The Layer 2 projects compete fiercely with each other, showcasing their strengths in technology, ecosystem, and operations.

By HTX Ventures

Arbitrum's airdrop in March 2023 marked the beginning of a year of flourishing Layer 2 projects. Due to the wealth effect, a large number of users flocked to interact with other unreleased Layer 2 projects, especially the remaining zkSync and StarkNet among the four major Layer 2 projects, and even projects on the Goerli test network attracted user participation. In contrast, in the new public chain race, both user activity and the innovation capability of new projects appeared to be exhausted in the bear market. The Layer 2 projects compete fiercely with each other, showcasing their strengths in technology, ecosystem, and operations. Here, we take stock of the characteristics of various projects in the Layer 2 track and speculate on the new trends of Layer 2 in the future.

1. Rise of the Layer 2 Track

As the cryptocurrency track continues to develop, there is an increasing need for on-chain support for more users and interactions. Ethereum's mainnet can only process about 15 transactions per second, and the network has become congested due to a large demand for usage, with high fees excluding some potential users. Ethereum needs to adopt scaling solutions to address these issues, which is the reason for the birth of Layer 2. Layer 2 mainly addresses scalability, transaction costs, transaction speed, and other issues. Layer 2 achieves similar security and decentralization to the Ethereum mainnet by regularly submitting transaction batches to the Ethereum mainnet.

According to technical classification, Ethereum Layer 2 has four solutions: state channels, Plasma, Validium, and Rollups. However, with the development and evolution of technology, the Rollup solution has proven to be the most successful in improving performance, reducing costs, and providing a better user experience. Currently, Rollup is considered the preferred Layer 2 scaling solution for Ethereum.

The Rollup solution was first proposed in 2018 to address the scalability issues of the Ethereum main chain by moving transaction data off-chain and using different verification methods to improve performance, reduce costs, and enhance security. These technologies have become one of the main scaling solutions in the Ethereum ecosystem, providing a solid foundation for the future development of decentralized applications and the Ethereum network. The main types of Rollups include:

- Optimistic Rollup: It operates using the Optimism execution method, conducting transactions and state updates off-chain, and then submitting them to the main chain. If there is no dispute, the transaction is confirmed; otherwise, dispute resolution is required. Representative projects include Arbitrum, Optimism, Base, Metis Andromeda, and Boba Network.

- ZK-Rollup: ZK-Rollup (Zero-Knowledge Proof Rollup) was proposed by Barry Whitehat in 2018. It introduces zero-knowledge proof technology to ensure the validity of off-chain transactions, thereby enhancing security. The core idea of ZK-Rollup is to store transaction data off-chain and then use zero-knowledge proofs to verify its validity, reducing the burden on the main chain. Representative projects include zkSync, Starknet, Scroll, Loopring, and Polygon zkEVM.

Currently, due to the difficulty of ZK-Rollup technology, most Layer 2 projects using this solution are developing slowly, and the largest share of the entire Layer 2 track is still held by the Optimistic Rollup solution. According to l2beat's data, there are currently 33 active Layer 2 projects, with 11 using Optimistic Rollup and 12 using ZK-Rollup. There are 15 projects set to launch soon.

2. Status of Various Layer 2 Projects

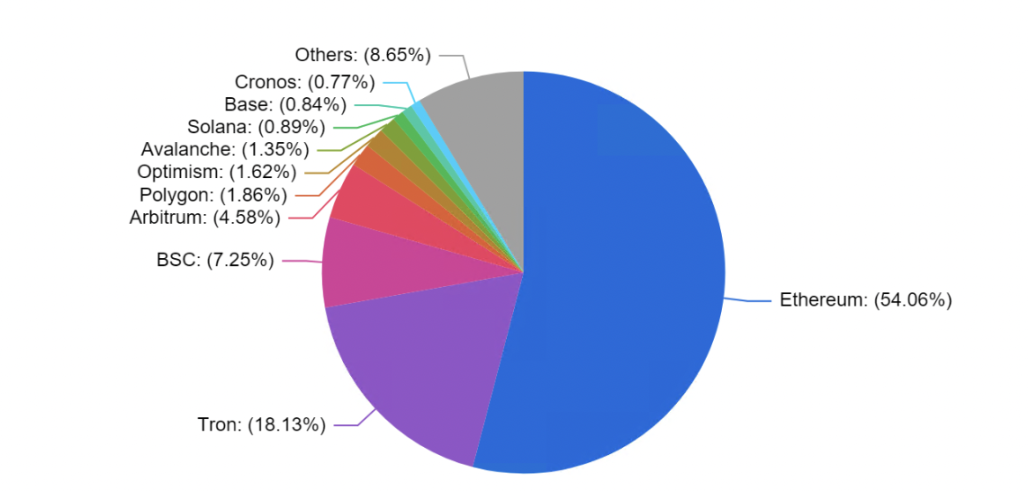

Since the cryptocurrency market entered a bear market in 2022, Ethereum's DeFi TVL market share still accounts for 54.06%. In contrast, the token prices of new public chains such as Solana, Avalanche, Cosmos, and Polkadot have declined, while Ethereum has risen by over 20% during the same period. In 2023, there was a major reshuffle in the new public chain landscape. For new public chains, becoming a killer of Ethereum is no longer possible. However, as a Layer 2 project, the performance in attracting funds, users, and developers from Ethereum is indeed much better in the bear market. Layer 2 not only consolidates Ethereum's position but also acts as a flywheel, helping to drive the value of ETH. The Layer 2 track is very likely to become the catalyst for the next bull market.

