Title: In-depth Analysis of Celestia's Core Mechanism: How Much Should TIA Be Estimated Under the Trend of Modularity?

Author: Poopman

Translator: BlockBeats

Editor's Note: In this article, encryption researcher Poopman provides a detailed analysis of Celestia's core mechanism and future potential. The article mainly focuses on Celestia as a modular data availability (DA) layer, detailing its working principles, data availability sampling (DAS), Namespace Merkle Tree (NMT), and other key technologies, emphasizing Celestia's advantage in addressing the increasing processing costs associated with on-chain activities in holistic blockchains. Additionally, the article discusses Celestia's future development direction, including the introduction of Quantum Gravity Bridge and Cevmos, elucidating why Poopman believes that a market value target exceeding 2 billion USD for TIA as its native token is reasonable.

In holistic blockchains, as on-chain activities increase, processing costs also rise. However, Celestia addresses scalability issues by utilizing a modular data availability (DA) network, maintaining relatively stable validation costs.

In this article, I will discuss the following 7 aspects:

What is Celestia?

Holistic vs. Modular

What is Data Availability (DA)?

Data Availability Sampling (DAS)

Namespace Merkle Tree (NMT)

Three Major Work Designs of Celestia

Use Cases of TIA and the Future of Celestia

What is Celestia?

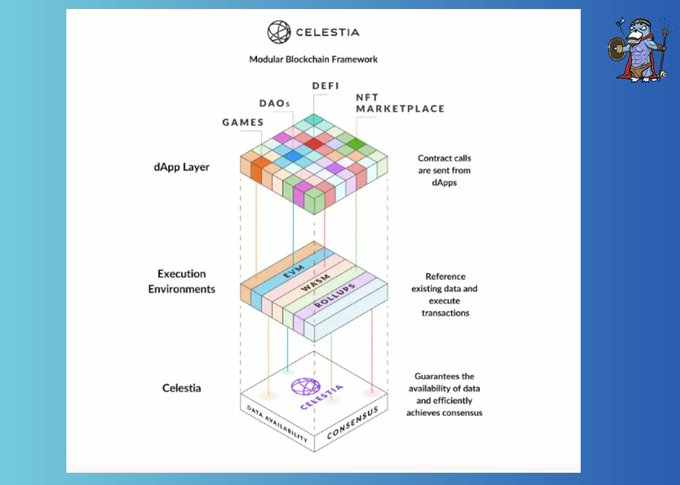

Celestia is a modular DA layer that allows applications/Rollups to be deployed on top of Celestia's existing DA and consensus layers. Therefore, applications can focus on execution while leaving the DA and consensus work to be handled by Celestia. To better understand this, it is necessary to grasp the basic knowledge of data availability (DA), holistic, and modular networks.

Holistic vs. Modular

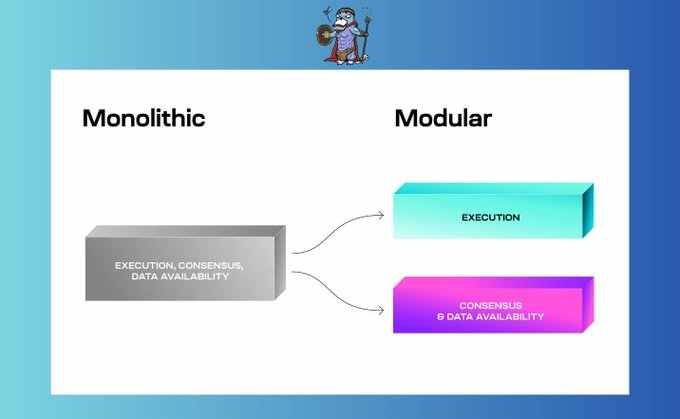

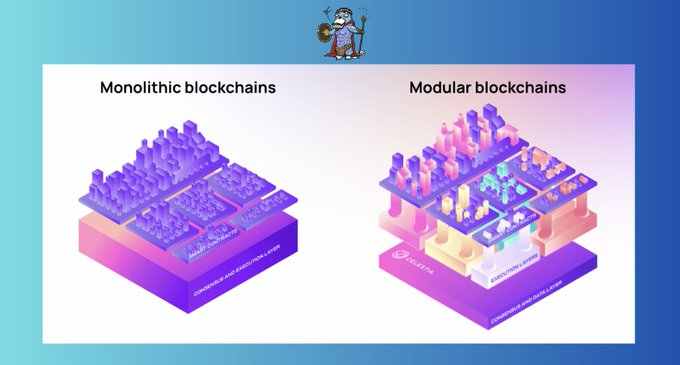

Holistic: In blockchain networks like Solana or Avalanche, a complete node must perform all four responsibilities of the blockchain, including execution, settlement, data availability (DA), and consensus.

However, as network traffic increases, the network burden also grows, making transaction costs more expensive.

To address this issue, modular blockchains decompose the network into several independent modules, providing flexibility for different modules to be upgraded and independently handle tasks. For example, Celestia only handles DA and consensus layers, while Dapps are responsible for execution, and so on.

