Old money is hard to chew, and new food is hard to make. Kujira has also crossed the ruins of Terra and made a name for itself in Cosmos.

By: Frank, Foresight News

Recently, the Cosmos ecosystem seems to be gradually emerging from a period of retrograde. Star projects like RUNE, INJ, and TIA have performed well in the secondary market, attracting a lot of attention. At the same time, another lesser-known project in the Cosmos ecosystem has quietly emerged, drawing attention with its rapid growth.

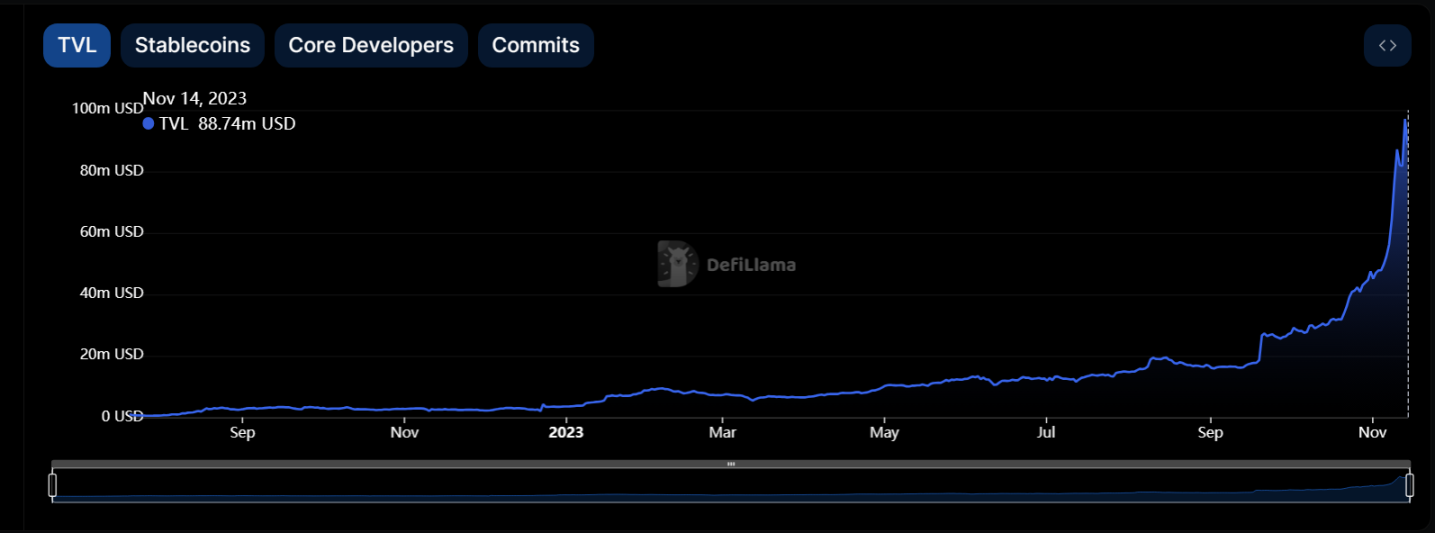

According to DeFillama data, the TVL of the Kujira ecosystem has grown more than fivefold since September, skyrocketing from around $16 million to approximately $88 million in just over two months. Its token, KUJI, has also seen a nearly 400% increase in value over three months, showing signs of a dark horse.

In fact, if we delve into Kujira's "past and present," we will find that in just a year and a half, it has crossed the ruins of Terra and grown into a dark horse newcomer in the Cosmos ecosystem, serving as a "rebirth model" in the crypto world.

From Anchor Liquidation Protocol to Layer1 Financial Public Chain

It is necessary to briefly review Kujira's development history, with May 11, 2022 being a crucial turning point.

Prior to the collapse of Terra in May 2022, Kujira's focus was on the liquidation protocol for collateral on Terra, essentially providing limit orders below the liquidation price for Anchor lending:

Any user looking to buy LUNA could bid on any form of collateral through Kujira during the liquidation period, allowing them to purchase discounted LUNA. This not only allowed users to obtain discounted LUNA but also improved the liquidation efficiency and avoided extreme scenarios of cascading declines.

