Author: Catrina Wang, Partner at Portal Ventures

Translation: Luffy, Foresight News

We all love pandas, they are very cute. But due to breeding issues, they are rare in number. As one of the most precious animals in the world, they are also an excellent store of value (the annual rental "income" for each panda is 1 million US dollars).

We keep pandas in zoos mainly to appreciate their cute appearance. Due to their biological characteristics, they repeat the same life every day: eating bamboo, sleeping, defecating, and then repeating the cycle. One day, someone came up with an idea: what if we train or genetically modify pandas to make them more useful to our society? Well, an interesting idea. In fact, making pandas contribute more labor will increase the world's GDP.

By now, most readers probably understand what I'm trying to say.

- Panda = Bitcoin

- Popularity of pandas = Attractiveness of Bitcoin as a store of value

- Making pandas more "useful" = Making Bitcoin programmable like EVM

In this article, we will explore the unexpected similarities between Bitcoin and pandas to express our interest in the Bitcoin ecosystem.

I. Why are we optimistic about the Bitcoin ecosystem?

Attempts to make Bitcoin more useful rather than just lying in hardware wallets are not new. Bitcoin's dominance in the crypto market has sparked curiosity and efforts, and we are currently in the most turbulent period of this journey.

First, let's review the main arguments against increasing Bitcoin productivity

Bitcoin should be a store of value, this is the most common belief held by some vocal and unyielding "BTC OGs," but due to the catalysts to be discussed later, there has been a significant shift in community sentiment recently.

Poor market fit for Wrapped BTC (WBTC): WBTC is an ERC-20 token on Ethereum that represents Bitcoin, backed 1:1 by custodian BitGo. The market value of WBTC is currently about 5 billion US dollars, at its peak it was about 15 billion US dollars, only a small fraction of Bitcoin's market value. However, we believe that the low activity level of WBTC does not reflect public interest in increasing BTC productivity. Instead, it only indicates that the centralized + EVM-centric way of Bitcoin may not be enough.

Bitcoin was not designed for programmability: Bitcoin's smart contracts are implemented using scripts, a non-Turing complete programming language, which is a design choice to maximize network security by limiting attacks (e.g., using script language prevents reentrancy attacks).

Contrary to popular belief, Bitcoin does support smart contracts, although its functionality is very basic compared to other blockchains like Ethereum or Solana. The types of smart contracts currently available on Bitcoin include:

- Pay-to-Public-Key-Hash (P2PKH)

- Multi-Signature Scripts

- Time-Locked Bitcoin Transactions

- Pay-to-Script-Hash (P2SH)

- Pay-to-Taproot (P2TR)

But why can't we just leave Bitcoin to be the store of value it was supposed to be?

The reasons can be summarized as follows:

1. Temptation of Bitcoin liquidity flowing into DeFi

For the past five years, Bitcoin has been dominating the cryptocurrency market, with a market share fluctuating between 40% and 70%. In contrast, despite the flourishing of L2 and DApps, Ethereum's market share has only been around 20% at its peak. Let's do a simple math: if one-third of the potential liquidity of Bitcoin is released, theoretically we can double the current DeFi liquidity scale. Of course, we should not assume that the liquidity injected into DeFi will be proportional to the market size of BTC—after all, most of the Bitcoin holdings belong to institutions, and institutions will never "degen." These subtle differences will be discussed later in this article.

