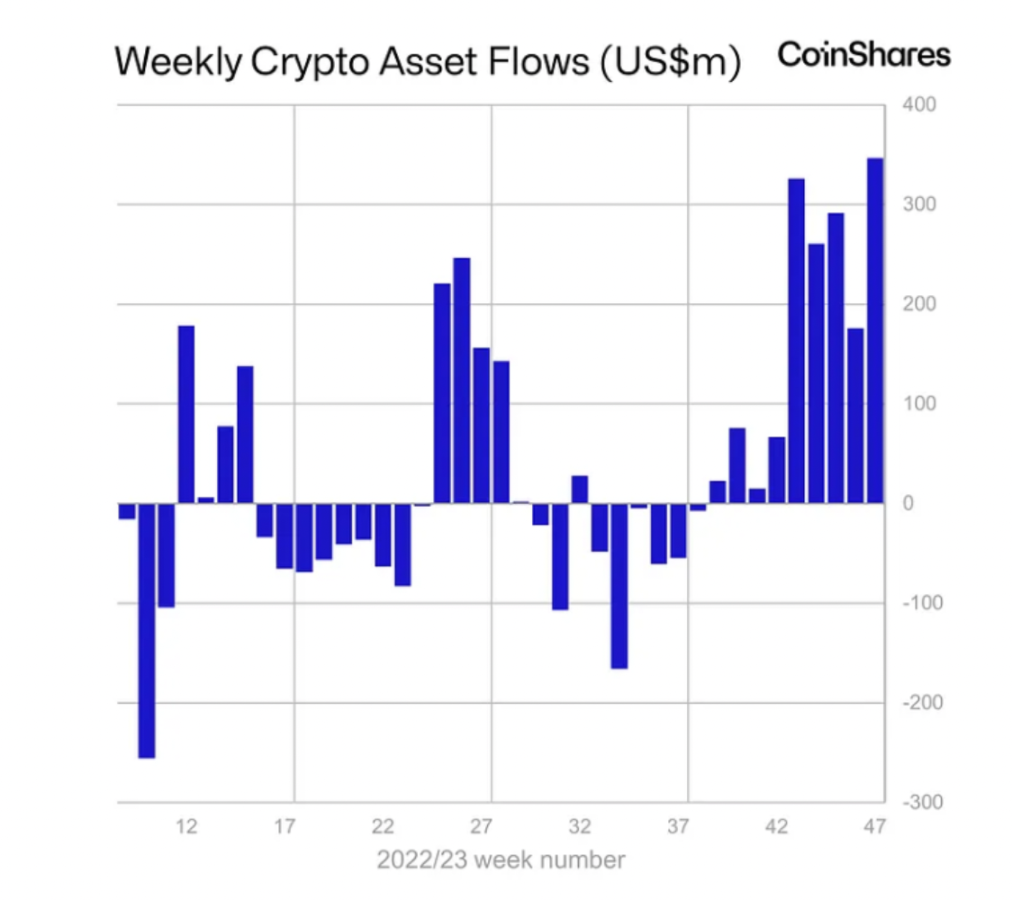

Last week, the inflow of digital asset investment products experienced nine consecutive weeks of growth, reaching $346 million.

Author: M6 Labs

In recent weeks, the cryptocurrency world has been thrilling. The market has been constantly fluctuating, with significant price swings in major cryptocurrencies, and major security vulnerabilities in several cryptocurrency exchanges have raised concerns about cybersecurity in the digital asset space. Let's delve into it!

Primary, Secondary, and DeFi

Market Situation: Cryptocurrency Circus

This period has been full of challenges and breakthroughs. For enthusiasts and investors, it's a constantly evolving field, ensuring that the cryptocurrency world is never dull!

In summary:

- Hacks have had a certain impact on the cryptocurrency space, with well-known exchanges Poloniex, Kronos Research, Velodrome, Aerodrome, Heco Bridge, and especially Kyber experiencing security issues.

- Inflow of digital asset investment products reached $346 million.

- Activity and inflows for Arbitrum have surpassed other Layer 2 solutions.