However, Terra's sudden collapse changed Kujira's original development plan, forcing it to shift on May 11, 2022, planning to leverage the Cosmos ecosystem and Cosmos SDK to build a Layer1 chain for rapid reboot and operation.

The chain went live on July 4, 2022, with the team taking a snapshot distribution of addresses still holding KUJI on Terra. After transitioning to the Cosmos universe, Kujira's positioning, according to the official description, is a "blockchain that achieves real income":

Providing a decentralized ecosystem for sustainable financial technology protocols, developers, and Web3 users.

Kujira's Ecosystem Matrix

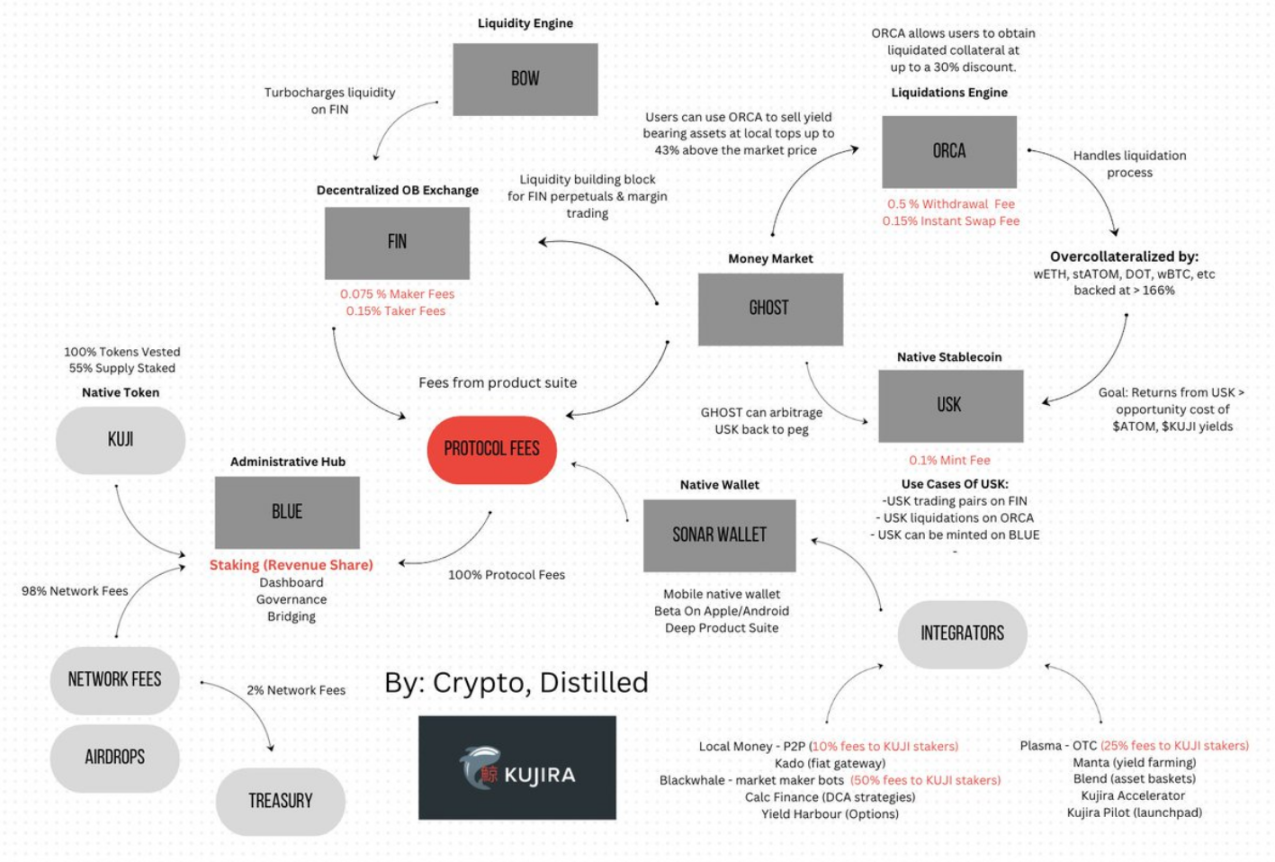

According to official statistics, as of November 14, Kujira's ecosystem matrix currently includes 22 protocols/products, covering collateral liquidation, DEX (margin trading, limit orders, etc.), liquidity farming, lending markets, Launchpad, wallets, strategy trading, OTC trading, P2P trading, NFT trading markets, LST, on-chain ETFs, and other tracks (only the main protocols/products are introduced below).

However, Kujira's core revolves around the "trading & income" L1 financial public chain. In addition to key protocols introduced by the project team such as Blue, FIN, and Orca, other protocols/products within the ecosystem can utilize Kujira's multi-chain decentralized trading liquidity as infrastructure to launch their services, achieving composability.

In fact, a comparison reveals that this product architecture and ecosystem development approach share many similarities with Injective, also based on Cosmos development, and even the former Terra ecosystem, indirectly confirming Cosmos's consistent advantage in the development of application chain ecosystems.

Source: Crypto, Distilled

Blue

Blue is one of the core infrastructure of Kujira's ecosystem, used for managing tokens, staking, voting, and exchange. Additionally, Blue's IBC functionality serves as a crucial bridge for assets to flow across the Cosmos ecosystem.

KUJI holders can stake tokens, claim rewards, delegate to validators, vote on governance, and transfer tokens across chains using Blue.

Furthermore, Blue can also be used to collateralize and mint USK, the over-collateralized stablecoin in the Kujira ecosystem (see below).

Orca

Orca continues the concept of Kujira before May 2022, serving as a public auction market for liquidating collateral, allowing anyone to bid on collateral awaiting liquidation.

