This article will delve into the unique value proposition offered by "DePINs" compared to existing solutions.

Written by: DWF Labs Research

Translated by: TechFlow

In the ever-evolving fields of Web3 and the Internet of Things (IoT), a revolutionary concept has emerged that challenges traditional connectivity paradigms and paves the way for a decentralized future. DePIN (Decentralized Physical Infrastructure Network) is an innovative framework at the intersection of decentralized technology and the Internet of Things.

In this article, we will delve into the unique value proposition offered by "DePINs" compared to existing solutions. Additionally, we will explore some key challenges the project may face and the essential elements we are looking for in building a project in this vertical.

Understanding DePIN: Origins and Market Potential

Messari coined the term DePIN at the end of 2022, which stands for Decentralized Physical Infrastructure Network. This term accurately describes Web3 protocols that aggregate and provide services or resources from decentralized physical machine networks and incentivize through a token model.

To understand the importance of DePIN, it is necessary to delve into the origins and evolution of the Internet of Things itself. The birth of the Internet of Things can be traced back to the 1980s. The basic concept revolves around integrating computing capabilities into ordinary objects to enable them to communicate with each other. As the Internet rapidly expanded from the early 2000s, the proliferation of interconnected devices sparked a demand for standardization. Under the leadership of the Internet Engineering Task Force (IETF), the Internet Protocol (IP) became the framework for cross-network data transmission. Over time, new iterations of IP continued to evolve, with the latest IPv6 breaking the boundaries of current infrastructure by being able to support the ever-changing demands of the Internet.

The rapid expansion of the Internet brought various challenges, such as security and privacy issues becoming critical concerns. The interconnected nature of devices brought significant risks, as a vulnerable device could compromise the entire network. Data breaches are one of the most common examples of IoT vulnerabilities, with a significant increase in data breach incidents in the United States since the mid-2010s. This provided a compelling reason to explore decentralized alternative solutions to protect the dynamic and evolving IoT environment.

Despite advancements in the Internet of Things, the pursuit of efficiency enhancement still exists. This driving force has given rise to Helium—a decentralized wireless network aimed at improving connectivity and fair user participation. In the oligopoly-dominated field, the emergence of decentralized alternative solutions provides valuable opportunities for users and potential founders. This has sparked healthy competition and the potential to launch better products. The IoT market is rapidly growing, with revenue expected to double within five years, potentially exceeding $20 billion by 2028. Therefore, these decentralized alternative solutions, or what we call "DePINs," certainly have incredible growth potential in the coming years.

Exploring the DePIN Lineage: Evolving from Physical Machines to Digital Resources in Web3

In the dynamic landscape of DePIN, the definition covers a broad range. Blockchain itself can be considered to align with the concept of DePIN. They operate through miners or validators in decentralized networks, ultimately providing critical resources called "consensus." The concept of DePIN may have existed since the theoretical birth of decentralized networks like Bitcoin, but it has only recently gained official recognition.

