The Bitcoin ecosystem has made significant progress in both technology and applications, but the balance between security and scalability still needs attention.

Author: Justmy2Satoshis / Source: https://justmy2satoshis.medium.com/bit-out-of-the-ordinal-l

Translation: Plain Language Blockchain

Among approximately 320 million cryptocurrency users, Bitcoin is well known. Understanding the basic principles of Bitcoin is a journey that expands our understanding from "internet currency" to spreading popular phrases such as "decentralization," "permissionless," "censorship-resistant," "antifragile," and attempting to understand why these phrases are so important.

While we believe that Bitcoin is a response to the global financial crisis of 2009, the fact is that it has been brewing for a long time and is a product that was deployed after more than 4 years of computer science research and development.

To gain a deeper understanding of Bitcoin, we must evaluate how the monetary system operates, why problems arise, and how Bitcoin fixes them.

Given that it is the original cryptocurrency, or at least the origin of the blockchain technology we know today, the purpose of this article is not to replicate or summarize tens of thousands of hours of education or even philosophical content. Instead, this article assumes that you have a basic knowledge of Bitcoin and uses some technical concepts to understand emerging use cases. Specifically, what is the significance of the Lightning Network, Segwit and Taproot upgrades, what are Unspent Transaction Outputs (UXTO), and how these features trigger the spread of Inscriptions and Ordinals and the circulation of BRC-20 assets, etc.

After explaining each part of the Bitcoin network, we will discuss in detail the potential impact of Bitcoin catching up and achieving the functions of numerous smart contract Layer1.

1. Lightning Network (BLN)

The Bitcoin Lightning Network (BLN) is a scalability solution for Bitcoin designed to address the problem of slow transaction speeds and high costs due to the limited block size and block time of cryptocurrencies. This concept was initiated by developers Thaddeus Dryja and Joseph Poon in 2014 and officially launched in March 2018.

Functionally, BLN facilitates fast and secure off-chain transactions through intermediary payment channels. This is achieved by using multi-signature wallets that hold collateral and automatically transfer owed or overpaid bitcoins (BTC).

These interconnected channels allow individuals to transact with each other without the need for a direct connection. The system even supports the creation of interoperable versions for any cryptocurrency using multi-signature wallets and hashed time-locked contracts. This feature can facilitate almost instant and near-zero-cost transactions between blockchains without the need for specialized cryptocurrency trading platforms.

The Bitcoin Lightning Network (BLN) is a key development in the Bitcoin ecosystem aimed at improving the efficiency and scalability of Bitcoin payments. Let's take a closer look at the adoption progress, features, challenges, and prospects of BLN.

Adoption Progress:

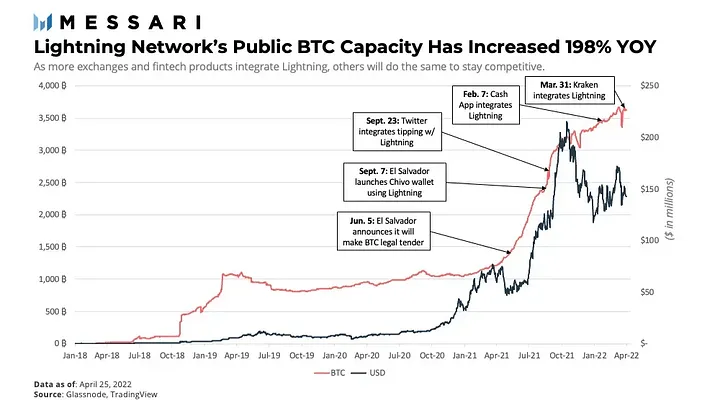

The adoption of BLN has been slow in the past, but there have been positive changes in recent years.

In 2021, the implementation of the Lightning Network (such as LND, Eclair, and Core Lightning) lowered the barrier for new developers to enter.

El Salvador released the government-supported wallet Chivo, integrated into BLN for legal transactions in the country.

Cash App integrated Lightning payments, increasing its user base from 10 million in October 2021 to over 80 million in March 2022.

Payment providers and centralized exchanges are also seeking integration with BLN. Public Channel Capacity:

The public channel capacity of BLN reached 3,624 bitcoins (approximately $143 million), a 198% increase year-on-year.

