Grayscale believes that the four-year cycle theory has failed, and Bitcoin prices are expected to reach a new all-time high next year.

Written by: Grayscale

Translated by: Luffy, Foresight News

TL;DR

- Bitcoin investors have reaped high returns but have also experienced multiple significant pullbacks. The approximately 30% drop since early October is consistent with historical averages, marking the ninth significant retracement in this bull market.

- Grayscale Research believes that Bitcoin will not fall into a deep and prolonged cyclical retracement, and prices are expected to reach a new all-time high next year. From a tactical perspective, some indicators point to a short-term bottom, but the overall situation remains polarized. Potential positive catalysts before the end of the year include another interest rate cut by the Federal Reserve and the advancement of cryptocurrency-related legislation.

- In addition to mainstream cryptocurrencies, privacy-focused crypto assets have performed outstandingly; meanwhile, the first exchange-traded products (ETPs) for Ripple and Dogecoin have begun trading.

Historically, investing in Bitcoin has typically yielded substantial returns, with annualized returns of 35%-75% over the past 3-5 years. However, Bitcoin has also undergone multiple significant pullbacks: its price usually experiences at least three declines of over 10% each year. Like all other assets, the potential investment returns of Bitcoin can be seen as compensation for its risks. Long-term holders (HODLers) of Bitcoin have enjoyed substantial returns, but they have also had to endure occasionally severe pullback pressures.

