Kava is built on Cosmos and can operate as an independent chain, so it can also be understood as striving to become the first Defi Hub chain on Cosmos.

Investment Summary:

Kava is the native USDt Defi Hub chain of Cosmos and holds a significant position in stablecoin liquidity.

As a Layer 1 bridging the interoperability between Cosmos and EVM, it ranked among the top 10 in market capitalization (as of October) and holds a leading position in stablecoin market value within the Cosmos ecosystem, with optimistic ecological development.

Kava has a clear roadmap, with clear expectations for EVM asset types, cross-chain bridge access, asset circulation, and more.

Kava's ecological development is strong, with the entry of well-known Defi products such as dydx into Cosmos, bringing more financial circulation possibilities to Kava and similar Defi Hub chains.

Kava has partnered with DWF market makers, which will significantly increase liquidity, market participation, and have a positive impact on Kava's brand image.

1. Project Summary

1.1 Project Introduction

Kava was originally a CDP (Collateralized Debt Position) automated collateralized lending platform similar to Maker DAO, allowing users to borrow stablecoin USDX by depositing a diverse range of cross-chain assets such as BNB, BTC, XRP, BUSD, and more. It also launched the Harvest.io lending protocol (later renamed Hard Protocol, and then Kava Lend), both of which together build Kava's Defi services.

Kava is built on Cosmos and can operate as an independent chain, so it can also be understood as striving to become the first Defi Hub chain on Cosmos.

However, with the development of Defi interoperability, in 2022, Kava 10 was launched, officially transitioning to a Layer 1 developed using Cosmos SDK, with a POS mechanism and EVM compatibility, dedicated to connecting the Cosmos and EVM ecosystems for cross-chain interoperability and asset circulation.

1.2 Basic Information

2. Project Details

2.1 Team

Currently, there are 45 employees, with an average tenure of 2.2 years. Core board members such as Brian Kerr and Scott Stuart have remained stable, with a tenure of up to 7 years.

Brian Kerr: Co-founder and board member of Kava Labs, previously founder and CEO of Fnatic Gear.

Scott Stuart: Co-founder and CEO of Kava.

Kevin Davis: Chief Engineer.

Aaron Choi: Vice President.

Ruaridh O’Donnell: Chief Developer and Co-founder.

Jack Zampolin: Investment Advisor.

2.2 Financing Situation

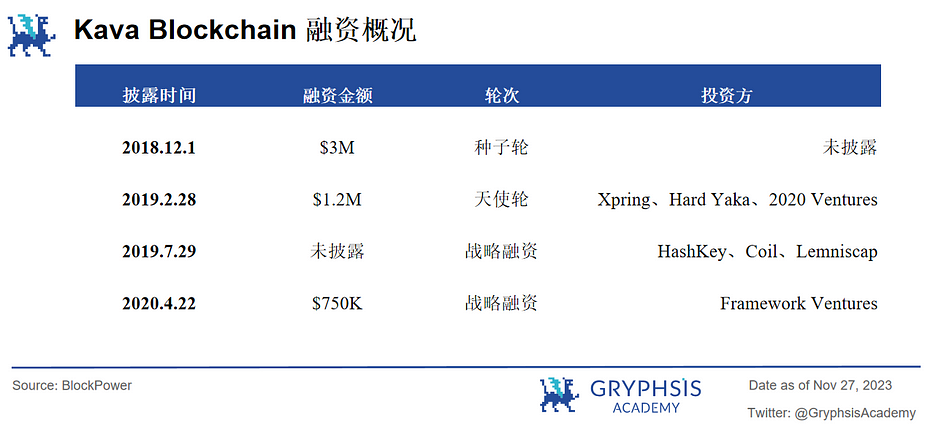

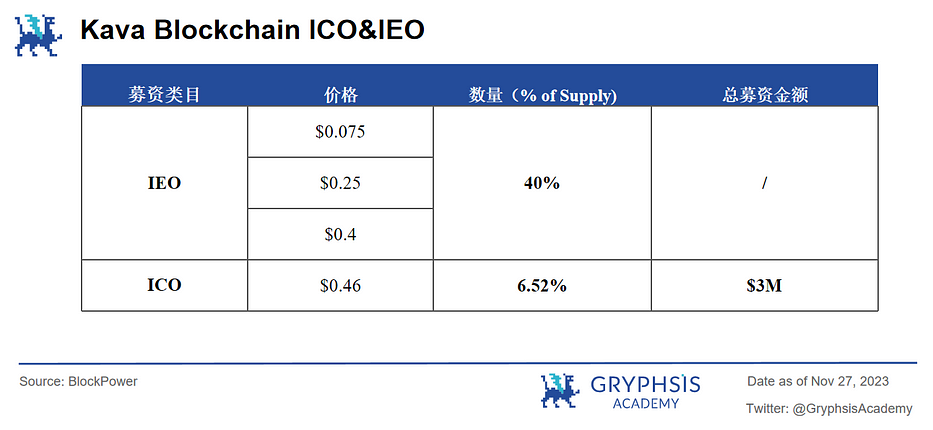

Kava has disclosed nearly $5 million in financing, with investors including Binance Labs, HashKey, Xpring, Framework Ventures, and others. On October 16, 2019, $KAVA was issued, selling 40% of the initial supply to investors through multiple private rounds, and an additional 6.25% of the total supply was publicly sold on Binance Launchpad at a price of $0.46, raising a total of $3 million.

