Opening

In the previous article "Guatian Academy GameFi Public Chain Research Series Part One - Ethereum's Development and Upgrade Roadmap," we initially introduced the development history of Ethereum and the basic information of Ethereum 2.0 upgrade, which extended to two main sub-tracks of Layer2, Optimistic Rollup, and ZK Rollup. If we compare Ethereum to a company, we can simply understand that the Ethereum 2.0 upgrade is a restructuring of the internal management structure of the company, changing from the original chain structure to the beacon chain-sharding (Shards) overall structure. Layer2 further outsources the tasks that need to be executed on this overall structure, further reducing the company's burden, improving efficiency, and enhancing overall task processing capabilities.

In this second research article, we will further explore Layer2 solutions and delve into the Optimistic Rollup track.

Layer2 Overview

To understand Layer2 scaling solutions, we first need to confirm the concept of Layer2.

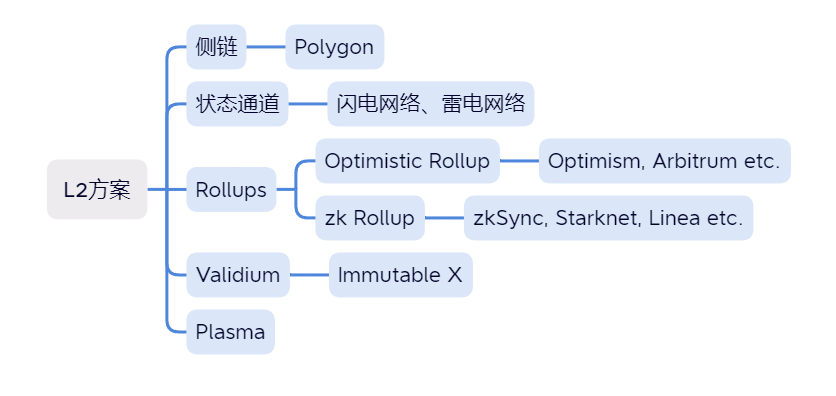

What is Layer2? Layer 2 refers to off-chain networks, systems, or technologies based on the underlying blockchain (Layer 1) to extend the underlying blockchain network. There are currently two ways to classify Layer2 in the market. In a narrow sense, Layer2 needs to inherit the security of the Ethereum chain and bundle transactions with Layer2 Ethereum, while Layer2 is only responsible for computation. ZK and optimistic rollup are orthodox Layer2 solutions. In a broader sense, Layer2 includes all Ethereum scaling solutions, mainly including the following 5 types:

1) Sidechain: A sidechain is an independent blockchain that operates in parallel with Ethereum. It achieves "atomic swaps" by locking a certain amount of assets in the main chain's smart contract and then minting the same amount of assets on the sidechain. The biggest problem with sidechain solutions is weak security, but they have good independence and flexibility. The well-known Polygon is a representative of Ethereum sidechains. Some people also consider BNB Chain as an Ethereum sidechain. Although BNB is also an EVM-compatible chain, strictly speaking, it is considered a replica of Ethereum and can operate independently of Ethereum, so we do not classify it as a sidechain for now.

2) State Channel: By establishing exclusive payment channels and multi-signature addresses between traders, off-chain transactions are completed. Only when settlement is needed, the final calculation result will be recorded on the chain. It has the characteristics of fast speed and low fees. Representative technologies include Lightning Network (based on Bitcoin) and Raiden Network (based on Ethereum).

3) Rollups: As mentioned in previous articles, it "outsources" data execution work to Layer2 and submits it to the main chain in batches. It is mainly divided into Optimistic Rollup and ZK Rollup. Optimistic Rollup takes an optimistic approach to the validity of data. If no one questions the data and submits fraudulent proof within a specified time, the data is considered true and accurate; otherwise, a fraud handling mechanism is activated to revoke the transaction. ZK Rollup bundles multiple transactions together and publishes them to L1, while simultaneously publishing a proof (using zero-knowledge proof technology) to claim the validity of these transactions.

4) Validium: Validium also uses zero-knowledge proof, but unlike ZK Rollup, it only uploads the state root and zero-knowledge proof to the mainnet, while transaction data is stored in Layer2, thus achieving higher throughput at the expense of some security. Because both use zero-knowledge proof, many people consider Validium as a variant of ZK Rollup, so another way to classify is to divide ZK and optimistic into two categories and classify Validium under ZK. The game chain ImmutableX mainly uses the underlying technology of Validium.

5) Plasma: Plasma is a framework solution for Ethereum Layer2 extension, also known as "a chain within a chain." By locking assets on the main chain and transferring transactions to the child chain, the child chain periodically submits state updates to the main chain. This not only speeds up settlement but also significantly reduces fees on a large scale. The difference between the child chain and the sidechain is that the child chain uses root storage, and users can safely exit the Plasma chain if any errors occur, while the sidechain does not have this function. In general, the child chain is more closely related to the mother chain.

In this article, we will focus on explaining the Polygon PoS sidechain solution, the two main projects of Optimistic Rollup, Arbitrum and Optimism, and the BNB ecosystem project opBNB and COMBO, which are both Ethereum replicas and Optimistic Rollup. We will mainly explain the basic technical principles, ecosystem, and support for blockchain games of these public chain projects. We will introduce ZK Rollup and Validium in the third part.

