By: Deep Tide TechFlow

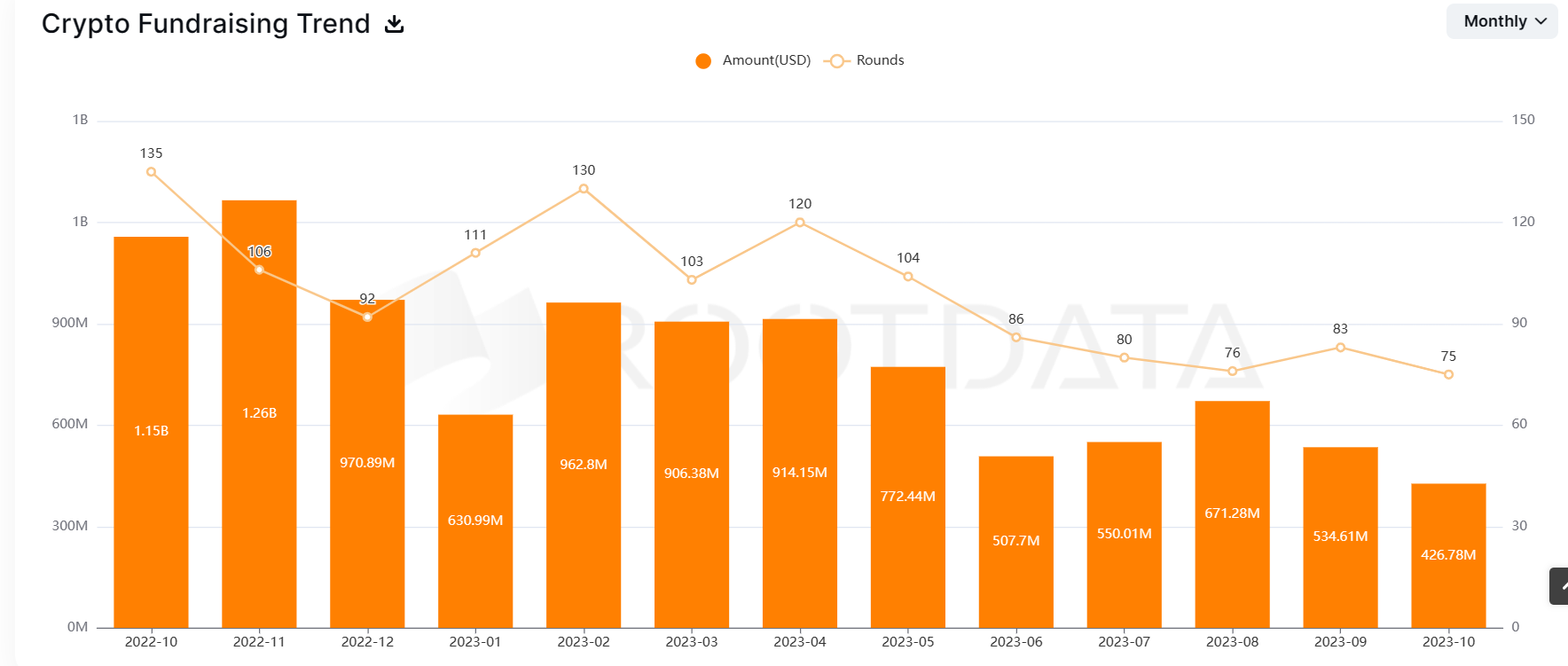

According to Rootdata, in October 2023, Web3 companies received 75 investments totaling approximately $427 million, hitting a new low since October 2022. This represents a decrease of about 20.19% from the $535 million raised in September.

