Telegram's integration with TON's payment ecosystem is a highly probable future event.

Author: Sullivan

Key Summary

TON started in 2018, initially named Telegram Open Network. In 2019, the project faced legal action from the U.S. Securities and Exchange Commission (SEC), leading the team to abandon further development of TON. After 2020, the New TON (TON Foundation) developer community took over the development and renamed it The Open Network. In September 2023, TON Token's circulating market value reached the top ten in the cryptocurrency market.

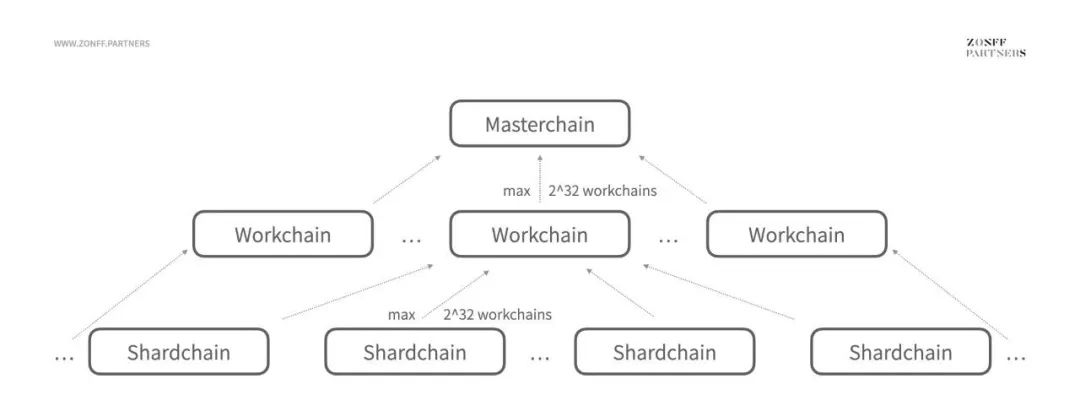

TON's technical feature is its heterogeneous multi-chain structure, allowing multiple chains to process transactions in parallel through the three-tier architecture of Masterchain, Workchain, and Shardchain. This is similar to a collection of blockchains, hence it is also known as a blockchain of blockchains or a collection of 2-blockchains. Through Workchain and dynamic sharding, TON's future goal is to handle large user groups and process millions of transactions.

TON's development is mainly achieved through strong control of token prices and the expansion of the Telegram ecosystem. In terms of technology, TON shares similarities with previous public chains such as Solana and ICP, and is not entirely original. Its core advantage lies in its close integration with Telegram's ecosystem, which has over 800 million monthly active users, making it a gateway for a large number of Web2 users to enter the cryptocurrency ecosystem.

Unlike other Layer1 projects, TON's development path does not rely on increasing on-chain DeFi ecosystem TVL amounts, but rather focuses on Telegram payments, bots (TG Bot), and mini-games as the main development track. Therefore, evaluating TON's valuation based on the traditional Mcap/TVL on-chain asset lock-up calculation method may be less accurate.

The TON Foundation announced the global launch of the self-hosted digital wallet TON Space based on Telegram in November. The wallet has been embedded in Telegram for some time, and the recent change mainly involves transitioning from the original embedded wallet's hosted mode to TON Space's non-hosted mode.

Based on Telegram's massive user base, the potential explosion of the payment ecosystem combining Telegram and TON is a highly probable future event. However, due to issues with the early PoW mining model, the current concentration of TON Token chips, and the mismatch between the circulating market value and the daily average trading volume, there are implications of strong control and potential selling pressure, which may favor price stability and project development in the short to medium term, but pose centralization risks and potential selling pressure in the long term.

I. TON Development History

In 2018, Telegram aimed to issue its own cryptocurrency and established the Telegram Open Network (TON) project, raising $1.7 billion through an ICO with the token name $GRAM. However, in October 2019, the U.S. SEC accused them of illegal fundraising. In May 2020, Telegram's founder Pavel Durov publicly announced the abandonment of the TON blockchain project and was fined $18.5 million by the SEC.

In May 2020, TON Labs, the TON technical development team, announced the open-sourcing of the TON project's code and the termination of the project's development. They agreed to pay a $18.5 million settlement to the SEC and return the raised funds to investors. Subsequently, a decentralized community called Free TON released a forked version of the "Free TON Blockchain" with the token name "Ton Crystals." However, the official updates for Ton Crystals were suspended for a long time.

