1. Basic Information

Official Website: https://www.thedatanerd.io/

Author: Ri Yue Xiao Chu

Project Introduction:

Nerdbot is a Telegram bot that focuses on on-chain data and is essential for on-chain experts. It has comprehensive functions, including alpha signals, on-chain radar, token data, DEX trading, monitoring alerts, and other complete transaction chains. The "Token Xsight" feature simplifies the most important dimensions for buying coins (such as security, market value, circulation, and smart money buying and selling), suitable for making quick decisions during a hot market or for ordinary beginners.

The on-chain radar function allows users to select potential opportunities based on smart money, new wallets, and mainstream market makers. The accuracy of the smart money feature benefits from the long-term accumulation of the Nerd team. Recently, a major upgrade has been made, with the official claim that the average investment return rate has increased from 50% to 100% within 2 weeks.

Alpha signal is a new feature of Nerd and one of its highlights. Nerd utilizes its expertise in on-chain data, integrating smart money, new wallets, snipers, and exchange data, not only to detect MEME coins but also to obtain signals of high market value. The official claim is that the returns from alpha signals are very high, and the author is currently tracking them.

Nerd currently has a circulation of 10 million tokens, with a market value of only $800,000. However, there will be monthly unlocks in the future, so please assess the risk on your own. This does not constitute any investment advice.

2. Token Xsight

Token Xsight is a major feature of Nerdbot. After entering the contract address, you can obtain information about the token, including the following three main parts:

1) Basic Information: Contract time, which can determine whether the coin is new or old. Market value, trading volume, and liquidity pool funds serve as the basis for initial judgment on whether to further research the project. For example, if the market value is too high, you may directly say no.

2) Smart money, exchange liquidity, new wallets: These can be used to measure whether the market's main force is accumulating or distributing.

3) Early buyers, top gainers: This data is very useful for finding smart money.

From the data content perspective, these data dimensions are similar to those of other platforms, but with fewer dimensions than major data platforms. However, the usage scenarios and target audience are different. Nerdbot's Token Xsight feature information is suitable for three scenarios:

1) Need for quick decision-making: For example, during a hot market, a delay could result in a rapid increase in coin price. If someone recommends a coin that is a hot topic, you need to quickly understand the information and make a decision on whether to buy or sell.

2) Regular tracking of long-held tokens: For tokens held for the long term, we need to regularly check the latest data. If you hold a large amount of tokens for the long term, you need a platform for quickly understanding the situation. You can use Nerdbot's features to check the increase or decrease in smart money holdings, the flow of tokens on exchanges, new wallets, and more.

3) People who are not familiar with on-chain tools: Nerdbot provides a relatively simple and efficient function.

3. On-Chain Radar

The Token Xsight feature is for when you know about a coin and need to use on-chain data to decide whether to purchase it. On-chain radar is for a different situation. It is for when you don't know what coin to buy, and the on-chain radar provides coin selection based on on-chain information, mainly including:

1) Smart money signals

2) Inflow and outflow of exchanges

3) Top pools

4) Top new wallets

5) Market makers: 4 major market makers, Wintermute Trading • Jump Trading • DWF Labs • GSR Markets

3.1 Smart Money

Smart Money, also known as the familiar smart money, was initially established by the Nasan platform (if I remember correctly) and refers to wallet addresses with very high profitability. Subsequently, almost every data platform has it. However, there is no unified standard for defining smart money, and each platform defines it according to its own criteria. Therefore, the effectiveness of this indicator is judged based on actual results.

A Twitter user tracked the smart money and top new wallet indicators on Nerdbot and compiled data for over a month. The combined returns were as high as 1104.56%. This is the sum of the returns for each indicator, not compounded investment. If it were compounded, the returns would be even more impressive. After the user started operating, they had already achieved a 4x return. For more details, please refer to the tweet.

