We are controversial, and we are proud of it.

Interview: Kean, Foresight News

Interviewee: Andrei Grachev, DWF Labs

Compiled & Translated by: Peng SUN, Foresight News

"I have 5 Chinese tattoos on my body," Andrei Grachev couldn't help but reveal his joy and excitement when talking about non-American markets.

As a Russian, Andrei Grachev embodies the wildness of a warrior. But his crypto investments do not reflect Russia's identity crisis between Europe and Asia; instead, he firmly chooses the East. In the crypto world, Asia has always been known for trading, speculation, and manipulation. Andrei Grachev's story has become part of this narrative. He started with trading, engaged in market making, high-frequency trading, and investment, believing that the Asian and Middle Eastern markets will lead the new trend.

Looking back at 2022, DWF Labs and Andrei Grachev are undeniably controversial focal points. With monthly investments reaching tens of millions of dollars, where does the funding come from? Market manipulation? Non-traditional market-making methods being marginalized by entities like Wintermute? Various controversies have surged, but Andrei Grachev doesn't care. He believes that he is just challenging tradition, not breaking the law or doing anything wrong.

In Grachev's view, this is an all-in-one solution that can meet all needs, rather than just providing a single market-making service:

Today, DWF Labs is a large high-frequency trading company, market maker, VC, OTC, incubator, ecosystem, fundraiser, event brand, TVL provider, DeFi Taker, advisor, listing agent, HR, public relations/marketing company, KOL, RFQ quote request platform, and more…

Grachev claims that in the past 16 months, DWF Labs has provided these services to about 350 Web3 projects in the top 1000 market cap on CoinMarketCap. When the founder of Wintermute disdains associating with them, the warrior never gives up. Grachev openly confronts, "We are controversial, and we are proud of it":

Being complicit with those "orthodox" market makers who accept loans, do nothing, sell off, or profit from call options is my shame. They are just envious. We dare to take risks, be innovative, change the order of the crypto world, and raise the standards for market makers.

Since Crypto is breaking the traditional narrative order of nationalities, why can't DWF Labs break the traditional order of crypto market makers? Since crypto is constantly reconstructing and has not yet provided a new framework, why can't DWF Labs reconstruct the past and build its own narrative? Moreover, the author has heard more than once about the demand for "all-in-one services" from Web3 projects.

In this interview, Grachev revealed the basic structure of DWF Labs, its various businesses, funding sources, risk management methods, investment logic and style, bull market planning, the latest progress in acquiring FTX, and his views on the global crypto market. Regardless of its operating mode and controversies, objectively speaking, DWF Labs has provided support to many projects even in bear markets.

