Author: Dark Side of the Moon, PANews

As an important entry point for the cryptocurrency market, trading platforms have been constantly innovating. Recently, many leading exchanges have been integrating new technologies such as AI to enhance the updates of copy trading products. In reality, after meeting various trading needs, how to maximize participation in the platform's growth, share the platform's growth dividends, and have more autonomy is the key to the battle for the cryptocurrency platform market in the future Web3 industry. Platform tokens are undoubtedly the most effective "weapon."

Analysis of Websea, a new type of CEX deeply integrated with Web 3.0

In the long-term development process, the most outstanding contribution of Web 2.0 is its product system, which meticulously grasps and polishes the psychology and behavior of users. For example, the Telegram Bot allows users to fully utilize the functions of DEX without the need to interact with the on-chain front end, directly meeting current user needs.

In the CEX field, a long-standing issue has been the lack of transparency in operations. After the collapse of FTX, major exchanges have resorted to using Merkle tree proofs of user assets to prove their innocence, but ultimately cannot prevent the black box status of the exchanges.

On the other hand, CEX still remains the main liquidity provider in the current market. Overall, DEX is still limited by issues such as the performance and usability of underlying infrastructure, and its scale is still relatively small compared to CEX, with the spot market accounting for less than 20% of CEX. The unanimous consensus in the industry is that the future direction of development is to organically combine the transparency of DEX with the user-friendliness and liquidity of CEX, in order to better safeguard the interests of users.

Over the years, Binance has become the strongest leader in the CEX field, attracting global users to the cryptocurrency market with excellent liquidity and tens of millions of users. Meanwhile, Uniswap has successfully established the basic model of DEX in its 5 years of development—on-chain AMM mechanism, user-controlled assets, and deployment across EVM chains, among others.

A CEX that truly embodies the spirit of Web 3.0 should reform its own paradigm, fully guide liquidity to migrate on-chain. This is the historical mission of Websea and its core advantage that sets it apart from existing products.

Websea combines the ease of use of Web 2.0 and the spirit of Web 3.0 to create a new concept CEX centered around users. It not only retains the convenience of CEX, but also actively guides users to explore various on-chain functions, innovating in areas such as dual-account system, trading incentive system, social metaverse system, and smart trading.

One of the most typical innovations is the dual-account system, which can be divided into two aspects:

- Dual fund management mode: Users can flexibly choose between CEX asset custody mode and self-managed asset mode, addressing the chronic issues of complex DEX operations and lack of security for CEX assets;

- Enhancing user fund utilization: Users can use platform accounts integrated with third-party on-chain wallets such as Metamask to seamlessly transfer assets to the on-chain ecosystem, thereby changing users' existing perception of the complexity of using Web 3.0.

In addition, the core idea of Websea is to build trust among users and involve AI in various aspects of trading. In Websea's vision, AI can help users reduce various risks associated with on-chain activities, such as intelligent prediction of on-chain data dynamics to capture trading opportunities or issue warnings. Furthermore, AI can customize learning strategies and even establish a strategy market, creating a more sophisticated intelligent trading system.

It is worth mentioning that Websea has targeted global users since its inception, initiating a global strategy. Currently, the main covered global markets include Canada, Japan, South Korea, Vietnam, India, and Turkey, attracting Web2 and Web3 users on a large scale.

User-centered token economic design

Token economics is an important part of Web 3.0, and in the competition within the CEX market, platform tokens play a crucial role in tightly connecting users within the CEX ecosystem. Platform tokens serve three main purposes: providing trading fee discounts, participating in platform governance, and serving as identity verification.

Trading fee discounts mainly refer to platform token holders enjoying fee discounts within different holding ranges, effectively growing together with the platform and sharing trading dividends.

Participating in platform governance mainly refers to the requirement for project applicants to hold platform tokens or deposit a certain amount of platform tokens as collateral when applying for listing. Additionally, platform token holders can vote on project listings and other matters.

Identity verification is currently deeply integrated with mechanisms such as NFT/DID/SBT, mainly referring to platform token holders having more opportunities to access a better ecosystem within the exchange.

Taking Binance as an example, holding BNB not only provides regular trading fee discounts, but also grants different levels of privileges based on the holding amount. For instance, holding BNB allows participation in activities such as Binance Launchpad. Binance Launchpad has launched over 30 projects, ensuring a high yield rate for participating in new projects, which is an important factor in maintaining its industry position.

Many platform tokens have implemented burning mechanisms, burning a portion of tokens quarterly based on the receivables or profit of the quarter, artificially creating token scarcity to strengthen the token price and instill confidence in holders. However, such CEX platform tokens have historical issues of uneven initial distribution. According to the Binance whitepaper, for example, 35% of the initial funds will be used to establish the platform and conduct system upgrades, and 50% will be used for brand promotion and marketing.

As time goes on, the market needs a more fair entry ticket, and the community is increasingly inclined towards projects with fair launches. Taking Websea's platform token WBS as an example, it adopts an almost fair launch model, with 60% ultimately distributed to the community, leaving only 6% for investors, and requiring linear release, effectively preventing issues with investors.