In May 2021, the New Ton developer community, spontaneously formed by the Telegram community, began to study and advance the TON project. The project transitioned from Telegram Open Network to The Open Network, with the token being TON. In November 2021, TON was listed on various exchanges, and Telegram's founder publicly supported the TON project.

In August 2021, the TON/WETH trading pair was listed on the decentralized exchange Uniswap and began trading. In the following Q4 and 2022, it continued to be listed on other DEXs and major CEXs (Binance has not yet been listed as of November 2023).

In November 2021, at the peak of the previous bull market, as BTC rose to its highest point and then fell, various altcoins began to surge, and TON's price quickly rose from $0.8 to $4.5 before falling back. Additionally, TON's price remained relatively stable during the bear market, ranging from $1 to $2.5, with its market value continuously rising.

In April 2022, the TON Foundation announced the establishment of the $250 million ecosystem fund "TONcoin Fund," with investments from exchanges and institutions such as Huobi, KuCoin, MEXC, 3Commas Capital, TON Miners, and Kilo Funds. Subsequently, the TON Foundation announced the provision of a wallet bot for Telegram, allowing Telegram users to send and receive TON and exchange other cryptocurrencies directly within Telegram.

In July 2022, the TON Foundation established the $90 million ecosystem fund TON Alpha-Vista, with investments from VistaLabs, Alphanonce, Miner's Fund, and Kilo Fund.

In September 2023, the rapid short-term rise in TON's price attracted significant attention in the market, with TON's circulating market value reaching $9 billion, ranking ninth among all cryptocurrency market values.

Although TON faced some difficulties in regulation and legal matters in the early years, it has garnered significant attention and support from the blockchain and cryptocurrency community and has continued to receive market enthusiasm in 2023. TON aims to provide fast, secure decentralized payments, digital identity, and other services for Telegram's 800 million-plus users. TON hopes to achieve scalability to process millions of transactions per second and support a decentralized ecosystem.

II. TON Features

1. TON's Technological Uniqueness

TON addresses blockchain scalability and interoperability issues through its multi-blockchain architecture. Specifically, TON's technological features can be divided into the following aspects:

a. Multi-chain Architecture: TON's blockchain is a collection of blockchains consisting of the main chain Masterchain, the work chain Workchain, and the shard chain Shardchain (the maximum number of work chains can reach 2^32, although other references mention 2^92; after reviewing the latest whitepaper, the author believes it should be 32 to the power of, and welcomes corrections if inaccurate). The main chain contains all information about the protocol and current parameters, the work chain processes smart contract transactions, and the work chain further shards into shard chains. Through the work chain and dynamic sharding, TON can verify and process millions of transactions per second, achieving rapid scalability and interoperability on a large scale regardless of network size, and enabling instant message transfer between any two blockchains.

Image Source: CGV FoF (Zonff Partners Remake)

The main chain and work chain on TON are heterogeneous multi-chains, where different work chains may have different "rules," such as different account address formats, transaction formats, smart contract virtual machines (VMs), and basic cryptocurrencies. However, they all meet certain basic interoperability standards to make interoperability between different work chains possible and relatively simple. In this respect, TON's blockchain heterogeneity is similar to the EOS and PolkaDot projects.

The work chain and shard chain on TON are homogeneous multi-chains, where each work chain can be divided into a maximum of 2^60 shard blockchains, or simply shard chains (other references mention 2^64, but after reviewing the latest whitepaper, the author believes it should be 60 to the power of, and welcomes corrections if inaccurate). Their rules and block formats are the same as the work chain itself, but they are only responsible for a group of accounts, depending on the first few digits of the account address. Since all these shard chains share common block formats and rules, they are homogeneous, similar to the content discussed in the Ethereum extension proposal.

b. Proof of Staking + Byzantine Fault Tolerant: TON uses a consensus algorithm similar to Cosmos and Polkadot. According to the whitepaper, becoming a node does not require permission, only a certain amount of tokens and basic IT operational capabilities. There are four roles in the TON network: validators, nominators, fishermen, and collators. If a validator signs an invalid block candidate, it may be automatically penalized, lose part or all of its stake, or be temporarily suspended from the validator set for a period of time. In addition, the BFT consensus mechanism ensures that consensus does not fork and is more suitable for the "tightly coupled" multi-chain architecture.