FIN

FIN is a decentralized exchange in the Kujira ecosystem, providing order books, swaps, and margin trading.

BOW

BOW is an automated market maker that allows users to profit by providing liquidity, while FIN offers deeper liquidity.

Liquidity providers earn a portion of fees from trades and can receive additional rewards from third parties when staking their LP tokens.

GHOST

GHOST is a full-featured money market where users can borrow using various financial instruments, earn competitive interest rates, and access short-term borrowing funds.

SONAR

SONAR is a mobile wallet application in the Kujira ecosystem, allowing users to make payments, trades, stake, and vote directly from their mobile phones.

PILOT

PILOT is a Launchpad platform built in collaboration with Kujira and Fuzion, using a bidding process based on Orca to provide equal participation and a fair chance for all users.

From this perspective, Blue, Orca, and FIN are indeed the infrastructure of the Kujira ecosystem, realizing the cross-chain flow of (liquidation) asset trading & liquidity at the bottom layer of the entire ecosystem:

Blue provides cross-chain and token management services for users, allowing them to exchange assets obtained through bidding on Orca for stablecoins or other Cosmos assets using FIN's limit order book and other trading functions, closing the liquidity loop between Kujira and the Cosmos universe.

BOW, GHOST, and others further enhance liquidity or trading combination functions for this process, forming a complete and closed-loop liquidity processing chain, interconnecting the entire Cosmos universe and IBC assets, and consolidating the revenue streams of all products/protocols into Kujira.

What Positive Factors Are Worth Paying Attention To?

Given KUJI's outstanding performance, are there any positive factors worth paying attention to recently in Kujira?

Accelerated Adoption of USK

USK is the over-collateralized dollar-pegged stablecoin in the Kujira ecosystem (similar to DAI), currently supported by collateral including ATOM, stATOM, wBTC, wETH, wstETH, wAVAX, wBNB, INJ, DOT, LUNA, and other crypto assets.

Since mid-September this year, the circulating supply of USK has been steadily increasing, nearly doubling from around $1.72 million to approximately $3.25 million as of November 14.

