Author: Jiang Haibo, PANews

With the market warming up and increasing volatility, the demand for stablecoins is increasing. In DeFi, the opportunity to earn income through liquidity mining has also increased. In this issue, PANews has compiled several opportunities to earn income through stablecoin mining, with the highest annualized return reaching 70.4%. The following data is updated as of November 23.

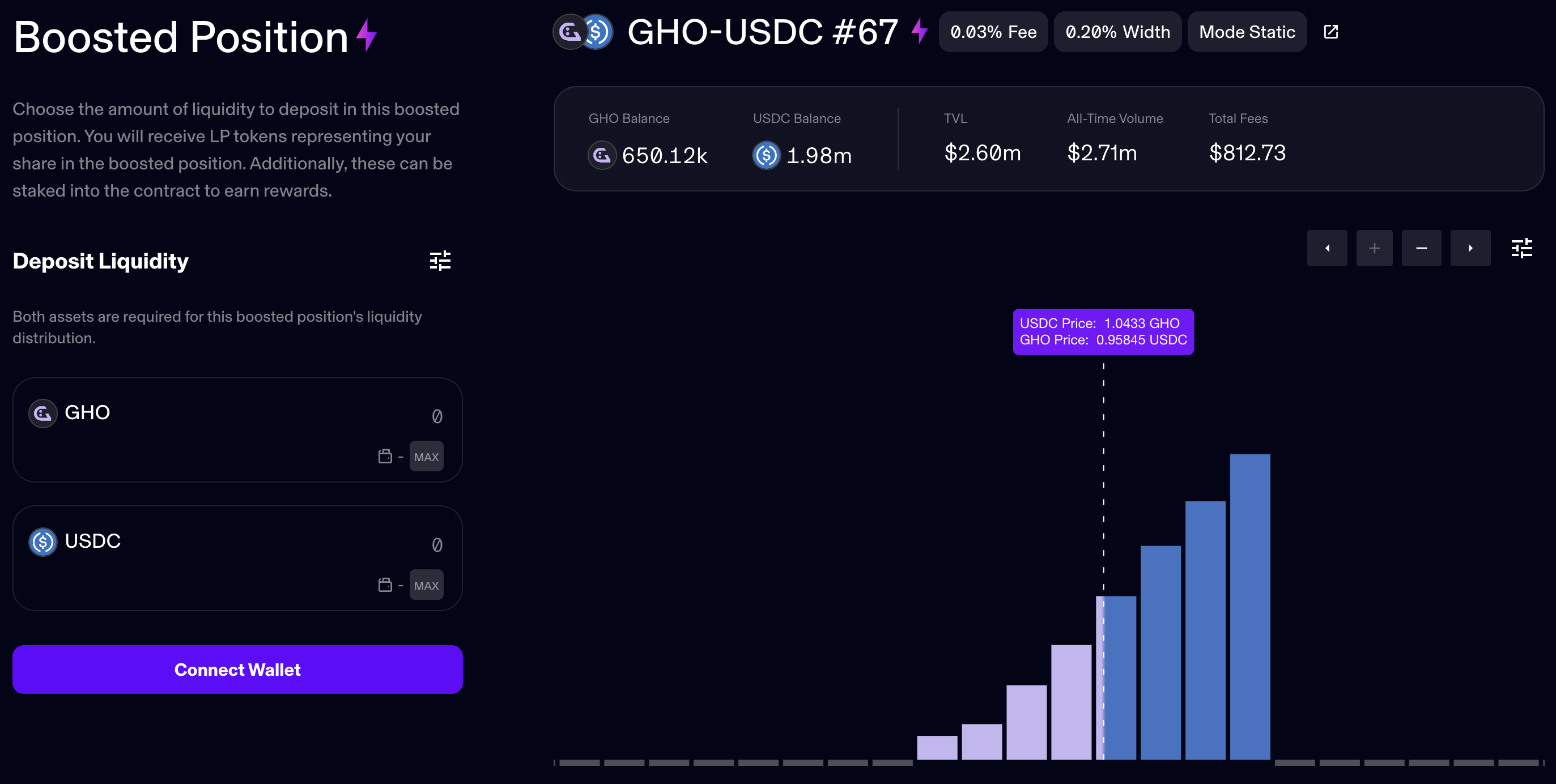

Maverick

Trading Pair: GHO-USDC APR 70.4%

Maverick is a decentralized exchange supported by top institutions such as Founders Fund and Binance Labs. The stablecoin GHO is issued by over-collateralizing positions in Aave.