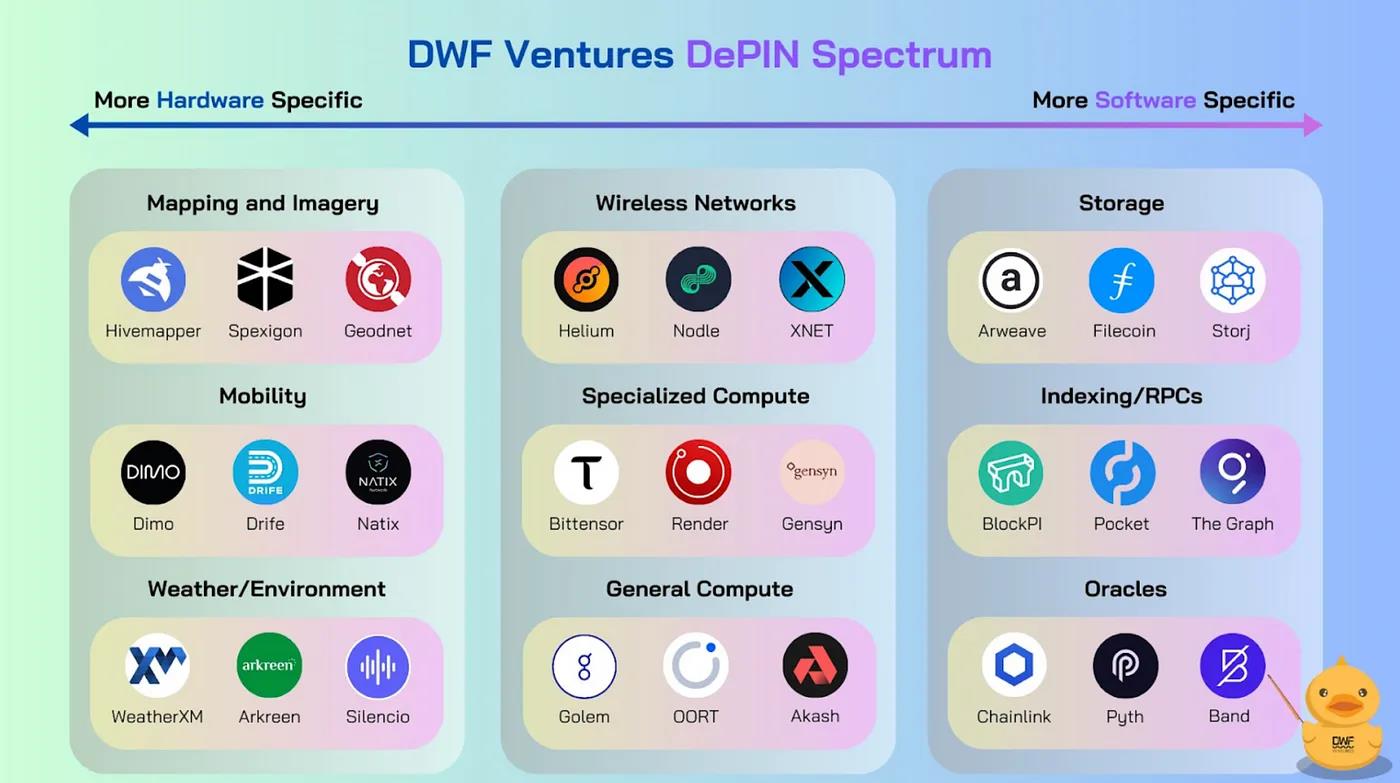

To provide a clearer understanding, we have created an icon to map DePIN. The scope of the icon covers from decentralized physical machine networks that emphasize hardware specificity and disregard software, to decentralized digital resource networks that emphasize software specificity and disregard hardware.

Many decentralized resource networks can be traced back to their corresponding versions in Web2, as their goal is to more effectively address existing problems. However, some are created to meet specific needs on-chain. In the Web2 world, such solutions were either impossible or unnecessary. For example, products unique to Web3, such as oracles like Chainlink, enable smart contracts to execute based on real-world data by using a decentralized network of independent oracle node operators to maintain the trustlessness of the system.

The debate over whether solutions like Chainlink can be considered DePIN depends on people's interpretation of the physicality of nodes/service providers in the network, which typically run on independent machines. However, the more important consideration is the value these decentralized networks bring relative to centralized networks. By focusing on the advantages of decentralization, we hope to guide the development of Web3 to create real substantive value for the masses.

Overall Value Proposition of DePIN

Now that we have introduced "what," it is time to explore "why." Each DePIN protocol has three main stakeholders:

- Demand-side users (consumers of resources)

- Supply-side users (resource providers)

- The protocol itself (team and investors)

Considering all the stakeholders involved, decentralization can bring three unique value propositions for DePIN:

1. Economic efficiency from underutilized resources

The primary and most significant benefit of DePIN is the economic advantage they offer, benefiting all relevant stakeholders. The significant economic efficiency brought about by decentralization comes from the ability to utilize globally idle resources that would otherwise go to waste.

In terms of decentralized computing, over time, the assets of globally idle servers, GPUs, and CPUs (suppliers) depreciate or become obsolete, and there is now a way to monetize these assets. Meanwhile, DePIN protocols (intermediaries) can aggregate these computing resources globally at lower integration and operational costs and offer these aggregated resources to users in need (demand-side) at lower prices. This also means that alternative resources such as computing power and bandwidth can be used more uniformly on a global scale, not only because of lower costs but also because there is no need to establish infrastructure everywhere.

