Optimism mainnet refreshed multiple historical records in the third quarter of 2023, while the average transaction cost also saw a significant decrease.

Author: Nicholas Garcia / Source: https://messari.io/report/optimism-q3-2023-brief

Key Points:

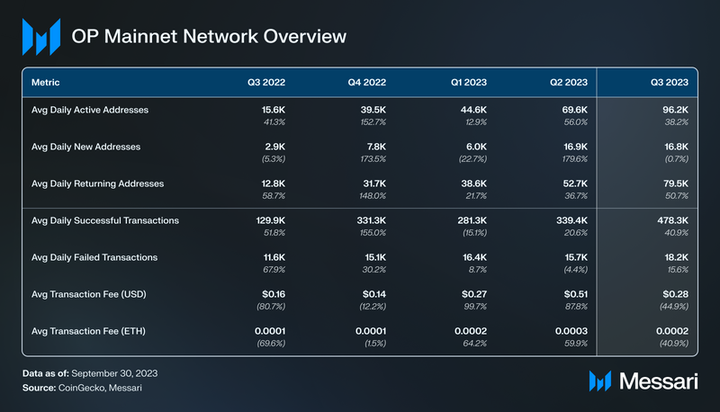

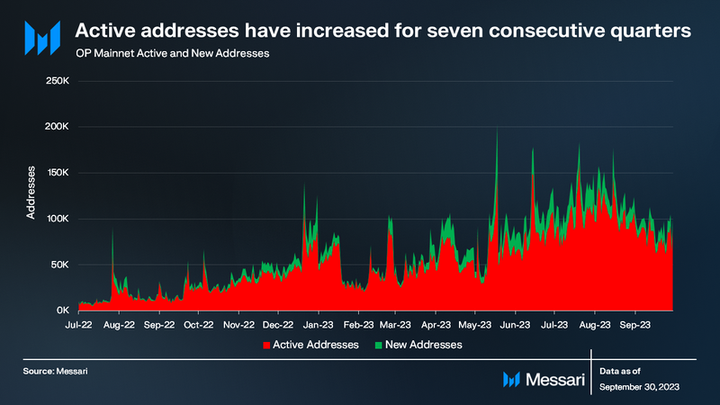

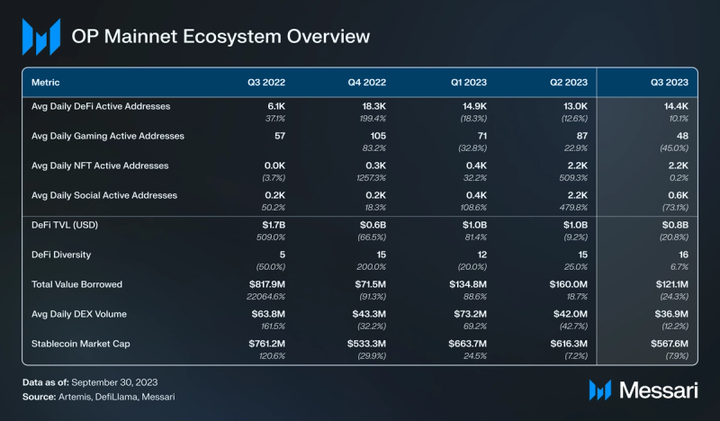

In the third quarter of 2023, the daily active addresses reached a historical high of 96,000. This marks the seventh consecutive quarter of growth, with DeFi (decentralized finance) activities leading the way.

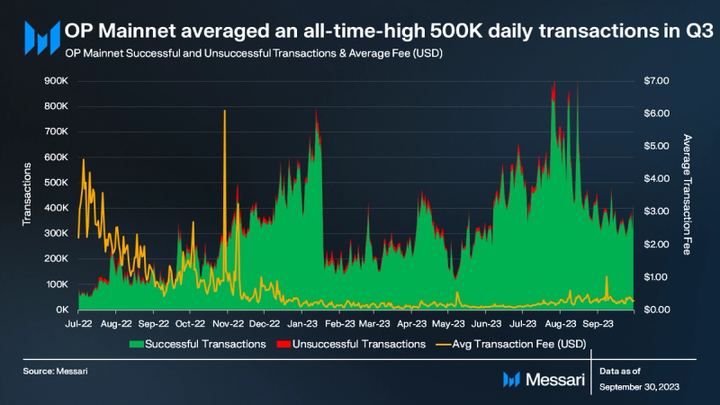

In the third quarter of 2023, the daily transaction volume reached a historical high of 500,000 transactions. The Bedrock upgrade led to a 45% decrease in average transaction fees, dropping to $0.28.