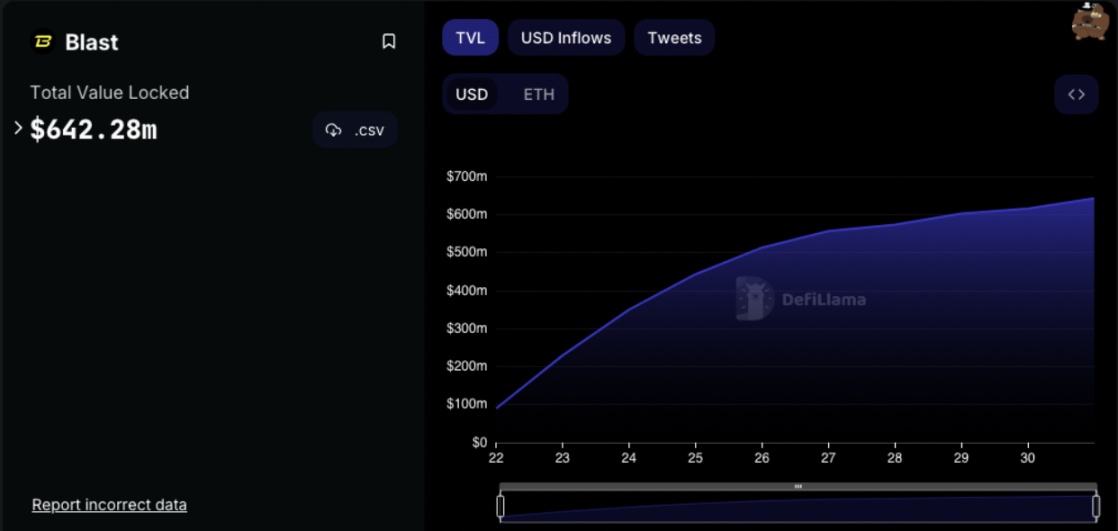

- Ethereum-based Layer 2 network Blast attracted $621 million in locked value within 10 days of its launch.

Hacks

In recent developments, the digital asset space continues to be plagued by serious security vulnerabilities. Notably, Poloniex suffered a major hack, resulting in a loss of approximately $114 million. Additionally, Kronos Research, known for algorithmic trading and market making, experienced security vulnerabilities resulting in a loss of $26 million.

These events also involved Velodrome and Aerodrome, whose front-end systems were compromised. These events highlight the ongoing fragility of the digital asset platform infrastructure. Furthermore, cross-chain interoperability platform Heco Bridge fell victim to a hack, resulting in a staggering $115 million loss.

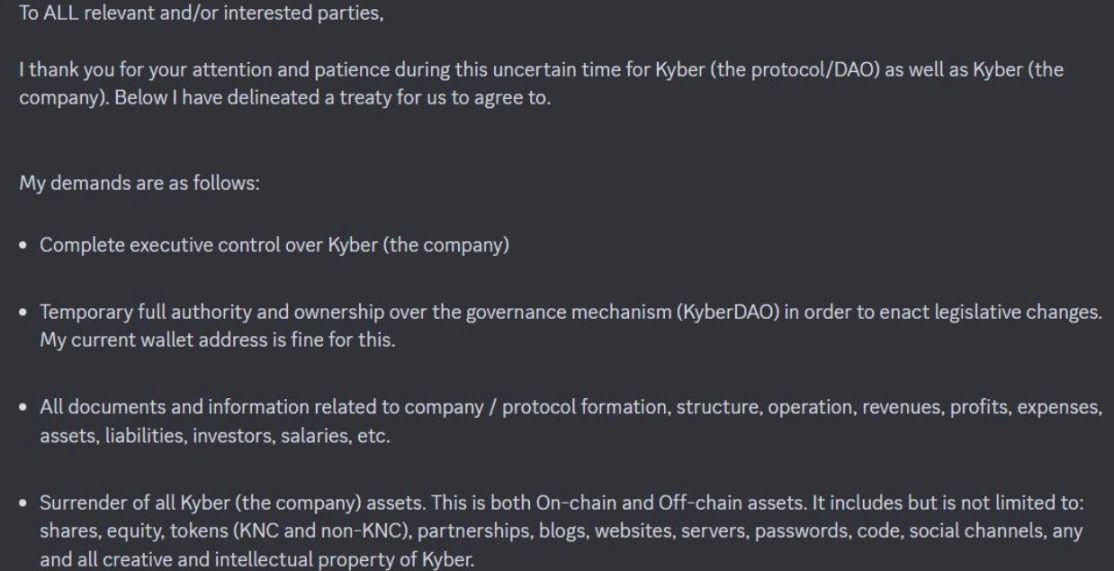

These events are not isolated but part of a series of major vulnerabilities in the digital asset space. The most notable event this week was the specific demands made by hackers to Kyber Network, which has garnered significant attention within the community. Below are some of the demands made by the hackers.

The cumulative effects of these hacks are multifaceted. On one hand, they undermine trust in the digital asset space, causing concern among investors and users. On the other hand, some analysts believe that these persistent attacks help strengthen the ecosystem by revealing and addressing vulnerabilities, thereby providing real-world testing for the infrastructure.