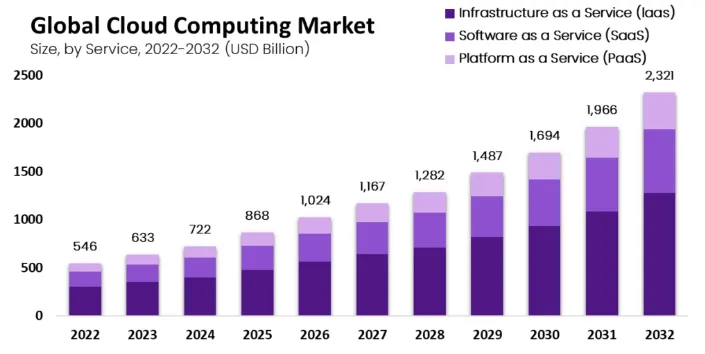

The global cloud computing market is valued at $633 billion, with a projected compound annual growth rate of 16% from 2023 to 2032. Depending on the use case, companies spend tens of thousands to millions of dollars solely on cloud computing demand, which can be significantly reduced through distributed computing.

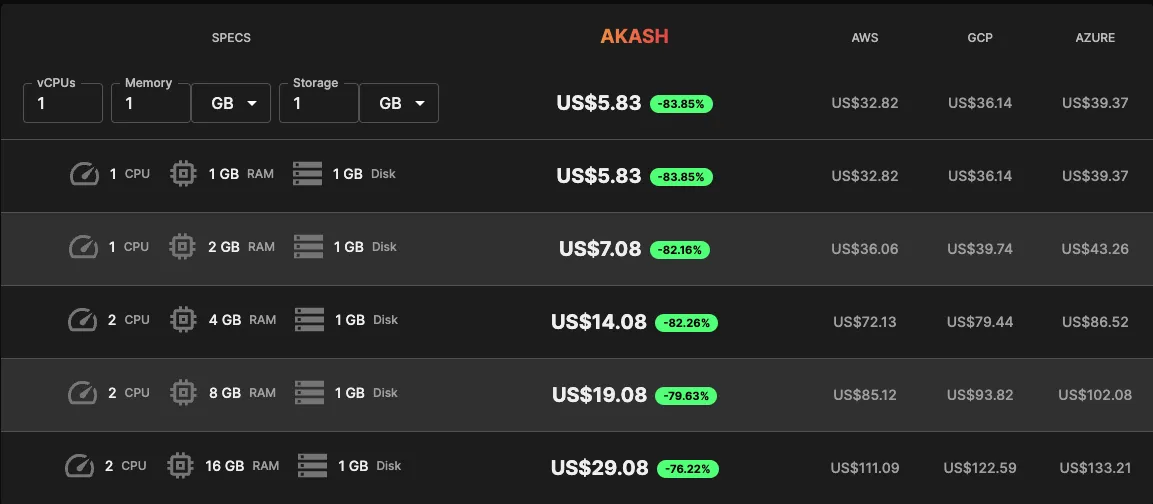

For example, Akash is a decentralized network of cloud service providers that can aggregate and provide the required cloud computing power to developers at a lower cost. Through decentralization, this service can be efficiently planned and is approximately 80% cheaper compared to traditional centralized service providers like AWS, Google Cloud, and Microsoft Azure.

Another potential source of economic efficiency is the ability to identify performance differences between nodes for different use cases. Certain nodes may specialize in producing/purchasing specific resources, and DePIN protocols can intelligently allocate work to match the strengths of each node. This efficiency is similar to the economic efficiency brought about by trade globalization, where each country naturally specializes in a set of resources and then trades them with each other for resources they do not specialize in, creating a more efficient global economy overall. This, again, reduces costs for the protocol and demand-side users, and allows supply-side users to focus on providing what their assets are best at, rather than trying to optimize everything.

2. Reducing barriers to entry for stakeholders and geographic access

DePINs fundamentally change the rules of market access, creating a more inclusive and dynamic ecosystem for resource providers and new projects by significantly lowering the barriers to entry for them.

Easy access to resources and services

DePIN simplifies the onboarding process for resource and service providers, eliminating unnecessary barriers and welcoming participants who meet DePIN standards. This simplified approach has been effective in attracting a variety of contributors, making the DePIN network more robust. The success of Storj is a testament to this, with its provider base far exceeding that of Filecoin, demonstrating the positive impact of this simplified onboarding approach.