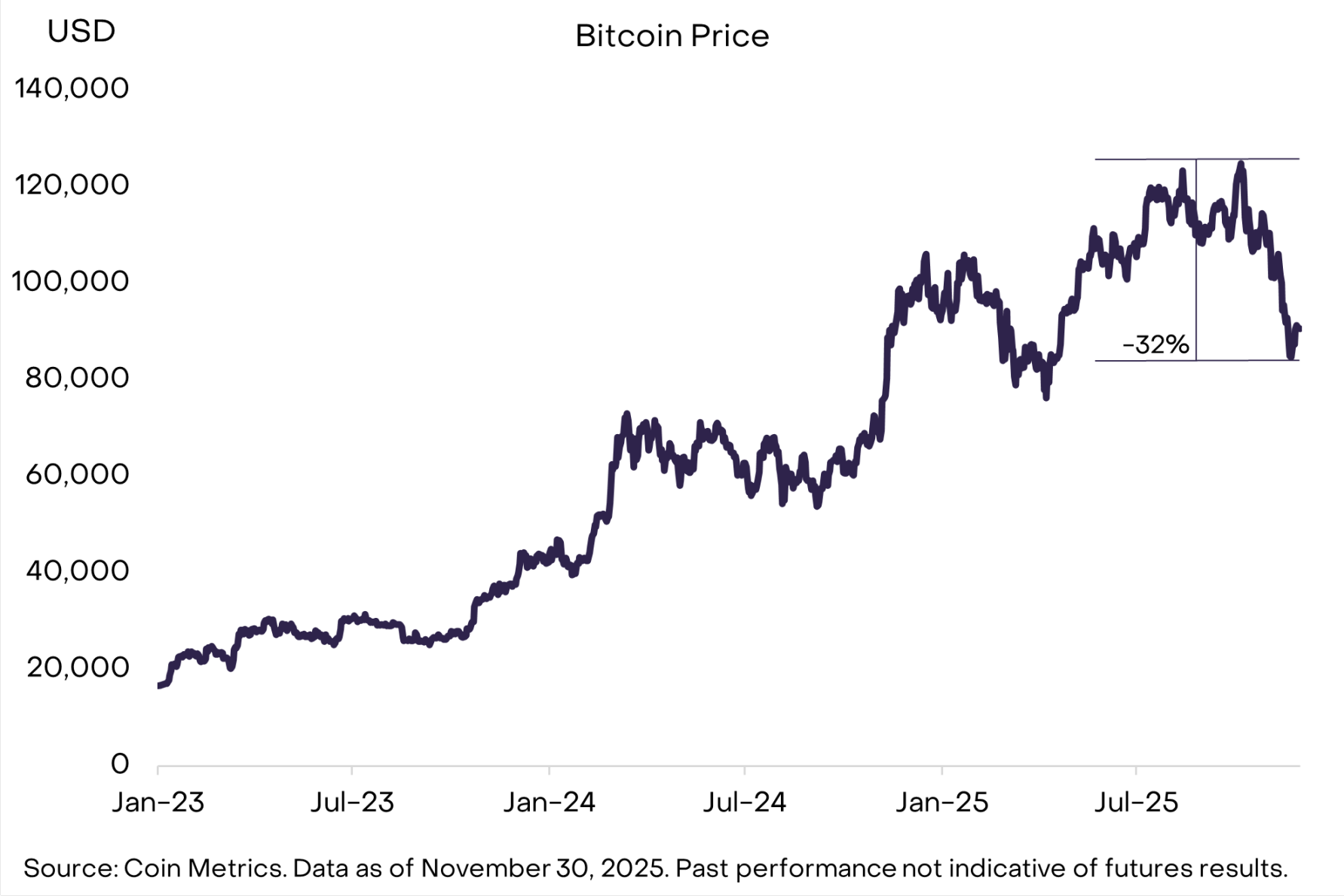

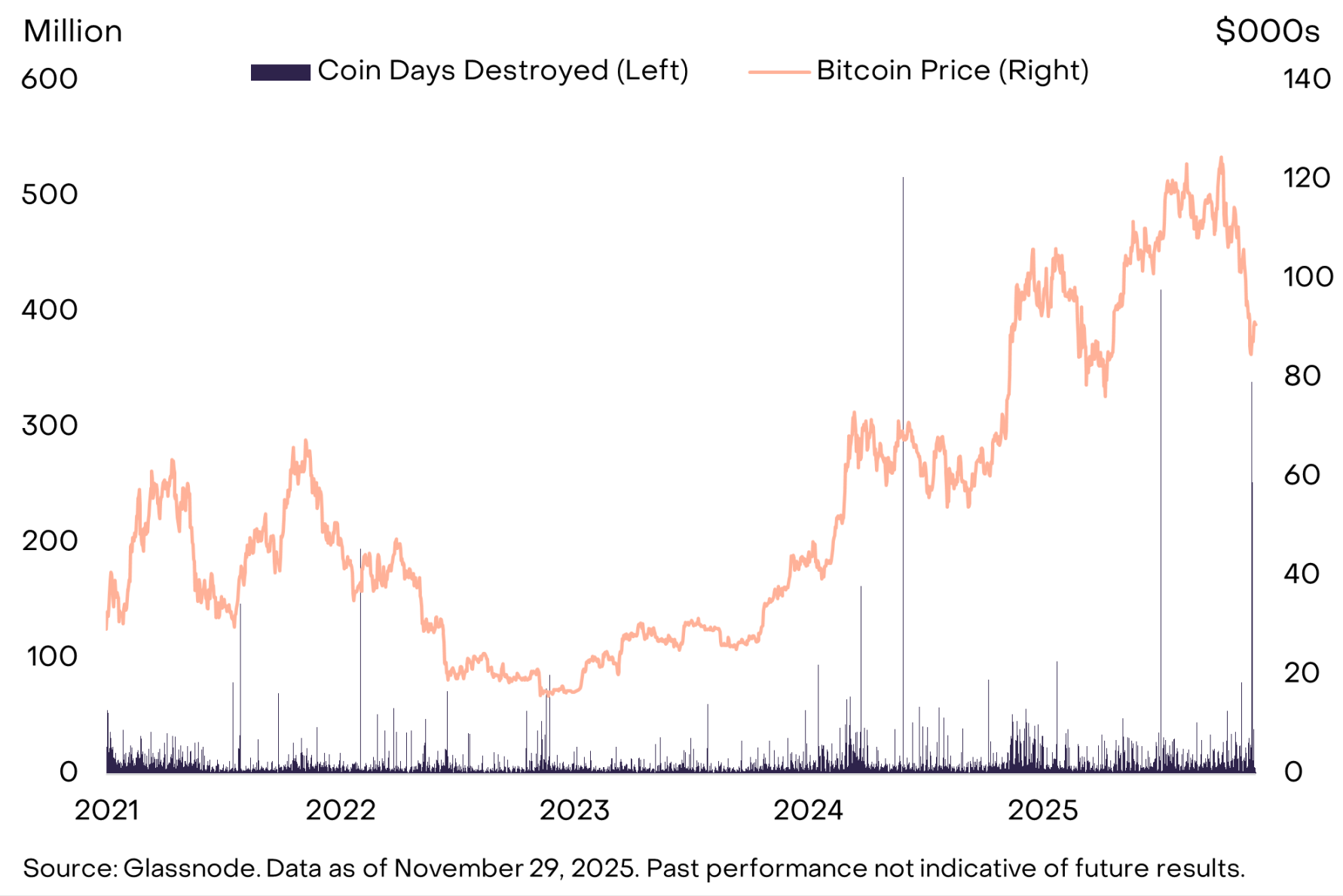

The Bitcoin pullback that began in early October continued to fester for most of November, with a maximum drop of 32% (see Figure 1). As of now, this retracement is close to historical averages. Since 2010, Bitcoin prices have dropped over 10% approximately 50 times, with an average pullback of 30%. Since Bitcoin hit its bottom in November 2022, there have been nine instances of declines exceeding 10%. Despite the volatility, this is not an unusual phenomenon in a Bitcoin bull market.

