Author: RockFlow

Key Points

① Coinbase has carved out a unique niche market in the complex crypto world. "Whether it can lead the U.S. crypto infrastructure" and "whether the crypto economy will become an important part of the real economy" will determine how far Coinbase can go.

② As one of the largest holders of publicly traded Bitcoin, MicroStrategy's core SaaS business limits downside risk, while using low-cost funds to continuously buy Bitcoin for the long term gives it considerable upside potential.

③ Marathon, as a leading Bitcoin mining company, is fundamentally engaged in energy arbitrage. Differentiated operational capabilities, hardware upgrades, and energy utilization strategies will be the core competitive strengths for mining companies to surpass Bitcoin returns and successfully cross cycles.

Every innovation cycle begins with speculation. Speculation often leads reality, and fundamentals take time to catch up.

The internet of the past few decades is a case in point. Despite experiencing the pain of the late 1990s bubble burst, today it has incubated a group of the world's largest and most profitable companies.

The crypto market may face similar challenges. If the rapid expansion of this market over the past decade was driven by pure fundamentals rather than speculation, that is clearly a lie. And now the question is, if this market gradually moves away from the late bubble, what is the real value it can leave behind? Which companies will be the representatives of this industry?

Starting from the present, the RockFlow research team will introduce you to the current U.S. companies that are likely to survive as long-term participants in the crypto market and grow into true giants.

1. COIN: Leading infrastructure, an important player attracting institutional investors

Coinbase has carved out a unique niche market for itself in the complex crypto world. Its history can be traced back to 2012, starting as an early platform centered around Bitcoin, incubated by Y Combinator. Over a decade later, Coinbase has become a leading exchange for buying and selling crypto assets, and has been pursuing a path of compliance.

In the past two years, Coinbase has been working to diversify its business scope, expanding beyond just the exchange to the entire blockchain technology field, from wallet infrastructure to staking services and on-chain scaling solutions. The previous L2 rollup Base is a typical example.

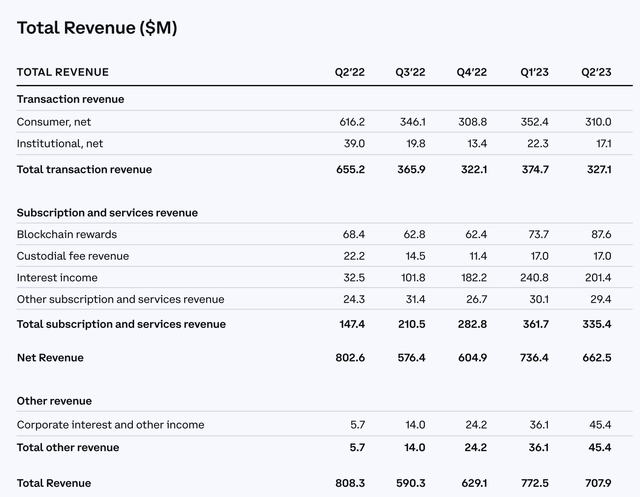

At the same time, its sources of revenue have significantly diversified: trading revenue from individual users has continued to decline (the fundamental reason being the significant decline in BTC and ETH prices in recent quarters), while other types of revenue have surged. Especially interest income, which increased rapidly from $32.5 million in the second quarter of 2023 to $201.4 million from the previous year. The following chart shows Coinbase's key financial data for the past five quarters:

In this tumultuous emerging industry, Coinbase is establishing a trusted reputation, which is the result of unwavering commitment, transparent operations, and a user-centric approach. This trust is reflected not only in its trading platform, but also in its diversified products—from multi-functional financial products such as savings and rewards to the Coinbase debit card, and its foray into Web3, Coinbase's ecological strategic vision is gradually unfolding.

Objectively speaking, the future valuation of Coinbase is mainly based on the answers to four propositions:

First, can Coinbase lead the construction of the U.S. crypto market infrastructure?

Second, is Coinbase more than just an exchange?

Third, will the "crypto economy" become an important part of the real economy?

Fourth, will the prices of Bitcoin and Ethereum continue to rise?

These four propositions imply almost the entire narrative of Coinbase.

Can Coinbase lead the construction of the U.S. crypto market infrastructure? From the current situation, exchanges like Binance still pose strong competition in terms of trading volume and scale. But a key difference in the crypto field is trust—users need to have confidence in the security of their assets and the compliance of the exchange. Binance faces difficulties in expanding its business in the U.S., and has unclear entanglements with entities like the SEC; whereas Coinbase is subject to strict supervision by the CFTC, SEC, and financial regulatory authorities in the UK and Europe. In comparison, Coinbase should be the preferred choice for individuals and institutions seeking secure Bitcoin investments.

