Author: Alex Xu

Introduction

After experiencing the bull and bear market cycle from 2020 to 2023, we found that in the Web3 business world, the truly established business models in the application layer are still mainly DeFi, and DEX, lending, and stablecoins remain the three cornerstones of DeFi (the derivatives track has also seen significant development in recent years), and even in a bear market, their business remains resilient.

Mint Ventures has written a large number of research reports and analysis articles on DEX and stablecoins, including DEX projects such as Curve, Trader Joe, Syncswap, Izumi, and Velodrome, as well as stablecoin projects such as MakerDao, Frax, Terra, Liquity, Angle, and Celo. This issue of Clips will return to focus on the lending track, with a particular focus on the emerging force Morpho, whose business data has grown rapidly in the past year.

In this article, the author will review Morpho's existing business and the recently announced lending infrastructure service Morpho Blue, attempting to answer the following questions:

-

What is the current market landscape of the lending track?

-

What businesses does Morpho include, and what problems does it attempt to solve? What is the current status of its business development?

-

What are the prospects of the newly launched Morpho Blue business, and will it impact the leading positions of Aave and Compound? What are the potential impacts?

The following content of the article represents the author's interim views at the time of publication, and may contain factual errors and biases, and is intended for discussion purposes only. The author also looks forward to corrections from other industry researchers.

Decentralized Lending Market Landscape

Organic demand becomes mainstream, Ponzi colors fade

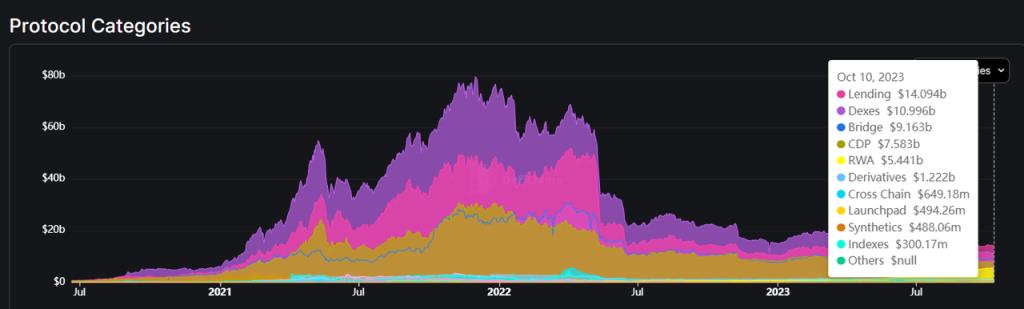

The share of decentralized lending in terms of capital has always been at the forefront, and the TVL has now surpassed DEX, becoming the track with the largest capital capacity in the DeFi field.

Source: https://defillama.com/categories

Decentralized lending is also a rare business category in the Web3 field that has achieved "PMF" (Product-Market Fit). Although during the DeFi summer boom in 2020-2021, there were many projects that heavily subsidized lending behavior through tokens, such phenomena have greatly diminished in the bear market.

