Key Points

The opportunity for Solana today is undoubtedly the best.

Article authors: Ryan Watkins, Wilson Withiam, Daniel Cheung

Article translation: Block unicorn

Key Points

Solana is a blockchain re-designed from first principles, with the potential to become foundational technology on par with Bitcoin and Ethereum. Its technical architecture is inspired by cellular networks and includes several new technical components that work together to maximize hardware potential, unleash unparalleled performance, and position Solana with the highest probability of leading the emergence of the next wave of breakthrough applications. Therefore, as Solana's on-chain economy accelerates, we believe SOL is most likely to accumulate a currency premium alongside BTC and ETH.

Although the smart contract platform space exhibits extreme power law dynamics, the possibility of a single ecosystem supporting every application is extremely low. There are trade-offs in blockchain - while many blockchains are moving towards similar technological end goals, path dependence plays a critical role in determining the product-market fit for different use cases. Solana has a huge opportunity to gradually weaken Ethereum's dominant position by providing a differentiated, integrated solution and launching a sufficiently large developer ecosystem.

Solana's current trajectory is reminiscent of Ethereum's rebirth process after the ICO boom collapsed in 2018. Despite the Solana ecosystem hitting bottom and embarking on a path to recovery after the FTX collapse, SOL has still been subjected to overly harsh punishment. As technological upgrades continue to drive Solana forward and momentum between enterprises and native crypto developers accelerates, the pricing error of SOL is increasingly widening, to about 13% of Ethereum's valuation.

This is a rare opportunity, as we rarely find a project that can rival Bitcoin and Ethereum in scale and open up new possibilities. We know this because we specifically created Syncracy to support such era winners and understand how rare it is for a project to meet this standard. However, after years of research and monitoring, and months of patiently waiting for an attractive entry opportunity, we believe we have found one of these rare opportunities in the Solana project - the first blockchain with the potential to rival Bitcoin and Ethereum as a foundational platform. Therefore, in the second quarter of 2023, Syncracy established a large SOL position.

After the FTX collapse, Solana faced a crisis of clearing the ecosystem from all disloyal parties. Emotions hit an extreme low, leaving behind an era-defining opportunity that formed in the subsequent quarters. Although stability in the Solana ecosystem took some time afterwards, it has now found a new foundation, and activity has begun to recover. The shadow of FTX is fading, and today the Solana ecosystem is becoming stronger than ever, with accelerating momentum from developers and enterprises. It is becoming increasingly clear that Solana's industry-leading scalability and unit cost are becoming hard to ignore.

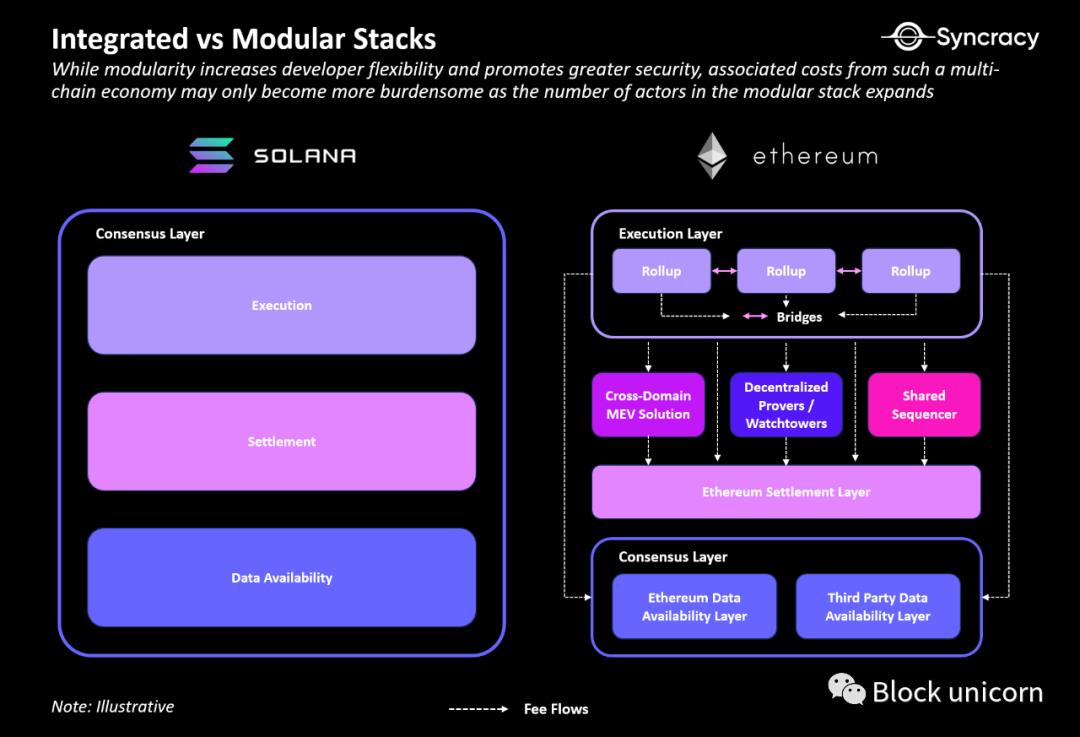

Indeed, the opportunity for Solana today is undoubtedly the best. Although many smart contract platforms are moving towards similar technological end goals, it is becoming increasingly clear that the path to get there has produced meaningful trade-offs in functionality. These trade-offs are so profound that it is becoming increasingly clear that a single technology stack cannot effectively support every application. Therefore, Solana's setup. As "integration" and "modularity" become the two ends of the blockchain design trade-off spectrum, Solana is poised to become the industry-leading standard - the preferred integrated system for the crypto economy to complement Ethereum as the latter further advances on the modular path.

The possibilities are endless. Below we share our views.

