"Five years ago, when I came to Dubai, there was no ecosystem. Now there are projects, there is money, there are exchanges, there is a community."

— A crypto entrepreneur who has lived in Dubai for 6 years.

I. Advantages and Disadvantages of Web3 Development in Dubai

What are the advantages of doing Web3 in Dubai?

-

Zero Tax Rate: Zero tax rate, zero personal income tax, zero corporate income tax ("0% tax rate for enterprises with a net profit not exceeding 375,000 dirhams per year"). "On April 1, 2022, India imposed a 30% income tax on all cryptocurrency revenue, and on July 1, it imposed a 1% tax on electronic asset buyers. Japan also imposes a 30% corporate tax on cryptocurrency assets, including unrealized income. This means that once the token enters the public market, even if the token does not generate income, it still needs to be taxed."

-

Strategic Geographic Location: Web3 naturally has a globalized attribute, and the UAE is located in the GMT+4 time zone, which is relatively friendly in terms of time difference with Europe, the United States, Southeast Asia, and other regions, making it an ideal choice for business center and connecting markets in the Middle East, Asia, Europe, and Africa.

-

Clear Regulatory Framework and Open Policies: The Crypto industry has a very high acceptance, with multiple related policies being introduced, a clear regulatory framework, open policies, and simple visa processing. "Compared to places like Singapore and the United States, visa processing in Dubai is very convenient."

-

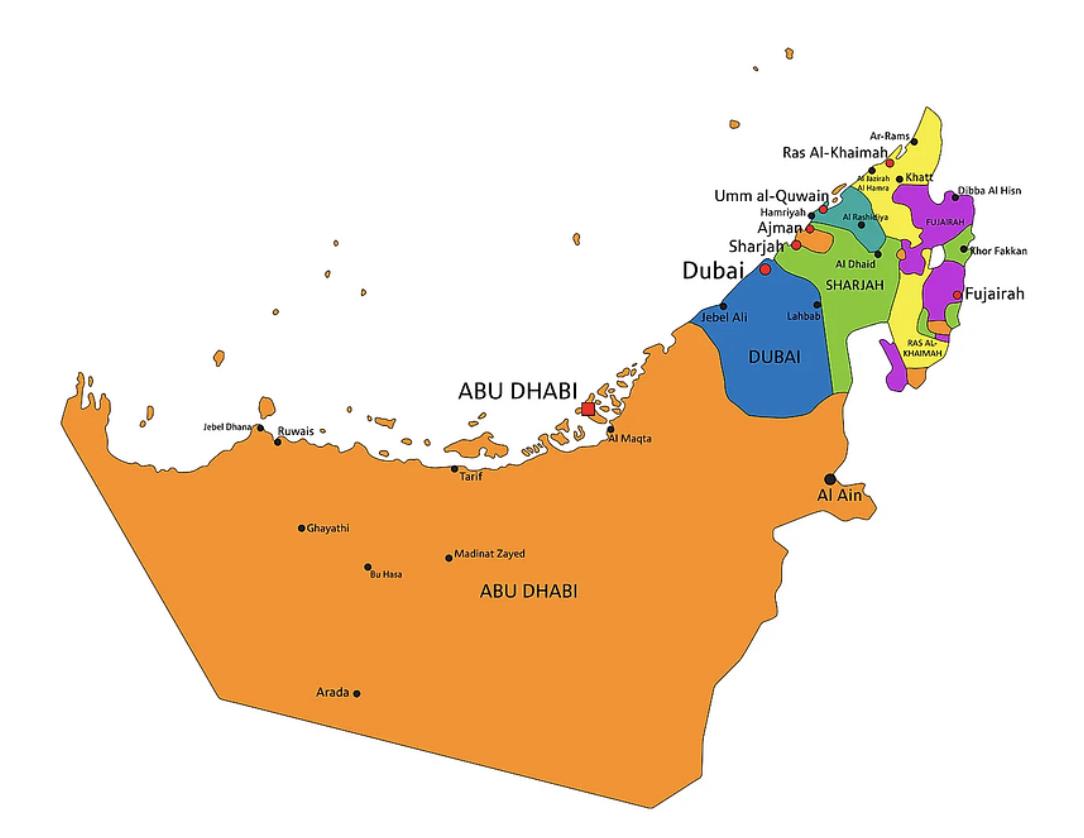

High Security Level: It is one of the top ten regions in the Global Security Index. "According to the global data website Numbeo report, Abu Dhabi has been rated as the safest city in the world for five consecutive years, while Sharjah and Dubai are ranked sixth and seventh, respectively."