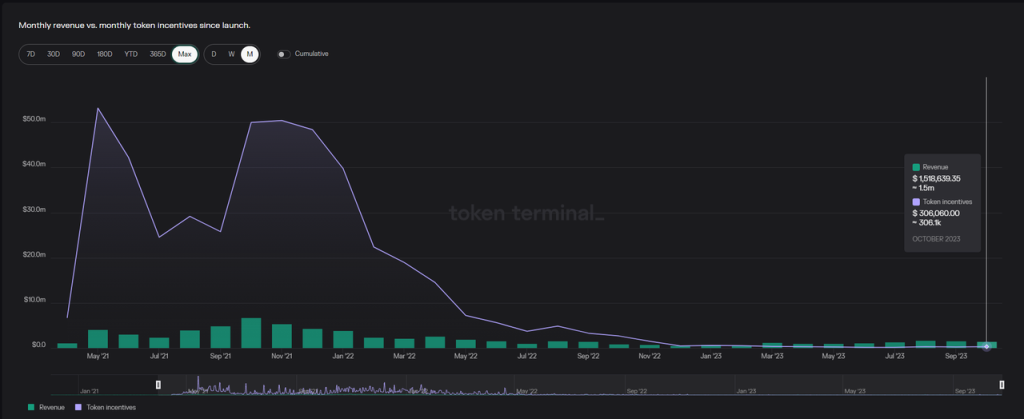

As shown in the following figure, the protocol revenue of the leading lending project Aave has exceeded its token incentives since December 2022, and has far surpassed token incentives to date (protocol revenue in September was $1.6 million, while Aave token incentives were $230,000). In addition, Aave's token incentives are mainly used to encourage token holders to stake Aave to ensure that the protocol can cover bad debts and insufficient treasury compensation, rather than to incentivize user deposit and borrowing behavior. Therefore, Aave's current deposit and borrowing behavior is completely "organic," rather than supported by a Ponzi structure based on liquidity mining.

Comparison of Aave's incentive collection and protocol revenue on a monthly basis

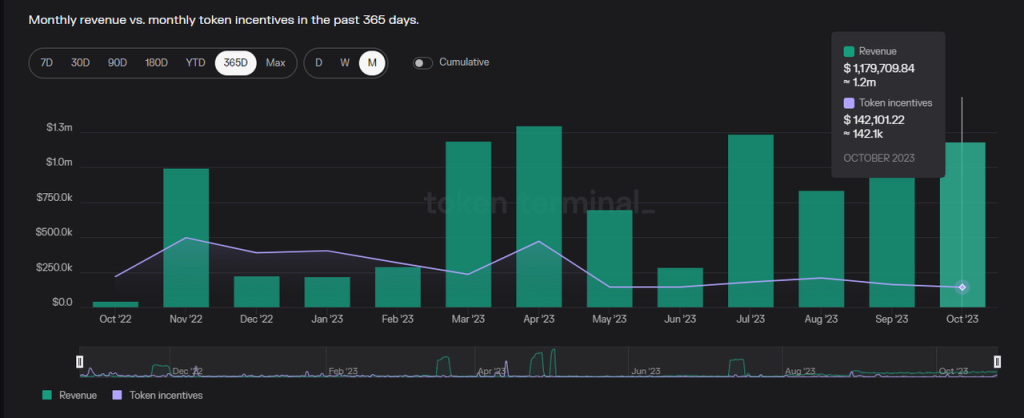

In addition, the leading lending protocol Venus on the BNB chain has also achieved a benign operation of protocol revenue surpassing incentive collection after March 2023, and is now basically no longer subsidizing deposit and borrowing behavior.

Comparison of Venus's incentive collection and protocol revenue on a monthly basis

However, many lending protocols still have high token subsidies behind supply and demand, where the value of protocol subsidies for lending behavior far exceeds the income obtained from it.

For example, Compound V3 still provides Comp token subsidies for deposit and borrowing behavior.

Nearly half of the USDC deposit rate on Compound V3 on the Ethereum mainnet is provided by token subsidies

84% of the USDC deposit rate on Compound V3 Base on the Ethereum mainnet is provided by token subsidies