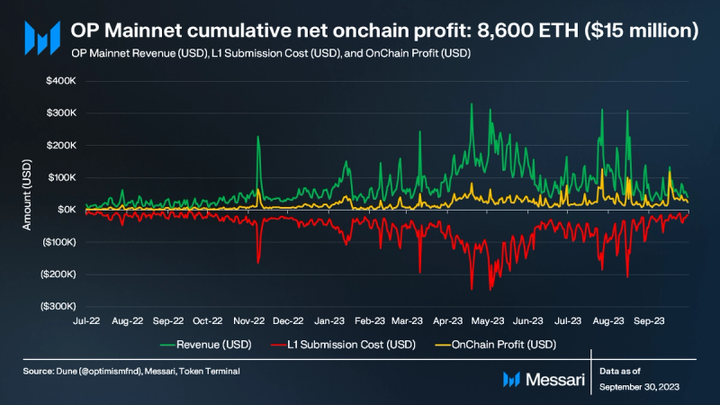

The on-chain profit for the third quarter of 2023 was $2.8 million. The cumulative on-chain profit for the OP mainnet has now reached $15 million or 8,600 ETH.

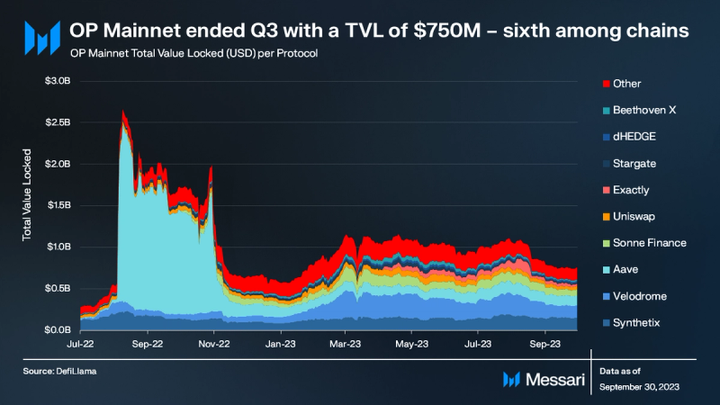

The total value locked (TVL) at the end of the third quarter of 2023 for the OP mainnet was $750 million, ranking sixth among all networks.

1. Introduction to Optimism

Optimism is a layer 2 scaling solution for Ethereum. It aims to increase Ethereum's transaction throughput and reduce transaction costs through optimistic rollup technology. When Optimism users sign and pay gas fees in Ether for transactions, the pending transactions are stored in a private memory pool and then executed by a sequencer. On the OP mainnet, blocks of executed transactions are created every two seconds, and the sequencer periodically submits these transaction call data as transactions to Ethereum.

The Optimism Foundation controls the unique sequencer. Since the mainnet launch, the Optimism Foundation has used all sequencer revenue denominated in Ether to support retroactive public goods funding. Plans are underway to decentralize the sequencer, with the expectation that the new sequencer will receive a portion of network sequencer transaction fees.

Optimism's long-term strategy is based on its vision for a superchain. The Optimism superchain is envisioned as a unified network of chains built using the OP Stack. The ultimate goal of the superchain is to achieve seamless interoperability between OP chains, sharing security, bridging, governance, upgrades, and communication layers. Notable protocols that have already used or are using the OP Stack to create chains include Base, opBNB, Public Goods Network, and Zora.

2. Key Metrics

3. Financial Analysis

4. Market Analysis

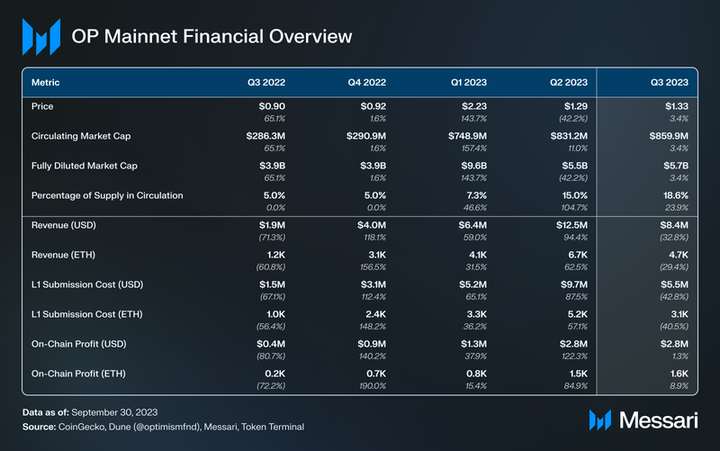

In the third quarter of 2023, despite favorable court rulings for XRP and Grayscale, the entire cryptocurrency market experienced a moderate decline. The overall cryptocurrency market cap decreased by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) falling by 7.5% and 10.0% respectively.