2.3 Technical Framework

Kava's structure is divided into Cosmos Co-Chain and Ethereum Co-Chain, both created on the Cosmos Tendermint consensus engine. The Ethereum Co-Chain allows developers to deploy using Solidity or directly migrate applications to Kava, while the Cosmos Co-Chain communicates with the entire Cosmos ecosystem through the IBC protocol. The Translator Module connects the two different execution environments to facilitate easier access for both parties.

Source: Whitepaper

Kava is internally divided into Kava IBC (Cosmos environment) and Kava EVM (EVM environment), where:

1) Cosmos to EVM:

The native internal bridge launched on Kava14, as a Cosmos SDK module, can be integrated into various applications and wallets. It allows users to transfer Cosmos assets in the form of ERC20 to the EVM environment, enabling asset transfers. For example, if $KAVA wants to be used in the EVM environment, it can be wrapped as $wKAVA (with ERC20 attributes) for use in the EVM environment.

Unlike external bridges, the Kava internal bridge transfers assets within the same ledger, similar to the way the IBC protocol changes states between different ledgers, ensuring consistency and compatibility.

2) EVM to Cosmos:

Currently allows Kava EVM to cross to Kava IBC, Osmosis on the Cosmos side, Injective, and Evmos on the EVM side, crossing $USDt and $ATOM.

It can be seen that Kava's asset transfer on the EVM side is relatively weak, as the only supported Evmos chain on the EVM side is not part of the Ethereum ecosystem. It is also a Layer 1 that is compatible with both EVM and Cosmos, so the full interaction with the Ethereum ecosystem has not been fully realized. Currently, the support for EVM assets to Cosmos is limited to bridges such as Stargate or other cross-chain aggregators, and Kava's internal support range is limited.

2.4 Product System

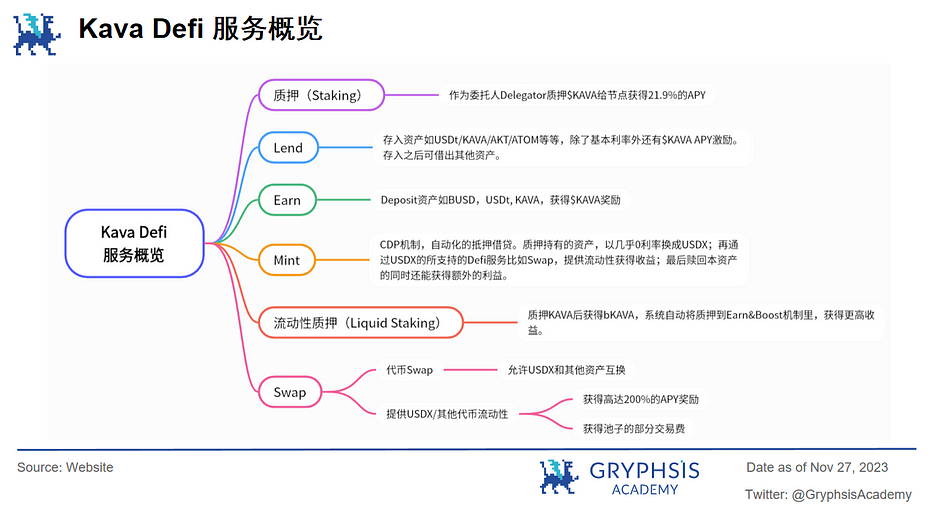

Kava Labs mainly consists of the following Defi services:

Kava Staking: Retail holders of $KAVA can delegate their assets to nodes for staking and earn profits from it.

Kava Lend: Originally known as Harvest, then renamed to Hard Protocol. It allows users to deposit various ecosystem assets such as BTC, XRP, BNB, BUSD, and lend out other assets. The ecosystem not only provides basic interest rate incentives for borrowers but also offers $KAVA mining incentives.

Kava Earn: As a Defi yield strategy, it incentivizes users to lock $bKAVA to earn high APY, thereby increasing Kava's TVL.

Kava Mint: Renamed from Kava CDP protocol, it allows users to collateralize cross-chain assets to mint collateralized stablecoin USDX.

Liquid Staking: Staking held $KAVA to earn $bKAVA, with the system transferring the staked $KAVA to the Earn mechanism to earn higher returns.