Polygon PoS Analysis

Polygon Introduction

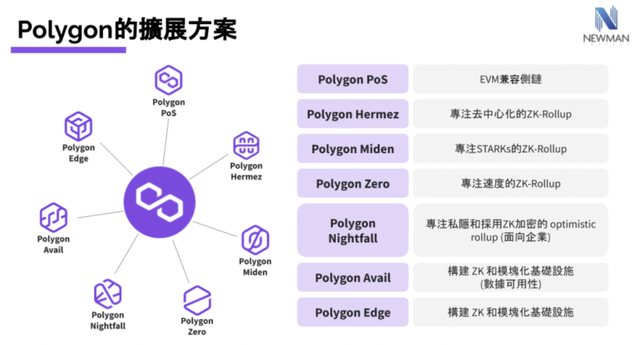

Polygon, originally named Matic, was initially a blockchain scalability platform known as the "blockchain internet of Ethereum." Later, as the ecosystem continued to develop, the platform expanded from a single Layer2 solution to a "Network of Networks," aiming to address the transaction speed and scalability issues of the Ethereum mainnet, with a primary focus on blockchain games and NFTs. Categorizing Polygon as a sidechain is not entirely accurate because based on Polygon's overall product matrix, the sidechain product Polygon PoS is the basic plate of Polygon, while the ZK Rollup matrix composed of Polygon zkEVM, Polygon Miden, Polygon Zero, and Polygon Nightfall is the potential growth point of Polygon. In the Polygon 2.0 upgrade plan released this year, the team is preparing to upgrade Polygon PoS as a whole to zkEVM Validium. Due to space limitations and thematic classification, we will mainly analyze the sidechain product Polygon PoS in this article, and the ZK part will be further explained in the next part.

Technology

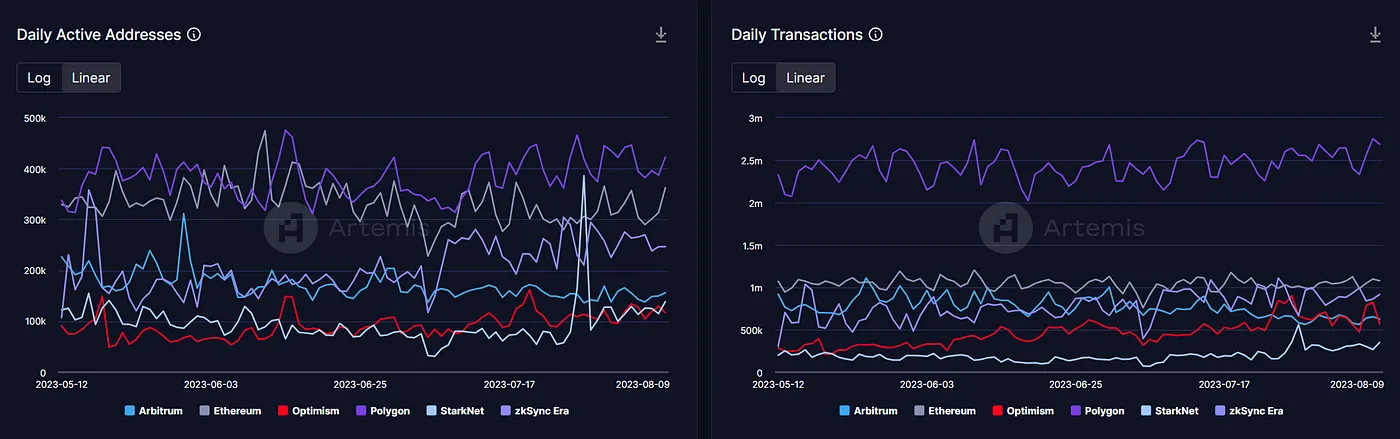

Although based on Ethereum, Polygon PoS benefits from faster speed and higher scalability, with its transaction volume stable at over twice that of the Ethereum mainnet (approximately 2 million daily transactions), while gas fees are only 0.1% of Ethereum's.