In the third quarter of 2023, despite favorable court rulings for XRP and Grayscale, the entire cryptocurrency market experienced a moderate decline. The overall cryptocurrency market cap decreased by 5.8%, with Bitcoin (BTC) and Ethereum (ETH) falling by 7.5% and 10.0% respectively.

In contrast, Optimism's native token OP showed growth in this quarter. The circulating market cap of OP increased by 3.4% and reached $860 million at the end of the quarter. Additionally, the fully diluted market cap of OP increased by 3.4% and reached $5.7 billion at the end of the quarter. As of the end of the third quarter of 2023, Optimism ranked 40th in market cap, becoming one of the largest 40 crypto protocols.

5. On-Chain Financial Data

In the third quarter of 2023, the OP mainnet's revenue (in USD) from network transaction fees decreased by 33%, from $12.5 million to $8.4 million. The main factor contributing to the decrease in revenue was a 45% decrease in average transaction fees, from $0.51 to $0.28. The reduction in average transaction fees is attributed to the Optimism Bedrock upgrade, which adopted various batch compression techniques and L2 support for EIP-1559.

In the third quarter of 2023, the OP mainnet's revenue (in USD) from network transaction fees decreased by 33%, from $12.5 million to $8.4 million. The main factor contributing to the decrease in revenue was a 45% decrease in average transaction fees, from $0.51 to $0.28. The reduction in average transaction fees is attributed to the Optimism Bedrock upgrade, which adopted various batch compression techniques and L2 support for EIP-1559.

As a second-layer scaling solution for Ethereum, the OP mainnet creates blocks of executed transactions every two seconds and the sequencer periodically submits these transaction call data as transactions to Ethereum. These submissions incur a cost for the OP mainnet. In the third quarter, due to the Bedrock upgrade, the cost of these layer 1 submissions decreased by 43%, from $9.7 million to $5.5 million.

Calculating on-chain profits requires subtracting these submission costs from network revenue. In the third quarter, this resulted in on-chain profits of $2.8 million for the OP mainnet. Overall, the cumulative on-chain profit for the OP mainnet is $15 million, equivalent to 8,600 ETH.

6. Network Analysis

7. Usage

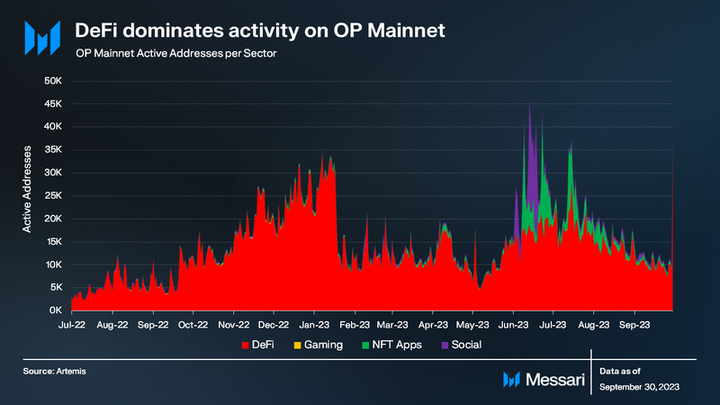

In the third quarter of 2023, the OP mainnet's daily active addresses reached a record 96,000, representing a 38% increase compared to the previous quarter and marking the seventh consecutive quarter of growth. DeFi activities accounted for the majority of active addresses, detailed information can be found in the report's ecosystem overview section. Meanwhile, the daily new addresses remained stable at 17,000, with a total of 1.5 million new addresses added during the quarter.

In the third quarter of 2023, the OP mainnet's daily active addresses reached a record 96,000, representing a 38% increase compared to the previous quarter and marking the seventh consecutive quarter of growth. DeFi activities accounted for the majority of active addresses, detailed information can be found in the report's ecosystem overview section. Meanwhile, the daily new addresses remained stable at 17,000, with a total of 1.5 million new addresses added during the quarter.

8. Economic Analysis

9. Industry Comparison

On the OP mainnet, in the four major consumer industry sectors including DeFi, gaming, NFT, and social, DeFi dominated in the third quarter of 2023, accounting for 83% of active addresses. NFT followed closely with a 12% share, while gaming and social activities were relatively less prominent. Non-DeFi industries still have potential for growth on the network.

