In November, the NFT market for various chains is bustling. This article provides the latest and most comprehensive insights into the NFT market trends.

Author: Cookie

In the real world, we have entered winter, and the weather is getting colder. However, in the Crypto world, November is full of excitement.

It's been a long time since I've seen so many money-making opportunities in the NFT market. As a dedicated NFT player, I have so much to share with you about the NFT market over the past week and even the past half month.

In this issue of NFT news, we summarize the performance and characteristics of various chain NFT markets in the form of a red and black list. Let's take a look at who stands out and who is falling behind in this wave of NFT market recovery.

Red List

No.1 - Bitcoin

Similar to the first round of Bitcoin NFT's uptrend, the strong performance of this round of Bitcoin NFT is still attributed to the popularity of various Bitcoin FT protocols led by BRC-20. After the continuous FOMO of various Bitcoin FT protocols, attention once again turned to Bitcoin NFT.

In this round of Bitcoin NFT market, the series with a total of 10K clearly received more preference. The advantage of the 10K series is "large quantity and low floor price," with high liquidity and easy capital flow.

Among the 10K series, the most outstanding performers are Bitcoin Frogs and Goosinals. Bitcoin Frogs broke through 0.1 Bitcoin during the first round of Bitcoin NFT's uptrend and has gained considerable popularity. Starting from the end of October, Bitcoin Frogs gradually recovered from the position of 0.02 Bitcoin and recently broke through the previous high, with a maximum increase of over 700%.

In terms of increase, Goosinals is even more dazzling. In the article "Ordinals ecosystem is fun again, is the Bitcoin NFT ecosystem returning from a 'big casino' to an 'art gallery'?," I introduced the background of this project. From the end of October to the present, Goosinals has achieved a maximum increase of over 3000%.

Under the leadership of these two star 10K projects, the 10K projects have shown a significant recovery. For example, both Bitcoin Bear Cubs and Bitcoin Whales, these two 10K projects, gained over 200% in just a few days.

There was also a new 10K series, Mutant Punks, which had a trading volume of over 6 bitcoins in just one day, and the floor price was FOMOed to 0.006 bitcoins.

However, after all the images of this series were completely included in the trading market, the volume began to decline. From the trends of the above 10K projects, we can see that except for Bitcoin Frogs, which is still relatively strong, the others have started to experience a pullback. If Bitcoin Frogs also experiences a significant retracement, then this wave of Bitcoin NFT market may temporarily come to an end.

Nevertheless, Bitcoin NFT still has unlimited potential. The main contributors to this market are Chinese, and there are still many incremental players in the English-speaking community waiting to be explored. In addition, Bitcoin PFP will have differences from Ethereum in terms of narrative, content, and development direction. For example, the highly anticipated "Taproot Wizards" white list was announced to have completed a $7.5 million financing before it was fully distributed, and projects based on Bitcoin's native meme culture are still waiting to be unleashed. Similarly, On-Chain Monkeys is about to complete migration, and the series on Bitcoin will all be engraved on the "Block 9" ancient Satoshi, with the narrative of rare Satoshis yet to be explored…

No.2 - Solana

The price of $SOL has tripled in the past month. As the token price continues to rise, attention has gradually shifted to Solana NFT projects.

Placing Solana in the second position on the red list is not only because Solana has produced influential "leading" NFT projects, but also because Solana has shown relatively FOMO events.

First, let's take a look at the NFT stars on Solana, Mad Labs and TENSORIANS.

Mad Labs is the successful project that has gained attention. Mad Labs announced the launch of its exchange, Backpack Exchange, on October 31, which was granted a VASP license by the Dubai Virtual Asset Regulatory Authority.

Starting from November 10, Mad Labs NFT began to rise, with a cumulative increase of over 100% to date, and the floor price broke through the historical high.

On November 16, Mad Labs launched an activity to stake $SOL to get $PYTH, where all users could stake at least 5 $SOL after completing KYC to receive $PYTH rewards, with the holders of Mad Labs NFT receiving the largest share of rewards.

