Writing: ck.eth

Compiled by: Lylia, Antalpha Labs

The original series has six parts, and this is the fifth part, which continues to introduce how options are combined with positions, and requires a certain understanding of the position strategy described in the previous series. In order to make more people access and understand useful information about Uniswap V3, we have translated the series of articles to provide Chinese readers with a deeper understanding of the Uniswap V3 mechanism and investment strategy choices. While reading this translation, you can always refer to the original text for more detailed information.

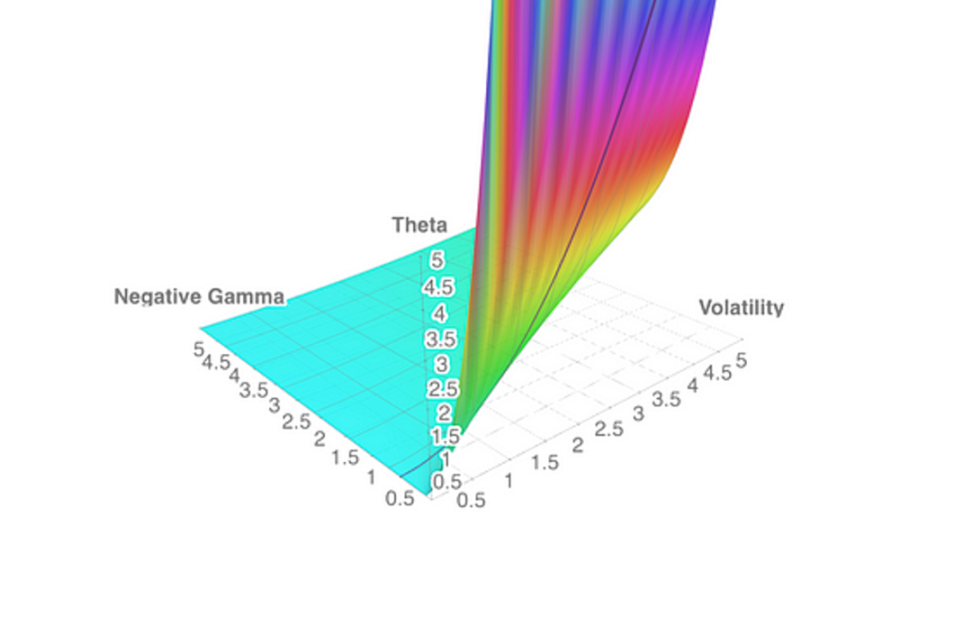

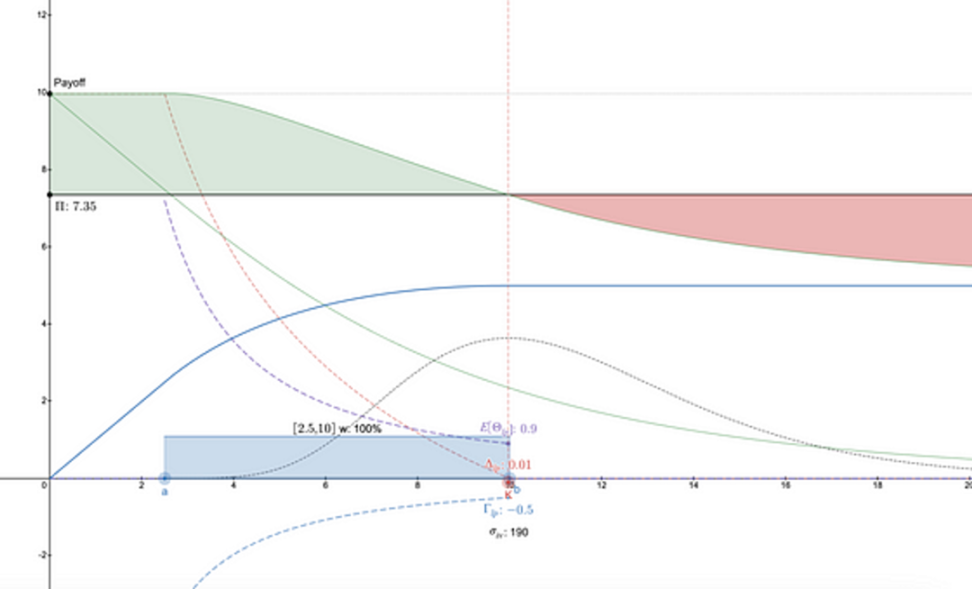

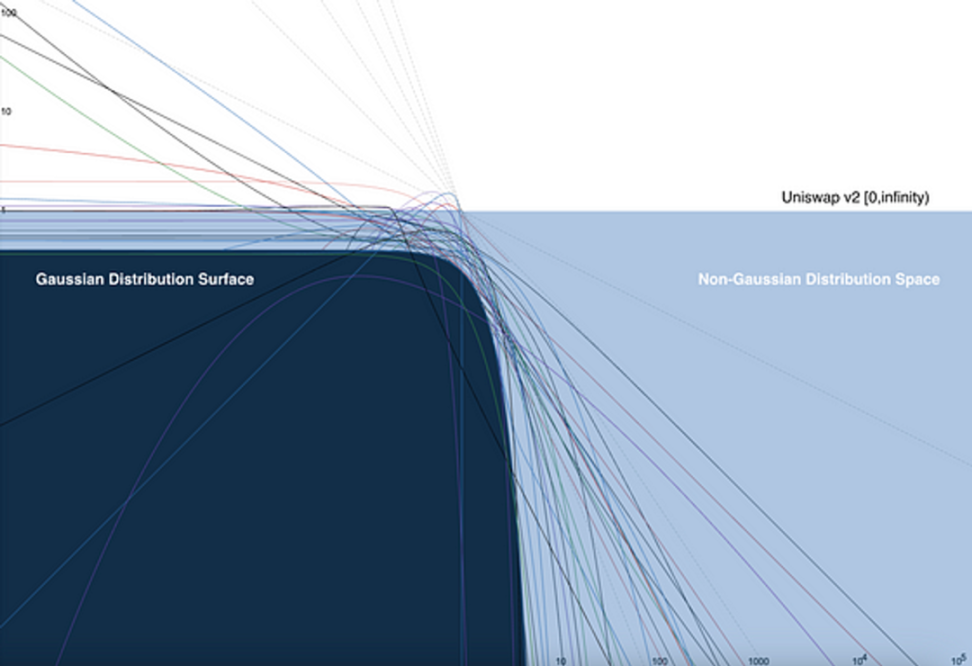

Non-linear convexity risk of Uniswap returns / Theta-Gamma volatility. https://www.math3d.org/WvsEXvTWD

In short:

- Showed the Greek solutions for Uniswap v2 and v3

- Provided solutions for hedging Asian options, European options, and Bachelier options using Uniswap v3 in an interactive desmos file.

- Demonstrated the accumulation strategy for LP hedging using desmos.

- Explained the historical causes and alternative derivations of LVR.