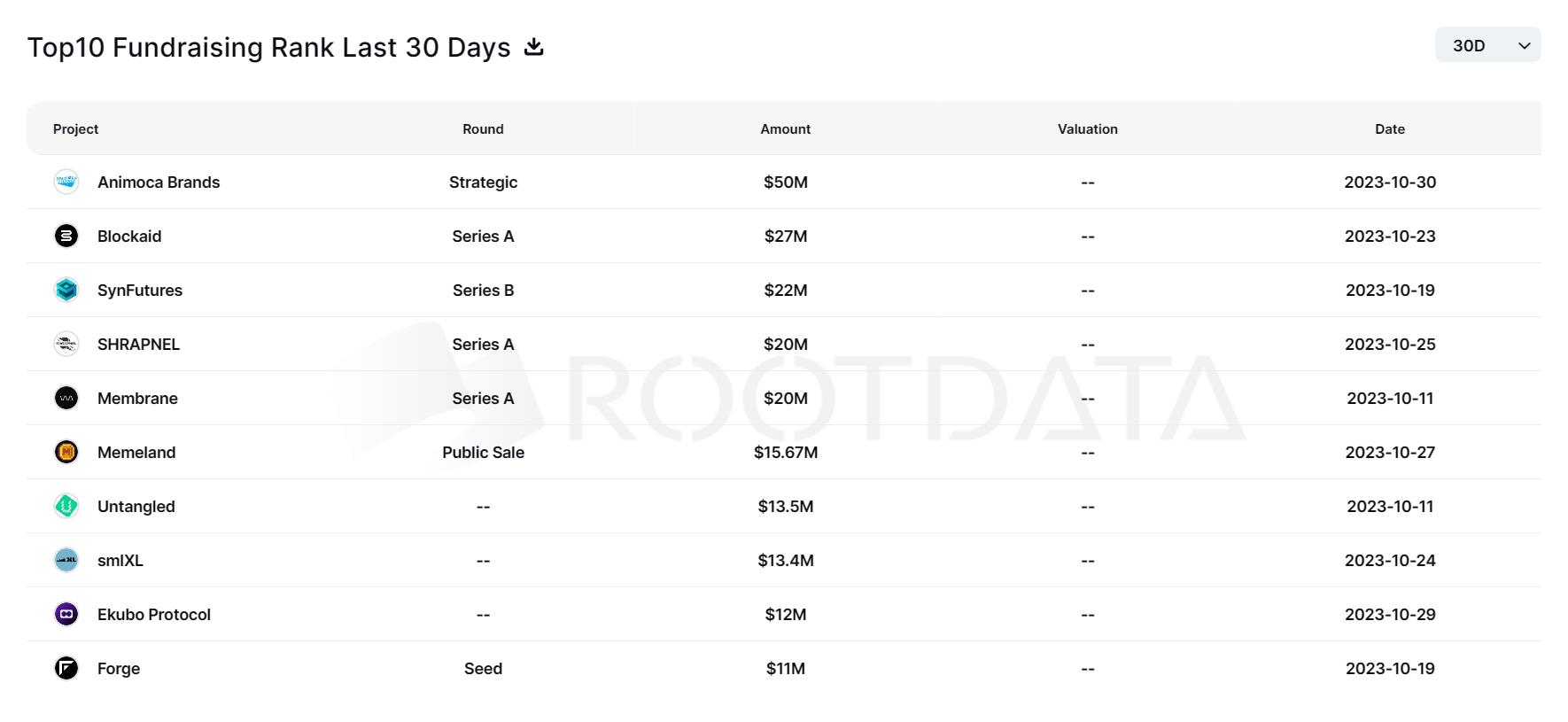

Top ten funded projects in October:

-

Animoca Brands ($50 million);

-

Web3 security startup Blockaid ($33 million);

-

Derivatives DEX SynFutures ($22 million);

-

Blockchain game developer Neon Machine for Shrapnel ($20 million);

-

Cryptocurrency exchange and lending platform Membrane ($20 million);

-

NFT project Memeland ($15.67 million);

-

RWA lending platform Untangled Finance ($13.5 million);

-

Cryptocurrency startup smlXL ($13.4 million);

-

Next-gen AMM on Starknet EkuboProtocol ($12 million);

-

Video game platform Forge ($11 million).

Which projects caught our interest?

Neon Machine (Shrapnel)

Overview: Neon Machine is a game studio based in Seattle. In October, it announced the completion of a $20 million Series A funding round, which will be used to further develop the shooting game Shrapnel. The company plans to release a beta version in December this year and a full release in 2024.