Figure 1: This retracement is consistent with historical averages

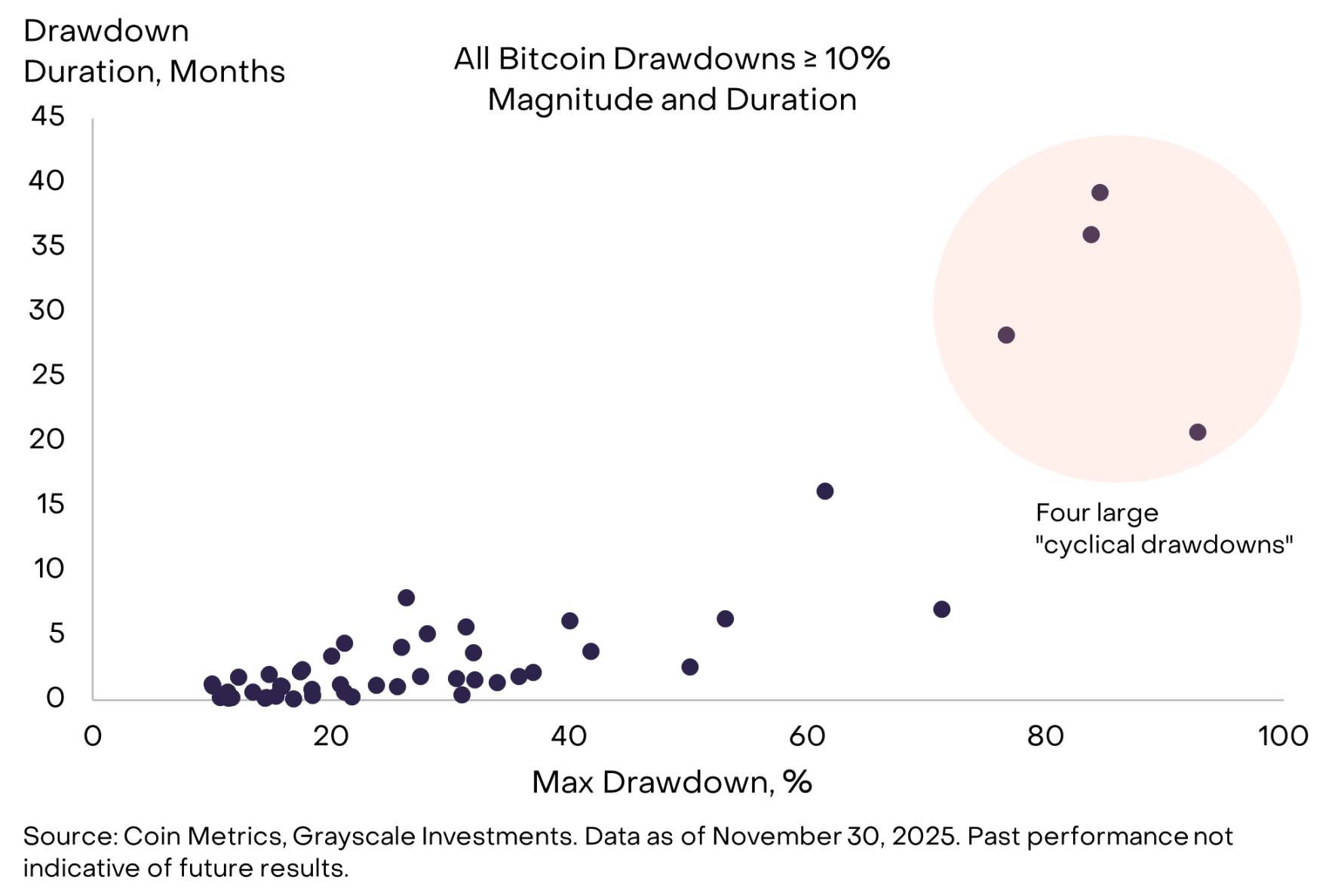

Bitcoin pullbacks can be measured in terms of magnitude and duration, with data showing two main categories (see Figure 2): one is "cyclical pullbacks," characterized by deep and prolonged price declines lasting 2-3 years, occurring approximately every four years in history; the other is "bull market pullbacks," with an average drop of 25%, lasting 2-3 months, typically occurring 3-5 times a year.

Figure 2: Bitcoin has experienced four major cyclical pullbacks

Diminishing the Four-Year Cycle Theory

Bitcoin supply follows a four-year halving cycle, and historically, major cyclical price pullbacks have also occurred approximately every four years. Therefore, many market participants believe that Bitcoin prices will also follow a four-year cycle—after three consecutive years of increases, prices will decline next year.