Greek Parameters - Uniswap v2

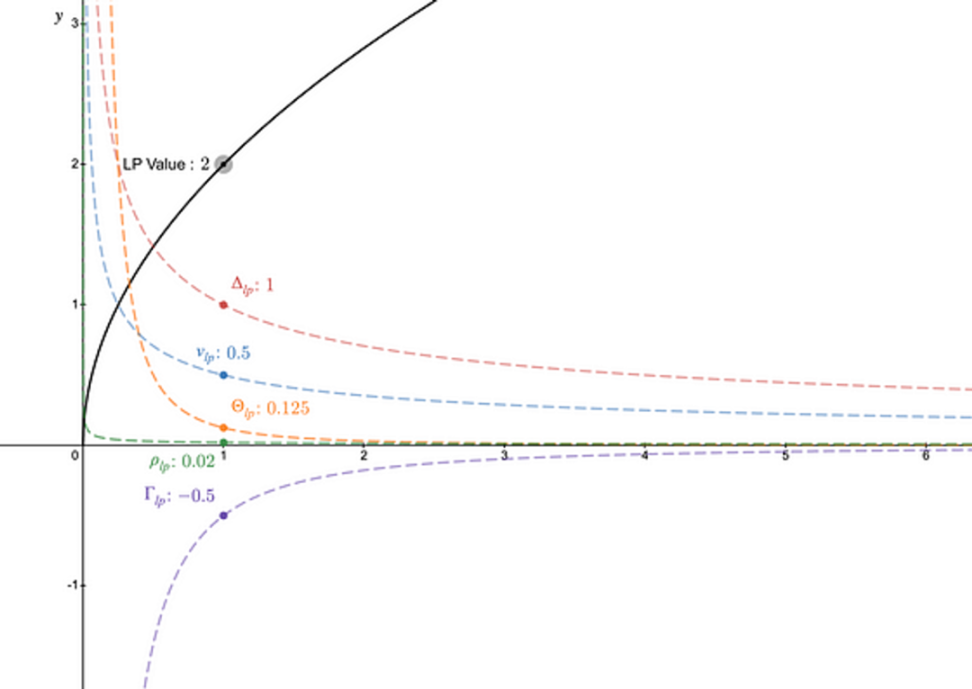

Instead of allocating 100% to LP positions, it is better to allocate a portion to the X asset and the remaining portion to short the X asset to reduce but not eliminate divergence losses. The result is to transform the payment structure from a cliff to a hill, as shown by Guillaume Lambert: Greek parameters tell people the sensitivity of the value of LP positions to another variable (such as time, volatility, and interest rates). We introduced Delta and Gamma in Part 4. LP Greek parameters are useful because you can match them with the Greek parameters of options to offset price divergences, such as the effects of price fluctuations, changes in volatility, or the passage of time, i.e., delta and gamma. The numerical values of the Greek parameters tell us the impact of various factors on the price of LP positions.

Interactive desmos file for v2: https://www.desmos.com/calculator/inwy6djhhm

It is important to note that compared to options, Uniswap's Greek parameters tend to infinity when the price of LP positions falls, as shown in the above figure at x=0 with a dashed line. To reduce these tail risks, we can use the concentrated range in v3.

