After the fraudster succeeded, he continued to disguise himself for more than a year.

Author: Fu Ruhe, Odaily Planet Daily

While Web3 brings wealth opportunities, it also comes with certain risks, and even some artificial traps. Recently, the "Private Placement Financing Fraud" incident spread on the X platform has attracted widespread attention.

Most Web3 private placement financings do not have legal effect, and are basically financing activities based on trust, with frequent investment traps and fraud. Fraudsters often disguise themselves as community members with abundant project resources, package and create their own identities to gain the trust of victims, and then carry out fraud.

Unlike previous cases, this time the victims also include some senior practitioners in the crypto industry, including KOLs. Odaily Planet Daily's investigation found that the total amount involved in the case has reached 4.22 million yuan (according to the statistics of the rights protection group), and most of the victims are investors from mainland China, with a scale of over 50 people.

Through the report, Odaily Planet Daily hopes that investors can be more vigilant and avoid being harmed by such scams. The following is the course of the event, and the related content is elaborated by the victims and compiled by Odaily Planet Daily.

A scam lasting for over a year, involving nearly 6 related projects

Let's go back to May 2022, when new public chains such as Aptos and Sui began to rise. Investors from mainland China were looking for related Chinese communities on Discord and Telegram, hoping to find like-minded community friends to explore early opportunities of new public chains together.

The fraudster posted node tutorials for new public chains on Twitter and YouTube, attracting users to join the Discord and Telegram groups he created.

Subsequently, the fraudster often distributed benefits and organized activities in the community, creating the image of an official community builder, gaining the trust of community members, and the related group chats also showed the respect of the community members towards him.

In August of the same year, the fraudster began to indicate in the community that he could help everyone obtain the quota for Aptos' private placement token financing. According to the description of the victims, at that time the fraudster revealed that the information about the private placement financing quota came from the institution he was in contact with—Alameda.

From August 2022 to December 2022, the fraudster constantly privately chatted with members of the community, asking if they would participate in Aptos' private placement financing. Due to the fraudster's performance in the previous few months, most community members had full confidence in his identity, so they did not have any doubts and thanked the fraudster for giving them the opportunity to participate in the private placement; even though no private placement agreement was signed, no one raised objections in the community.

Since most projects' private placement financings would have a lock-up period, the fraudster also used this method and claimed that the lock-up period was 1 year. As Aptos' token APT was launched in October 2022, the fraudster stated that the private placement unlocking time point would be November 12, 2023. This series of operations were in line with the conventions of Web3, further dispelling the investors' doubts.

After the private placement, the fraudster also frequently organized community activities. For example, the first community AMA event claimed to be the official Sui was held in his Sui Chinese community, and there were also suspected official personnel from Sui participating at that time. According to the victims, at its peak, the community had nearly 8,000 members.

