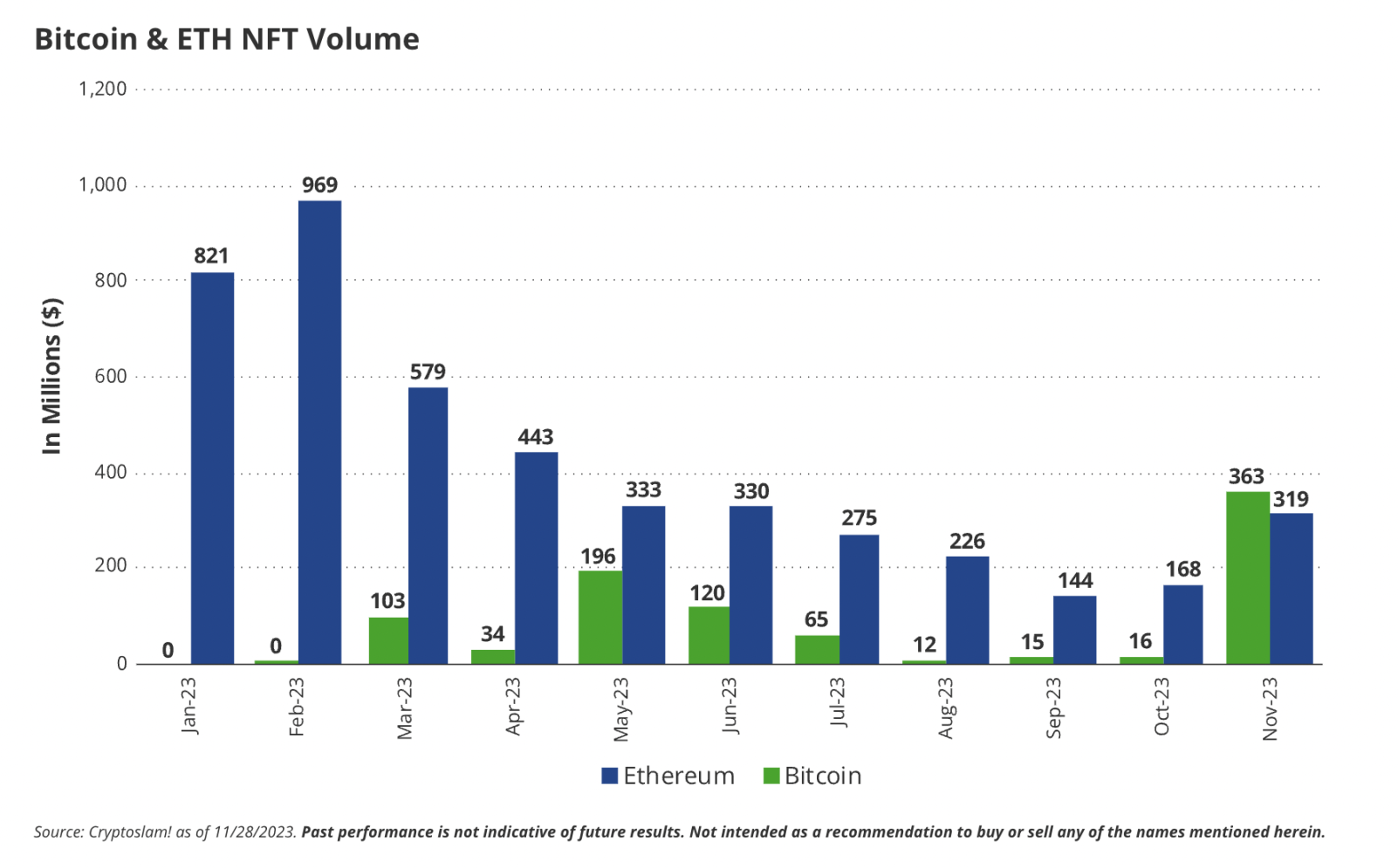

With speculators returning to the cryptocurrency space and flocking to top NFT collections on Ethereum, improved crypto games, and new products in the Bitcoin ecosystem, monthly NFT trading volume will reach historic highs. Although the ratio of Ethereum to Bitcoin in major NFT sales has been close to 50:1 since its inception, the Ordinals protocol for Bitcoin and emerging L2 solutions on Bitcoin will drive continued growth in network fees. The ratio of Ethereum to Bitcoin in major NFT issuances will approach 3:1 in 2024. Stacks (STX), a Bitcoin-based smart contract platform, will become a top 30 token by market capitalization (currently ranked 54th).