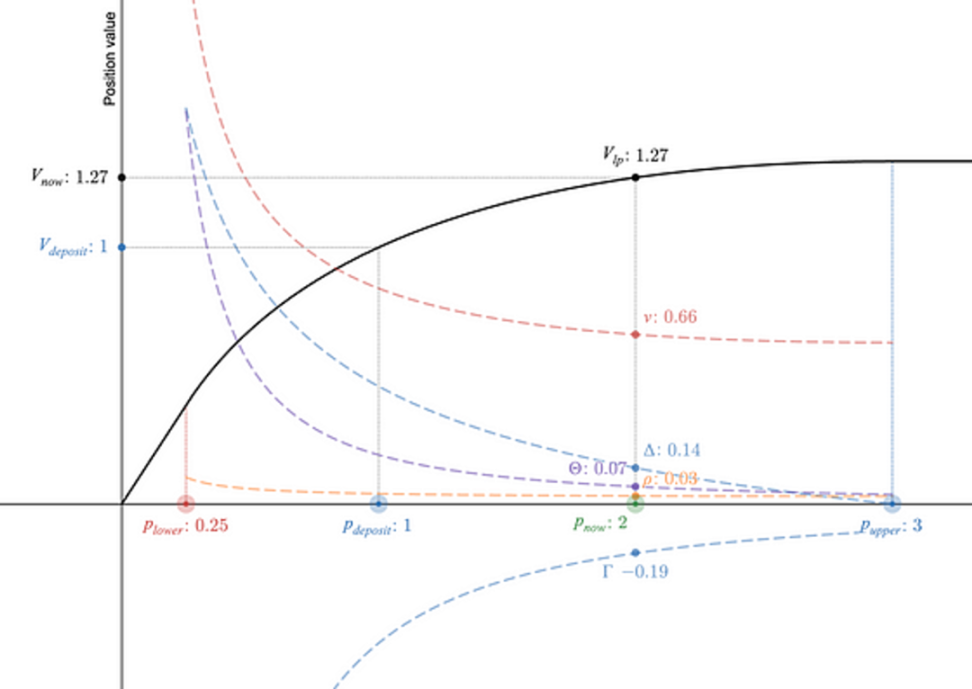

Greek Parameters - Concentrated LP Range v3

Desmos file for univ3 Greek parameters: https://www.desmos.com/calculator/l8sqzlwkf5

The smaller we concentrate the range p_a (lower limit) to p_b (upper limit), the more sensitive our Delta Δ and Gamma Γ become. Note that Gamma is negative, which means our LP payments have a concave black shape. Our theta /Θ / expected cost will also increase, while the interest rate sensitivity ρ is basically unaffected.

However, although the payment diagram of a single LP position may match that of an option, other Greek parameters may not match.

LP Greek parameters do not look like conventional options: https://www.desmos.com/calculator/nyuw7sybin

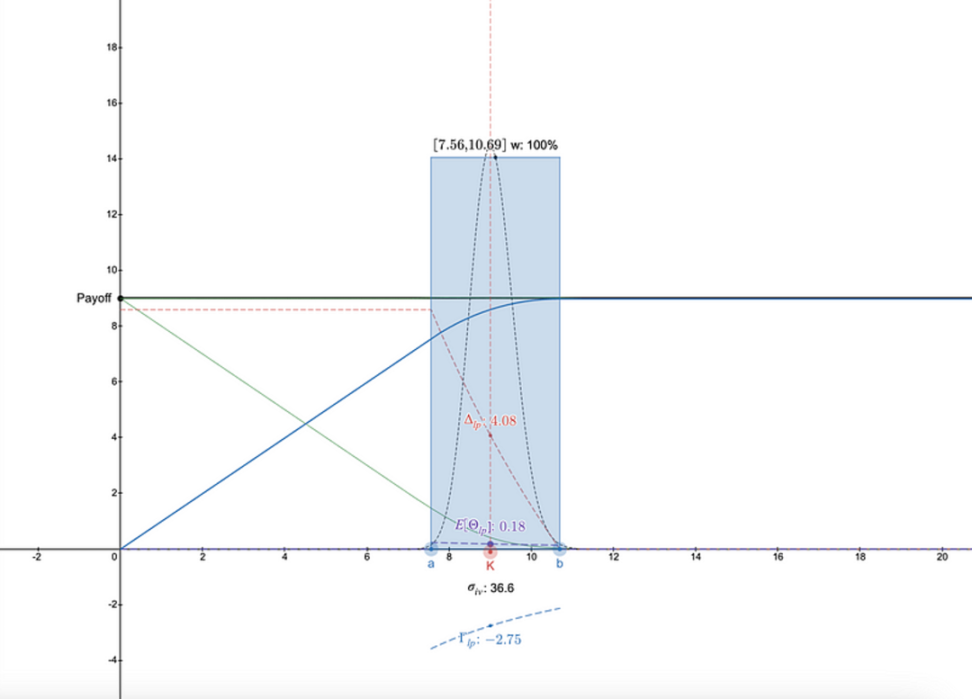

Here, we have a single LP range call option, but the other Greek parameters are not fixed.