c. Account Privacy and Anonymity Protection: TON Proxy (network proxy/anonymous layer), similar to I2P (Invisible Internet Project), is used to hide identities and create decentralized virtual private networks (🪜) to protect online privacy. This feature is important for account nodes with a large number of tokens or those wishing to hide their exact IP address and geographical location to defend against DDoS attacks.

d. FunC/Fift/TACT: FunC is a programming language for the TON Virtual Machine (TVM). This domain-specific statically typed language is used to write smart contracts on the TON blockchain. In TON, FunC is typically not directly compiled into bytecode, but is instead compiled through another lower-level programming language called Fift. Like FunC, Fift is another language designed specifically for the TON blockchain. Fift is a low-level language very close to TVM opcodes, specifically used for developing and managing smart contracts on the TON blockchain and interacting with the TON Virtual Machine. For most developers, both FunC and Fift are challenging, so the official TACT programming language has been introduced to provide a relatively easy language for developers to use.

2. Differences Between TON and ETH, Solana

The TON team specifically wrote a paper outlining the differences between TON, Solana, and Ethereum:

Image Source: https://ton.org/zh/analysis

a. Blocks and Finalization Time

Users are typically concerned with transaction speed and blockchain speed. The faster blocks are built, the less time users have to wait for remittances and smart contract execution.

TON - TON generates a new block on each shard chain and the main chain approximately every 5 seconds. New blocks on all shard chains are generated almost simultaneously, while new blocks on the main chain are generated approximately one second later, as it must include the hash values of the latest blocks on all shard chains.

ETH - Ethereum includes slots and epochs, where a slot is a 12-second time interval during which validators can propose new beacon chain and shard chain blocks. 32 slots make up an epoch (6.4 minutes), and there are specific rules that require at least 2 epochs for block finalization, meaning it takes at least 12.8 minutes to finalize a block.

Solana - Solana claims to generate a block every second or faster, but it has an extended block finalization time. A block is typically finalized after 16 rounds of voting, with each round expected to last about 400 milliseconds. This means a delay of 6.4 seconds.

b. Performance

Blockchain performance represents the platform's ability to handle large-scale smart contracts, which is crucial for complex blockchain products such as DeFi, GameFi, and DAO.

TON - TON is a Turing-complete high-performance blockchain that can accommodate any complex transactions on the main chain and all work chains.

ETH - Ethereum has Turing-complete EVM only on the beacon chain and is limited to 15 transactions per second. The lack of cross-shard interaction means that other transactions cannot be executed in a truly decentralized environment.

Solana - Solana is Turing-complete, but it performs well only in a few very simple predefined types of transactions (those that only change account balances without changing state), and only when all account data fits in RAM (if it doesn't, there are some issues).

c. Scalability

Scalability is directly related to the number of users and their interactions (transactions, smart contract execution, infrastructure requests).

TON - TON supports work chains and dynamic sharding, allowing the system to accommodate up to 2^32 work chains, each of which can be subdivided into up to 2^60 shard chains, with almost instant cross-shard and cross-chain communication capabilities, achieving millions of transactions per second.

ETH - Ethereum will support up to 64 shard chains and the beacon chain. At this stage, it is unclear what the exact performance of the new 64 shard chains will be and how shard chains will interact with each other. However, if message passing between shard chains is introduced, it will be necessary to wait 10-15 minutes for shard chain blocks to be finalized before processing the message on another shard chain. Additionally, additional shards are not expected to run EVM smart contracts. Instead, they are expected to be used for additional data storage in the distributed ledger.

Solana - Solana does not support sharding or work chains.

Whitepaper: Comparison of TON, Solana and Ethereum 2.0

III. Toncoin Token

TON has an initial total supply of 5 billion tokens, with no upper limit on supply. The team holds 1.45% of the tokens, and the remaining 98.55% were mined in the early stages through POW. The network consensus has transitioned from POW to POS, and the total TON supply is inflating at a rate of approximately 0.6% per year, with these tokens used to reward validators who maintain network security. The creation and initial issuance of TON tokens were unique, similar to Bitcoin in some aspects. In June 2020, all TON tokens (98.55% of the total supply) were available for mining until the last TON token was mined on June 28, 2022, marking the successful conclusion of the TON IDO.