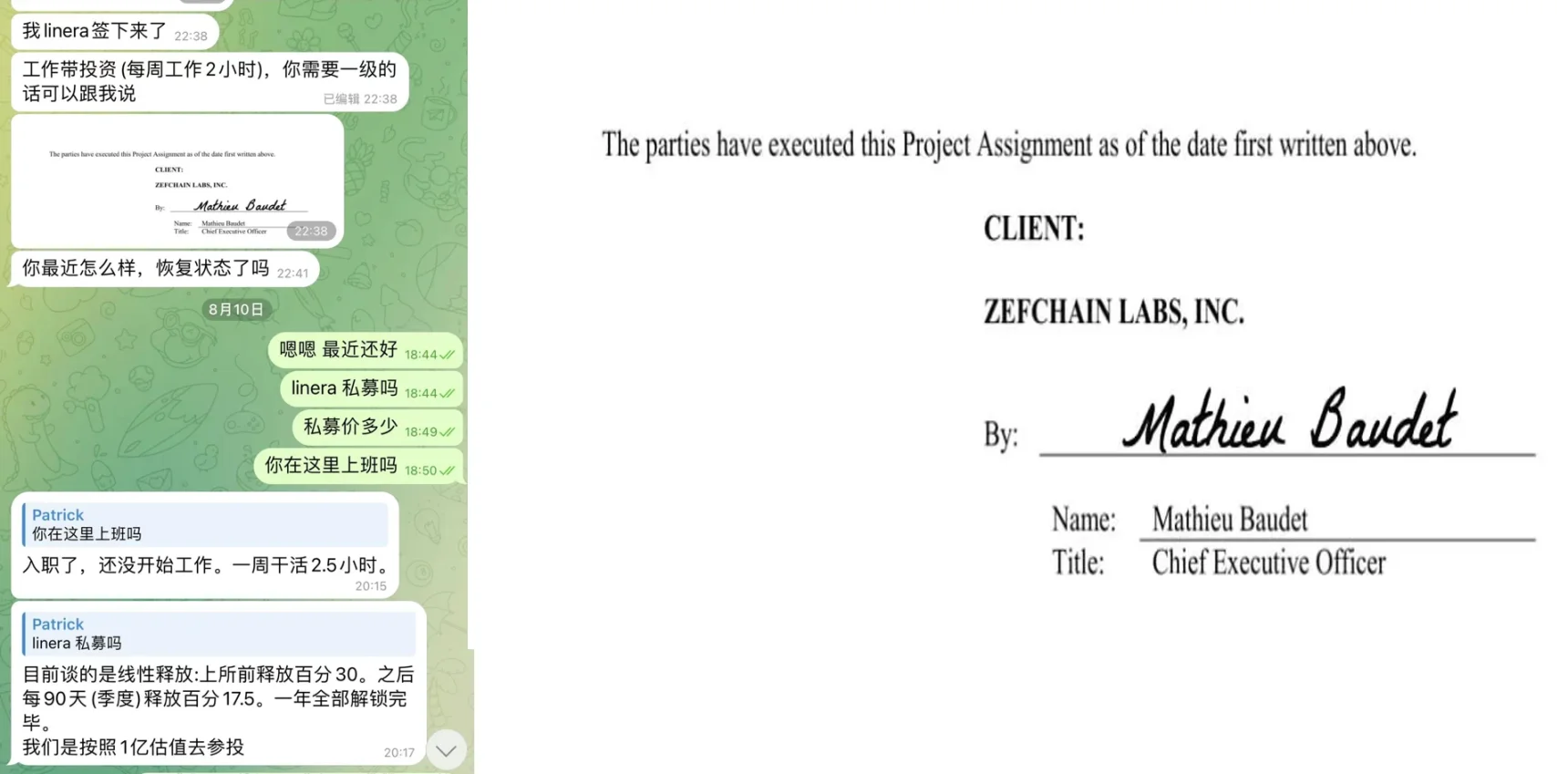

For nearly a year, the fraudster remained active in the community, occasionally releasing his own updates, such as joining the APTOS Foundation and becoming a member of the foundation; he also revealed chat screenshots with official personnel from Sui, showing the close relationship between the two; later, he also revealed that he had joined the core team of the Linera public chain. Below are screenshots of the fraudster's proof of information.

During this time, the fraudster often updated information about related projects, and the community members felt that the information description was quite realistic. At the same time, he often went to Taiwan, Singapore, and Hong Kong to participate in events, packaging his own identity.

The awakening from the dream, the private placement scam is exposed

But dreams are bound to be shattered one day. On November 12, the unlocking time for the private placement arrived.