The activity has now ended. This was a very successful activity for both Mad Labs NFT and the Solana ecosystem. In just 3 days, there were approximately 150,000 KYC applications, and over 300,000 $SOL (18 million USD) were deposited into Backpack Exchange. Many people were discussing this "staking" activity on Twitter and in various chat groups.

The market for TENSORIANS also started on November 10, with a cumulative increase of over 100%, and the floor price is on the verge of breaking through the historical high.

TENSORIANS is a 10K PFP series officially launched by Tensor in the Solana NFT market. Tensor is currently the largest NFT trading market on Solana.

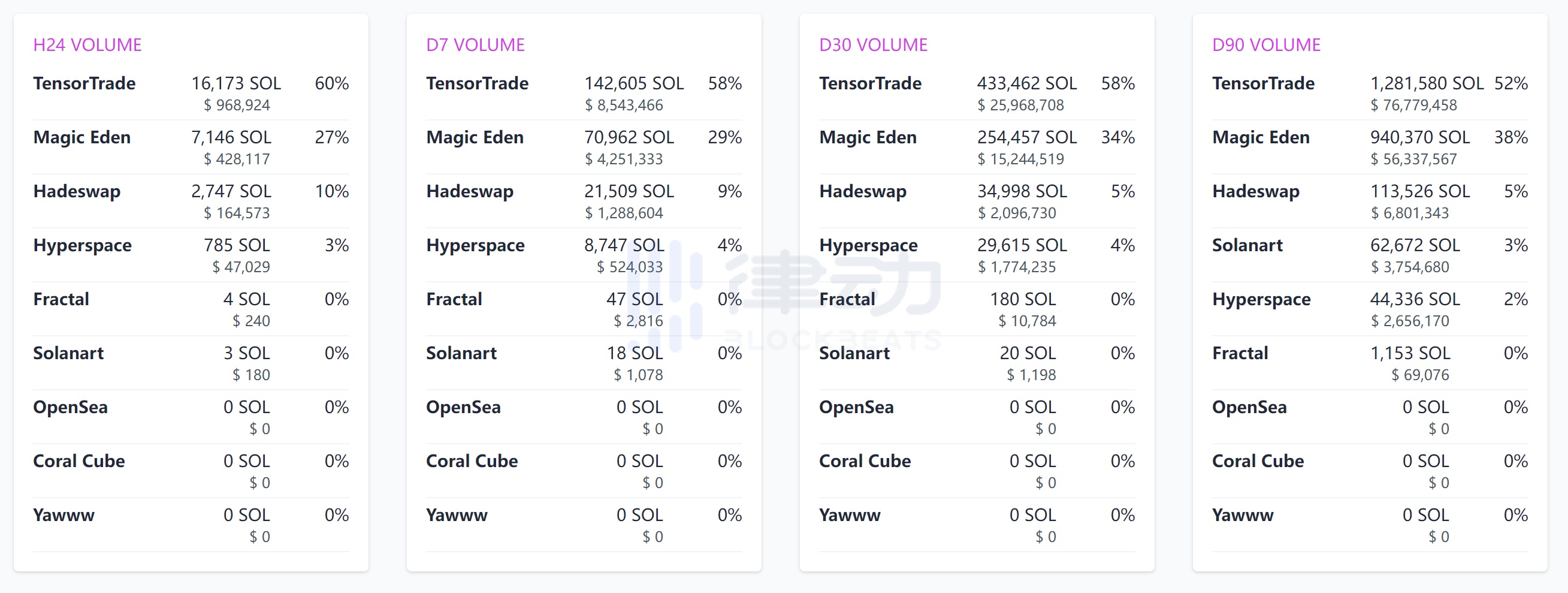

From daily, 7-day, 30-day to 90-day, the trading volume of Tensor has surpassed the former Solana NFT market leader, Magic Eden.