The main uses of TON tokens in the network include paying transaction fees, ensuring chain security through staking, making decisions about the network's future, and ultimately making payments. Additionally, TON tokens are used for decentralized data storage, TON proxy usage, TON DNS, voting, and rewarding validators.

The current total supply of TON is approximately 5 billion, with 1.08 billion frozen in early miner inactive wallets, approximately 470 million staked by POS validators, and a circulating supply of 3.53 billion TON tokens.

Due to TON's unique history, unlike other new public chains, early investment institutions and project parties do not hold a large number of tokens, which is advantageous in that there is no concern about institutional unlocking and dumping. However, a disadvantage is that early large miners hold a relatively concentrated amount of tokens, replacing institutions, with the top 100 whale addresses currently holding over 50% of the total token supply.

In February 2023, TON VOTE passed a proposal for the "TON Token Economic Model Optimization," which proposed temporarily freezing inactive mining wallets for 48 months. There are currently 171 inactive mining wallets holding a total of over 1.081 billion TON, accounting for approximately 21% of the total TON supply at that time.

While temporarily freezing inactive mining wallets through community voting may temporarily alleviate selling pressure, it is unlikely that these wallets will be permanently frozen due to the decentralized nature of the concept. In comparison, the total holdings of the top 100 Bitcoin addresses account for only 13.63%, making the unreasonable token distribution a significant threat to the TON ecosystem in the future.

In addition to temporarily freezing inactive wallets through community voting, a proposal to burn half of the transaction fees was also passed to reduce the circulating supply. However, currently, only about 450 TON tokens can be burned per day, which is insignificant considering the initial supply of 5 billion.

Careful observation of TON's price reveals a significant mismatch between its circulating market value and average daily trading volume. TON currently ranks 11th in circulating market value and 139th in trading volume, with this market value being only the circulating market value and not the fully diluted valuation (FDV). If all TON tokens were included, the FDV total market value would exceed tens of billions of dollars. Since its initial listing on Uniswap in August 2021, TON's price has remained between $1 and $2.5, even during the bear market, and has not dropped below the $0.5 issuance price. This is likely because during the bear market, retail investors did not have many TON coins to sell, so the price trend did not experience the prolonged bearish trend seen in many other public chains. Additionally, TON's circulating market value has consistently remained at a high value of over a billion dollars since 2022, while its average daily trading volume has dropped to as low as a few million dollars. In comparison, Solana, which has maintained a circulating market value of several billion dollars since the bear market, often sees daily trading volumes reaching several hundred million dollars, with TON's daily trading volume not even reaching one-tenth of Solana's.

The concentrated holding distribution of TON and the potential selling pressure pose significant psychological barriers to the entry and turnover of large funds and institutions. Combined with the current low trading volume, it is difficult to make a reasonable valuation. It is expected that multiple adjustments to the chip structure and circulation mechanism will be needed in the future to stimulate trading volume and establish a more stable market expectation.

In the short to medium term, the steady rise in TON's price is most likely the result of market value management in conjunction with favorable ecological speculation. Market value management for public chains like TON is not necessarily a bad thing, and a stable price performance is also beneficial for the long-term stable expansion of the TON public chain ecosystem, preventing the impact of price volatility on the ecosystem development. In the previous cycle, with the cooperation of the market value management team, Solana's price performance reached a circulating market value of up to $80 billion, making market value management a favorable factor for TON's price in the short to medium term. However, in the long term, with the top 100 whale addresses holding over 50% of the total token supply, TON also faces centralization risks and potential significant selling pressure, allowing those holding a large amount of TON coins to monitor these 100 on-chain addresses.

It is also worth noting that the well-known market maker DWF Labs announced in June that it would contribute to the token economics, market making, and liquidity of the TON ecosystem. Additionally, as of November 2023, among the top 100 market cap cryptocurrencies, apart from platform coins from other exchanges and BSV, only TON has not been listed on Binance, leaving room for a new round of growth expectations for TON.