However, due to the lack of application scenarios, the price of GHO has long been below $1. Therefore, Aave has taken a series of measures to incentivize the liquidity of GHO in hopes of bringing the price back to $1.

Related reading: Aave's Innovation and Challenges: From Aave V3's High Growth to GHO's Liquidity Strategy

The GHO-USDC pool with the highest liquidity on Maverick on Ethereum adopts the static mode, with a total liquidity of $2.6 million. It distributes 5,000 GHO incentives to the pool daily, with a mining APR of 67.11% and a trading fee-generated APR of 3.29%, totaling 70.4%.

In addition, there is also a GHO-USDC pool on Maverick that adopts the bi-directional mode, meaning that liquidity will move with the price of GHO. The liquidity of this pool is $1.04 million, with a mining APR of 47.89% and a trading fee-generated APR of 18.65%, totaling 66.54%.

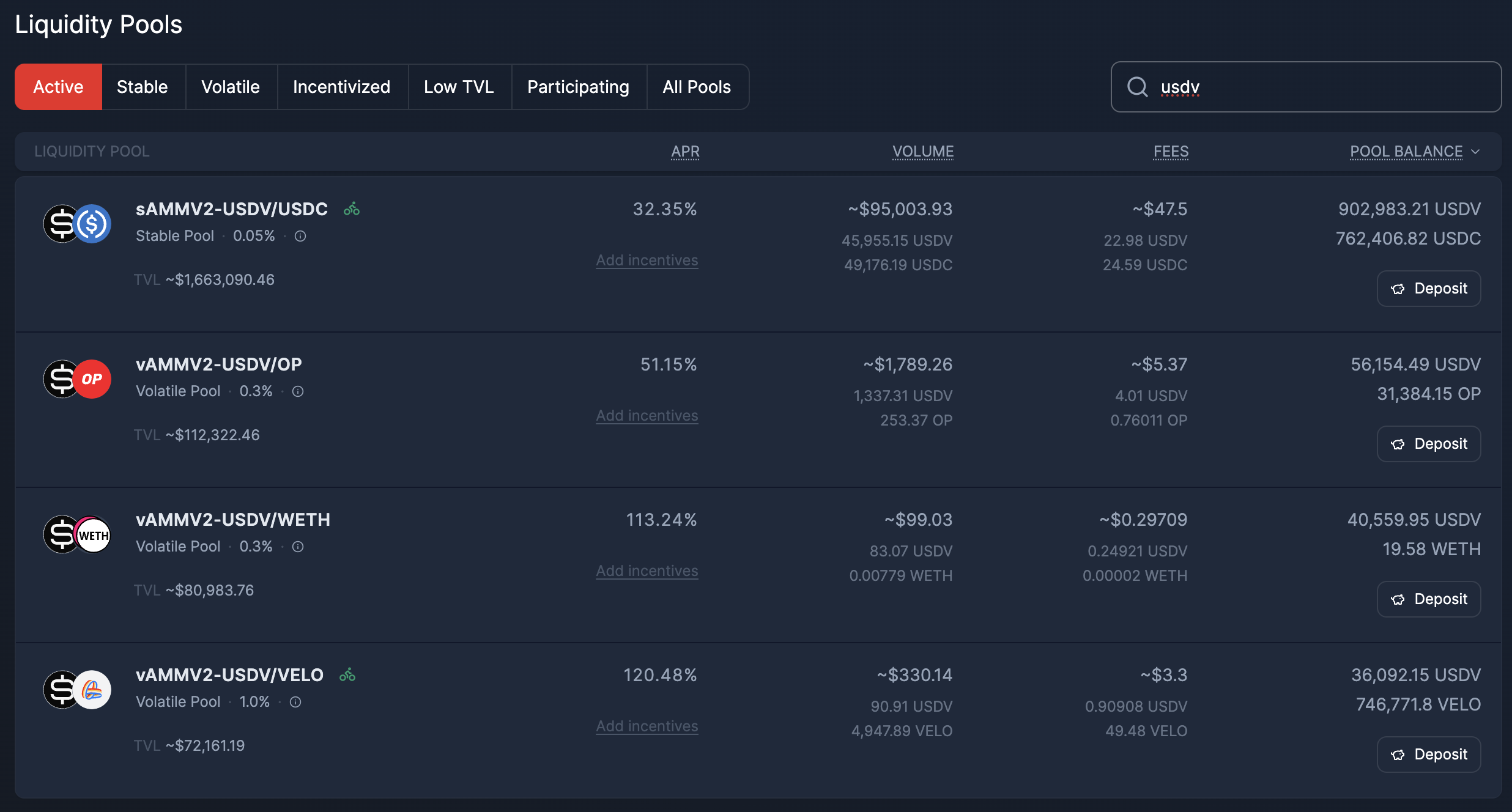

Velodrome

Trading Pair: USDV/USDC APR 32.35%

Velodrome is a leading DEX on Optimism, and USDV (Verified USD) is a unique stablecoin with its underlying asset being STBT, which is issued through a special purpose vehicle (SPV) by Matrixdock (a subsidiary of Matrixport). The underlying asset of STBT is US Treasury bonds, but it is designed for accredited investors, following the ERC-1400 standard, and only accredited investors can purchase and hold it on-chain. Therefore, USDV, compatible with the ERC-20 standard, has emerged. It is built on the LayerZero Omnichain Fungible Token (OFT) standard, eliminating the problem of unofficial packaging/bridging versions and liquidity fragmentation.

Related reading: Analyzing the "New Star" USDV: Creating a Native On-Chain Stablecoin, Riding the RWA Trend to Start a New Narrative

USDV is the first stablecoin to reward "verified minters" based on the contribution of tokens in active circulation. As the underlying assets can generate income, it uses the ColorTrace Algorithm to mark each stablecoin with a unique "color" and allocate benefits to minters by tracking the minting volume of each color token and the total supply of all colors in the reserve.

For users, USDV can be understood as a stablecoin with tokenized US Treasury bonds as the underlying asset. However, ordinary holders cannot directly benefit from the income generated by the underlying assets and need verified minters to incentivize some use cases. USDV has partnered with many DeFi protocols, such as Curve, Maverick, Trader Joe, Abracadabra, Velodrome, Wombat, and SushiSwap.

On Velodrome, the liquidity of the USDV/USDC trading pair is $1.66 million, with an APR of 32.35%.

On the BNB chain, Wombat shows that the average total APR of USDV in the USDV pool is 62.49%, with a base APR of 23.4%, but the pool has relatively low liquidity. Additionally, Trader Joe also has the USDV/USDC trading pair, with an APR of 27.73%, allowing simultaneous rewards in ARB and USDV.