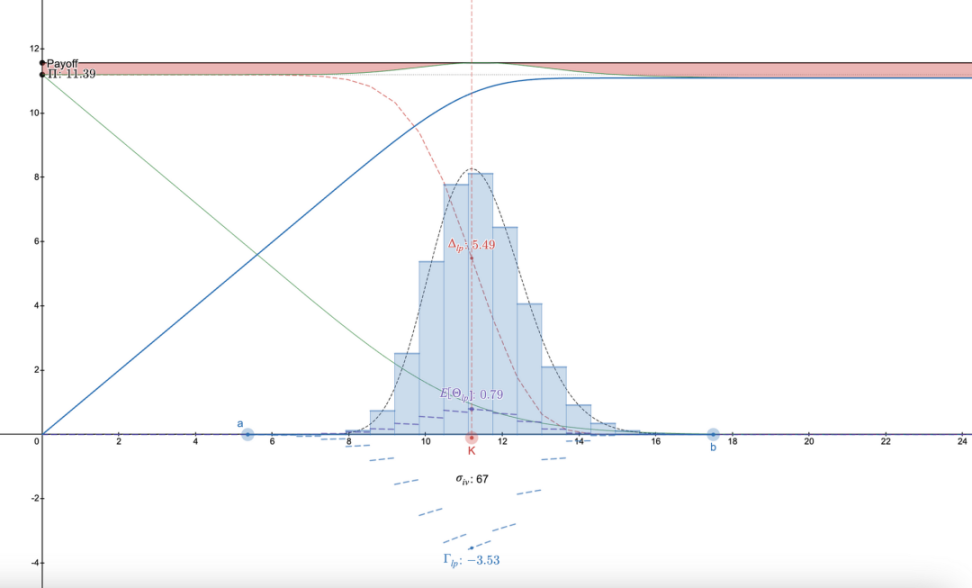

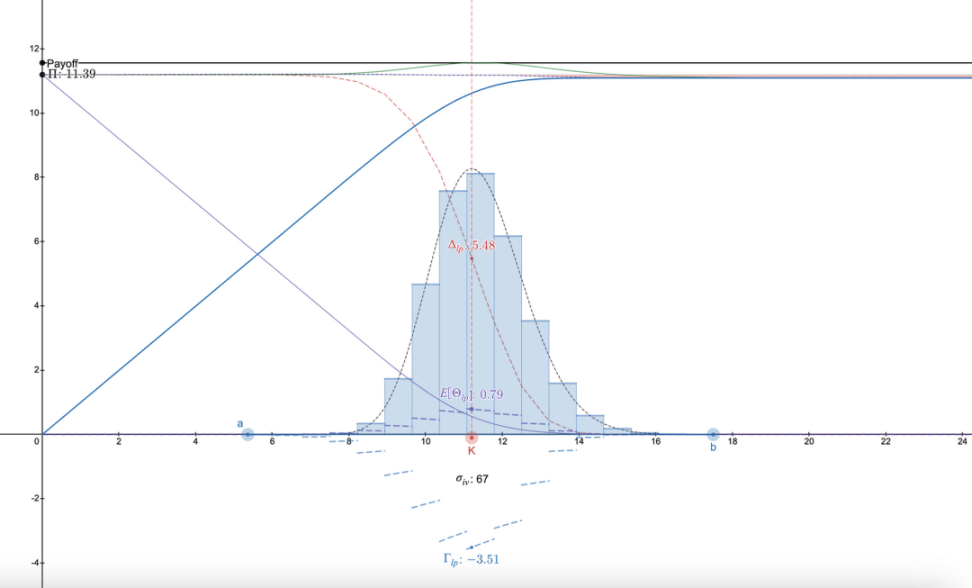

A trick that can be used is, instead of trying to find a way to hedge LP positions, one first needs to find an option in the market with an exercise price (K) as well as an implied volatility (σ_iv) and time to expiration (t). Then, a series of LP positions can be constructed that follow a log-normal distribution, initially inspired by Dan Robinson's liquidity fingerprint for Uniswap v3 [1]. Granularizing LP positions in price space to match the log-normal distribution allows for smoothing of the Greek parameters:

Note that LP Greek starts to resemble options. With the drop in price, the diversity of LP positions allows one to switch to the next range. More than 7 LP positions will bring diminishing returns.

Interestingly, it seems very difficult to completely cancel payments with a log-normal distribution (correct me if I'm wrong), but if the log-normal liquidity fingerprint approaches the Dirac Delta function, the above differences (visualized in red in the above figure) will disappear. For example, Asian options also follow a log-normal distribution, but surprisingly, they are more sensitive to price, where Δ and Γ are sharper, as the volatility of Asian options is 1/√3 of that of regular options, thus having a smaller impact on payment divergences:

Hedging LP position combinations with European put options to use their equivalent Asian put options for hedging.

A single LP position can roughly match a European option, but it will ignore smooth Greek parameters, while a series of LP positions will smooth the Greek letters but leave a hill. This trade-off may be improved in the future through potential adjustments / skewed liquidity fingerprints.

LP Hedging Strategies

On the other hand, if one is not interested in trying to cancel concave LP payments, then the desmos file: https://www.desmos.com/calculator/khvbqzncg9 can also be used to see how various payment methods work. Below are examples of a series of payments that may occur.

Vertical put spread >> Put options >> Some long straddle. Please note that due to theta decay, the put options will exacerbate over time, while the LP position can grow due to fees.

I noticed an interesting feature of v3 is that if the liquidity of p_a is concentrated at exactly 75% or lower of the current price, and p_b is set to the current price, the value of the X asset peaks at 25%, which may have strategic value for those trying to accumulate assets.

Dan Robinson's v3 tool: https://twitter.com/danrobinson/status/1430678225945042945

Such a single range can be combined with market put options to obtain the following payments: https://www.desmos.com/calculator/a8y3pl3t03:

Put option parameters can be extracted from the market. As time passes, if the price does not decrease fast enough, the value of the option will decline.