Figure 1. Total Value Locked All Chains (Source: DefiLlama)

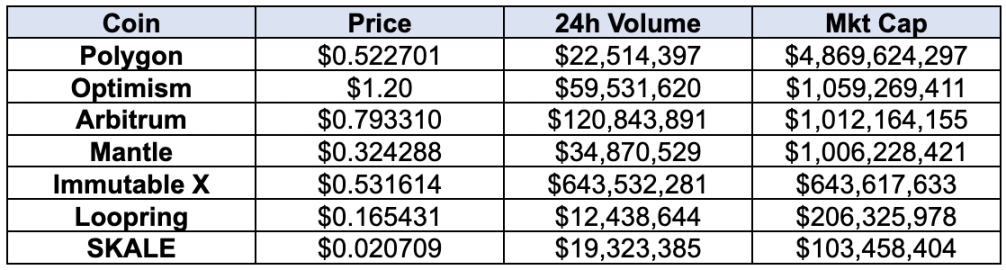

Currently, the market value of the Layer 2 sector is $9.25 billion, with a 24-hour trading volume of $1.13 billion. The market values of Optimism and Arbitrum are close to $1 billion. However, in terms of the total number of developers developing their protocols, Starknet stands out today, while zkSync leads in daily addresses and total transaction volume over the past month.

Table 1. Status of the top 7 Layer 2 projects by market value (Source: coinmarketcap, Oct.17, 2023)

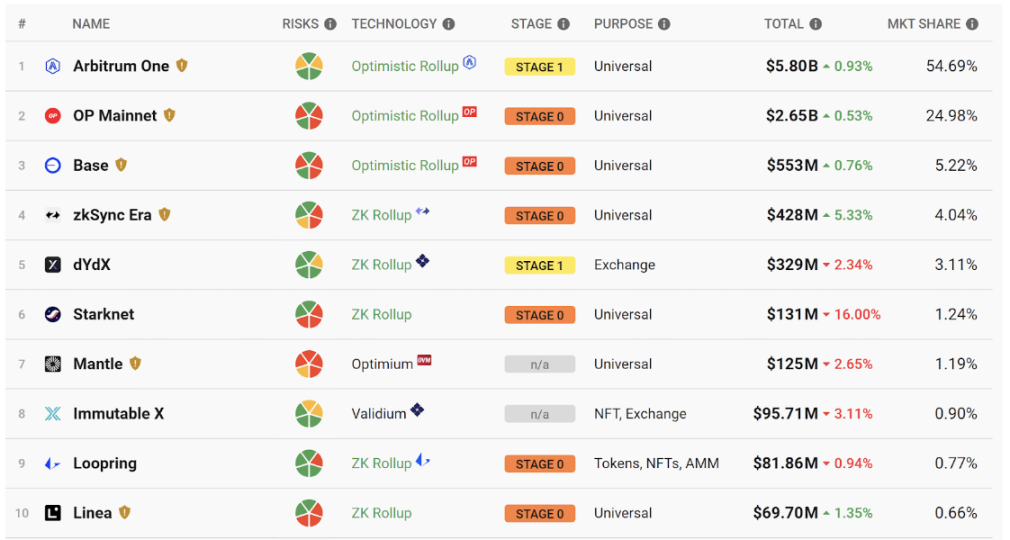

According to L2BEAT's data, as of October 17, 2023, the total Layer 2 TVL is $10.6 billion, an increase of 136.8% from the end of 2022. Arbitrum One has the largest TVL at $5.80 billion, accounting for 54.69% of the entire Layer 2 project market share, followed by Optimism at 24.98%.

Figure 2. Status of the top 10 Layer 2 projects by TVL (Source: l2beat.com, Oct.17, 2023)

2.1 Arbitrum

Arbitrum was built by the Offchain Labs team. It uses the optimistic rollup technology solution to scale Ethereum. Arbitrum One uses fraud proofs and has on-chain call data availability, meaning that all data for each transaction is fully ordered, bundled, and submitted to the mainnet. Due to Arbitrum's use of fraud proofs, its withdrawal period is approximately seven days.

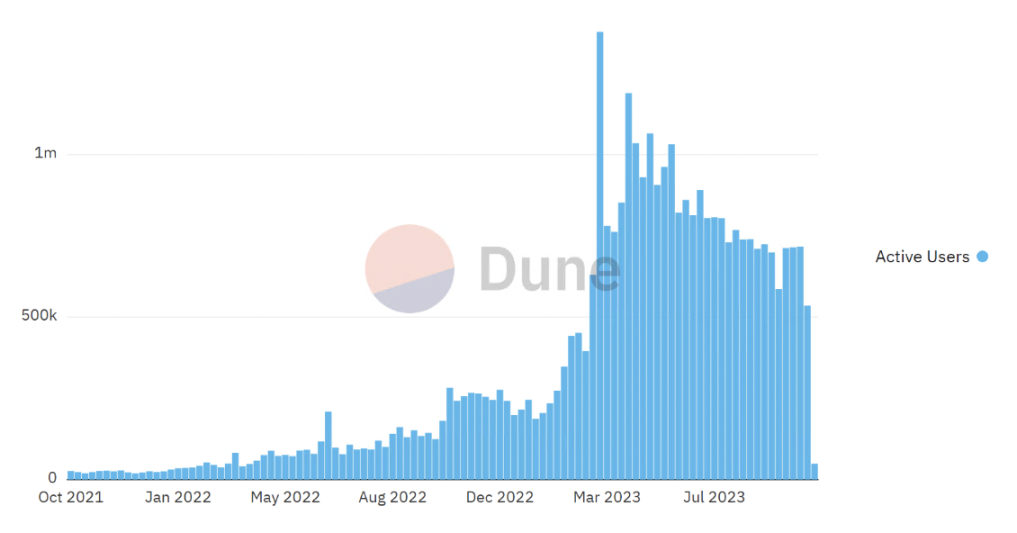

The most exciting thing in March 2023 was undoubtedly Arbitrum's airdrop, which brought a wave of wealth effects. Since the release of the airdrop rules, Arbitrum One's TVL has risen all the way to $5.80 billion, second only to Tron and Ethereum itself. Its TVL accounts for 54.69% of the entire Layer 2 ecosystem, with over 11 million unique addresses and over 330 projects.