Solana Vision

The Genesis of Solana

The story of Solana began in 2017, when Solana's co-founder Anatoly Yakovenko set out to build a blockchain that could rival the performance of a single machine and overcome the scalability constraints of existing solutions. His insight was that if software does not hinder hardware operation, it is possible to build a blockchain where the overall performance of the network grows linearly with hardware advancements. He believed that the core to achieving this vision was to design an efficient way for nodes to communicate, removing bandwidth as a bottleneck.

In October 2017, Anatoly had an epiphany when he realized that blockchain networks shared many similarities with the cellular networks he was familiar with from his time at Qualcomm. He recalled how telecom companies overcame bandwidth limitations of radio towers by introducing "multiple access technology" to enable multiple phone calls on the same frequency. At the core of this solution was the concept of a global available clock, allowing towers to divide each radio frequency into time slots and allocate these time slots to each phone call, effectively supporting multiple simultaneous data channels.

Shortly after, in November 2017, Anatoly published a whitepaper introducing "Proof of History" (PoH) - a mechanism for maintaining time between untrusted computers. While it seemed simple on the surface, having a global clock before consensus had far-reaching implications. Unlike other blockchains that require validators to negotiate time past consensus, each Solana validator maintains its own clock. This independently verifiable global clock made network synchronization simple and unleashed Solana's ability to process transactions almost as they arrive. With PoH, Anatoly laid the foundation for a novel blockchain that could more efficiently propagate data between nodes, bringing him closer to realizing his vision - a blockchain that scales with hardware speed.

Block unicorn note: Multiple access technology refers to multiple devices on the same frequency, allocated at different times and with different communicators, avoiding interference with each other's communication.

Proof of History (PoH): A mechanism for maintaining time between untrusted computers, which can be understood as a proof mechanism to show the order and time of occurrence of an event or data.

In the context of Solana, the innovation of Proof of History lies in its efficient way of allowing nodes in the network to easily reach consensus without the need for frequent communication. It's like each node having its own clock, operating in different time slots, avoiding confusion and conflicts, and improving the performance of the entire blockchain system.

Overview of Solana Architecture

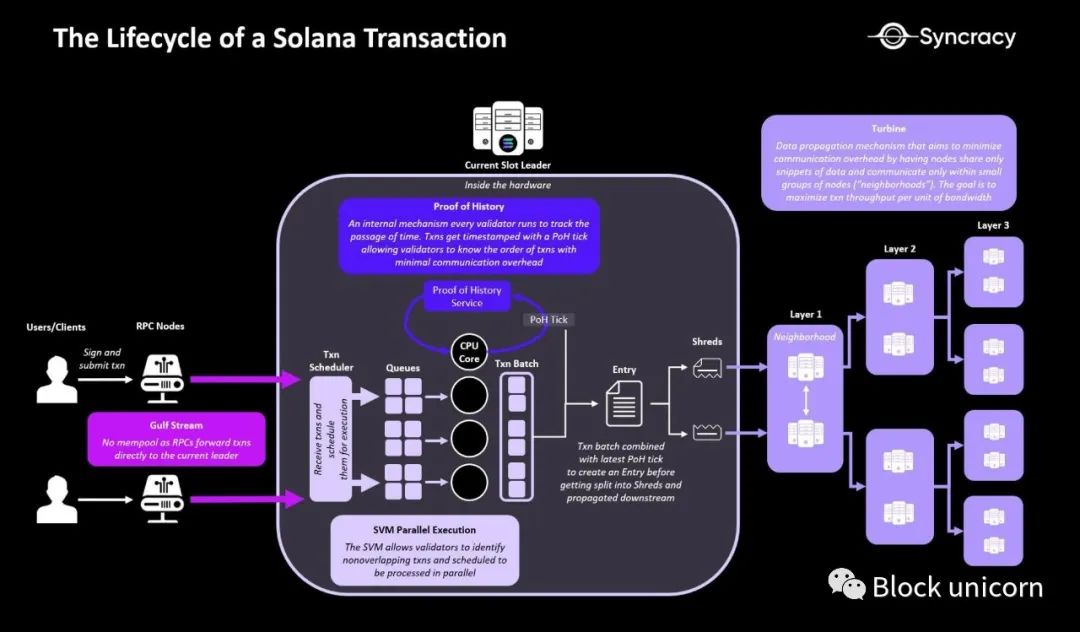

As mentioned earlier, Proof of History (PoH) is a key feature of the Solana architecture. At a technical level, PoH works by running a recursive SHA-265 algorithm, where each output hash marks the passage of time, as it requires validators to spend a certain amount of time to generate results. Validators continuously run Solana's PoH algorithm on one of their CPU cores, enabling each validator to independently track the passage of time and execute transactions almost immediately upon arrival.

This process of timestamping within blocks plays a crucial role in Solana's throughput scalability.

PoH enables block producers to execute and propagate transactions as if they were being streamed. Unlike other blockchains, block producers do not need to wait to create and forward complete blocks, as PoH timestamps provide a standardized order. With a defined order propagated in advance, downstream nodes can receive transactions in the correct order, even if they receive them in an unordered manner; they can start executing and approving transactions without receiving complete block data. The benefit to users is that they can receive soft confirmations for their transactions faster (about 400 milliseconds) compared to blockchains that combine time and state simultaneously.

The lifecycle of transactions begins with Gulfstream - a transaction forwarding protocol that allows RPC nodes to directly forward incoming transactions to block producers, eliminating the need for a memory pool. Once block producers receive the transactions, they use a multi-threaded scheduling algorithm to arrange the execution of transactions. This is where Solana's Sealevel runtime (Solana Virtual Machine) comes into play. In Solana, programs are stateless, and the state is stored in separate accounts. This separation allows Solana to achieve awkward parallelism, as transactions do not need to be processed in order when touching the same contract, only when they write to the same account. The multi-threaded scheduling algorithm allows block producers to detect which transactions write to the same account. Transactions that do not write to the same account are processed in parallel, while those that write to the same account are executed in order. After execution, block producers use a PoH tick (referred to as an "entry," Solana's time unit) to timestamp all simultaneously processed transactions and then split these entries into "shreds" to send to downstream consensus validators.