Shrapnel is being developed on the Avalanche subnetwork.

Investors: Polychain Capital, Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, Tess Ventures.

Highlights:

1. The team split from the well-known company HBO Interactive in 2014 and has been involved in the production of over 30 well-known games and films such as "Halo," "Call of Duty," and "Madden NFL," winning more than 40 entertainment awards. 2. Token economics are widely used: for example, they are used for releasing player-created content (PCC). All PCC on the platform will be published on-chain as NFT items using the SHRAP token. The SHRAP token is not only an in-game currency but also a key for community participation. 3. Their operatives series will appear in their upcoming independent comic series, which is one way to build a brand and IP. **Nocturne Labs** **Overview:** Nocturne is a protocol that supports private Ethereum accounts with built-in asset privacy features. Using a combination of account abstraction and zero-knowledge proofs, Nocturne has built a private account layer that allows users to send, receive, and trade their funds without exposing their addresses, completing a $6 million seed round. **Investors:** Bain Capital Crypto and Polychain Capital co-led the round, with Ethereum co-founder Vitalik Buterin, Bankless Ventures, Hack VC, Robot Ventures, and others participating. **Highlights:** 1. Building private user accounts directly on L1/L2 and compatible with existing Ethereum accounts. 2. Wallets are made more user-friendly with account abstraction, helping Web3 wallets attract more users, especially those with privacy needs, particularly related to on-chain transactions and gambling. 3. Investment recognition from Vitalik Buterin. **Noble** **Overview:** A dedicated blockchain in the Cosmos ecosystem designed for the issuance of native assets within the Cosmos ecosystem, as well as tokenizing and issuing real-world assets (RWA). **Investors:** Polychain Capital led the round, with participation from Borderless Capital, Circle Ventures, Wintermute Ventures, and others. **Highlights:** 1. Circle is the first issuer to launch its $USDC stablecoin on Noble. 2. Noble supports IBC, allowing it to connect to over 50 other IBC Appchains in Cosmos. 3. The Noble team is composed of respected Cosmos OGs (Zaki, Jelena, Jack, Stefan). **Virtual Labs** **Overview:** They are a startup focused on developing ZK technology, primarily in the ZK rollup field, aiming to use this technology to eliminate gas fees and simplify wallet interactions to enhance the user experience in the Web3 ecosystem. Their solution (e.g., Virtual Rollups) provides the ability to transact with 0 gas fees, instant processing, and seamless functionality across different blockchain networks. In October, they announced a $1.2 million funding. **Investors:** OP Crypto led the round, with participation from Byzantine Marine, Koyamaki Ventures, NEAR Foundation, and several individual angel investors. **Highlights:**1. The company's flagship product, Virtual Rollup, also known as "ZK State Channels," allows games, social platforms, and loyalty point providers to connect bundled infinite transactions and infinite players without the need for trust. 2. It has received support from the Binance Incubation Program. 3. They have partnered with Winner to eliminate over 90% of on-chain betting gas fees and delays, and plan to improve more on-chain betting/casino protocols. **MyShell** **Overview:** MyShell is an AI platform based on opBNB that allows users to create chatbots called "Shells." This Web3-centric AI project provides services for content creators and users. In October, MyShell announced the completion of a $5.6 million seed round, valuing the company at $57 million. **Investors:** INCE Capital led the round, with participation from Hashkey Capital, Folius Ventures, SevenX Ventures, OP Crypto, and others. **Highlights:** 1. Currently using highly practical AI chat tools, which can be used for English learning, directly TO C. 2. The token economics continue to evolve, matching its own development positioning from applications to data and computing. **Funding Details for Various Tracks:** **DEFI** - Solana ecosystem DEX Convergence, valued at $30 million, completed a $2.5 million pre-seed round with C² Ventures leading the investment, along with Big Brain Holdings, Israel Blockchain Association, Auros Global, and others participating. Convergence RFQ will support spot and derivative trading, expected to launch in early November, and aims to expand to Arbitrum. Additionally, Convergence RFQ has set the trading symbol for its governance