Figure 3. Arbitrum's weekly active addresses (Source: dune, @Henrystats)

Figure 3. Arbitrum's weekly active addresses (Source: dune, @Henrystats)

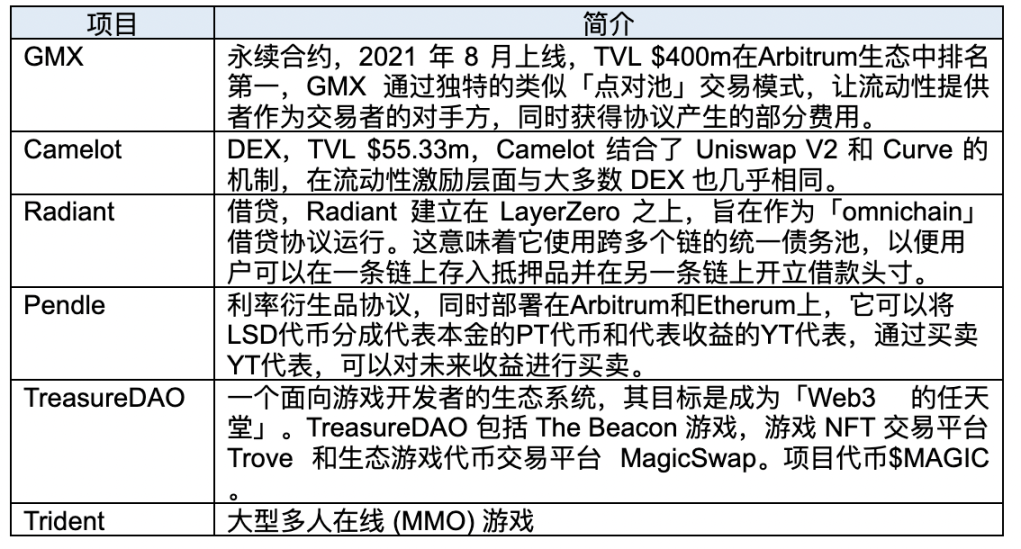

Arbitrum Ecosystem Inventory

Arbitrum's application ecosystem can be divided into two main categories: DeFi and consumer applications. In the DeFi ecosystem, DEX, lending, and perpetual contracts are the main focus. There are four projects with a TVL of over $100 million, namely GMX, Uniswap V3, Radiant, and AAVE V3.

2.2 Optimism

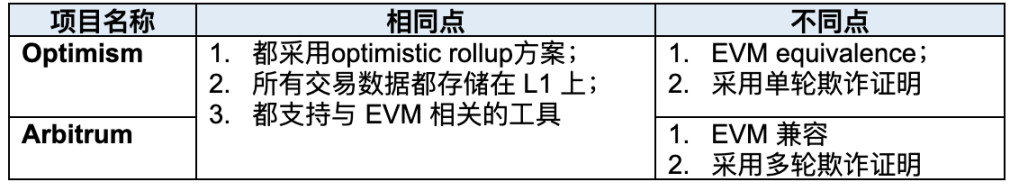

Optimism was created by a group of Ethereum developers and is a second-layer scaling solution based on Optimism Rollup technology, capable of handling large-scale transaction processing while maintaining Ethereum's security. However, there are some differences in technical implementation between Optimism and Arbitrum:

Table. Comparison of Optimism and Arbitrum

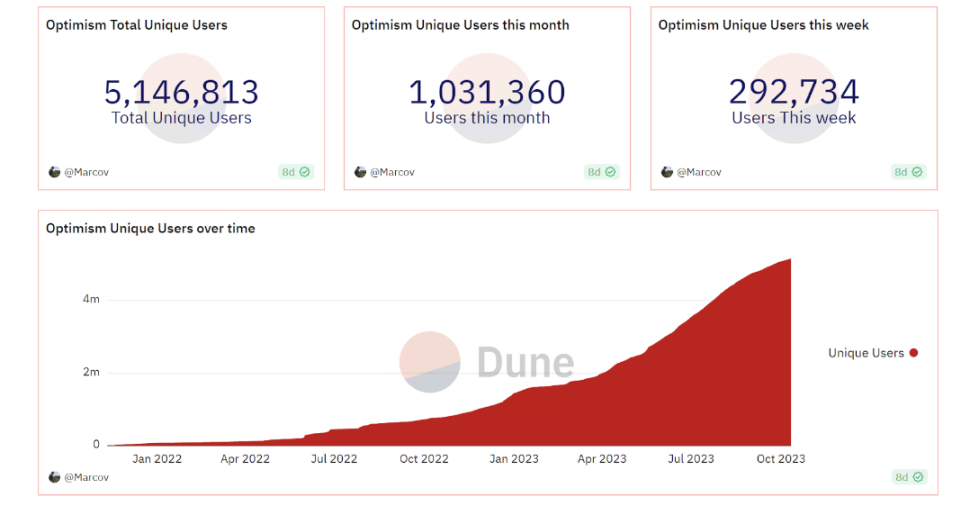

Currently, in terms of TVL, Optimism is at $2.6 billion, ranking second in Layer 2. There are 173 protocols on Optimism, with over 5 million unique addresses.

Figure 4. Optimism Unique Users over time (Source: dune, @Marcov)