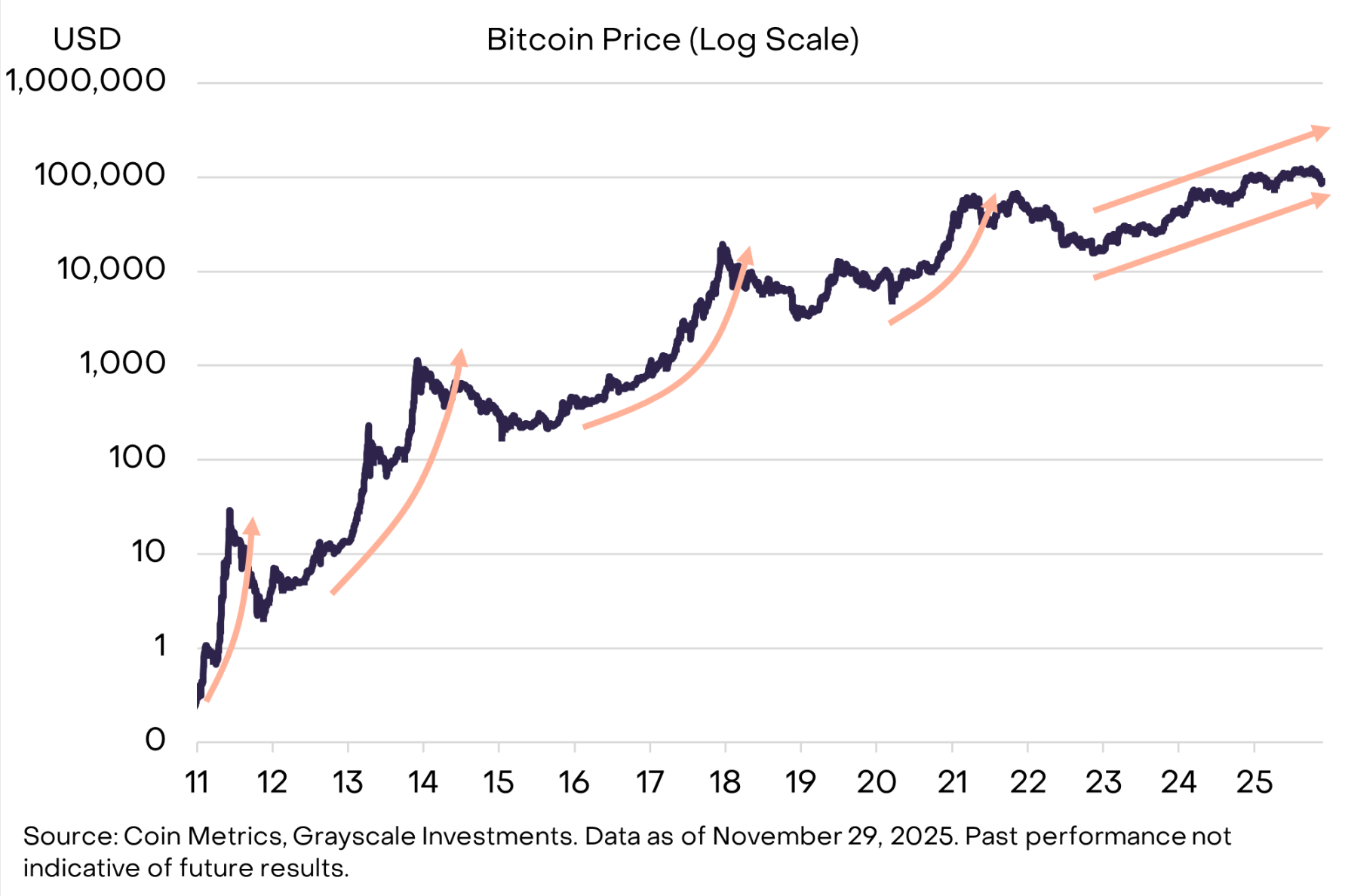

Despite the uncertainty in the outlook, we believe the four-year cycle theory will prove incorrect, and Bitcoin prices are expected to reach a new all-time high next year. The reasons are as follows: first, unlike previous cycles, this bull market has not seen a parabolic price increase that could signal overheating (see Figure 3); second, the market structure of Bitcoin has changed, with new funds primarily flowing in through exchange-traded products (ETPs) and digital asset trusts (DATs), rather than retail investors; finally, as discussed below, the overall macro market environment remains favorable for Bitcoin.