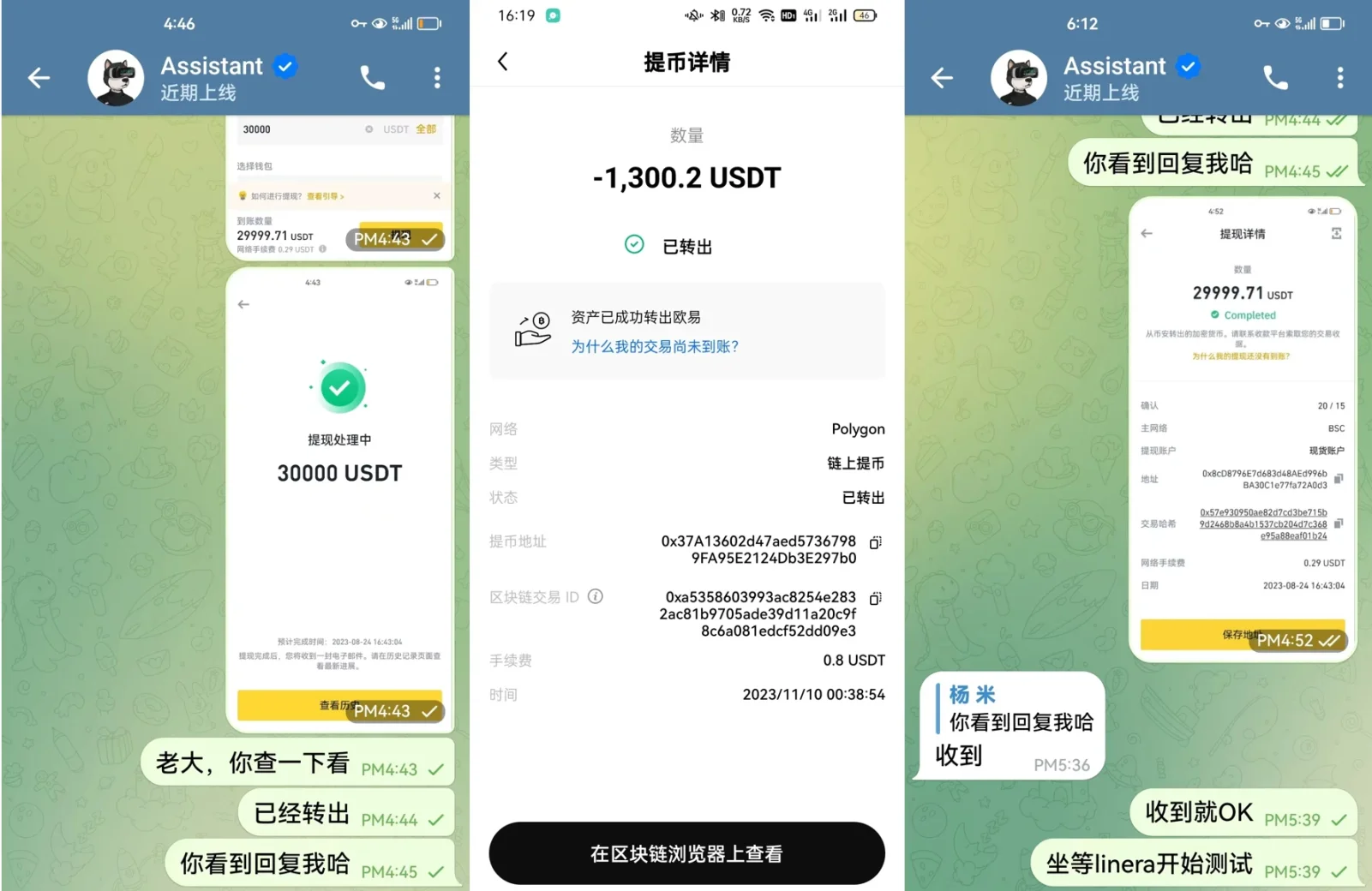

At this time, the fraudster did not show his "fangs" yet, still explaining to the community members that the official did not want to unlock all at once, but after his unremitting efforts, he finally distributed it to everyone on November 17. The whole behavior seemed very sincere, like an actor in disguise.