-

High Degree of Internationalization: With over 90% of the population being expatriates, it means a high degree of internationalization and a high level of openness and inclusiveness. "The natural attributes of Web3 are decentralization, internationalization, freedom, and openness."

-

High Per Capita Income: The UAE's "Dubai" per capita GDP is $44,315, ranking 31st globally, which means that starting a company here has strong commercial realization capabilities.

What are the disadvantages of Web3 development in Dubai?

-

Low Number of Developers: With a total population of over 3 million, the number of developers is low, with most of them coming from India.

-

Low Number of Well-Known Investors: There are few well-known local investors, and the investment funds for project parties are not abundant enough, with leading investors in the crypto field still mainly located in Europe and the United States.

-

Extreme Summer Heat: Dubai has a long, hot, and humid summer, and is arid and partly cloudy, making it uncomfortable, while the winter (November to March) is comfortable, dry, and mostly sunny. Most friends who are not used to living in Dubai have feedback that the summer in Dubai is hot and not suitable for living.

-

Economic Vulnerability: Dubai has a clearly outward-oriented economy, focusing on trade, finance, and tourism, with an extremely weak industrial base. Dubai relies on the stability of the global cycle, and its economy is less resilient to macroeconomic shocks, which also exacerbates doubts about its long-term development prospects.

However, some of the disadvantages of Web3 development in Dubai will no longer be disadvantages.

In terms of funding, although it is difficult to obtain local funds in Dubai, funds from the West are pouring into Dubai. It is well known that the current U.S. policy is not friendly, and a lot of money and people from the United States are coming to Dubai, even more so from India and Russia. And funds always flow to free places.

In terms of the number of developers, where there are public chains and funds, there will be no shortage of projects. In Dubai, the number of developers will not experience explosive growth, but the number of projects landing in Dubai will continue to increase. In addition, the Middle East, Africa, and South Asia (MEASA) have a population of over 3 billion, and the Dubai International Financial Centre (DIFC) is an important financial center for the MEASA region.

Like Singapore, Dubai, as a Web3 Hub, has world-class infrastructure and a well-established financial industry, as well as a clear and transparent regulatory framework. Despite its relatively small population base, Dubai has a wide reach. Singapore radiates the Southeast Asian market, while Dubai radiates the Middle Eastern market, as well as Africa and South Asia.

In the entire Middle East and North Africa market, the on-chain transaction value from July 2022 to June 2023 was approximately $389.8 billion, accounting for nearly 7.2% of the global transaction volume.

Turkey ranked first in transaction volume, while the UAE ranked second.

Among them, the UAE's share of the global cryptocurrency market increased by 500% from July 2020 to June 2021, exceeding $25 billion in transaction volume.

II. Review of Dubai's Web3 History

Start Time: 2016.

In 2016, Dubai established the Global Blockchain Council, which currently has over 30 members, including government entities, international companies, and blockchain startups. Tech giants such as Microsoft, SAP, and Cisco are members of this council.

The Global Blockchain Council announced 7 new blockchain proof of concepts, including: medical records, securing jewelry transactions, ownership transfer, enterprise registration, digital wills, tourism management, and improving freight. It can be said that Dubai is the blockchain R&D center for the Middle East region.

Starting Point: 2018.

In 2018, Abu Dhabi established the world's first cryptocurrency regulatory framework, with the goal of establishing a forward-looking cryptocurrency regulatory framework to promote innovation while protecting consumers and ensuring that the UAE is at the forefront of the cryptocurrency field.

Slow Development Period: 2019–2021.

In 2019, the Dubai government released the "Dubai Blockchain Strategy 2020," aiming to apply blockchain technology to various industries, including finance, real estate, supply chain, and government services, among others;

"The impact of the pandemic since 2020 has severely hit the Dubai economy. The root cause is the lack of internal driving force in Dubai, which heavily relies on the external world. Relying solely on internal circulation is far from enough."

Affected by the pandemic, Dubai's GDP in Q1 2020 was $26.2 billion, a 3.7% year-on-year decrease, with a 55% decline in the tourism industry, a 32% decline in the logistics industry, a 10.5% decline in the accommodation and food industry, and a 9.7% decline in the oil-related industry. However, the financial industry did not decline but increased by about 3.5%, providing 12.8% of the economic contribution. The crypto industry, with its strong financial attributes, receiving more attention and support from the government, is a natural fit."

According to a report by PWC, from July 2020 to June 2021, the UAE's share of the global cryptocurrency market increased by 500%, exceeding $25 billion in transaction volume.

Becoming a Hot City for Web3: 2022–2023.