token as CVG. - Liquidity staking ecosystem integrated with Curve, Accumulated Finance, completed a new private funding round with Curve, De Facto Capital, Stake DAO, and others participating. The Accumulated Finance team announced the launch of Accumulated Finance V2 protocol in August this year, which will provide incentivized liquidity staking and DeFi pools for mid-to-low market cap proof-of-stake protocols, based on the ACFI token governance, expected to be officially launched in early 2024. - Arbitrum ecosystem DeFi derivatives lending platform ParaFinance completed a $5 million seed round with OKX Ventures leading the investment, and participation from Uniswap Labs, Gate Labs, and Kosmos Ventures. - AirDAO received a $7.5 million investment from DWF Labs. The investment plan is divided into a one-year cliff period and a 36-month vesting plan, aimed at increasing the larger-scale adoption of the AirDAO ecosystem. - The first RWA perpetual DEX, Ostium Labs, completed a $3.5 million funding round, with General Catalyst, LocalGlobe, SIG, Balaji Srinivasan, and Alliance participating, and plans to launch the Arbitrum testnet in Q4. Ostium Labs aims to attract traditional commodity traders and cryptocurrency native traders by providing transparent and flexible alternatives for trading assets such as oil, bitcoin, and forex. - RWA lending platform Untangled Finance completed a $13.5 million funding round and launched on the Celo network. The platform plans to expand to Ethereum and Polygon through the Chainlink cross-chain interoperability protocol. Untangled aims to introduce traditional private credit markets to blockchain through tokenization, focusing on fintech (such as invoice financing and wage-based consumer loans) and "green asset" loans. The platform provides infrastructure to host blockchain-based credit pools, where investors deposit funds to lend and earn returns, and depositors receive ERC-20 tokens representing their positions.- Cryptocurrency trading and lending platform Membrane completed a $20 million Series A financing round, with QCP Capital, Electric Capital, Jump Crypto, GSR Markets, and Framework Ventures participating. The company initially established a settlement and clearing engine that allows institutions to choose where and how to custody funds, and then decides on the front end where and how to execute trades. - DeFi protocol Elixir, valued at $100 million, completed a $7.5 million Series A financing round, with Hack VC leading the investment and participation from NGC Ventures, AngelList Ventures, and others. Elixir allows users to provide liquidity directly to trading pairs on order book exchanges and earn market-making rewards with a risk-return profile similar to AMMs. Elixir's delegated proof-of-stake protocol is expected to launch on the mainnet in the coming weeks and plans to support permissionless market functions on dYdX V4 in early 2024. - Singapore-based derivative DEX SynFutures completed a $22 million Series B financing round, with Pantera Capital leading the investment and participation from HashKey Capital, SIG DT Investments, and others. The platform launched a new version V3 on the Ethereum testnet and is expected to go live on the mainnet later this year to early next year. SynFutures is open to the idea of launching a native token in the future. - Aera, a startup founded by Gauntlet's DeFi risk manager Tarun Chitra, completed an $8 million financing round, with Bain Capital Crypto leading the investment and Jump Trading participating. Aera aims to help DAOs manage their finances without sacrificing decentralization principles, providing them with crowdsourced portfolio management advice. - Next-generation AMM EkuboProtocol on Starknet completed a $12 million financing round, with Uniswap Labs participating. Uniswap contributed 3 million UNI tokens (approximately $12 million) in exchange for a 20% share of future Ekubo Protocol governance tokens. - Permissionless derivative exchange Surf Protocol completed a $3 million financing round, with ABCDE Capital leading the investment and participation from OP Crypto, C2 Ventures. The funding will be used to develop a permissionless Perp DEX based on the Base network. Surf Protocol aims to provide users with a more diverse range of tradable Perp assets while reducing user trading slippage. - L1&L2: Cosmos ecosystem Move L1 project Initia received investment from Binance Labs, with the amount undisclosed. The funds raised will be used to develop Initia infrastructure and developer tools. The project is still in the development phase on the testnet. - Cosmos ecosystem application chain Noble