2. Offsetting the erosion of network security caused by each Bitcoin halving

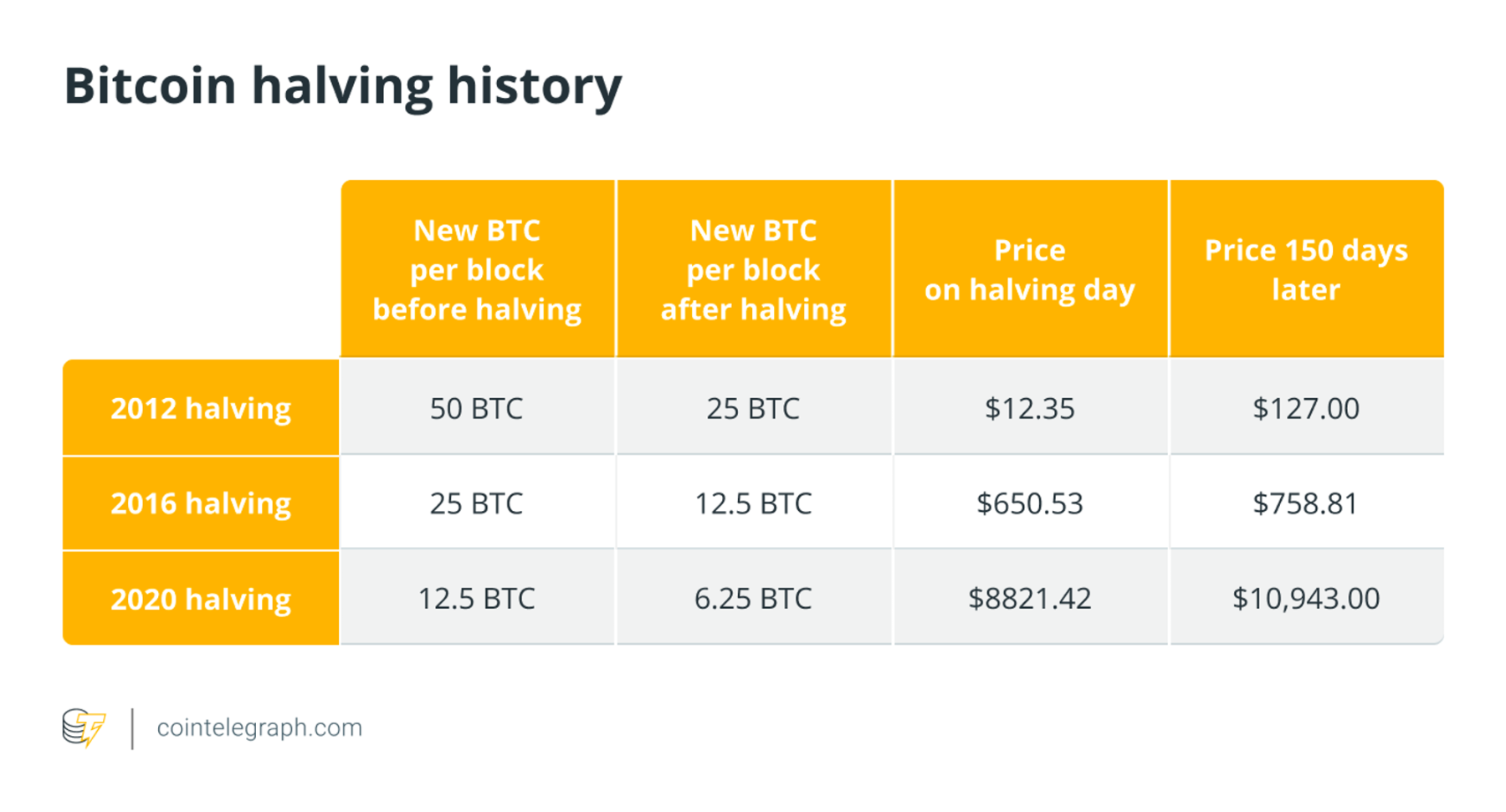

Bitcoin halving refers to the reduction of mining rewards for validating network transactions every four years. Currently, the block reward is 6.25 BTC per block, and the next halving will take place in April 2024. While halving is an essential part of Bitcoin's supply control design, it may affect network security in two ways:

- Reduction in the number of miners: Halving directly reduces the profitability of miners, leading some miners to shut down their machines when mining costs exceed returns.

- Lowering the cost of 51% attacks: With each halving, the cost of bribing miners for a 51% attack will also be halved.

Bitcoin has two ways to counter the erosion of network security:

- The first way (less reliable): The scarcity of the total supply of Bitcoin drives up the token price. However, Bitcoin's maximum supply of about 21 million is well known and priced in, and its real-time price is more driven by macro and cryptocurrency market sentiment.

- The second way (the focus of this discussion): Assuming that the fees generated by the increasing on-chain activity on the Bitcoin network will grow over time to compensate for the decreasing block rewards. Apart from the earlier Ordinal inscription craze this year, this approach has not yet come into play, but that is about to change.

Increasing the demand for Bitcoin block space to raise miner fees is an uncompromising pursuit of the vitality and security of the Bitcoin network.