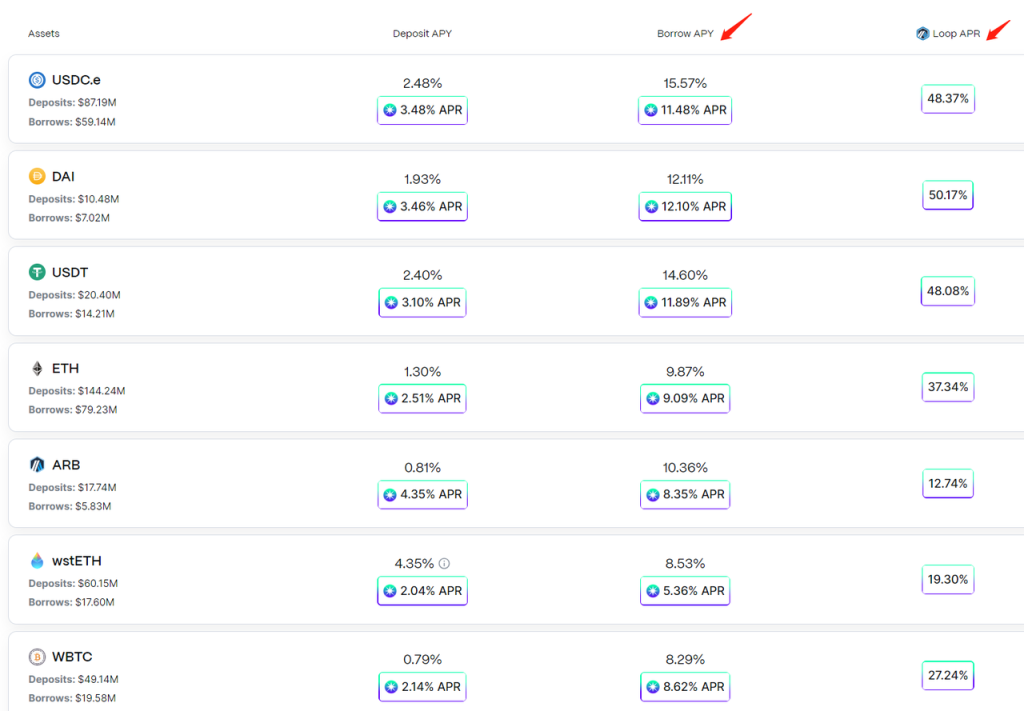

If Compound is maintaining its market share through high token subsidies, another protocol, Radiant, is purely a Ponzi structure.

On Radiant's lending market page, we can see two unusual phenomena:

First, its asset lending rates are significantly higher than market rates. The stablecoin lending rates in mainstream currency markets are usually around 3-5%, while Radiant's rates are as high as 14-15%, and the lending rates for other assets are 8-10 times those in mainstream currency markets;

Second, its product interface mainly promotes circular lending, encouraging users to repeatedly use the same asset as collateral for deposits and borrowing in order to maximize their "total lending amount" and maximize their mining rewards for the platform's token, Radiant. Essentially, the Radiant project is indirectly selling its token, RDNT, to users by collecting borrowing fees.

The problem is that the source of Radiant's fees—user borrowing behavior—is not based on genuine organic lending demand, but rather to obtain the RNDT token. This creates a "robbing Peter to pay Paul" Ponzi economic structure. In this process, the lending platform does not have genuine "financial consumers." Circular lending is not a healthy lending model, as both the depositor and borrower of the same asset are the users themselves, and the economic source of RDNT dividends also comes from the users themselves, with the only risk-free beneficiary being the platform project party that profits from the fees (it takes 15% of interest income). Although the project has delayed the short-term death spiral pressure on the RDNT token through the dLP staking mechanism, in the long run, unless Radiant gradually transitions its business from a Ponzi scheme to a normal business model, the death spiral will eventually come.

Overall, however, the decentralized lending market, represented by leading projects like Aave, is gradually moving away from relying on high subsidies to sustain operating income and returning to a healthy business model.