7. Binance Will Lose Its Position as the Top Spot Trading Exchange

After reaching a settlement of over $4 billion with US regulatory agencies, Binance will lose its position as the top centralized exchange by trading volume. OKX, Bybit, Coinbase, and Bitget will become well-funded competitors and have the potential to take the top spot. The inclusion of cryptocurrency exchange quotes in regulated indices (such as those managed by VanEck subsidiary MarketVectors) will be a key variable in determining whether centralized exchanges are eligible to provide liquidity for ETF authorized participants and sponsors. With Binance now under a three-year surveillance by the Department of Justice, Coinbase will capture a larger share of the international futures market, with daily trading volumes exceeding $1 billion, higher than the approximately $200 million in November 2023.

8. USDC Market Share Rebounds, Stablecoin Market Cap Reaches Historic Highs

The total value of stablecoins will reach over $200 billion (currently $128 billion), a historic high. With the implementation of MiCA, regulated stablecoins will be introduced in Europe, leading to a surge in transaction volume for interest-bearing stablecoins. Controversially, USDC will replace USDT as institutions prefer USDC, a trend already evident on new L2 chains. Following the enforcement actions taken by the Department of Justice against Justin Sun and his companies, the loss of market share for Tether may become a reality.

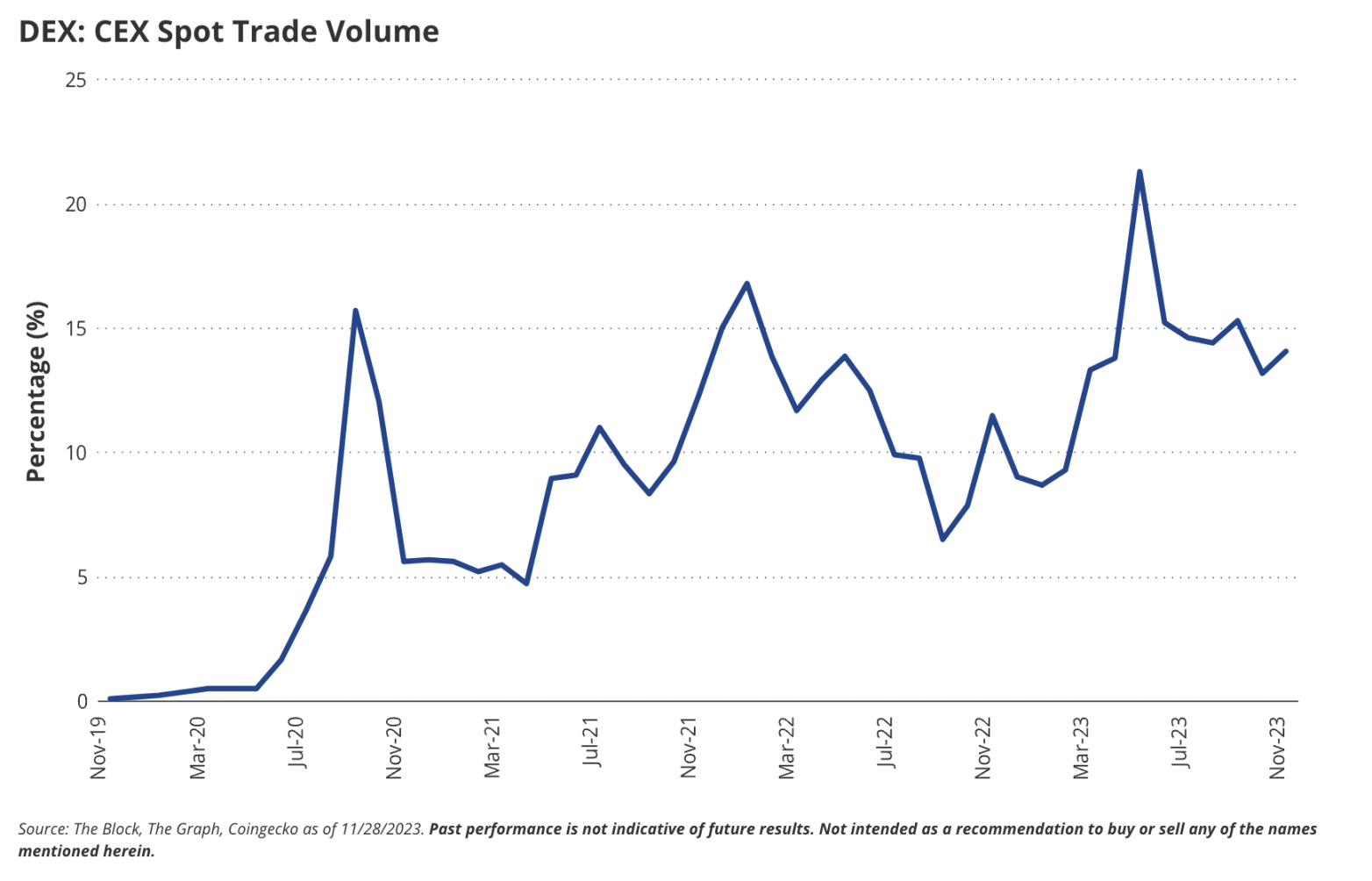

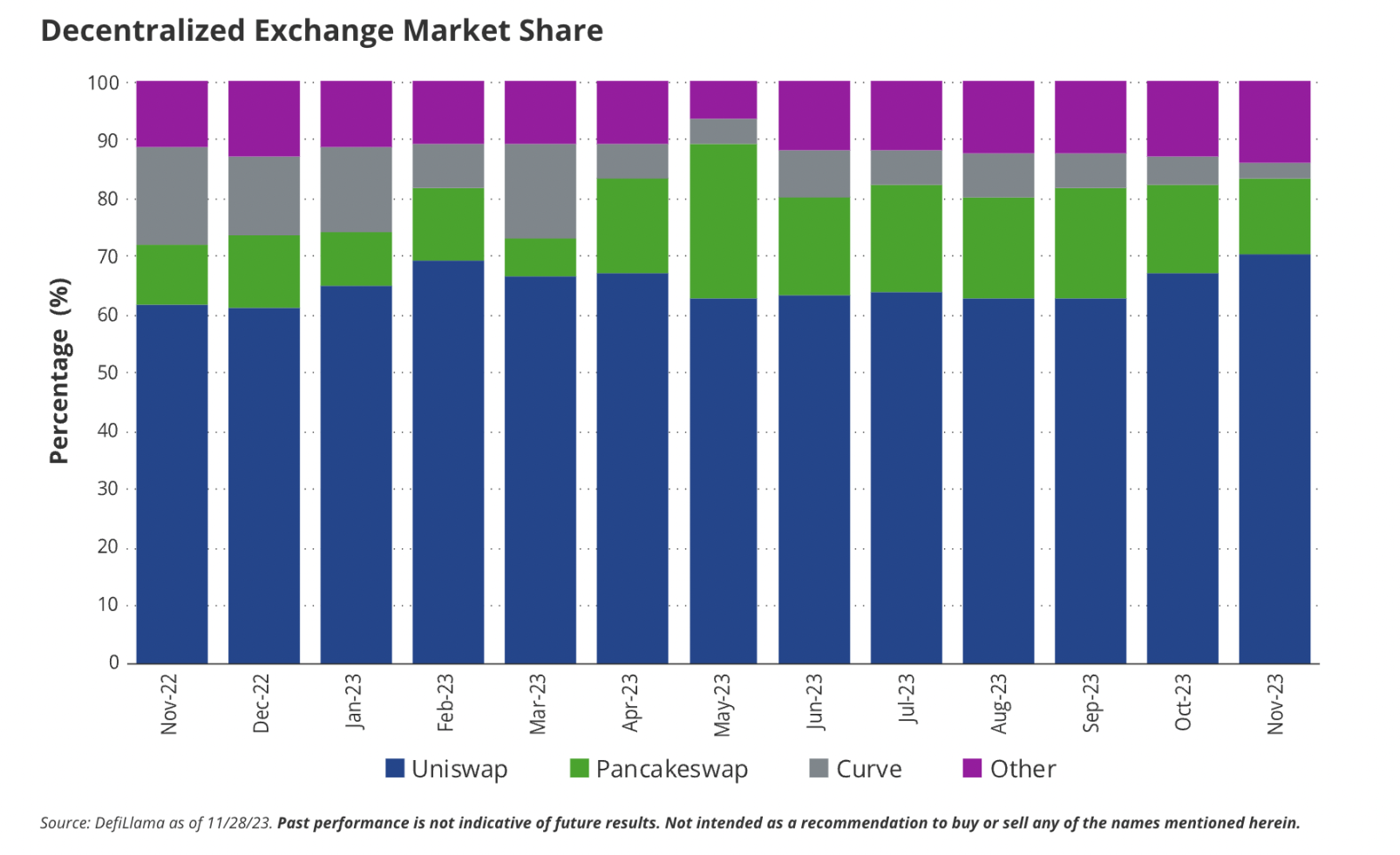

9. DEX Spot Market Share Will Reach Historic Highs

With high-throughput blockchains like Solana improving the on-chain trading experience for users, the market share of decentralized exchanges (DEX) in spot trading will reach historic highs. Additionally, the integration of "account abstraction" wallets, which enable automatic payments, will drive more user on-chain activity and self-management of assets. As the market dominance of Bitcoin and Ethereum may decline after the Bitcoin halving, long-tail assets may grow more prominently, and DEXs actively listing new tokens will have an advantage.

10. Remittance and Smart Contract Platforms Will Drive New Bitcoin Revenue Opportunities

Remittances will become a killer app for blockchain, as the withdrawal and spending of stablecoins become easier, making it more acceptable in emerging markets. With the use of Bitcoin and the Lightning Network (LN) in some remittance channels, "Bitcoin staking" becomes possible. By 2024, this will become a mainstream narrative. As transaction costs on the Bitcoin blockchain rise, Bitcoin maximalists will begin to spread the message: you can stake on the Bitcoin network and earn rewards. Cases of staking to Lightning nodes have already occurred, but with low risk and low returns, as your Bitcoin is used for payment settlements on the Lightning Network. As protocols like Amboss that abstractly manage Lightning node technical details and solutions like Fedi for joint self-custody become more widespread, users will be able to participate in the remittance market through cold wallets and earn some returns. Additionally, as a security provider for proof-of-stake blockchains, Bitcoin holders will find new business opportunities in 2024. Projects like Babylon based on Cosmos will enable Bitcoin holders to earn rewards through non-custodial staking.

