The game, as the most important functional and scenario-based application track of blockchain technology, naturally has the opportunity to become a bridge connecting blockchain technology and RWA.

This article was written in early November 2023. As of today, November 28, BTC has repeatedly attempted to stabilize at the concentrated distribution area of 38,000 points. The fourth point of the new narrative of this bull market mentioned in this article, "Bitcoin ecosystem," is the leading track driving the surge of this bull market, with Ordi listed on Binance outperforming, with a 4-fold increase in 10 days. So, will RWA, mentioned as the third point of the new narrative in this article, have the opportunity to fully showcase itself in this bull market? What kind of spark will it create when it collides with games?

I. Is the Bull Market Here?

If we look back at the turbulent cryptocurrency market over the past two years in November 2025, we might be surprised to find that October 23, 2023, may have been a typical sign of the start of this bull market: within 24 hours, BTC surged from 30,000U to 34,000U. Many friends who had heavily invested around 20,000U were jubilant: "See, I told you the crypto bull market was definitely coming!" Some friends who missed out and were still hesitant continued to argue: "Currently, there is no new money entering the chain, and the total amount of stablecoins like USDT is still at a low point. This is a false bull market amplified by the news of Bitcoin ETF, and there will be a pullback!"

The bullish view that "the bull has come" is very clear, and the three major bullish factors in the future are enough to support the bull market:

The acceleration of traditional financial institutions' funds entering the market through Bitcoin ETF;

Bitcoin's halving in May 2024, with mining costs rising to over 28,000;

The United States not raising interest rates, or even cutting them;

Whether it's a real bull or a false one, what I have always pondered is: to support a bull market of at least 12 months, there must be a new narrative driving the entire industry forward. Of the three factors supporting the bull market, the first and third are external forces, and the second is the four-year halving rule known to everyone when the BTC white paper was released. So, what are the industry's new narratives that can support this bull market? If we don't develop ourselves and rely solely on external information and policies, it will probably be short-lived.

Let's take a look at the development trajectory of the previous bull market: it started with the DeFi summer of July 2020, when Bitcoin took off from around 10,000U. DeFi was a major innovation in the industry, using smart contracts to simulate some functions of the real-world financial system, such as earning interest on collateral, decentralized trading, and derivatives. Then, influential figures like Elon Musk began to promote it. After that, applications of NFT and Gamefi 1.0 appeared, allowing many novice users to enter the circle without needing to learn about the knowledge threshold of DeFi, and most importantly, to potentially get rich. Finally, the concept of the metaverse became popular, and Facebook changed its name to Meta. The bull market peaked in November 2021, with the price of Bitcoin reaching 69,000U.

II. The New Narrative of This Bull Market

See that? At least DeFi, NFT, Gamefi 1.0, and the metaverse were the evolutionary points of the crypto industry in the previous bull market. So, what are the new evolutionary points, or the new narratives of this bull market? Let's summarize:

SocialFi, decentralized social networking, with recent rising stars like Friend.Tech as examples;

Chain Game 2.0, which is web2.5's chain game: assets are on the chain while the game is centralized, focusing on highly playable games, and then making use of on-chain assets;

RWA (Real World Asset), a huge track that can link the massive old money of WEB2 and the crypto industry. Depin, which has been repeatedly mentioned in the HK crypto community in recent days, is also one of the RWA tracks;

The rise of the Bitcoin ecosystem. After all, whether in WEB2 or WEB3, BTC has been seen as a value store similar to gold. Why can't we do something on it? After all, gold in the financial industry can be used to play various derivative products.

Today, we will focus on discussing the third point, RWA, because I have always felt that RWA is the extension narrative of the DeFi engine that started the previous bull market. Just think about it, DeFi created a bunch of virtual currencies with code, then used smart contracts to play with them, and simulated parts of the real-world financial system. It's like children playing house, with a father, a mother, pots and pans, and groceries. BUT, does this have any impact on the real world? No! Currently, except for BTC, which has a certain consensus in the WEB2 world, other currencies are seen as nothing by outsiders. So, what's the point of a bunch of extremely complex operations based on air?

Does this mean that DeFi is meaningless? Not at all! It can only be said that the DeFi that started the previous bull market was only the first half of this new narrative. It laid the groundwork, rules, and direction for participation, just like preparing the kitchen, cooking utensils, and chefs for a grand feast. Therefore, I understand RWA as the second half of DeFi, just like the two parts of "A Chinese Odyssey," "The Magic Brush" and "The Monkey King's Marriage," which are beautiful only when connected.