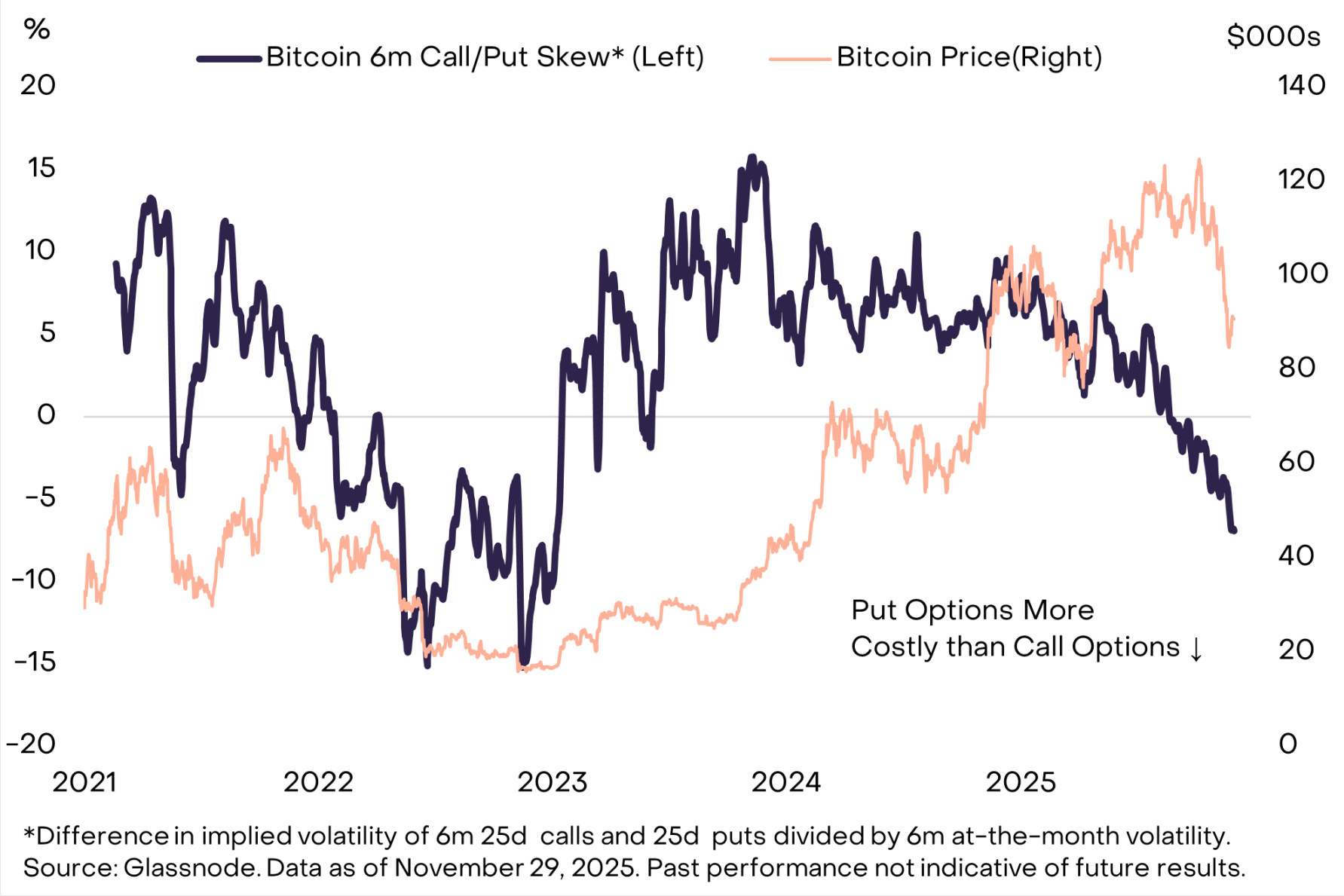

Figure 3: No parabolic price increase has occurred in this cycle

There are already signs that Bitcoin and other crypto assets may have bottomed. For example, the skew of Bitcoin put options is at an extremely high level (Note: option skew is a measure of the asymmetry of the implied volatility curve of options, reflecting the market's expectations of the future price volatility direction of the underlying asset.), especially for 3-month and 6-month options, indicating that investors have widely hedged against downside risks (see Figure 4); the largest digital asset trust is trading below the value of the crypto assets on its balance sheet (i.e., its "adjusted net asset values" mNAVs are below 1.0), suggesting light speculative positions (usually a precursor to recovery).

Figure 4: High put option skew indicates downside risks have been hedged

At the same time, several fund flow indicators show that demand remains weak: November's futures open interest further declined, and ETP fund flows only turned positive at the end of the month, with possible additional selling by early Bitcoin holders. Regarding the latter, on-chain data shows that the "coin days destroyed" (CDD) surged again at the end of November (Note: CDD is calculated as the number of Bitcoins transacted multiplied by the number of days since the last transaction). Therefore, when a large number of long-term unspent tokens are transferred simultaneously, CDD rises. Similar to the CDD surge in July, this increase at the end of November may indicate that large long-term holders are selling Bitcoin. For the short-term outlook, investors can only be more confident in determining that Bitcoin has bottomed when these fund flow indicators (futures open interest, ETP net inflows, early holder selling) show improvement.