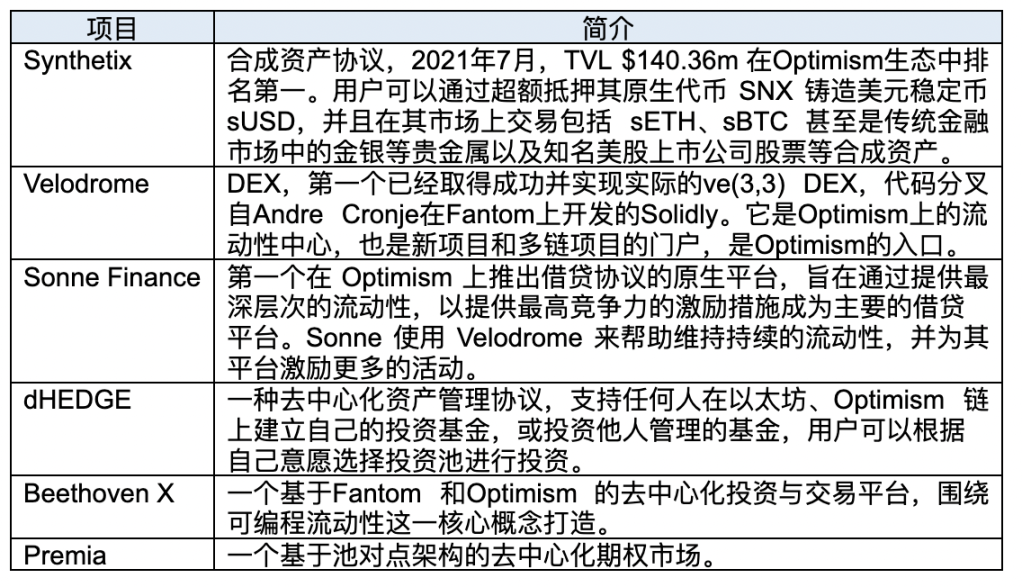

There are relatively few native projects on Optimism, and apart from the DeFi track, there are hardly any well-known projects. There are 2 projects with a TVL of over $100 million, namely Synthetix and Velodrome.

2.3 Base

Base Network was announced by Coinbase on February 23 and went live on the mainnet in August. Base is based on OP Stack technology. The launch of Base helps with the development and deployment of Coinbase's own decentralized applications, and in the future, combining Coinbase Wallet and smart contract wallet account abstraction technology will allow Coinbase's customers to easily access financial service protocols hosted by Base.

After more than a month of launch, BASE surpassed the daily transaction volume of its Layer 2 competitors and Ethereum itself, reaching over 1 million on September 14. The total number of users is currently 2.1 million, TVL is $548 million, and there are over 100 ecosystem projects.

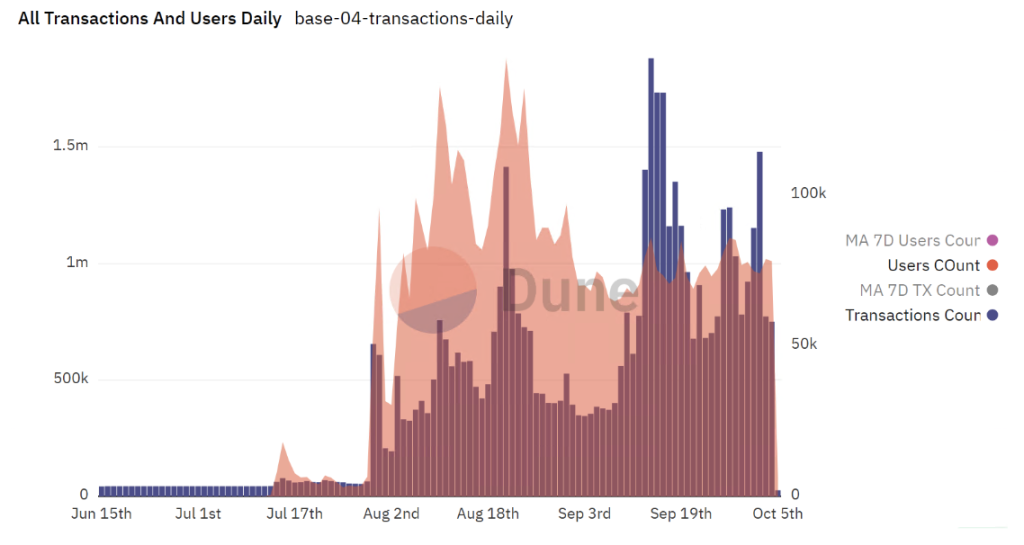

Figure 5. Base all transactions and Users Daily (Source: dune, @sixdegree)

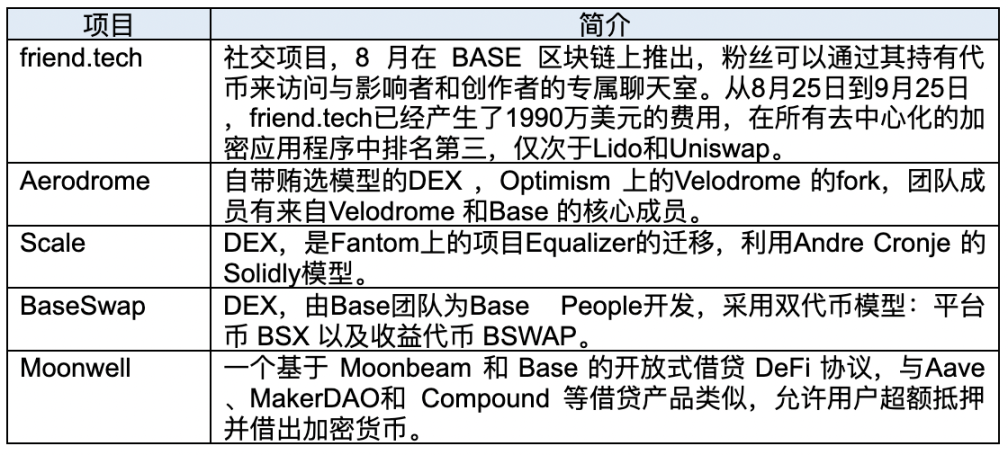

The popularity of the Base ecosystem is mainly attributed to friend.tech, with other projects mainly focused on DeFi, and many are replicas on other chains.

2.4 Zksync era

zkSync, developed by Matter Labs, uses zero-knowledge proofs to bundle multiple transactions into one proof, which can then be verified on the Ethereum blockchain. zkSync Lite is version 1.0, and zkSync Era is essentially version 2.0 of zkSync. The project has not yet been valued, estimated at around $4 billion.

Currently, zkSync Era network TVL has reached $428 million, and according to Dune Analytics data, the number of unique addresses on zkSync Era has reached 1.9 million, with 1.7 million ETH already cross-chain transferred to the zkSync Era network.