III. How to Play RWA

What is RWA? The full name is Real World Asset, which translates to "tokenization of real-world assets." Corresponding to real-world assets, RWA can be divided into tangible assets and intangible assets based on the type of underlying assets. Tangible assets mainly include real estate, commodities, art, etc.; intangible assets include bonds, stocks, carbon credit points, etc. Since RWA is based on real-world assets, it requires a process of off-chain operations supported by law to confirm asset rights and value, and then tokenization through DeFi protocols and circulation in the on-chain market, while monitoring the value changes of off-chain assets through oracles.

In fact, there are already some practical use cases of RWA. The stablecoins we often use, such as USDT and USDC, are examples of RWA. For example, the physical asset "Satoshi Island" and the hottest RWA in financial assets this year, US bonds, are all examples of on-chain token issuance supported by physical assets. The idea of Bitcoin ETF is a reverse financial RWA, where WEB2 funds participate in Bitcoin investment through a compliant ETF financial product; while RWA US bonds are WEB3 funds participating in US bond investment without the need for cashing out, earning around 5% annual returns.

The STO boom in 2018 was a early attempt at RWA, during which there were attempts to make traditional assets compliant and on-chain, and a batch of Web3 entrepreneurial projects emerged with this goal, such as tZERO, Polymath, Aspen, etc., and some case attempts were made, such as Aspen REIT, Resolute.Fund Fundament Group, etc. However, due to various reasons such as market environment, economic cycles, and regulations, the STO market did not develop as smoothly as imagined.

Currently, the mainstream play of RWA is relatively simple, which is to tokenize real-world assets or financial assets, allowing funds from the crypto community (such as various stablecoins) to have ownership or income rights in the real world. This is a simple one-to-one correspondence, and ownership is also subject to real-world legal restrictions. If we want to diversify the play of RWA and attract more users to participate, we need to design better application scenarios for RWA. We believe that this will shine in this bull market and can be defined as the basic application infrastructure of RWA.

Imagine this: in a game scenario similar to "Monopoly" or "The Sims," you enter a stock exchange, link your wallet, and actually use game tokens or U from your wallet to buy Tesla stocks, then enjoy the benefits given to you by Elon Musk. Or, in a gamified scenario, when virtually traveling to a city, you can also buy shares of REITs in landmark buildings in the city, becoming an investor in real-world assets. Isn't that exciting? Of course, we are only considering the user experience of the product here. As for legal regulations and how to connect to real-world securities departments, this requires the project team to be adept at handling it.

In a broad sense, the basic application settings of RWA described above are part of the metaverse, but they are more hardcore in terms of security and connection to WEB2, so they need to be singled out as a separate new narrative. It seems that the gamified scenario of RWA should be able to attract more users to join, not only allowing WEB3 players to link tokens in their wallets to the real world, but also allowing WEB2 players to experience the uniqueness of WEB3 products: no need to complete so many document signings in the real world, just link the wallet; the ownership shares are always reflected on the chain and can be traded at any time.

So, the question is, how can we make it easier for WEB2 players to enter WEB3 smoothly and accept the new play of RWA + games? Let's put ourselves in the shoes of a WEB2 user who wants to enter the virtual world of WEB3, or even the embryonic metaverse. What difficulties will they face, and what desires will they have?

First, they will be overwhelmed by the previously unfamiliar WEB3 information, such as public chains, wallets, DeFi, and other basic knowledge, which seem simple and clear, but are bottomless and have countless threads to learn, making it difficult to know where to start. Then, they will be attracted by various innovative projects and models in WEB3, seeing one after another rags-to-riches myth, always itching to join in, but afraid of becoming a sheep and losing everything, so they seek advice everywhere, hoping to learn the true investment wisdom of WEB3 or find reliable investment advice. Furthermore, they hope to find a truly enjoyable gaming experience in the virtual world of WEB3, and they also hope that the noble status in the virtual world can extend to the real world, allowing them to participate in some ceremonial high-end activities, achieving full integration of online and offline experiences.

The above imagination may seem overly idealistic, but it is indeed the most simple and fundamental desire in the hearts of most players entering WEB3 from WEB2. Are there any products or games on the market that can meet or partially meet the above needs? We specifically searched the market and found the following cases for your reference.