Figure 5: More long-term unspent Bitcoins are being transferred on-chain

Privacy Assets Stand Out

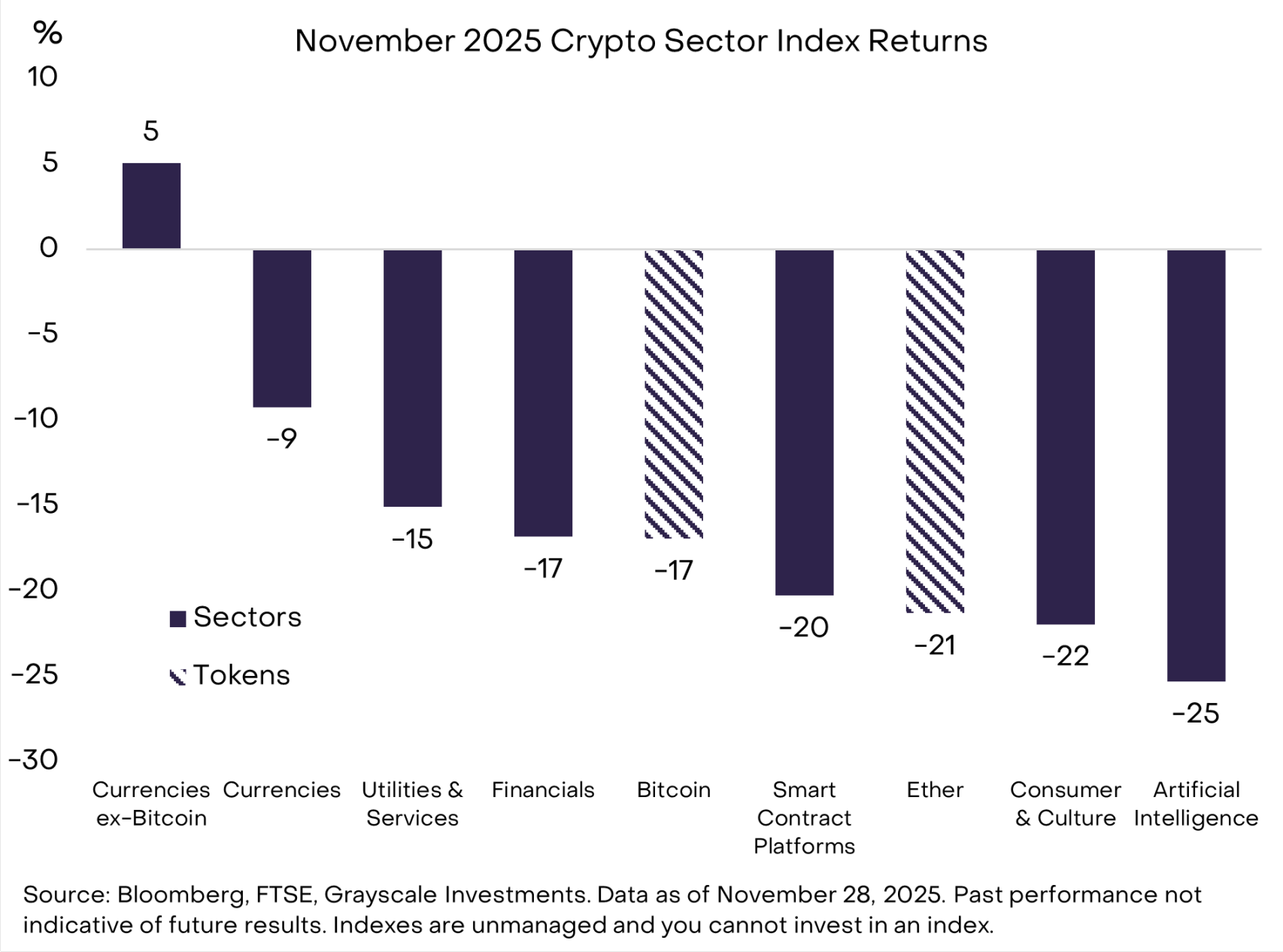

According to our Crypto Sectors classification index, Bitcoin's decline in November was moderate among investable crypto assets. The best-performing market sector was the "currency crypto asset sector" (see Figure 6), which saw gains in the month after excluding Bitcoin. The increase was mainly driven by several privacy-focused cryptocurrencies: Zcash (+8%), Monero (+30%), and Decred (+40%). There has also been a surge of interest in privacy technology within the Ethereum ecosystem: Vitalik Buterin unveiled a privacy framework at the Devcon conference, and the privacy-focused Ethereum Layer 2 network Aztec launched its Ignition Chain. As discussed in the previous monthly report, we believe that without privacy elements, blockchain technology cannot fully realize its potential.

Figure 6: Non-Bitcoin currency assets performed outstandingly in November

The worst-performing market sector was the "AI crypto asset sector," which fell 25% in the month. Despite the price weakness, this sector has seen several significant positive fundamental developments.