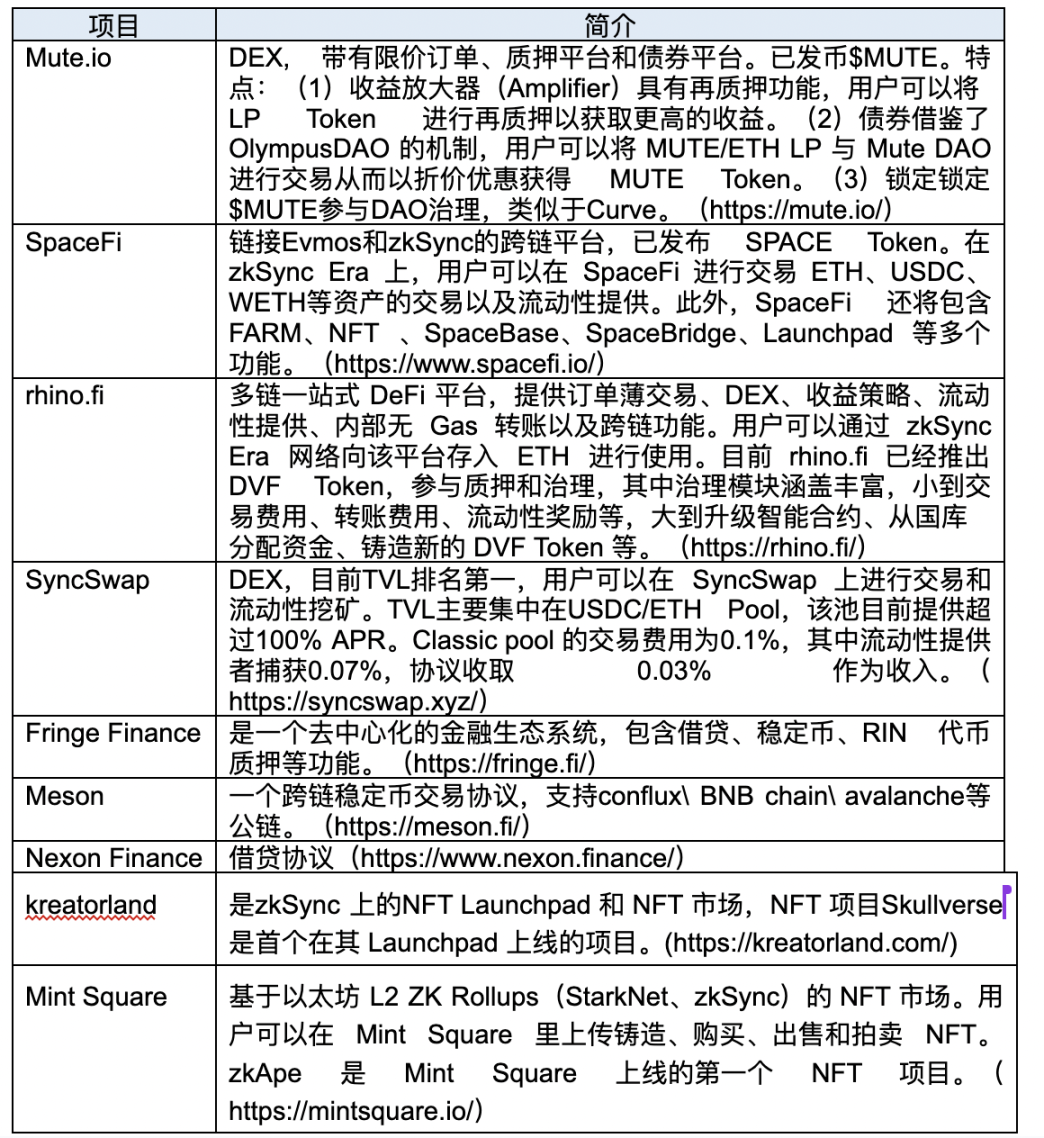

According to Defillama data, there are 9 DeFi projects included, mainly DEX projects. There are 34 projects announced to go live, including wallets, cross-chain, NFT, etc., but there are few innovative projects, and there is still a gap from the OP ecosystem.

2.5 Starknet

StarkNet is a ZK Rollup protocol released by StarkWare Ltd on the Ethereum testnet in November 2021. StarkWare Ltd focuses on creating cryptographic proof systems to improve the scalability and privacy of various blockchain networks, and it has created two projects using zk technology: StarkEx and StarkNet. StarkEx provides dedicated Rollup technology services for each application and went live in 2020. Projects developed based on StarkEX include Sorare, immutableX, and dYdX. StarkNet can deploy a general-purpose Rollup for any smart contract and has over 50 ecosystem projects already live. StarkNet's TVL is currently around $131 million.

Given that StarkWare is currently valued at $8 billion, the value of the StarkNet ecosystem projects goes without saying. StarkNet announced the deployment of its native token $STRK on the Ethereum mainnet on November 16, 2022, for voting, staking, and fee payment, with token distribution still pending.