The rise of infrastructure service providers has facilitated this growth, making the use of BLN simpler for enterprises. Challenges and Improvements:

BLN has some unresolved issues, including code vulnerabilities and structural problems.

Multi-signature wallets require a significant balance, and the costs associated with opening and closing payment channels have been criticized as somewhat centralized.

The recent Bitcoin Taproot upgrade has made multi-signature wallet transactions indistinguishable from regular transactions, improving privacy and reducing fees. Potential Applications:

BLN has the potential to fundamentally change payment systems and is suitable for various industries, such as games requiring high-speed, low-cost transactions.

It makes Bitcoin more useful as a medium of exchange, going beyond its current use as a store of value for everyday transactions. The development of BLN will continue to impact the way Bitcoin is used, bringing us a more convenient, efficient, and flexible payment experience.

2. How is BLN different from Ethereum Layer2 solutions?

BLN and Ethereum L2 solutions aim to scale their respective blockchains and achieve faster, cheaper transactions. However, they differ in specific implementation, design goals, and supported types of applications.

BLN is a Layer2 protocol that achieves off-chain transactions by creating user payment channels. These channels allow users to transact with each other almost instantly at minimal cost, without broadcasting each transaction to the blockchain. Only the opening and closing of these channels are recorded on-chain.

On the other hand, Ethereum Layer2 solutions consist of technologies including sidechains, rollups (such as Optimistic Rollups and zkRollups), and Plasma. While their common goal is to improve Ethereum's scalability, their methods differ. For example, Rollups bundle multiple transactions into a single transaction submitted to the chain, while sidechains are independent blockchains running parallel to the main Ethereum blockchain.

BLN is primarily designed for payment transactions. It is best suited for small, frequent transactions, such as micropayments or retail transactions.

*On the other hand, Ethereum's Layer2 solutions are not only aimed at scaling transactions but are also used to scale smart contracts*, which are self-executing contracts with the terms of the agreement directly written into code. This makes Ethereum's Layer2 solutions more suitable for complex applications, such as decentralized finance (DeFi) or decentralized applications (dApps).

In BLN, transactions occur off-chain and rely on the security of the Bitcoin blockchain only when payment channels are opened or closed. In contrast, Ethereum Layer2 solutions inherit the security of the Ethereum blockchain to varying degrees. For example, transaction data is stored on-chain in an aggregated manner, providing higher security.

BLN is intended to be used with any cryptocurrency that supports its basic requirements, such as multi-signature wallets. Ethereum Layer2 solutions are typically designed specifically for the Ethereum network, but they can also be adjusted to be used with other blockchain networks.- Inscriptions are not Ordinals

When it comes to Bitcoin transactions and network upgrades, it is crucial to understand UTXO (Unspent Transaction Outputs), as well as the SegWit and Taproot network upgrades.

UTXO (Unspent Transaction Outputs):

- UTXO is a way of managing transactions in Bitcoin. It does not use the total balance of a single Bitcoin address, but instead uses a set of unspent outputs to construct transactions.

- Every Bitcoin transaction generates new UTXOs, which are destroyed when spent. This helps confirm a user's actual Bitcoin balance and prevents double spending.

- Similar to physical cash, UTXOs require change when used. For example, if Grace has a UTXO worth 1 BTC and wants to pay Michael 0.4 BTC, she must use the entire 1 BTC as input. To send exactly 0.4 BTC to Bob, Grace forms two outputs: the first output to Michael (0.4 BTC) and the second output as her "change output" (0.59 BTC, considering Grace's transaction fee is 0.01 BTC). This transaction consumes one UTXO and creates two new ones.

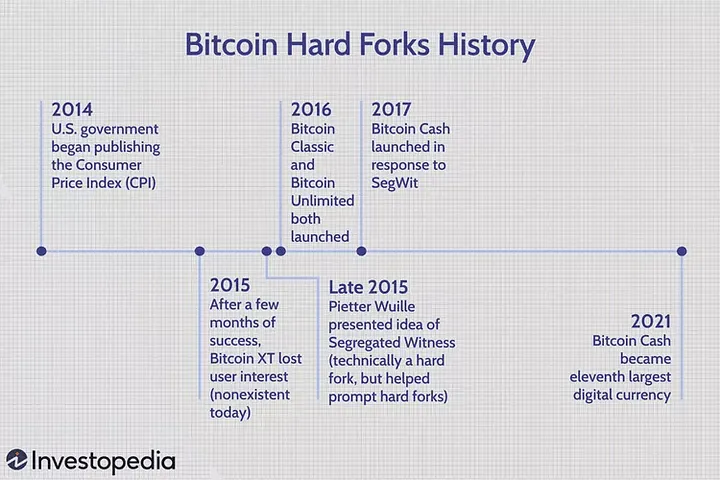

SegWit (Segregated Witness): - SegWit is a software upgrade introduced to Bitcoin in 2017. It changes the way block size is measured, switching from bytes to a new measurement called vBytes.

