Author: RockFlow

Key Points

① ETF is a special form of fund. It can track any target, such as major indices, industry indices, prices of certain commodities, and even specific investment strategies.

② With the help of ETFs, ordinary investors can "one-click invest" in a variety of assets, with low trading costs and good liquidity.

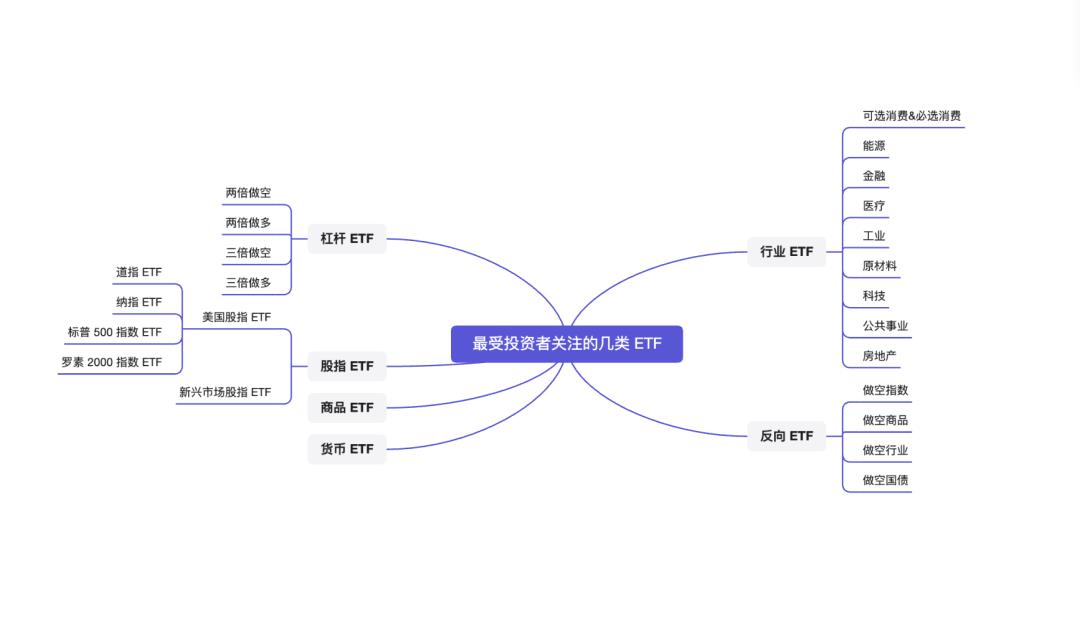

③ ETF has four important categories: industry ETFs, inverse ETFs, leveraged ETFs, and stock index ETFs. Industry ETFs invest in specific industries; inverse ETFs move opposite to the target (if the target falls, the ETF rises, and vice versa); leveraged ETFs can produce multiple effects, with the target's rise and fall causing the ETF to fluctuate by multiple times; stock index ETFs track a specific stock index.

The 1987 stock market crash in the United States brought profound lessons to investors, but also gave birth to an extraordinary financial innovation for future generations - ETFs.

On October 19 of that year, the Dow Jones Industrial Average plummeted by 22.6%, marking the largest single-day decline in history. The government quickly increased trading regulations, but did not solve the problem of insufficient liquidity. The market urgently needed a simple, reliable, and effective mechanism to hedge stock portfolio risks, giving birth to the idea of a "basket of stocks".

After several years of exploration, the first ETF that truly tracked the S&P 500 Index was launched by the American Stock Exchange in 1993 - SPDR. To this day, SPDR remains the world's largest and most popular ETF product.

In the following thirty years, the types of ETFs have become extremely diverse. The U.S. stock market has successively introduced cross-border, industry, commodity, leveraged, inverse, actively managed, and rotational FOF varieties. As of mid-2023, the global AUM of ETFs has reached a staggering $10 trillion (with U.S. stock ETFs contributing nearly 70%).

Why are ETFs suitable for ordinary investors? What exactly are they? How to choose the right category for yourself? The RockFlow research team will answer these questions in the following articles.

1. What is an ETF?

ETF stands for Exchange Traded Funds, which provide investors with a relatively inexpensive way to invest in a large number of assets and indices.

It can be understood as follows: the issuing institution buys all the stocks tracked by a certain index, combines them to form a new fund, and then sells them in small pieces. This makes it a typical ETF. Buying this ETF is equivalent to buying all the stocks in this index.

The advantage of ETFs is that ordinary investors can "one-click invest" in a variety of assets, with low trading costs and high liquidity.