Achieving cross-regional adaptability through localized solutions

DePINs can rapidly expand into different regions. Through incentive mechanisms, DePINs can easily expand the network, bypassing the traditional expansion methods of centralized entities. Additionally, DePINs can fully utilize their decentralized structure to provide customized resource solutions in different regions and population groups. This flexibility ensures widespread availability of resources and high alignment with specific market needs in different regions.

Hybrid expansion with centralized supply

DePINs can adopt a flexible expansion strategy that combines centralized and decentralized resource supply. For example, Storj optimizes scalability by centralizing access and database management through Storj's controlled satellites. This strategic hybrid model allows individual operators to ensure network security with minimal infrastructure, as evidenced by Storj's large provider base (approximately 514k) compared to Filecoin's (approximately 3.8k).

Fundamentally, by lowering barriers and adopting a hybrid expansion approach, DePIN cultivates a more inclusive, globally responsive, and dynamically adaptive ecosystem for stakeholders such as resource providers and project developers.

3. Governance and Security

Decentralized networks can also implement better governance systems. Users investing in DePIN protocols on both the supply and demand sides can voice their opinions through voting and open governance proposals. This allows decisions to align with the maximum benefit of all stakeholders and promotes proposals that have a synergistic effect on stakeholders. In contrast, decisions in centralized systems are entirely investor-driven, with investors focusing more on personal financial returns.

The inherent trustlessness, security, and resilience of resource provision in DePINs do not incur the high costs associated with security and high-quality infrastructure in centralized systems. Even if some nodes fail, the DePIN network can maintain service provision. In contrast, centralized service providers face single points of failure, which can lead to severe disruptions if their systems fail or are compromised. In 2022, various cloud service interruptions occurred, such as Google Cloud's delayed addition in January, a three-hour outage for Slack in February, and a two-hour outage for AWS due to a power outage in July 2023. While not common, the likelihood of most nodes in the DePIN network individually crashing or being compromised is much lower, providing better resilience and security guarantees.

However, ensuring that these benefits truly provide value to stakeholders requires taking appropriate measures. When building DePINs, it is also important to consider some factors and obstacles that DePINs may face, which is what DWF Ventures is looking for in DePIN protocols.

Potential obstacles and factors for successful consideration

While DePINs do have the potential to bring significant value to users on both the supply and demand sides, we consider several key factors when looking for successful DePIN projects.

Some key factors include:

- Scalability to match centralized players

- Ease of onboarding and adoption

- Consistency in token economics and incentive measures

1. Scalability to match centralized players

While considering economic benefits, DePINs must also ensure that they are competitive in performance compared to centralized participants. The performance of DePIN protocols is a key factor driving adoption by demand-side users, which in turn can drive adoption by supply-side users. The performance of DePIN protocols can be managed in three main ways:

- Hardware and software specifications

- Addressable demand

- Location sensitivity and density

Hardware and software specifications

Hardware and software specifications involve the requirements for the quality of resources or services provided by supply-side participants. DePINs may require dedicated equipment/programs to ensure consistency in service quality, or allow compatibility with more common devices such as smartphones or laptops. Requiring dedicated equipment/programs can enhance end-user reliability and uptime but will be another barrier to entry for service providers. In most cases, performance is usually prioritized, as service providers are generally willing to incur costs or effort for strong service demand, even with entry barriers.

Projects may also choose to become exclusive distributors of their dedicated equipment/programs or collaborate with third parties for production/development. Outsourcing may promote competition, potentially enhancing the capabilities of providers and reducing costs. However, if production is too dispersed among different providers, there is a risk of quality issues, or if providers cannot meet the project's requirements, it may lead to potential supply shortages.