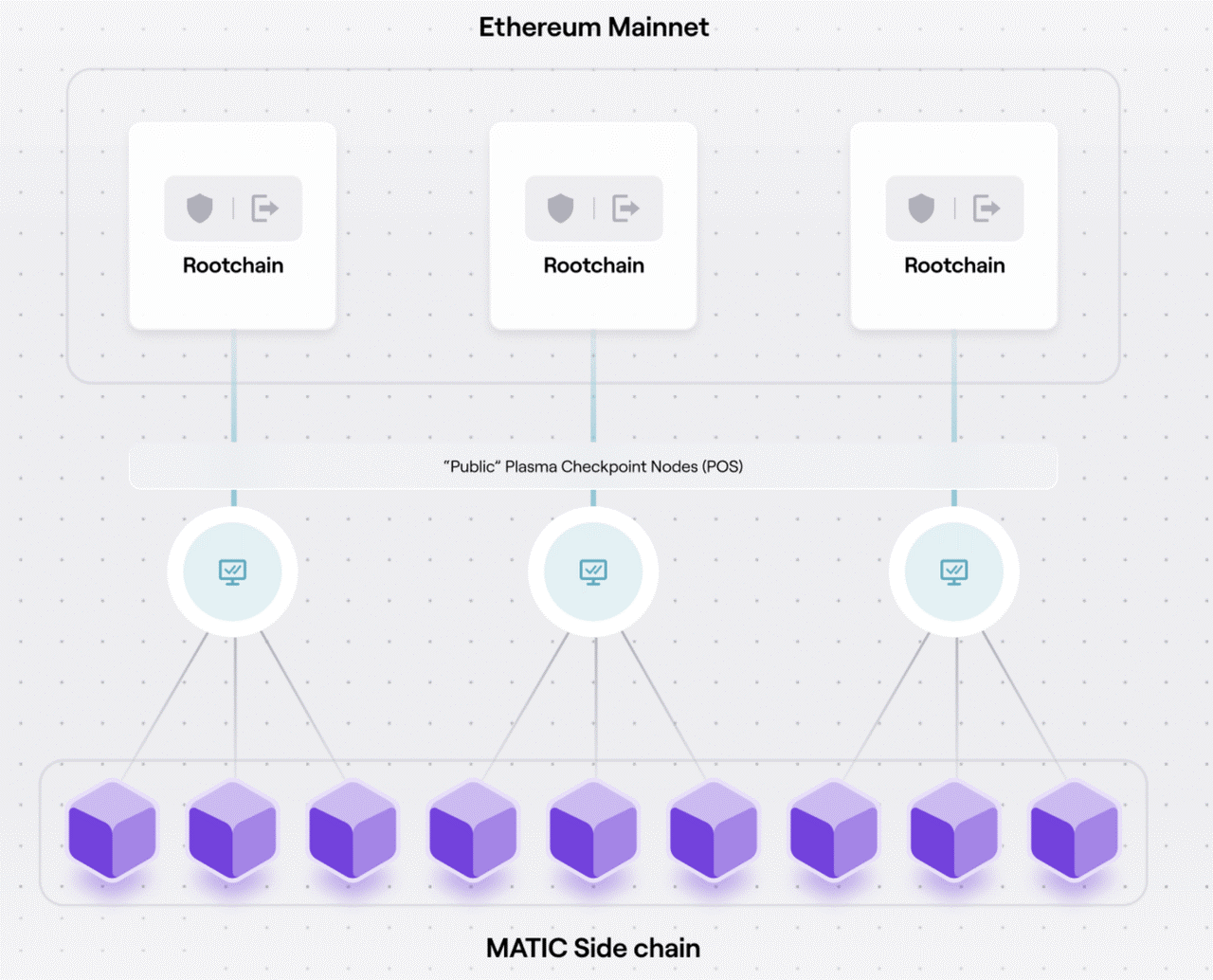

Polygon PoS is an EVM (Ethereum Virtual Machine) compatible sidechain that went live on June 1, 2020, and is currently the main business of Polygon. Polygon PoS is also the most mature Ethereum sidechain solution to date. The overall architecture of Polygon PoS can be divided into three layers:

1) Ethereum Layer: This layer consists of a series of Ethereum smart contracts responsible for processing on Ethereum and, by using Ethereum as the endpoint, can effectively utilize Ethereum's security as a shield, while the token Matic is also staked in this layer.

2) PoS Checkpoint Node Layer: This layer is the core layer of Polygon, responsible for producing and verifying Matic sidechain blocks. PoS nodes can listen to events on the Ethereum chain, pass information to the Matic sidechain, and regularly publish Matic-generated blocks to the Ethereum chain to achieve information synchronization between the Matic sidechain and the Ethereum mainnet.

3) Matic Sidechain Layer: Responsible for transactions, shuffling, block generation, and regularly publishing checkpoints to the node layer.

Polygon's unique hybrid structure enables Polygon POS to support the Plasma framework and inherit the security of Ethereum. The PoS Bridge further ensures the security of the chain through MATIC staked by the same set of validators and pledgers.

Ecosystem

Since its launch in 2020, Polygon entered a period of explosive growth in Q2 2021 and became the third public chain with a complete ecosystem after Ethereum and BNB. By the first quarter of 2023, the projects in the Polygon ecosystem had exceeded 53,000.