This strategy is essentially seeking a price drop in order to accumulate assets in the future and earn fees. It should be noted that without options, this would become a riskier approach and only makes sense if the executor has a very firm belief in the rebound of the asset. However, please note that this does not constitute any financial advice, I am just doing mathematical calculations.

Historical Deep Dive Leading to LVR:

In Part 4, I pointed out the relationship between concave LP positions and returns, and hoped to expand from a historical and LP divergence loss / loss and rebalancing (LVR) perspective.

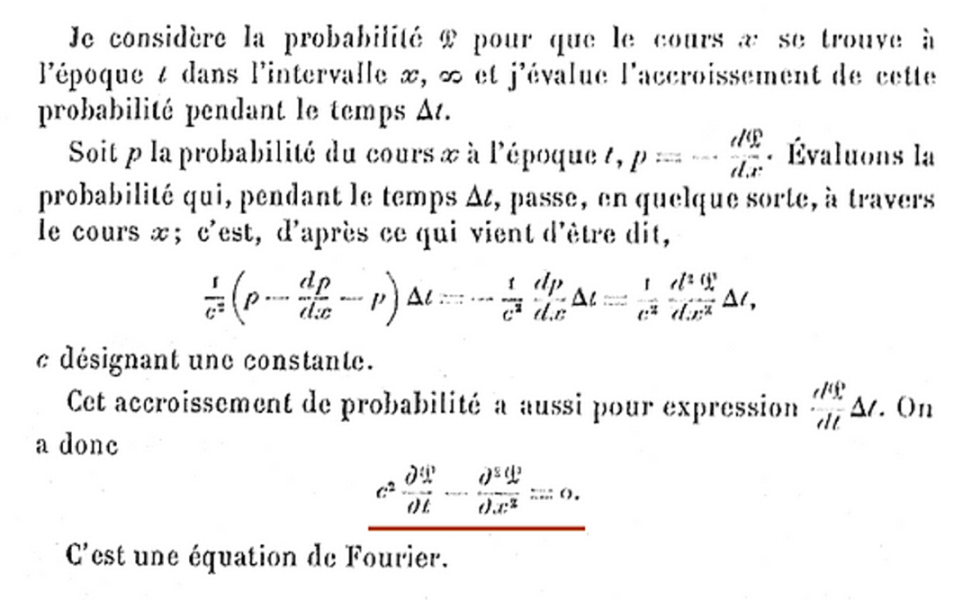

Taleb pointed out that the first person to write down the non-linear relationship between risk and return was Louis Bachelier [2] in his Theory de la Speculation in 1900, attributing it to its similarity to Fourier's heat equation. Coincidentally, Lambert used the Feynman-Kac method to solve the value of concentrated LP positions [4].

Page 46 of "Theory de la Speculation". A constant squared, a dt, and a dx²!