On the OP mainnet, in the four major consumer industry sectors including DeFi, gaming, NFT, and social, DeFi dominated in the third quarter of 2023, accounting for 83% of active addresses. NFT followed closely with a 12% share, while gaming and social activities were relatively less prominent. Non-DeFi industries still have potential for growth on the network.

10. DeFi

The total value locked (TVL) of the OP mainnet decreased by 20% compared to the previous quarter, reaching $750 million at the end of the third quarter. At the end of the third quarter, the OP mainnet ranked sixth in TVL-based network rankings. The decrease in TVL for the OP mainnet is consistent with the overall market trend, which began to decline after reaching a peak in mid-2022.

Synthetix is the protocol with the highest TVL on the OP mainnet, with a TVL of $150 million, accounting for 19.9% of the total TVL. Velodrome closely follows with a TVL of $147 million, accounting for 19.5%. Aave ranks third with a TVL of $120 million, accounting for 15.8%. Aave has experienced a significant decline over the past year, dropping from $1.3 billion to $120 million, a 90% decrease. The "other" category refers to protocols not within the top ten TVL protocols, with a TVL of $143.22 million, accounting for 19.0% of the total value, but decreasing by 28.6% compared to the previous quarter.

DeFi diversity refers to the number of protocols that make up 90% of the TVL in DeFi. A more widespread distribution of TVL among various protocols can mitigate potential systemic risks from negative events. At the end of the third quarter, the DeFi diversity index for the OP mainnet was 16. (The diversity index is a measure of the degree of diversity within a specific field or market. In the DeFi space, the diversity index is typically used to measure the distribution of TVL among various protocols. A higher diversity index means a more dispersed TVL, with relatively balanced shares among various protocols, reducing systemic risk.)

In the third quarter, the average daily decentralized exchange (DEX) trading volume on the OP mainnet was $37 million, a 12% decrease compared to the previous quarter. This trend is similar to the overall DEX market trend, which has declined since reaching a peak in March due to the USDC unlocking event. In terms of DEX trading volume, the OP mainnet ranks sixth among networks.

In the OP mainnet ecosystem, Uniswap accounts for 55% of the total DEX trading volume. Velodrome follows closely with 16%, while Curve and KyberSwap each account for 5%. Other DEX platforms collectively account for the remaining 16% of the trading volume.

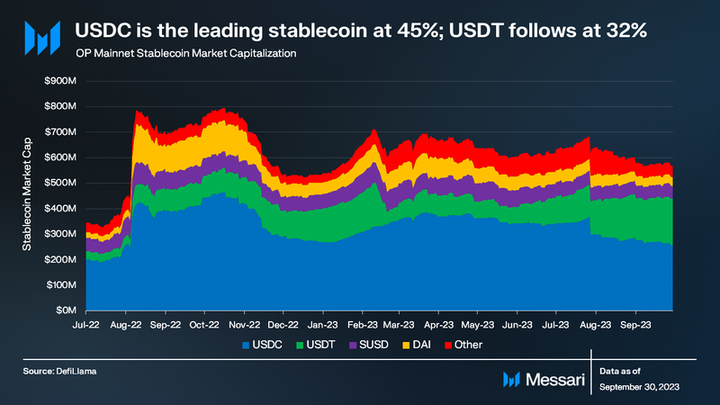

As of the end of the third quarter, the stablecoin market value of the OP mainnet reached $568 million, ranking eighth among networks. The market value of USDC is $258 million, accounting for 45% of the total market value of the OP mainnet. Meanwhile, the market value of USDT reached $182 million, accounting for 32% of the stablecoin market value of the OP mainnet. It is worth noting that the market value of USDT on the OP mainnet increased by 77% compared to the previous quarter.

11. Summary

In the third quarter of 2023, despite significant volatility in the cryptocurrency market, the OP mainnet demonstrated resilience. The network experienced a surge in usage, with historical highs in active addresses and transaction volume. Conversely, transaction fees decreased by 45% to an average of $0.28. This fee reduction is attributed to the Bedrock upgrade, which introduced advanced batch compression techniques and L2 support for EIP-1559.

As the dominant industry on the OP mainnet, DeFi accounted for over 80% of consumer-oriented activity. However, gaming, NFT, and social industries remain potential areas for growth. At the end of the third quarter, the TVL of the OP mainnet reached $750 million, ranking sixth among networks.

As the quarter ends, the OP mainnet has become one of the networks to achieve growth in a bear market. However, the road ahead is not without challenges. Competing networks and emerging protocols adopting similar growth strategies will inevitably impact Optimism's position and strategy in subsequent quarters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。