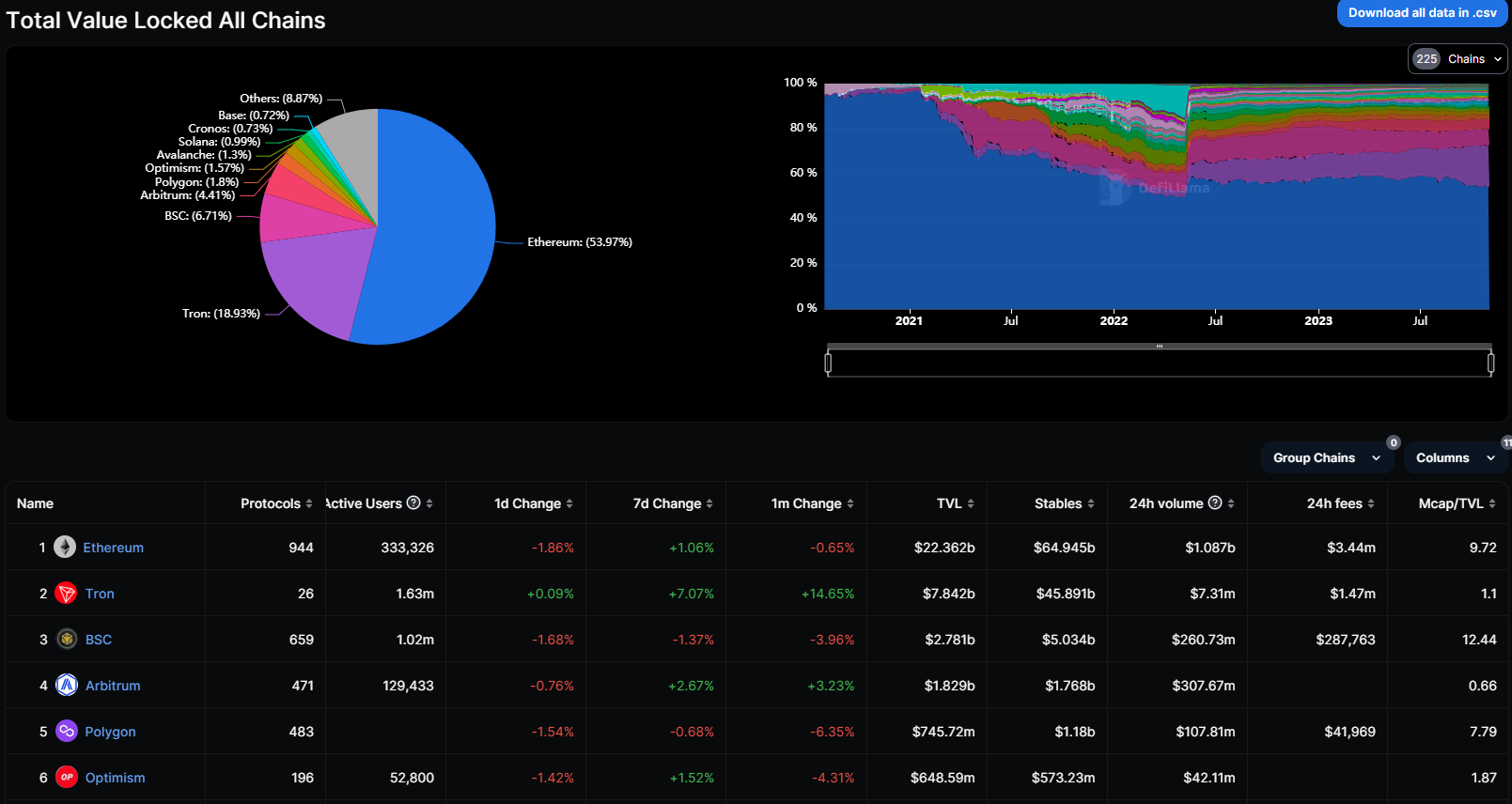

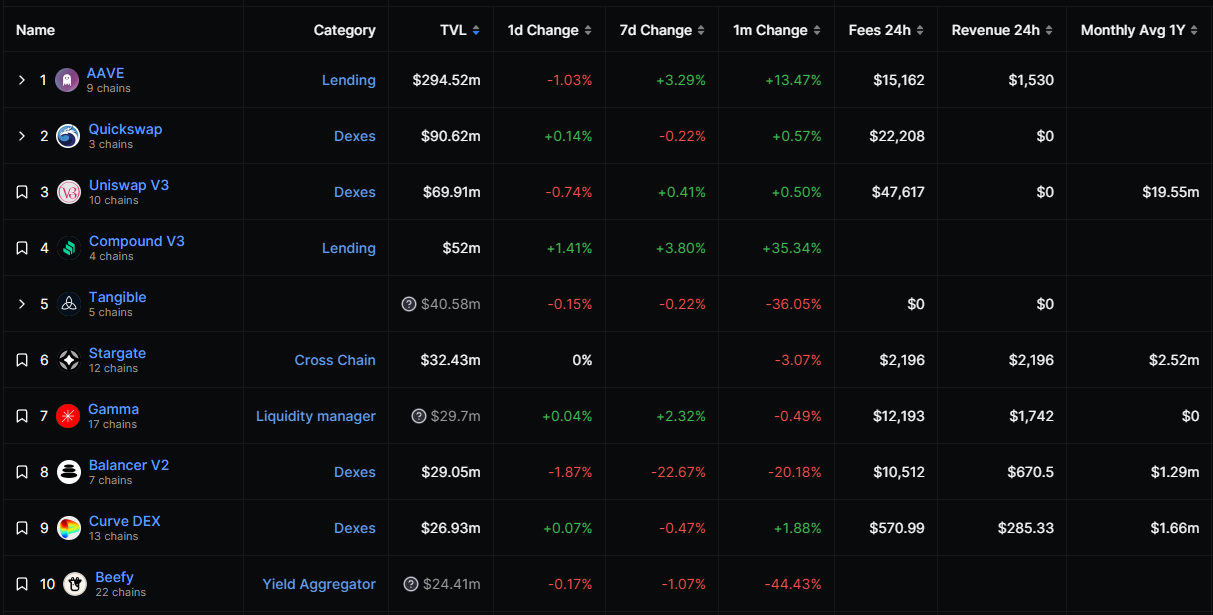

Benefiting from the platform's early development during the flourishing stage of DeFi, the expansion of DeFi projects was quite rapid. For example, when leading DeFi projects like Uniswap, Aave, and Curve deployed on multiple chains, the first choice was Polygon. In April 2021, Polygon launched a $1.5 million DeFi development fund to reward Matic projects. While DeFi projects in the Polygon ecosystem also have the drawback of insufficient innovation, the overall TVL ranking is fifth and has been surpassed by the rising star Arbitrum.

Polygon has shown great foresight in its NFT layout. In June 2021, Opensea first supported the Polygon chain, after which Ethereum and Polygon almost split the high-end and low-end NFT markets. Many international big brands have already launched their NFTs on Polygon, including Starbucks, Mastercard, Adidas, and more. These leading companies have gradually attracted more brands to join, creating a positive cycle. Other popular projects include Lama Kings, Doodle Changs, y00ts, Bungo Beanz, and Super Pengs.