IV. Examples of RWA + Games

1. DeFi Kingdom

If you want to learn WEB3 knowledge but find reading articles, studying whitepapers, and doing desktop research too boring, is there a product that allows you to learn WEB3 knowledge while playing games? Yes, there is such a project, and DeFi Kingdom is one of them.

DeFi Kingdom is a Play2Earn game based on the Harmony public chain from the previous bull market. But it is not just a game; it is also a DEX and an NFT trading market. The entire game map can be said to visualize and gamify the functions of DEX and NFT. For example, in the Gardens, users can provide LP through Druid and receive Jewel token rewards. In the Marketplace, users can buy the main game token Jewel and pledge it in the Jeweler Bank to receive xJewel tokens and enjoy a series of rights and governance privileges in the project, and participate in voting. Users can also use Trader to exchange Jewel tokens, Harmony tokens, stablecoins, and other mainstream tokens.

Another part of the game is based on hero NFTs, including hero blind boxes, completing tasks for rewards, and PVP battles, among others. Users can buy or lease heroes in the Tavern and produce offspring heroes through breeding. Heroes have different attributes such as lineage, profession, rarity, and ability values, and the quality and attributes of the offspring produced through breeding are related to these attributes. The higher the lineage level, the more times it can be bred and the lower the breeding cost. The next generation of heroes' professions, rarity, and attributes are distributed with a certain probability and require some effort to study. After obtaining heroes, players can complete various tasks in the kingdom, including gardening defense, Jewel mining, dungeon raids, and more, to defend the garden from attacks or dig up new treasures. They can also participate in tournaments with three people on a regular basis to compete for prizes.

The game has subsequently launched features such as land, buildings, equipment, PVP, and more, forming a more complete game ecosystem. Overall, DeFi Kingdom is a successful game that integrates the functions of DEX and NFT markets. Through the game, players can learn, use, and experience the knowledge and operations of DEX and NFT trading, and also earn game tokens through Play2Earn, staking, mining, and more.

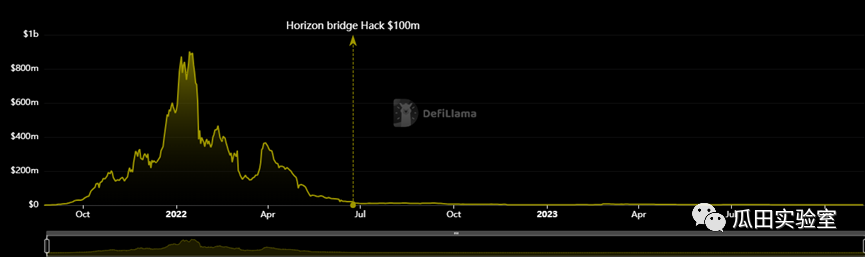

However, like most games, the excessive financial attributes have led to rapid development of the game, but it is inevitable to avoid the death spiral. According to Defi Llama data, at its peak in early 2022, the TVL once reached over $900 million, making it the traffic star of the Harmony public chain. But with the end of the previous bull market and the decline of the chain game craze, the latest TVL data is only around $2.2 million, just over 0.2% of the peak period.

DeFi Kingdom is a gamified attempt at DEX and NFT markets, and its successful integration of DeFi and games has profoundly influenced the WEB3 market. The breakout of RWA + games is essentially similar to DeFi Kingdom, requiring the creation of a gamified scenario to seamlessly integrate RWA into the game, allowing players to learn about relevant financial and investment knowledge through an unconscious experience, and directly participate in the investment process through the game. This will undoubtedly be an innovative breakthrough for RWA.

2. Monopoly-style Board Games

Real estate is one of the main asset categories of RWA, and games in the real estate category easily bring to mind Monopoly-style board games. I believe that most of us have had some exposure to Monopoly-style games from childhood to adulthood, whether in online or offline versions. Like WEB2, WEB3's Monopoly-style games have also stood the test of time. There are currently two influential Monopoly games in the WEB3 market, one is Meta World (Richman 2), and the other is Mhaya.

Meta World (Richman 2)

Meta World (Richman 2) is a new work from Netmarble, South Korea's largest mobile game company. It is a land-building chess strategy game based on the Monopoly gameplay. In addition to the basic Monopoly gameplay, which involves moving pieces, building houses, upgrading, collecting tolls, and ultimately achieving victory, it also incorporates Web3 content. Players can connect their Web3 wallets to exchange diamonds and further exchange them for crystals and in-game items.