Kava Swap: An AMM model swap mechanism that allows users to seamlessly trade various assets on different blockchains or earn additional returns by providing liquidity.

2.5 Ecosystem

Currently, Kava's total TVL is 340.67M, stablecoin market value is 129.06M, and daily trading volume is 1.44M. There are over 116 protocols deployed on it, with a high proportion in the Defi category. However, according to protocol rankings, Kava's native Defi services still dominate, with the top five mainly covered by Kava Lend, Kava Mint, Kava Earn, and others. The ecosystem does not have standout native independent protocols like Blur on Arbitrum.

3. Development History

3.1 Major Historical Events

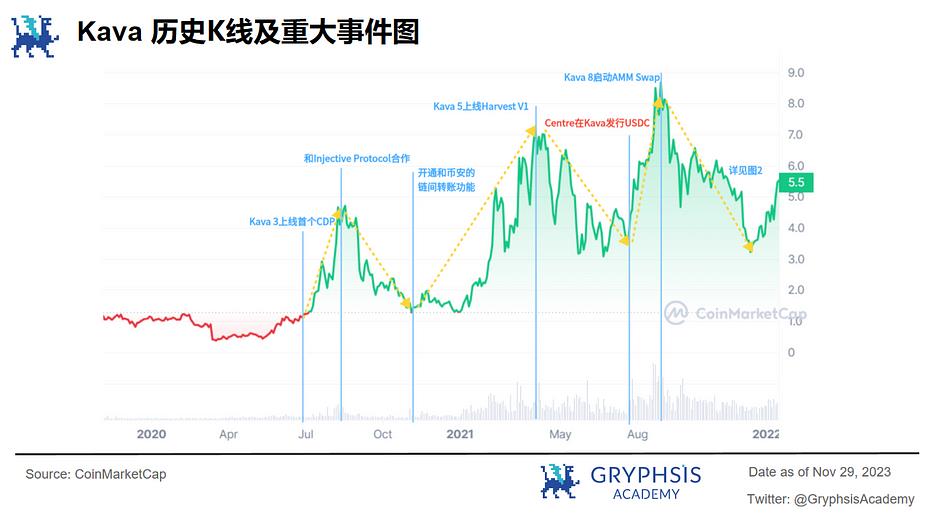

Let's first take a look at the major events in Kava's history from its inception to the present.

March 1, 2019: Kava raised $1.2M in funding led by Venture Capital.

February 5, 2020: Kava launched the first cross-chain lending platform CDP testnet.

February 27, 2020: Official integration with Trust Wallet, supporting storage, transfer, and staking of $KAVA.

March 25, 2020: Announced a long-term strategic partnership with Chainlink.

April 16, 2020: Became one of the first partners in the OKChain open-source cross-chain ecosystem.

April 30, 2020: Kava released the CDP pre-registration page, opening it for user testing.

May 15, 2020: Established an on-chain governance committee mechanism.

June 11, 2020: Kava3 launched the first CDP, supporting collateralized BNB for borrowing USDX.

August 13, 2020: Established a partnership with Injective Protocol.

October 15, 2020: Kava4 supported Harvest.io V1 version.

November 6, 2020: Inter-chain transfer functionality with Binance Chain was enabled, supporting cross-chain trading and transfer of BTC, XPR, BNB, BUSD.

February 9, 2021: CertiK audit passed.

April 9, 2021: Kava5 launched Harvest V2 version, allowing asset borrowing and providing $HARD mining incentives.

July 26, 2021: Kava5 mainnet rollback.

July 27, 2021: Centre plans to issue USDC on Kava.

August 31, 2021: Kava 8 launched the AMM Swap mechanism.

September 22, 2021: Kava Rise incentive program released $185M to attract projects to join.

January 20, 2022: Kava9 integrated the IBC protocol, targeting a broader Cosmos ecosystem.

March 3, 2022: Launched the $750M Kava Rise developer incentive program.

April 7, 2022: Ethereum Co-Chain Alpha.

April 27, 2022: Official launch of CosmosEVM Era.