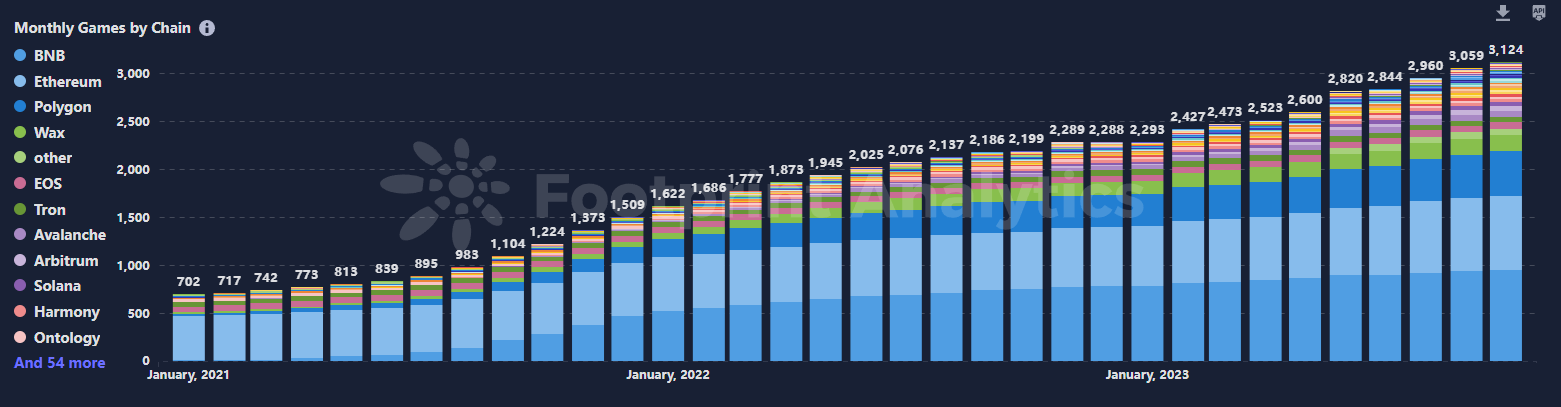

In the gaming and metaverse sectors, according to Footprint's data, the number of active gaming projects on the Polygon chain has reached 468, ranking third, only behind BNB and Ethereum. Specifically, two leading metaverse projects, Decentraland and The Sandbox, were deployed on the Polygon chain in April and June 2021, respectively. Other popular games include Pixels, Arc8, Benji Bananas, Sunflower Land, and Skyweaver.

In July 2021, Polygon announced the establishment of Polygon Studios, focusing on investments in the NFT, gaming, and metaverse fields. In offline promotion, Polygon has been frequently involved, leveraging its low-cost and fast transaction experience, making it one of the best choices for Web2 and traditional enterprises looking to explore blockchain or web3.

Summary of Advantages and Disadvantages

Polygon PoS, as the earliest mature Ethereum Layer2 ecosystem, has a significant first-mover advantage, and its advantages are also very apparent:

- Speed: Intuitive, efficient bridging, deposits, and withdrawals, with a transaction speed of up to 7000 tps, far exceeding the performance before the Ethereum upgrade (15 tps);

- Security: Relies on Ethereum and shares its security;

- Compatibility: Full EVM compatibility means smart contracts can be deployed directly on the Polygon chain;

- Low cost: Approximately 0.1% of Ethereum's fees

The low transaction fees and considerable speed make Polygon the best choice for high-frequency trading projects (DeFi, GameFi, etc.) within the Ethereum ecosystem. Although the rise of second-layer star projects such as Arbitrum, Optimism, and zkSync will to some extent affect Polygon's market position, Polygon itself is constantly evolving and embracing the ZK track comprehensively, acquiring and launching a series of products based on ZK technology. We will provide a detailed analysis in the next part.

Polygon PoS entered the market at the right time. In 2020, the Ethereum network was severely congested, and scalability issues were prominent, creating an urgent need for a phenomenal product in the Ethereum ecosystem to improve its performance. At that time, the Rollup track and the Ethereum 2.0 upgrade were still in the development process, and the main competitors in the Layer2 market had not yet formed a strong threat. In addition, Polygon's marketing strategy was very effective in the early stages of development, leveraging the DeFi trend and adopting a subsidy strategy to expand giants like Aave, Curve, Uniswap, and Quickswap. In the gaming and metaverse tracks, it adopted an investment + incubation strategy for extensive layout, bringing a significant number of high-quality projects. In terms of ecosystem integration, deep cooperation with platforms like ImmutableX also shared the traffic dividends of these platforms. With further improvement of the Polygon ecosystem and the gradual maturity of the Polygon ZK ecosystem, we believe Polygon will continue to experience substantial growth and consolidate its position in the top tier of public chains.

Arbitrum Project Analysis

Introduction to Arbitrum

As a leading project in Layer2, Arbitrum has always been surrounded by a halo. Especially during the coin issuance period in the first half of 2023, it became one of the hottest topics in the blockchain community, attracting a large number of people eager to join the Layer2 ecosystem. According to statistics from Defillama, Arbitrum has surpassed many public chain competitors and ranks fourth in total locked value (TVL) after ETH, BSC, and TRON, even surpassing the veteran Layer2 sidechain Polygon, firmly establishing itself as the leader in Layer2.

Arbitrum went live in May 2021: Arbitrum One officially launched on the Ethereum mainnet. In October 2021: The public testnet of Arbitrum Nova was launched. In 2022, the plan for Arbitrum Orbit is steadily advancing, designed as a Layer 2 solution specifically for NFT and virtual reality (VR) applications. This will provide more scalability for digital assets and applications in the virtual world.

Arbitrum now has a TVL of $5.93 billion, a circulating market value of $1.45 billion, and a fully diluted valuation of $11.3 billion, with no new unlocks in the next 6 months. The current daily active addresses are around 150,000, and the number of transfers is around 620,000, closely following Polygon and firmly holding its position in the top tier.

Technology

Arbitrum is a Layer2 scalability solution that follows a similar technological path to Optimistic Rollup, assuming all transaction verifications are honest but setting a challenge period during which anyone can raise a challenge. The system introduces two different roles to ensure transaction execution: Verifiers and Managers. Verifiers are responsible for processing transactions and receive Ethereum as a reward, while Managers monitor whether Verifiers have correctly executed the transactions. There is a 7-day challenge period before the transactions return to the Ethereum mainnet, during which all Managers can challenge the transactions. If it is confirmed that there is a problem with the transactions, the malicious actor will lose the staked tokens. This way, as long as there is at least one honest Manager during the challenge period, the security of Arbitrum is ensured.