The game's biggest highlight is the addition of a virtual island gameplay, where players can build properties on the virtual island, which can bring continuous income. The higher the value of the property, the higher the income it generates. If players purchase land NFTs, they can receive token rewards. By participating in the game and competitions to earn trophies, the higher the number of trophies, the higher the investment level, which can further increase game earnings. The game also includes hero characters, and as the game progresses, more heroes are unlocked, providing additional bonuses during the game, such as special dice rolls and free buildings.

Overall, the game quality of Meta World (Richman 2) is top-notch in Web3. The game's art style, smoothness, and overall experience are not much different from traditional Web2 games. However, after incorporating Web3 elements, it instantly ignites players' passion for making money. Many people in the community are researching how to make money through the game rules and have achieved good returns.

Another Monopoly-style game, Mhaya, is still in the testing phase. The project completed a $5 million Pre-A round of financing in May of this year and recently completed an airdrop of NFT assets, with a total of 4 levels (F1-F4), each corresponding to different values, staking rewards, and output rewards. Higher-level NFTs are all produced in the game and have much higher output efficiency than regular NFTs.

Mhaya emphasizes concepts such as free, easy to get started, making money, and anti-monopoly. It has both single-player and multiplayer game modes, allowing players to build various buildings, collect tokens, explore lucky events, and create their own cities in the game. The game includes a series of random and entertaining reward mechanisms, all of which are open and transparent. There are a total of 40 events in the game, with 82.5% being favorable events, 2.5% unfavorable events, and 15% random events, determined by the number of events distributed on the game board. In random events, the comprehensive probability of triggering a favorable result is 64.44%, while the comprehensive probability of triggering an unfavorable result is 35.56%. The game's main profit comes from building structures, which are divided into commercial buildings or miracle buildings. The higher the level of the building, the higher the profit bonus. When a player enters a building unit, they can receive corresponding HAYA rewards. The reward value is determined by the character level and building level, with higher levels resulting in higher rewards.

The game has two tokens, MAYA for governance and HAYA for in-game use. HAYA tokens can be earned as rewards through gameplay and staking. A notable feature of the game is the inclusion of free and staking pools, corresponding to 10% and 60% of the total token volume, showing a sincere effort. The staking incentives for 60% of the tokens will greatly encourage player staking behavior and reduce the pressure of short-term mining and selling. The game also features character NFTs, which can be obtained with MAYA tokens and correspond to different output rates.

These two highly anticipated Monopoly-style games are a concentrated embodiment of Web3 financial simulation game products. In fact, Monopoly-style games are best suited to be transformed into the concept of RWA, as the entire game mode is based on real estate investment and can be transformed through Web3, integrating Web3 gameplay to make it enjoyable and profitable. However, the drawback of these games is that they are too focused on entertainment, diluting their educational capabilities, including the inability to effectively replicate the real investment process and details in the gameplay. In simple terms, they have not yet entered the process of linking real-world real estate, and can only be played as games, without providing much education or being considered true RWA.

AssetClub

Recently, there is a game called AssetClub in the market. At first glance, it seems to be a Monopoly-style chess Web3 game, but after playing the beta version, it became clear that it is an online version of a wealth flow game. Many people have participated in offline wealth flow sand table game board game activities, such as the globally renowned bestseller "Rich Dad Poor Dad," which also has an offline wealth flow board game. Typically, such activities last at least 2-3 hours, but everyone enjoys it because in each game, through the simulation of investments, wealth, and various life events, each move feels like experiencing a virtual life. At the end of each activity, everyone will have a myriad of feelings, including joy, regret, and reluctance, and will always think about what the outcome would be if they made different decisions at key points if they were to play again from the beginning. AssetClub is an online version of such a wealth flow game. Compared to the slow-paced gameplay process offline, AssetClub speeds up the entire game process, taking about 10-20 minutes to play a game.

The main interface of AssetClub is also a chessboard-style game interface. However, unlike the game objective of Monopoly (building more buildings, collecting more tolls, and ultimately achieving success), the goal of AssetClub is to achieve financial freedom, meaning monthly investment income > monthly expenses. The game realistically simulates the investment experience of the golden 40 years of life from the age of 25 to 65, starting from a recent college graduate entering the workforce, getting promotions and raises, getting married and having children, and going through a series of life, career, and investment practices to ultimately achieve the goal of financial freedom at a certain stage of life. The game emphasizes randomness, with each event on the board being random, and the map composition also having a certain degree of randomness, ensuring that each game experience is different, and there will be different life insights.