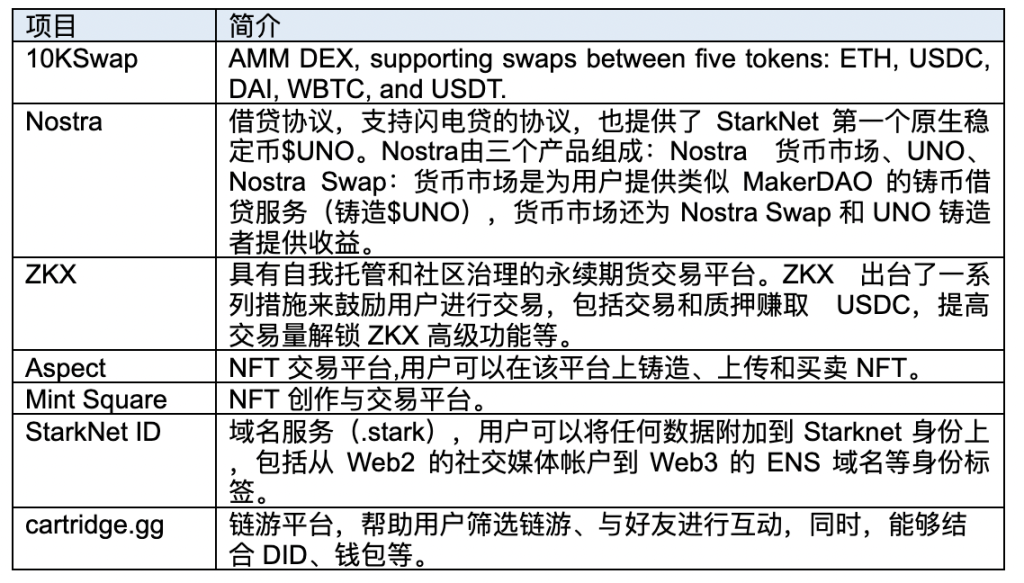

Due to StarkNet's high throughput and customizability, developers can create innovative, high-performance, tailored dApps on StarkNet. This opens up many new possibilities for developers, leading to some innovative projects in the Starknet ecosystem, mainly focused on DeFi, NFT, and Game fields.

2.6 Others

In addition to the well-known Layer 2 projects mentioned above, there are some projects worth paying attention to:

Linea: A zk rollup project supported by Consensys, the mainnet is live, with over 100 projects and a TVL of $25.5 million.

Scroll: The project's popularity in the zk rollup track is second only to zkSync and Starknet, and the mainnet went live not long ago. Scroll received a $30 million Series A financing in April 2022 and a $50 million financing in July 2023, with an estimated value of $1.8 billion. Scroll's goal is to build an EVM-compatible zk-Rollup, with a team mainly composed of Chinese.

Polygon zkEVM: An Ethereum Layer 2 built on ZK Rollup technology, formerly acquired by Polygon for $250 million, Hermez Network. The mainnet Beta version is live, with a TVL of $54.93 million.

Loopring: Used to support DEX protocols, based on StarkWare. Unlike other public networks, external developers cannot build their own general protocols or products on Loopring, they can only call Loopring's API. And because Loorping focuses on building its own products, the Loopring protocol is not just a network, it is a collective.

Immutable X: Built on Starkware, it is specific to applications, focusing on the NFT and gaming ecosystem.

Aztec: Focused on privacy, it has invented the PLONK proof system.

Kakarot: Started in October 2022, it is a community-driven project, written in the Cairo language, and provides provable computing capabilities using the ZK-STARK proof system. It allows developers to deploy EVM applications on it and allows end users to interact with these applications using their familiar toolchains.

Taiko: Describes itself as a "fully decentralized, Ethereum-equivalent zk-rollup." Currently in the testnet stage. Taiko can accurately handle all Ethereum behaviors; using the same hash functions, gas prices, and encryption algorithms. The drawback of Type 1 ZK-EVM is that generating proofs takes a long time, and it takes several hours for users to bridge ETH from Taiko L2 back to Ethereum L1.

In addition, multiple Layer 2 application chains are built on StarkEx, including Sorare, rhino.fi, ApeX, dYdX, etc. In these projects, data is sent as calldata to Ethereum and published on-chain. In the Validium mode, data is stored off-chain, with only the hash value stored on-chain. While the Rollup mode ensures higher security (users only need to interact with the Ethereum blockchain to recreate the state of the ledger), the Validium mode can ensure lower costs and higher privacy.

3. OP VS ZK

Layer 2 projects have been launching mainnets one after another this year, and the competition in the track is fierce. The discussion about Optimistic rollup or zk rollup has never stopped. Although ZK Rollup theoretically has stronger performance, much faster finalization time than Optimistic Rollup, and higher security, Optimistic Rollup has better compatibility and lower barriers. Furthermore, from the data performance of Layer 2 projects, Optimistic Rollup has taken the lead. Therefore, these two solutions will coexist in the medium to long term. The strengths and weaknesses of Optimistic Rollup and ZK Rollups are comprehensively compared from the perspectives of technology, user experience, and ecosystem development.

3.1 Technical Comparison

Working Principle

The working principle of Optimistic Rollup is to use a sidechain connected to the mainnet to process off-chain transactions. The sidechain is responsible for processing transaction computation and verification, and periodically sends its state summary to the mainnet. In Optimistic Rollup, there is a premise of the "Optimism" hypothesis, where the sidechain assumes all transactions are valid and only submits proof when fraudulent transactions are detected.

ZK Rollups combine multiple transactions into batches to be executed on the main chain. Once the transactions in a batch are executed, the ZK rollup operator submits the summary of changes required for each batch. In addition, the operator is responsible for providing a validity proof, which is a zero-knowledge proof (ZKP), to ensure the accuracy of the changes made.

Validity Proof

In Optimistic Rollup, transactions are initially assumed to be valid, and if found to be invalid, a challenge is subsequently raised. To determine the validity of transactions, users must challenge a set of transactions in Optimistic Rollup. This is done using fraud proofs to prove the validity of transactions. The accuracy of transactions in Optimistic Rollup depends on game theory incentives.

In ZK Rollup, transactions are verified through zero-knowledge proofs, which are cryptographic protocols that allow verification of computations without revealing any input or output. This means that ZK Rollup can process transactions off-chain while ensuring their validity without compromising network security and privacy. Mathematical proofs can ensure the accuracy of validity proofs in zk-rollups.

Transaction Finality

Optimistic Rollups require users to wait for a challenge period before withdrawing funds, resulting in a delay in transaction finality, which is typically 7 days. In contrast, ZK Rollups allow funds to be withdrawn based on validity proofs, without any waiting period.

3.2 Cost Comparison

In theory, Rollups can aggregate hundreds of transactions into one transaction on Layer 1, resulting in hundreds of times gas fee savings. From the user's perspective, low gas fees and fast transaction confirmation are the main requirements. Due to minimal data published, Optimistic Rollups require lower costs. There is no need to provide transaction proofs unless challenged in special cases. Therefore, Optimistic Rollups may achieve better cost efficiency. In contrast, ZK Rollups incur additional expenses for creating and verifying proofs for different transaction blocks, resulting in higher costs. Additionally, it should be noted that creating zero-knowledge proofs requires high-end hardware. The on-chain verification costs associated with ZK Rollups are also more expensive.