Therefore, it has developed rapidly in North America, with a wide variety: tracking major indices, industry indices, and even stock market indices of other countries... There are also those that track bonds, gold, oil, foreign exchange, and agricultural product prices, among other types. The structure of ETFs can track any target, from the price of a single commodity to a large and diverse collection of securities, and can even track a specific investment strategy.

Now, more and more investors are starting to trade ETFs. According to statistics, more than half of the daily trading volume on the three major U.S. stock exchanges is in ETFs.

In addition, ETFs are particularly suitable for medium to long-term investors, as they are most concerned with the "big picture", do not have the energy to research various company performances, and do not want to see their investment portfolios fluctuate greatly due to unexpected events (holding individual stocks often experiences this phenomenon). These investors can choose several highly liquid ETFs, buy in at the right price, wait for the trend to reverse, and sell out, with few trades per year, relatively low risk, and the ability to sleep soundly.

2. Various Types of ETFs

Investors can choose various types of ETFs, including passive & active ETFs, bond & stock & commodity & currency ETFs, and long & short ETFs, according to different classification methods.

Passive ETFs replicate the performance of a certain securities index (such as the S&P 500 Index, Nasdaq Index, etc.) to achieve a return rate that is basically the same as that of the index, or more specifically, a certain target industry; actively managed ETFs are managed by fund companies, equivalent to giving money to fund managers to trade stocks on their behalf. For example, the ARK Innovation ETF managed by the female version of Warren Buffett, Cathie Wood, depends on the skill of the fund manager to make money. Its costs are slightly higher than passive ETFs, but its range of investments and potential return limits are much higher.

If classified by target, stock ETFs are the most common, with many subcategories; currency ETFs mainly track currency exchange rate trends; bond ETFs are mainly in the bond market, and returns depend on the performance of the underlying bonds. Returns are relatively stable, with lower potential returns compared to other ETFs; and commodity ETFs include related ETFs such as oil, gold, silver, and others.

If classified by direction, a positive ETF, such as the S&P 500 ETF (SPY), tracks the rise and fall of the S&P 500 Index. In theory, if the index rises by 1%, the ETF also rises by 1%; a reverse ETF, such as shorting the S&P 500 (SH), also tracks the S&P 500 Index, but the rise and fall are in the opposite direction. In theory, if the S&P 500 Index rises by 1%, this ETF falls by 1%, and if the S&P 500 Index falls by 1%, this ETF rises by 1%.

Below, we will provide a detailed introduction to the four most popular types of ETFs—industry ETFs, reverse ETFs, leveraged ETFs, and stock index ETFs.

2.1) Industry ETF

An industry ETF is a fund that invests in a specific industry. If you are bullish on a certain industry, you can choose to invest in an ETF that tracks that industry, bypassing the stock selection process and gaining the overall returns of that industry.

In recent years, hot (and currently popular) industries include consumer goods, the internet, AI, and others. If you have a deep understanding of a particular industry, you can anticipate the industry's cycles and make heavy bets.

Clearly, industry ETFs are more suitable for investors with strong analytical abilities. Its advantage is that if chosen correctly, it is possible to achieve returns higher than the market average; but the downside is also obvious, as betting on a specific industry can result in wasted time and sunk costs if the industry enters a downturn at a high point.

The current 10 major industry categories in the U.S. stock market include consumer discretionary, consumer staples, energy, financials, healthcare, industrials, materials, technology, utilities, and real estate, all of which track the components of the Dow Jones and S&P indices. The latest "Industry Select ETF" released by the RockFlow research team has selected high-liquidity and representative industry ETFs for everyone (for the overall reading experience, the image below only shows a partial display):

2.2) Reverse ETF

We all know that although the main stock indices in the U.S. have a long-term upward trend, they also experience short-term violent adjustments or prolonged stagnation. In a bear market, investors can actively respond and even profit from it, using one of the most commonly used tools, the reverse exchange-traded fund, or reverse ETF.

It is also called a short ETF, and it profits from the decline in the underlying asset or market index using derivative contracts. It is the opposite of the related asset. As much as the related asset falls, it rises, and conversely, as much as the related asset rises, it falls. Compared to short selling or buying put options, the main advantage of reverse ETFs is their simplicity and ease of operation, making them more popular among some investors.

It is important to note that reverse ETFs refer to the daily rise and fall of the related index, not the cumulative rise and fall over a period of time, so they are only suitable for intraday trading and not for long-term holding, as this could lead to unnecessary losses.