While the space has shown strong resilience, the persistent nature of these attacks poses a key challenge. The path to establishing a more secure and robust digital asset environment depends on effectively addressing and mitigating these security vulnerabilities.

This evolution is essential for the advancement and mainstream acceptance of digital assets and blockchain technology. This situation also often prompts regulatory authorities to consider and potentially implement stricter regulatory measures to protect investors and maintain market integrity, ultimately hindering the cryptocurrency industry.

Inflows

Last week, the inflow of digital asset investment products experienced nine consecutive weeks of growth, reaching $346 million, primarily driven by the anticipated launch of Exchange Traded Funds (ETFs) on US spot exchanges. This surge in inflows pushed total assets under management to $45 billion, surpassing the highest level in over a year and a half.

Canada and Germany contributed 87% of the total inflows, while the US, which is expected to be awaiting the launch of ETFs, saw inflows of only $30 million. Additionally, other cryptocurrencies such as Solana, Polkadot, and Chainlink received inflows of $3.5 million, $800,000, and $600,000, respectively.

Source: Coinshares.

Activity in the derivatives market has significantly increased, with DEX trading volume expected to exceed $7.5 billion, marking the highest monthly total since February 2022. DYdX has emerged in the perpetual contract ecosystem. Currently, it has firmly established itself with a strong performance of approximately $1 billion in daily trading volume.

Source: Messari.

Arbitrum has recently seen increased activity, primarily attributed to the introduction of a new short-term incentive program. Launched in September 2023, the program aims to allocate up to 50 million ARB tokens from the Arbitrum DAO Treasury to support its ecosystem, particularly decentralized applications and DeFi projects.

Source: DefiLlama.

Blast is a new Ethereum-based Layer 2 network that achieved a total locked value of $621 million within 10 days of its launch, approaching Solana's TVL. Blast was founded by Tieshun "Pacman" Roquerre, who is also the creator of the NFT marketplace Blur.

In conclusion, despite recent challenges and security vulnerabilities, the crypto market remains healthy and on a positive trajectory. Major exchanges face regulatory issues, but the market remains stable. Hacks have raised security concerns, but the market continues to show resilience. The $346 million inflow into digital asset investment products indicates strong investor confidence. Layer 2 solutions like Arbitrum are experiencing growth, while new networks like Blast are gaining attention.

Blue Chips and Major Asset Overview

Source: Tradingview.