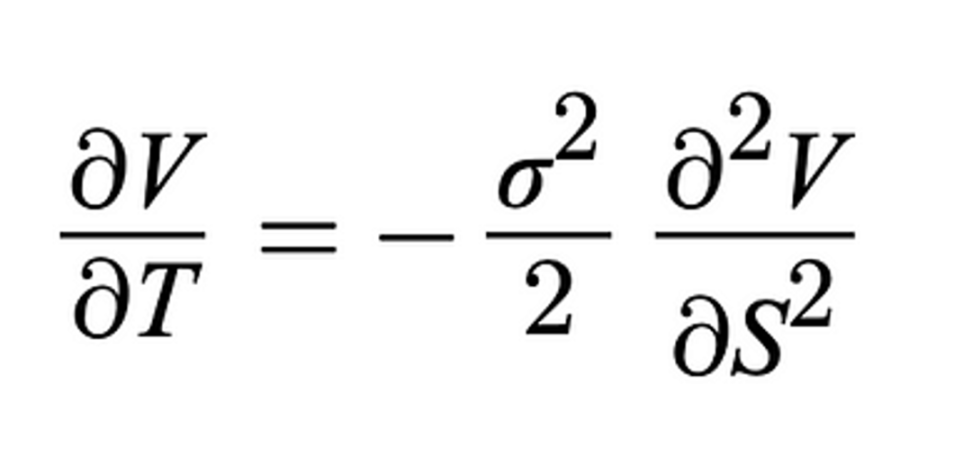

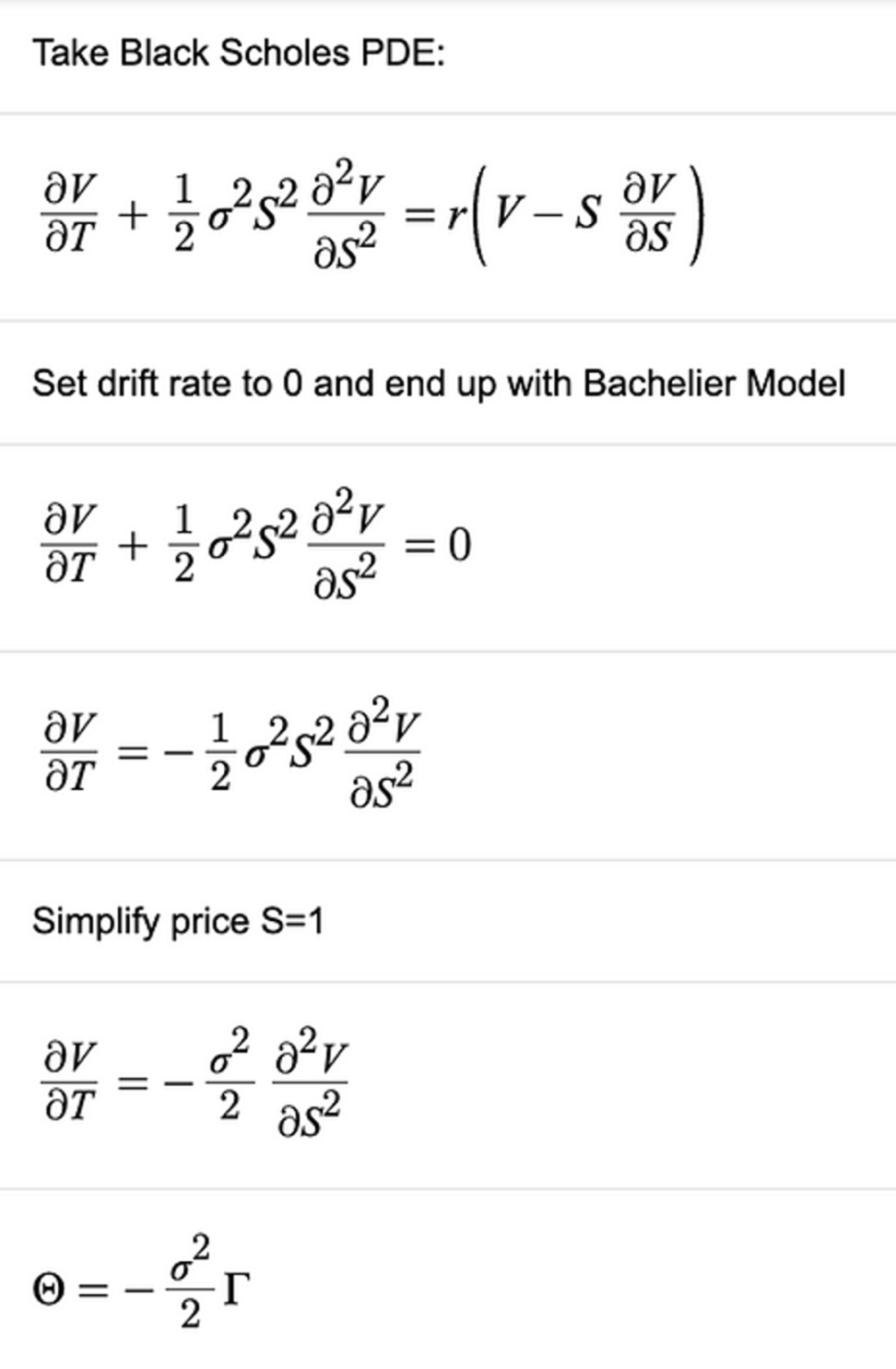

Bachelier's equation is just a slightly rearranged Black-Scholes-Merton equation, with the drift rate set to zero [5].

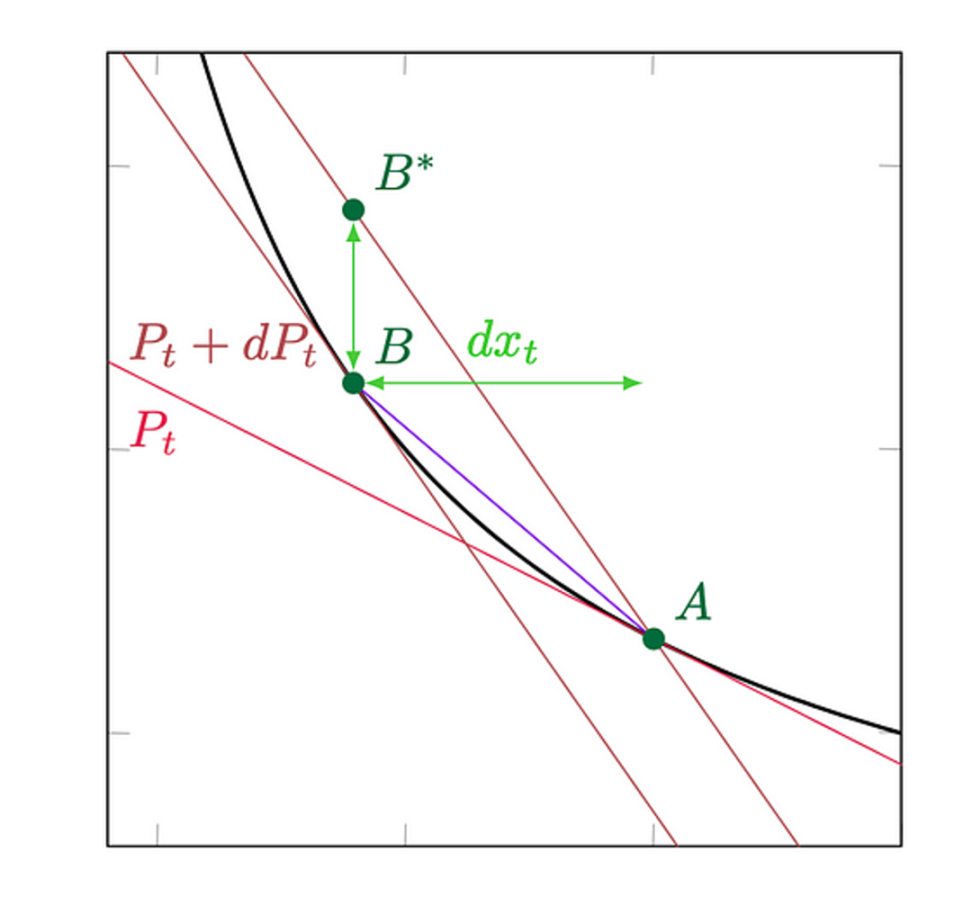

The change in asset price over time is related to volatility and curvature.