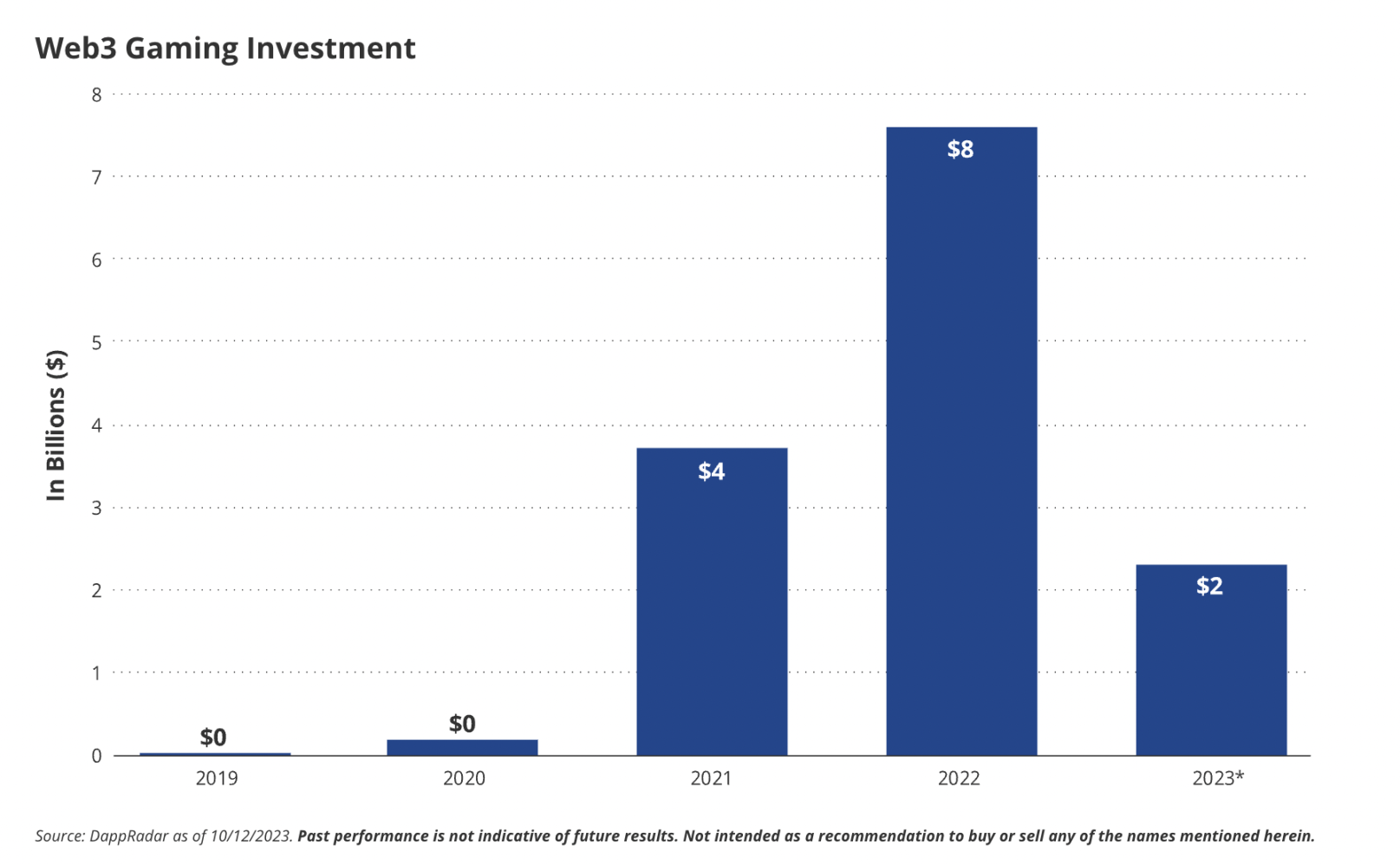

11. Breakthrough Blockchain Games Appear

At least one blockchain game will have over 1 million daily active users, demonstrating the long-awaited potential. Among the candidates to achieve this milestone, IMX is most likely to become a top 25 token by market capitalization (currently ranked 42nd), due to the release of Illuvium, Guild of Guardians, and other high-budget games and carefully designed tokens in 2024. According to a recent report by DappRadar, the WAX blockchain currently leads in the gaming space, with 406,000 independent active wallets per day, with about 100,000 playing Alien Worlds, a metaverse containing various simple games that reward players with Trillium tokens. However, due to the simplicity of the games, many of these players may be gold farming bots. On the other hand, Immutable has built multiple AAA games on its platform, which have achieved a token model that cannot be exploited by gold farming bots and are truly engaging games. These games have been in development for years and have raised over $100 million, and will be released in 2024. They can attract players like traditional AAA games such as "Starfield," which attracted 10 million players within two weeks of its release earlier this year.

