Original | Odaily Planet Daily

Author | Azuma

OKX market data shows that the decentralized derivative protocol (now perhaps should be called a network) dYdX (DYDX) has surged significantly today, reaching a peak of 4.1 USDT at one point, and as of the time of writing, it is temporarily reported at 3.94 USDT, with a 24-hour increase of 15.66%.

It's not difficult to find the key events that have driven the current surge of DYDX.

On the evening of November 13th, the governance proposal #1 for dYdXChain, which aims to activate all trading markets, was successfully passed. This means that dYdX Chain has transitioned to the Beta stage, and trading functions have been officially activated on dYdX Chain. In other words, the long-awaited v4 version of dYdX has been successfully launched, and users can now freely trade on the v4 market.

As a key milestone in the dYdX roadmap, the landing of v4 is undoubtedly a long-awaited positive development for the market. However, the extent to which this upgrade can bring new momentum to the DYDX token still requires a more intuitive analysis by the market.

In June of this year, dYdX announced the most important news about the v4 version —— it will transition from the Ethereum ecosystem to the Cosmos ecosystem, and dYdX Chain, based on the Cosmos SDK, will serve as the foundation for the v4 version.

The significance of this transformation lies in the fact that DYDX has achieved an upgrade in its positioning.

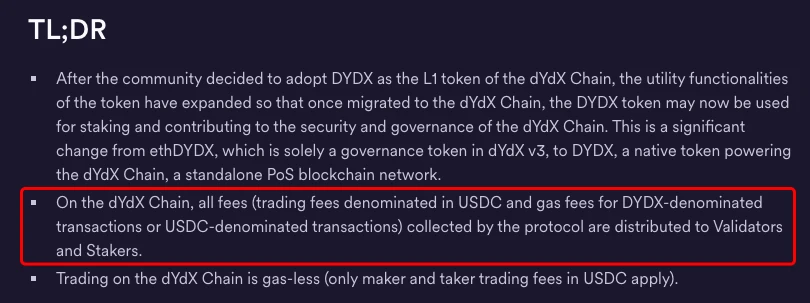

Originally, the ERC-20 version of DYDX on Ethereum (referred to as ethDYDX for distinction) only had governance utility for the v3 version of the protocol, but could not share protocol income. However, with the launch of dYdX Chain, the DYDX tokens bridged from ethDYDX at a 1:1 ratio will become the native token of dYdX Chain, thus unlocking more new utilities for DYDX beyond governance.

According to the dYdX Foundation, on dYdX Chain, all fees collected by the protocol (including trading fees denominated in USDC, gas fees for transactions denominated in DYDX or USDC) will be distributed to all participants staking DYDX, including validators and stakers.

It is worth noting that 100% of the fee income will flow to the DYDX staking community, and the income composition includes not only DYDX, which has a certain degree of volatility, but also the stablecoin USDC.

According to dYdX founder Antonio Juliano, in order to ensure that dYdX Chain is always controlled by the community, dYdX's development parent company, dYdX Trading, and its employees will not participate in staking DYDX.

About two weeks ago, dYdX Chain completed the mainnet genesis and subsequently activated DYDX staking on the chain.

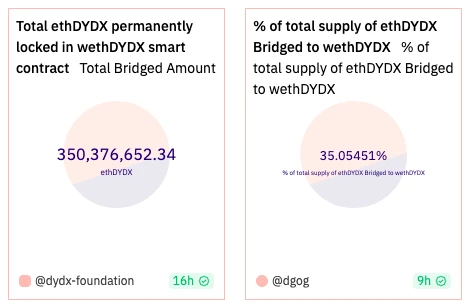

On-chain data shows that as of the time of writing, approximately 350 million ethDYDX tokens have completed the migration to dYdX Chain, and the amount of staked DYDX tokens has approached 10 million.

However, since the trading function on dYdX Chain has just been activated, the overall trading volume is still relatively low for the time being. There have been only 609 transactions in the past 24 hours, with open interest contracts totaling only about $10,000, and the total trading volume is only $30,000. Based on this data, the actual income share that staked DYDX can currently receive can be temporarily ignored. Perhaps for this reason, the official staking interface of dYdX has not yet provided the expected staking yield (APR) for DYDX.

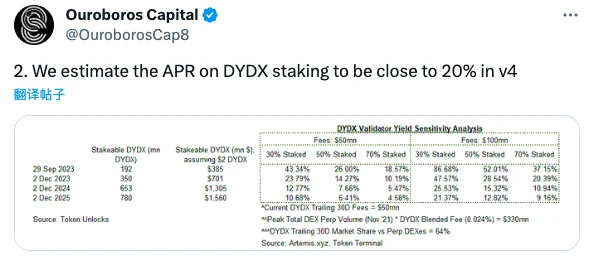

So, if dYdX v4 gradually scales up, what level of income can DYDX expect to receive? In theory, this data will be directly linked to the overall staking rate of DYDX and the actual trading volume of the v4 market. Crypto hedge fund Ouroboros Capital has previously provided a forecast of 20% APR through calculations, but this is just one opinion, and the specific situation still needs to be verified by subsequent facts.

In summary, the landing of the v4 version has upgraded the token positioning of DYDX, unlocking new potential income possibilities and improving the market's value expectations for the token.

Finally, it is important to emphasize that the content of this article is only a logical analysis of the recent developments of dYdX and does not involve investment advice. From a risk perspective, one is that DYDX will face a large unlock in December, and secondly, the transition of dYdX to the Cosmos ecosystem will also face certain challenges in expanding liquidity (compared to the Ethereum ecosystem), which may directly affect the market performance of the v4 version. Therefore, please consider carefully before taking any action, and DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。