development company NASD completed a $3.3 million seed round, with Polychain Capital leading the investment and participation from Borderless Capital, Circle Ventures, Wintermute Ventures, and others. Noble will be the first non-EVM blockchain supported by Circle's CCTP. Noble is built for the issuance of native assets for the Cosmos and IBC ecosystem and launched its mainnet on March 27th. - GameFi platform NexGami, combining traditional games with Web3.0, completed a $2 million seed round, with Polygon Ventures, Fundamental Labs, and Ledger Capital participating, valuing the company at $20 million. NexGami aims to provide seamless integration solutions for game products and enhance the gaming experience for users within the Polygon network, bringing non-crypto game users into the GameFi ecosystem. - NFT-driven fantasy horse racing startup Game of Silks completed a $5 million financing round, with participation from Duncan Taylor. Game of Silks issues NFTs related to thoroughbred horses, and the owners can earn rewards based on the real-world performance of the horse corresponding to the NFT. The company was founded in June 2021 and has partnerships with organizations such as the New York Racing Association, Belmont Park, the Jockey Club, and Americas Best Racing under Fox Sports.- Subsidiary of Animoca Brands, Darewise, completed a $3.5 million private financing round, with Gamefi Ventures, London Real Ventures, Citizen Capital, Blocore, Animoca Ventures, and Animoca Brands co-founder and chairman Yat Siu participating. Darewise plans to launch the first metaverse ecosystem token based on the Bitcoin blockchain, which is expected to be released in early 2024 with support from ApeCoin strategic technology provider Horizen Labs. - Video game platform Forge completed a $11 million seed financing round, with Makers Fund, BITKRAFT Ventures, and Animoca Brands leading the investment, and participation from Hashkey Capital, Polygon Ventures, Formless Capital, and Adaverse, and is open to player testing. - Metaverse game Upland, based on EOS, completed a $7 million A+ financing round, with EOS Network Ventures leading the investment, and participation from Animoca Brands and C3 Venture Capital, and plans to launch a token on Ethereum. The funding will be used to add game features to support players in purchasing digital land on real-world maps. - Third Time, the parent company of the Solana-based horse racing game Photo Finish LIVE, completed a $2 million seed financing round, with Sfermion leading the investment, and participation from Reciprocal Ventures, Big Brain Holdings, 32-Bit Ventures, and 6th Man Ventures. Third Time launched the game earlier this year. - Game platform HYTOPIA (formerly NFT Worlds) completed a $3 million financing round, with Delphi Digital leading the investment, and participation from several VCs and angel investors, and is set to launch a public beta. HYTOPIA integrates social features and provides developers with a Minecraft-inspired game creation toolkit with flexible monetization. It is building a transparent and open monetization layer supported by its proprietary L2 blockchain and TOPIA support. - Neon Machine, the developer of blockchain game Shrapnel, completed a $20 million Series A financing round, with Polychain leading the investment, and participation from Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, and others. The funding will be used to further develop its shooting game "Shrapnel," with plans to release a beta version in December and a full release in 2024. - Web3 game studio Moonveil Entertainment completed a $5.4 million seed financing round, with Gumi Cryptos Capital and Arcane Group leading the investment, and participation from LongHash Ventures, IOSG, and Infinity Venture Crypto. Moonveil Entertainment's first game, Astrark: STAGE ONE, is an immersive tower defense mobile game centered around PvP and PvE battles and multiplayer cooperative experiences. The second game is a multiplayer strategy game, with information set to be released in November. - Infrastructure: Blockchain product development company Trinetix received a $10 million strategic investment from investment fund Hypra to expand its presence in the Latin American market. Trinetix primarily provides blockchain engineering solutions, smart automation services, and cloud support to global enterprises, including clients such as Coca-Cola, Procter & Gamble, and ExxonMobil. - Fairblock Network, a privacy infrastructure provider built on the Cosmos SDK, completed a $2.5 million pre-seed financing round, with Galileo leading the investment, and participation from GSR, Robot