Another major feature of AssetClub is the integration of a lot of Web3 knowledge, allowing players to quickly get in touch with Web3 concepts through quizzes, investments, and cryptocurrency transactions, and forming initial awareness through simulated operations. Through the rise and fall of assets in the game, players can have a more intuitive and vivid, close-up experience with assets they are interested in, and can understand potential opportunities and risks through simulated deductions in advance.

In terms of tokenomics, the game has two tokens, ACC and FLC. ACC is the game token, mainly used for in-game production and empowerment, such as drawing professions, battles, purchasing items, and equipment. FLC is the governance token, with staking, voting, and sharing platform income rights.

Another major narrative of this project is to establish a global investor community through the game, creating a decentralized, borderless, and fully shared investment world for global users to fully learn, share, explore, and practice digital assets. This actually combines with the first point mentioned at the beginning of this article: social interaction.

Actually, compared to the Monopoly-style games mentioned above, what's more noteworthy about this project is that the team behind it is really taking action to implement RWA. In their public introduction, the main members of the project team were originally engaged in the financial education industry in the Web2 sector and are now trying to use AssetClub as a Web3 product to link the team's existing real-world resources, establish a fast track for investments (such as brokerage, banking, investment advisory channels), and more accurately recommend investment products suitable for players based on game data and player investment preferences. Perhaps in the future, it may be possible to directly buy and sell global stocks and bonds through cryptocurrencies in AssetClub.

In the future, the project team will also empower game assets, linking more game resources to offline activities, hosting more investment exchange meetings, cocktail parties, VIP services, etc., attracting Web2 players and truly breaking out of the circle.

Overall, AssetClub is an investment education game that takes the form of a game, with financial education content as the main focus and investment resource integration as its essence. Players can practice Web3 investment skills in the game, gain insights into life, obtain wealth secrets in the community, and through investment, achieve a greater connection between the virtual world and real life. Currently, the concept of AssetClub is relatively new and most likely to achieve the breaking out of RWA+ games and integration, making it a key case in the new narrative of this round of the bull market. The project has completed its angel round of financing, but the financing information seems to have not been announced yet. The game will be launched on Google Play and the App Store soon, and interested players can experience it.

V. Conclusion and Outlook

In this in-depth research article, we have explored the favorable conditions for the upcoming new round of the bull market and compared it to the foundation of the previous bull market. We then discussed the four new narratives of the new bull market and further analyzed the RWA track and its evolution. Finally, through four case studies: DeFi Kingdom, Meta World (Richman 2) + Mhaya, and AssetClub, we discussed the possible forms of breaking out of RWA+ games.

RWA is not a new proposition. At the beginning of the blockchain, people hoped to empower the real economy and finance through blockchain technology and its naturally transparent and tamper-proof transaction attributes. It's just that after so many years of effort, practitioners have gone through multiple attempts, and the only track that has truly broken out and been widely applied is the trading and payment track. In such a vast real asset world of RWA, what will be the next category to break out? Some say it's US Treasury bonds because they are the most standardized financial products; others say it's real estate because it is the most important window to connect the real world. We believe that in addition to financial assets and tangible assets, integrating Web2 business models is also a very important direction to explore.

On the other hand, games, as the most important functional and scenario-based application track of blockchain technology, also have the opportunity to become a bridge between blockchain technology and RWA. Through gamified scenarios, complex and tedious digital and financial principles can be presented to users in an imaginative and entertaining form, allowing people to better understand and apply them. DeFi Kingdom is a good example of a Dex gamified scenario, while Meta World (Richman 2) and Mhaya are attempts at gamifying real estate investment, and AssetClub is more comprehensive, appearing to be a wealth flow game, but actually creating a Web3 investment, communication, and resource integration platform. All three models have the potential to break out of RWA, corresponding to financial, real estate, and comprehensive investment platforms.

In the Web3 industry, where opportunities abound, one of the goals that many people strive for is to achieve financial freedom. This is true for games, and it's also true for life. I hope that through continuous self-learning, everyone can seize the new narrative RWA track of this bull market and achieve their own breakthroughs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。