The recently launched "Vanguard of the Bears ETF" stock list by the RockFlow research team has aggregated highly liquid reverse ETFs for major U.S. indices, as well as financials, real estate, Chinese stock indices, and other targets (for the overall reading experience, the image below only shows a partial display):

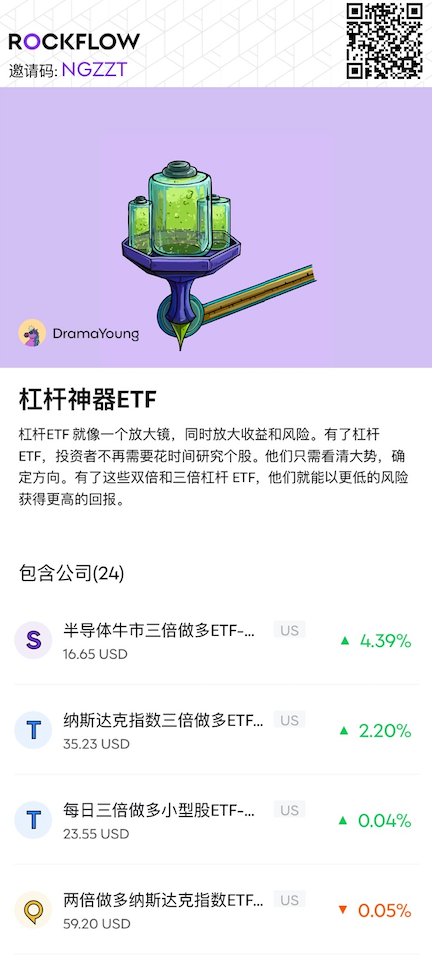

2.3) Leveraged ETF

Many investors are enthusiastic about stock trading and do not like ETFs, feeling that ETFs do not offer high returns and are not stimulating enough. In fact, there are also leveraged ETFs in the U.S. stock market that offer double and triple returns, fully meeting investors' needs for (relatively) low-risk and high returns. Also known as multiple ETFs, they achieve the effect of tracking index multiples by holding a basket of underlying derivatives, acting like a magnifying glass, amplifying both returns and risks.

Compared to stock index futures, margin trading, and other aggressive leverage tools, the advantage of leveraged ETFs lies in their lower entry barriers, both in terms of capital and expertise. They have no position limits, no need to pay margin, and lower operational risks. For investors seeking leveraged investments, they are more efficient and convenient.

The RockFlow research team has recently aggregated highly liquid leveraged ETFs for major U.S. indices and popular industries (such as semiconductors), forming a high-quality "Leverage Artifact ETF" stock list for interested investors. With these leveraged ETFs, you can also leverage high returns with a smaller capital (for the overall reading experience, the image below only shows a partial display):

2.4) Stock Index ETF

A stock index ETF tracks a specific stock index. In the U.S. stock market, the four major indices are the Dow Jones Industrial Average, the Nasdaq 100 Index, the S&P 500, and the Russell 2000. Each of these tracks the overall market, technology stocks, large-cap stocks, and small and mid-cap companies, respectively.

How do they specifically achieve this?

-

The Dow Jones Index is one of the oldest indices in the U.S. stock market, consisting of the 30 largest and most well-known publicly traded companies in the U.S.;

-

The Nasdaq 100's 100 component stocks represent U.S. technology stocks, generally with high growth potential;

-

The S&P 500 is a comprehensive measure of the top 500 publicly traded companies in the U.S., used to reflect the ups and downs of the U.S. economy;

-

The Russell 2000 Index is composed of the smallest 2000 stocks in the Russell 3000 Index and is considered a barometer for small and mid-sized companies.

The latest stock list released by the RockFlow research team—U.S. Stock Index ETF, includes highly liquid ETFs tracking the four major indices in the U.S. stock market, making it easier for everyone to choose their preferred type for relatively stable investment.

Of course, stock index ETFs can be used for shorting as well. For example, DSQ is a mainstream ETF for shorting the Nasdaq 100 Index (for the overall reading experience, the image below only shows a partial display):

In addition to the above four types of ETFs, there are also commodity ETFs and currency ETFs.

Commodity ETFs invest in commodities such as crude oil or gold. They not only help achieve portfolio diversification, making it easier to hedge during economic downturns (for example, commodity ETFs can provide a buffer during stock market crashes), but also have lower costs than actually owning the commodity, as the former does not involve insurance, storage, and other expenses, making it very convenient.

Currency ETFs track the performance of currency pairs composed of domestic and foreign currencies. They have various uses, such as speculating on currency exchange rate prices based on a country's political and economic development, or allowing importers and exporters to achieve portfolio diversification or hedge against fluctuations in the foreign exchange market.

The above is an introduction to "What is an ETF," "Why it is suitable for ordinary investors," "How to classify and their respective characteristics." In the next article, we will specifically analyze how to choose ETFs and which types of ETFs are most worth long-term investment as of November 2023.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。