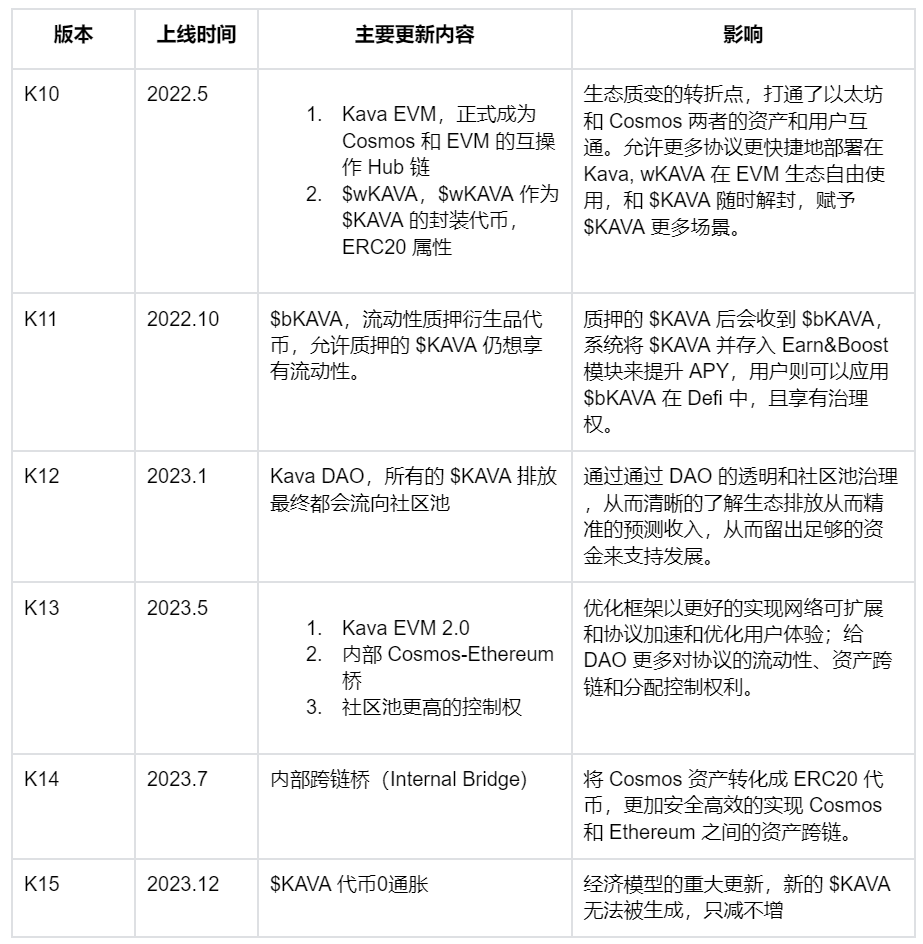

May 25, 2022: Kava10 EVM launched, officially becoming a Cosmos&EVM interoperable Hub chain.

June 21, 2022: Partnered with Celer cBridge to achieve asset cross-chain interoperability.

September 9, 2022: Curve Finance launched on Kava.

October 26, 2022: Kava11 launched $bKAVA to increase staked token liquidity.

January 12, 2023: Kava12 launched DAO.

March 15, 2023: Kava13 launched EVM 2.0.

April 4, 2023: Community proposal to create a dual-foundation structure.

May 12, 2023: Kava EVM roadmap launched.

June 22, 2023: Tether to launch stablecoin USDT on Kava.

July 13, 2023: Kava14 upgrade successful, deployed an internal cross-chain bridge to convert native Cosmos assets to Ethereum ERC20 standard.

July 14, 2023: Kava 14 opened native Cosmos assets to Ethereum.

September 2, 2023: Stargate launched Kava native USDt liquidity pool.

November 15, 2023: Kava reached a strategic partnership with DWF Lab.

December 7, 2023: Kava 15 achieved token zero inflation.

3.2 Price K-Line Trend

3.3 Kava 15

The Kava 15 mainnet will officially launch on December 7th. Proposal 141, which plays a crucial role in K15, lists three key areas in the future roadmap: Adoption, Security, and Governance.

1) Adoption:

Kava aims to position itself as the stablecoin gateway of the Cosmos ecosystem, integrating various stablecoins into Kava. This will enable it to become the exclusive stablecoin hub chain for Cosmos, allowing better interaction with other application chains such as DYDX, Osmosis, and more. For example, Injective already supports Kava's BTC/USDC, ETH/USDT perpetual pools.

In terms of the EVM native bridge, Kava will integrate with mainstream bridges such as Layerzero, Wormhole, Multicahin, Axelar, etc., to interact more efficiently and quickly with EVM native assets. At the token level, consideration will be given to integrating more wrapped tokens such as WBTC, WETH, and others. Currently, Stargate already supports wETH on Kava.

By connecting EVM liquidity, the native protocols in the ecosystem can not only benefit but also attract more investment and CEX liquidity.

2) Security:

Mainly focused on node availability and software scalability, optimizing nodes to improve reception, processing, and validator interaction, and ultimately decentralized services; optimizing software scalability to support higher transaction and request volumes.

3) Governance:

In line with maintaining the principle of sovereign autonomy in Cosmos, Kava will extend community governance to the Kava EVM level to maintain governance consistency between Cosmos and EVM frameworks. In the future, two independent foundations will be established to jointly maintain the continuous development of Kava, with the net profits from the ecosystem, excluding staking rewards, being controlled by the two foundations.

4. Economic Model

4.1 Model & Allocation

4.1.1 Token Model

1) Dual-token economic model

Kava adopts a dual-token economic model, with the equity and governance token $KAVA and the stablecoin $USDX.