Second, Coinbase is more than just an exchange. In the traditional U.S. financial system, institutions often play different roles in various aspects. For example, Robinhood, TD Ameritrade, and Schwab have retail brokerage businesses, State Street and BNY Mellon have asset custody businesses, PayPal, Visa, and Mastercard have payment businesses, and NYSE and Nasdaq have stock trading businesses.

The current crypto financial system is clearly not like this. Coinbase already has retail brokerage, custody solutions, exchange business, and is a leading player in the crypto payment field. It could be said that it is "the crypto NYSE + Robinhood + State Street + PayPal."

Third, will the "crypto economy" become an important part of the real economy? There is a great deal of market divergence on this point. All mature physical economy markets that have stood the test of time—such as agricultural products, oil, and natural gas—thrive because the entire industry profits by selling basic commodities to consumers. The oil market is not just about speculating on oil prices—it is the physical business of upstream and downstream energy producers; the corn market is not just about speculating on corn prices—farmers and large institutions also trade and hedge risks to provide consumers with stable food prices. But what about the crypto market? How many real business participants are there?

Currently, very few people actually use Bitcoin as a form of payment, and mainstream cryptocurrencies are almost impossible to use as a daily means of payment. More widespread use and circulation will require the final approval of a Bitcoin spot ETF in the U.S., which will expand the effective "commercial use" of the crypto market, such as allowing individuals and institutions to hold Bitcoin. The crypto economy is expected to continue to exist as a speculative method and emerging asset class, but the difficulty of commercial viability remains significant.

Fourth, will the prices of Bitcoin and Ethereum continue to rise? Coinbase charges fees based on the value of assets traded or held by customers on its platform, and it also holds a large amount of Bitcoin on its balance sheet. Therefore, the rising prices of cryptocurrencies directly contribute to its market value. And from past events, inflation has always existed, fiscal and monetary stimulus never stops, and the two main choices for safe-haven assets—gold and Bitcoin—are becoming a larger consensus.

Although the crypto industry is full of challenges, this also means that the remaining players can benefit more. Coinbase is one of the few exchanges that can truly attract institutional investors to enter this field, and in the long run, it is expected to outperform the performance of cryptocurrencies themselves.

2. MSTR: A Better Choice Than BTC

The prolonged delay by the U.S. SEC in making a formal decision on multiple Bitcoin spot ETF proposals is disappointing news for the vast majority of investors. However, for those familiar with MicroStrategy and Bitcoin investors, this will only enhance the attractiveness of MSTR, as MSTR is currently the most convenient way to obtain Bitcoin through a U.S. stock account.

MSTR is one of the largest publicly traded Bitcoin holders in the world, thanks to its strategic move in August 2020—using excess cash, as well as debt and equity financing, to continuously buy Bitcoin for the long term.

According to its 2023Q2 financial report, as of July 31, MSTR holds 152,800 Bitcoins, with a total cost of $4.53 billion, or $29,672 per Bitcoin. Of these, 15,731 are pledged as collateral for the company's 2028 senior secured notes, and the remaining 137,069 (about 90% of the total holdings) are unpledged.

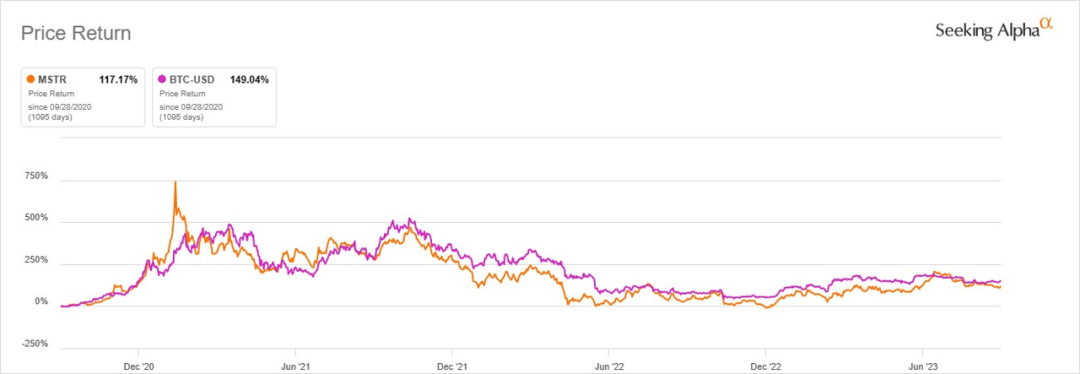

Since the strategy of buying and holding Bitcoin was introduced three years ago, the stock price of MSTR has shown a strong correlation with the price of Bitcoin, as shown in the following chart:

For investors hoping to profit from the rise in BTC price, MSTR is not the only choice. Stocks of Bitcoin mining companies such as Marathon Digital and Riot Platforms, as well as crypto exchanges like Coinbase, also fluctuate in sync with the price of Bitcoin. However, unlike these stocks, MSTR has a core business, which is a strong competitive advantage.

