This article provides an in-depth analysis of the characteristics, market performance, and token economics of three Telegram bots - Unibot, Banana Gun, and MaestroBot - in the cryptocurrency trading field. In comparison, Banana Gun has an advantage in user growth and sustainability.

Author: Kunal / Source: https://medium.com/@Kunallegend/the-battle-of-the-telegram-b

Translation: Plain Blockchain

Telegram bots have become a novel innovation in 2023, with their main appeal being the user-friendly interface achieved through the popular messaging platform Telegram. One of the main obstacles to the adoption of cryptocurrencies is the relatively complex process of trading cryptocurrencies compared to trading stocks.

The goal of Telegram bots is to address this issue by allowing users to trade cryptocurrencies within the Telegram application and implement trading strategies. It achieves this by routing orders to the decentralized exchange platform Uniswap V3, eliminating the need for users to interact directly with Uniswap.

The simplicity offered will play a significant role for Telegram bots in the next bull market, helping to attract more cryptocurrency users. In this article, I will analyze the top three Telegram bots, namely Unibot, Banana Gun, and MaestroBot. Please note that only UniBot and Banana Gun have launched their own tokens. MaestroBot was launched in July 2022, Unibot in May 2023, and Banana Gun in June 2023.

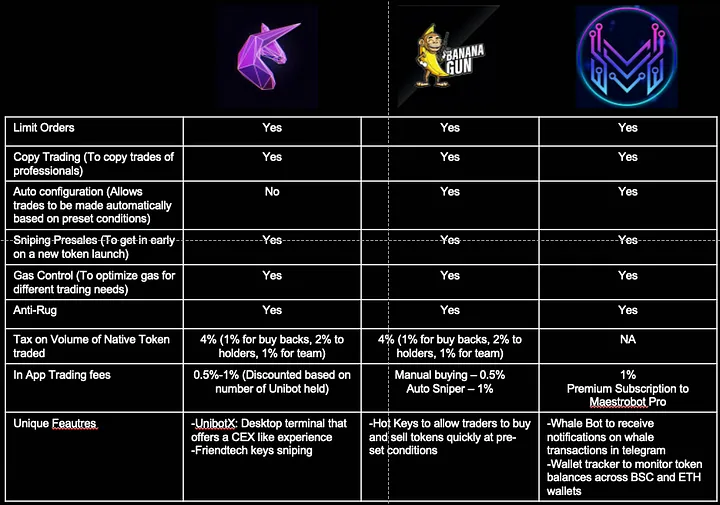

1. Feature Comparison

A simple comparison reveals that these bots have similar features. Although MaestroBot is the original bot in this field, other bots have quickly caught up in terms of features. MaestroBot and Unibot are committed to providing a more decentralized trading experience for users, while Banana Gun seems to focus on making trading more convenient within the Telegram application. We are currently in the early stages of development for Telegram bots, and there will be more innovative innovations to come.

Advanced feature comparison

2. Metric Comparison

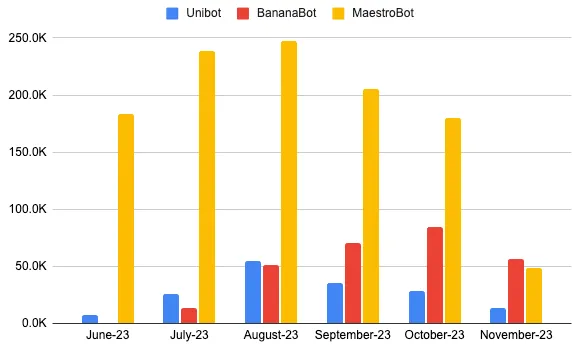

From the overall monthly user chart, although MaestroBot is dominant, its monthly user count is declining, while Banana Gun is quickly catching up.

Total monthly active users

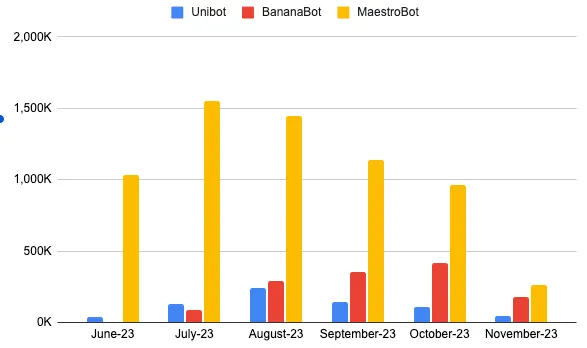

The total monthly trading volume chart also shows a similar trend. However, the number of trades per user is similar across the bots. Unibot users average 4.26 trades, Banana Gun 5.27, and MaestroBot 5.70.

Total monthly trading volume

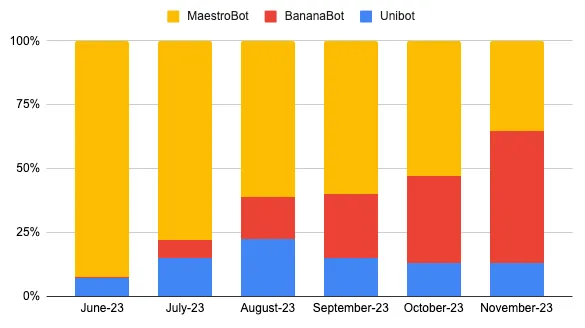

Key statistics, such as the trading volume of the bots, provide a good indication of the bots' health. Banana Gun has steadily captured market share from MaestroBot and seems to be dominating this field. In October, the trading volumes of Unibot, Banana Gun, and MaestroBot were 55 million, 143 million, and 223 million, respectively. For comparison, GMX's derivative trading volume reached 314 million in the past 24 hours. This indicates that Telegram bots still have significant room for growth.