Block unicorn note: RPC is a remote procedure call technology. For example, if you forget to do your laundry when you go to work, you can call your mom to put your clothes in the washing machine or cook for you, and your mom helps you handle these things so you don't have to deal with them.

Once block producers execute these transactions, they use a mechanism called "Turbine" to propagate the transactions downstream - this is a data propagation protocol inspired by BitTorrent, designed to maximize throughput per unit bandwidth. At a high level, Turbine organizes downstream validators into subgroups called "neighborhoods." The topology is similar to a tree. Upstream neighborhoods provide data to downstream neighborhoods, and adjacent neighborhoods share data. Solana assigns validators to these neighborhoods based on their weight, with the highest-weight validators occupying upper neighborhoods (closer to the leader) and the lowest-weight validators occupying lower neighborhoods. The result is a significant reduction in validator overhead - minimizing the number of direct peer-to-peer connections and reducing the need to transmit duplicate data packets, resulting in more efficient bandwidth utilization and higher transaction throughput.

Taken together, these innovative technical components pioneered by Solana work together to realize Anatoly's vision of a blockchain that scales with hardware speed. By more fully utilizing available hardware, Solana achieves significantly higher scalability compared to previous blockchain designs, without being constrained by hardware requirements. The result is a truly innovative system that expands the design space of the crypto economy.

Solana Whitepaper

1)

With its outstanding scalability and unit cost, Solana is poised to be a long-term winner in on-chain economic activity over the next few years, as competitors are still limited by performance constraints, while Solana continues to consolidate its leading position through a series of upcoming upgrades.