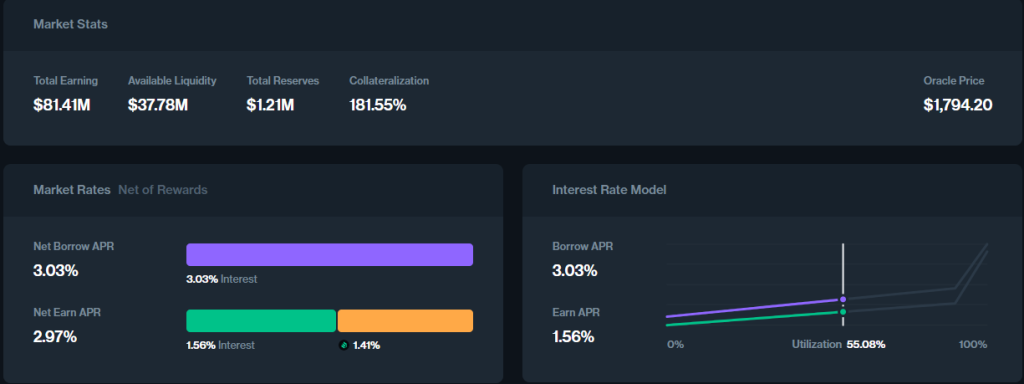

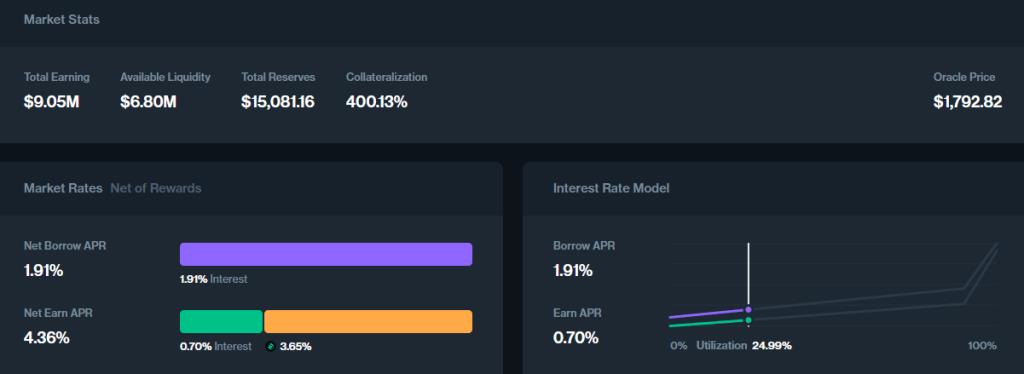

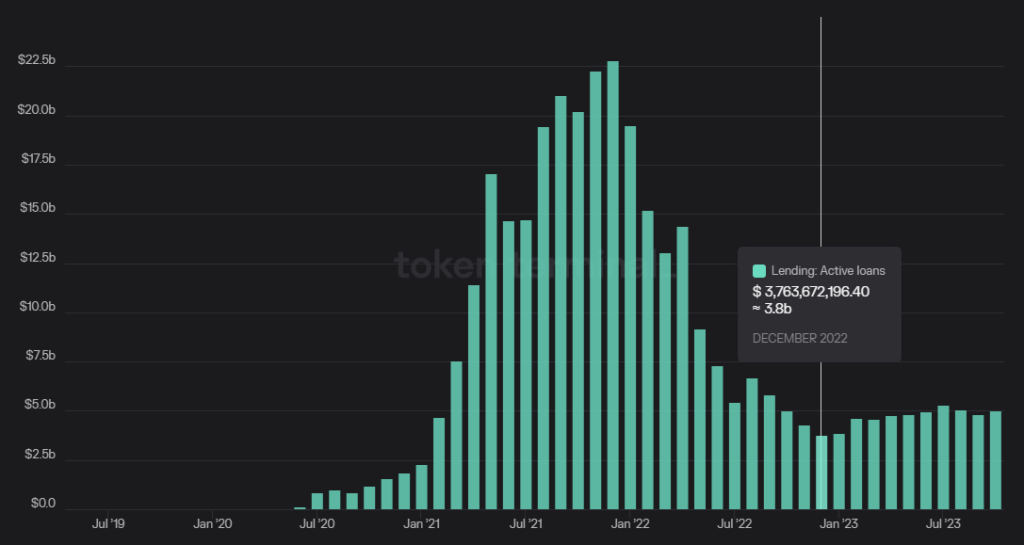

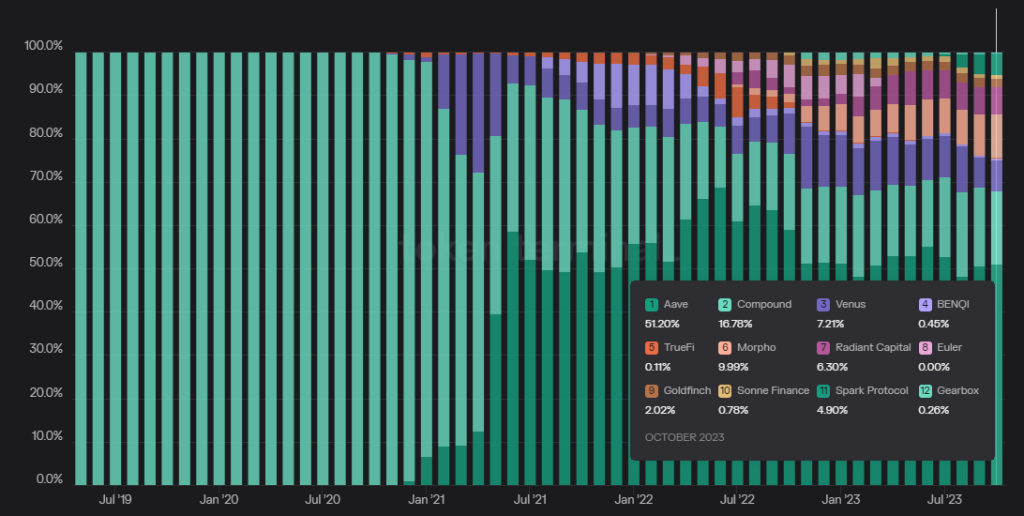

The following image shows the changes in the active loan volume in the web3 lending market from May 2019 to October 2023, starting from a few hundred thousand dollars, peaking at $22.5 billion in November 2021, dropping to $3.8 billion in November 2022, and now at $5 billion. The lending market volume is slowly bottoming out and rebounding, demonstrating good business resilience in the bear market.  ### Strong Moat, High Market Concentration Both being DeFi infrastructure, compared to the fierce competition in the Dex market, leading projects in the lending track have a stronger moat, as evidenced by: 1. More stable market share. The chart below shows the changes in the active lending volume share of various projects from May 2019 to October 2023. Since Aave's efforts in mid-2021, its market share has remained stable at 50-60%, while the second-place Compound, although squeezed, still maintains a relatively stable ranking.  In contrast, the market share changes in the Dex track are more drastic. After quickly capturing nearly 90% of the trading volume market share following its launch, Uniswap's market share dropped to 37% due to the rapid growth of Sushiswap, Curve, and Pancakeswap, and is now back to around 55%. Additionally, the number of projects in the Dex track is much higher than in the lending track. 2. Stronger profitability of lending track projects. As mentioned earlier, projects like Aave have been able to achieve positive cash flow without subsidizing lending behavior, with monthly interest income of around $1.5-2 million. In contrast, most Dex projects either have not started charging fees at the protocol level (only at the frontend) like Uniswap, or their token emission for liquidity incentives far exceeds the protocol's fee income, resulting in actual loss-making operations. The moat of leading lending protocols can be broadly summarized as brand strength in security, which can be further divided into the following two points: - **Long-standing secure operational history**: Since the DeFi Summer in 2020, many Aave or Compound fork projects on various chains have encountered theft or significant bad debt losses shortly after establishment. Aave and Compound have not experienced serious theft or unsustainable bad debt incidents, providing crucial security endorsement for depositors. New lending protocols may have more