The project mainly includes the following main product lines:

1) Arbitrum One: Based on Optimistic Rollup technology, Arbitrum One achieves high-performance and low-cost smart contract execution by verifying transactions on the Ethereum chain. Arbitrum One provides a fast and cost-effective way to execute Ethereum smart contracts, alleviating congestion issues on the Ethereum network and promoting performance improvements in DeFi applications and the NFT market. Most applications (DeFi and NFT, etc.) are deployed on this product line, the flagship rollup of Arbitrum One platform.

2) Arbitrum Nova: Arbitrum Nova adopts zk-Rollup technology to verify transactions using zero-knowledge proofs, enhancing security and efficiency. The introduction of Arbitrum Nova adds diversity to Arbitrum, allowing developers to choose different solutions to build applications that meet the needs of various projects. Arbitrum Nova is primarily used for high-throughput applications, such as gaming and social applications. 3) Arbitrum Orbit: Arbitrum Orbit is Arbitrum's ecosystem development plan aimed at providing tools, libraries, and support to facilitate developers in building applications on Arbitrum. The goal of Arbitrum Orbit is to expand the Arbitrum ecosystem, provide resources and support for developers, and promote application development and deployment. These three components collectively drive the development of Arbitrum, providing more technical choices and ecosystem support, attracting more developers and projects, and further promoting the growth of the Ethereum ecosystem. Ecology: The Arbitrum ecosystem has reached 600 projects, including many excellent ecosystem projects such as GMX, Radiant, TreasureDAO, and Camelot, bringing a wide range of use cases to Arbitrum. Projects like Treasure DAO and Pirate Nation have experienced explosive growth, contributing to significant activity on Arbitrum. Advantages and Disadvantages Summary: Arbitrum inherits the advantages of Optimistic Rollup, including the following strengths: - High performance: Arbitrum improves transaction throughput, reduces costs, and alleviates Ethereum network congestion by optimizing smart contract execution. - Low cost: By executing transactions on Layer 2, Arbitrum significantly reduces gas fees on the Ethereum main chain, lowering the cost for users to participate in activities such as DeFi and NFT markets. - Compatibility: Arbitrum is compatible with Ethereum smart contracts, supporting the migration of existing dApps and smart contracts. - Security: Arbitrum adopts Layer 2 extension security measures, such as Rollup technology, to ensure the security of user funds and data. - Ecosystem support: Attracting well-known projects in the Ethereum ecosystem, providing users with more choices, and offering growth opportunities for DeFi and NFT projects. Arbitrum's disadvantages include: - Centralization: Compared to the Ethereum main chain, Layer 2 solutions generally have a higher degree of centralization, which may raise some security and trust issues. - New learning curve: New users may need to learn new workflows and usage methods, increasing the learning curve for some users, such as transferring ETH mainnet assets to the Arbitrum Layer 2 network through bridging. - Low network effect: It takes time to establish sufficient network effects to attract more users and developers. Overall, Arbitrum has significant advantages in providing high performance, low cost, and compatibility, but it still needs to address some challenges related to centralization and network effects. In the future, with the further development and adoption of Layer 2 technology, Arbitrum is expected to improve the scalability and user experience of the Ethereum ecosystem. Optimism Project Analysis Introduction to Optimism: Optimism is Ethereum's Layer 2 solution, which moves transfers, smart contracts, and other processes to the Optimism chain for processing, recording only the final results on Ethereum, significantly reducing transaction fees for each transaction. The Optimism project was launched in early 2020 and released a whitepaper, followed by the launch of a testnet at the end of 2020 to verify the feasibility and security of its technology. On the testnet, developers and projects could begin deploying smart contracts and applications on Optimistic Ethereum. In 2021, Optimism began actively collaborating with the Ethereum community to promote the development of Layer 2 solutions. The Ethereum community recognized the urgent need for scalability, and Optimism provided a viable option. The mainnet of Optimism was officially launched at the end of 2021, marking the launch of the first orthodox Layer 2 scaling solution on Ethereum. Since the mainnet launch, Optimism has gained widespread adoption and attracted many projects to deploy applications on it, including DeFi projects, NFT markets, and other applications in the Ethereum ecosystem. The development of Optimism demonstrates its important role in addressing Ethereum network congestion and high transaction fees, as well as its continuous growth and adoption in the Ethereum ecosystem. It represents a significant advancement of Layer 2 scaling technology in the blockchain field. Technology: When discussing OP's technology, it is essential to mention the OP Stack. The OP Stack can be understood as a set of open-source software components that allow anyone to build their own L2 blockchain using Optimistic Rollup on Ethereum. The OP Stack consists of four main components: - Mainnet: The OP mainnet is a low-cost and fast L2 network compatible with the Ethereum Virtual Machine (EVM). - Contracts: These are smart contracts that implement the core logic and functionality of the OP Stack. They include the State Transition System (STS), Fraud Proofs (FP), State Commitment Chain (SCC), and Canonical Transaction Chain (CTC). - Services: These provide data availability, synchronicity, and communication between L1 and L2. - Tools: These facilitate the development, testing, deployment, monitoring, and debugging of L2 blockchains based on the OP Stack. The OP Stack is designed to be a forkable, modular, and scalable blockchain infrastructure. To achieve this vision, all types of L2 need to be integrated into a single Superchain, which combines separate L2s into an interoperable composite system. The release of L2 will be as simple as deploying smart contracts on Ethereum today. Essentially, the Superchain is a horizontally scalable blockchain network that shares Ethereum's security, as well as communication layer and development tools. It can be likened to a Cosmos based on Ethereum security, but now the OP Stack has become a Cosmos Killer. Benefiting from the OP Stack or Superchain architecture, five public chain projects, including Optimism, Base, Zora, Aevo, and Public Goods Network, have been launched, and opBNB has recently been officially launched. In terms of architecture, the OP Stack can be divided into six layers from bottom to top: the Data Availability Layer (DA Layer), Sequencing Layer, Derivation Layer, Execution Layer, Settlement Layer, and Governance Layer. Each layer of the OP Stack is a modular API that can be combined and decoupled at will. The most critical layers are the DA Layer, Execution Layer, and Settlement Layer, which constitute the main workflow of the OP Stack. 