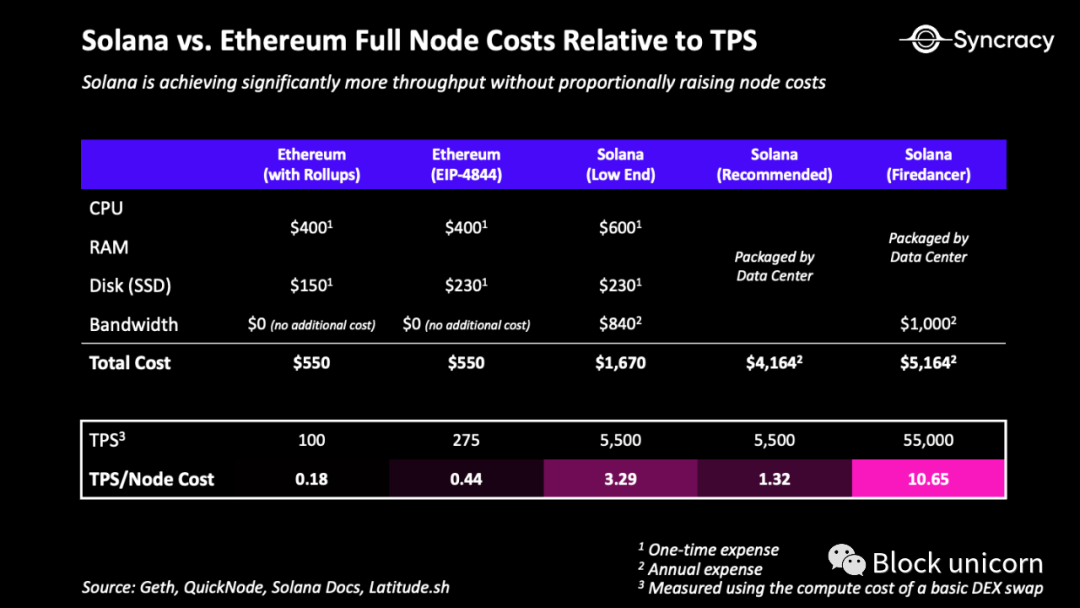

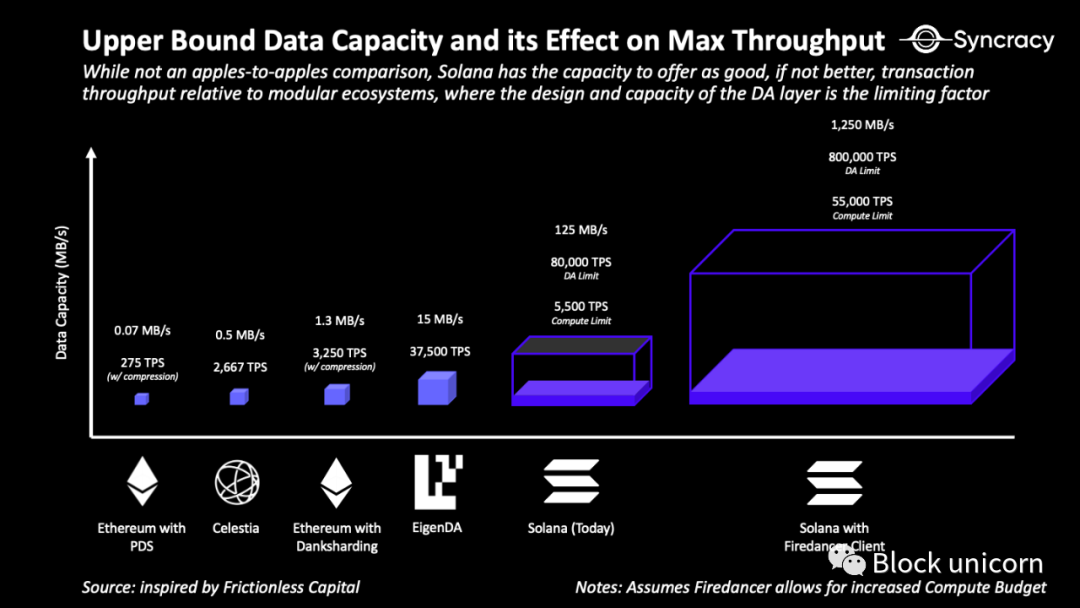

As discussed in the architecture overview section, Solana has several new technical components that work together to maximize the potential of available hardware in nodes, achieving extremely high performance. Through recent upgrades, such as state compression - a mechanism that greatly reduces application storage costs - Solana now also has the best unit economics for on-chain transactions in the industry, with data results being impressive. Today, Solana offers a maximum transaction throughput of 5,500 TPS and will soon reach 55,000 TPS in the upcoming Firedancer client. At the same time, state compression has reduced the cost of minting NFTs on Solana by 1,000 times, and many teams are trying to apply these advantages to other use cases. As Solana leverages further hardware advancements, these performance metrics will compound over time - a unique feature that doubles Solana's performance every two years without further upgrades. Most importantly, Solana achieves this performance not by simply increasing hardware requirements, but through genuine innovation in software design. The result is that Solana achieves 1-2 orders of magnitude of throughput per dollar spent on hardware (1-2 times improvement).

All of this is happening against the backdrop of competitors being limited by performance constraints in the foreseeable future. While Ethereum's Rollup ecosystem has begun to demonstrate its strength, often processing more transactions than Ethereum itself, its recent reality is still unsatisfactory. The challenge is that Rollup is still limited by the Ethereum main chain, and upgrades will not provide substantial help in the short term. The anticipated EIP-4844 upgrade (expected in the first quarter of 2024) provides only about 0.375 MB of data availability capacity per block, equivalent to about 275 transactions per second (using basic DEX exchanges) for the entire Ethereum Rollup ecosystem. And Danksharding, which may not enter the mainnet until 2025 or later, provides only about 1.3 MB of data availability capacity per block, equivalent to about 3,250 transactions per second for the entire Ethereum Rollup ecosystem. These numbers are not only far below Solana's current levels, but may not meet mainstream activity levels.

While there are some Rollup options that can bypass Ethereum's limitations, they all involve significant trade-offs around security. The most popular method to achieve higher throughput involves third-party data availability providers, such as Celestia and EigenDA, which provide data availability capacity for Rollup that is 1 to 2 orders of magnitude higher than existing solutions. However, introducing these solutions in specific Rollup setups introduces new counterparty risks for applications and users. Rather than relying solely on Ethereum's security, Rollup outsources most of its security to new, unverified networks.

2)

Although many smart contract platforms are moving towards similar technological endgames, path dependence plays a critical role in determining the product-market fit for different use cases - Solana's integrated design provides a structurally simpler, more cost-effective development environment compared to modular stacks, making it more likely to win over developers in the growing crypto economy over the next few years.

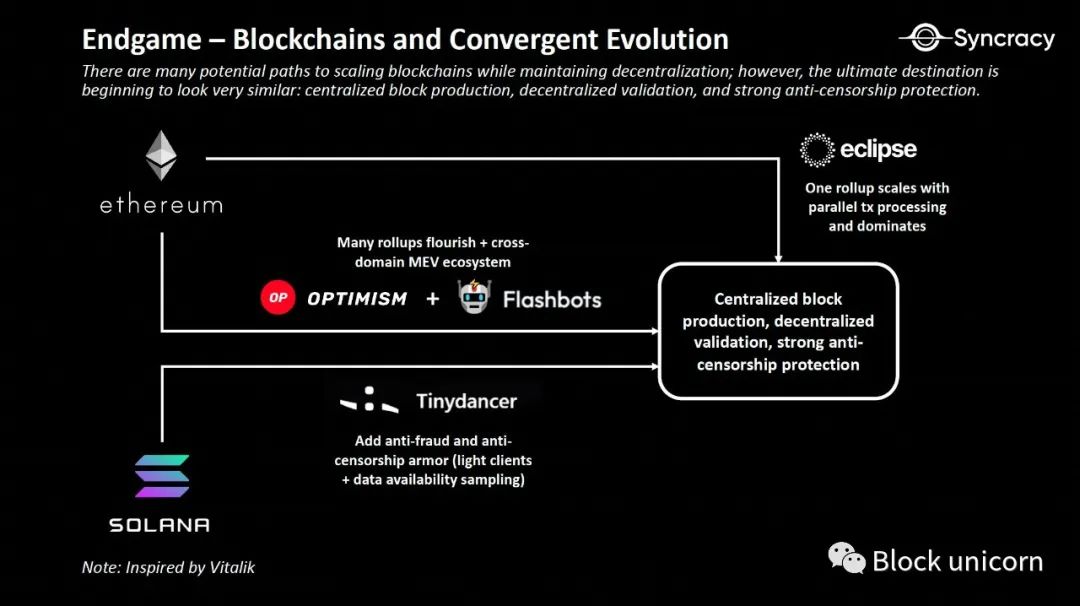

In Vitalik's visionary "endgame" article, he discusses potential approaches to scaling blockchain while maintaining decentralization. He suggests that while there are many such approaches, the end goals are starting to look very similar: centralized block production, decentralized validation, and strong anti-censorship protection. It doesn't matter whether a blockchain starts from an integrated or modular beginning. The key issue is that scaling blockchain with low validator hardware requirements is impossible, so it's necessary to ensure affordable verifiability. This way, even with high validator requirements, users can still verify and maintain the security of the chain.

Two years later, Vitalik's predictions seem increasingly likely to become reality, with many projects emerging in the Ethereum and Solana ecosystems to achieve this future. However, while many leading blockchains are moving towards similar endgames, there are meaningful trade-offs in the paths chosen by these blockchains.