I. The Path of "Internet Celebrity" Market Makers

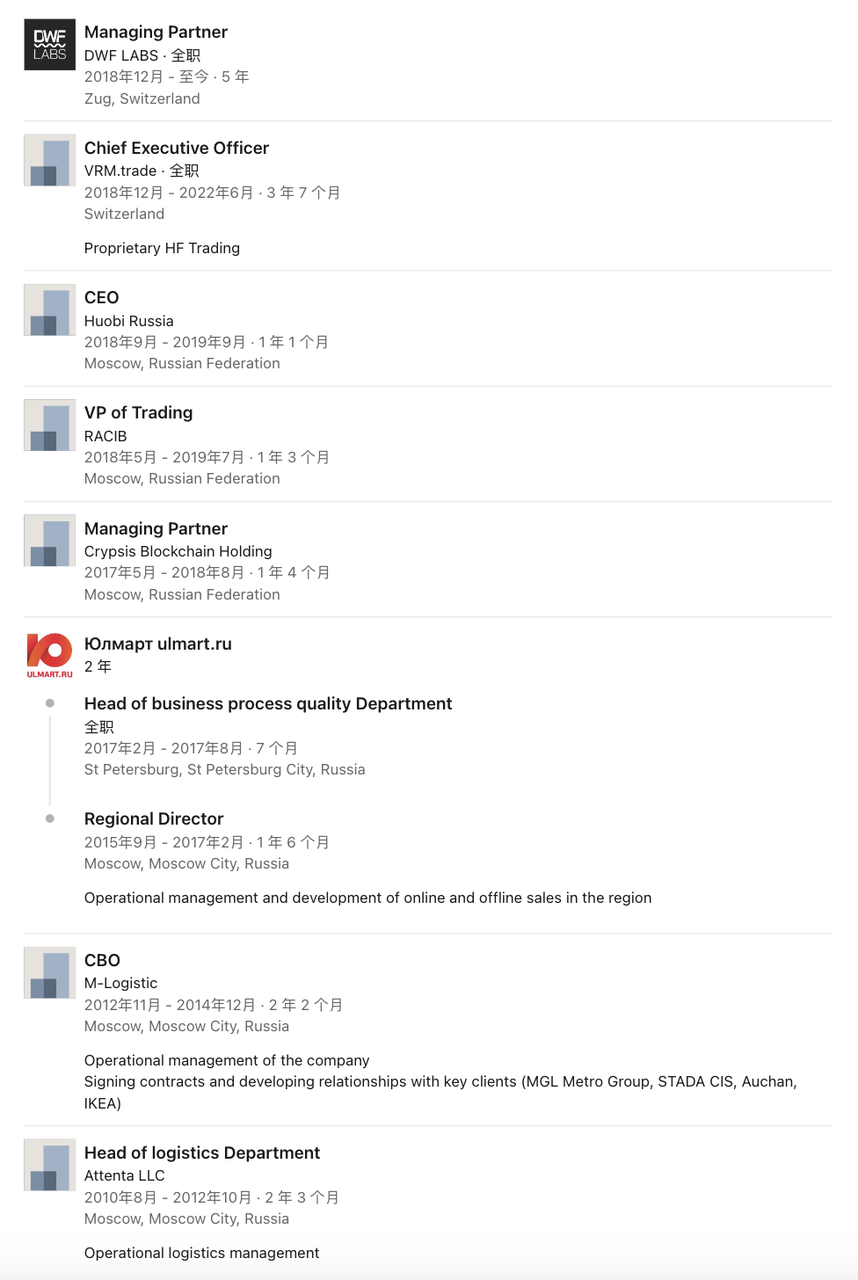

Andrei Grachev has been working in the logistics industry since August 2010, and he started trading in traditional markets around 2014, embarking on his trading career. In 2016, Grachev seemed to have purchased his first ETH, which also allowed him to make a fortune during the 2017 bull market. His experiences in founding a crypto trading company and serving as Huobi Russia's CEO have also contributed to his rapid growth.

Foresight News: How did you transition from the logistics industry to the crypto field? Are there any key turning points or interesting experiences you'd like to share? How have these experiences influenced your current career?

Andrei Grachev: I entered the logistics industry at the age of 18 and worked in logistics for 8 years. Around 2014, I started trading in traditional markets. Later, I transitioned to e-commerce, which gave me more time to learn about financial markets and other aspects. In fact, my experiences in the logistics and e-commerce industries did not have much impact on my cryptocurrency trading, but they did influence my management skills and work style. In fact, since 2010, I have been working remotely with large distributed teams. These two industries have helped me develop a broad perspective.

In 2016, a friend in London told me about Ethereum mining, which was my entry point into the crypto world. The 2017 bull market was a crucial turning point. At that time, Ethereum rose from $7 to $350. We sold some ETH and embarked on our crypto journey. Initially, I and my friends created Crypsis Blockchain Holding to explore the crypto market, which was a good time for us to gain experience and learn how to operate. I also joined a community organization called RACIB, but it was not a job. It piqued my interest to some extent, but I also realized that the organization seemed like a self-regulatory body, but it was not. I won't work in such an organization again. At that time, I also managed funds for friends and family, provided advice, and eventually became the CEO of Huobi Russia.

Huobi Russia is my most important experience. I met partners from Digital Wave Finance (DWF) and later became good friends with them. As the fastest-growing and largest-scale Huobi Cloud, we also received two awards from Huobi Global, which helped me establish many relationships in China and Southeast Asia. Although I resigned as CEO in 2019, I continued to work as a partner there until 2021. Finally, we sold the business of Huobi Russia back to Huobi and made a lot of money. Before founding DWF Labs, we also created VRM.trade, where we conducted proprietary high-frequency trading on secondary CEX and learned a lot about product and technical details.

Foresight News: That's an interesting journey. So, why did you establish DWF Labs? How did your team come together? Where are the members located, and how do you communicate and coordinate work?

