Authors: Lawyer Liu Honglin, Lawyer Liu Zhengyao

The so-called "good fortune does not come alone, and misfortune does not come singly," the leeks always seek to cut the tender ones.

For friends in the currency circle, besides the ease of having bank cards for selling virtual currency frozen, more and more friends are encountering even more distressing situations, such as having their accounts on virtual currency exchanges frozen.

Previously, a friend in the currency circle forwarded an article to me, roughly stating that the account of a virtual currency encrypted fund in the United States was frozen on a well-known exchange in China, because the account received assets related to the case. After the fund contacted the public security in mainland China and provided work certificates and account transaction records, the public security still did not apply to unfreeze its exchange account. The author of the article stated that he did not know about the involved gambling website, and his transactions were only regular operations on other virtual currency exchanges. He provided evidence to the public security, but the public security did not unfreeze his account, suspecting that he might be involved in illegal activities.

Many friends are puzzled. They can understand if their Chinese bank cards are frozen, after all, they are all in mainland China. But the virtual currency exchange I use is registered overseas, so how can the Chinese public security still have jurisdiction? In this article, we will discuss this topic.

Can Chinese public security freeze overseas exchange accounts?

Let's start with a simplified version: not only can they, but virtual exchanges generally cooperate very well.

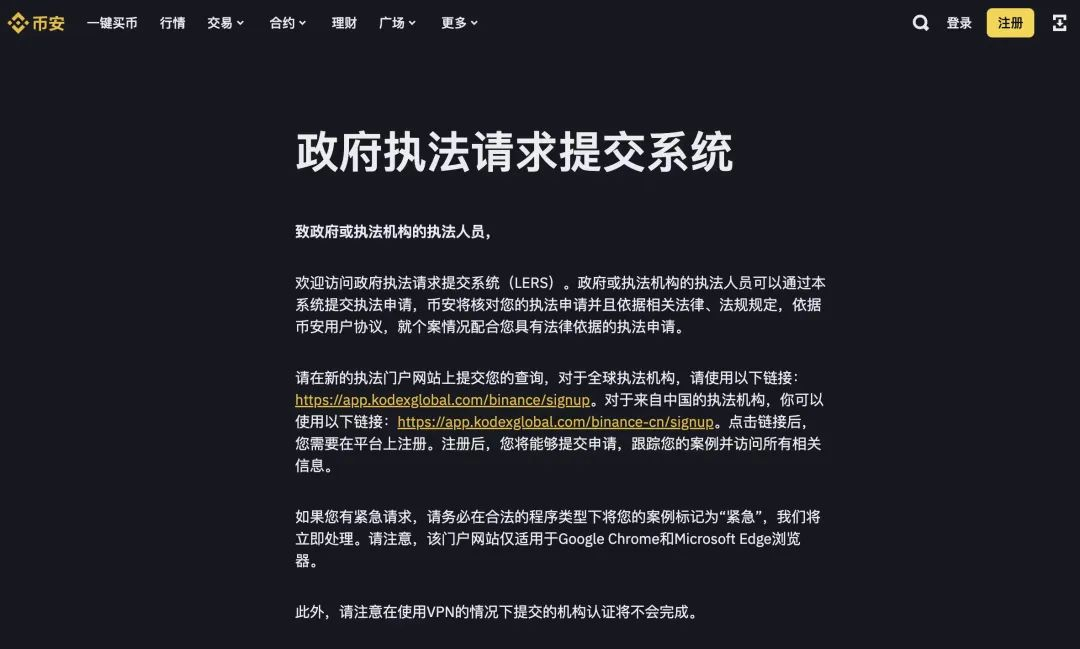

Taking a leading company in the industry as an example, on its official website, it even has an exclusive link for law enforcement agencies in China, fully assisting in the smooth conduct of law enforcement work in mainland China. Moreover, it is rumored that a certain virtual currency exchange has established special law enforcement channels with public security in multiple places in China, exchanging information and cooperating, which is quite stimulating (unverified insider information).

According to Article 144, Paragraph 1 of the Criminal Procedure Law, public security organs, as needed for investigating crimes, can, in accordance with regulations, inquire about, freeze the deposits, remittances, bonds, stocks, fund shares, and other property of criminal suspects. Relevant units and individuals shall cooperate. Therefore, public security organs will seal and freeze the accounts involved in the case during the investigation. These accounts often belong to the channels of new types of illegal crimes in the telecommunications network, and frequently involve charges such as aiding and abetting crimes, money laundering, and concealing or disguising proceeds of crime.

So, are virtual currency users' accounts on exchanges considered involved property or property rights? If public security organs have evidence proving that a user's virtual currency account is related to criminal activities, such as suspected money laundering, fraud, gambling, or pyramid schemes, then public security organs have the right to take compulsory measures to clarify the facts and collect evidence. If a user's virtual currency account is not related to criminal activities, then public security organs have no right to take compulsory measures, otherwise it would constitute an abuse of power and infringement of property rights. Of course, in this case, users also have an obligation to cooperate with the investigation by public security organs and provide relevant evidence materials.