1) DA Layer: The Data Availability Layer is the original data source of the OP Stack, which can use single or multiple data availability modules to obtain input data. Currently, the main DA Layer is Ethereum, but more chains are expected in the future. 2) Execution Layer: The state structure in the OP Stack provides the possibility for the EVM or other VMs, adding support for L2 transactions initiated on Ethereum, while also adding additional L1 data costs for each transaction in the comprehensive cost of publishing transactions to Ethereum. 3) Settlement Layer: This layer aggregates L2 transaction data on the OP Stack and sends the information to the target chain after L2 confirmation to complete settlement. In the future, it is also expected to access ZK and other validity proof mechanisms to bridge the gap between different chains and even connect OP system L2 and ZK system L2. Ecology: DeFi is always the highlight of public chains, and the prosperity and innovation of DeFi projects attract and accommodate a large amount of liquidity, revitalizing the entire public chain ecosystem. OP's DeFi ecosystem is relatively complete, with decentralized exchanges, lending, and more. For example, Velodrome is the largest DEX on OP, and Sonne Finance is the native lending platform on OP, ranking second in TVL among lending projects. In the GameFi field, unfortunately, there are not many standout projects on the Optimism side. There are no projects like Tresure DAO, which is a "chain game Nintendo," or innovative projects like Trident's Risk to Earn. However, in the gaming sector, Optimism also has a trump card, which is Op Craft based on Op Stack. Full-chain games represent a new paradigm. When it comes to pure on-chain games, you would probably first think of Dark Forest. Expanding on pure on-chain games, a popular term now is Onchain Autonomous World, which may be the most blockchain-like gameplay, originating from games but transcending games. This trendy term was pioneered by Op Craft. Optimism has four major advantages: EVM equivalence, data security, speed, and cost. - Optimism is one of the most EVM-compatible chains, with a focus on further equivalence with EVM. Optimism can use its Optimistic Virtual Machine (OVM) to support any Ethereum application, which is a virtual machine compatible with EVM. Developers can deploy any Ethereum-based dApp on Optimism with minimal architectural changes, allowing seamless integration of decentralized applications (dApps) built on Ethereum onto Optimism. - Optimism's rollup architecture provides security from the Ethereum mainnet. Transactions are processed on Optimism, but transaction data is written to and stored on Ethereum. This allows Optimism to inherit Ethereum's security while maintaining scalability. - Optimism can achieve 10-100 times scalability improvements based on the nature of transactions. Optimism offers near-instant transaction finality, allowing users to check their transaction results almost immediately. - Transactions on Optimism are also inexpensive, costing only about 1% of Ethereum transaction costs. Optimism has three main disadvantages: long withdrawal times and high costs, potential incentive misalignment among network participants, and underlying L1 scrutiny of transactions. - Withdrawals through the official Optimism bridge have a 1-week waiting period due to the 1-week challenge period for fraud proofs. It is important to note that withdrawals through the main bridge cannot be canceled once submitted. Due to the security measures implemented in the bridge, the cost of withdrawals through the main bridge can be high, potentially exceeding $100. Such long and costly withdrawal periods may have a negative impact on adoption and composability. - The network relies on incentivized validators to challenge fraudulent proposals. If there are few or no fraudulent proposals, validators receive fewer or no rewards from operating nodes, as they only receive rewards when successfully challenging fraudulent proposals. This can inhibit validator node operation. - If specific transactions have sufficient value, the Sequencer may bribe Ethereum miners to allow fraudulent proposals to pass through the computation check at very low cost. opBNB and COMBO Project Analysis opBNB: opBNB is a Layer 2 network built on BSC using OP Stack technology. Similar to Ethereum's Optimism Rollup, opBNB processes transaction data off-chain and submits it uniformly to Layer 1 to improve network performance, ultimately achieving high TPS, low gas fees, and consistent security with Layer 1. In 2020, amid Ethereum network congestion, the launch of BSC provided a fast, secure, and low-cost decentralized application environment for users and developers. However, with the surge in transaction volume, BSC also faced network congestion and high gas fees at times, and the existing design and architecture were no longer able to meet scalability demands. In this context, opBNB emerged to provide new possibilities for addressing BSC's scalability issues. The open-source nature of OP Stack allows developers to easily use OP to build and develop Layer 2 public chains. For example, Coinbase's Base is also based on OP Stack, with the main difference being that Base is an Ethereum L2, while opBNB is a BSC L2. BNB chose OP over ZK primarily for its practicality, ease of use, high degree of customization, and true EVM compatibility, allowing for rapid integration into application development and user usage. ZK narratives are grand, but they have high development difficulty. Compared to Ethereum, BSC can be considered "fast," and opBNB takes it a step further. opBNB raises the gas limit to an astonishing 100M, exceeding Optimism's 30MGas limit, processing over 4000+ transfer transactions per second, with an average transaction cost of less than $0.005. COMBO: Unlike the three public chain projects detailed earlier, COMBO is a Layer 2 network focused on Web3 games, with an open testnet launched in April of this year. Based on BNB Chain, COMBO is similar to opBNB and adopts Optimistic Rollup Layer 2 technology, achieving speeds of up to 5,000 TPS and gas fees as low as 0.001Gwei. To facilitate game developers, COMBO has partnerships with numerous