Perhaps due to increased risks and severe inflation, many tycoons have seen a significant shrinkage in their assets. And the biggest victim among them is undoubtedly CZ Zhao Changpeng, the founder of Binance.

2021 may have been Zhao Changpeng's heyday. At the beginning of the year, he briefly held a fortune of nearly $100 billion, making him one of the new richest individuals in Asia. However, with the cryptocurrency market entering a bear market and Binance facing various challenges, CZ's wealth has evaporated significantly. In the recently released 2023 Hurun Rich List, Zhao Changpeng ranks 97th with a fortune of 45 billion RMB. In other words, his current net worth is less than 7 billion USD.

From this perspective, the period from 2022 to 2023 has undoubtedly been a tough year for Zhao Changpeng. It also raises the question of what exactly Zhao Changpeng has experienced, going from the richest person in China to 97th place.

Uncovering CZ's Rags-to-Riches Story: From Rags to the Top Seat.

In 1977, Zhao Changpeng was born into a teacher's family in Lianyungang, Jiangsu Province. He later went to Canada with his father to study and pursued a degree in computer science at the prestigious McGill University. After graduation, Zhao Changpeng smoothly entered the financial technology industry as a software developer. In less than 2 years, Zhao Changpeng became an important member of the world's largest financial information company, Bloomberg, and served as a team leader in its branches in New Jersey, London, and Tokyo, demonstrating his outstanding business capabilities.

During his time at Bloomberg, Zhao Changpeng gained diverse multinational work experience. At the same time, he realized the high remittance fees and complex processes involved in cross-border remittances, which laid the groundwork for his subsequent involvement in Bitcoin.

In 2013, Zhao Changpeng learned about Bitcoin from a venture capitalist. The unique characteristics of Bitcoin, such as its encryption, convenience, and liquidity, piqued Zhao Changpeng's strong interest. Subsequently, he began to delve into cryptocurrency projects and joined Blockchain.info as the "3rd founding member". In 2014, Zhao Changpeng, having experienced the unique charm of Bitcoin, sold his house in Shanghai against his family's opposition to invest in Bitcoin. During this period, he met Xu Mingxing, the founder of OKCoin, and became the CTO of OKCoin, leaving a year later.

In 2017, Zhao Changpeng experienced the most important turning point. In June of that year, he officially founded Binance and launched its exclusive blockchain currency, Binance Coin (BNB), with a total issuance of 200 million and a circulation of 100 million in July of the same year.

Binance mainly profits from platform trading and withdrawal fees. Its biggest feature lies in not only supporting the trading of mature currencies like Bitcoin, but also providing a stage for the growth and development of a range of emerging currencies, which is a significant business opportunity in the cryptocurrency industry. Seizing the opportunity, Binance quickly grew to become a pillar in the cryptocurrency exchange industry. As of August 28, 2017, Binance had over 120,000 users from more than 180 countries, with 60,000 daily active users and 4,000-6,000 new users added daily. By January 2018, in just half a year, Binance's registered user count exceeded 6 million, covering over 180 countries, with 97% of users being foreign users. By July 2022, Binance's user base had grown to an astonishing 120 million.

In November 2021, Forbes estimated Zhao Changpeng's net worth at $90 billion, approximately 573.3 billion RMB, surpassing Nongfu Spring Chairman Zhong Shanshan's 424.4 billion RMB fortune and ByteDance founder Zhang Yiming's 382.5 billion RMB fortune. Zhao Changpeng momentarily became the undisputed "richest person of Chinese descent," enjoying unparalleled attention.

However, the valuation of assets in the cryptocurrency field is highly uncertain, as Zhao himself has stated, "Valuations without liquidity are not very meaningful." This has been well demonstrated now, as in this year's Hurun Rich List, Zhong Shanshan topped the list with a fortune of 450 billion RMB, while Zhao Changpeng's ranking plummeted to 97th.

Continuous Lawsuits, Declining Performance, Big Tree Attracts the Wind, Binance's Challenges.

Today, Binance remains a powerful top-tier exchange in the industry, but it is undeniable that Binance's influence within the industry is declining.

In March of this year, the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance and Zhao Changpeng, accusing the company of providing cryptocurrency derivatives, such as futures or options contracts, to U.S. customers without being registered as a futures commodity merchant. The commission also accused Zhao Changpeng and its former compliance executives of intentionally evading U.S. law and implementing a planned regulatory arbitrage strategy for commercial gain. The lawsuit also alleged that for most of the time, Binance did not require its customers to provide any identity verification information before trading on the platform, despite its legal obligations. Additionally, Binance failed to implement basic compliance procedures to prevent and detect terrorist financing and money laundering.

In response, Zhao Changpeng stated, "Although we have been cooperating with the CFTC for over two years, the unexpected and disappointing civil complaint filed by the CFTC seems to contain incomplete factual statements upon preliminary review. We disagree with the characterization of many issues in the complaint."