The rise of TENSORIANS is not only due to the strong performance of $SOL and Tensor itself, but also the ability to provide holders with airdrops of the Tensor native token $TNSR, which is an important factor.

There is another matter unrelated to NFTs but indicative of the recent vibrancy of the Solana ecosystem. On November 16, @HGEABC, a well-known NFT KOL 9x9x9 in the Ethereum ecosystem, started a "gambling" game similar to ben.eth's "money-betting" for meme tokens.

Currently, the 222.sol address has nearly 27,000 $SOL, worth over 1.6 million USD.

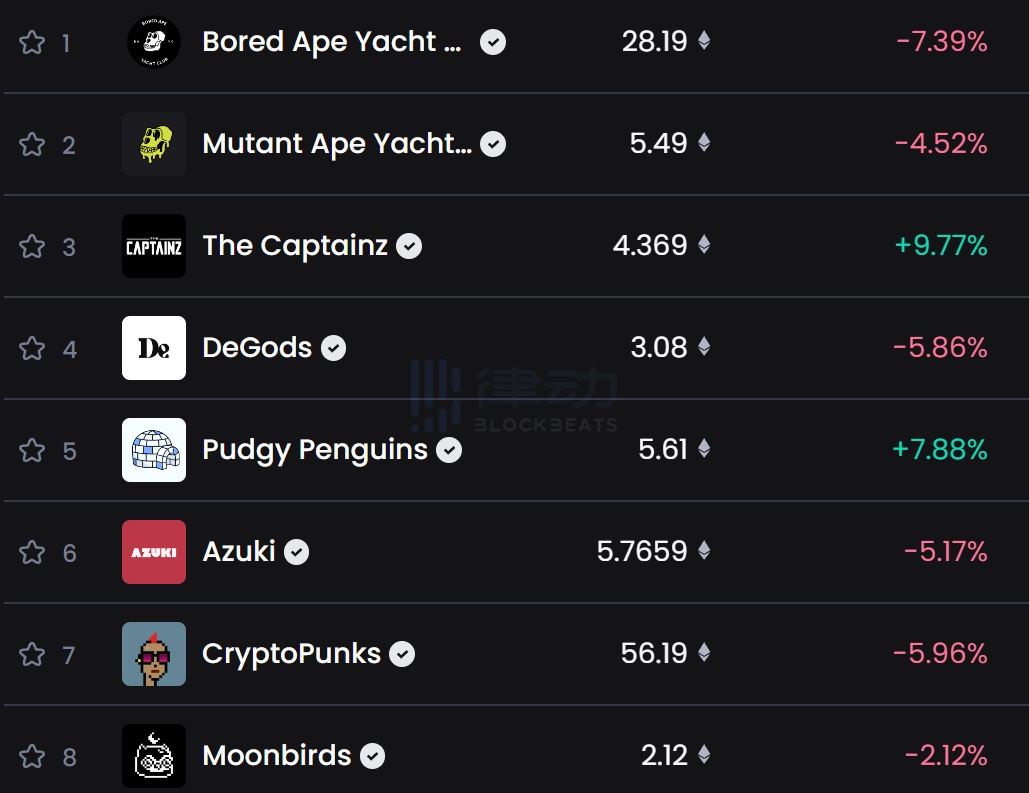

Speaking of which, I must mention DeGods. As the undisputed king of Solana NFT projects in the past, the migration to ETH of DeGods has seen a 5% decline in the past week and an 8% decline in the past 30 days. Frank, you once conquered the land, but do you regret it now?

No.3 - Ethereum

I hesitated for a while on whether to include Ethereum in the red list.

First, if we compare the trend of Ethereum's top PFP blue-chip projects with the hot trends of Bitcoin and Solana, it's definitely not great…

In the past 7 days, most of the top 8 Ethereum NFT projects have declined.

But if we shift our focus to gaming NFTs and art NFTs, Ethereum still has some noteworthy performances.