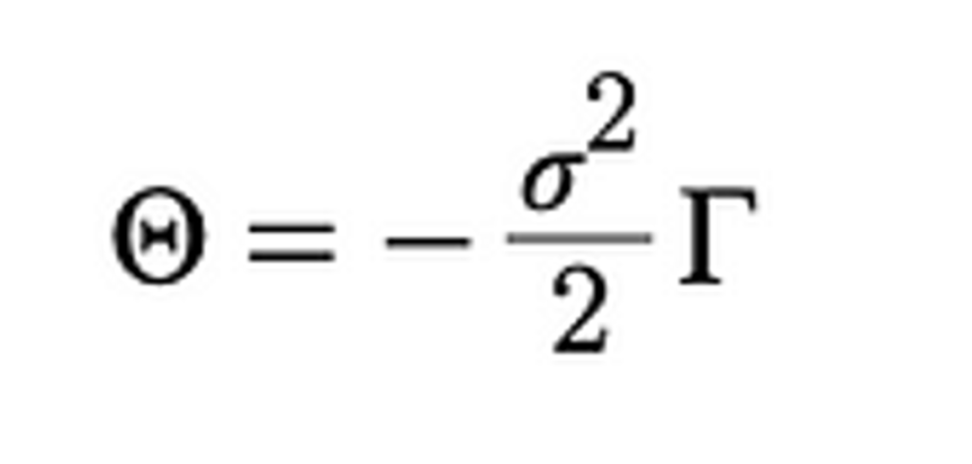

LHS is theta-Θ, RHS is curvature gamma Γ, and due to the negative sign, it is exactly concave. Then, Angeris, Evans, and Chitra [6] pointed out that LP positions of AMMs must have concave payment functions. From Curve's CSMM [7] to Forgy & Lau [8]'s entire symmetrical liquidity curve space, all LPs should be concave.

Based on the concave equality in our right-hand equation, this means that the market maker (LP) position itself must have a premium. If there is no premium, the equality below will be violated, and a perpetual long straddle trade can be constructed simply by borrowing such an LP position and buying part of the underlying asset, and waiting for an increase in volatility to take advantage of it.

Bachelier equivalent / BSM dynamic hedging - called concave command returns and convex command costs. Mathematically represented as:

Returns ∝ Risk multiplied by concavity (negative convexity). BK derivation in the appendix.

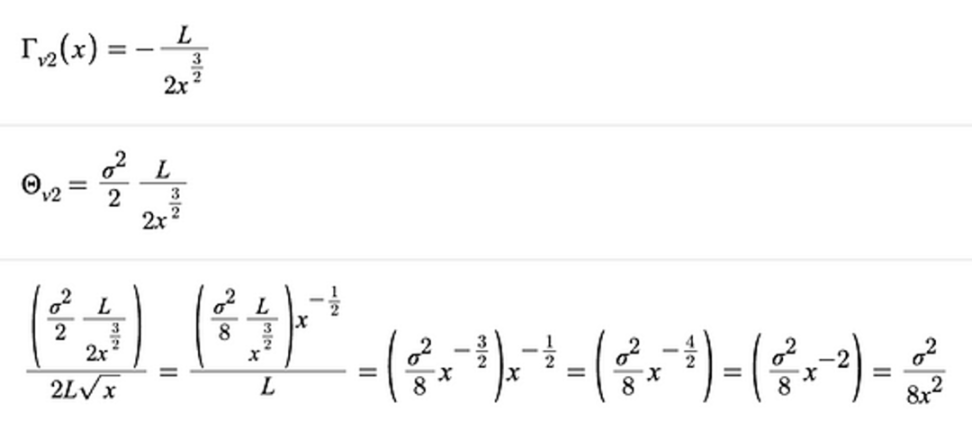

In solving the Theta Greek value of Uniswap [9], I noticed that by substituting the second derivative of the LP position into the above formula, the same equation as LVR can be obtained [10].

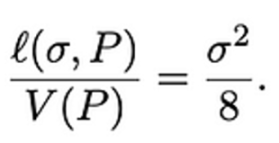

Formula 16. If the Gamma in the Bachelier equivalent is -L/2sqrt(x)³, the same result is obtained.

LVR paper Figure 2 derives the vol²/8 LVR relationship from the invariant xy=k graph, which leads to concave LP returns.

This is not a coincidence, as people from different perspectives have come to the same conclusion. Lambert actually includes the drift rate [11], while others exclude it [12].