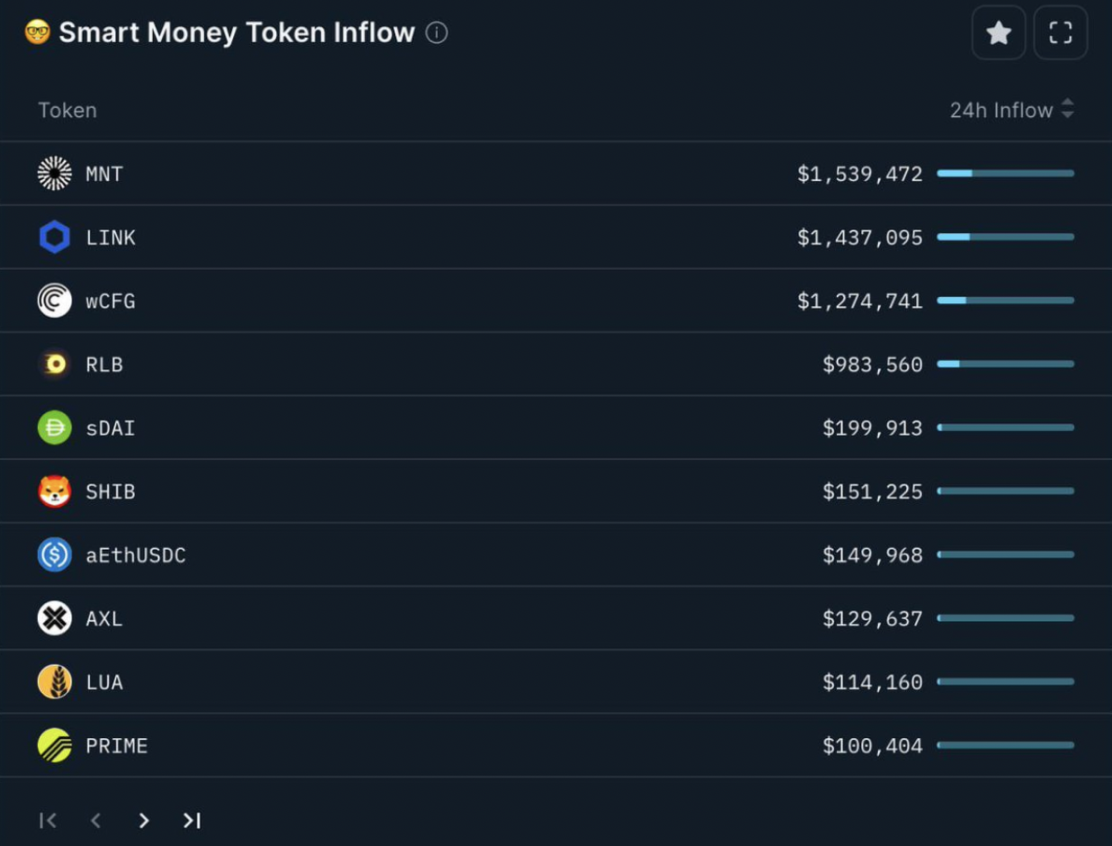

Mantle has shown strong performance in the past week, rising by 13%. In fact, since October 19, 2023, MNT has been on an upward trend, delivering a remarkable return of 62.5%. Currently, Mantle is the sixth-largest Layer 2 platform in the world, with a total locked value of $218 million.

Source: Nansen.

- dYdX experienced an 8.5% decline before the upcoming launch of a significant token in December. This event will introduce a token worth $50 billion to the market, drawing close attention from investors and market analysts.

- Terra Luna Classic (LUNC) experienced a significant surge, with a 60% valuation increase last week. Since October 20, LUNC's valuation has remarkably increased by 111.4%.

- BNB saw a 4% decline in the past week due to ongoing legal challenges involving former CEO Zhang Changpeng. As Zhang Changpeng was formally designated as a flight risk in the lawsuit, the situation escalated further.

- UNI rose from $4.90 to $6.35 between November 22 and 28, leading to increased liquidity due to events on Binance. However, the price subsequently dropped to $5.90.

- Since November 27, TORN has dropped by 57% after being delisted from Binance.

- SOL rose by 5% this week, partly due to the strong performance of the Solana-based memecoin BONK, which has risen by 600% in the past 30 days.

- XRP broke below the $0.60 support line after a whale sold over 57 million XRP tokens, but later recovered.

Smart Money Trends

Tokens

- dYdX experienced an 8.5% decline before the upcoming launch of a significant token in December. This event will introduce a token worth $50 billion to the market, drawing close attention from investors and market analysts.

- Terra Luna Classic (LUNC) experienced a significant surge, with a 60% valuation increase last week. Since October 20, LUNC's valuation has remarkably increased by 111.4%.

- BNB saw a 4% decline in the past week due to ongoing legal challenges involving former CEO Zhang Changpeng. As Zhang Changpeng was formally designated as a flight risk in the lawsuit, the situation escalated further.

- UNI rose from $4.90 to $6.35 between November 22 and 28, leading to increased liquidity due to events on Binance. However, the price subsequently dropped to $5.90.

- Since November 27, TORN has dropped by 57% after being delisted from Binance.

- SOL rose by 5% this week, partly due to the strong performance of the Solana-based memecoin BONK, which has risen by 600% in the past 30 days.

- XRP broke below the $0.60 support line after a whale sold over 57 million XRP tokens, but later recovered.

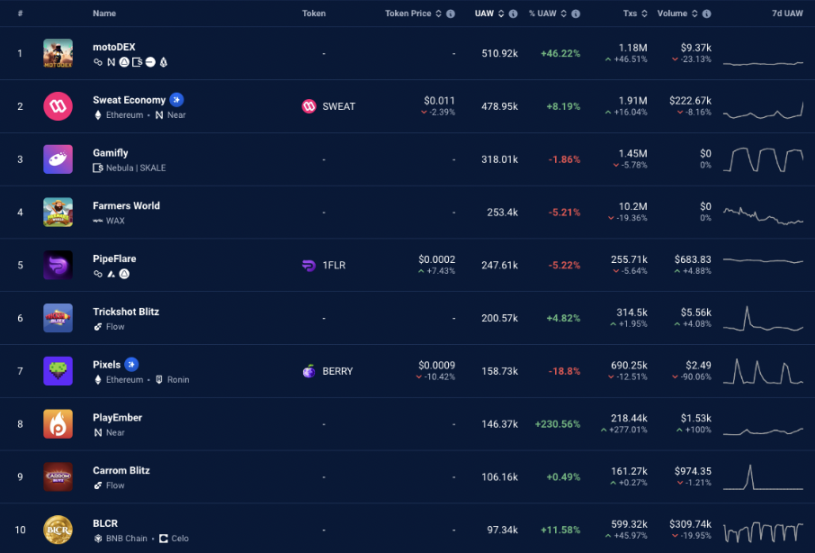

NFT and Gaming

Project Updates

- ReadON and MOBOX announced a strategic partnership aimed at unifying the Web3 gaming community.