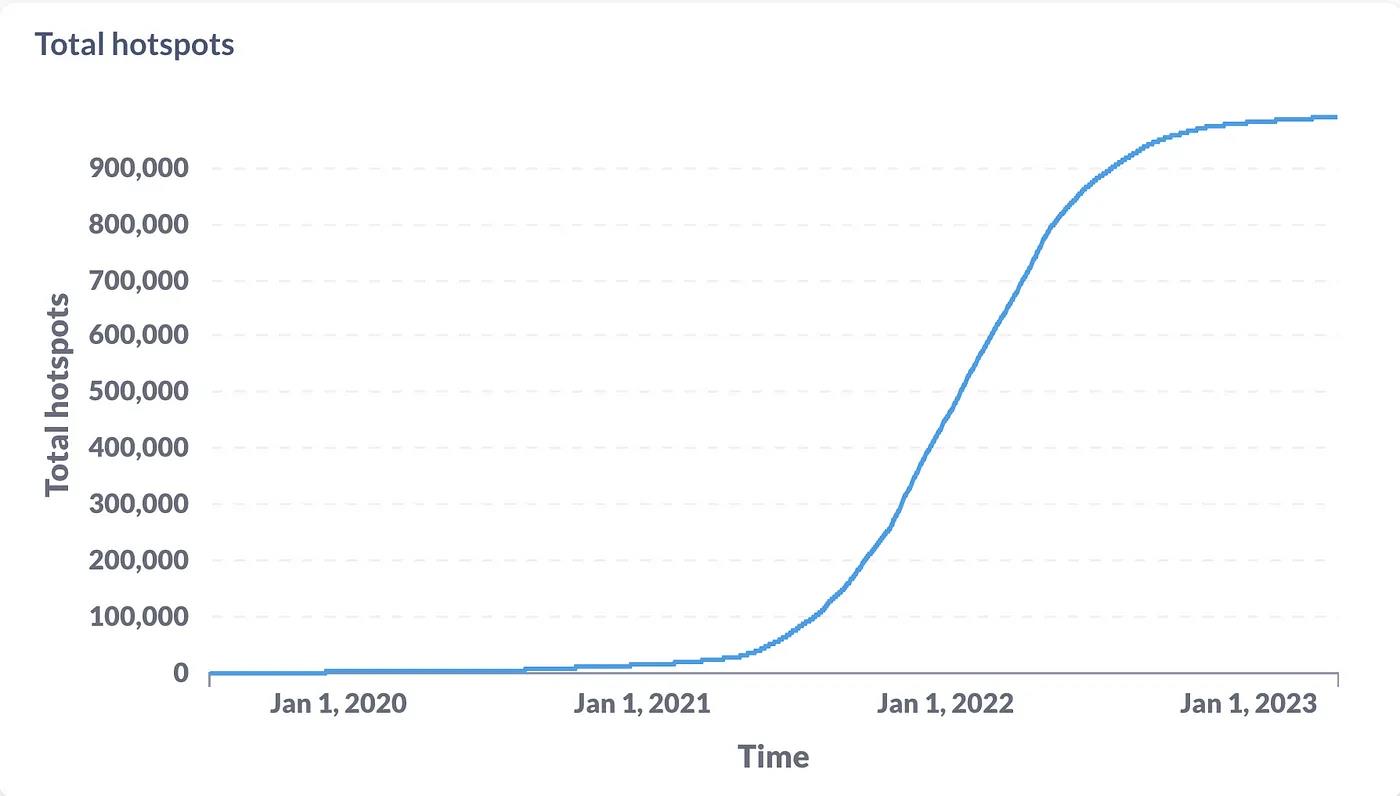

For example, Helium began creating its own hotspots in 2019 but only successfully attracted about 15,000 hotspots by the end of 2021. A proposal passed in early 2021 allowed third-party manufacturers to participate as long as they met the requirements, which may have contributed to the exponential growth of hotspots from early 2021 to 2022. Helium now has over 28 manufacturers joining, which helps decentralize and provide users with a wider range of choices. For example, the relatively cheaper hotspot devices offered by Sensecap are priced at around $130, much cheaper than the original Helium hotspots, which cost around $495.

Addressable demand

One aspect that many DePINs lack compared to these more mature participants is the full suite of capabilities provided by these more mature participants. Centralized cloud service providers like AWS offer a vast tool ecosystem for users to deploy their applications and develop their products, while many DePINs today are more focused on a single service, such as computing power or data storage. This shows the potential for DePINs to grow to match the capabilities of centralized solutions.

OORT is taking a step in this direction by providing decentralized computing and storage facilities by building a service provider network for different use cases vertically and horizontally. OORT achieves this by having three layers of service providers:

- Archive nodes: Data storage nodes from Filecoin, Storj, Crust, and Arweave.