In March 2022, Dubai issued the Virtual Asset Law and established the Virtual Assets and Regulatory Authority (VARA). Dubai became the first government agency to enter the metaverse. Under VARA's push, companies in the cryptocurrency industry such as Binance, FTX, crypto.com, and Bybit have obtained licenses and set up headquarters or branches in Dubai.

In August 2022, the ruler of Dubai personally announced the Metaverse Strategy, aiming to further expand Dubai's influence in the metaverse. Prior to the plan, 1,000 blockchain and metaverse companies had already chosen to establish themselves in Dubai. Following the plan, Dubai is expected to add 30,000 virtual jobs by 2030, adding $4 billion in additional value to the Dubai economy. In the same year, Dubai launched a five-year metaverse strategy, aiming to create a "metaverse capital" and become one of the top ten XR and metaverse markets globally. To achieve this goal, Dubai is increasing its research and development in metaverse-related technologies, nurturing metaverse-related talent, and attracting global tech companies to establish a presence, including AR/VR/MR/XR, digital twins, 5G, edge computing, and other technology companies. The goal is to create 40,000 metaverse-related jobs and bring about $4 billion in annual economic growth within 5 years. In August 2023, the Dubai Artificial Intelligence and Web 3.0 Zone announced that it will issue Artificial Intelligence (AI) and Web3 licenses to support distributed ledger technology services, professional AI research and consulting, IT infrastructure builders, technology research and development, and public network services. The licenses will be issued by the Dubai International Financial Centre (DIFC), providing 90% subsidies to businesses wishing to operate in Dubai. Predictions for 2024 are expected to be even better than 2023. In September 2023, TOKEN2049 (a leading global Web3 and cryptocurrency conference) announced that it will be held in Dubai at Madinat Jumeirah on April 18-19, 2024. As one of the industry's long-standing conference series, TOKEN 2049 has become a global iconic gathering, with past events being hailed as annual crypto events. On October 30, 2023, UAE Minister Essa Kazim (Governor of DIFC) announced that the first "Dubai AI & Web3 Festival" will be held at Madinat Jumeirah on September 11-12, 2024. The event is expected to attract over 100 exhibitors and 5,000 global policymakers and industry leaders. Undoubtedly, the momentum of Dubai's Web3 in 2024 will only increase compared to 2023. 2023 is not the end point for Dubai Web3, but the starting point. III. Comparison of Dubai's Web3 with Other Countries' Web3 Environments The author has only lived in Singapore, Hong Kong, China, and Dubai for a period of time, and the field survey is only applicable to these four regions. 1. Singapore: Policy-wise, it seems friendly, but in reality, it is difficult for blockchain companies to open accounts in Singapore. With a series of black swan events, Singapore has clearly implemented tighter policies for the blockchain industry. In terms of events, the frequency is high, with 2-4 events per week, but the quality is inconsistent, and some events have a significant overlap of attendees. The advantage is that three universities in Singapore are actively promoting the development of the blockchain industry, with high-quality teaching and stable talent output. 2. China: Policy explicitly prohibits, only open to consortium chains and blockchain applications in the real economy. The frequency of events depends on the region, but if there are no large blockchain conferences, major cities have an average of one or two offline events every one or two weeks, with a relatively low frequency. The advantage is the large population base and a large number of developers, with a rising trend in Web3 industry professionals. 3. Hong Kong: The government began to support the Web3 economic ecosystem in 2022. Adjacent to Shenzhen, it can attract innovative talents from the mainland who want to enter the Web3 industry. However, the drawbacks are significant. First, obtaining a license requires sacrificing too much content, with limited profitability, and the cost of obtaining a compliant license is very high. Second, it has the most expensive housing prices in the world, and according to consulting firm Mercer's research, considering expenses including housing, transportation, food, and entertainment, Hong Kong is rated as the city with the highest cost of living for expatriates in the world. Third, being adjacent to the mainland is both convenient and risky. 4. Dubai: Open policies, clear regulatory regulations, and most exchanges have obtained licenses. It has the most frequent events among the four regions, with almost daily events, and the quality of events is high. The cost of living is lower than in Singapore and Hong Kong. Visa processing is convenient and efficient. The downside is the hot and dry climate, which is not suitable for living, and the small population and insufficient number of developers. When it comes to developers, an obvious trend is that the United States is losing nearly 2% of its Web3 developer share on average each year. High-quality, high-paying jobs are leaving the United States for more favorable conditions for innovation. However, the SEC is not focused on providing clear, common-sense regulation, but is taking enforcement actions against compliant U.S. companies such as Coinbase and Grayscale, which are making every effort to