I personally speculate that the reason Nerdbot's smart money indicator is effective is due to the team's expertise in this area. Prior to this project, Nerdbot operated a Twitter account for a year, specifically tracking on-chain data and wallets, with over 50,000 followers. Recently, Nerdbot made a major upgrade to the smart money feature, including:

Scanning 10 million wallets daily

Producing: 2000 high-quality wallets (SM trading on DEX, VC, MM, KOL)

Daily scanning frequency (previously once a week)

Deep label search for real-time smart traders

Average win rate of Smart Money wallet list increased from 42% to 58%

Average investment return rate of Smart Money list increased from 50% to 100% within 2 weeks

Soon enable automatic purchase based on SM signals (Platinum only)

Vault activation to allow investment based on smart money list (coming soon)

4. Alerts

There are three types of alerts:

1) Alerts for wallet transfers of interest

Users can set alerts for transfers on wallets of interest.

2) Radar alerts

These are the main data on Nerd, with alert settings.

3) Alpha alerts

I believe this is also one of Nerd's highlights. Unlike other data platforms, Nerd utilizes its expertise in on-chain data for alpha signals, which include:

Quantity and amount of tokens purchased by Smart Money

Quantity and amount of tokens purchased by Fresh Wallet

Sniper quantity

Net inflow and outflow of exchanges

And it can be tracked at 15 minutes/30 minutes/1 hour intervals. Therefore, Nerd's alpha signals can detect not only MEME coins but also high-market-value coins like Pendle.

Nerd has listed some of its own cases, and the returns from alpha signals are very high. I have not fully verified this, but I have been following a few and the results are acceptable. I am still in the process of verification.

4. Other Functions

Nerdbot has other functions, which are relatively common, so I will briefly introduce them here:

1) Wallet analysis

Mainly used for analyzing the profit and loss situation of wallet addresses, current major holdings, etc. It is mainly used for analyzing some wallets and creating one's own address library (such as smart money). Most ordinary people do not need this most of the time.

2) Wallet and DEX trading

Users can create their own wallets for one-stop trading, allowing Nerdbot to provide new project information, project analysis, and finally conduct trading. Of course, the trading function is available on many Telebots.

3) Community bot

Users can deploy Nerd's community bot in Telegram groups, providing the following dimensions:

/s: Check if the token is "healthy"

/c: Token price chart

/p: Quickly view the token's price and basic information

/sm: Smart money wallet buying and selling behavior in the past 14 days

/w: Display an easy-to-understand report on the wallet's operation status

/e: Displays the inflow and outflow of tokens within the exchange

/early: Summary of early tokens

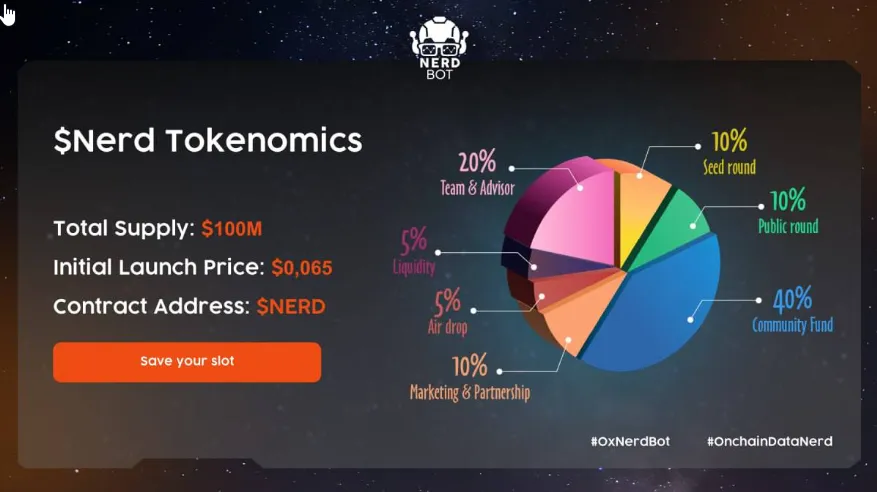

5 Token Economy

The total supply of NERD is 100 million, with the TGE (Token Generation Event) date being October 24, 2023. The token distribution is as follows:

- Seed round: 10%. Locked for 3 months, then released linearly over 12 months

- Public sale round: 10%. TGE 50%, then released linearly over 3 months

- Community fund: 40%. Locked for 6 months, then released linearly over 24 months