- Edge nodes: OORT network releases devices with home PC capabilities for decentralized computing.

- Super nodes: Public and private cloud service providers such as Tencent Cloud, Alibaba Cloud, and Seagate, meeting higher-end computing and storage needs.

This means that OORT can provide a full range of cloud computing services while retaining the advantages of decentralization, as any demand for intensive or simple computing and large or light data storage can be met by one or more of the three layers of service providers.

Location Sensitivity and Density

For some projects, achieving sufficient user density within specific geographical areas is crucial to ensuring the effectiveness and practicality of the services they provide. This is similar to the concept of common addressing in traditional technologies. For services that heavily rely on location-based data and interactions, such as map services or ride-hailing platforms, this becomes particularly important.

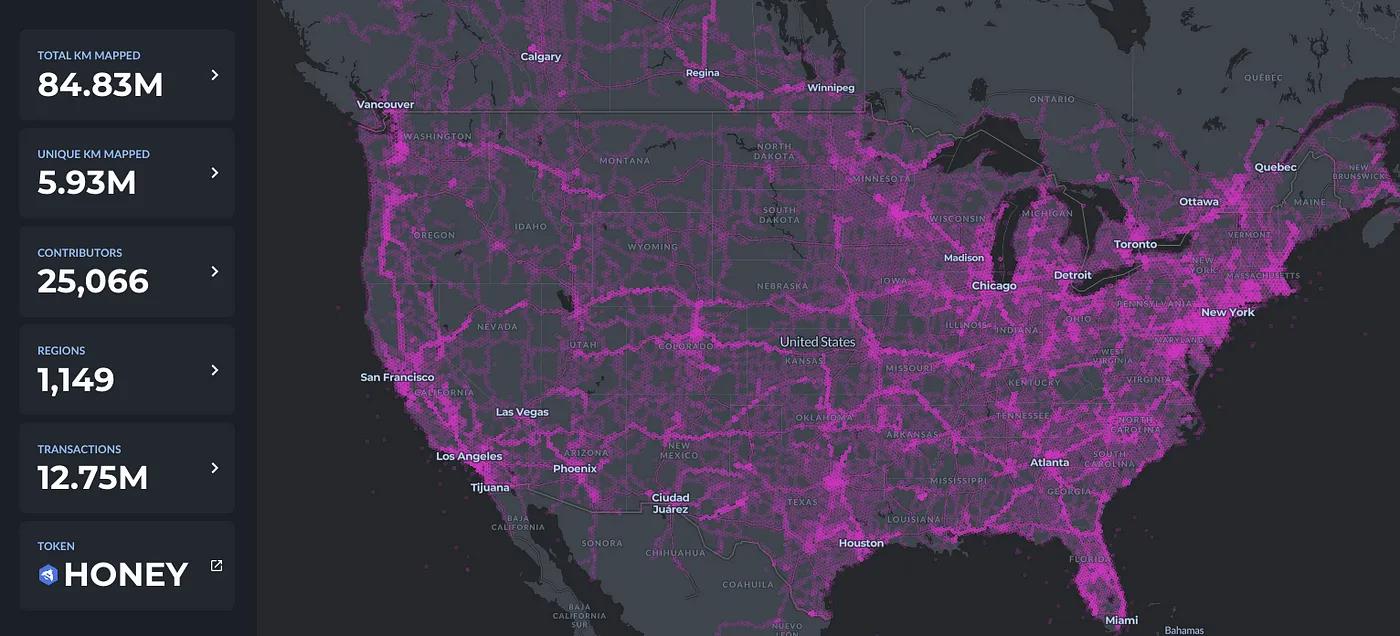

For map services like Hivemapper, having highly concentrated users in specific areas is crucial for the platform to provide accurate and up-to-date information, which affects the utilization of the product. For example, most of Hivemapper's coverage is currently concentrated in the United States and a few European countries. As coverage in regions like East Asia is more dispersed, Hivemapper has set up bounties as part of a targeted mapping initiative under MIP-2. Additional rewards are allocated for areas listed in the proposal to encourage more comprehensive coverage in those areas. This is crucial for Hivemapper to compete with centralized alternative solutions.