Ethereum

The origins of Ethereum can be traced back to Vitalik's experience of having his character weakened by Blizzard Entertainment in World of Warcraft (WoW). This experience was crucial for Vitalik as it was the first time he personally experienced the "terror that centralized services can bring." This experience had a profound impact on the design of Ethereum; hence, the vision for Ethereum was to build a minimal-trust world computer. Settlement assurance became a crucial design goal - derived from the minimal-trust currency argument of Bitcoin. Trusted neutrality - that Ethereum would not discriminate or favor any particular person - became a guiding principle.

Given the crucial importance of settlement assurance to Ethereum, the developer community adopted an ideology of decentralized philosophy. The rationale was that while ideological decentralization might lead to slower evolution, it would create greater stability and predictability. In a similar vein, the Ethereum community adopted a user-centric hardware philosophy. The rationale was that if more users could run full nodes and supervise the system, Ethereum would be more decentralized, providing stronger settlement assurance.

The combination of Ethereum's ideological decentralization and hardware philosophy led to a modular ecosystem to address the scalability trilemma. Today, execution is gradually being pushed towards Rollups with higher hardware requirements, which leverage Ethereum for settlement and data availability. The idea is that Ethereum can maintain lower hardware requirements and focus on security, while Rollups can outsource security to Ethereum and optimize for higher performance. This division of labor creates simultaneous benefits, even as the underlying infrastructure of Ethereum stabilizes to support its minimal-trust computation innovation.

The commitment to trusted neutrality from day one is crucial for launching mission-critical monetary and financial applications - one of the most challenging but also most critical features for any smart contract platform to develop. Monetary premium (the practicality of assets as a unit of account, medium of exchange, and store of value) not only provides the highest valuation multiples for native assets in the blockchain, but it may be the only way for the blockchain to maintain overall sovereignty in the long term while ensuring its own security. Blockchains like Ethereum have a circular security arrangement, where validators are paid in assets issued by the blockchain. As by definition, sovereign blockchains cannot rely on currencies outside of validators (such as the US dollar) for payment, it is crucial that their underlying assets have intrinsic value. Ensuring that this underlying asset is valuable enough to protect the blockchain from any detectable threat globally is best achieved by making it one of the most valuable assets in the world: money.

However, Ethereum's approach is not without trade-offs. While Ethereum has launched these mission-critical monetary and financial applications by emphasizing security, it has done so at the cost of being unable to launch higher throughput, cost-sensitive applications. Additionally, while modularity increases developer flexibility, promotes greater security, and creates new monetization opportunities for applications, the associated costs from such a multi-chain economy are worth examining. Once again, while Ethereum is likely to address these performance issues in the future, it will take several years, providing ample opportunity for another system advancing along a different path to gain market share.

Solana

The origin story of Solana begins with Anatoly's experience of his trades being front-run by high-frequency trading firms. This experience was crucial for Anatoly as it made him realize that blockchain could ensure fairer information transmission between users and exchanges. This experience was so crucial that fair and affordable access to global state became a key design goal for Solana; hence, Solana envisioned a globally programmable order book, synchronized at the speed of light. Performance would be crucial, and Solana would first position itself as a technology platform - a departure from the currency argument that guided previous blockchain designs. Software should not hinder hardware - Solana would fully utilize all the computing and bandwidth capabilities available in today's multi-core computers to maximize system performance - this became a guiding principle.

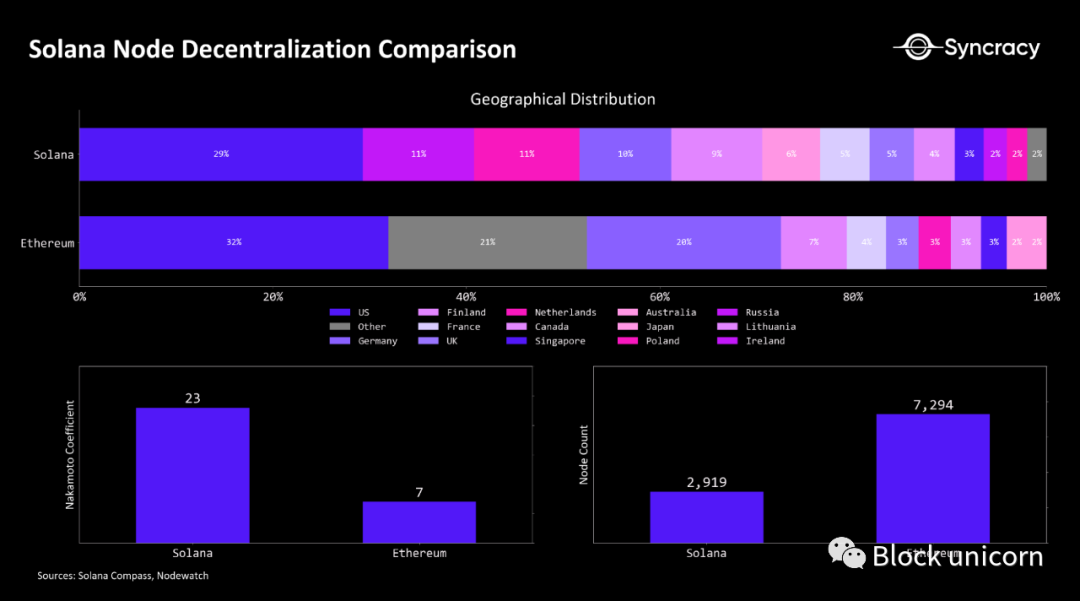

Given the crucial importance of performance to Solana, the developer community adopted a pragmatic philosophy. An engineering-oriented culture took root. While more aggressive than Ethereum, the idea is that while this "fast action, break the rules" mentality may lead to greater instability, it also drives faster product evolution. Similarly, the Solana community adopted a hardware philosophy centered around practical decentralization - the core idea of this philosophy is that not all nodes are equal, and the number of nodes is a lagging indicator of product-market fit.