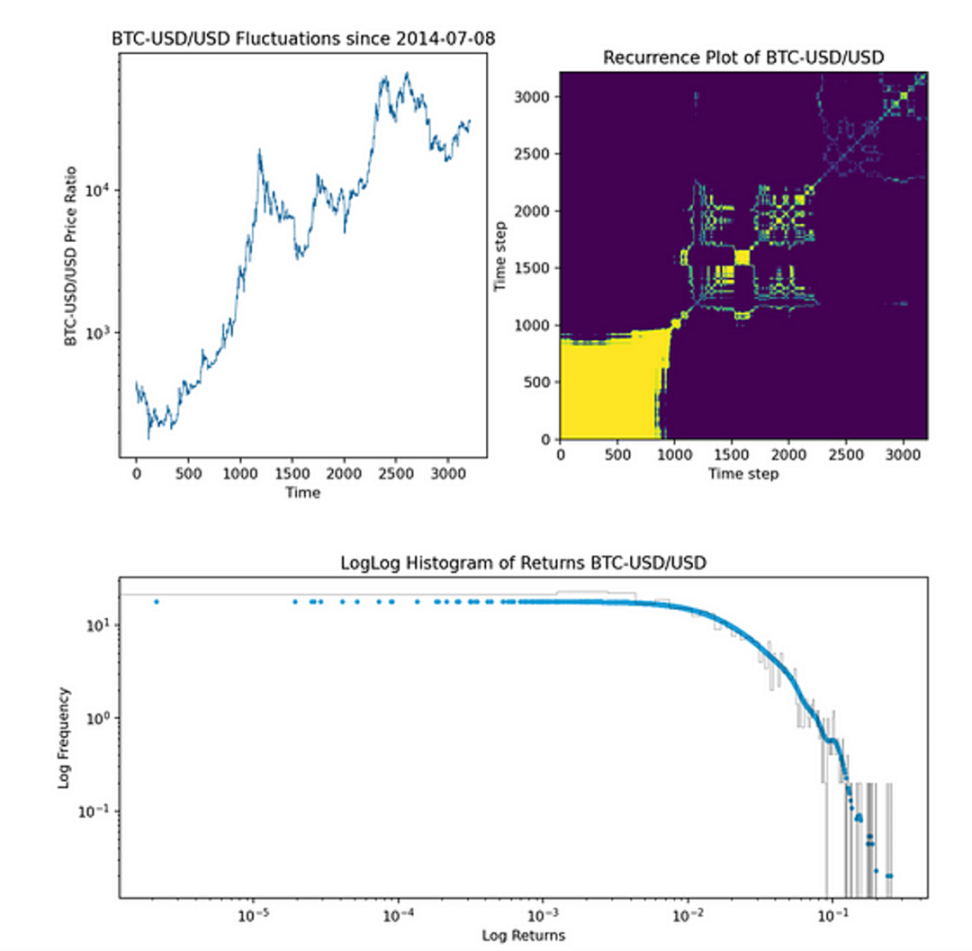

Please note that all these models assume a Gaussian distribution, originally derived from Brownian motion (BM) in Ito's lemma [13], which gives us the internal -σ²/2 term, which also appears in Angeris, Evans, and Chitra's final equation [6], but we know that digital assets, including stablecoins, exhibit a Hurst exponent >0.5, implying fractal BM behavior [14], and Sepp and Rakhmonov also point out that stochastic volatility methods are applicable to the skewed implied volatility structure of digital assets [15].

By examining the tail returns of the log-log histogram of the most persistent digital assets, we also see non-Gaussian tails.

BTC-USD histogram returns with kernel density smoothing shown in blue

Given the shape of the histogram, we will have to delve into the full range uniform distribution of Uniswap v2 and go beyond the Gaussian cliff to truly understand the leverage ratio (LVR) theta value suitable for market makers.

Log-log histogram of the 50+ distribution. Power laws and exponential laws await us in the abyss.

Appendix:

Derivation of Bachelier equivalence.

LVR of Uniswap LP position derived from Bachelier equivalence.

References:

https://www.desmos.com/calculator/l1oivvaptt

https://www.maths.usyd.edu.au/u/UG/SM/MATH3075/r/Haug_Taleb_2010.pdf

https://en.wikipedia.org/wiki/Louis_Bachelier#CITEREFBachelier1900a

https://lambert-guillaume.medium.com/pricing-uniswap-v3-lp-positions-towards-a-new-options-paradigm-dce3e3b50125

https://en.wikipedia.org/wiki/Black%E2%80%93Scholes_equation

https://arxiv.org/abs/2103.14769

https://classic.curve.fi/files/stableswap-paper.pdf

https://arxiv.org/pdf/2111.08115.pdf

https://www.desmos.com/calculator/fg8a730ddz

https://arxiv.org/pdf/2208.06046.pdf

https://lambert-guillaume.medium.com/an-analysis-of-the-expected-value-of-the-impermanent-loss-in-uniswap-bfbfebbefed2

https://twitter.com/odtorson/status/1603337199465865216?s=46&t=e0EQ5vcj_HihnkeZ26T4eA

https://en.wikipedia.org/wiki/It%C3%B4%27s_lemma#Geometric_Brownian_motion

https://scholar.google.com/scholar?q=modelling+multifractal+properties+of+cryptocurrency+markets&hl=en&as_sdt=0&as_vis=1&oi=scholart

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2810768

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。