attractive concepts and higher short-term APY, but it's challenging to gain user trust, especially from whale users, without years of real-world operational history. - **More abundant security budget**: Leading lending protocols have higher business income and ample treasury funds to provide substantial budgets for security audits and asset risk control, which is crucial for future feature development and introducing new assets. **In summary, lending is a market that has proven to have organic demand, a healthy business model, and relatively concentrated market share.** ### Morpho's Business and Operational Status #### Business Content: Interest Rate Optimization Morpho's current business is a peer-to-peer lending protocol (or interest rate optimizer) built on top of Aave and Compound. Its role is to address the inefficiency issue in Aave-like money markets where deposit and borrowing funds are not fully matched. **Its value proposition is simple and clear: to provide better rates for both lenders and borrowers, i.e., higher deposit returns and lower borrowing rates.**The reason why the point pool model of Aave and Compound has low capital efficiency is because its mechanism dictates that the total size of deposit funds (pool) is always greater than the total size of lending funds (point). In most cases, the USDT money market has a total deposit of 10 billion, but only 6 billion USDT is lent out. For depositors, because the idle 4 billion funds also have to share the interest generated by the 6 billion loan, the interest each person can receive is reduced. For borrowers, even though only a portion of the pool funds is borrowed, they are required to pay interest for the entire pool. This mismatch between deposit and lending funds creates the problem. Let's take the example of the interest rate optimizer module built on Aave V2, which currently has the largest deposit volume for Morpho, to see how Morpho's interest rate optimization service solves this problem. - **Deposits**: Depositor BOB deposits 10,000 Dai into Morpho, and Morpho first deposits the funds into Aave V2's money market at an interest rate of 3.67%. - **Borrowing Collateral**: Borrower ALICE first deposits 20 ETH as collateral into Morpho and requests to borrow 10,000 Dai. Morpho then deposits the collateral into Aave V2's money market. - **Matching Deposits and Loans**: Morpho then retrieves the 10,000 Dai previously deposited by BOB into Aave and directly matches it to lend to ALICE. At this point, BOB's deposit is fully matched