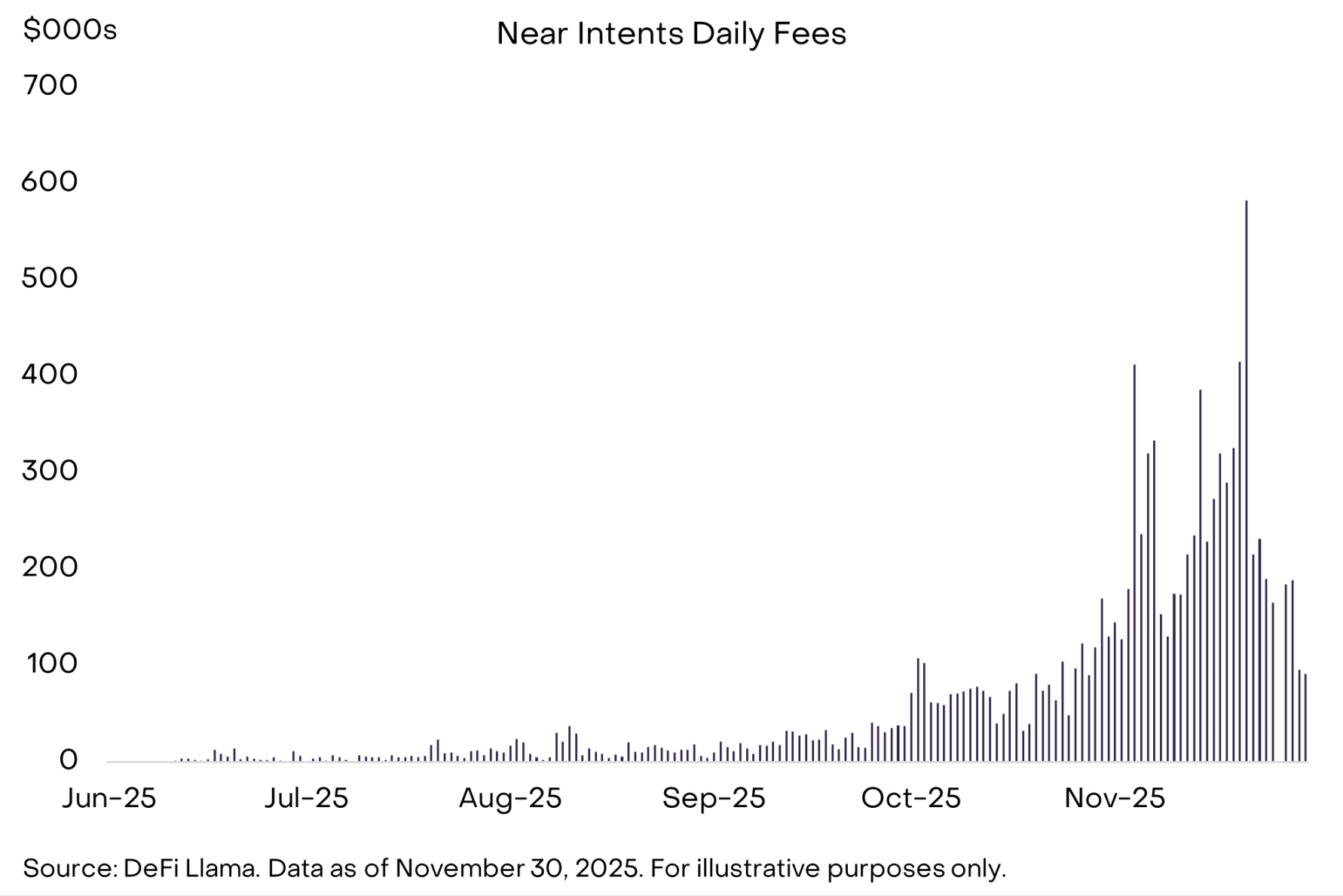

Specifically, as the second-largest asset by market capitalization in the AI crypto asset sector, Near's Near Intents product adoption continues to rise (see Figure 7). Near Intents connects users' expected outcomes with a "solution provider network," allowing solution providers to compete for the optimal execution path across chains, thereby eliminating cross-chain complexity. This functionality has enhanced the utility of Zcash—users can privately spend ZEC, while the recipient can receive assets like Ethereum or USDC on other chains. Although still in its early stages, we believe this integration could play an important role in promoting privacy-preserving payments across crypto ecosystems.

Figure 7: Near's Intents product finds market fit

Additionally, developers' attention has turned to the x402 protocol. This is a new open payment protocol developed by Coinbase that allows AI agents to drive stablecoin payments directly over the internet. This payment standard does not require account creation, manual approval steps, and does not charge custodial payment processing fees, enabling frictionless, autonomous microtransactions executed by AI agents, with blockchain serving as the settlement layer. Recently, the adoption of x402 has accelerated, with daily transaction volumes increasing from less than 50,000 in mid-October to over 2 million by the end of November.

Finally, thanks to the new universal listing standards approved by the U.S. Securities and Exchange Commission (SEC) in September, the crypto ETP market continues to expand. Last month, issuers launched ETP products for Ripple and Dogecoin, with more single-token crypto ETPs expected to list before the end of the year. According to Bloomberg data, there are currently 124 crypto-related ETPs listed in the U.S., with a total managed asset size of $145 billion.

Interest Rate Cuts and Bipartisan Legislation

In many ways, 2025 is a milestone year for the crypto asset industry. Most importantly, regulatory clarity is driving a wave of institutional investment, which is expected to lay the foundation for sustained growth in the industry over the coming years. However, valuations have not kept pace with the long-term fundamental improvements: our market-cap-weighted Crypto Sectors index has fallen 8% since the beginning of the year. Although the crypto market may be volatile in 2025, fundamentals and valuations will ultimately converge, and we are optimistic about the crypto market outlook for the end of the year and 2026.