Ventures, and Reverie. Fairblock aims to make conditional decryption and pre-execution privacy a reality, and its blockchain recently upgraded to the second private testnet, with plans to launch a public testnet soon. - Bitcoin infrastructure company OrdinalsBot completed a $1 million financing round, with participation from Lightning Ventures, Bitcoin Magazine Ecosystem Fund, Bitcoin Frontier Fund, Angsana Investments, and Deep Ventures. OrdinalsBot recently launched an SDK product to provide seamless integration tools for developers. - On-chain crypto data analytics platform Parsec announced a $4 million financing round, with Galaxy Digital leading the investment, and participation from Uniswap Labs Ventures, Robot Ventures, CMT Digital, and others. Parsec also launched a DeFi and NFT analytics product called "Team" and opened its API to the public.- Cryptocurrency wallet provider Account Labs completed a $7.7 million financing round, with lead investments from Amber Group, MixMarvel DAO Ventures, and Qiming Venture Partners. Simultaneously, they launched the self-custody smart wallet UniPass Wallet, which focuses on peer-to-peer (P2P) stablecoin transfers and utilizes account abstraction to improve user experience. - The holding company Virgo Group, which operates the Canadian compliant cryptocurrency platform VirgoCX and the Australian exchange platform Virgo.co, completed a $5 million CAD financing round, with investments from Waterdrip Capital, Skylean Capital, Nextport Capital, and others. The new funding will be used to develop its compliant entities and continue its expansion into new regions, further solidifying its integrated ecosystem from trading to asset management. - AI platform MyShell, based on opBNB, completed a $5.6 million seed financing round at a valuation of $57 million, with INCE Capital leading the investment, and participation from Hashkey Capital, Folius Ventures, SevenX Ventures, and OP Crypto. The platform targets content creators and consumers, allowing creators to generate AI content robots and consumers to find and use these robots. It is also set to release a professional legal master model designed specifically for role-playing and character creation. - Squads Labs, the main developer of the Solana-based multi-signature protocol Squads, completed a $5.7 million strategic financing round with lead investment from Placeholder VC, and participation from Multicoin Capital, Solana Ventures, Jump Crypto, and others. They also launched SquadsX, the first multi-signature network extension wallet on Solana, which is still in the testing phase. - Web3 file management app Fileverse completed a $1.5 million seed financing round, with lead investments from Gnosis Chain and actor, and participation from Safe, Mask Network, Arweave EcosystemGalxe, and former Coinbase CTO, among others. Fileverse aims to provide users with better ownership of their personal data, offering an alternative to centralized providers like Google or Notion. It utilizes smart contracts and stores encrypted data on the InterPlanetary File System (IPFS). - Cryptocurrency platform Beluga completed a $4 million seed financing round, with lead investment from Fin Capital, and participation from Anagram, UDHC, Dispersion Capital, Aptos Labs, 2 Punks Capital, Borderless Capital, Kyber Capitals, and others. The management team of Beluga consists of senior crypto professionals from Silicon Valley, Robinhood Crypto, dYdX, CoinDesk, and Coupa Software. - Web3 security startup Blockaid, founded by two former Israeli military intelligence network personnel, announced the completion of a $33 million financing, consisting of a $6 million seed round and a $27 million Series A round. Seed round investors include Sequoia Capital, Greylock Partners, and Cyberstarts. Three investors, along with co-lead investors Ribbit Capital and Variant, participated in the Series A round. Blockaid provides web3 security tools to help prevent crypto fraud, phishing, and hacker attacks. - Cryptocurrency startup smlXL completed a $13.4 million seed financing round, with participation from a16z crypto, Greylock, and others. Its mission is to make blockchain more transparent, useful, and accessible. The raised funds will be used to build a 16-person team and develop products, including EVM.code and evm.storage. - Privacy project Nocturne Labs completed a $6 million seed financing round, with lead investments from Bain Capital Crypto and Polychain Capital, and participation from Vitalik Buterin, Bankless Ventures, Hack VC, and Robot Ventures. They plan to launch the initial protocol on the mainnet in November. Nocturne