$KAVA: Widely used as an ecosystem token, such as for staking in POS, inflation rewards, transaction fees, voting, and governance, etc.

- $bKAVA: Liquidity staking derivative token that allows staked $KAVA to still have liquidity.

- $wKAVA: Wrapped token for $KAVA, with ERC20 properties.

$USDX: The system's native stablecoin, primarily used in the CDP protocol, where users can collateralize tokens to obtain USDX, thereby gaining higher liquidity, similar to DAI in MakerDAO.

2) Use cases for $KAVA:

- Transaction fees: Ecosystem fees need to be paid in $KAVA, including asset transfers, opening/closing CDPs, and transfer transactions, etc. CDP transaction fees are distributed to validators and delegators in a certain proportion.

- Staking rewards: Staking $KAVA tokens can earn an APR of 3%-20% based on the network's total staking rate.

- Validator commission: Node validators can earn a certain percentage of commission from the earnings of their delegators.

- Community governance: The right to propose and vote to modify platform rules.

3) Deflationary mechanism:

For every new block generated in the network, new $KAVA tokens are emitted as rewards for node validation, with an expected annual inflation rate of 7%. However, each CDP will have a corresponding stability fee, and when $KAVA is used to pay the stability fee for collateralized debt positions, it will be burned to maintain the token's supply and demand balance.

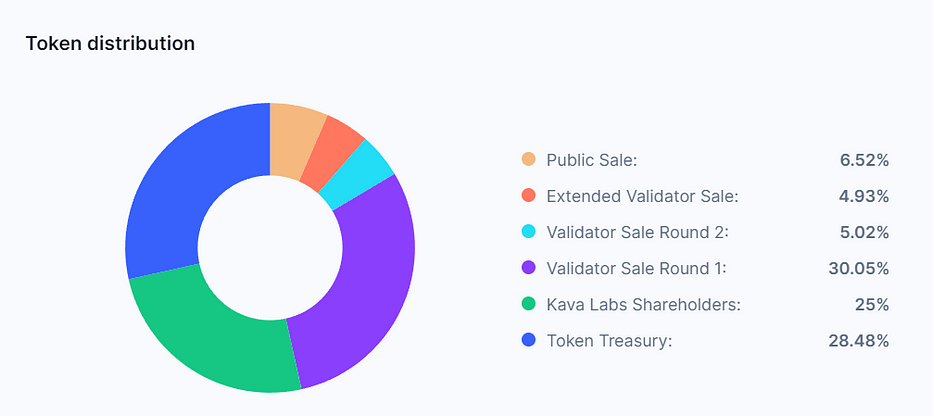

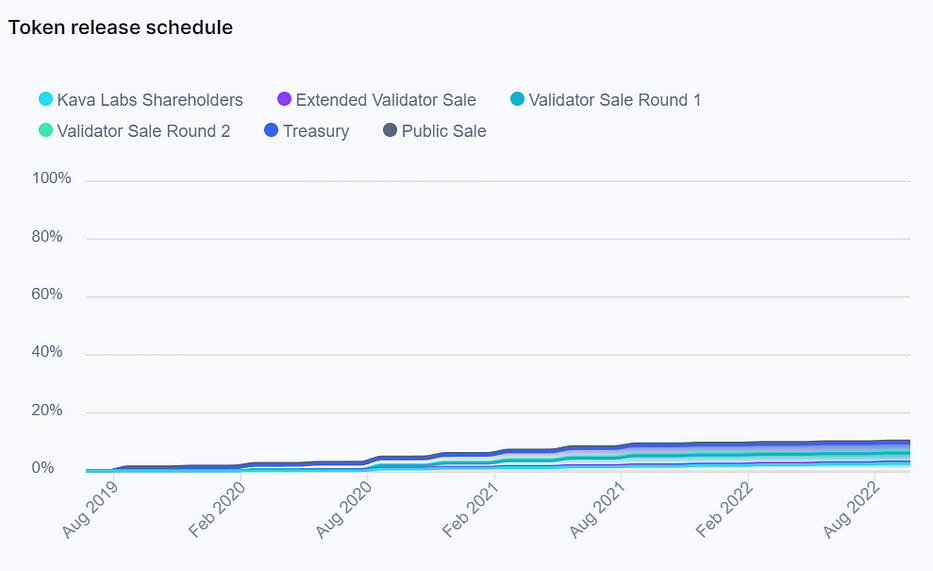

4.1.2 $KAVA Allocation Mechanism:

There is no upper limit to token issuance, but there were 100 million tokens at the genesis.

Source: CoinMarketCap

Source: CoinMarketCap

4.1.3 $USDX Pegging Mechanism

USDX is a stablecoin collateralized in the CDP, pegged to the US dollar at a 1:1 soft peg, and adjusted based on an algorithm to maintain price stability through elastic supply.

