The recent market situation can be described as hot, but from the current position and trend, it has already reached the end of the uptrend at the daily level. The subsequent market, even if it extends further upwards, is also the tail of the current daily level. Chasing high at this point is definitely not advisable. What must be done now is to reduce positions and start considering setting up short positions.

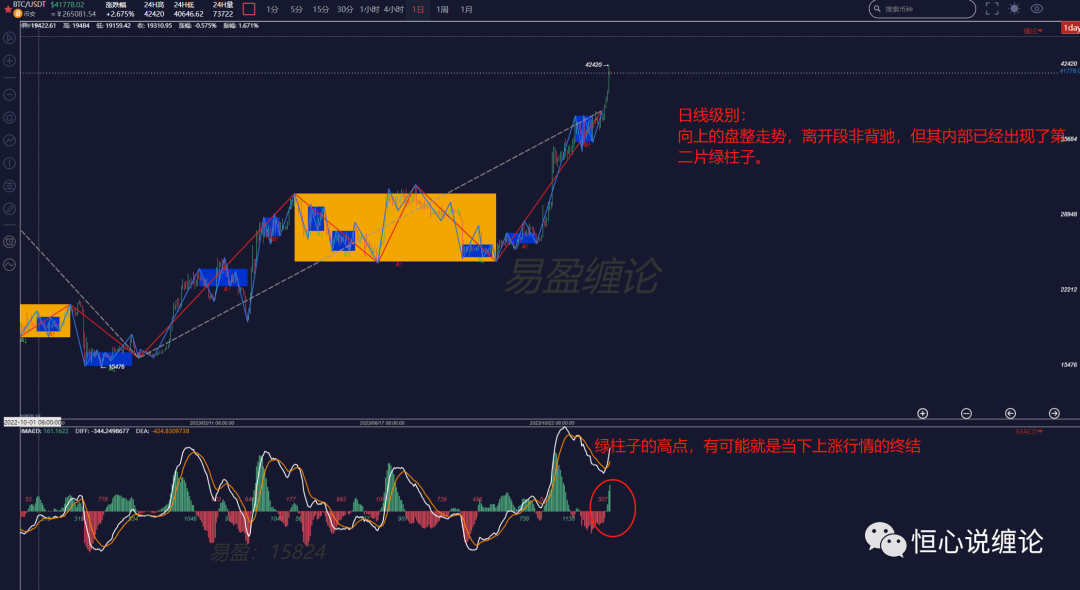

First, let's look at the daily level:

The daily chart has shown a strong departure segment, and at the current second center's departure segment, the final surge is likely the prelude to the end of the uptrend.

From the structure of the MACD, the appearance of the second green bar, and when the second green bar starts to shorten, it likely represents the end of the uptrend at the daily level (corresponding to the sub-level, i.e., the four-hour level, a sell signal).

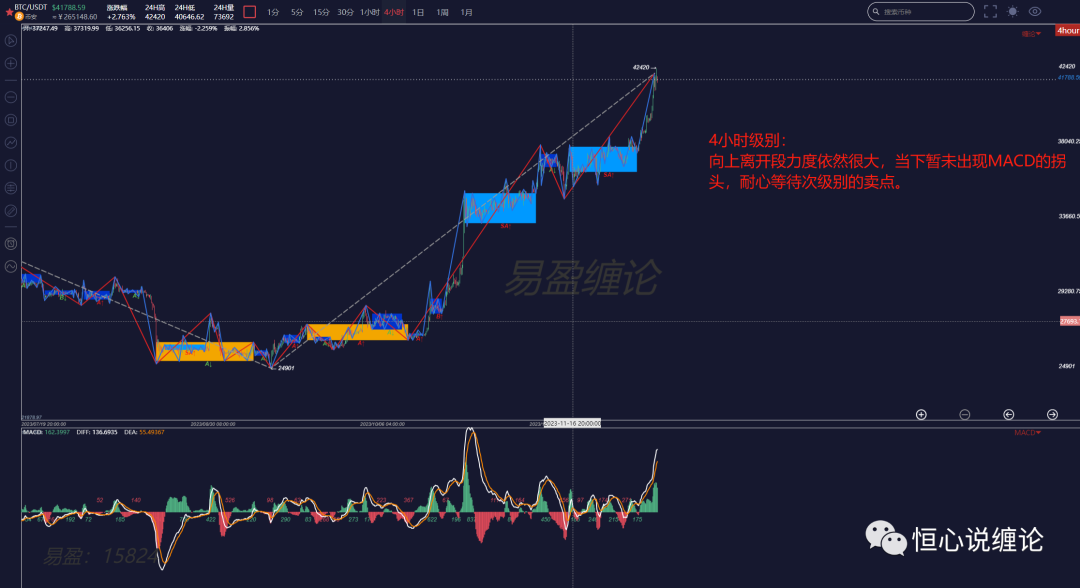

4-hour level:

Just from the 4-hour pattern, it is likely that the uptrend has not ended yet, and there is still a possibility of further upward extension within the last segment of the line. But at this point, chasing high is definitely not an option. Even if you want to go long, you should look for opportunities at a smaller level and trade quickly.

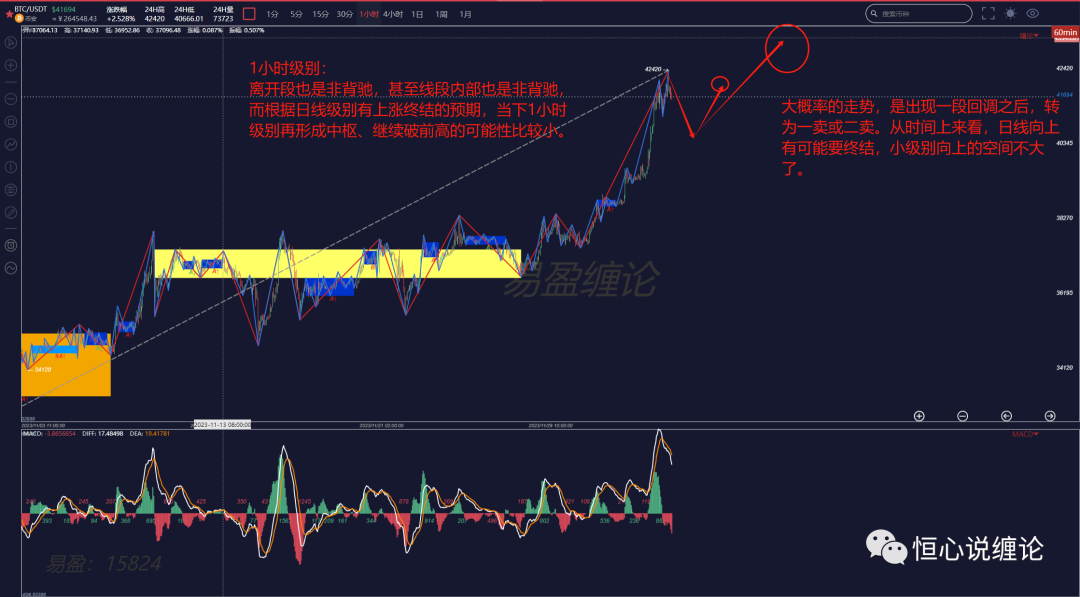

1-hour level:

Considering the imminent signal of the end of the uptrend at the daily level and the current trend at the 1-hour level, there is a high probability of a high-level oscillation followed by a selling point, which may be the resonant selling point at the daily level.

Therefore, the current rhythm must be to reduce long positions, not to chase high, not to chase high, not to chase high.

Simple terminology explanation:

Level: A unique concept in the Chande theory, representing the market in two dimensions of time and space. The larger the level, the longer the time and the greater the fluctuation space, generally including 4-hour level, 1-hour level, 30-minute level, etc.

Trend type: Divided into consolidation and trend, with upward and downward trends; each level has its corresponding trend type.

Segment: The composition of the trend type at the sub-level, "a segment of a certain level" specifically refers to a segment.

Divergence: Refers to the end of an uptrend or downtrend, where the price reaches a new high/low, but the momentum clearly weakens. It is usually judged with the help of the MACD.

The views in the article are for learning and reference only and do not constitute investment advice.

If you want to systematically study the Chande theory, use the Chande theory automatic drawing tool, participate in the Chande theory offline training camp, improve your trading skills, and form your own trading system to achieve a stable profit target, use the Chande theory technology to timely escape the top and bottom. You can scan the following QR code to add the WeChat account (vhenrythu) for consultation and learning exchange!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。