3. Imminent catalysts

a. 12 spot Bitcoin ETF applications: The world's largest asset management company, BlackRock, submitted a spot Bitcoin ETF application in June. Following suit, a series of similar ETF applications were submitted by institutions such as Fidelity Investments, Invesco, and WisdomTree. The significance behind these actions is manifold:

- Market access: 80-90% of the wealth in the US is controlled by financial advisors or institutions, and their primary way of entering the market is through ETFs. The approval of spot ETFs will have a significant impact on market demand, potentially more than doubling it.

- Price impact: Spot ETFs actually require financial institutions to purchase and hold the underlying assets, while Bitcoin futures ETFs are based on contracts.

- Regulatory comfort: This ETF will be regulated by the SEC, which may enhance investor confidence and market stability.

- Industry signal: The launch of spot Bitcoin ETFs marks an important step in the legalization of cryptocurrencies and their integration into traditional finance.

b. Impact of the next halving in April 2023: Historically, Bitcoin halving events have been associated with significant price increases, as shown in the following chart (provided by Cointeleprah).

4. Bitcoin's UTXO model is more suitable for certain use cases/functions

- Privacy: The UTXO model enhances privacy by making each UTXO unique, making it more challenging to trace transaction history compared to Ethereum.

- Simplified verification: Using UTXO, transaction verification is simpler. Each transaction references specific UTXOs as inputs and outputs, making it easier for nodes to verify transactions without calculating the entire state of the network.

- Security: The UTXO model has certain security advantages. In the event of network compromise or attack, the UTXO model may damage specific UTXOs, while an account-based model may expose a broader range of accounts and their associated assets.

- Atomic swaps and smart contracts: The UTXO model is also suitable for atomic swaps, allowing transactions on different blockchains to be executed simultaneously. Additionally, while Ethereum's account model is more favorable for complex smart contracts due to its Turing-complete language, Bitcoin's UTXO model can still effectively execute simpler, more deterministic smart contracts.

5. The demand for Bitcoin block space cannot be met, and the current state of the Bitcoin blockchain cannot support it

During the Ordinals craze, Binance had to integrate with the Lightning Network to reduce transaction costs. Users in places like El Salvador expressed on crypto Twitter that a $100 transaction fee was close to $20. Interestingly, a few months ago, the gas fee for my experimental BRC-20 minting was $800. These situations must change.

Most importantly: the Bitcoin community is experiencing a revival…

1. Taproot Upgrade (not so new "news," but recent progress)

The Taproot upgrade was activated on-chain in November 2021, making Bitcoin more private and secure through Schnorr signatures (BIP 340). By introducing Pay-to-Taproot (P2TR) and Merklized Alternative Script Trees (MAST) from BIP341, it becomes more scalable; and by modifying Bitcoin's script language to read Schnorr signatures, it becomes more programmable. Our analyst Vikramaditya Singh summarized the Taproot upgrade.

2. Ordinals, BRC-20, and new standards

Ordinals were achieved through two updates to the Bitcoin protocol: Segregated Witness (SegWit) in 2017 and Taproot in 2021. These updates expanded the data stored on the blockchain, allowing the storage of images, videos, and other media, giving rise to Ordinals. Following this, DOMO invented the BRC-20 token standard, bringing JSON into Ordinals—as a thought experiment.

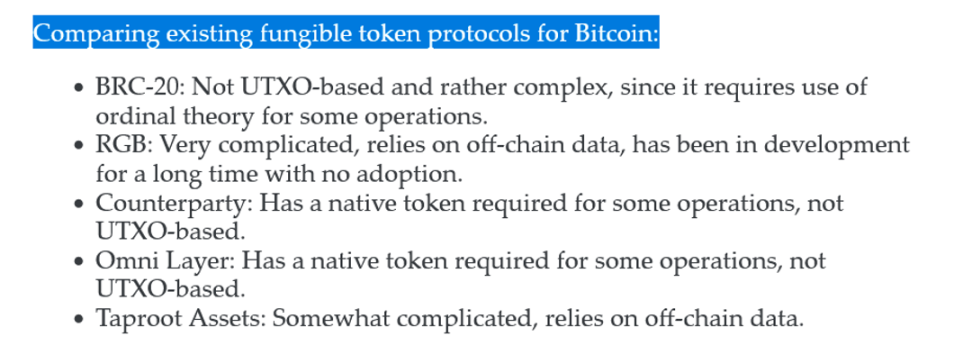

BRC-20 has no underlying value: it lacks the smart contract functionality, programmability, or interoperability you would expect from Ethereum's ERC-20. New token standard alternatives are a popular work in progress in the community, first proposed by Casey Rodarmor, the inventor of Ordinals (source).