The reasons for this are twofold. First, the increase in the number of actively monitoring complex node operators will increase security, rather than simply counting the number of passively participating users. Second, the increase in the number of nodes over time is more dependent on the demand to run nodes rather than how low the cost is to run nodes - the more activity Solana hosts, the more individuals, companies, and other organizations will be incentivized to run nodes as part of their operations. Today, this idea seems to have had a positive impact on Solana.

In extreme cases, Solana's pragmatic philosophy is based on the argument that while Solana may not achieve nuclear-level decentralization, it may cover 99% of the functionality users ultimately need, while maintaining a single-stack architecture. This "integrated" approach has been crucial in positioning Solana as the preferred platform for mainstream applications focused on speed and cost, although it currently sacrifices crucial monetary and financial applications. However, Anatoly believes this may not be a problem - settlement is just a feature, a byproduct of maintaining state synchronization. If Vitalik's ultimate goal is correct, then in the long run, Solana will achieve sufficient censorship resistance in any case, at which point the scale of economic activity will be a key differentiating factor for the smart contract platform's native asset to accumulate the largest monetary premium.

In this regard, Solana has some levers to operate. In addition to being used as a medium of exchange (Gas payments) and a unit of account (NFT pricing), SOL is the primary store of value within the Solana economy. As a proof-of-stake asset, SOL directly receives fee income and MEV generated by on-chain activity. While Solana aims to keep user fees for transactions low, it can offset the difference by increasing transaction volume and expanding the dimensions of its fee market (more sources of income). Additionally, SOL serves not only as the fee rate for the Solana economy, but also as the lowest-risk asset on Solana, making SOL the purest collateral within its financial system.

Furthermore, while Ethereum is often praised for its sound monetary policy, Solana may not be far behind in credibility. While Solana must grow transaction activity by several orders of magnitude to make SOL deflationary, like ETH, Solana's supply schedule may be more predictable than Ethereum's - Solana has never changed its issuance schedule, while Ethereum has changed its issuance schedule three times. In any case, it is important to remember that these attributes are mostly products of product-market fit and lagging indicators - is it not possible for competitors to achieve similar levels of adoption?

Taking a broader view, Solana's integrated design may be the key to accelerating its economic growth. Compared to modular stacks, an integrated system provides a structurally simpler, more cost-effective development environment. Firstly, an integrated system abstracts all the low-level infrastructure and economic complexity needed for trust-minimized computation, allowing developers to focus on their core products. In contrast, modular stacks exponentially increase developer complexity, as they force developers to consider a broader range of crucial technical components and expend resources on often unrewarding work, such as cross-chain deployments. Additionally, modularization not only increases developer complexity, but also incurs incalculable costs in user experience due to incompatibility between different layers and immature abstraction mechanisms. In practice, this means that application developers on Solana can spend more time and resources perfecting their applications and user adoption pathways, relative to their modular peers who need to spend relatively more time on infrastructure.

Most importantly, carrying all logic and data within a single layer minimizes the time and cost involved in cross-contract (or composable) transactions, which form the basis of financial transactions in the crypto economy. An economy built on multiple chains is bound to incur hidden costs such as latency, slippage, cognitive burden, and additional fees. Over time, as the number of participants in the modular stack increases, these costs may become more apparent. Today, the modular stack involves Rollup chains, settlement layers, third-party bridges, external data availability providers, cross-domain MEV solutions, decentralized sequencers, and watchtowers/proof networks, each vying for a piece of the pie. At some point, it's worth asking whether a multi-Rollup economy is worth it, considering that the most common reason for launching specific application Rollups is "dedicated block space," a problem that Solana's parallel execution environment and native fee market explicitly address without additional costs.

In conclusion, when faced with the choice of where to build, developers will choose where to build. It's important to remember that there is no absolute best solution, only trade-offs.

3)

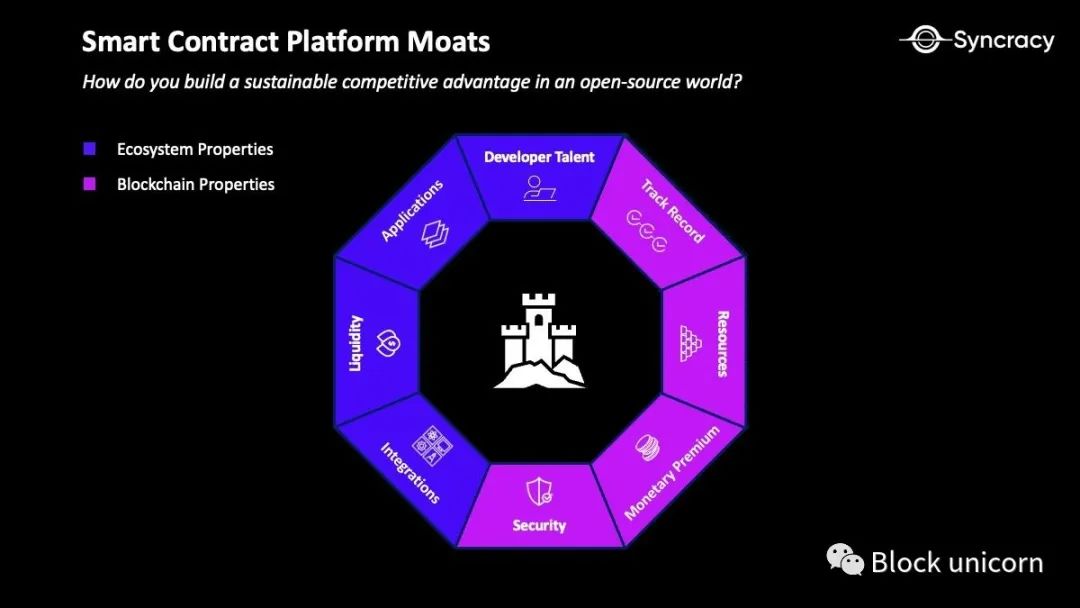

The smart contract market represents the largest total addressable market (TAM) in the crypto economy. It follows a power-law distribution, where the combination of ecosystem attributes and blockchain attributes consolidates top leaders and enables them to continue to garner the majority of attention and economic activity - by providing highly differentiated, integrated solutions and nurturing a sufficiently large developer ecosystem, Solana has a huge opportunity to become one of these entrenched participants.