The gaming NFT with the best increase on Ethereum is the card game Parallel on the Base chain, with its PFP NFT assets launched on the Ethereum mainnet, showing an increase of over 100% in the past week. This time, the "big brother" is benefiting from the "little brother"…

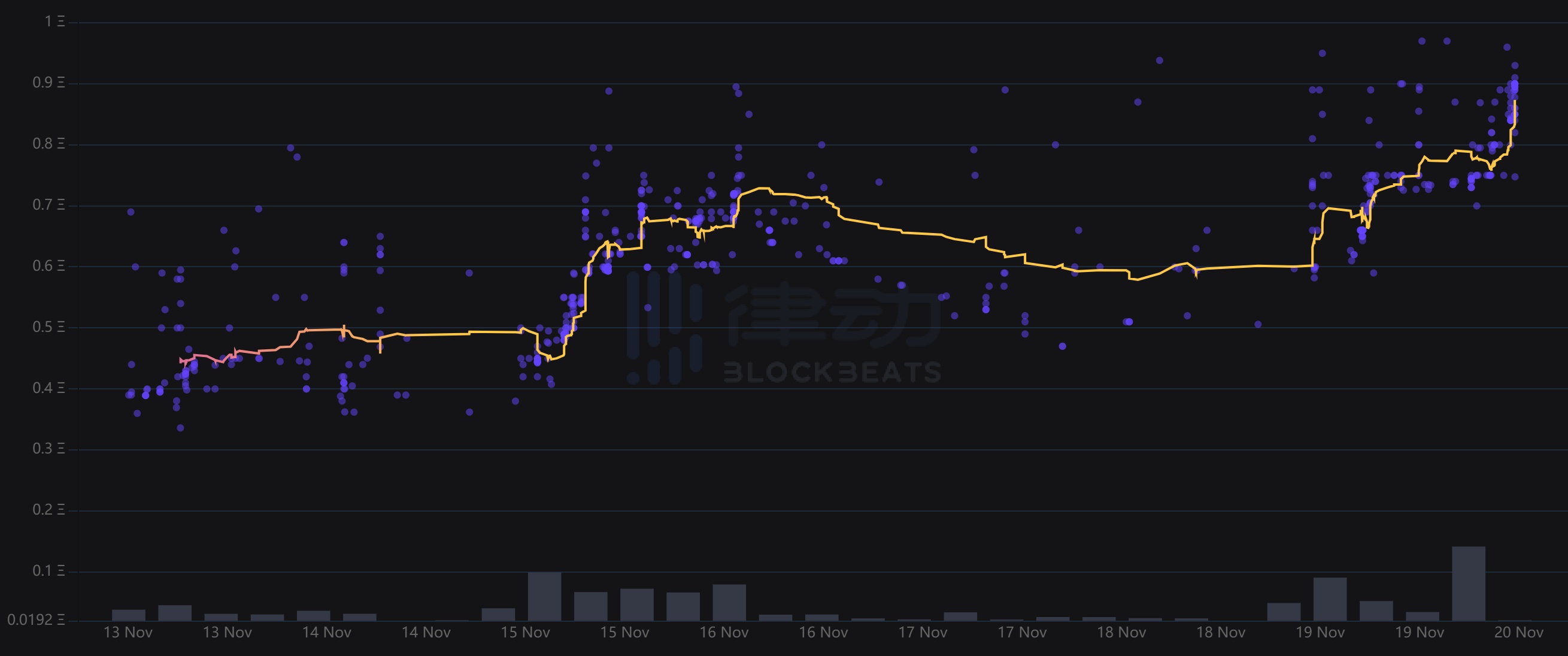

Parallel Avatars price trend in the past week

Parallel has performed exceptionally well recently. Not only has the price of the NFTs increased, but the price of its token $PRIME has also reached a new high, with an increase of over 100% compared to the beginning of the month.

$PRIME seems to have no intention of stopping…

The Pixels, a "QQ Farm" that has migrated to the Ronin chain, is also gaining more attention, bringing more light to Ethereum. The game's land NFT asset "Farm Land" is launched on Ethereum and has seen an increase of about 26% in the past week. If we go back to the end of October, the floor price of Farm Land has tripled.

