This article summarizes the three most popular assets in the current BRC-20 ecosystem: ORDI, SATS, and RATS.

Author: Ryan Lee, Chief Analyst of Bitget Research Institute

Recently, the BRC20 ecosystem has been very hot, not only with wealth effects, but also with continuous improvement and increasing support from major exchanges. For example: Binance launched ORDI, Bitget launched SATS, UniSat Wallet launched BRC-20 Swap, and so on. Today, let's take a look at the three most popular assets in the current BRC-20 ecosystem:

「ORDI」

The first-generation BRC-20 token ORDI is undoubtedly the most well-known, with the largest trading volume and the best liquidity in the ecosystem. Every significant development and positive time in the BRC-20 ecosystem will drive up the price of ORDI. With Binance's listing of ORDI, its total trading volume has reached over $600 million in a single day. In addition to the huge trading volume on CEXs, ORDI has accumulated over 13,000 holding addresses on the BTC network.

「SATS」

Conceptually, "SATS" represents the smallest unit of Bitcoin, "satoshi," and is easily associated with various developments and positive news in the Bitcoin ecosystem.

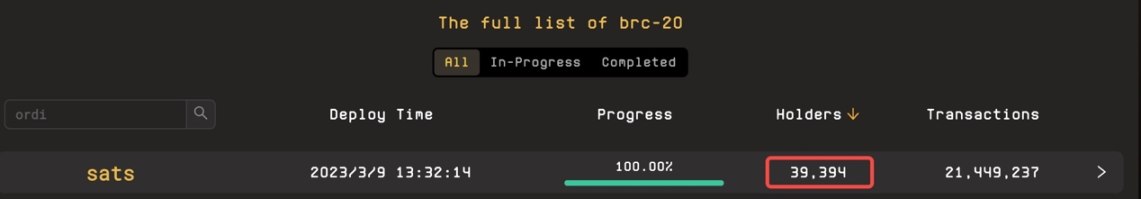

In terms of consensus on funds, the biggest feature of SATS is "total supply of 21 trillion, with a maximum minting quantity of one billion each time," which means that it would take 21 million mintings to achieve 100% Mint Out. Roughly speaking, based on the gas level on the BTC chain, it would cost at least $10-20 million to achieve 100% Mint Out. Such high costs initially made people not believe that SATS could be Mint Out, but surprisingly, SATS achieved 100% Mint Out in just 6 months. This demonstrates its strong consensus on funds. The number of addresses holding SATS has now exceeded 39,000.

In terms of asset empowerment, SATS is favored by Unisat, which will use SATS as the handling fee for its new product, BRC-20 Swap. This gives practical value to BRC-20 tokens that originally only had meme attributes, and also brings consumption deflation scenarios to SATS, undoubtedly making users more optimistic about it. This direct empowerment in the BRC20 ecosystem is much more direct and effective than XEN founder Jack's BRC-20 token "VMPX" crossing to the Ethereum network to seek empowerment opportunities.

「RATS」

"RATS" has been widely promoted on social media because people who missed "SATS" are looking for the next potential target. This logic is similar to those who were not willing to miss the wealth effect of PEPE, which led to the sharp rise of PEPE 2.0.

Generally, the market prefers "speculating on new rather than old," so the BRC20 sector is also in the speculative stage of market curiosity. Therefore, although these three assets on BRC20 are very hot, the associated risks are equally high. When investing, we need to assess our own risk tolerance and operate cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。