Monthly trading volume percentage composition

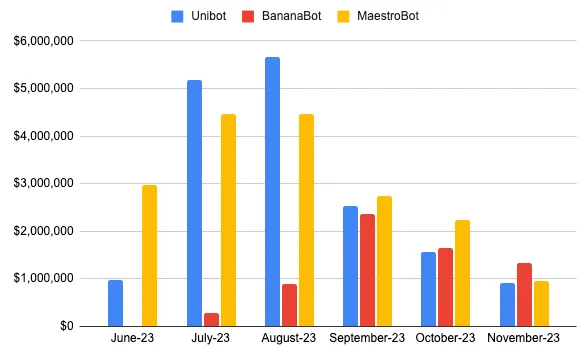

The monthly fee situation shows that over time, the fees for all three bots have decreased, and their generated revenues are also similar. Although Unibot's actual trading volume is much lower than the other two, its native token's monthly trading volume is approximately 200 million. Considering the 4% tax on each purchase and sale of UNIBOT, this results in about 80% of Unibot's generated fees coming from this. Banana Gun generates a large volume of in-app trades, but its native token BANANA's monthly trading volume is only about 30 million. Compared to the tax on its native token trades, Banana Gun only charges a 0.5–1% fee per trade. For MaestroBot, its sole source of fees is a 1% fee charged per trade, yet it is currently the bot generating the most revenue.

Monthly fees

3. Token Economics

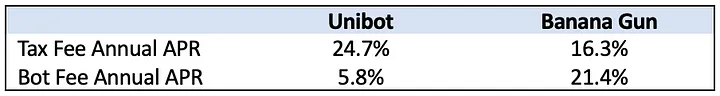

People holding BANANA and UNIBOT tokens are eligible to share in the revenue, with Banana Gun and Unibot following the same proportion, where 40% of the trading fees and 50% of the native token trading tax will be distributed to token holders. To be eligible to share in the revenue, one must hold at least 10 Unibot, while Banana Gun does not have such a restriction.

Current token holders' annual percentage yield (APR)

Based on my conservative estimate, I believe that these two bots will generate similar comprehensive annual percentage yields, close to 25%. Currently, all UNIBOT tokens are fully in circulation, and considering token buybacks, I expect a future deflation rate of 5%. However, for Banana Gun, only 26.3% of the tokens are in circulation. Banana Gun currently partially reimburses users for a certain proportion of bot fees with its native token (0.05–1). In the past four months, 2.82% of the total issued tokens have been distributed as rewards, while only 1.45% have been burned, indicating an issuance-to-burn ratio of about 2. I expect that as its trading volume grows, Banana Gun's revenue will increase. This will increase the amount of burned BANANA over time, offsetting any inflationary pressure. Based on my calculations, I expect a 0.3% deflation for Banana Gun in the next year.

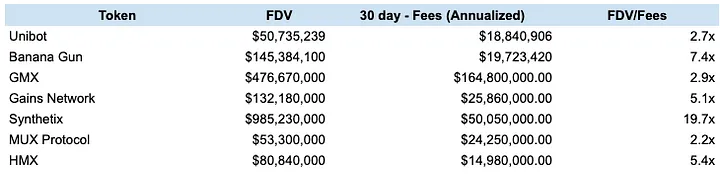

4. Evaluation

With few industry competitors, I have decided to conduct a reasonableness check using perpetual contracts and the FDV/Fees metric. Unibot's valuation looks quite reasonable, while Banana Gun is slightly overvalued. If I were to enter this trade, I would wait for the valuation to approach 5x, which means the price of BANANA would be close to $10.

FDV/Fees valuation comparison

5. Risks

When using Telegram bots, it is important to know that the wallet keys are "securely" stored within the Telegram bot itself. All of these bots have security features to protect these keys and plan to introduce more security features. In fact, all three of the mentioned bots have been subject to some level of attack. Fortunately, the issues were quickly resolved, and affected users were compensated.

6. Conclusion

I am impressed with the performance of Banana Gun. Despite being a newcomer, it has quickly caught up and improved with strong trading volume and user growth. This can be attributed to their user-centric focus and the introduction of trading competitions to drive trading volume. Typically, newcomers increase token issuance to stimulate growth, but in the case of Banana Gun, this has been controlled to ensure the protocol's sustainability.

Banana Gun still holds a reserve of 60% of the total token supply to drive demand for their application. While this may create inflationary pressure, if done in a controlled manner, the increased revenue can offset these issuances through their buyback and burn mechanism. The team emphasizes the deflationary nature of BANANA and recently used their funds to buy back and burn BANANA worth $21,000. With more tokens in circulation, the trading volume of their native token will also increase, further driving the bot's revenue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。