In addition, Immutable has been dedicated to solving many of the technical challenges that have hindered the success of Web3 games, such as wallet management. Immutable's "passport" allows users to log in to games and manage blockchain-based game items through a familiar single sign-on process, while abstracting away blockchain interactions. Immutable provides simplicity for gamers and, in combination with major distribution partners like Epic Games Store and GameStop, could ultimately make blockchain-based games mainstream.

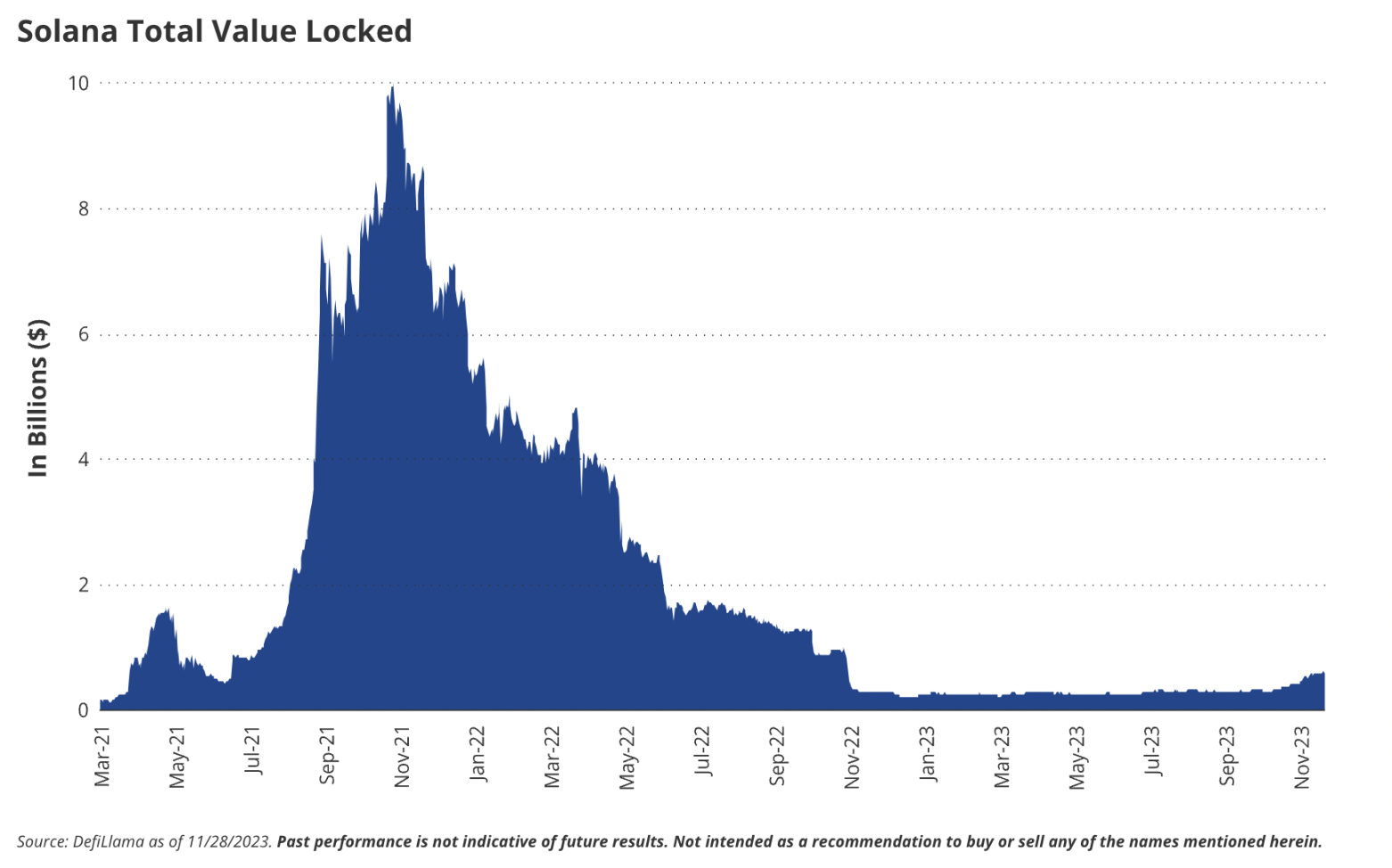

12. DeFi TVL Returns, Solana Will Outperform Ethereum

Solana will rank in the top three in terms of market capitalization, total value locked (TVL), and active users. With this upward momentum, Solana will join the spot ETF battle as a result of numerous asset management companies filing documents. In connection with the continued growth of Solana's market share, we believe it is possible for the Solana-based price oracle Pyth to surpass Chainlink in Total Value Secured (TVS). For reference, Chainlink's current TVS is approximately $15 billion, while Pyth's TVS is less than $2 billion, primarily driven by blue-chip DeFi protocols on the Ethereum mainnet. As TVL continues to grow on high-throughput chains like Solana, and Chainlink continues to struggle with institutional adoption of its LINK token, we expect Pyth to gain meaningful market share with several true innovations (including its "push" architecture and confidence interval system) supporting it.

13. DePin Network Gains Meaningful Adoption

Multiple decentralized physical infrastructure (DePin) networks will gain meaningful adoption, attracting public attention.