- Ubisoft's "NFT Champions Tactics" game will enter Animoca's "Mocaverse."

- Japanese giant SquareEnix will launch a new Web3 game's NFT auction on Ethereum and Polygon.

- Azuki DAO has been renamed "Bean" and has dropped the lawsuit against founder Zagabond.

- Pudgy Pendguins released an exclusive Walmart product called the "Influencer Gift Box."

- A game studio behind a mobile NFT shooting game raised $10 million.

- Magic Eden launched a wallet supporting Bitcoin, Ethereum, Solana, and Polygon. Users can apply for the waitlist through their Twitter link.

- According to CoinGecko research, 2,127 Web3 games failed in the past five years, accounting for 75.5% of the total, with an average failure rate of 80.8%.

- Blast, a new L2 platform built by Blur founder Pacman, reached a total locked value of $600 million within 10 days.

Multiple projects' social activities continue to reach new highs. While Blur is expected, the addition of Floki, Naka, and VRA is also noteworthy.

Blue Chip Overview

NFT trading volume continues to rise, indicating sustained user interest in traditional NFTs. Despite concerns about the bear market's negative impact on NFTs, the popularity of these digital collectibles remains high, and users recognize their value.

It can be expected that established blue-chip NFT series will maintain their importance and value in the future. It is noteworthy that while Crypto Punks occupied the top spot in sales volume in the past 7 days, this original blue-chip series is either declining in rank or moving towards the lower end. Additionally, Ordinals on OKX and other markets show significant trading volume, indicating that this trend is becoming a permanent feature of the Bitcoin ecosystem.

In terms of NFT trading volume, Blur continues to lead, surpassing OpenSea, proving that a reasonable incentive mechanism can overcome the advantage of being a pioneer in the field.

However, users should note that Blur has been flagged for a higher degree of money laundering transactions. OKX's NFT market recently launched successfully, with a significant increase in trading volume, with most of the volume coming from BTC Ordinals. Meanwhile, Magic Eden has established itself as the preferred marketplace for NFTs on Solana.

That's the complete translation of the provided markdown.

However, users should note that Blur has been flagged for a higher degree of money laundering transactions. OKX's NFT market recently launched successfully, with a significant increase in trading volume, with most of the volume coming from BTC Ordinals. Meanwhile, Magic Eden has established itself as the preferred marketplace for NFTs on Solana.

The Ethereum main chain remains the primary hub for NFT trading, with many users preferring to trade on the main chain. Despite the growth of successful NFT platforms on Layer 2 solutions like Arbitrum and Optimism, NFT trading on these networks has not gained significant traction.

Interestingly, even as trading volume and liquidity continue to increase in the Arbitrum ecosystem, NFTs still seem to be a secondary focus for Arbitrum traders, while Polygon continues to be the preferred network for NFTs on L2.

Degen Corner

- DeFimons continues to make significant progress. The game is currently playable for free and is set to launch important blockchain integrations. Try it out here.

- Pixels is a casual farming game gradually gaining popularity on the Ronin chain within the Axie Infinity ecosystem. The game revolves around resource collection, farm building, and joining others in the gameplay. Check it out here.

- Duel Arena is a one-on-one duel game with Ether prizes, integrated into Cambria. In this mini-game, players stake Ether in an on-chain custody system and engage in life-or-death duels to win the staked Ether. The game is currently ongoing and has seen significant development, with over $1 million worth of Ether staked in duels.

- Kamigotchi is an on-chain pet RPG game developed on Canto, now planning to launch on the Optimism Layer 2 (L2). The game's mechanics are similar to Pokémon and include an on-chain room system. While there is no exact release date, it is expected to launch in the first half of 2024. Keep an eye on this one.

- Game-related tokens have seen significant growth in the past week: $MAGIC (+16%), $ILV (+8.3%), $RON (+28.2%), $WILD (+32.9%), $RARE (76.4%), TLM (16.9%), and $GENE (48.1%).

- Major leaders in the NFT space, such as $IMX (-9.3%) and $BLUR (-2.3%), have seen pullbacks after recent gains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。