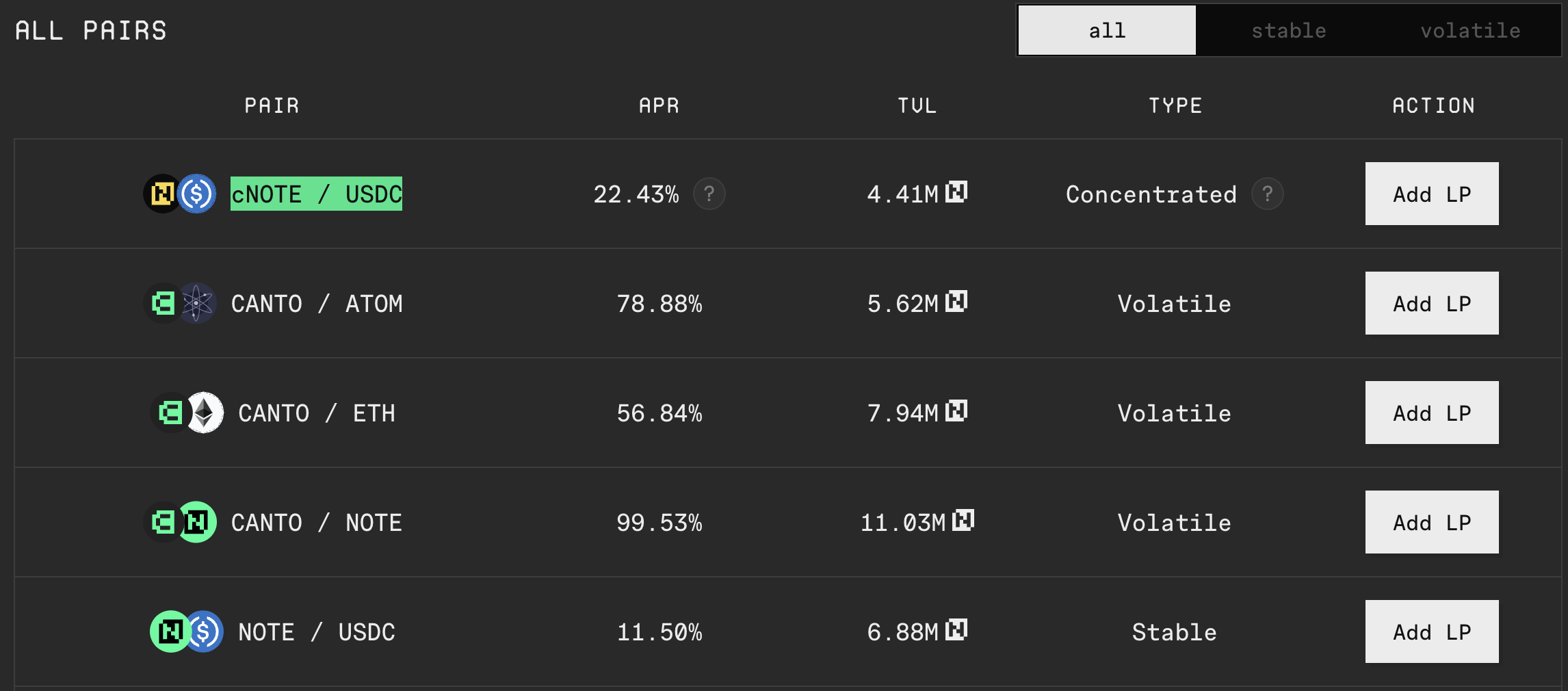

Canto

Trading Pair: cNOTE / USDC APR 22.43%

Canto is transitioning from a general blockchain platform and DeFi ecosystem to a blockchain solution tailored for physical assets, and cNOTE is issued in this context.

NOTE is the accounting unit in Canto, minted by over-collateralizing with USDC and USDT. It is now possible to deposit NOTE to the Canto lending market and receive cNOTE in return. Due to the deposit interest, the exchange rate of cNOTE relative to NOTE will continue to increase.

Related reading: Canto's Integration of RWA and DeFi: USYC Backed by a Well-Established Trading Company, What New Income Opportunities Are There?

Currently, the liquidity of the cNOTE/USDC trading pair on Canto is $4.41 million, with an APR of 22.42%. Users can directly purchase NOTE, deposit it to receive cNOTE, provide liquidity with USDC, or over-collateralize USDC or USDT to mint NOTE for subsequent operations.