comply with the rules. In 2023, three leading exchanges, including Binance, Bybit, and OKX, have completely exited Canada. Gemini announced a significant increase in its staff and operations in Singapore. Venture capital firm Andreessen Horowitz (a16z) has established its first non-U.S. branch in London.For cryptocurrency companies, the market is constantly changing due to the unstable regulatory environment. In 2023, the market is shifting from North America to the East, with the United States and Canada being considered unfriendly places. Over the past year, Dubai has established the Virtual Asset Regulatory Authority (VARA), while neighboring Abu Dhabi is working on its own crypto-friendly regulatory framework. In April, the European Union passed the Markets in Crypto-Assets Regulation (MiCA), and in the same month, the Securities and Futures Commission of Hong Kong began accepting license applications from crypto exchanges. Therefore, one of the crucial indicators for the crypto industry is the future of regional cryptocurrencies from a regulatory perspective, which is a determining factor. Let's take a look at the regulatory policies of other mainstream crypto countries: 1. United States: As the most developed global financial market, the U.S. has detailed regulatory rules for the crypto market. Multiple administrative agencies have formulated specific regulations based on the nature of cryptocurrencies. For example, the Securities and Exchange Commission (SEC) considers some tokens as "securities," while the Commodity Futures Trading Commission refers to them as "commodities," and the Internal Revenue Service views them as "property." Recently, the SEC has shifted its regulatory focus towards DeFi. The SEC chairman stated that any DeFi project offering services related to security tokens falls within the SEC's regulatory scope, causing significant controversy in the crypto market. 2. Singapore: Singapore is one of the most crypto-friendly countries globally and has implemented detailed regulatory policies. The Monetary Authority of Singapore (MAS) is the primary regulatory authority for the crypto market in Singapore. MAS categorizes tokens into utility tokens, payment tokens, and security tokens. In 2019, MAS introduced a regulatory sandbox mechanism, allowing financial institutions and fintech participants to experiment with innovative financial products or services in a defined space and duration. 3. South Korea: South Korea is one of the active cryptocurrency trading markets. Due to the high enthusiasm of cryptocurrency investors in the country, cryptocurrency prices in South Korean exchanges are higher than in other global exchanges, known as the "kimchi premium." In September 2017, the Financial Services Commission (FSC) banned all forms of ICOs but did not establish specific regulations for cryptocurrency exchanges. In December 2020, the South Korean government announced that it would tax investor profits from cryptocurrency trading. 4. United Kingdom: The Financial Conduct Authority (FCA) is the primary regulatory authority for the crypto market in the UK. The FCA's regulatory purpose is solely for anti-money laundering and counter-terrorism financing. The FCA does not regulate specific crypto assets and related businesses but does regulate crypto asset derivatives and crypto assets considered as securities. Due to concerns about the volatility and valuation of crypto assets, the FCA has prohibited the sale of crypto asset derivatives to retail customers. 5. Japan: The Japanese government has included Web3 as part of its "new capitalism" economic policy, aiming to address social issues through growth and innovation. The Payment Services Act, which came into effect in April 2017, added a chapter on "virtual currency," clearly defining virtual currency as a means of settlement and payment with property value. The law also introduced a regulatory mechanism for cryptocurrency exchanges, allowing only companies registered with the Japanese Financial Services Agency to provide cryptocurrency exchange services. Additionally, Japan has established a tax mechanism for cryptocurrency trading. 6. United Arab Emirates: Approximately 30% of the population in the UAE owns cryptocurrencies, and the country's three main regulatory authorities have introduced a framework to become a global cryptocurrency center. 7. Brazil: The current president plans to position Brazil as the cryptocurrency center of Latin America based on regulations passed during the previous president's term. 8. Hong Kong: Hong Kong has implemented a cryptocurrency regulatory framework, which came into effect in June 2023. The "Crypto New Policy" allows retail investors to engage in cryptocurrency trading starting from June 1. 