Following this, the main event came in June. On June 5th, the U.S. Securities and Exchange Commission (SEC) filed 13 charges against Binance and its founder Zhao Changpeng, including operating an unregistered exchange, providing false trade control and supervision statements on the Binance.US platform, and offering and selling securities without registration. In this 136-page document, the SEC made 13 allegations against Binance.

The SEC stated that Zhao Changpeng and Binance controlled customer assets on the platform, arbitrarily commingled or transferred customer assets, including transferring to an entity owned and controlled by Zhao Changpeng called Sigma Chain, which engaged in manipulative trading and artificially inflated the platform's trading volume. Additionally, Binance commingled billions of dollars of customer funds and secretly transferred them to another company, Merit Peak Limited, also controlled by Binance founder Zhao Changpeng. The SEC also stated that Zhao Changpeng and Binance created BAM Management and BAM Trading in September 2019, claiming that BAM Trading independently operated the Binance.US platform for use by U.S. customers to comply with U.S. regulatory requirements. However, in reality, Zhao Changpeng instructed Binance to allow and conceal many high-net-worth U.S. customers from continuing to access the Binance global exchange platform.

Regarding the details and consequences behind this matter, we have previously analyzed the complex relationship between Zhao Changpeng, SBF, and the SEC chairman in detail. Interested friends can review it.

In conclusion, 2023 has just passed its halfway mark, and Binance and Zhao Changpeng have been bombarded by major U.S. regulatory agencies, truly experiencing an unfortunate year. As we all know, the cryptocurrency market is highly interconnected, and when the SEC's accusations against Binance were revealed, the cryptocurrency market responded with a downturn. Not only did Bitcoin fall below the $26,000 mark, but BNB also experienced a drop of over 9% on the same day. Since then, BNB's performance has been lackluster, with no opportunity for an upward trend or comeback.

There was a time when Binance, as the undisputed largest cryptocurrency exchange, had a tenfold difference in volume and trading volume compared to the second largest. However, this gap is gradually narrowing. According to multiple data websites, the 24-hour trading volume between Binance and the second largest exchange has narrowed to just over twice. In other words, Binance's assets have shrunk from a reserve of over $70 billion to just $7.357 billion, a nearly 90% decrease.

At present, Binance has attracted attention worldwide. It initially relied on the Chinese market and then expanded to the European and American markets after 2020. However, with intensified U.S. regulation, Binance's U.S. business has been greatly affected, with Binance.US's market performance almost approaching zero, causing a significant blow to Binance's overall business. In this situation, the future path of Binance is indeed full of challenges, requiring it to find space for survival and development in a strict regulatory environment.

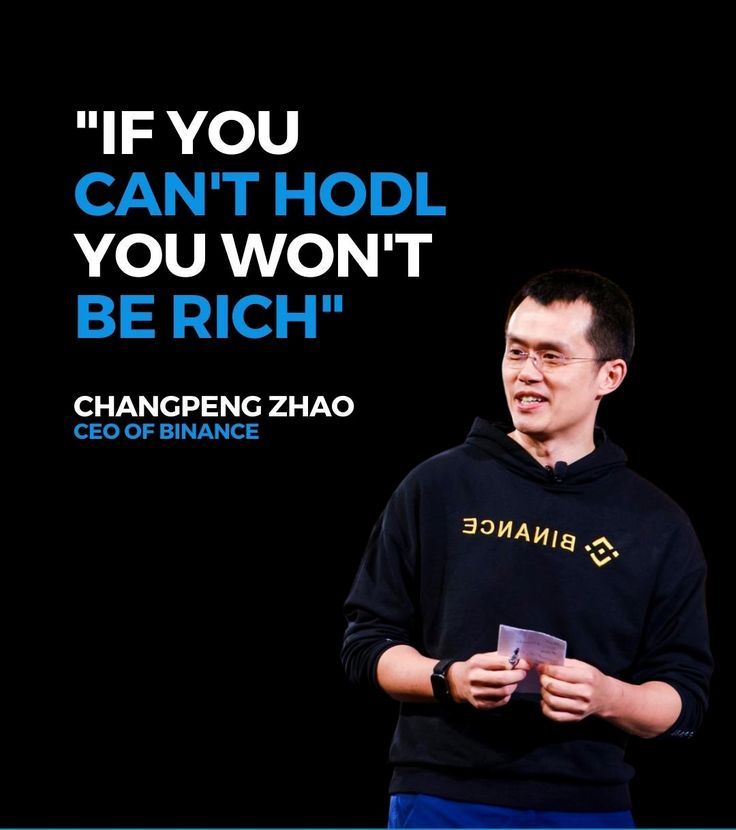

As the founder of Binance, Zhao Changpeng has experienced multiple ups and downs of the company. He deeply understands that only continuous effort and adaptation to change can keep Binance competitive in the complex and ever-changing market environment. His motto "if you can't hold you won't be rich" reflects his confidence and determination for the future development of the industry. Although facing many difficulties at present, Zhao Changpeng and his team are still seeking new market opportunities, looking forward to the next rise. In the constantly changing global cryptocurrency market, Binance will need to innovate and adapt to new regulatory environments to maintain its market position and continue to develop.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。