combines the best ideas of ZK, AA, and stealth addresses to create an abstract Ethereum account with built-in asset privacy. They are developing a protocol to allow users to transact anonymously within the Ethereum ecosystem. - Virtual Labs, the first functional ZK state channel startup, completed a $1.2 million pre-seed financing round at a valuation of $20 million, with lead investment from OP Crypto, and participation from Byzantine Marine, Koyamaki Ventures, NEAR Foundation, and others. Virtual Labs aims to enhance the user experience of Web3 by eliminating gas fees, delays, and cumbersome wallet interactions. The company's flagship product, Virtual rollup, is a ZK state channel that facilitates unrestricted transactions from an unlimited number of participants.- The Web3 hotel platform Blackbird completed a $24 million Series A financing round, with lead investment from a16z Crypto, and participation from Amex Ventures, QED Investors, and others. Blackbird aims to provide loyalty and connection tools for restaurants, allowing users to gain access, rewards, benefits, and FLY loyalty points every time they dine out through Blackbird. - The Web3 social protocol Phaver completed a $7 million financing round, with investments from Polygon Ventures, Nomad Capital, Symbolic Capital, dao5, Foresight Ventures, and Superhero Capital. Phaver aims to help users easily join Web3 social platforms, providing a Web3 onboarding experience similar to existing social platforms. Phaver has integrated its technology or social graph with decentralized social network ecosystems Lens Protocol and Web3 social network CyberConnect. - The Web3 content creation platform RepubliK completed a $60 million seed financing round at a valuation of $750 million, with investments from OKX Ventures, 6th Man Ventures, Arcane Ventures, CMS Holdings, Comma3 Ventures, Define Ventures, Enjin, FBG Capital, HTX Ventures, Mirana Ventures, and others. They will launch and airdrop RPK tokens, representing the full value of the Republik community, governance, and utility. - The Web3 social data portal website Port3 Network received investment from DWF Labs, with the specific investment amount undisclosed. - Cryptocurrency investment firm Deus X Capital, led by former Galaxy Digital EMEA head Tim Grant, announced $1 billion in investment assets, focusing on private equity, venture capital, and fund allocation. The company aims to build an innovative digital asset and fintech investment portfolio to promote financial system reform and lower entry barriers. Deus X is also involved in cryptocurrency market making and global investments. Grant also serves as the chairman of AlphaLab40, one of Deus X's incubation projects. - The Saudi NEOM Investment Fund plans to invest $50 million in Animoca Brands and enter into a strategic partnership to drive Web3 projects. $25 million will be through convertible note issuance, and the remaining $25 million will be used to purchase shares of Animoca Brands. Animoca Brands co-founder Yat Siu stated that NEOM is expected to be the first region to fully harness the power of blockchain. - On-chain credit risk management company Cicada completed a $9.7 million Pre-Seed financing round, with lead investment from Choppa Capital, and participation from Bitscale, Bodhi Ventures, Shiliang Tang, among others. They will provide seed funding for multiple new non-custodial lending pools and conduct research and development on new blockchain lending application cases. - On-chain wealth and asset management protocol L1 Advisors completed a $1.6 million seed financing round, with strategic investment of $1 million from VanEck, and participation from Ironclad Financial, Ismail Jai Hokimi, and others. The funds will be used to build an operating system for on-chain wealth and asset management. L1 Advisors aims to enable financial professionals and their clients to utilize decentralized infrastructure (such as protocols and wallets) to manage, grow, and protect their assets. - Token-based enterprise financing platform Tokenize.it completed a €2 million seed financing round, with investments from w3fund, High-Tech Gründerfonds (HTGF), Seed+Speed, and others. They will launch features such as employee participation and public sales (a form of public fundraising). - The anti-witch platform Verisoul completed a $3.25 million financing round, with investments from HashKey Capital, BITKRAFT Ventures, King River Capital, Third Prime, and others. The product aims to identify fake users and address threats from artificial intelligence, bots, and fraud for enterprises.免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。