- SegWit also separates transaction data into transaction data and witness data. Transaction data includes information about who sends and receives Bitcoin, while witness data includes the scripts and signatures related to the transaction.

- Each byte of witness data is counted as 1 weight unit (wu), compared to 4 wu for each byte of transaction data. This makes it more economical and simpler to store a large amount of data in the witness part of transactions.

- In short, SegWit makes it easier and more cost-effective to store a large amount of data in the witness part of transactions, enjoying discounts of up to 75%. These improvements are crucial for the scalability and security of the Bitcoin network, providing us with a more flexible and efficient way of transacting.

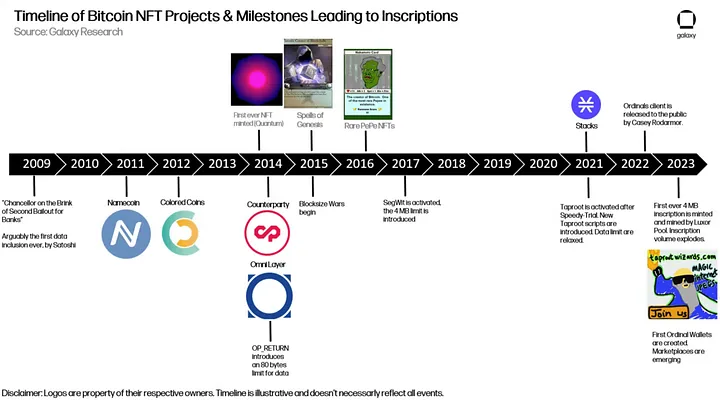

After a significant period without major upgrades, Taproot was implemented in November 2021. The main function of Taproot is to enhance the script of the witness part of transactions. Notably, Taproot removes the limit on the amount of data that can be included in the witness part of transactions, allowing up to 4 MB of data to be stored there.

With sufficient understanding of SegWit and Taproot, we can now begin discussing Ordinals (recommended reading: Ordinals Whitepaper).

The upgrades of SegWit and Taproot inadvertently enable the storage of a large amount of arbitrary data on the Bitcoin blockchain. Users quickly utilized this newly discovered capability by storing JPEGs on-chain and creating Bitcoin-based NFTs. A notable example showcasing potential applications is the formation of the largest Bitcoin block and transaction in history, including the Taproot Wizard NFT.

What most people don't know is that the concept of NFTs existed in Bitcoin long before Ethereum adopted it and ran with it.

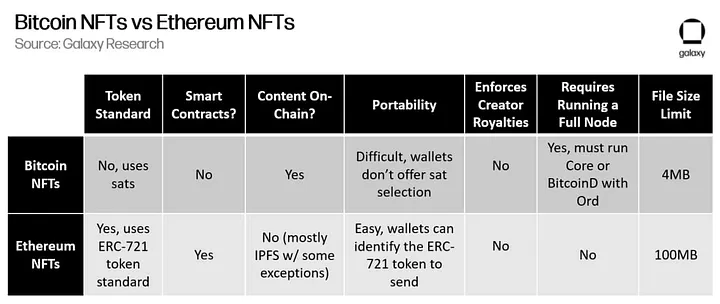

Ordinals is a new NFT protocol built on Bitcoin that has recently caught the attention of NFT enthusiasts, highlighting the feasibility and appeal of NFTs on the Bitcoin blockchain. Ordinals allow any type of data (such as images or text) to be recorded on a single Bitcoin unit, called a satoshi (or sat), effectively creating fully on-chain NFTs.

Although "Inscriptions" and "Ordinals" are often used interchangeably, they represent different concepts. "Ordinals" stems from ordinal theory, which proposes using a numbering system to monitor and move individual satellites within the entire Bitcoin supply. This numbering system essentially provides a way to sequentially number sats, transforming sats into NFTs.