Rodarmor on the issues with Bitcoin's existing alternative token protocols, source: Casey Rodarmor

In any case, the rapid rise of BRC-20 and Ordinals in early 2023 increased Bitcoin fee income for miners by 128 times, totaling up to $45 million (Note: data range is from January to June this year).

3. BitVM

BitVM is the first step in achieving Turing-complete Bitcoin contracts without changing the operation code. The key innovations of BitVM are:

- Introducing state between different UTXOs or different scripts through Bit Commitments.

- Achieving verifiability through logical gates: any problematic program execution in the virtual machine can be verified by deconstructing it, and its validity can be verified by the prover. This ensures that any false claims can be quickly proven wrong.

- Keeping the Bitcoin network lightweight: Similar to Optimistic Rollup on Ethereum, BitVM does not perform extensive computation on Bitcoin. Instead, it minimizes on-chain activity, only refuting incorrect executions, acting more as a solver and verifier. Only the outputs of BitVM programs are used in Bitcoin transactions.

While the functionality of BitVM is extremely limited today, with only a feasible function called zero-check function, potential use cases in the future include bi-directional pegs with sidechains for scalability. If a ZK verifier can be built in BitVM, Rollup can be enabled on Bitcoin without a soft fork. More information can be found in Stephan Livera's podcast.

4. Urbit Architecture for Bitcoin Scalability

- Bitcoin's shared UTXO and client-side verification model naturally align with Zorp's Nockchain.

- Volt: Lightning Network implementation on Urbit.

- Implementing L2 scaling solutions on Bitcoin using Urbit's built-in identity.

5. New thinking around scalability

The Bitcoin community has proposed and tested various experimental methods, including:

- Taproot Assets: A protocol driven by Taproot for issuing assets on the Bitcoin blockchain, working in conjunction with the Lightning Network to enable fast and low-cost transactions.

- RGB: A client-side validation state and smart contract system running on Bitcoin's ecosystem Layer 2 and Layer 3, also usable in conjunction with the Lightning Network.

- Spiderchain: A PoS Layer 2 for Bitcoin, using a distributed multi-signature network to secure all actual Bitcoin on Botanix.

- STX's sBTC and Nakamoto Upgrade: A significant milestone for STX, formally becoming Bitcoin's L2 and ensuring 100% security for BTC. sBTC aims to be a trust-minimized anchored token for BTC.

- Integration of various ecosystems with the Lightning Network: SOLightening (integration of Solana with the Lightning Network), Binance, Coinbase, Cash App, and others.

- Surge in builder interest and incubators: The Bitcoin community has also seen exciting moments to nurture the developer ecosystem and new ideas, such as Bitcoin Startup Labs, Bitcoin Frontier Fund, Outlier Venture's BTC base camp, Wolf Incubator, and more.

II. Our viewpoint: Bitcoin's capital efficiency is superior to programmability

Ethereum's explicit mission is to become a programmable internet computer, whereas Bitcoin's mission has always been a fiercely debated topic. What will be the future positioning of Bitcoin: as the "lazy" digital gold store of value, a payment currency for emerging markets, or a programmable and high-performance Layer 1 currency?

Long been, the role played by Bitcoin has always been a fiercely debated topic: institutional-grade asset, global remittance system, or programmable blockchain network? While Bitcoin has always been the de facto store of value, numerous technological, institutional, and market catalysts are pushing it towards a more productive direction than just being the "lazy" digital gold. In this article, Catrina introduces her research on the history of Bitcoin innovation, catalysts for new movements, and proves the conclusion that capital efficiency of Bitcoin is more important than programmability.

In our view, this ambiguity is a feature, not a mistake. The debate around what Bitcoin should be is exactly the catalyst needed to build a diverse and vibrant ecosystem around Bitcoin.

We see two overlapping but distinct innovation schools: "programmability" and "capital efficiency."

The "programmability" school aims to develop Bitcoin into an ecosystem similar to Ethereum by addressing the lack of native smart contracts and scalability (speed and cost-effectiveness). Its scope covers various verticals, including:

- Interoperability with other chains, such as EVM integration.