IV. TON Ecosystem

According to ton.app statistics, the Ton ecosystem currently has 551 apps, which is not a small number for a public chain that has not yet exploded. However, only 9 apps included by DefiLlama, with the top-ranked Bemo accounting for over half of the TVL (7.3M). Most of these are non-financial products, which aligns with Ton's positioning and expectations as a good testing ground for non-financial products.

a. The Enormous Payment Ecosystem Implied by the Integration of Telegram and TON

Recently, at the Token2049 summit, the official Telegram and TON Foundation announced a partnership. Telegram integrated the "TON Space" self-custody encrypted wallet launched by TON, allowing direct access to the wallet in the Telegram menu to complete crypto self-circulation. Telegram has a large global user base, with 1.3 billion registered users, many of whom are from Russia, Iran, India, and other Asian and European countries. According to Telegram's founder, more than 2.5 million new users register on Telegram every day, with over 800 million monthly active users.

In January 2023, data compiled by Statista showed that the user base of Telegram, now known as X, is 1.4 times that of Twitter (5.56 billion), 0.61 times that of WeChat (13.09 billion), and 0.86 times that of Facebook (9.31 billion), surpassing TikTok (7.15 billion). Telegram, as one of the essential apps for Crypto, currently has a massive Crypto user base.

TON Space users can seamlessly connect with TON ecosystem applications through their Telegram accounts. Users can directly connect to TON Space from decentralized applications (dApps) based on TON and enjoy its features and services. TON Space serves as a blockchain account supporting assets such as TON within the ecosystem. Some have compared TON Space to Telegram, similar to WeChat Pay's relationship with Tencent, to illustrate the importance of this collaboration.

As early as April 2022, the TON Foundation announced the provision of a new wallet bot @wallet to Telegram, allowing users to send and receive Toncoin and purchase Bitcoin directly within Telegram. This means users do not need to enter lengthy wallet addresses or wait for verification to complete transactions.

In September 2023, the TON Foundation announced the global launch of the Telegram-based self-custody digital wallet TON Space in November. TON Space accounts provide self-custody services, ensuring that third parties cannot access users' assets, thereby ensuring a certain level of security. Once launched, TON Space will be integrated into the Wallet, and the built-in non-custodial wallet does not require the introduction of third-party payment settlement platforms. This not only avoids the risk of transferring to other platforms but also enhances the encryption and financial attributes of the Telegram platform itself.

Telegram currently allows users to directly access the wallet without any downloads and allows the deposit of assets such as USDT/TON/BTC for trading.

The current payment functionality of Telegram allows users to send TON and BTC directly to friends in the app's chat rooms, similar to WeChat Pay. This convenient payment experience has empowered TON significantly. Many public chains may have a well-developed ecosystem but lack traditional user scenarios, making it difficult to gain traction. TON, on the other hand, has the backing of Telegram from the start, enjoying the massive traffic and direct application scenarios brought by Telegram's 800 million monthly active users.

b. Depressed DeFi Ecosystem

In contrast to the significant empowerment brought by Telegram to TON, the current DeFi lock-up amount for TON is very low, at only $9.2 million. Only 9 apps included by DefiLlama, with the top-ranked Bemo accounting for over half of the TVL ($7.3M). Even a struggling public chain like EOS has a TVL exceeding $69 million.

Unlike other Layer1 chains, TON's development path may not rely on increasing on-chain DeFi ecosystem TVL amounts but rather on Telegram payments, bots (TG Bot), and mini-games (similar to mini-programs in the WeChat ecosystem) as the main development track. Therefore, using the traditional Mcap/TVL on-chain asset lock-up amount calculation method to judge TON's valuation may be less accurate. TON's core advantage lies in its close integration with Telegram's 800 million monthly active users, making it a gateway for a large number of Web2 users to enter the crypto ecosystem. In the next cycle, the GameFi and SocialFi sectors with Ponzi attributes will see many new projects, and the TON ecosystem with a massive Web2 traffic may become a focus of attention for these projects.

c. Rapidly Developing TG Bot Track

In addition to the potential payment ecosystem brought by the integration of TON and Telegram, the bot (TG Bot) track is also likely to be a breakout point. Since May 2023, the bot track has shown a steady increase in trading volume, business revenue, and the number of new users. The top three, Maestro, Banana Gun, and Unibot, have shown good trading volume even in the bear market. Unibot's token price even increased tenfold in the bear market, and the top-ranked Maestro achieved a daily revenue of $54K (DeFiLlama data; Maestro has not yet issued tokens).