When users collateralize assets to borrow USDX, there is a certain collateralization ratio. For example, depositing assets worth 150U and borrowing 100U of USDX, the price is pegged to the collateralized assets.

If the price of the collateralized assets drops too quickly, the system will initiate liquidation or debt auctions to sell the collateralized assets at a price below market value, while increasing the supply of USDX, causing the price of USDX to also drop and maintain stability with the pegged assets. Additionally, if market movements exceed the system's automatic adjustment range, $KAVA tokens will act as the "lender of last resort," inflating and auctioning off $KAVA tokens as collateral to compensate for the USDX price.

In addition, Kava has made some optimizations to the price mechanism of USDX, such as:

- Obtaining high-quality market data through Chainlink's Oracle Feed to ensure accurate anchoring of collateral and USDX.

- Diversifying collateral assets to mitigate the risk of a single asset. When the system is forced to sell collateral at a low price, the recovered assets may not cover the system's bad debts, so profits from other collateral assets can be used to cover the shortfall, thereby enhancing risk resistance.

However, the price of USDX still experiences severe pegging. On April 11, 2023, the price of USDX plummeted to $0.1, then quickly rebounded to $0.8. Founder Scott Stuart pointed out that price stability for USDX is not a necessary condition, and instead believes that USDX is best suited to be pegged to market fluctuations.

4.2 2.0 Update

In the upcoming K15, it is explicitly stated that the inflation rate will be abandoned, meaning that the circulating supply of tokens in the market will be the maximum supply. No new $KAVA can be created, and the inflation rate is planned to be permanently reduced to 0 on December 31.

The surplus of $KAVA mainly comes from native project emissions, transaction fees, and the foundation. This means that the portion of $KAVA used as ecosystem fees will return to the community rather than going directly to node validators. The community will decide how to use these funds (burn or reinvest), further enhancing the network's decentralization.

As a result, the total supply of $KAVA will only decrease, and with $KAVA being used for ecosystem fees and governance rights, the demand will gradually increase as the ecosystem grows.

5. Track Analysis

5.1 Overview of the Track

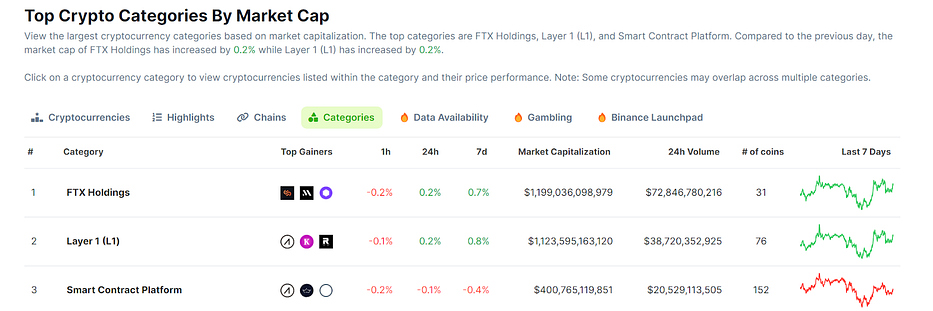

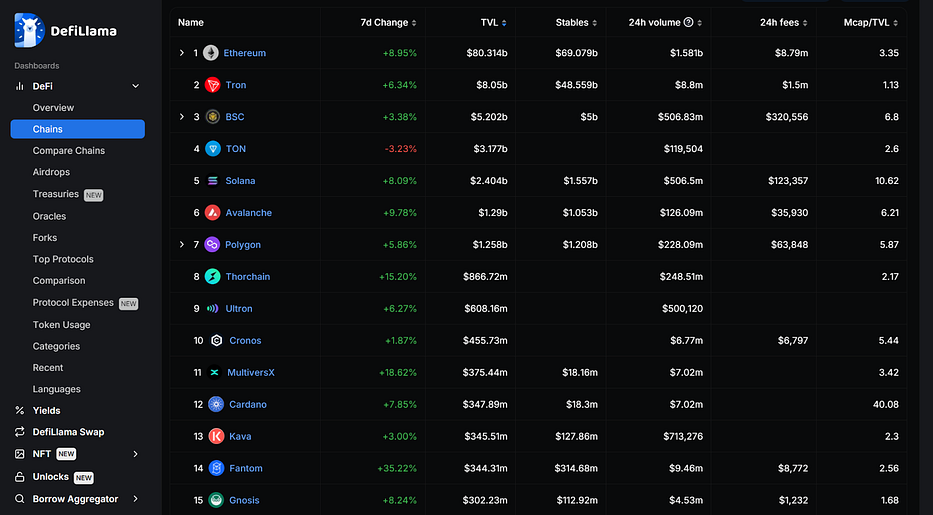

Kava belongs to the Layer 1 track, extending a series of Layer 1 underlying networks such as BSC, Sui, Aptos, Solana, etc., from Ethereum and Bitcoin as pioneering networks, leading to the overall prosperity of the ecosystem. As of the time of writing, the market value is 1125 billion, ranking second in the overall blockchain market value category. Ethereum dominates the track, with other public chains such as Tron, BSC, TON, Solana performing well.