- Complex DeFi and trading functionalities, including swaps, various DEX platforms, synthetic assets, and LSD.

- Support for Ordinals, BRC-20, and further token standards.

- Ability to issue new assets on the Bitcoin chain using specific token standards.

- Layer 2 solutions utilizing Bitcoin as a data availability layer, such as VM, Rollup, and other scaling solutions.

The "capital efficiency" school views Bitcoin as a store of value asset and builds basic financial products on this basis. They do not prioritize the scalability or versatility of the Bitcoin chain. Instead, they focus solely on financializing Bitcoin to achieve stable yields, increase capital efficiency, and balance risk. This approach is a gradual extension of the spirit of "Bitcoin as a store of value":

- Trustless Bitcoin staking and yield.

- Native Bitcoin stablecoins.

- Bitcoin-backed stablecoins.

- Bitcoin insurance, on-chain or off-chain.

- Solutions to address Bitcoin MEV (Miner Extractable Value) issues.

- Layer 2 solutions, defined in the context as any scaling solution that accelerates transaction speed and reduces Bitcoin network fees (potentially including virtual machines, Rollup, using Bitcoin as DA, etc.).

L2 scaling solutions belong to both categories, as they serve as infrastructure to make Bitcoin more programmable and capital efficient. This is the area of interest for us.

We believe that enhancing Bitcoin's capital efficiency is more important for the following reasons.

Bitcoin's clear product-market fit as a store of value

Which cryptocurrency has the most clear product-market fit in the entire crypto industry? For native DeFi users, the answer might be Ethereum. But for non-crypto native audiences, Bitcoin is a store of value.

Why not leverage and expand on this validated PMF as the sole digital gold, rather than trying to excel in someone else's domain? After all, there are plenty of use case-specific solutions outside the Bitcoin ecosystem (Solana, ETH L2, new EVMs like Monad) that are "genetically" designed to be more suitable for speed and scalability than the Bitcoin chain.

Net new demand sources are not degens

As we get excited about unlocking liquidity for Bitcoin, an important question to ask ourselves is: where does the new liquidity come from? I believe it comes from institutional Bitcoin holders and non-native crypto retail holders. Unlike skilled DeFi users (or "degens"), both institutional and retail investors have similar low-risk preferences and tolerance for complexity. What appeals to these entirely new customer segments is the simplicity of Bitcoin products that make their Bitcoin more capital efficient, generating sustainable and reliable yields without complex operations and counterparty risks.

The psychology of spending and using Bitcoin

Due to their different perceptions and characteristics, the transfer psychology of BTC and ETH is vastly different. In fact, what is most important when someone transfers Bitcoin from a hardware wallet? The most important consideration is security. Enhanced programmability comes with increased costs of vulnerabilities, which may deter risk-averse institutional miners and holders from participating.

To summarize with the analogy of a panda, our focus is on finding projects that help breed more panda babies, rather than changing the DNA of pandas.

III. Attempts to improve Bitcoin

Overall, we have not yet seen a fully trustless bi-directional pegging solution that does not require BIPs (Bitcoin Improvement Proposals). BitVM seems to be the most promising solution at the moment, but it is still in its early stages with a long road ahead.

Pioneers of the older generation

Long-standing innovators in the Bitcoin space have the following first-mover advantages:

- Community support

- Liquidity

- Code.

Stacks

Our summer intern Vikram wrote an in-depth exploration of STX. Since February 2022, I have been personally tracking the STX ecosystem. Some common criticisms of its design approach are the new language, which is not Turing-complete, the sBTC-BTC peg not being fully trustless, and the lack of EVM compatibility. However, the project still has many advantages:

- Firstly, staking STX can earn BTC, making it a very unique and valuable asset.

- Plans to launch two ecosystem catalysts (Nakamoto Upgrade and sBTC) in early 2024.

- Future plans for an L3/subnet combining EVM and RustVM.

- A large portion (~78%) of the token economics is locked.

- Stacks is one of the largest general-purpose L2 ecosystems on Bitcoin, unlike the more payment-focused Lightning Network.