and not idle, while ALICE only pays interest for the 10,000 Dai borrowed, not for the entire pool. In this matching scenario, BOB receives a deposit interest rate of 4.46%, higher than Aave's point pool model of 3.67%, and ALICE pays a borrowing interest rate of 4.46%, lower than Aave's point pool model of 6.17%. Both parties' interest rates are optimized. *Note: Whether the 4.46% P2P interest rate in the example is closer to the lower limit (deposit APY) or the upper limit (borrowing APY) of the underlying protocol depends on Morpho's parameters, which are determined by governance.* - **Mismatch Resolution**: If at this point BOB wants to withdraw the previously lent Dai, and ALICE has not yet repaid, with no other lenders on Morpho, Morpho will borrow 10,000+ Dai with ALICE's 20 ETH as collateral from Aave to complete the redemption for BOB. - **Matching Order**: Considering gas costs, the P2P matching of deposits and loans prioritizes "matching larger funds" to minimize the gas consumption ratio. If the gas consumption value relative to the matched fund amount is too high, the matching will not be executed to avoid excessive wear and tear. Through the above explanation, we find that **Morpho's business essence is to use Aave and Compound as capital buffers to provide interest rate optimization services for deposit and borrowing users through matching**. The cleverness of this design lies in the way Morpho attracts user funds through the composability of the DeFi world. For users, the attraction lies in: 1. At the very least, they can obtain financial rates equivalent to Aave and Compound through Morpho, and when matching occurs, their returns/costs will be significantly optimized. 2. Morpho's product is mainly built on Aave and Compound, and the risk parameters are completely replicated and executed. Its funds are also allocated in Aave and Compound, thus inheriting the brand reputation of the two established protocols to a great extent. This clever design and clear value proposition have allowed Morpho to achieve a deposit volume of nearly $1 billion, second only to Aave and Compound, within just over a year of its launch.Business Data and Token Situation

Business Data

The following chart shows the trend of Morpho's total deposits (blue line), total borrowings (light brown line), and matched amounts (dark brown).

Overall, all aspects of Morpho's business scale continue to grow, with a deposit fund matching rate of 33.4% and a borrowing fund matching rate of 63.9%, which is quite impressive.