- Partnerships: 10%. Locked for 1 month, then released linearly over 6 months

- Airdrop: 5%. TGE 0%, not locked, released linearly over 6 months

- Liquidity: 5%. Fully unlocked

- Team advisors: 20%. Locked for 12 months, then released linearly over 24 months

Staking NERD allows participation in dividends, including three parts:

- 80% of NerdBot Premium revenue

- 50% of Nerd trading tax revenue

- 80% of DEX trading fees (planned)

The specific proportions will vary based on the amount and duration of staked NERD. For details, refer to the official documentation.

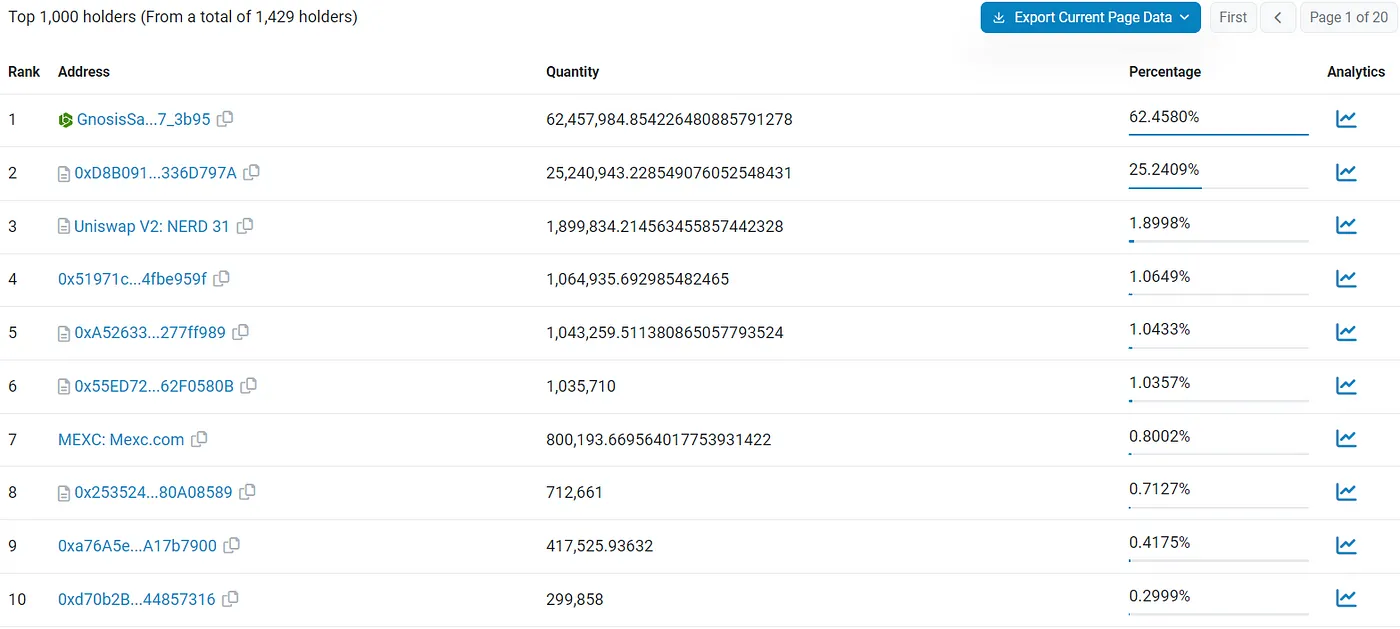

6 On-Chain Data Analysis 11/27

Nerd's on-chain data is relatively simple, with most of the tokens in the hands of the project team, as per the whitepaper, in lock-up.

Holding address 1 and holding address 2 are controlled by the project team, holding 87.6% of the tokens.

Holding address 3 is the Uniswap pool.

Holding address 4 is the Bitget address.

Holding addresses 5 and 6 are still controlled by the project team and are used for specific purposes.

Overall, the current circulation is around 10%, which is approximately 10 million tokens, matching the whitepaper.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。