Furthermore, in terms of foundation allocation, it not only sets a low quota of 12%, but also requires the first year to be locked and linearly released, in order to ensure the basic rights of ordinary users as much as possible, demonstrating the fairness of WBS.

WBS is redefining the special value of platform tokens to promote the decentralization concept, aiming to include more users in a complete ecosystem cycle where everyone can obtain WBS.

Implementing the X2E route, comprehensively incentivizing users

Various incentive models have been fully integrated, starting from user registration to holding and trading, all incorporated into a comprehensive incentive model design, ultimately creating a Websea metaverse that encompasses everything.

Out of the total 6 billion WBS in the community, the registration incentive has been increased to 30%. New users can receive WBS rewards after registering, but it is important to note that users can only unlock the various rights of WBS after completing eligible trades that meet the corresponding fee standards, ensuring the interests of token holders.

The real focus of WBS lies in binding the user growth flywheel and platform token usage scenarios together. Therefore, Websea has introduced a rebate model into the on-chain ecosystem, transforming each user into a practitioner of the decentralization concept. As a result, team rewards have been set up, which in the traditional CEX battle has been proven to have a similar effect to the promotion of Alipay and WeChat red packets, widely attracting retail investors.

The most practical incentive method is trading incentives. In theory, Websea will only collect a portion of the trading fee income, and the remaining portion will be returned to platform users in various ways, moving steadily towards a DAO governance model. This can be specifically divided into the following points:

Websea will return a certain proportion of the daily spot and contract trading fee income to users in the form of platform token WBS;

Websea will reward users who stake platform token WBS in proportion, and the remaining proportion of WBS will be burned directly to promote the appreciation of WBS.

Furthermore, Websea has ingeniously designed an ecological incentive model, rather than passively waiting for scenarios to increase, such as ecological builder incentives, LP incentives, and IXO incentives. Drawing from the successful experiences of platforms like Binance, various IXO models can widely mobilize user enthusiasm. Therefore, Websea has reserved ample space for this, incentivizing more participants to join in and collectively build the Web 3.0 ecosystem.

Overall, the current market environment is nurturing the hope of the future, with the most important aspect being the migration of existing centralized infrastructure to the blockchain. As the strongest traffic entry point, CEX has long been somewhat disconnected from the blockchain. Websea's approach is to capture the commonalities between on-chain and off-chain, transforming traffic and user efforts towards the path of decentralization, cultivating "cold-resistant and frost-resistant" seed users.

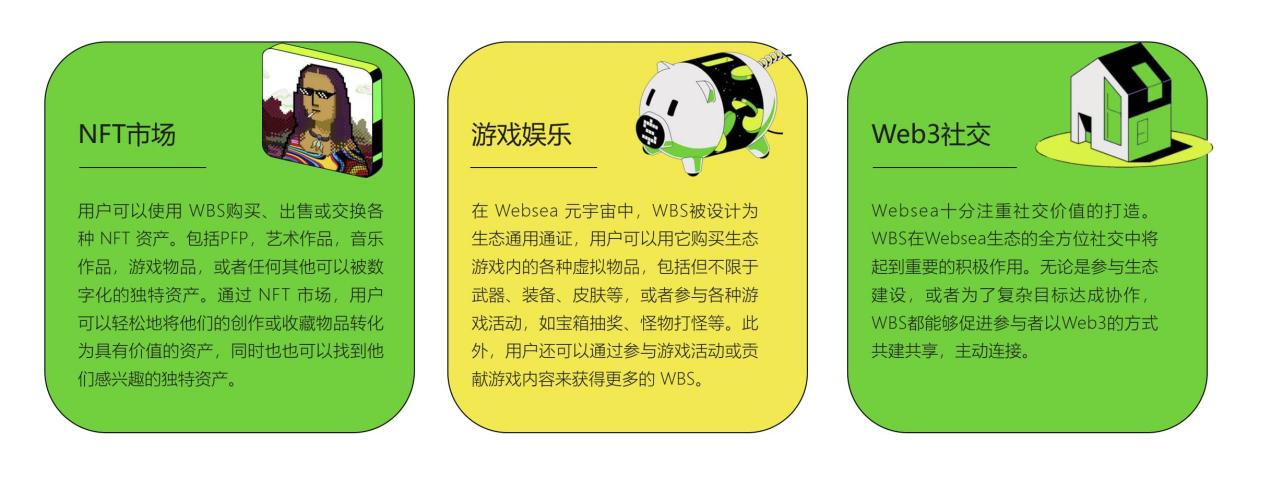

Currently, the Websea platform token WBS has been officially launched and is being distributed to ordinary users, beginning to play a role in innovating the current CEX ecosystem. In the future, WBS will serve as a pass allowing users to deeply participate in co-construction and sharing. In Websea's future ecosystem design, such as CEX + DEFI / CEX + GAMEFI / CEX + SocialFi, WBS will eventually be unified into Websea's social metaverse ecosystem.

WBS stands at a turning point in the development history of CEX, on one hand, it will assume all the responsibilities of traditional platform tokens, but on the other hand, it will represent a new direction, bringing more users into a complete on-chain ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。