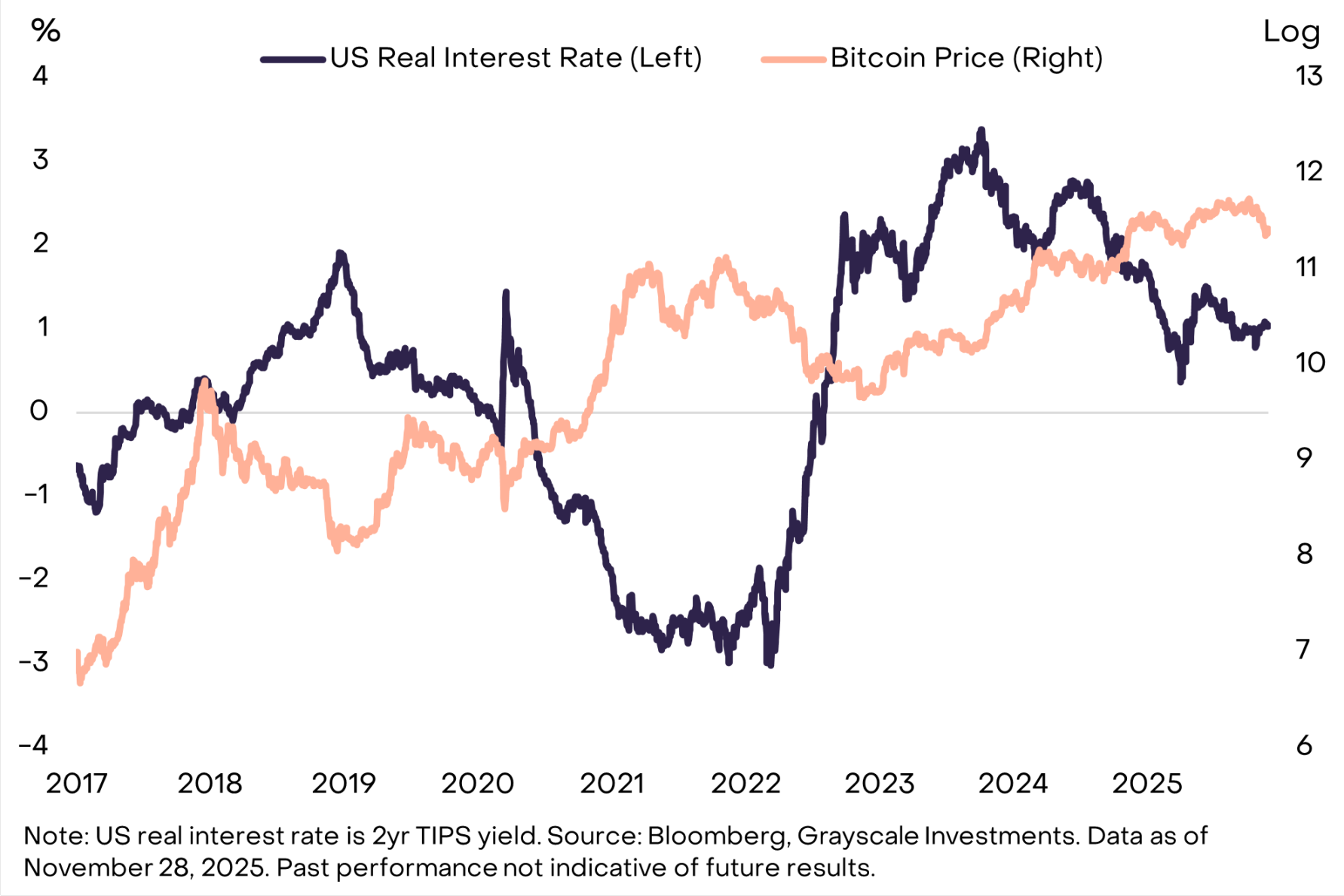

In the short term, a key variable may be whether the Federal Reserve will cut interest rates at its meeting on December 10, and the guidance on policy rates for next year. Recent media reports indicate that National Economic Council Director Kevin Hassett is a leading candidate to succeed Federal Reserve Chair Powell. Hassett may support lowering policy rates: he stated in a September interview with CNBC that a 25 basis point cut by the Federal Reserve is a "good first step" toward "significant rate cuts." All else being equal, a decline in real interest rates typically has a negative impact on the value of the dollar and benefits assets that compete with the dollar, including physical gold and certain cryptocurrencies (see Figure 8).

Figure 8: Federal Reserve rate cuts may support Bitcoin prices

Another potential catalyst may be the ongoing bipartisan efforts in cryptocurrency market structure legislation. The Senate Agriculture Committee (which oversees the Commodity Futures Trading Commission) released a bipartisan draft text in November. If cryptocurrencies can maintain bipartisan consensus and not become a partisan issue in the midterm elections, then the market structure bill may make further progress next year, potentially driving more institutional investment into the industry and ultimately boosting valuations. While we are optimistic about the short-term market outlook, truly substantial gains may come from long-term holding.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。