Similarly, for ride-hailing services, having a sufficient number of drivers and passengers in specific areas is crucial to ensuring the best experience for both parties. Higher driver density means shorter wait times for passengers and more options for transportation. Drife is an example, as the company focuses on onboarding drivers onto its platform in Bangalore and has recruited over 10,000 drivers to date. This ensures a better user experience for passengers, leading to a continuous demand for rides to match the supply of drivers. Therefore, achieving sufficient density in specific geographical areas is crucial for improving service performance.

2. Ease of Onboarding and Adoption

The initial stage of interaction between providers and the network is the onboarding process. While hardware specifications play a role, the subsequent steps after acquiring the necessary hardware are equally important. After setup, providers must monitor the hardware to ensure they meet the necessary conditions to earn rewards. Projects that require passive or active management by providers will impact the number of providers motivated to join.

For most users, setting up a Helium hotspot is relatively straightforward. For providers using Sensecap, an intuitive process involves turning on the device and configuring Bluetooth to start earning rewards. Despite a one-time setup fee of $15, it eliminates the complexity of interacting with the blockchain, making it more appealing to a wider potential provider base. Providers using the app can easily monitor the status of the hotspot in one interface, ensuring the hotspot remains operational and passively earns rewards.

In contrast, projects like Spexigon require users to actively participate in the project to earn rewards. After purchasing a specified drone (DJI Mini 2, priced at approximately $339), users must personally fly and capture images from their location while ensuring compliance with local regulations. Additionally, since Spexigon focuses on capturing images from different geographical areas, the income potential for users may be limited by the surrounding environment. Therefore, the number of users that can join Spexigon is limited by various factors—from onboarding and regulations to the active use of drones to earn rewards.

Overall, a user-friendly and easy-to-navigate onboarding process will enable projects to reach a broader audience. However, this also depends on the specific requirements and priorities of the project. For services that benefit from a large number of providers (such as Helium), this factor is more important than managing high-quality providers.

3. Integration of Token Economics and Incentive Measures

The last important factor that DePIN protocols should carefully plan is the utility and value flow achieved through the token mechanism. A great product needs an equally great token model to ensure all stakeholders participate in an incentivized manner, allowing the token to accurately reflect the project's value.

First, we can draw inspiration from Chainlink's proven token utility model to determine the fundamental token framework for DePINs. In Chainlink's token utility model, stakeholders are similar to any decentralized resource network:

- Demand-side users (token consumers)

- Supply-side users (token recipients and stakers)

- Team and investors (token holders)

Demand-side users pay LINK tokens to access Oracle services, while supply-side users earn LINK tokens by providing services. This creates demand for the token in a way directly related to service demand.

Supply-side users also need to stake tokens to ensure service quality, or they will face significant penalties. This encourages higher-quality services and creates demand for the token, with the demand for the token directly related to the overall service quality of all service providers, and the token itself dependent on the demand for the product—higher demand encourages more service providers to offer higher-quality services.

Finally, token demand benefits the token price, which is what token holders expect. This creates additional demand for the token from secondary market investors.

From this, we can see that demand-side users are least concerned about the token price, while the team and investors are most concerned. Supply-side users are in the middle, as they also have exposure to the token price through staked tokens. In any case, this framework creates a scenario where all stakeholders play a role in supporting the token price.

Token issuance also needs to be planned. In most cases, token issuance exists as part of early incentive activities to attract users. Considering these three stakeholders, it makes sense to allocate token incentives to these three stakeholders based on how difficult the project believes it is to attract these users to the network. Of course, with token issuance comes inflation, so the project must also consider how to manage token issuance and burning. The project must also be careful not to overly rely on token issuance to incentivize demand-side users, as these users should be attracted first and foremost by a high-quality product, which is where everything begins. In general, token incentives should focus more on attracting supply-side users to meet the demand for a high-quality product.

Some DePINs also allow demand-side users to pay through other means. As long as the received payments are used to purchase tokens to pay supply-side users, this does not affect token demand. In fact, it simply provides flexibility for demand-side users to choose payment channels.

