Author: Jiang Haibo, PANews

Jupiter, the largest decentralized trading aggregator on Solana, announced the airdrop rules and query entry on December 2. In the airdrop calculation, in addition to considering the trading volume of aggregated trades, a 5x multiplier is also applied to the trading volume of limit orders and Dollar Cost Averaging (DCA).

Perhaps everyone's impression of it still lingers on the trading aggregator, but in addition to this, Jupiter has also made achievements in multiple areas. The following will introduce the five major functions of Jupiter: trading aggregator, limit orders, Dollar Cost Averaging, cross-chain trading aggregator, and perpetual contracts.

Trading Aggregator Providing the Best Liquidity

Compared to the dominance of Uniswap on overall liquidity on Ethereum and the advantage of Curve in stablecoin trading, there is no DEX on Solana that clearly dominates liquidity. The largest DEX, Orca, only has a liquidity of $84 million. In a situation where liquidity is more dispersed, a trading aggregator is almost a necessary choice for every on-chain transaction.

As a trading aggregator, in addition to the liquidity in DEX, it also needs to integrate anywhere on-chain that may bring liquidity, in order to find the optimal exchange path. For example, in MakerDAO on Ethereum, the anchored stable module, in most cases, is the optimal path for exchanging DAI and USDC. Aggregators like 1inch need to integrate such functions in a timely manner when other projects develop such features. In spot trading, Jupiter not only aggregates the liquidity of various DEXs but also integrates the liquidity of projects such as Sanctum. After integration, Jupiter may provide a better exchange price for SOL liquidity collateral derivatives than all DEXs.

Limit Order Function

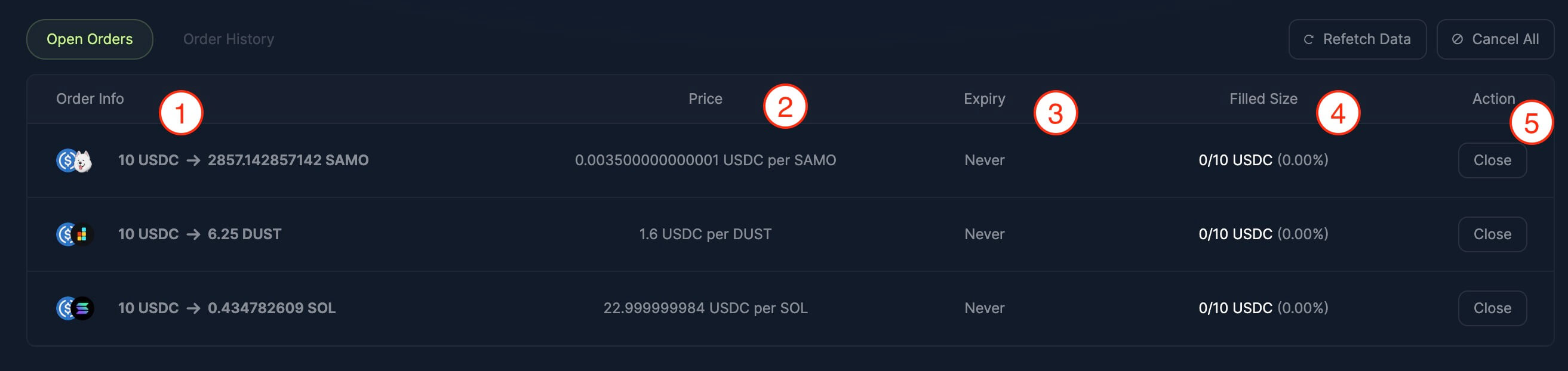

To improve user experience and flexibility, Jupiter also provides a limit order function similar to 1inch. When using it, users only need to enter order information, price, and expiration date, and the transaction will be automatically completed when the price reaches the target price.

Although the experience is similar to that of centralized exchanges, this is not an order book system. This function is used by Jupiter's keeper to monitor on-chain prices using the Jupiter Price API and Birdeye API, and when the user's target price is reached, the order will be automatically executed for the user.

Dollar Cost Averaging (DCA)

Due to the lack of optimal liquidity on Solana, when the amount of funds needed for trading is large, the liquidity in DEX may not directly meet the trading demand. Jupiter has developed the DCA function for this purpose. Through this function, users can set a fixed time interval and investment amount, and the system will automatically purchase specific cryptocurrencies for them at the specified time.