Rootstock

Rootstock (RSK) is a Bitcoin sidechain that introduces smart contracts compatible with the Ethereum Virtual Machine (EVM) to the Bitcoin network, improving the speed of Bitcoin transactions. Unlike the Lightning Network, which runs on the Bitcoin blockchain using native BTC, RSK utilizes bi-directional pegging to cross-chain BTC to RSK's derivative asset smartBTC (or RBTC). RBTC is pegged 1:1 to BTC but is not trustless and relies on centralized custodians for its security based on merge-mining.

Threshold Network

Bridges Ethereum and Bitcoin networks using threshold ECDSA signatures. It mints ERC-20 tBTC with BTC as reserves and achieves BTC-tBTC pegging with an honest majority assumption among validators.

The Liquid Network is a Bitcoin sidechain that allows users to anchor their BTC to the Liquid Network, convert it to the corresponding token (L-BTC), and use it for faster and more private transactions. However, similar to RSK, it also has similar trust assumptions for reputable cryptocurrency exchanges and service providers, acting as "functional institutions."

Lightning Network

A Layer 2 scaling solution on Bitcoin, using payment channels for a mix of on-chain settlement and off-chain processing to speed up and reduce transaction costs. While I believe the Lightning Network is more of an "application" chain specifically tailored for payment use cases, unlike Ethereum's Layer 2 solutions like Arbitrum, which aims to be its own multifunctional ecosystem.