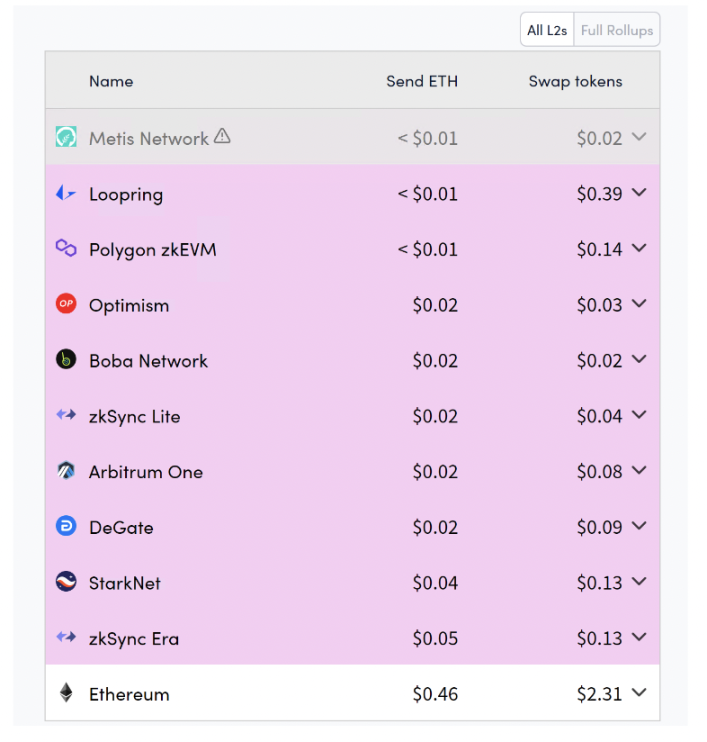

In practice, there is a certain gap in gas fees between the various solutions. According to data from L2Fees.info on October 19th, sending ETH on the Ethereum mainnet costs approximately $0.46, and swap transactions cost about $2.31 in gas fees. The cost of sending ETH for Layer 2 projects is generally below $0.02.

Figure 6. Layer 2 fees (Source: l2fees.info)

3.3 Ecosystem Development

ZK Rollup is a strong competitor to OP Rollup, but currently, due to its greater technical difficulty, it is much slower in product launch and ecosystem development than OP-based L2. Therefore, Arbitrum and Optimism have the first-mover advantage, launching earlier, with more funds and collaborative applications, and a larger number of projects and native projects. In 2023, many ZK projects have launched mainnets, indicating that ZK technology has matured and stabilized to a certain extent. However, in the current ZK Rollup ecosystem, the top 5 ecosystems in terms of TVL are mostly DEX, severely lacking native projects and innovative ecosystem projects, such as games and social applications.

4. New Narrative: Rollup As A Service

As some dapps grow and various new applications expand, especially in the DeFi and gaming fields, being a standalone dapp is no longer sufficient to meet the project's requirements for user experience and profitability. These projects need higher-performance infrastructure to handle large traffic and customization needs. Many applications are starting to adopt the app chain solution, such as dYdX. The concept of the app chain became a hot topic in 2022, where different projects can customize their dedicated chains based on their application scenarios and needs, allowing dapps to exclusively access resources on a single chain and achieve lower operating costs and higher performance while ensuring integration with other ecosystems.

For these dapps, there are many options, such as using the Cosmos SDK to build a dedicated chain, or as a Subchain of BNB Chain or Avalanche, but another option is to develop a Layer 2 chain, which can attract the large user base of Ethereum and achieve good interoperability among successful Layer 2 projects. To quickly launch a Layer 2 chain for a dapp, RaaS was born. This has become a battleground for leading Layer 2 projects.

Optimism, Arbitrum, zkSync, etc., are all trying to extend their L2 technology and solutions by providing modular solutions to meet different chain deployment scenarios and needs, to expand their ecosystems and create their own superchain ecosystems. The first to stand out is the OP Stack developed by Optimism.

4.1 Superchain War Launched by OP Stack

OP Stack was proposed by the development team of Optimism, and it is a highly scalable and interoperable modular blockchain stack. OP Stack decouples different functional levels and combines all levels in the form of an API software stack. OP Stack is maintained by op collective, allowing anyone to use Optimistic Rollup to build their own L2 blockchain on Ethereum.

Functionalities implemented by OP Stack:

- Creating a shared standardized open-source codebase;

- Simplifying the construction process of modular blockchains, enabling rapid deployment of modular blockchains based on the existing codebase of OP Stack;

- Developers can easily abstract various components of the blockchain and modify them by inserting different modules. (op rollup can quickly switch to zk rollup)

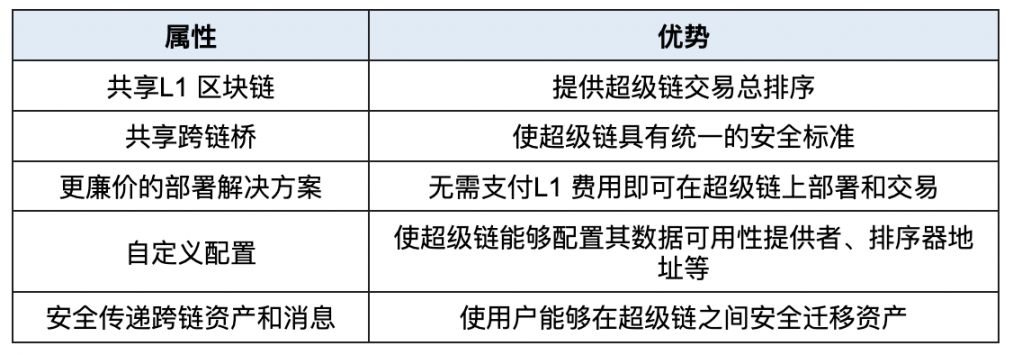

The Layer 2 projects developed through OP Stack have formed a superchain ecosystem. Currently, a total of 19 projects have joined or plan to join the OP Stack superchain ecosystem, covering various fields such as exchanges, public chains, clients, NFT, games, derivatives, etc. Including opBNB, Zora, Base, Wordcoin, DeBank, the superchain ecosystem has the following attributes and advantages:

OP Stack brings greater possibilities for Optimism. In terms of revenue, currently only Base can bring an additional $4.5 million to the OP treasury each year. BASE needs to pay 2.5% of its total fees to Optimism Collective and adhere to Optimism's "superchain" standards, paving the way for future interoperability. In exchange, as a member of Optimism Collective, BASE has a governance role.