Another well-known function of Dollar Cost Averaging is dollar-cost averaging, which is a common investment strategy in both traditional finance and the crypto field. It can help users diversify the risk of investment timing and avoid investing all funds at once due to market fluctuations. Dollar-cost averaging can also be combined with some trading indicators. For example, Jupiter gives an example: during the period from 2018 to 2019, starting from when BTC dropped by half from its peak, periodic fixed-amount investments were made whenever the RSI was below 30 for 7 days, and the final average purchase price of BTC was $6,000.

Cross-Chain Trading Aggregator

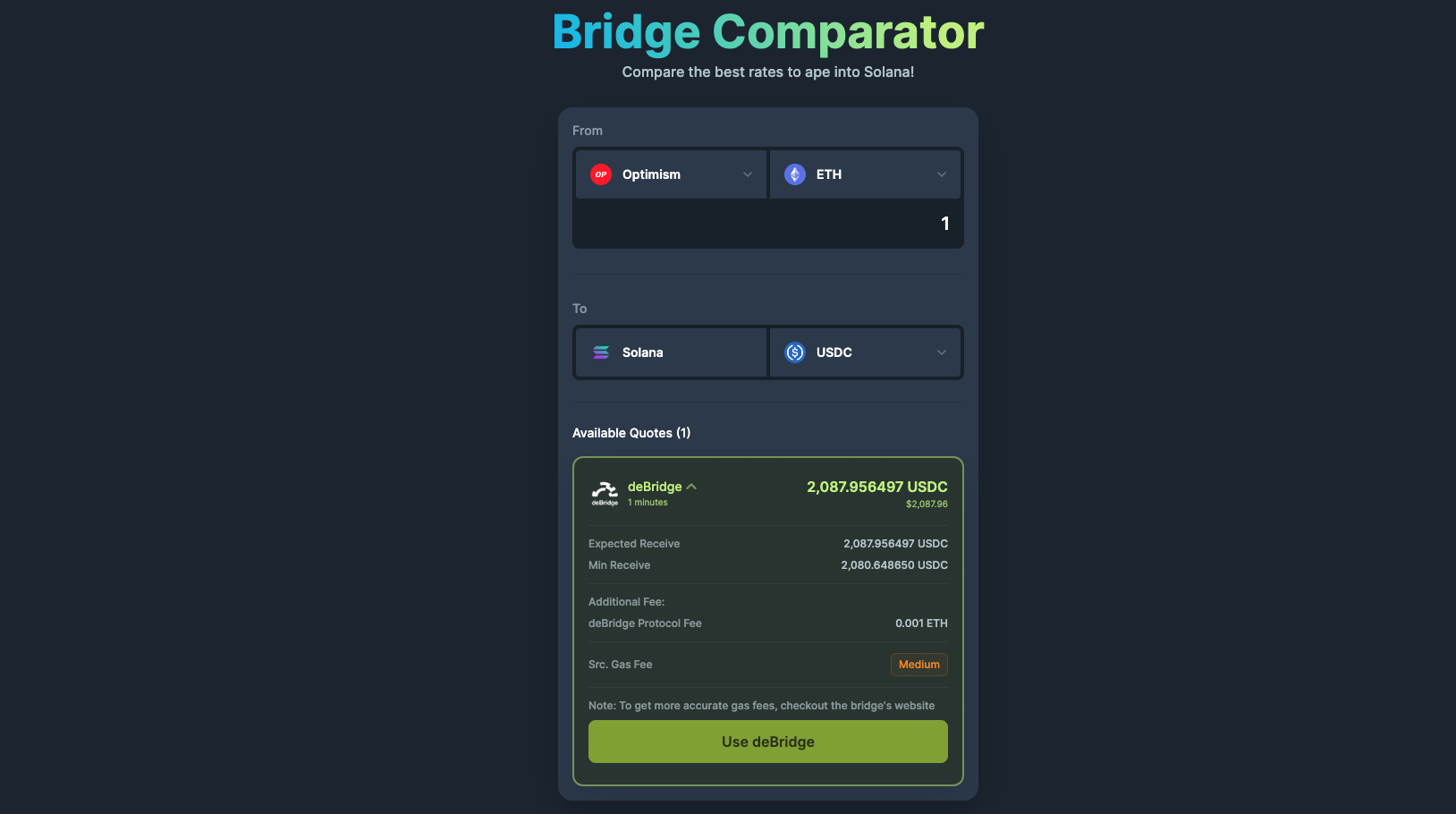

Jupiter also has a cross-chain trading aggregator, supporting the cross-chain exchange of assets on Ethereum, Optimism, Arbitrum, Base, Polygon, BNB chain, etc., into assets on the Solana chain. It integrates cross-chain bridges such as Allbridge and deBridge to provide cross-chain trading services to users. For example, it is possible to directly exchange ETH on Optimism into USDC on Solana.