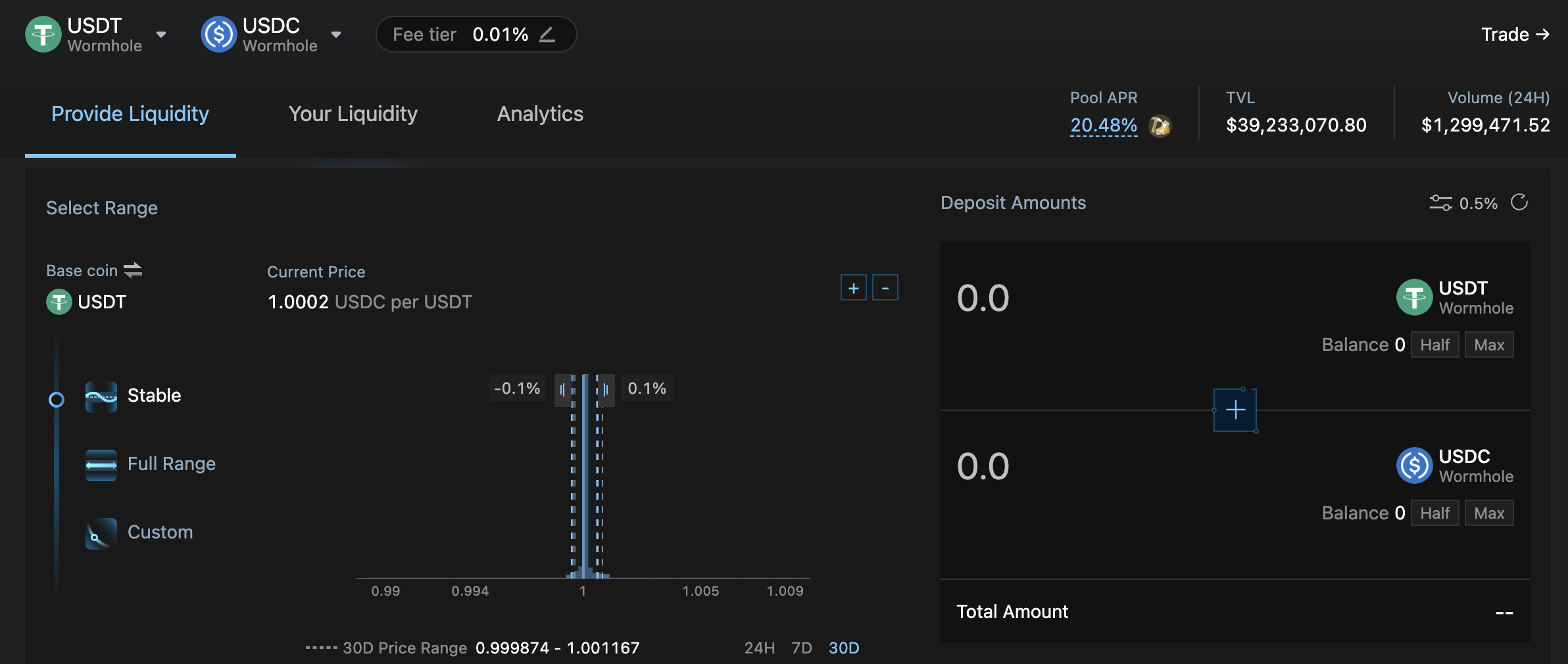

Cetus

Trading Pair: USDT/USDC APR 20.49%

Cetus is a leading DEX on the Sui public chain, where USDT and USDC are cross-chain assets obtained from Ethereum by Wormhole. They can also be directly purchased in cross-chain versions on DEXs on chains such as Solana and then cross-chain to Sui.

The liquidity of this trading pair on Cetus is $39.23 million. However, it is important to note that Cetus allows centralized liquidity, and to achieve higher returns, liquidity providers generally concentrate liquidity within a relatively narrow range. If the USDC/USDT price fluctuates, adjustments may be necessary.

The main rewards obtained here are SUI tokens allocated by the Sui public chain. Similarly, in other DEXs on Sui, SUI rewards can also be obtained. For example, the APR for USDT/USDC on Turbos is 28.02%, and on FlowX, the APR for wUSDC/wUSDT is 33.74%.

Thala

Trading Pair: MOD/USDC APR 20.53%

Thala is a leading DEX on Aptos, with products including DEX, stablecoins, liquidity staking, and Launchpad. MOD is a stablecoin minted by over-collateralizing on Thala and can also be directly exchanged and redeemed with USDC through the anchored stable module, with a 0.25% fee.

Thala

Trading Pair: MOD/USDC APR 20.5%

Thala has $2.97 million in liquidity in the MOD/USDC pool, with an APR of 20.5%, but it is important to note that the obtained MOD will take one month to unlock.