The explosion of the bot ecosystem is inseparable from Telegram's own empowerment. Users on Telegram use bots to find and follow Smart Money's trades to make profits, which is one of the few positive income paths in the bear market. Additionally, many experienced Web3 users on Twitter have a positive view of the TG Bot track and have started using features such as on-chain monitoring alerts within Telegram. Traditional on-chain monitoring is often nested within wallets, data websites, and self-made monitoring software, and Telegram is gradually breaking these user habits. Through Telegram, users can directly integrate information retrieval, user communication, data monitoring, payment transfers, and crypto financial management.

Apart from this, the potential integration of Telegram with the gaming, social, and NFT tracks in the future may give rise to new product models, all of which are potential areas of empowerment for TON. Similar to the gaming ecosystem of WeChat mini-games, Telegram may also develop many similar gameplay options in the future. The rapid integration of @wallet with mini-games, and even bypassing the fiat currency entry and exit restrictions in games around the world (compliance is still under discussion), significantly reduces the entry barriers for many game developers into the GameFi ecosystem. The models of the previous cycle, such as Axie and StepN, can still be realized in Telegram through new simplified gameplay. For the Social track led by Friend.tech and the NFT track led by Opensea and Blur, users often need to switch to another platform to participate or purchase after discovering a product on a social platform (such as a popular NFT). However, Telegram's integration with TON Space allows users to participate or purchase directly on the same platform where they discovered the product, significantly reducing user participation and developer development barriers.

d. Development Tools and Developer Ecosystem

Currently, the TON official provides a lot of support for developers, including building Telegram Mini Apps and smart contracts.

Telegram Mini Apps are web applications that run within the Telegram Messenger. They are built using web technologies (HTML, CSS, and JavaScript). Developers can use the widely used programming language JavaScript to create interfaces. Here are some key points about Telegram Mini Apps:

- Integration within Telegram: Telegram Mini Apps are designed to seamlessly integrate into Telegram, allowing users to access them directly from Telegram chats or group conversations.

- Cross-platform compatibility: Telegram Mini Apps can be accessed with a single click on Telegram on different platforms such as Android, iOS, PC, Mac, and Linux without the need for additional installation.

- Bot interaction: Telegram Mini Apps typically utilize Telegram Bots to provide interactive and automated experiences. Bots can respond to user input, perform tasks, and facilitate interaction within Mini Apps.

- Development framework: Developers can use web development technologies such as HTML, CSS, and JavaScript to build Telegram Mini Apps. Additionally, Telegram provides developer tools and APIs for creating these applications and integrating them with the Telegram platform.

- Monetization opportunities: Telegram Mini Apps can be monetized in various ways, such as in-app purchases, subscription models, or advertising.

- Integration with Web3 TON ecosystem: The TON SDK has been built, making it convenient for many developers who want to integrate Mini Apps with the TON ecosystem/tokens.

Smart contracts on the TON blockchain are created, developed, and deployed using the FunC programming language and the TON Virtual Machine (TVM). FunC is a domain-specific, C-like static type language. Developer FunC programs are compiled into Fift assembly code, generating corresponding bytecode for the TVM. This bytecode (actually a unit tree, just like any other data in the TON blockchain) can be used to create smart contracts on the blockchain or run on a local instance of the TVM. Interested developers can find more specific development tool information on the TON official website.

In addition, the TON Foundation also provides many developers with Grants programs, focusing on development in areas such as DeFi, Gamefi, cross-chain middleware, development tools, and DAO governance tools. Projects such as Tali AI, TonUp, Oputs DEX Aggregator, and Gatto have all received Grants from the TON Foundation in the third quarter of 2023. Developers interested in building projects in the TON ecosystem may consider applying.

V. Future Growth Potential of the TON Ecosystem

In conclusion, TON is an excellent testing ground for non-financial products, which sets it apart from foreign public chain products. Despite facing many difficulties in its early development, such as a hefty fine from the SEC and the return of $1.2 billion in investment, TON has still done many things right in its subsequent development. It launched its token at the end of the bull market in 2021, creating a rapid surge in value using the favorable market conditions. Afterward, it maintained a high market value for TON by controlling liquidity and gradually listing on major exchanges after the bear market began in 2022. Additionally, by integrating TON with the Telegram ecosystem, it has developed the payment sector and leveraged the massive Web2 traffic of TG to drive traffic to TON. Overall, the development of TON in the next bull market is highly anticipated.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。