Source: Coingecko

Source: Defillama

The underlying protocol of Layer 1 blockchains, including module architecture, consensus mechanisms, block mechanisms, etc., has a significant impact on the performance and scalability of the entire blockchain. Different Layer 1 designs lead to different characteristics, with some public chains focusing on transaction processing speed, while others focus on privacy and security.

Classifying based on characteristics, such as EVM-compatible and non-EVM-compatible, and those focusing on creating their own chains, such as Cosmos & Polkadot, etc.

Here is the translated text in English:

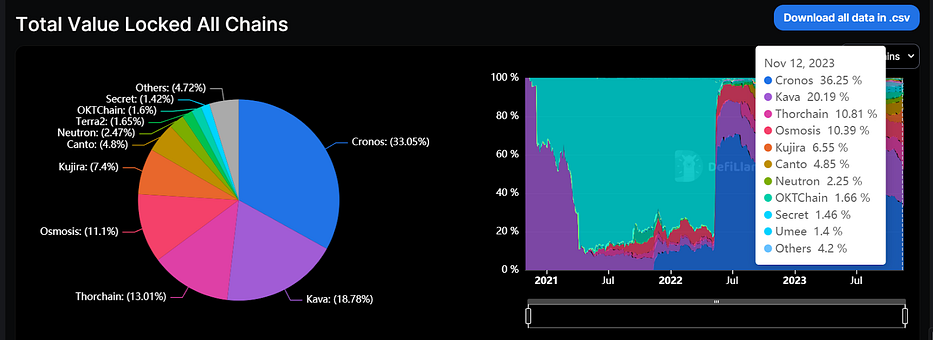

Kava is a subdivision of Cosmos, focusing on connecting the Cosmos and EVM ecosystems, and providing cross-chain interoperability as a Layer 1 public chain. It ranks third in TVL within Cosmos.

5.2 Competing Projects

Let's take a look at Kava's competitors in the Cosmos & EVM Compatible Layer 1 public chain.

- EVMOS

Source: Website

EVMOS originated from Ethermint, an EVM chain built using the Cosmos SDK, aiming to link the Ethereum and Cosmos ecosystems through the Tendermint consensus protocol.

The team later realized the potential for mutual prosperity and benefits between Cosmos and Ethereum, leading to the founding of EVMOS. The goal is to build an EVM Stack solution on Cosmos, allowing the existing EVM community to quickly deploy on Cosmos while providing interoperability between the two ecosystems.

In 2022, Ethermint successfully rebranded as EVMOS, bringing the EVM chain, applications, assets, and users into the Cosmos ecosystem. As of the time of writing, EVMOS has a TVL of 4.52M, a stablecoin market value of 130K, and a 24-hour trading volume of 160K.

- Cronos

Source: Website

Cronos is also built on the Cosmos SDK and provided rapid connectivity between Ethereum and other EVM ecosystems through the open-source project Ethermint (formerly EVMOS), using the IBC protocol and other Cosmos interoperability. It focuses on Layer 1 for Defi, NFT, Games, and Metaverse. The mainnet was launched in November 2021 and quickly accumulated millions of users and 500+ applications.

It has launched a dedicated NFT marketplace, allowing users to create and trade NFTs, and implemented cross-chain bridging to allow users to transfer assets from other blockchains to Cronos. However, its EVM-based public chain is still under development. As of the time of writing, Cronos has a TVL of 453.34M, a stablecoin market value of 5.9K, and a 24-hour trading volume of 4.2M.

5.3 Kava Competitive Advantages

1) Ecosystem Status

Kava, as the native USDt Defi Hub chain in Cosmos, has a significant position in stablecoin liquidity. As a Layer 1, it ranks in the top 10 in the overall track (as of October 2023); it ranks second in the Cosmos ecosystem, with a leading position in stablecoin market value, and the ecosystem's development is optimistic.

Source: Defillama

Moreover, it has a clear roadmap for the development of EVM asset compatibility, including the types of assets, access to asset cross-chain bridges, and the circulation of assets with other application chains in Cosmos, with clear expectations.

With well-known Defi products like DYDX entering Cosmos, the overall ecosystem development is strong, bringing more financial circulation possibilities to Kava and similar Defi Hub chains.

2) DWF Market Maker Partnership

On November 15th, Kava reached a partnership with DWF Market Makers. In their announcement, it was explicitly stated that DWF would not only provide basic risk management, liquidation mechanisms, fee structures, etc., but also provide strategic guidance and begin proprietary trading in the DEX on the Kava chain, accounting for 7.5% of the total trading volume of all DEX in the ecosystem.