infrastructure projects, providing comprehensive on-chain development tools, including: - Full-stack development toolkit: Providing a comprehensive set of tools and resources for game developers, covering front-end and back-end development, including frameworks, libraries, documentation, testing tools, and more. - ComboUp: Providing developers with an available environment to launch games and applications, offering templates, modules, and infrastructure to accelerate the development and deployment process. - Web3 game solutions and ecosystem: Providing features such as asset ownership, decentralized markets, and interoperability with other blockchain-based games, and bringing together developers and players to build a complete game ecosystem. COMBO's ecosystem layout revolves around games and the metaverse, covering foundational infrastructure, networks, security, wallets, data, NFT markets, and basic applications. It has heavyweight metaverse projects such as Lifeform, Ultiverse, and SecondLive in support. Although not extensive, it is comprehensive. Backed by the large BNB ecosystem, opBNB has inherent advantages and can smoothly accommodate BNB ecosystem projects. DeFi projects include derivatives trading platform OpenOcean, the recent hot projects Goose Finance and BabySwap, and the cross-chain bridge Orbit Bridge. GameFi projects include the football game Ultimate Champions, the metaverse game Mobox's NFT Farmer, and the upcoming Cards Ahoy, and more. The project has raised a total of $40 million, with Binance leading with $12 million. In June of this year, the COMBO team allocated $80 million to the ecosystem fund to support developers creating Web3 games on COMBO, providing them with advisory and game industry resources to assist in the Web3 game development process. For COMBO's ecosystem projects, there is also an opportunity to receive $100,000 in COMBO tokens as grants, as well as further strategic investments. COMBO, in relation to BNB and Optimistic Rollup, is similar to Immutable in relation to ETH and ZK Rollup. Both are game-specific chains backed by large ecosystems like BNB and ETH, respectively, and adopt the two most mainstream Layer 2 technologies. Both platforms have flagship games/metaverse products, with Immutable being Gods Unchained and COMBO being SecondLive. Leveraging the influence and topicality of SecondLive in the metaverse sector, the backing of Binance, and its deep cultivation of the metaverse and gaming sectors, it is believed that the COMBO ecosystem will also be able to capitalize on the vigorous development of the game and metaverse sectors to experience a round of growth. Conclusion: In this in-depth research article, we have initiated an analysis of Layer 2, focusing mainly on the OP track and analyzing Polygon PoS based on sidechain technology, Arbitrum and Optimism based on Optimistic Rollup technology, as well as opBNB and COMBO, which are also based on Optimistic Rollup but are part of the BNB ecosystem.Overall, Rollup is the mainstream solution in the Layer 2 track, with significant improvements and enhancements in security, speed, scalability, and cost compared to the original Layer 1 mainnet. Of course, the Rollup solution also has some existing issues, especially the withdrawal delay caused by the OP challenge period, low interoperability caused by cross-chain bridges, limited supported asset types, fragmented asset liquidity, and centralization of sequencers, as well as potential security vulnerabilities and risks associated with Rollup technology, which are also points of concern for many users. How to address the above issues, reduce the impact of OP withdrawal waiting periods, improve capital efficiency and security, and decentralize sequencers will be the continuous improvement content for the future of the OP track. The five Layer 2 public chain projects introduced in this article, three of which are in the Ethereum ecosystem and two in the BNB ecosystem; one is sidechain technology (Polygon PoS), and four are based on the OP architecture. It can be said that these five projects are the pearls of the Layer 2 and OP tracks, bearing the great responsibility of ecosystem development. Of course, there are other Layer 2 public chains based on OP technology, such as Metis, Boba, Mantle, etc., which are also the pillars of the current OP ecosystem, but due to the limited length of the article, further analysis cannot be provided. In the final section, because people often compare Optimism and Arbitrum, we will also discuss the differences between the two in terms of technical and non-technical aspects. From a technical perspective, the main difference lies in the dispute resolution method. When Optimism encounters a challenge, it relies on the Ethereum EVM to run, while Arbitrum uses an off-chain dispute resolution process to reduce disputes to a single step in a transaction, and then sends the result to the EVM for final verification. Therefore, in terms of dispute resolution processes, Optimism will be simpler than Arbitrum and will also have certain advantages in speed and cost. From a market perspective, the difference in transaction data and performance between Arbitrum and Optimism is not significant, both are at a similar level, with Arbitrum possibly slightly ahead; their market valuations are also similar, with market caps of $1.36 billion and $1.32 billion, respectively. In terms of market strategy, Optimism is pursuing horizontal expansion using the OP Stack, attracting more developers to launch Layer 2 public chains on the platform, and leveraging strong B-end resources to drive the participation of major ecosystems such as Binance and Coinbase; while Arbitrum has chosen a vertical ecological layout based on the Arbitrum Orbit framework and is actively laying out the Layer 3 track, launching XAI Games to achieve higher performance. Looking at the GameFi field, Arbitrum's ecosystem is currently ahead of Optimism. Although Optimism has OP Craft, it is not as popular as Arbitrum's TreasureDao in terms of popularity, and it does not provide as much exclusive support for GameFi as Arbitrum Nova, a high-frequency interactive exclusive chain, and XAI, a Layer 3 game exclusive chain. Overall, the two projects, Arbitrum and Optimism, have their own characteristics and focuses in terms of technology and the market. With the intensification of competition in the Layer 2 track, it is believed that each public chain will continuously bring higher performance, a more complete ecosystem, and a better user experience based on its own advantages. In the next article, we will focus on exploring several Layer 2 public chains in the ZK and Validium tracks to analyze the overall development of the ZK track. Stay tuned!免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。