Smart contract platforms are crucial to the crypto economy. At their core, smart contract platforms are block space markets on blockchains - spaces for storing information and running code. Users pay fees to access this block space, where all economic activity on the blockchain settles. This block space will one day underpin global currency, financial, and commercial activities. Indeed, as smart contract platforms continue to grow their "GDP," their economies may eventually surpass those of dominant sovereign nations. In this regard, considering that the native assets of these smart contract platforms are the most deeply integrated and widely held assets within their economies, they are likely to become the world's reserve currencies in the long term.

While the smart contract platform market is highly concentrated around Ethereum today, the market structure may continue to evolve towards more oligopolistic dominance due to Ethereum's limitations in supporting a wide range of use cases. It is important to note that we are not implying that Ethereum will not continue to be a dominant player in the market; however, competitors have the opportunity to erode Ethereum's share and expand the market by offering highly differentiated solutions and nurturing a sufficiently large developer ecosystem. While many still lack the development tools and middleware to support application layer innovation and experimentation, the incentive to solve their remaining development challenges will increase as the incentives for building on these chains grow.

From a technical perspective, the smart contract platform market is perfectly competitive, and all code is open source. However, while competitors can fork the code, they cannot replicate the emergent properties of smart contract platforms. Ecosystem attributes, including developer talent, applications, liquidity, and integrations (bridges, exchanges, wallets, etc.), as well as blockchain attributes, including monetary premium, security, resources, and records, make smart contract platforms nearly uncopiable. Once a protocol becomes a standard, strong network effects emerge - a thriving ecosystem rapidly accumulates, allowing the winners to maintain their lead. Code can be copied, but the community cannot be replicated.

These attributes are worth delving into. Ecosystem attributes such as developer talent, applications, integrations (bridges, exchanges, wallets, etc.), and on-chain liquidity are critical factors that underpin the economic potential of smart contract platforms. Each smart contract platform faces a daunting cold start problem, not only needing to kickstart these attributes, but to do so in a sustainable manner. Once a chain reaches critical mass in developer adoption and on-chain activity, it has the potential to experience powerful flywheel effects, creating conditions for sustained economic growth over many years. A deep pool of developer talent leads to more useful applications, which leads to greater economic activity, which in turn leads to greater network revenue, sparking greater investor interest and providing more capital for developers to build within the ecosystem.

The blockchain attributes, such as security, records, resources, and monetary premium, may be even more powerful. For example, despite scalability constraints, Ethereum remains the leading smart contract platform by far, mainly because it was the first to market - this has allowed Ethereum to develop the best security, achieve a long-term track record of overcoming adversity, and create a monetary premium for its native asset ETH, as we mentioned earlier, one of the most important attributes that a blockchain finds difficult to achieve. Overall, these blockchain attributes reinforce the flywheel effect of ecosystem attributes - most developers will always choose the platform that offers them the greatest financial opportunity and the strongest sustainability guarantee, making the most economically sensible blockchain the most logical choice.

Given the discussion in the previous section about the trade-offs between integration and modularization, an integrated blockchain is likely to substantially erode Ethereum's market share, and as the undisputed leader in the integrated blockchain space, Solana is likely to become a player in the smart contract platform landscape. This market structure is not uncommon in history - the most recent example in the computing field is the competition between Android and iOS in the mobile space over the past decade. In fact, the question is not whether there will be more than one winner - it is clear that a single technology stack will not effectively support every application. The question is whether the current participants are reflecting this opportunity at a reasonable price, and whether new winners will emerge.

4)

Solana's current trajectory is reminiscent of Ethereum's rise after the 2018 ICO boom and bust. Although the Solana ecosystem has bottomed out and is on the path to recovery after the FTX crash, SOL has still been punished too harshly. As technical upgrades continue to drive Solana forward and enterprise and crypto-native developer momentum accelerates, SOL is undervalued in market cap, equivalent to about 13% of Ethereum's market cap.

Although it may be forgotten today, Ethereum's dominance was not without its challenges. It first went through a massive speculative phase known as the "ICO craze" in 2017, where over 90% of projects failed to generate any meaningful economic value, and many projects failed to deliver. This led to a loss of confidence in Ethereum and the potential of smart contract applications.

In hindsight, this speculative frenzy was crucial to Ethereum's success, as it brought the network into the spotlight, winning the attention of Ethereum developers and investors. This was crucial for attracting mission-driven contributors, and despite declining sentiment in 2018 and 2019, these contributors continued to innovate on Ethereum. Their work eventually paid off. After years of building critical financial infrastructure, the innovation of "liquidity mining" in 2020 sparked renewed interest in Ethereum among institutions and developers, and users now find a rich, practical application economy - this DeFi revolution helped solidify Ethereum as the leading smart contract platform in the crypto economy.

Today, Solana finds itself in a similar position to Ethereum after the ICO boom. The recent bull market has seen a wave of speculation that has propelled its market cap to a comprehensive diluted valuation of about $140 billion. This boom has been primarily driven by FTX's involvement in guiding the application ecosystem and providing liquidity for Solana tokens. However, over 90% of the applications built on Solana are almost replicas of what they are on Ethereum, with almost no organic usage, a large amount of hired capital, and a terrible token supply schedule, leading to a collapse in developer activity, price, and commitment after the FTX crash.