In contrast, "Inscriptions" represent the act of implanting any form of data into the Bitcoin blockchain through the witness data segment of a transaction. Using the Ordinals protocol (which leverages naming conventions from ordinal theory), users can inscribe sats (ordinals) to generate NFTs.

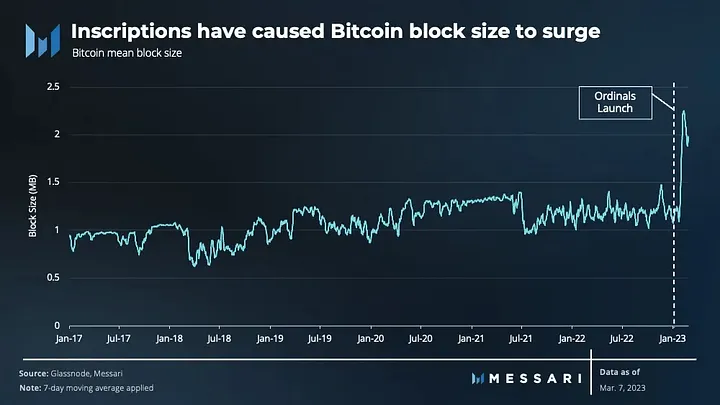

The recent surge in inscriptions has led to a 71% increase in average block size over the past month. As inscriptions transactions typically contain more data, block size will continue to grow.

Nevertheless, the increase in average block size also indicates a faster pace of blockchain expansion. In 2022, the Bitcoin blockchain has grown by 16%. However, with the recent surge in inscriptions, the annual growth rate of the blockchain has accelerated to 24%.

4. BRC-20: Ordinals Experiment

BRC-20 is a novel creation that utilizes inscriptions to generate alternative tokens, playing a leading role in driving the latest wave of activity in Bitcoin. Although similar in name to the widely recognized ERC-20 tokens, BRC-20 has more limited functionality. Unlike ERC-20, which can enable certain functions through programming, such as the automatic yield generation demonstrated by Lido's stETH, BRC-20 does not have this capability. Their main features are the ticker symbol, total supply, and creator, making them more akin to ERC-20 meme coins.

Despite often being overlooked by serious investors, meme coins hold significant value in the cryptocurrency space, with substantial market capitalization. For example, Dogecoin (DOGE) ranks as the third-largest payment chain by market capitalization, trailing only Bitcoin and Ripple. Shiba Inu (SHIB) is the largest non-pegged ERC-20 token, surpassing Uniswap (UNI) and Chainlink (LINK).

However, compared to other meme tokens, BRC-20 tokens have a relatively smaller market capitalization. ORDI is the first and largest BRC-20 token, with a market capitalization of approximately $250 million, significantly lower than SHIB's $5 billion or PEPE's $800 million. When considering the market capitalization of their respective parent chains, this contrast becomes even more apparent. ORDI accounts for only 0.05% of Bitcoin's market capitalization, while SHIB and PEPE account for 2.3% and 0.4% respectively.

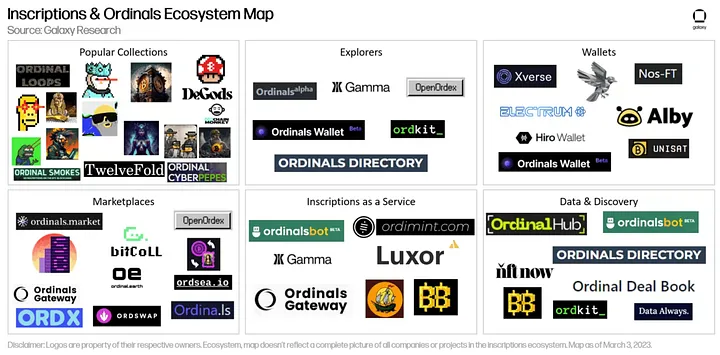

The smaller market capitalization of BRC-20 tokens may be due to their relatively early stage in the adoption cycle. While seen as an experiment by their creators, resources for creating, purchasing, and selling BRC-20 tokens are noticeably less mature than other platforms. It is worth noting that some renowned collectibles, such as CryptoPunks and Autoglyphs, also began from limited-resource experiments.