Elixir

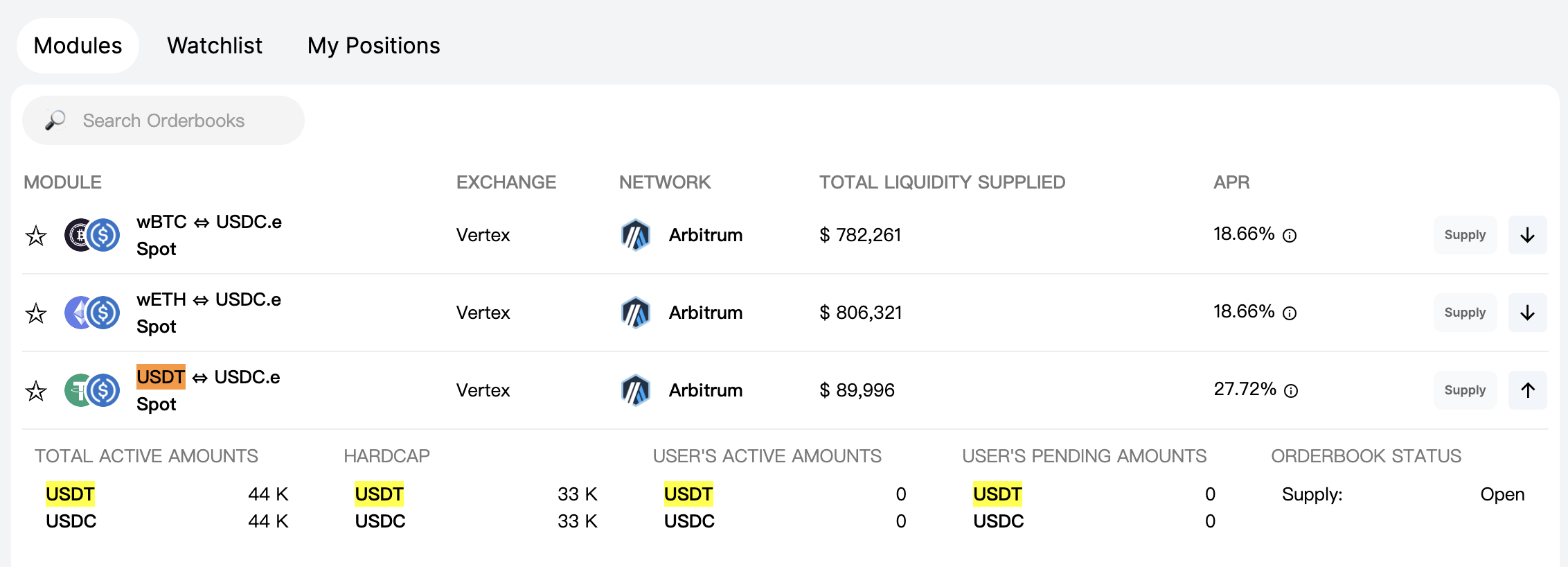

Trading Pair: USCT/USDC APR 27.72%

Elixir Finance is a decentralized and algorithm-driven liquidity protocol, and its trustless algorithm model allows widespread participants to provide liquidity for trading pairs on both decentralized and centralized platforms. Currently, the liquidity on Elixir will be used for Vertex.

The APR for the USDT/USDC spot trading pair on Elixir is currently 27.72%, with liquidity of only $90,000. However, 15% of the APR is in ARB rewards, calculated across all trading pairs, so increasing the liquidity of this pair will not significantly dilute this portion of the rewards, and the remaining rewards are in locked VRTX.

The project was valued at $100 million in financing, and the tokens have not been released yet. There is a possibility of receiving an airdrop for early usage.