This can significantly help Kava improve liquidity by providing more trading pairs and depth, thereby increasing market participation. Additionally, this strategic partnership has a positive impact on Kava's brand image. Overall, the cooperation with DWF has brought positive effects in the market and product aspects for Kava.

3) Strong Community Expectations (Mainnet and Economic Model)

After the official announcement on November 11th that the K15 mainnet will go live on December 7th, the token price rose by 13.7% on the same day, indicating strong community expectations for the mainnet update. In addition, the changes to the token economic model after the launch will restrict the circulation of $KAVA, likely leading to a new surge in $KAVA.

Source: Coingecko

5.4 Cosmos Beta

In addition to Kava, the recent development of the Cosmos ecosystem has been strong. We have collected the following excellent protocols as Beta recommendations:

5.4.1 Neutron ($NTRN)

Neutron is the first chain launched on Cosmos's Replicated Security, allowing project teams to quickly deploy by deploying smart contracts on the Cosmos Hub.

Positive narratives:

- Collaboration benefits. The Mars Protocol V2 will be deployed on Neutron and will allocate a certain percentage of tokens to Neutron; Apollo, the LSDfi protocol on Cosmos, has also successfully launched on Neutron.

- Acquisition of 25% equity in Conflio, the developer of the programming environment CosmWasm.

- Neutron's existence increases the demand for $ATOM by project teams, and it is more endorsed by the Cosmos official. Because while sharing validators with the Hub chain, it also needs to pay $ATOM as a service fee. If the project forms its own ecosystem and uses its own token to maintain the ecosystem, the use case for $ATOM will be weakened.

5.4.2 THORchain ($RUNE)

THORChain is a cross-chain liquidity protocol that supports native DEX cross-chain transactions (focused on swapping native assets across chains), lending, and other Defi functions related to earning. Its AMM mechanism's DEX has unique protection mechanisms against impermanent loss and dynamic slippage fees.

Positive narratives:

- LiFi is about to integrate THORChain to expand swap functionality.

- Native asset swaps support native BTC transactions, and the booming BTC ecosystem is driving up trading demand, indirectly increasing LP incentives and promoting the purchase of $RUNE.

- THORChain's Forks will be driven by $RUNE to support asset liquidity for various protocols, but also stimulate the demand for $RUNE.

5.4.3 Celestia ($TIA)

Celestia is a POS blockchain based on CometBFT and Cosmos SDK, focusing on modular data availability.

Positive narratives:

- Launch of Ethereum Fallback feature to ensure user funds do not get stuck in Layer 2 contracts.

- Integration with Manta public chain.

- Collaboration and integration with OP Stack technology, using Celestia as the DA layer.

5.4.4 Injective ($INJ)

Injective is dedicated to building interoperable Layer 1 blockchains for Defi applications, supporting Ethereum, IBC-compatible blockchains (such as the Cosmos ecosystem), and non-EVM compatible chains (such as Solana) for cross-chain interoperability.

Positive narratives:

- Volan mainnet update is imminent.

- $INJ burning mechanism.

6. Risks & Challenges

- The ecosystem protocols are monopolized by local services, with Kava Lend accounting for 1/3 of the total TVL. Other supported Defi protocols such as Curve, Sushi, etc., are not native protocols of Kava, leading to a single ecosystem, which seems to still be in the stage of Defi services, and it will take some time to move towards the public chain ecosystem.

- The maturity of cross-chain asset exchange is not high. The internal native bridge has high support for transferring Cosmos assets to EVM, but the service for transferring EVM assets to Cosmos is not extensive. Currently, only Stargate or other DEX Aggregators support transferring EVM assets to Kava, and the strong financial properties of Ethereum will amplify this deficiency.

- Kava's development is also limited by the development of Cosmos itself and its ecosystem. If the development of the ecosystem is overtaken or replaced by other underlying cross-chain protocols, DeFi attached to the Cosmos ecosystem will also be affected.

7. Conclusion

As a Cosmos and EVM interoperable chain, Kava has relatively weak support for EVM assets on the Cosmos side internally, but still has advantages compared to other competitors. In particular, it holds $72.5M of USDT (EVM) stablecoin assets in the treasury, providing a foundation for future interoperability with the Cosmos ecosystem.

In addition, in the current prevailing narrative of "application chains," whether it is Layer 2 Stack or Layer 1 ecosystems such as Cosmos & Polkadot, ecosystem development always depends on interoperability. As an interoperable chain, Kava will act as an intermediary for Defi services between major EVM application chains and Cosmos application chains in the future.

It is worth noting that $KAVA, as the token for ecosystem and governance fees, will achieve zero inflation on December 7th. Stopping the supply-side output in the context of expanding use cases will undoubtedly trigger a demand-side surge. Combined with its formal cooperation with DWF, it is believed that $KAVA can bring more surprises in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。