In the quarters following the impact of FTX, the ecosystem has successfully shaken off the influence of FTX. Today, with new developer optimism and emerging community leaders with stronger moral values, missionaries have once again taken control of Solana. With the emergence of new use cases, the issue of system uptime may have become a thing of the past, and the likelihood of successful development of unique DeFi primitives being built on Solana in the coming years has greatly increased.

Similar to Ethereum's six-year journey to escape velocity, we believe Solana is moving in the same direction, albeit at a faster pace. Despite having only a three and a half year history, its recent enterprise and ecosystem momentum make it likely to generate breakthrough use cases in the next cycle. On the enterprise front, Solana recently integrated with Visa and Shopify, indicating that despite the events of last year, it still has attention in institutions. The continued support and validation from Visa and Shopify could lead to significant downstream network effects when other enterprises seek to explore crypto initiatives by partnering with Visa or Shopify.

In the crypto economy, sentiment towards Solana continues to improve, with many significant product announcements in recent quarters. Eclipse recently announced its SVM Rollup mainnet, which, while not directly benefiting Solana itself, reduces the risk for developers to launch applications on Solana and increases the number of contributors to the Solana ecosystem. In the same light, Rune, the founder of Maker, proposed forking Solana's codebase to launch Maker's upcoming chain. This proposal not only provides significant validation for Solana's technical stack, but also signals an expanded Solana contributor ecosystem from one of the most respected builders in Ethereum.

This evidence is also reflected in the data, with the latest generation of Solana DeFi protocols, aptly called "DeFi 2.0," driving on-chain financial activity on Solana to heights not seen since the bull market. Decentralized exchange (DEX) trading volume on Solana is growing at the highest monthly rate ever, surpassing the peak of the 2021 bull market. Total locked value - the best proxy for users trusting the core financial infrastructure of the chain to store wealth - has almost quintupled since the beginning of the year, currently reaching $1.5 billion. Most importantly, Solana's DeFi efficiency, measured by trading volume divided by total locked value, is growing at about four times the rate, almost an order of magnitude higher than Ethereum's DeFi efficiency. With major projects launching their tokens, these numbers could further increase, providing more high-quality assets to the Solana ecosystem.

Solana's non-financial sector is also thriving. While Solana's NFT trading volume has dropped by 80% since January 2023, the introduction of compressed NFTs (cNFTs) has reignited growth in the industry, positioning Solana to be a continuous gainer in the NFT market. On Solana, the minting and distribution costs of cNFTs are about 1,000 times cheaper than in any Ethereum environment - this means that cNFTs can be distributed to 10 million users on Solana for a few hundred dollars, while it would cost tens of thousands of dollars on Ethereum L2, and hundreds of millions of dollars on Ethereum L1. Since Metaplex introduced its cNFT standard in April 2023, the number of NFTs issued on Solana has exceeded the total for the previous three years - the cost reduction provided by cNFTs is so significant that large brands can reasonably attempt to use on-chain assets at scale, greatly increasing Solana's appeal to enterprises and raising the probability of it becoming the home of the next breakthrough application in the industry.

In addition to the resurgence of Solana's NFTs, Solana has become a popular choice for decentralized physical infrastructure networks (DePIN) due to its low latency and low fees. It is worth noting that the decentralized wireless network Helium migrated to Solana in April 2023, indicating that Solana enables it to achieve greater scale, and recently Render also completed a similar migration, indicating that Solana's unparalleled performance and state compression capabilities will increase the profitability of node operators and expand its market potential.

At some point, investors need to ask themselves: Is the probability of Solana's success really as low as the market implies? Solana's current valuation is about 13% of Ethereum's, indicating that the market believes Solana has about a 13% chance of becoming a top smart contract platform. Despite the acceleration of the Solana ecosystem after the FTX low point, winning momentum from enterprises and crypto-native developers, the Solana blockchain is preparing for the Firedancer upgrade, which can be seen as "Solana 2.0" in every way. Considering all of the above factors, we believe the risk/reward ratio for Solana is excellent. As the market realizes that Solana is a foundational platform outside of Bitcoin and Ethereum, we believe its market cap can reach at least 25% of Ethereum's - relative to the previous cycle's peak market cap ratio with Ethereum. Furthermore, if the market begins to favor Solana over Ethereum in the long term, this ratio could be even higher.

Rebirth in the Flames, Building Paradise in Hell

"If paradise now arises in hell, it's because in the suspension of the usual order and the failure of most systems, we are free to live and act in another way." - "Paradise Built in Hell"

In the crypto economy, the greatest projects have repeatedly overcome the greatest adversity. Bitcoin survived the infamous Mt. Gox hack, despite Mt. Gox handling 70% of Bitcoin trading volume and losing 6% of all Bitcoin at the time. Ethereum survived the infamous DAO hack, despite the DAO raising $150 million and ironically also losing 6% of all Ether at the time. In both cases, the recovery was a testament to their resilience - the lasting impact is the strengthening of their souls and the consolidation of their fundamental propositions. Decentralized currency and autonomous programs will endure.

Today, Solana is writing its own history. Despite FTX being one of the largest contributors to the Solana ecosystem, holding about 8% of Solana's supply through its fraudulent and now bankrupt Alameda entity, the Solana ecosystem is rising from its worst nightmare. Just as Bitcoin and Ethereum reached new heights after improving their resilience and identity, we believe Solana has the potential to become the next successful ecosystem. After all, in the crypto economy, legends often emerge from difficult circumstances. In the permissionless world, only projects that can survive disasters can reach the promised land.

As mentioned earlier, it is rare to encounter a project that can unlock new possibilities on a scale comparable to Bitcoin and Ethereum. Finding such a project at such a special moment as Solana is even rarer. And a project like Solana, so fluid, is even more rare.

We are very excited to see Solana rise from the ashes, leading the way with steady steps once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。