However, truth be told, the current total circulating supply of USK is only around 3.25 million, still extremely small, almost negligible in the entire stablecoin race.

Perhaps for this reason, according to CoinGecko statistics, the anchoring situation of USK has not been very stable, oscillating widely in the range of $0.98-1.04 over the past three months.

In addition, in terms of collateral, aside from wrapped assets of BTC and ETH (around 1 million each), the minting ratio of ATOM and other IBC assets undoubtedly accounts for the majority (around 800,000). From an empowerment perspective, this also helps ATOM capture the expansion value of DeFi protocols in the Cosmos ecosystem.

Of course, this requires USK to not only become a core part of the Kujira ecosystem but also extend to become one of the universal currencies in the Cosmos universe:

For example, users can mint USK and bid on liquidated collateral on ORCA, then exchange the acquired assets for liquidity on FIN, and support cross-chain transfers to other IBC networks, or engage in arbitrage for liquidation from other IBC networks.

By combining with other trading & liquidity products/protocols, it can also create a siphon effect through usage scenarios such as stablecoin trading, establishing Kujira as one of the trading & liquidity nodes in Cosmos.

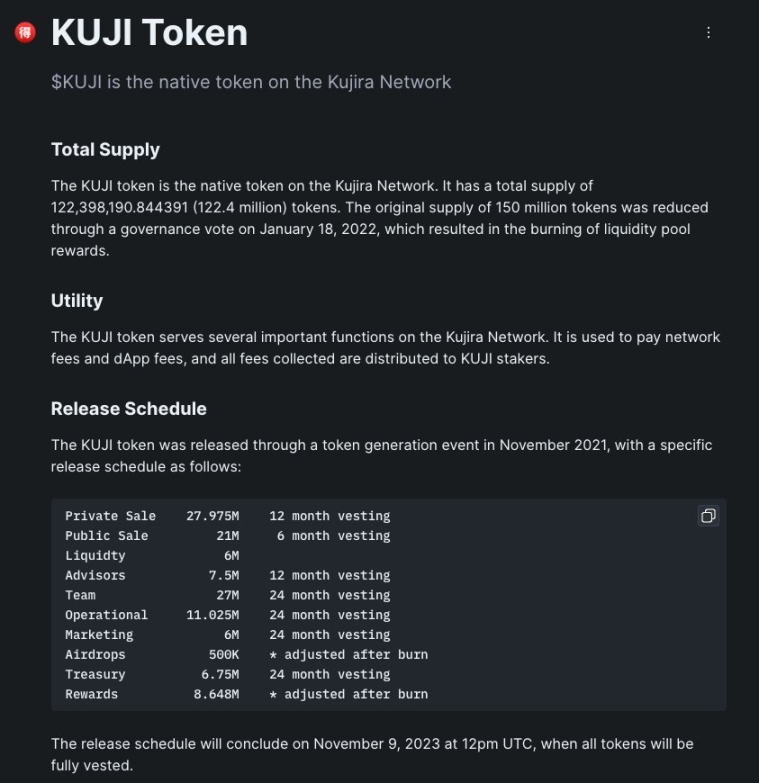

Full Token Circulation and High Staking Ratio

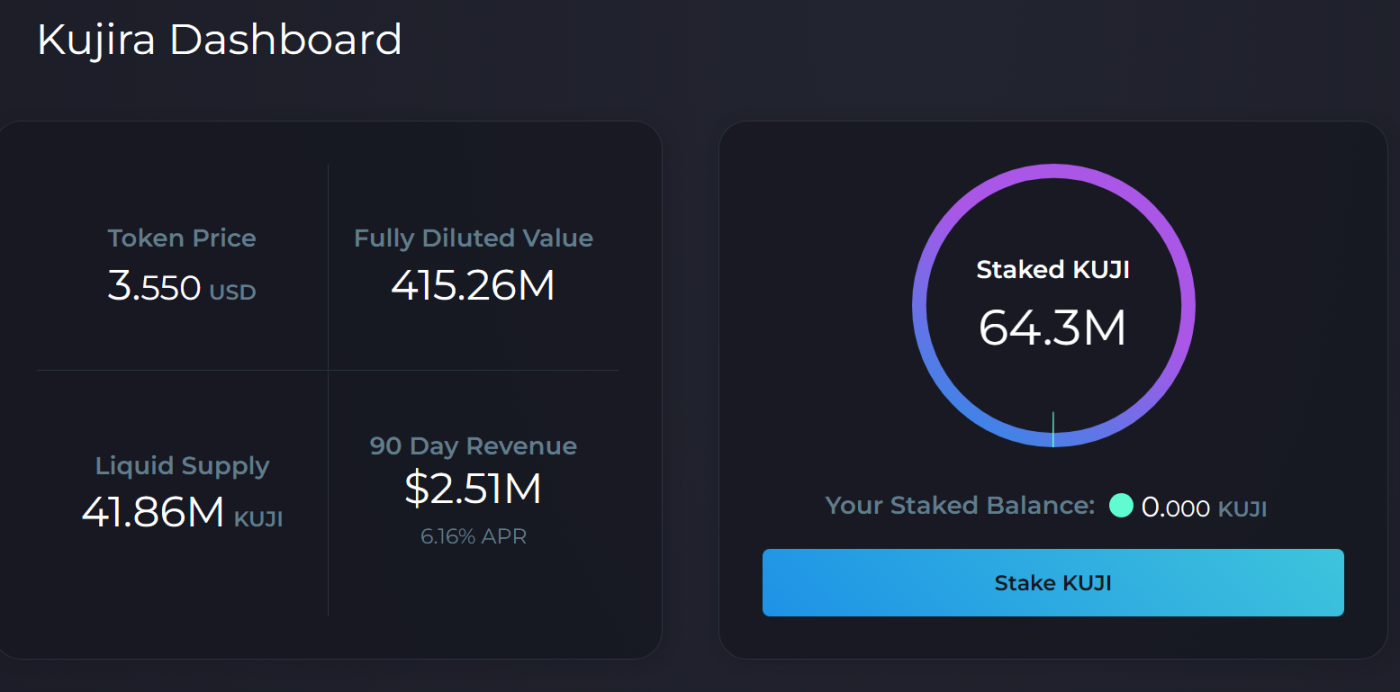

Additionally, in terms of token economics, on November 9, 2023, Kujira unlocked the final batch of allocated KUJI tokens, meaning that the total supply of approximately 122 million KUJI tokens is now fully in circulation.

This is a rare occurrence in the high-inflation Cosmos ecosystem, effectively dispelling potential selling pressure on KUJI tokens from a secondary market supply-demand perspective.