For the protocol itself, revenue can come from a portion of the fees paid by demand-side users to supply-side users, or separately charging membership fees or licensing fees to both demand-side and supply-side users. These revenue streams can be used to cover operational costs, and any excess revenue can be used to further increase token demand through revenue sharing or buyback and burn mechanisms. The project can also require token holders to stake tokens or provide liquidity to benefit from revenue sharing, thereby stabilizing the token price or increasing liquidity.

Shaping the Next Era of DePINs: What We're Looking For

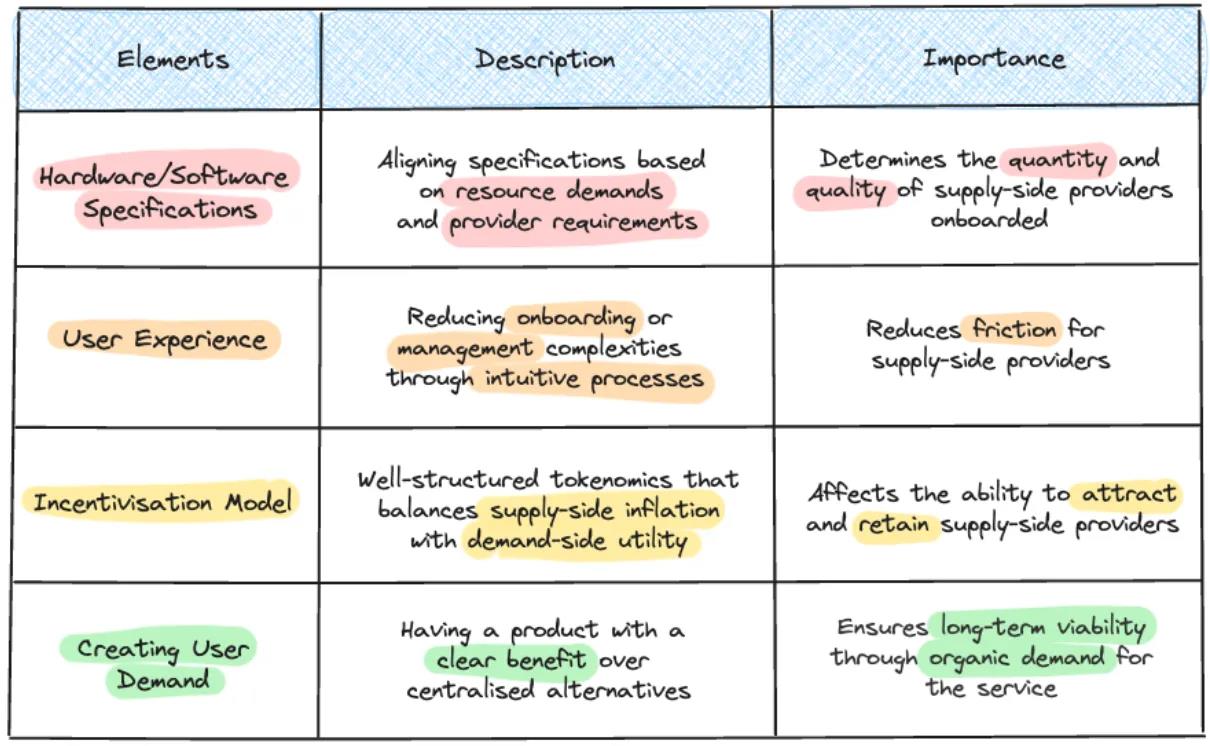

At DWF Ventures, we believe the success of DePIN projects lies in integrating specific elements. These elements include custom hardware specifications that align with the project's resource requirements. Additionally, a robust incentive model, combined with well-designed token economics, is crucial for sustaining the project's ecosystem. Prioritizing the creation of an optimized user experience for supply-side and demand-side participants is also important. This ensures that the project can attract and retain users, ultimately contributing to the overall success and longevity of the project. These comprehensive factors lay the foundation for the success and sustainable development of DePIN initiatives.

Currently, we see that most existing DePIN projects have established the first three elements, as most projects primarily aim to incentivize supply-side users. This is understandable, as supply-side users are crucial for the initial network expansion.

However, investing heavily in developing a truly appealing product that attracts demand is still important, rather than just becoming a decentralized alternative to existing services.

The entire DePIN ecosystem is still relatively young. While some projects have been around for several years, we expect to see more innovation in this field, potentially leading to a protocol that changes the game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。