Stable Core Business Limits Downside Risk

MSTR is also a SaaS company that has been providing enterprise analytics software and services for decades. It has a solid customer base, including companies like Hilton Hotels and Sony, with annual revenue that is quite predictable—$4.99 billion in 2022, $5.11 billion in 2021, $4.81 billion in 2020, and $4.86 billion in 2019. Analysts expect revenue to reach $5.01 billion in 2023.

MSTR is migrating its enterprise analytics software customers to the cloud, shifting from revenue generated through product licenses to revenue generated through subscriptions. So far, the subscription model has proven successful, with a high renewal rate. The customer renewal rate for 2023Q2 was 93%, and has remained above 90% for the sixth consecutive quarter.

To adapt to technological trends, MSTR's core enterprise analytics platform is also exploring integration with AI. MSTR is expanding its partnership with Microsoft to integrate its analytics capabilities with Azure OpenAI services and Microsoft 365. MSTR is also seeking greater innovation through MicroStrategy Lightning, aiming to leverage the Bitcoin network to achieve new e-commerce use cases and address cybersecurity challenges.

While these initiatives are unlikely to bring explosive revenue growth, they are reliable signs of the healthy development of MSTR's core business, meaning it has the ability to continue providing sufficient cash to cover operating costs. This limits the downside risk of its stock price.

From a valuation perspective, MSTR's current stock price is reasonable compared to other software companies; however, the difference is that MSTR is not just an ordinary software company, it also holds over 137,000 unpledged Bitcoins. This makes it more likely for its stock price to outperform many tech giants and SaaS peers.

Primary Advantage of Obtaining Low-Cost Capital

Another major reason for investors bullish on BTC to choose MSTR is its ability to raise funds on attractive terms. The company reportedly has outstanding debt and convertible notes totaling $2.2 billion, with a weighted average interest rate of approximately 1.6%. Compared to the average rate of 2.1% at the end of 2022, the annualized interest expense has been reduced by over $15 million.

Continuously purchasing BTC with low-interest debt is a wise move, as the capital appreciation of Bitcoin is expected to exceed the debt and interest costs with the improvement of the crypto market in the coming quarters (catalysts include the approval of a Bitcoin spot ETF by the U.S. SEC, the Bitcoin halving in 2024Q2, and the possibility of interest rate cuts during a period of decreasing inflation).

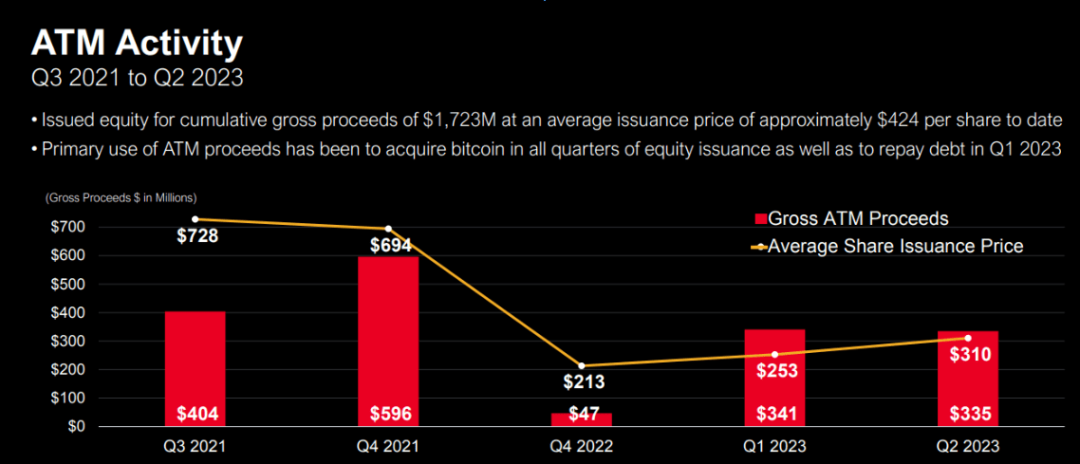

Issuing new shares to raise funds is another financing method for MSTR. Since 2021Q3, MSTR has raised a total of $1.7 billion through an ATM program, with an average stock issuance price of approximately $424 per share. The primary use of the funds raised is, of course, to purchase more Bitcoin.

The unique aspect of MSTR's ATM program is that, compared to other participants in the Bitcoin space such as MARA and RIOT, which regularly issue new shares for financing, its increase in outstanding shares is very low.