At the same time, due to the token economics of KUJI allowing stakers to receive 100% of protocol fees, the staking ratio of KUJI has been consistently increasing, with over 50% of KUJI currently staked (approximately 64.3 million tokens).

However, it is important to note that currently, KUJI has almost no exchange trading pairs—it has not been listed on any major or secondary exchanges, and liquidity is mainly concentrated within the ecosystem, so caution is advised.

Conclusion

Looking back, the secondary disasters caused by the collapse of Terra in May 2022 have not dissipated for developers who originally intended to build financial protocols based on UST in Terra. Many projects have since fallen into difficulties or even halted development.

In addition to projects that chose to continue staying in Terra 2.0, there are also proactive efforts from projects like Stader, Mars, and Kujira, among others. For many projects, Cosmos, being close to the water, naturally became the best choice for migration.

But old money is hard to chew, and new food is hard to make. Now, a year and a half later, only Kujira has managed to temporarily find its way in Cosmos.

Overall, now Kujira has its over-collateralized stablecoin (USK), a relatively mature trading & liquidity infrastructure, and is striving to become a major liquidity node in the Cosmos universe, which is truly remarkable considering its journey out of the Terra quagmire.

As long as it doesn't fall, it can stand up. Kujira has set a good example, and hopefully, more original Terra ecosystem projects can emerge from the quagmire and enter a new stage of development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。