Author: Shaurya Malwa, CoinDesk; Tom Mitchelhill, Cointelegraph

Translation: Felix, PANews

Over the past two weeks, the price of Bitcoin has surged sharply, briefly surpassing $35,000 on October 24 for the first time since May 2022, with options trading activity approaching record levels. According to TradingView market data, Bitcoin has risen by over 27% in the past two weeks.

Over the past two weeks, Bitcoin has risen by 27.9%. Source: TradingView

This surge seems to be closely related to the approval of a Bitcoin spot ETF, with many experts believing that this will trigger a new wave of buying from institutional investors. Senior ETF analysts Eric Balchunas and James Seyffart believe that the likelihood of approval by January 10, 2024, is 90%.

The impact of this Bitcoin surge is not limited to the crypto sector, as data indicates that its appeal to traditional industries is also increasing.

Bitcoin Prices in Turkey and Nigeria Soar to All-Time Highs

Although priced in US dollars, Bitcoin's trading price is 50% lower than its historical peak. However, in Turkey and Nigeria, the devaluation of national fiat currencies and overall economic instability have propelled Bitcoin prices to historic highs.

Data shows that the surge in Bitcoin prices has led to the prices of Bitcoin against the Turkish lira (TRY) and the Nigerian naira (NGN) reaching new highs. As of the morning of October 27, the price of Bitcoin against the lira was 9.6 million, and against the naira was 27.4 million, resulting in a monthly increase of 30% when calculated in local currency.

According to CoinGecko data, local cryptocurrency exchanges have traded a total of $40 million worth of Bitcoin in the past 24 hours. This figure may not include local users trading on global exchanges such as Binance or Coinbase.

Correspondingly, the naira has fallen by 0.45% and 45% against the US dollar in the past month and six months, respectively, while the lira has fallen by 2.9% and 31% against the US dollar in the same periods.

A study by the International Monetary Fund shows that compared to 2022, Nigeria's inflation rate has risen by 25%, while Turkey's inflation rate has soared by 51%, leading to a significant decline in the purchasing power of the lira and naira. Inflation may be boosting the demand for Bitcoin in the market.

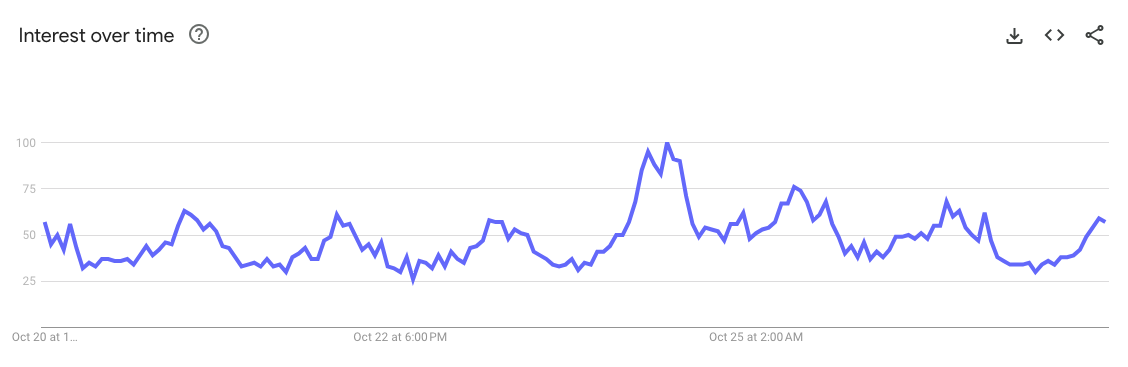

The exchange rate of Bitcoin against the Turkish lira has surpassed its all-time high. (Source: Google)

The exchange rate of Bitcoin against the Turkish lira has surpassed its all-time high. (Source: Google)

In addition, the adoption of cryptocurrencies in Turkey and Nigeria is very high. Cryptocurrency analysis company Chainalysis stated in a report in September that Nigeria is the second most active country after India in terms of users participating in DeFi and crypto trading activities, while Turkey ranks 12th among 20 countries.

Surge in Google Search Volume

With the significant rise in cryptocurrency, the Google search volume for the keyword "buy Bitcoin" has surged globally, with the search volume in the UK increasing by over 800% last week. According to research by Cryptogambling.tv, the search volume for the term "buy Bitcoin" in the UK surged by 826% in 7 days.

Search terms related to buying Bitcoin have surged globally. Source: Google Trends

A spokesperson for Cryptogamble.tv stated: "In the UK, the significant increase in the search volume for 'buy Bitcoin,' coupled with the recovery of the crypto market, is leading to growing interest and potential impact from traditional financial institutions entering the digital asset space."

While the search volume from UK users is leading, the search volume related to buying Bitcoin has also increased significantly.

According to Google Trends data, the search volume from US users for "should I buy Bitcoin now?" has increased by over 250%, while other keywords, including "can I buy Bitcoin on Fidelity?" increased by 3100% last week.

The search volume for the keyword "Is now a good time to buy Bitcoin?" has increased by 110% globally last week. In contrast, the search volume for "BlackRock Bitcoin ETF" has surged by 250%. This data shows a widespread enthusiasm in the market for information related to the BlackRock spot Bitcoin ETF, which is currently awaiting approval.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。