Andrei Grachev: DWF Labs was established in 2022, previously only Digital Wave Finance, which was founded in 2018. Initially, I helped Digital Wave Finance to collaborate with exchanges to negotiate better fees and conditions. During this period, I met my current partners Zac, Eugene, and Heng, who helped me a lot in the Asian market. While discussing cooperation with Digital Wave Finance, I proposed to my Asian friends to start a market-making business, which was the starting point for us to establish DWF Labs. We are mainly based in Asia and Switzerland, so remote work has always been our normal way of working. We mainly communicate using Telegram, Zoom, and Google Meeting.

Foresight News: What is the departmental structure and composition of DWF Labs? What is the relationship between OTC, DWF Ventures, and market makers as shown on the official website? How is the team divided?

Andrei Grachev: We have multiple departments that offer various products, such as OTC trading. Here, we mainly provide seamless transactions for individuals or entities that meet our KYB, KYC, and AML requirements, settling their tokens. Typically, handling token settlements is straightforward, as we only need to provide the option of whether to sell the tokens, simplifying the decision-making process. Currently, we have several people in charge of this work and are enhancing our settlement capabilities to provide online prices from multiple clearing engines to more users.

For the initial OTC projects we were involved in, our goal was to transition them to other products, such as market makers and DWF Ventures. Additionally, we established the DWF ecosystem to facilitate communication between different projects and entrepreneurs, enabling them to explore and participate in new investment projects and increase trading opportunities.

However, these three directions are distinct. The market makers operate as a separate technical trading department, with no connection to the sales team. Even in different countries, their focus remains on using specialized token trading strategies. We also engage in incubating and nurturing projects. Currently, about 60 companies in the DWF Ventures portfolio have received our support at the angel and seed funding stages. These projects have not yet been listed on exchanges, but we firmly believe that once the time is right, most of them will be successful on exchanges. DWF Ventures and the OTC department work closely together, and their functions are intertwined, requiring effective communication to ensure successful transactions.

II. Is Money All Blown in by the Wind?

Perhaps the bull markets of 2017 and 2022 allowed Grachev to make a fortune, but is all the money blown in by the wind? Money blown in by the wind can also be blown away by the wind. Let's take a look at Grachev's money-making and risk-thinking.

Foresight News: Your frequent large investments have been the subject of much discussion for quite some time, and many people, including myself, are curious about the source of DWF Labs' funding and whether you have raised funds.

Andrei Grachev: We have never raised funds, and there are currently no plans to do so. DWF has always been financially stable, especially after making a lot of money during the bull market from 2020 to 2022. While we continue to be profitable, we also utilize these funds. Although I cannot disclose specific numbers, I can assure you that we have the financial capacity to easily invest tens of millions of dollars in early-stage companies every month. Our main goal is not to invest 10 million and make 200,000; we prefer to invest 10 million, be patient, and then make 50 million.

Foresight News: How do you manage tokens and control risks?

Andrei Grachev: We distribute tokens through CEX and adhere to strict risk protocols. We have very high requirements for risk management, and there is a reason for that. Making money is one thing, but protecting those earnings is equally important. Exchanges are always targeted by hackers, protocols are targeted by hackers, and market makers are targeted by hackers. We don't want to be part of that. Therefore, we need to adopt solutions to reduce risks.

According to our risk strategy, we have some funds stored in CEX and use custody services like Fireblocks, which, according to our assessment, provide robust solutions. We also have on-chain multi-signature wallets and use them when necessary. As for BTC, most of it is still stored in cold wallets, mainly because BTC does not need to be transferred to exchanges frequently.

III. The "Nokia Era" of Market Makers is Fading Away

DWF Labs has chosen a unique path, and as long as it is compliant, let the doubts go to hell. "DWF Labs is an all-in-one solution that meets all needs," this is Andrei Grachev's positioning of DWF Labs. In the past 16 months, they have provided these services to about 350 Web3 projects in the top 1000 market cap on CoinMarketCap. They want to compete with "iPhone," not "Nokia." As Grachev mentioned, DWF Labs supports portfolio companies in the Korean market, which is challenging for many, but they can accomplish it in a compliant manner. "Be creative, not biased."

Currently, DWF Labs has invested in 470 projects, with 70% of the projects being in DeFi, decentralized derivatives (such as perpetual options or options), GameFi, and SocialFi, while the rest include some high-market-share coins and memecoins.