There are not many bridges providing cross-chain services for Solana, but with Circle's Cross-Chain Transfer Protocol (CCTP) soon to support Solana, this may bring new liquidity to Solana, and Jupiter has also announced that it will integrate CCTP. CCTP allows native USDC to seamlessly transfer between multiple blockchains, destroying USDC on the source chain and then minting an equivalent amount of USDC on the target chain. However, Circle does not provide a frontend for cross-chain use, only providing the integrated CCTP cross-chain protocol on its official website, and these cross-chain protocols charge a small relay fee when providing this service. Jupiter plans to provide CCTP cross-chain services through Wormhole (Portal), and users can also use Portal or other cross-chain bridges to cross-chain native USDC on their own when using it.

Perpetual Contracts

Jupiter has also launched perpetual contract functionality, which is currently similar to GMX V1. Because it integrates Jupiter Swap, any asset can be used for opening positions.

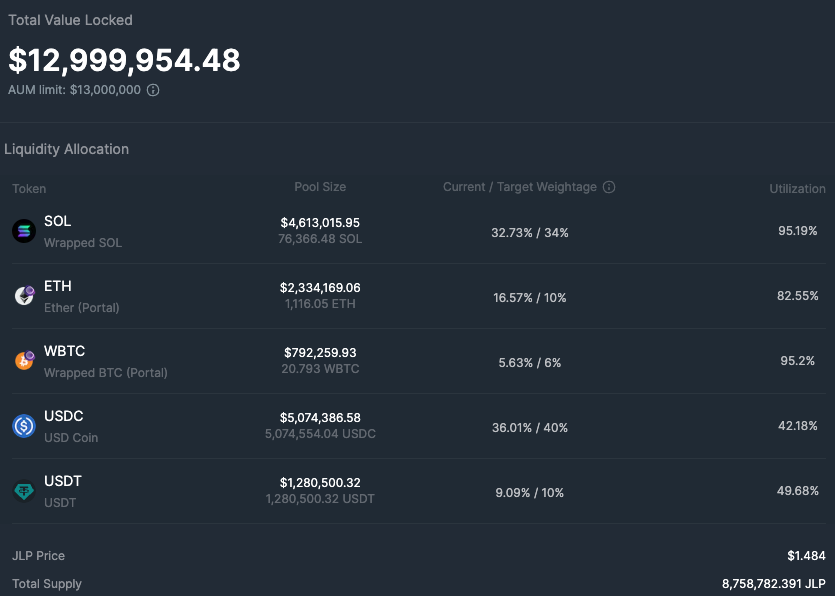

Its perpetual contracts support up to 100x leverage, with no price impact and slippage during trading. The LP token is called JLP, which contains 5 assets: SOL, ETH, WBTC, USDC, and USDT, meaning that currently only leveraged trading of SOL, ETH, and BTC can be realized.

From the weights of the various assets in JLP, it can be seen that this service is mainly to meet the demand for SOL leverage services on the Solana chain. Among them, the target weights of stablecoins USDC and USDT together are 50%, the target weight of SOL is 34%, the target weight of ETH is 10%, and the target weight of WBTC is 6%, with the weight of SOL significantly higher than that of ETH and WBTC.

Currently, this feature is still in the beta stage and has not been fully opened up. The minting of JLP has already reached its limit. From the data, it can also be seen that there is a strong demand for this feature from users. As of December 1, the market value of JLP was $13 million, the fund utilization rates of SOL and WBTC were both above 95%, and the fund utilization rate of ETH was also at 82.55%. Long positions have almost reached the upper limit that this liquidity can support. According to data from the previous week (November 20 to November 26), the APR of JLP was 111.77%.

In terms of trading volume, in the past 24 hours, the trading volume of SOL-PERP was $30.68 million, the trading volume of ETH-PERP was $3.29 million, and the trading volume of WBTC-PERP was $2.04 million. The daily trading volume generated is close to 3 times the TVL, which also indicates that the perpetual contract service in Jupiter is very popular among traders.

Conclusion

In addition to being a trading aggregator on Solana, Jupiter has also developed multiple functions, including limit orders and DCA functions to provide a better trading experience, cross-chain trading, and perpetual contracts.

Perpetual contracts have been proven to be a profitable feature on various chains, and Jupiter will also charge a 30% fee from trading fees, which may compensate for the lack of profit space in the trading aggregator through this channel.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。