4.2 Arbitrum Orbit & ZK Stack

Arbitrum Orbit & L3: The Orbit development framework allows the creation and deployment of L3 on the Arbitrum mainnet. L3 Rollup, also known as an app chain, plays a crucial role in settling transactions on the Arbitrum chain. They form the basis for the next stage of Arbitrum's expansion journey. Orbit is designed to be compatible with the upcoming Arbitrum Stylus upgrade. This compatibility provides developers with the possibility to build dApps using C, C++, and Rust and extends the versatility and coverage of Arbitrum.

ZK stack: On the evening of June 26, zkSync announced the launch of ZK Stack, a modular open-source framework for building custom zkRollups, aiming to empower developers with full autonomy, from choosing data availability modes to using their own token for decentralized sequencing. Expected to launch by the end of the year.

In the existing RaaS projects, most projects are mainly based on Optimistic Rollup. The main reasons are:

The ecosystem always comes first. RaaS based on OP has better compatibility, greatly reducing the migration/development threshold for project parties, allowing more project parties to deploy quickly, rapidly build a more prosperous ecosystem, and gain a first-mover advantage.

Lower threshold, independent of computing power support. RaaS based on Optimism also verifies transaction validity through anti-fraud measures, thus imposing lower requirements on machine performance and reserves in terms of computing power. This is also a limiting factor for many RaaS to start.

More scalable. RaaS based on Optimism has a lower development threshold, unlike ZK RaaS, which pursues performance, more underlying customization, and requires deep involvement from providers in development. At the same time, limited by the computing power required to generate ZKPs, it is difficult for ZK RaaS to be deployed on a large scale like OptimismRaaS.

Although OptimismRollup has a clear advantage in ecosystem layout, RaaS based on ZK also has some advantages, such as performance and security. In the short term, the ecosystem advantage of RaaS based on Optimism is unshakable, but from the perspective of long-term demand and value creation, RaaS based on ZK is likely to gain a larger market share in the future.

5. Challenges and Opportunities

Arbtrum's airdrop has sparked a Layer 2 craze, but behind the FOMO, it has also raised a series of issues:

- Speculators are too enthusiastic, neglecting the development of the projects themselves and the technological progress of the blockchain. Compared to the AI industry, the wealth effect is too obvious, and users do not actually benefit from the technical advancement brought by the products, which is very detrimental to the industry's development;

- Despite being in a bear market, the competition and mutual cutting of funds in the market have become more intense;

- Expectations for Layer 2 are much higher than for public chains, and the Ethereum ecosystem has borne too much capital, shifting the narrative and opportunities to Layer 2.

Many Layer 2 projects have not yet issued tokens, and their wealth effect may continue into the next bull market, which also promotes user and investor attention to these projects. Some of these projects are still experimental, and Layer 2 still has some risks and issues:

- Centralization risk: These scaling solutions are still in the early stages of decentralization and carry certain risks. Layer 2 sacrifices decentralization by processing transactions and data off-chain, requiring sequencers to package transactions and upload them to the mainnet. Currently, only one entity operates the "sequencer," posing a centralization risk. The Arbitrum network has experienced sequencer issues, leading to widespread downtime.

- Excessive liquidity fragmentation: This phenomenon exists in both Layer 1 and Layer 2 networks. With the increase in Layer 2 projects and the adoption of different scaling solutions, the composability between dApps is limited, leading to fragmentation issues and liquidity being divided among Ethereum and different Layer 2 solutions, increasing the liquidity costs for project parties.

- Overly limited ecosystem: The theoretical TPS of Layer 2 projects can reach tens of thousands, but the actual maximum is around 30. This is because current applications do not require such high performance. Layer 2 lacks a killer application that can truly leverage its infrastructure capabilities.

Future Trends

- Data availability trend: All the zk rollup projects mentioned above use a hybrid approach to address the storage of transaction proofs (data availability), providing a rollup version with traditional on-chain data storage and a validium version with off-chain data storage. There are also some on-chain infrastructures that provide data availability, such as Celestia, which is a more decentralized approach and may become the preferred solution for Layer 2.

- Decentralized sequencers: Decentralized sequencers are one of the solutions to the security and fairness of Layer 2. Some projects (Espresso, Astria, and Radius) are already developing shared sequencers.

- The implementation of EIP4844 and danksharding will further reduce the cost of L2 rollup, promoting the adoption of Layer 2 projects.

- The demand for interoperability protocols is increasing to maintain the composability and liquidity of the Ethereum ecosystem.

References

https://www.panewslab.com/zh/articledetails/2l96xr0c.html

https://web3caff.com/zh/archives/53435

https://www.panewslab.com/zh/articledetails/o0f2mnp4.html

https://mirror.xyz/0x30bF18409211FB048b8Abf44c27052c93cF329F2/DSAO5lW92IWKUNnwoZJwZUpB8M3A8llSdkTN-dmeYyI

https://consensys.net/blog/research-development/consensys-zkevm-is-ready-for-public-testnet/

https://foresightventures.medium.com/foresight-ventures-what-is-raas-which-type-of-raas-will-win-the-market-b010006f5cd

https://news.marsbit.co/20221125171155965076.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。