Can public security directly seize assets involved in the case?

(1) Traditional involved property

According to Chinese law, public security organs can take measures such as sealing, seizing, and freezing involved property in criminal cases, but in principle, the involved property in criminal cases cannot be directly seized by public security organs. It is only after a court judgment that the subsequent disposal of the involved property in criminal cases is directly carried out by the court or by the court commissioning public security organs.

However, there are also some exceptional situations in reality: for telecommunications network crime cases, under specific conditions, public security organs can directly deduct and return the funds of victims from the involved property. For example, according to the Ministry of Public Security's "Several Provisions on Freezing and Returning Funds in Telecommunications Network New Type Illegal Crime Cases," under three specific conditions, public security organs can directly deduct and return the involved funds. First, the crime involved is a telecommunications network crime, i.e., criminals defraud or steal others' legal funds through telecommunications and internet technology; second, the frozen funds verified by public security organs are indeed the legal funds of the victim; third, public security organs must return the funds in accordance with the prescribed methods, such as direct tracing, direct full return according to the timestamp, and proportional return based on the victim's loss amount and the total amount involved.

(2) Involved virtual property

The operation methods of judicial organs for returning virtual currency as involved property are not entirely consistent. Although China has some relevant regulations and notices for the supervision of virtual currency, such as the "Notice on Preventing Bitcoin Risks" and the "Announcement on Preventing Risks of Token Issuance and Financing" issued by departments including the People's Bank of China, as well as the recent "Notice on Further Preventing and Dealing with Risks of Speculation in Virtual Currency Trading" issued by ten ministries including the Supreme People's Court, the Supreme People's Procuratorate, and the Ministry of Public Security, these documents do not specifically stipulate the procedures and judicial disposal methods for public security organs to seal, seize, or freeze virtual currency. Therefore, disputes and controversies are inevitable in practice.

In addition to regulatory provisions, public security organs also face certain difficulties in the technical operation of sealing, seizing, freezing, and deducting involved virtual currency. Because virtual currency has no physical form, it only exists in the blockchain network, controlled by a string of passwords and keys. For public security organs to deduct a user's virtual currency, they need to first obtain the user's account information and password on the exchange, and require the exchange to provide relevant evidence and assistance in execution. However, the exchange may refuse or resist the requests of public security organs, as they also need to protect the privacy and interests of users.

Currently, in practice, for criminal suspects who have been subjected to compulsory measures (criminal detention, residential surveillance at a designated place, etc.), after being educated by public security organs (specific methods vary by region), they often actively cooperate with public security organs in handling involved virtual property, such as transferring the virtual currency they hold to a virtual currency account address created by public security. For simple cases, such as in the case of online crime, where A steals one bitcoin from B, and after B reports the case, public security arrests A and requires A to transfer the stolen bitcoin to a wallet address created by public security, public security can directly transfer the involved bitcoin to B after confirming that B is the victim.

Of course, in reality, criminal cases are often quite complex, with a large number of victims and even a large number of criminal suspects, making it difficult to directly deduct virtual currency. However, sealing and freezing are still possible, and the operation of seizing generally involves transferring the involved virtual currency from the account of the criminal suspect to the virtual currency wallet account of public security.

How can citizens protect their own interests?

According to Article 145 of the Criminal Procedure Law, if it is confirmed that the sealed, seized, or frozen property, documents, mail, telegrams, deposits, remittances, bonds, stocks, fund shares, and other property are indeed unrelated to the case, they shall be released within three days and returned.

If a citizen's exchange account is frozen, they can actively submit the corresponding asset proof and legal documents, proving that the investment behavior is personal and the source of funds is legal, and apply to public security organs to lift the compulsory measures. If public security organs do not lift the measures or do not respond, an appeal can be made to the People's Procuratorate. If the People's Procuratorate does not support or respond, an administrative lawsuit can be filed with the People's Court. Of course, in this process, it is also possible to choose to engage a lawyer for assistance.

Conclusion

Based on the need to combat illegal crimes, Chinese public security has the right to freeze citizens' bank accounts or exchange accounts in accordance with the law, and exchanges are likely to cooperate when faced with formal documents from public security. In addition to passively waiting for public security to handle the situation, investors can also actively contact public security, provide relevant evidence materials, and strive to unfreeze their accounts as soon as possible.

Of course, all the operations shared above are after-the-fact measures. As the saying goes, "an ounce of prevention is worth a pound of cure." For friends in the currency circle, if you have a large amount of legal digital assets, it may be a more recommended choice to keep them in a truly decentralized wallet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。