The total number of MSTR's outstanding shares has increased from 11.3 million shares in 2021 to 14.1 million shares in the most recent quarter. In comparison, MARA's outstanding shares have increased from 102.7 million shares in 2021 to 174.2 million shares in the most recent quarter, and RIOT's outstanding shares have increased from 117.3 million shares in 2021 to 185.3 million shares in the most recent quarter.

The slow pace of share quantity growth means that MSTR has greater room in the future to issue more new shares for financing. Additionally, on September 24, the company sold a total of 403,362 shares, with a net profit of $147.3 million, used to purchase Bitcoin.

Risk Factors

It is necessary to point out that MSTR has two potential risks. First, disposing of part or all of its Bitcoin holdings for any reason in the future could lead to an overly negative investor reaction. Therefore, the company must continue to carry debt and issue shares to maintain its Bitcoin strategy. However, it is also difficult to guarantee that it can continue to raise funds on attractive terms in the long term, especially if the price of Bitcoin continues to trade sideways (or worse, experiences a significant decline). It's worth noting that during the last crypto bear market in 2022, many crypto companies went bankrupt due to excessive leverage.

The second potential risk is the company's valuation. While investors can use the price-earnings ratio to understand its value as a software company, according to GAAP accounting requirements, MSTR's held Bitcoins need to be revalued for impairment each quarter, so the company's financial reports may frequently incur impairment charges. Due to the significant short-term fluctuations in the price of Bitcoin (e.g., impairment charges were $24 million in 2023Q2, compared to $918 million in 2022Q2), the already challenging company valuation becomes even more complex.

3. MARA: Is Mining a Good Business?

Marathon is a Bitcoin mining company that offers investors an indirect Bitcoin investment solution. There is a strong positive correlation between the stock prices of mining companies and the price of Bitcoin, and in general, mining companies are essentially a leveraged game of cryptocurrencies.

Historical data shows that when the price of Bitcoin rises, the stock prices of mining companies rise even more, as investors are exceptionally excited, believing in the existence of a multiplier effect; and when the price of Bitcoin falls, miners are hit even harder.

The essence of the mining business is arbitrage. It is more accurate to say that mining companies need to learn from "mining" experiences to operate energy arbitrage businesses as efficiently as possible, rather than delve into the technical details of Bitcoin. The top mining companies are often excited about new cooling methods, new architectural approaches, new transformers, or new energy arbitrage strategies.

Arbitrage is crucial, and it is one of the differentiating factors that allows mining companies to stand out among their competitors. The best mining companies need to have the best equipment assets and the lowest production costs. More importantly, they need someone who understands energy arbitrage, an excellent CFO.

They sometimes shut down machines because they can achieve greater profits through energy recovery programs. The importance of an experienced CFO is that they can guide the company through Bitcoin's cyclical bear markets and "crypto winters."

Marathon's 2023Q2 financial report released on August 8 revealed the current state of its business development: quarterly revenue increased by 228.5% year-on-year, with a net loss of $21.3 million (nearly 200% increase from $7.2 million in Q1). This indicates high Bitcoin production costs, less than ideal market prices, and other heavy operating expenses such as energy costs.

Although falling short of expectations, MARA's performance still showed significant growth compared to the previous year. Bitcoin production increased by 314% year-on-year, averaging 32 per day, but the average Bitcoin price decreased by 14%, affecting revenue.

The reason for the increase in production is that MARA's operational hash rate in the second quarter increased by 54% from the first quarter to reach 17.7 EH/s, reaching a historical high. After the second quarter, the operational hash rate continued to rise, reaching approximately 19 EH/s in July.

The path to profitability for mining companies is more challenging than for exchanges and asset management businesses. In addition to the common regulatory resistance in the crypto field, the significant fluctuations in the price of Bitcoin often seriously affect the profits and cash flow of mining companies, as Bitcoin is their main source of income.

Furthermore, the next Bitcoin halving is expected to occur in April 2024, and as Bitcoin block rewards halve, mining company revenue may decrease. The Bitcoin halving will also lead to an increase in mining difficulty, forcing mining companies to purchase more powerful hardware. More powerful hardware will result in higher energy costs and generate more operating expenses, which are challenges that mining companies find difficult to avoid.

Therefore, compared to exchanges and asset management businesses, mining is a riskier crypto investment.

4. Conclusion

The crypto industry itself has experienced multiple speculative cycles, each driven by speculation about the triggering factors of innovation. These cycles have brought more attention, users, and capital to the crypto ecosystem, and have expanded the potential of crypto technology on the basis of the progress made by predecessors.

At present, the industry may have reached a point where there are enough puzzle pieces—rearrangeable in different ways to meet broader needs and real use cases—leading the industry to a new realm.

In this process, even if you are not in the crypto industry, you can support the companies you believe in through investment. Here are the top crypto companies and crypto strategy ETFs currently selected by the RockFlow research team in the US stock market:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。