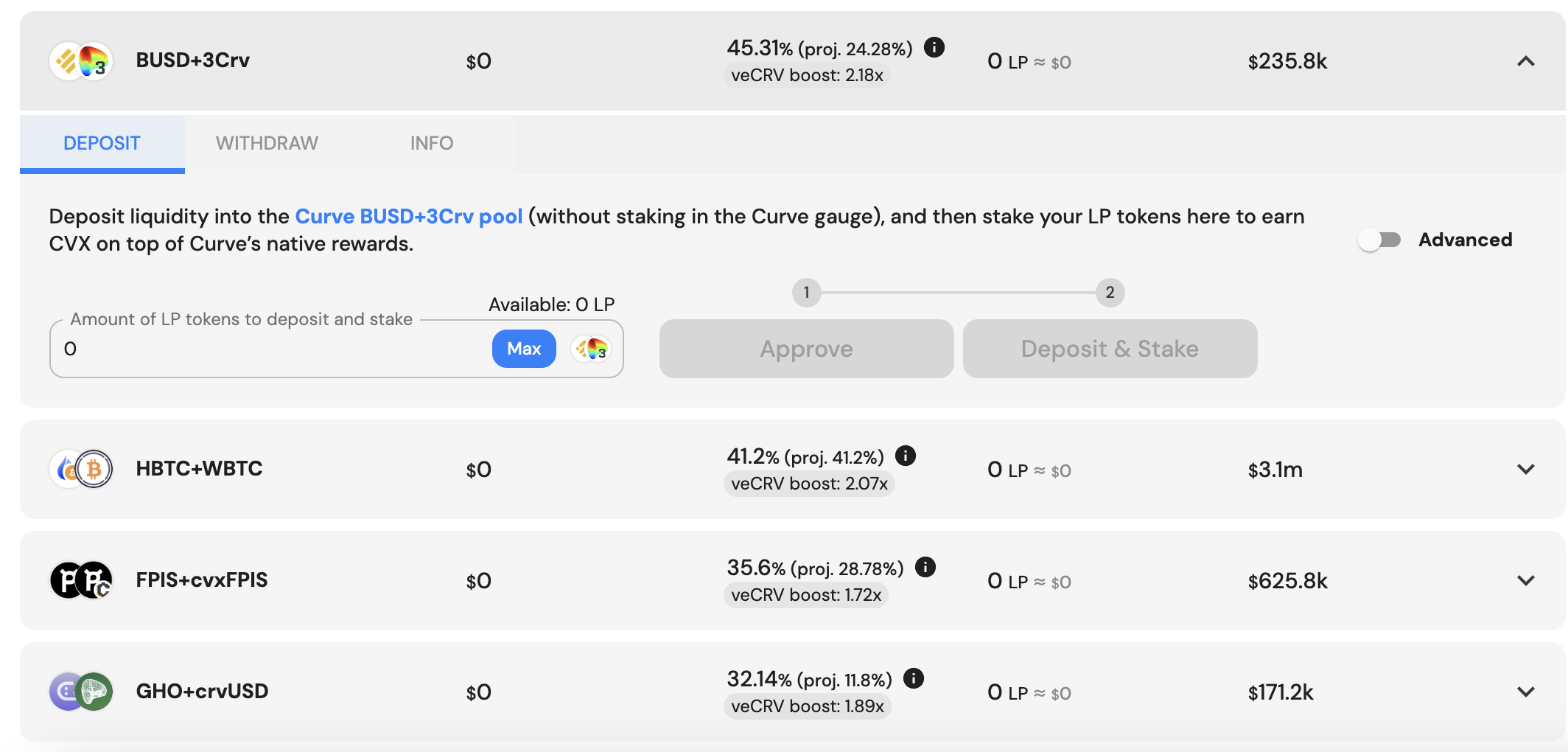

Convex

Trading Pair: BUSD/3Crv APR 45.31%

Convex and Curve are well-known DeFi projects, and BUSD, DAI, USDT, and USDC are stablecoins that are frequently encountered.

You can provide liquidity in Curve with one or more of BUSD, DAI, USDT, or USDC, then stake the liquidity tokens in Convex to earn rewards. The liquidity for this trading pair is $236,000, and the rewards are mainly in CRV, with a small amount of CVX and trading fees. However, it is important to note that the deadline for Binance and Paxos to support BUSD is February 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。