Foresight News: Since the beginning of this year, your composite operation of "investment + market making" has been in the center of public opinion. Since March, traditional crypto market makers like Wintermute have been extremely disdainful of your investment approach, claiming that you are only "trading" and not "investing." So, what kind of relationship do you currently maintain with these traditional market makers, and do you have any business connections with them?

Andrei Grachev: I don't think there are many ways to cooperate with them. Perhaps the only way I can think of is to hire some of their talents for DWF. But in the business world, it's like you, a media person. Suppose you are a pioneer in the media industry, and another media starts complaining about your interview style, saying that your interview style is not traditional enough, would you care? I don't think so. You might be happy because you are innovative and can attract more attention.

For us, the focus is on legality. As long as we operate within the correct and legal scope, if a certain method is proven to be effective, we will adopt it without worrying about what others say, and we are not afraid of criticism or complaints from competitors.

Foresight News: The secondary market also believes that you are manipulating the market, and data companies and the media are reporting on the flow of your on-chain funds. Your fund flow has become a directional light for institutions, retail investors, and market judgments. How do you view this?

Andrei Grachev: I often encounter such discussions. In terms of trading volume, we handle transactions worth billions of dollars every day. However, compared to the overall trading volume, our volume is relatively small, and importantly, we do not engage in wash trading. Although the media and people may speculate and comment, we do have an impact. When people observe our behavior, they may buy or sell, but these are their own decisions, and we cannot control them. We play the long game, not the short game.

Engaging in cryptocurrency trading and investment means that depositing and withdrawing cryptocurrencies from exchanges is part of our business, and this is crucial. We do not engage in trades that are conditional on market manipulation; our approach remains unique.

Market manipulation is not attractive to us. As the industry moves towards more regulated and legal directions, our focus is on long-term gaming rather than short-term gains. Ultimately, whether their trading choices follow ours or go against them varies from person to person, but our goal is to engage in strategic long-term gaming in the constantly changing market environment.

Foresight News: I noticed that you responded to Coin98 Analytics on Twitter, stating that the 174 projects they compiled account for 40% of DWF Labs' entire investment portfolio, which is 435 projects. So, what types of projects do you generally invest in, and what different strategies do you choose for different projects?

Andrei Grachev: Our investment portfolio mainly revolves around long-term narratives, accounting for about 70% of our investments. This includes our focus on DeFi, decentralized derivatives (such as perpetual options or options), and a significant amount of investment in emerging areas like GameFi and SocialFi.

The remaining portion of our investment portfolio is allocated to specific coins, which may have a high market share or be popular. Additionally, we reserve a small portion for short-term narrative investments, such as some memecoins. The appeal of memecoins lies not in any groundbreaking technology they possess, but in the culture they represent. They embody a cultural phenomenon, and it is beneficial to invest in this trend. Once the time is right, these memecoins may experience significant increases, which is why we invest in this culture.

Foresight News: On several occasions, you have stated that investing directly in tokens is helping projects in "distress," which implies that these projects are relatively mature. Does this mean that you do not trust the initial teams? Because the seed round is basically just an idea, without even a product.

Andrei Grachev: Of course, we believe in startups. When it comes to investment, there is a clear distinction between startups and the secondary market. The secondary market provides data insights, attractiveness, and interest from users or traders, allowing for risk assessment and potential hedging. However, for startups, it's completely different. It's not about trust, it's more about risk management, considering that market narratives are long-term, such as DeFi or GameFi, and so on. If a startup has an excellent team, a good product, and aligns with the long-term market narrative, it's a good fit for investment. While it cannot be guaranteed to be successful, you can play the game, weigh various possibilities, and then the question is how much capital to allocate from the investment portfolio. If 90% of your investment portfolio is in startups, the risk will be high; if it's 5% to 10%, then there's no problem at all. You can make some investments, and even if they are not successful, they won't jeopardize the entire investment portfolio. But if you win, the potential returns can be huge.

This is the approach we take, always trusting startups; otherwise, we wouldn't work with them. What we need to do is control risks based on calculating probabilities and optimize investment decisions.

IV. It's Not Just About Funds, Confidence is Needed in Bear Markets

Andrei Grachev stated that DWF Labs' investments are not just about financial investment, but also about providing further support to the invested projects through DWF Ventures and the technical team. For him, building confidence in the industry during bear markets is crucial.

Foresight News: How do you currently make decisions and operate in OTC trading and secondary market coin purchases? Besides purchasing coins, what support do you provide to the invested projects?