Token Situation

Source: Official Documentation

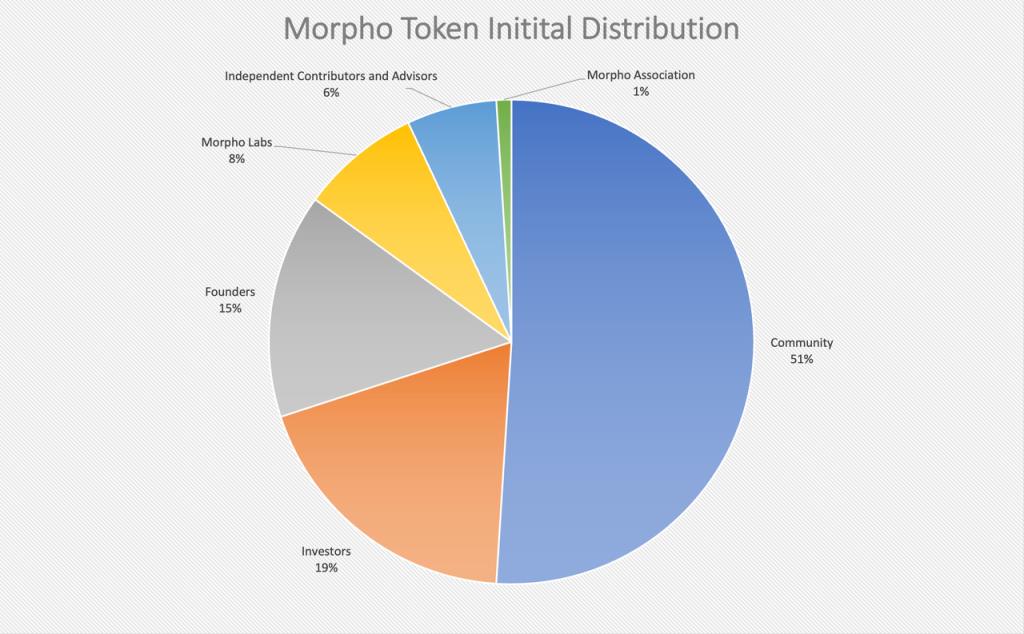

The total supply of Morpho tokens is 1 billion, with 51% allocated to the community, 19% sold to investors, and the founders and the behind-the-scenes development company Morpho Labs and the operating organization Morpho Association owning 24%, with the remainder allocated to advisors and contributors.

It is worth noting that although Morpho tokens have been issued and used in voting decisions and project incentives, they are in a non-transferable state. Therefore, they do not have a secondary market price, and recipients of the tokens and investors can participate in governance voting but cannot sell them.

Unlike projects like Curve that hard-code the future output and incentives of tokens, Morpho's token incentives are batched and determined on a quarterly or monthly basis, allowing the governance team to flexibly adjust the intensity and specific strategies of incentives based on market changes.

I believe this is a more practical approach and may become the mainstream model for token incentive distribution in Web3 business in the future.

In terms of the target of incentives, Morpho incentivizes both deposit and borrowing behaviors. However, the allocation of Morpho tokens for incentives is currently not significant, with only 30.8 million tokens allocated in the past year, accounting for 3.08% of the total supply. Furthermore, from the incentive periods and corresponding token allocations in the chart below, the official token expenditure on incentives is rapidly decreasing, and the decrease in expenditure has not slowed down the growth rate of Morpho's business.

This is a positive signal, indicating that Morpho's product-market fit is quite strong, and user demand is becoming more organic. With nearly 48% of the community token allocation still available out of the initial 51%, this reserves ample budget space for future business incentives in new areas.

However, Morpho currently does not charge for its services.

Team and Financing

The core team of Morpho is from France, with most members based in Paris. The core team members have been identified, and the three founders all come from the telecommunications and computer industries, with backgrounds in blockchain entrepreneurship and development.

Morpho has completed two rounds of financing, including a $1.3 million seed round in October 2021, and a $18 million Series A round led by A16z, Nascent, and Variant in July 2022.

Source: Official Website

If the above financing amount corresponds to the 19% investor share disclosed by the official, then the project's comprehensive valuation is approximately around $100 million.

Morpho Blue and Its Potential Impact

What is Morpho Blue?

In simple terms, Morpho Blue is a permissionless lending infrastructure.Compared to Aave and Compound, Morpho Blue opens up most of the lending dimensions, so anyone can build a lending market based on Morpho Blue, and the dimensions that builders can choose from include:

- What to use as collateral;

- What to use as the lending asset;

- What oracle to use;

- What the loan-to-value ratio (LTV) and liquidation ratio (LLTV) are;

- What the interest rate model (IRM) is like.