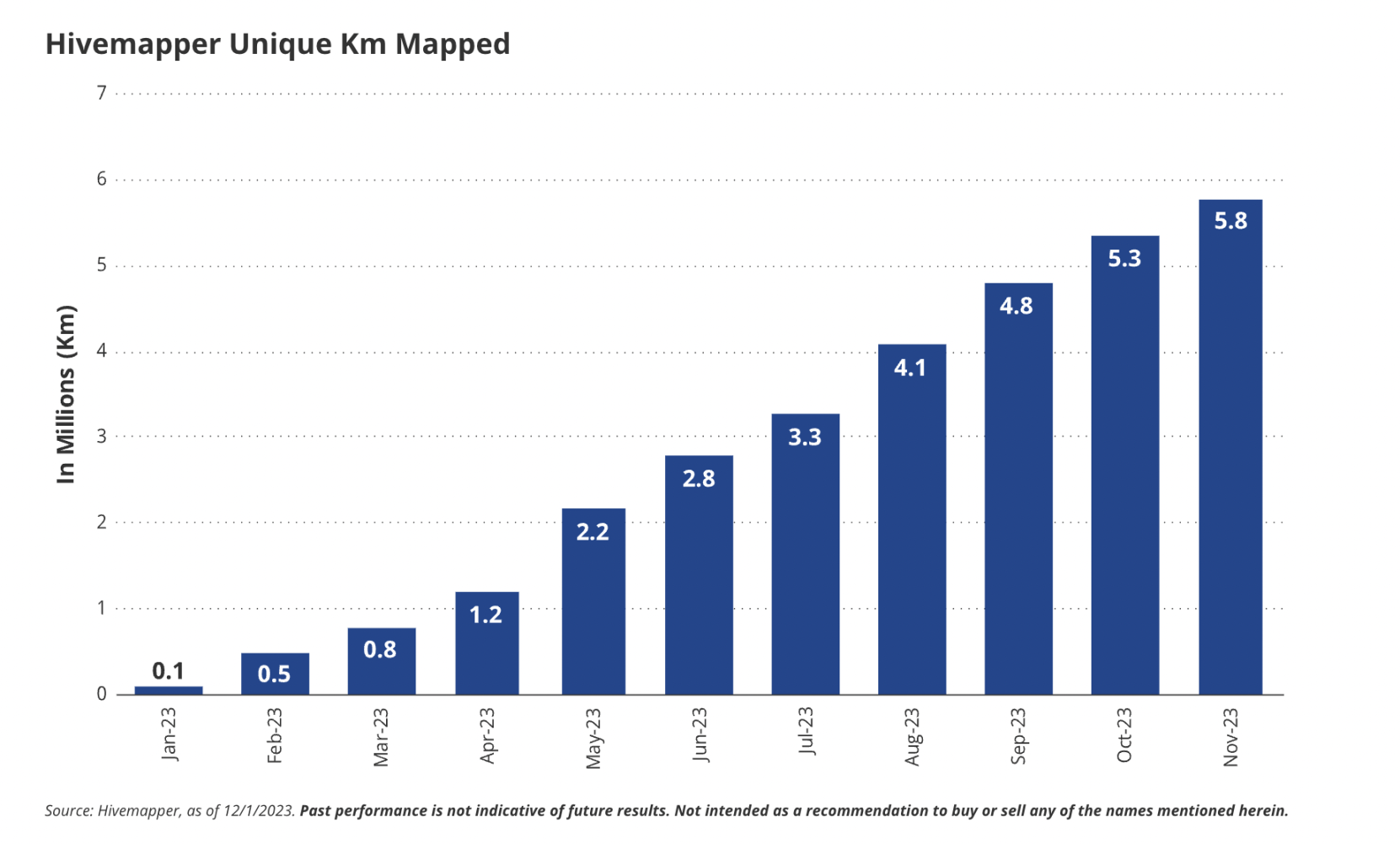

Hivemapper is a decentralized mapping protocol designed to compete with Google Streetview, aiming to map 10 million kilometers, exceeding 15% of global road capacity. Hivemapper uses its native token $HONEY to incentivize thousands of drivers globally to install dashcams in their cars and contribute to its growing database. This global network composed of permissionless contributors may bring meaningful progress and cost advantages to Hivemapper compared to existing Google. Google Maps' revenue is expected to exceed $11 billion by 2023, presenting a meaningful opportunity for Hivemapper.

Helium is a decentralized wireless hotspot network, and the number of paid users for its nationwide 5G plan will increase from the current 5,000 to 100,000. Anyone can set up a hotspot, and hotspot operators receive payments in Helium's native token. This powerful incentive system provides Helium with several key advantages:

It is capital-light (from Helium's perspective).

It transforms hotspot providers into advocates and supporters (given their staking of tokens in the network).

It enables Helium to respond to real-time data and improve the network by adjusting incentive measures (i.e., increasing rewards for poorly covered areas).

The wireless infrastructure market is a $200 billion, relatively mature market. As end users tend towards low-cost solutions with differentiated branding ("user-owned"), we will see a significant space for traditional providers to be disintermediated. Helium claims they can provide data at less than 50% of the cost of traditional networks. With the increasing mainstream adoption of cryptocurrencies, if this claim holds true, they may gain significant market share.