Andrei Grachev: Our focus is not only on providing financial support, which is secondary; anyone with cash can invest. In the cryptocurrency and venture capital fields, money is usually not the issue; good projects often find enough funding. What sets us apart is the value-added services we provide.

We have our own incubation department, which can assist in developing market strategies, conducting market research, and collaborating with KOLs, media entities, and local businesses. Additionally, we provide solutions through our human resources department to help portfolio companies recruit talent for their teams.

Furthermore, we provide technical assistance through an internal team of around 10 developers. Although this team is currently managed by us, we plan to spin them off soon. They provide consultancy, computation, and other technical expertise for our projects. Lastly, we also provide support services such as listing and market making.

Foresight News: In 2022, the crypto market experienced collapses of Three Arrows Capital, Celsius, Voyager, FTX, and others, causing immeasurable harm to the crypto industry. In the midst of a crypto winter, financial markets are cooling down, and the global economy is becoming more conservative. However, DWF Labs has been moving against the tide, supporting Binance's industry recovery fund plan, TON Foundation's "rescue fund," and even accelerating overall investment pace. What considerations and decisions are behind this?

Andrei Grachev: Looking back to the beginning of this year, when FTX collapsed, it was a great opportunity to deploy funds. When everyone is selling, you need to buy; this is the golden rule of investment. In times of market fear, taking proactive action often means reducing competition.

The impact of Binance's industry recovery plan after the FTX collapse has been profound, and our collaboration with Binance has made a positive contribution to the industry. For us, this is not just about making money, but about building confidence. When the market is in turmoil, it's very important to have someone or a group of people saying, "Hey, keep building, we will support you." I want to emphasize that we have made multiple investments, provided significant support to projects, and have reaped substantial returns.

Regarding the TON Foundation, we have invested a significant amount of funds in TON, and this is no secret. It's a long-term commitment with low capitalization, but we firmly believe in its potential, so we have invested tens of millions of dollars. When TON initiated the proposal, we naturally provided support. Whether it's supporting market makers or facilitating OTC trading, we will support our partners in various areas.

V. What to Do When the Bull Market Comes? "We are very adaptable"

Andrei stated that DWF Labs is very adaptable, with a bear market investment logic in bear markets and preparing for bull markets through other support and investments. Additionally, due to a significant portion of their own funds being frozen in FTX, DWF Labs will also acquire a local exchange of FTX.

Foresight News: How long will this "high-frequency" large-scale investment continue? Currently in a bear market, you are investing in projects facing "difficulties" through OTC trading. In a bull market, the flow of funds for the projects will be more abundant, and the existing investment strategy is likely to be ineffective. What plans do you have for the next bull market in terms of investment and market strategy?

Andrei Grachev: First, we don't only invest in projects facing "difficulties." We have also made a large investment in Fetch.ai, which is not a "difficult" project but has performed very well. It's a profitable investment, and we will continue to support it.

Our efforts are not just about injecting funds into businesses but also about building an ecosystem. What we are selling now is not just our funds but also our comprehensive support, and it has been proven to facilitate more transactions.

In July last year, when DWF Labs had been operating for 12 months, I wrote on Twitter: "During this period, our portfolio has reached 250 projects." Since then, our investment portfolio has expanded to approximately 470 projects. This means that in the first 12 months before the market fell into difficulties, we easily made transactions, and we did the same in the following four months of positive market conditions. This demonstrates our adaptability in various market conditions, and our ability to operate in a more optimistic market sentiment. It can be said that our current efforts and achievements have surpassed those of six months ago.

Foresight News: You previously mentioned considering the acquisition of FTX assets, and there is currently a high demand for the acquisition of FTX and the relaunch of FTX 2.0. The FTT token has also seen a significant increase. Have you had any communication with FTX? Are you progressing with this plan?

Andrei Grachev: Our lawyers are in contact with the FTX liquidators regarding the asset issue, and everything is going smoothly. As for FTX 2.0, a local FTX exchange has approached us, seeking our participation as a market maker. I cannot disclose the specific exchange at the moment, but I believe we will participate. Because a significant portion of our funds is frozen on FTX, we need to make some trades to recover these funds. However, we are currently unsure how this process will develop. I have no objections to FTX 2.0.