Of course, if we are a bit more tolerant of Ethereum and not just focus on its recent competition with Bitcoin and Solana, the upward trend of gaming NFTs on Ethereum is still quite good:

- The PFP series Matr1x 2061 of Matr1x FIRE has increased by 100% since the beginning of the month

- The parkour game Nounish Punk based on the Nonus image had a maximum increase of 500% at the beginning of the month

- BlockGames Dice from the Web3 game platform BlockGames had a maximum increase of 200% at the beginning of the month

- Balthazar raW Pass from the GameFi project Wallet War had a maximum increase of over 200% at the beginning of the month

- The land Treeverse Plots from the MMORPG game Treeverse had a maximum increase of over 100% at the beginning of the month

Gaming NFTs are gaining popularity for two reasons. Firstly, the token $MEME from Memeland has led to a surge in interest in NFT projects with token expectations on Ethereum at the beginning of the month. A typical example is The Grapes, a PFP project like Memeland with confirmed token airdrops, backed by Animoca, which rapidly increased by over 200% at the beginning of the month and has maintained a stable floor price. Secondly, the currently active players in the Ethereum NFT community are mainly from the English-speaking community, and there has been a change in player attitudes. In terms of games, Parallel's game quality has been highly praised, and The Pixels has captured the attention of players in the blockchain gaming community. NFT players seem to be more tolerant of gaming projects—having a token and a team that makes me feel secure, I am willing to hold on for a while longer as a collector and degen.

The change in player attitudes is also reflected in art NFTs. People have higher demands for art quality and more patience, and there are frequent opportunities for "consumer-level art."

"Consumer-level art" is a term I came up with. Compared to master-level art series, these artists have relatively limited fame within the community. Their works may not have compelling storylines connecting the pieces, and there may even be some flaws in the works, but overall, they give a pleasing feeling, and NFT players in the community are willing to collect them. This creates a relative balance between being a collector and a degen.

The stars of these projects are ANOMALY A.I. by Star Im and Gruffters. ANOMALY A.I. by Star Im is a Free Mint with a total of 8888, and its floor price once exceeded 0.1 ETH. The remarkable thing about this project is that after the Free Mint, the price rose from 0.002 ETH and still has a floor price of 0.06 ETH, showing a relatively stable trend, all of which happened while waiting for the creator to clearly define the gameplay for the second phase, which will take a month. Gruffters is a 0.04+ ETH Mint, and its peak price reached around 0.35 ETH. However, since the creator has not clearly indicated that this series will be followed by an Art Pass, the floor price has now fallen to 0.08 ETH.

Treeangles by nix.eth perhaps best reflects the patience of current Ethereum NFT players towards art NFTs. During the public sale phase, 70 units were minted by bots, which almost spelled doom for a project with a total of only 300 units. However, even so, the project has not fallen below the sale price.

The resurgence of Ethereum NFTs before the rise of Bitcoin NFTs may be the reason why Ethereum NFTs have been overlooked recently. The "stability" demonstrated by Ethereum NFT players in the recent period is the reason why I ultimately decided to include Ethereum in the red list.

Black List

Polygon

I still have high hopes for the future of Polygon NFTs. I have discussed the outlook for the Polygon NFT market in detail in the article "NFT Trading Volume Exceeds $1.2 Billion, Will Polygon Repeat the NFT Boom on Solana?".

However, this wave of Polygon NFTs has completely fallen behind, with the only decent performer being the "Polygon flagship" Pluto Misfits, which saw a 50% increase at the beginning of the month…

Polygon, oh Polygon, you were willing to spend $3 million to bring y00ts over (the money was later returned to Polygon, and y00ts left), indicating that you still have plans for NFTs. With the market doing so well and $MATIC rising, why are you hiding…

Although it's important to be patient with Polygon, it still needs to be included in the black list this time. As the only member falling behind this time, I hope Polygon can surprise us in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。