What is Data Availability (DA)?

Data Availability (DA) refers to the accessibility of transaction data for nodes in the network. DA also needs to ensure that transaction data is not susceptible to malicious attacks, which could occur if block proposers only publish block headers without the transaction data.

To alleviate the burden on the network, some off-chain solutions can store transaction data elsewhere. Common off-chain solutions include:

Data Availability Committee (DAC);

Data Availability Network (DAN).

Among all DANs, Celestia is the most popular choice. Celestia is a modular DA layer consisting of two important functions:

Data Availability Sampling (DAS);

Namespace Merkle Tree (NMT).

Data Availability Sampling (DAS)

First, light clients only download block headers (similar to a summary of block data). To prevent light clients from accepting malicious transactions, DAS allows light clients to conduct multi-round random sampling of different parts of block data.

As the number of sampling rounds increases, confidence in data availability also grows. Once a 99% confidence level is reached, the data is considered "valid" and available. To make DAS in Celestia possible, they have adopted a 2D Reed-Solomon encoding scheme.

What is the 2D Reed-Solomon Encoding Scheme?

In simple terms, if all block data is imagined as a large puzzle composed of K x K blocks, Celestia uses a 2K x 2K block and the "Reed-Solomon encoding" scheme to rearrange this data into a larger puzzle.

Afterward, light nodes randomly select a few puzzle pieces and query full nodes for the corresponding data. If full nodes consistently provide answers, the likelihood of the data being "valid" increases.

Additionally, as long as light clients on Celestia sample enough data, full nodes can reconstruct complete block data. In other words, the more light clients Celestia has, the more transactions they can handle, and the larger the blocks they can process.

Namespace Merkle Tree (NMT)

Simultaneously, data in Celestia is divided into different parts (i.e., namespaces). Each namespace corresponds to a specific application using the DA layer. This helps applications download their own data while ignoring data from other applications.

To organize and verify data, Celestia uses NMT to sort data by namespace identifiers. Now, each node in the Merkle tree has a series of namespaces exclusive to that node, enabling Celestia to provide proofs of data integrity.

Three Major Work Designs of Celestia

Combining DAS and NMT, the main work designs of Celestia can be summarized as:

1. Celestia only provides data availability and consensus layer services, without handling settlement and execution.

Execution is handled by applications. This gives them higher scalability compared to holistic blockchains, as they delegate DA to Celestia and utilize DAS to enhance scalability.

2. Security increases with the number of light clients.

The more light clients there are in Celestia, the greater the likelihood of full nodes reconstructing original block data. Additionally, more light clients mean larger blocks without sacrificing decentralization.

3. Interoperability

Finally, Cosmos allows Celestia to connect to networks supporting IBC, enabling interoperability between all chains built on top of Celestia.

Future Prospects of Celestia

Celestia has two exciting development directions:

Quantum Gravity Bridge

Cevmos

Quantum Gravity Bridge: QGB will enable Celestia to connect with any EVM-compatible chain beyond the universe, including ETH and AVAX, bringing more liquidity.

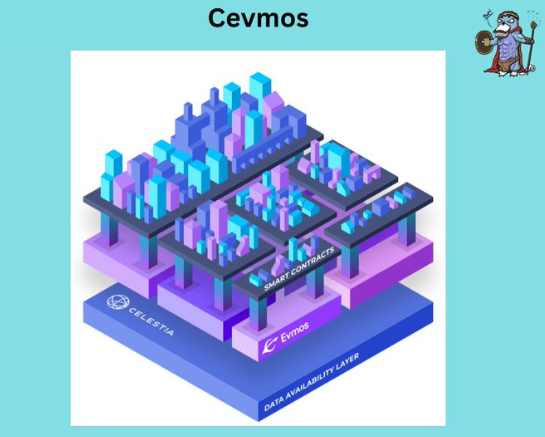

Cevmos: Cevmos is a Cosmos SDK chain designed specifically for Rollup settlement. The integration of EVM functionality in this chain allows ETH Rollups to upload their data to Cevmos, which is then passed on to Celestia, improving the connection between the EVM and Celestia ecosystems.

TIA

TIA is the native token of Celestia:

- Fully Diluted Valuation (FDV): 60 billion USD

- Circulating Supply: 8.46 billion USD (4.1%)

The utility of the token includes:

- Rollup/developers pay TIA for data publication, with fees determined by fixed and variable costs

- Use of TIA as the native GAS token for Rollup

- Governance

- Staking

Investing in TIA implies that users are betting on more Rollups and applications using Celestia as their DA and consensus layer, all of which require TIA for data publication.

Optimistically, with the increasing demand for the DA layer, more stakers will be attracted to stake TIA for data processing, forming a stronger and more secure network.

With the development of the Quantum Gravity Bridge and Cevmos, I believe that holding TIA for the long term (HODL) is reasonable, and I estimate a market value target of over 20 billion USD.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。