9. Australia: Australia has conducted comprehensive token mapping consultations and is expected to propose a cryptocurrency licensing framework in the fourth quarter of this year. 10. European Union: Through the Markets in Crypto-Assets (MiCA) regulation, the European Union has brought clear regulatory rules for all 27 EU member states. IV. Progress of Licensing for Dubai Exchanges Leading exchanges play a crucial role in the Web3 field and are a force that cannot be ignored.It is well known that a large number of exchanges are establishing their headquarters in Dubai. Here is some information I have gathered: - **Binance**: In 2022, Binance obtained a Minimal Viable Product (MVP) license from the Virtual Asset Regulatory Authority (VARA) in Dubai, allowing it to open domestic bank accounts to hold client funds locally, operate a cryptocurrency exchange, and provide payment and custody services. The transition from the temporary license obtained in 2022 to the operational MVP license means that eligible users in Dubai will now have access to authorized services, including the secure conversion of virtual assets into fiat currency in accordance with the international Financial Action Task Force (FATF) standards specified by VARA. Binance has passed three out of the four stages of Dubai's licensing process, with the Full Market Product (FMP) license still pending, expected to be obtained after a demonstration of compliance with all rules. - **OKX**: The Middle East branch of OKX, the second-largest cryptocurrency exchange by trading volume, has obtained a Minimal Viable Product (MVP) readiness license from the Virtual Asset Regulatory Authority (VARA) in Dubai, allowing it to prepare for operation when the license becomes effective. OKX Middle East has established a new office in the Dubai World Trade Centre and plans to expand its staff to 30 people, focusing on local recruitment and senior management. Once the MVP license is fully effective, OKX Middle East will offer spot, derivatives, and fiat currency services, including deposits, withdrawals, and spot trading pairs in USD and the United Arab Emirates Dirham (AED). - **Bybit**: In April 2023, Bybit opened its global headquarters in Dubai and has since increased its local staff to 60 people, with ongoing recruitment. Bybit is collaborating with the local government and universities and has organized hackathons to support the development of the developer ecosystem in Dubai. Bybit is expected to become the first cryptocurrency company to obtain approval for Dubai's four-stage licensing process. - **Other Exchanges**: The Singapore-based crypto platform Crypto.com obtained an MVP readiness license from VARA in March this year. Bitget plans to expand into the Middle East and is recruiting up to 60 new employees in the region. The company has opened an office in downtown Dubai to support its expansion and plans to establish a regional headquarters. Other exchanges of various sizes have also obtained MVP licenses from VARA in Dubai. V. Life in Dubai - **Climate**: Dubai, UAE, has a tropical desert climate, with two seasons throughout the year: May to October is the hot season (summer), with hot and humid weather, temperatures exceeding 40°C, and coastal areas reaching over 45°C during the day, with humidity around 90%. November to April is the cool season (winter), with mild and sunny weather, occasional rainfall, and temperatures generally ranging from 15–35°C. The average annual rainfall is about 100 mm, mostly concentrated in January and February. - **Payment Methods**: Credit card usage is widespread, and Visa and MasterCard issued by Chinese banks can be used in major shopping malls and supermarkets. UnionPay cards have full coverage within the country and offer certain discounts in specific areas such as airports. Alipay and WeChat Pay have signed cooperation agreements with UAE banks and institutions to promote their online payment tools in the UAE.Overseas payment methods are also mostly feasible. Due to the presence of over 80% of the expatriate population, Dubai has excelled in internationalized payment methods. **Cost of Living**: The cost of living in Dubai has slightly increased in 2023 but remains significantly lower than other popular destinations for expatriates such as Hong Kong and Singapore, as reflected in Mercer's latest 2023 annual cost of living survey. **Visa Processing**: In recent years, the UAE (Dubai) has gradually become one of the most popular residences for high-net-worth individuals (HNWIs) globally, even becoming a strong competitor to traditional jurisdictions such as the UK, Switzerland, Monaco, and Singapore. With no personal income tax, no property and capital gains tax, no value-added tax, direct administrative requirements, low processing costs, political stability, convenient transportation, abundant sunshine throughout the year, and other favorable conditions, UAE residency has become favored by the crypto market. For those without a signed employment contract, there are two methods to obtain residency in the UAE: through real estate investment (property residency visa) or by establishing a company structure that can act as a sponsor. - Option 1: Obtain residency by purchasing and owning property. To meet the residency visa requirements, the property must be worth at least AED 1 million (approximately US$272,000). The visa is generally issued for a validity period of 2 years but does not allow working in the UAE. - Option 2: Become a UAE resident by registering a company in a free zone. This option allows company shareholders and employees to apply for residency. Obtaining UAE residency through company registration is a more popular route as there are no investment requirements, the visa can be issued for a longer period (3 years), and it provides the opportunity for the applicant to conduct business activities in the UAE and enjoy tax benefits. Additionally, in March 2021, Dubai launched a "Digital Nomad Visa Program" for remote workers and entrepreneurs, allowing foreign citizens with a certain minimum monthly income to work and live in Dubai for one to two years. In conclusion, for the crypto industry, 2023 will not be the end point for Dubai's Web3 but rather a starting point.免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。