14. New Accounting Standards Drive Increased Corporate Cryptocurrency Holdings

Coinbase will become the first publicly listed company to disclose Layer 2 blockchain revenue in its quarterly reports, with its Base annualized revenue surpassing $1 billion. The adoption of new FASB standards may promote additional disclosures, allowing companies to value cryptocurrencies at market value, which will drive corporate holdings of Bitcoin and other cryptocurrencies as inventory assets. As these accounting changes will take effect in 2025 but can be adopted earlier, major non-crypto financial entities (banks, exchanges) may announce the creation of public blockchains similar to L2.

15. DeFi and KYC Regulation Alignment

KYC-supported walled garden applications (such as applications using Ethereum proof of service or Uniswap hooks) will gain significant traction, approaching or even surpassing non-KYC applications in user base and fees. Uniswap will lead this feature, driving institutional liquidity and trading volume for the protocol. The additional trading volume brought by KYC-gated hooks will significantly increase protocol fees, allowing new entrants to participate in DeFi without concerns about interacting with entities subject to OFAC sanctions. The increase in hooks will help Uniswap strengthen its moat and competitiveness, which should drive token appreciation, especially when DAO eventually votes to open the Uniswap protocol fee switch to allow token appreciation. If this happens, we expect this fee not to exceed 10 basis points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。