What value will this bring? In the official article, the characteristics of Morpho Blue are summarized as follows:

Trustless, because:

- Morpho Blue is un-upgradable, and no one can change it, following the principle of minimal governance.

- Only 650 lines of Solidity code, simple and secure.

Efficient, because:

- Users can choose higher LTV and more reasonable interest rates.

- The platform does not need to pay for third-party audit and risk management services.

- Based on a simple code singleton smart contract (referring to a protocol that uses a single contract to execute, rather than a combination of multiple contracts, similar to Uniswap V4), this significantly reduces gas costs by 70%.

Flexible, because:

- Market construction and risk management (oracles, lending parameters) are permissionless, no longer following a uniform model, meaning the entire platform follows a set of standards established by DAO (Aave and Compound's model).

- Developer-friendly: Introducing various modern smart contract patterns, account management achieves gas-free interaction and account abstraction functionality, and free flash loans allow anyone to access assets from all markets with a single call, as long as they are repaid in the same transaction.

Morpho Blue adopts a similar product concept to Uni V4, which means it only provides a basic layer for a type of large financial service and opens up the modules above the basic layer, allowing different people to come in and provide services.

The difference from Aave is that although Aave's fund borrowing is permissionless, everyone can decide what kind of assets to deposit and borrow in Aave, whether the risk control rules are conservative or aggressive, which oracle to use, and how to set interest rates and liquidation parameters. These are determined and managed by Aave DAO and various service providers behind the DAO, such as Gauntlet and Chaos, which monitor and manage over 600 risk parameters on a daily basis.

Morpho Blue is like an open lending operating system, where anyone can build their own optimal lending combination on top of Morpho Blue, just like Aave. Professional risk management institutions like Gauntlet and Chaos can also seek partners in the market to sell their risk management services and obtain corresponding fees.In the author's view, the core value proposition of Morpho Blue is not just about trustlessness, efficiency, and flexibility, but rather about providing a free lending market that facilitates collaboration among participants in various aspects of the lending market, offering richer market choices for customers at each stage.

### Will Morpho Blue pose a threat to Aave?

It's possible.

Morpho differs from many previous challengers to Aave in several ways, and over the past year, it has accumulated some advantages:

- It has a management volume of 1 billion other funds, which is now at the same order of magnitude as Aave's 70 billion management volume. Although these funds are currently deposited in Morpho's interest rate optimizer function, there are many ways to import them into new features.

- As the fastest-growing lending protocol in the past year, coupled with its token not yet in formal circulation, there is a lot of room for imagination, making it easy to attract user participation in the launch of major new features.

- Morpho's token budget is sufficient and flexible, with the ability to attract users through subsidies in the early stages.

- With its stable operational history and fund volume, it has already accumulated a certain level of security brand.

Of course, this does not mean that Aave will necessarily be at a disadvantage in future confrontations, as most users may not have the ability and willingness to select services from numerous lending schemes. The lending products output under Aave DAO's centralized management model may still be the most favored in the end.

Furthermore, the Morpho interest rate optimizer largely inherits the security and credibility of Aave and Compound, which gradually instills more confidence in using funds. However, Morpho Blue is a completely new product with standalone code, so there will inevitably be a period of hesitation for whales before they feel comfortable investing. After all, the recent theft incident involving previous-generation permissionless lending markets like Euler is still fresh in memory.

Moreover, Aave has the capability to build a functionality similar to the Morpho interest rate optimizer on its existing platform to meet the demand for improving fund matching efficiency, potentially squeezing Morpho out of the P2P lending market. Although this possibility currently seems unlikely, as in July of this year, Aave provided grants to a P2P lending product similar to Morpho called NillaConnect, rather than developing its own.

Finally, the lending business model adopted by Morpho Blue ultimately does not have any fundamental differences from Aave's existing solutions, and Aave also has the ability to observe and emulate successful lending models on Morpho Blue.

However, in any case, after the launch of Morpho Blue, it will provide a more open lending experimental ground, offering the possibility for participation and combination in all aspects of lending. Will these newly connected lending clusters produce solutions that are challenging enough to compete with Aave?

We will have to wait and see. 免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。