As expected, the development and adoption of BRC-20 tokens are steadily improving. Some decentralized markets and wallets have emerged, and some of the most prominent BRC-20 tokens are beginning to be listed on centralized trading platforms. BRC-20 is an experimental token standard that allows the minting and transfer of alternative tokens through the Ordinals protocol on the Bitcoin blockchain. BRC-20 tokens are created using the Ordinals protocol to generate new script files on the Bitcoin blockchain. These script files contain the metadata of the tokens, such as their name, ticker symbol, supply, and minting restrictions. After creating BRC-20 tokens, they can be transferred to other addresses using regular Bitcoin transactions.

BRC-20 tokens are not native to the Bitcoin blockchain. This means they are not stored on the blockchain but on the Ordinals protocol. This implies that BRC-20 tokens are not subject to the same security and scalability constraints as Bitcoin transactions. However, it also means that BRC-20 tokens do not enjoy the widespread support that native Bitcoin assets do.

5. Fool's Gold or New Standard?

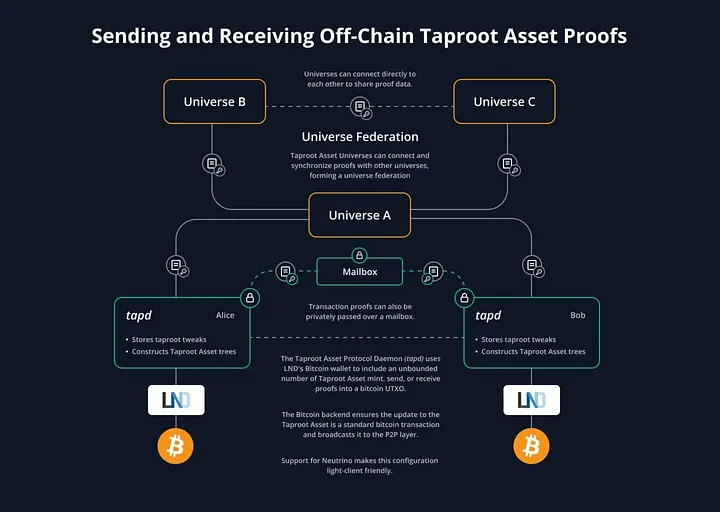

When delving deeper, it is often important to avoid getting lost in the details. Bitcoin (BTC) typically dominates our investment portfolios due to its liquidity and security, but Ethereum (ETH) may be an exception. The new features of BLN, Inscription, Ordinals, and BRC-20 will all have an impact on the future of Bitcoin and are worth exploring. Lightning Labs has introduced the Taro protocol based on Taproot, intending to integrate stablecoins and other assets into the Bitcoin network. BLN is important for Bitcoin to realize its value proposition as a P2P transaction leader. The success of Taro may lead users to transfer stablecoins and digital assets almost for free via the Lightning Network, increasing transaction volume and liquidity, but it may also increase costs for node operators. Bitcoin miners secure the network through transaction fees and block rewards. As the Lightning Network strives to shift network activity to another layer, the sustainability of the Bitcoin security model becomes a concern once block rewards decrease. The growth of the Lightning Network may increase the demand for block space, which is beneficial for Bitcoin. By optimizing connectivity and capacity through increasing on-chain transaction volume, the Lightning Network may ensure the sustainability of miners. BLN is a significant step for the scalability and usability of Bitcoin and other cryptocurrencies. Observing its future development to address challenges such as incentives and centralization will be very interesting. The implementation of the Bitcoin Taproot upgrade significantly enhances the privacy and efficiency of Lightning Network transactions. The controversy surrounding Bitcoin inscriptions highlights an issue: the lack of discussion on the potential impacts of upgrades in collective protocols or consensus. Considering the resistance of the Bitcoin community to storing a large amount of arbitrary data, Taproot may face rejection if these potential consequences are not fully understood. Bitcoin, with the emergence of collectibles, is shaping a new cultural layer, changing the perception of users and investors regarding its role as a medium of exchange, settlement layer, and application protocol.

High-value collectibles are thriving in the inscription ecosystem, attracting high-quality art projects and unique items, while traditional NFT collectibles are left to other blockchains such as Ethereum. Renowned NFT studios and creators, such as Yuga Labs, plan to adopt inscriptions. Yuga Labs plans to auction 300 generative art collectibles minted in inscription form, potentially leading other artists to follow suit and even impacting major NFT markets like OpenSea.