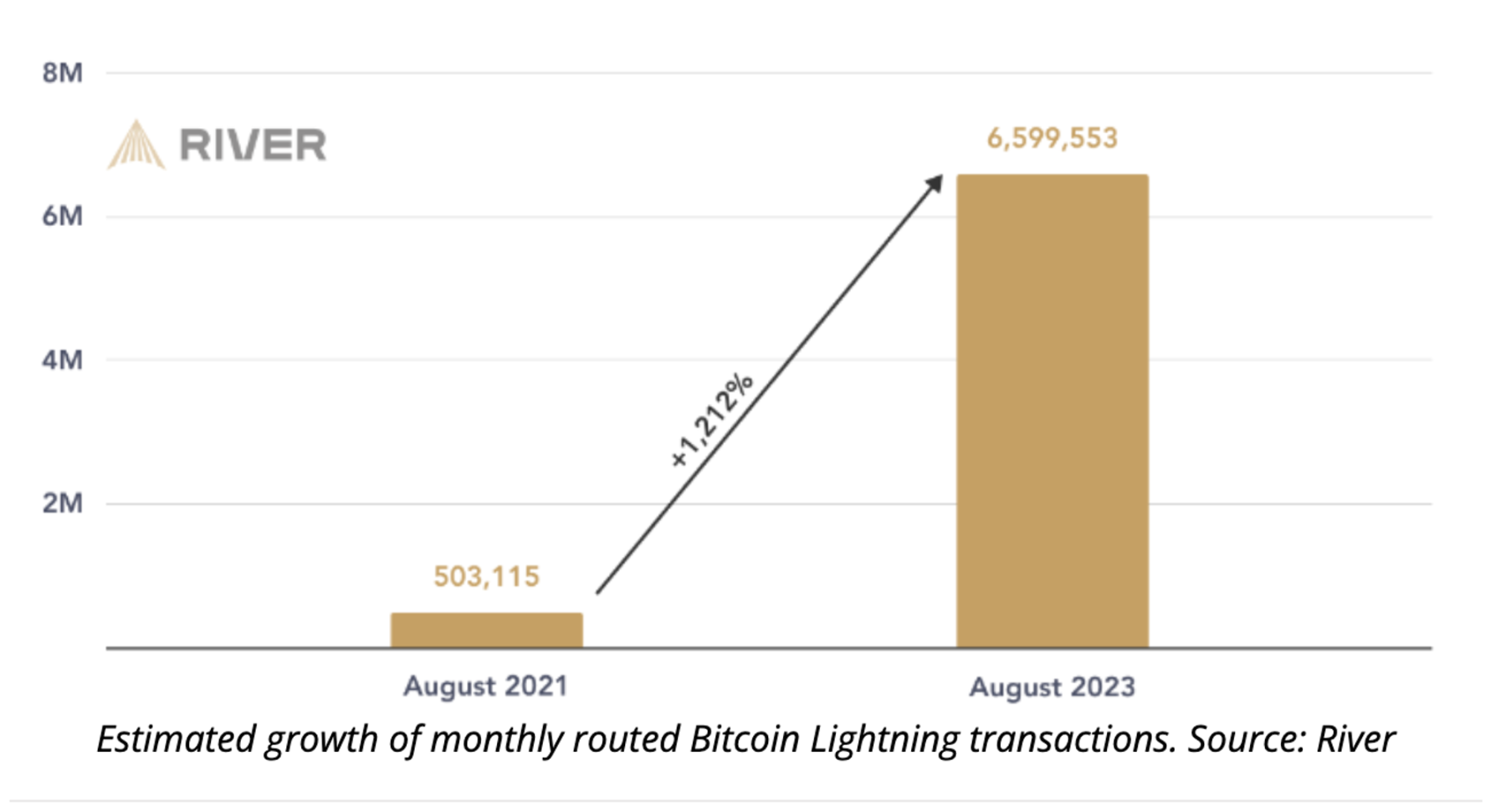

The network has grown by 1212% over the past two years, with a TVL of approximately $160 million at the time of writing. However, off-chain components also bring unique challenges, such as the threat of a replacement loop attack that could compromise the network (source).

Drawbacks: The Lightning Network is not entirely trustless, as it requires peer-to-peer payment channels with sufficient liquidity and continuous online presence. There is a risk of unilateral channel closure when a user goes offline, potentially resulting in funds being locked. Congestion in these channels could expose the network to fraud and attacks.

The use of the Lightning Network also comes with various costs. Network latency can lead to higher transaction fees for miners due to longer validation times. Additional routing fees set by nodes apply to transactions across multiple channels. Any enterprise or exchange using the Lightning Network may also incur additional fees. Therefore, even with potential improvements such as Taproot Assets or Taro protocols, using the Lightning Network for ordinals may still result in unacceptable costs.

New Generation Adventurers

Taproot Assets (formerly Taro) and RGB

New initiatives like Taproot Assets and RGB aim to enable asset issuance on Bitcoin and collaborate with the Lightning Network. If they enable native stablecoins on Bitcoin, utilize the Lightning Network for secure transfers (assuming no attacks or security issues), and then return to Bitcoin to leverage its security as a data availability layer, could this lead to the creation of new ERC-20 equivalent systems on Bitcoin?

Rollups/L2 on Bitcoin

- Botanix Labs: EVM L2 on Bitcoin using SpiderChain (no need for BIP)

- Alpen Labs: ZK Rollup on Bitcoin (requires BIP)

- BitVM: Making Bitcoin Turing-complete through fraud proofs (no need for BIP)

Trust-minimized staking on Bitcoin (one of Portal's recent main focuses)

- Babylon: A trust-minimized Bitcoin staking platform without the need for cross-chain bridges. Stakers can earn rewards in the currency tokens of the PoS chain of their choice. Similar to Bitcoin's Eigenlayer but with an additional layer of cryptographic innovation that can "shard" on the non-degradable Bitcoin chain.

- Papaya: A platform for Bitcoin staking using the underlying infrastructure of STX and sBTC.

- Atomic Finance: Allowing users to earn self-custodied Bitcoin rewards using DLC.

To EVM or Not to EVM

Whether or not it is EVM-compatible does not affect our preference for investing in startups. While EVM compatibility allows access to liquidity and products in the EVM ecosystem, it also increases the risk exposure for Bitcoin holders. Additionally, focusing on EVM compatibility goes against the argument for "capital efficiency," as the goal is to unlock new liquidity from the Bitcoin ecosystem, not the other way around. Solana has never prioritized EVM compatibility, just like successful Web2 cases such as Apple to Android or Nvidia to Intel chip standards.

Conclusion

Finally, revisiting our analogy of the panda, we believe in technologies that can produce more panda babies (i.e., more "capital efficiency"), rather than those that steer pandas away from their core advantage (cuteness). The vertical areas we are particularly focused on are:

- Scaling solutions on Bitcoin (Rollups/L2)

- Bitcoin-backed stablecoins

- Bitcoin insurance products

- Solutions to the Bitcoin MEV problem

Thanks to the following friends for reviewing my draft and providing valuable feedback: Evan Fisher from Portal Ventures, Aleksis Tapper from Token Terminals, Jason Fang from Sora Ventures, Kyle Samani from Multicoin, Kevin Williams and Kyle Ellicott from Bitcoin Frontier Fund, Jian & Haotian from Amber Group, and Sankha Banerjee from Babylon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。