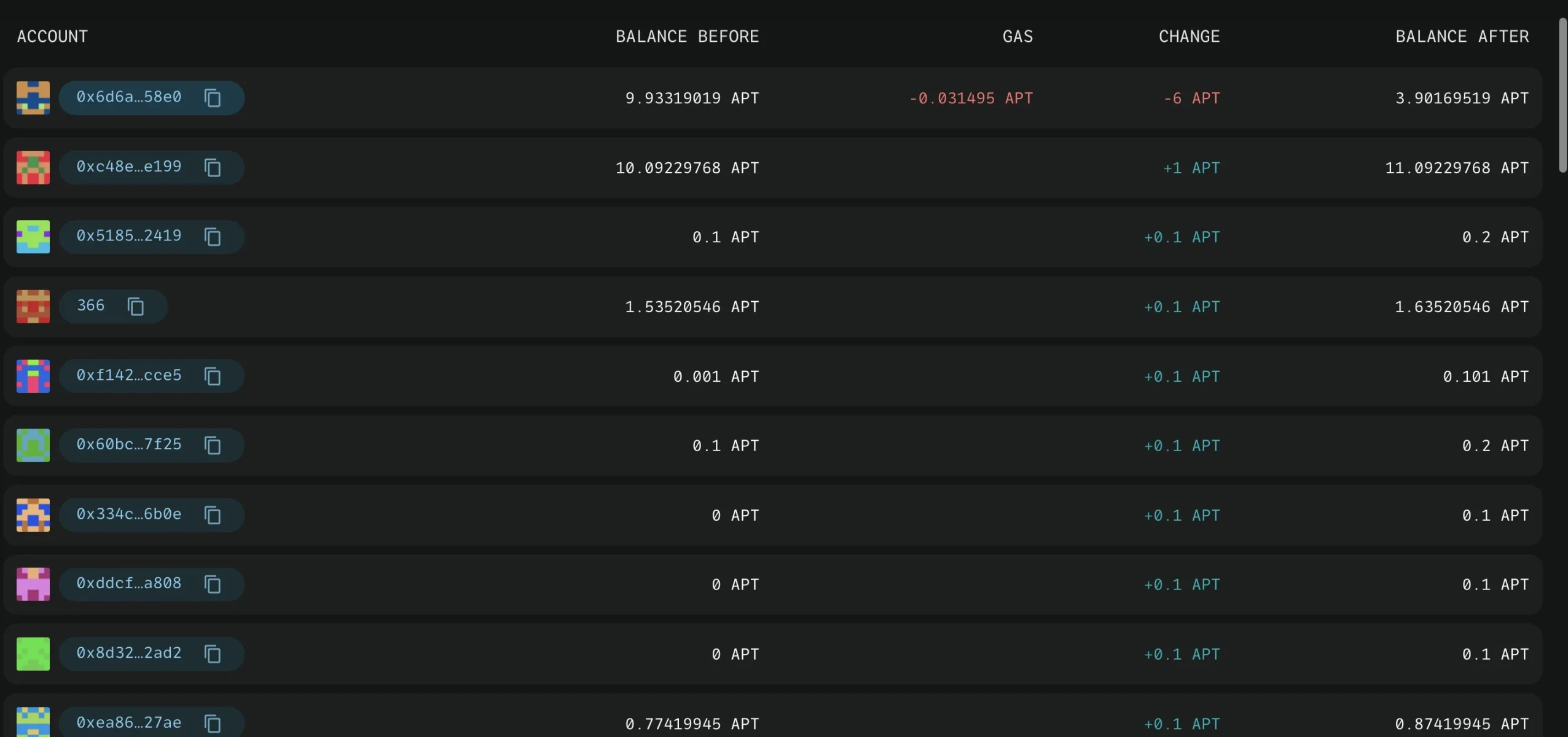

Afterwards, he also proposed to test the wallet addresses reported by everyone before, and transfer 0.1 APT to each deceived person to test if the accounts were usable.

On the morning of November 17, the victims found that the fraudster's related communities had all been disbanded, and the social media accounts had all been cancelled, and the related traces had been cleaned up very thoroughly. The previously promised unlocking of the private placement tokens had not been fulfilled.

It was not until this moment that the victims woke up from the dream and realized that they had been deceived. Angry victims began to post on social media, offering a high reward for information about the fraudster, but the harvest was minimal. More victims began to gather together, actively discussing countermeasures, trying to make up for their losses.

The story of private placement fraud is not uncommon, but there has always been a question lingering in everyone's mind: why did the fraudster continue to disguise his identity for over a year after succeeding? Could it be that the information about the previous private placement rounds of related projects was all true, and the scam was only dissolved after the tokens were unlocked and transferred to the fraudster's own account?

According to the victims' accounts, the fraudster used similar methods to privately chat with users in other communities throughout the year; in addition to Aptos' private placement financing, Sui, Linera, ZKS, and Starknet projects were all used for private placement fraud.

Regarding the issue of recovering the victims' assets, Ms. Xiao Sa, a member of the China Banking Law Research Association, told Odaily Planet Daily: "Without a signed agreement, only WeChat chat records and on-chain token transfer records, which means that even if they enter into litigation, investors may face the risk of not being able to provide evidence. In addition, the investment target is virtual currency, and its 'transfer' is done through wallet addresses, although the records are stored on the Internet, the query channels need to be done on various major coin circle websites. Therefore, when investors present transaction records to judicial authorities, the evidential effectiveness of website query results may be insufficient compared to bank transfer records, and it is highly likely that they will not be able to meet various litigation proof standards; secondly, the real-name information of the wallet address cannot be directly reflected in the query results, so it will also be difficult to prove that the recipient is the corresponding party in communication."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。