Investors are expected to follow this trend, and while the Bitcoin market is open-source and decentralized, it may require more monetization opportunities. However, due to the lack of smart contracts in Bitcoin, mandatory usage fees become impractical, while the NFT ecosystem tends towards zero or non-mandatory usage fees.

Blue-chip inscriptions will be evaluated based on a range of standards, including inscription numbers, the uniqueness of minting, the rarity of inscriptions, artistic quality, and creator reputation. It is expected that over time, the secondary trading volume of inscriptions in the market will increase, possibly due to the improved cost-effectiveness of transferring inscription numbers.

By the end of the fourth quarter of 2023, it is expected that robust market infrastructure will be established, including new wallets, markets, and other tools. With the growth of inscriptions, Bitcoin's scaling solutions (such as the Lightning Network) will become even more critical. An upcoming protocol based on the Lightning Network, Taro, may provide a new platform for inscriptions and digital collectibles, enhancing the scalability of Bitcoin.

The widespread use of inscriptions may increase the liquidity of BTC-USD, but considering the historically low success rate of Bitcoin tokenization initiatives, the success of inscriptions is still uncertain. However, over the years, the role and narrative of Bitcoin have continued to evolve, and the emergence of inscriptions is just one step in this evolution, potentially stimulating new uses, interests, and adoption of Bitcoin.

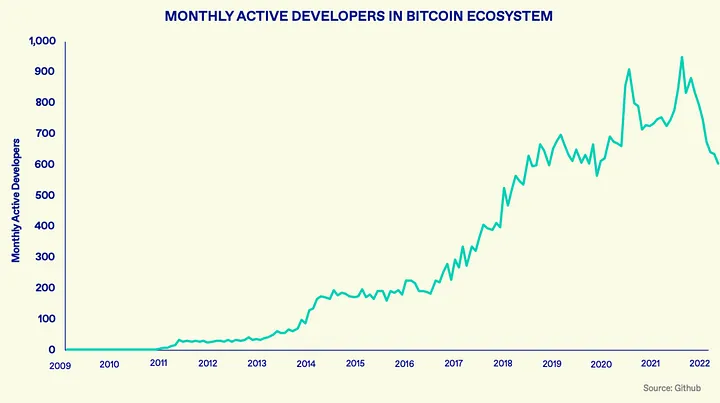

There are some important issues in the Bitcoin ecosystem: developers have low participation in the Bitcoin network, perhaps because their improvement proposals are difficult to gain unanimous support and network changes may lead to hard forks. In contrast, Ethereum and its compatible networks dominate developer activity and there is no sign of developers shifting to the Bitcoin network. Smart contracts are relatively low-level for Bitcoin because the Bitcoin base layer does not support the deployment of smart contracts. There is controversy in the Bitcoin community regarding smart contract functionality. Some believe that more complex financial transactions require smart contracts, while others are concerned about the potential market behavior, similar to that seen in bull markets, which is not welcomed by traditional Bitcoin supporters. However, smart contract functionality brings more users into the Bitcoin network, users who may not have chosen to invest in Bitcoin because they are seeking higher returns. Although some oppose smart contracts, they can enhance Bitcoin's payment capabilities and reduce transaction costs, which is also one of the reasons for hard forks. However, the core Bitcoin community is not concerned about this; they are more optimistic about the BLN protocol. The emergence of new opportunities, especially from the largest network by market capitalization, may have a positive impact on user numbers and the continued introduction of use cases such as BRC-20 and Ordinals. Although BLN has successfully reduced transaction costs, its sustainability is still limited due to the lack of incentives for node and channel operators. The scalability issues of Bitcoin still exist, and BLN is a prerequisite for achieving scalability. At the same time, BRC-20 and Ordinals have sparked network activity, but have also opened the door to larger functionalities and diversified sidechains that leverage the security of the Bitcoin network. Recent cryptocurrency activities show that cryptocurrency investors are interested in new products, but the actual adoption of cryptocurrencies is still to be observed. Despite internal controversies, Bitcoin continues to exist as an important store of value. Regardless of its future direction, Bitcoin may still attract investors and become an important collateral asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。