Foresight News: I wrote a brief history of LocalBitcoins, once the world's largest Bitcoin OTC platform, which operated for ten years and announced its cessation of operations this year. There were several factors contributing to its peak, such as bull markets, the lack of widespread payment infrastructure in third-world countries, and the political, economic, and regulatory environments of different countries. Ultimately, its failure was due to LocalBitcoins complying with regulations, implementing KYC, and the loss of its original P2P anonymous privacy attributes. Under similar conditions, Binance P2P and other OTC platforms have seized market share in many regions, and Binance P2P is better liked for its functionality and services, leading to the failure of LocalBitcoins. So, I would like to know about DWF Labs' OTC operating mechanism, the regions for which you provide this service, and how you handle regulation. Additionally, can you provide an introduction to DWF Liquid Markets, the institutional-grade OTC/RFQ platform you are planning to launch?

Andrei Grachev: I haven't considered too many details yet because we will officially announce it when the time is right. However, what I can say is that it is different from LocalBitcoins and more similar to Binance P2P, but with some unique innovations. We will announce more details when the time is right.

Foresight News: You previously mentioned that DWF Labs has obtained a license from the Dubai Multi Commodities Centre (DMCC) and has become its financial ecosystem partner. What kind of business will you conduct in Dubai in the future?

Andrei Grachev: We recently applied for multiple licenses to expand our operations to the Middle East. To ensure that our business is fully licensed, we are undergoing an audit by one of the Big Four audit firms.

Just yesterday, DWF Labs, along with DMCC, Bybit, and other partners, held a hackathon at DMCC in Dubai. We provided funding and consulting services to startups headquartered in the UAE DMCC. This is what we are doing here. These efforts have received positive feedback, although it may not have made the news, it has indeed been effective.

VI. All in the East, Embracing the Mysterious Power

"I have 5 Chinese tattoos on my body," Andrei Grachev said with great pride and excitement. He has some Eastern elements on his body, and perhaps his involvement in trading is in line with the characteristics of Eastern crypto, which makes him so dedicated and confident in the East.

Foresight News: You have offices in Singapore, South Korea, and Hong Kong in Asia, with the other two in the British Virgin Islands and Dubai. The majority of your team members are of Asian descent, and it seems that you have had close ties to the Chinese market for a long time. How do you view the Asian market? The U.S. domestic market is still significant, but it seems that you are more focused on non-U.S. markets?

Andrei Grachev: The Asian market is the leading cryptocurrency market globally. All leading exchanges come from Asia, such as Binance, OKX, and Bybit. Only Coinbase and Bitfinex are not from Asia, but in terms of trading volume, I believe Coinbase is not even as competitive as some Asian exchanges like Gate.io.

In terms of regulation and compliance, the global regulatory and financial landscape seems to be splitting into two parts: East and West. You need to make a choice because both the Eastern and Western markets cannot simultaneously prioritize compliance and risk-free trading. Therefore, we have decided to focus on the East, which is why we have many Asian colleagues. I love Asian culture, and I even have 5 tattoos in China. I have been dealing with Chinese people since 2018. This is our target market, and we enjoy working there. The Middle East, Asia, and China are all our target markets.

For the entire industry, I want to say that the development of the entire industry, including market makers and regular trading, has been affected by the firewall between the United States and other parts of the world. We trade on Coinbase International, an offshore perpetual contract trading platform, but we do not trade on Coinbase's spot market because it may be considered market-making by the U.S. Securities and Exchange Commission (SEC). From a risk and return perspective, this makes no sense.

The whole world is now talking about Bitcoin ETFs. Although it may start with news of ETF approval in the United States, its success and momentum are expected to come from the Asian and Middle Eastern markets, further driving its adoption and growth.

Foresight News: One last question, with CZ being forced to resign from Binance recently, what impact do you think this will have on the crypto market?

Andrei Grachev: This is bad news because Binance is undoubtedly a leader in the industry, but I don't think it will change the crypto landscape quickly. In fact, U.S. regulatory agencies have won big, and they can access all of Binance's data and understand all user behavior. I think this may prompt users to turn to DeFi, as they seek more decentralized and less regulated alternatives. Exchanges not related to the U.S. may benefit from this shift in user behavior.

Nevertheless, I don't think this will have a significant impact on Binance's business. Binance has already solidified its major position in the crypto field, and while regulatory scrutiny may lead some users to other platforms, it is unlikely to significantly weaken Binance's market dominance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。