The price of Bitcoin has reached its highest point in 17 months, the highest level since May 2022. This surge has caught many people off guard, and with the steady rise of this "king of cryptocurrencies," it has brought a bullish atmosphere to the crypto market. So, what are the reasons driving this surge? And what is the future development of BTC?

Previously, an article from the veDAO Research Institute mentioned that although fake news caused a roller-coaster ride in BTC prices, the market sentiment is positive, and the future trend is expected to be positive. In this article, the veDAO Research Institute will bring recent reasons for the BTC surge and an analysis of its future trend.

Reasons for the Increase in BTC Price

Considering that the crypto market is easily influenced by volatility, a single factor cannot be seen as the sole reason for the surge. In the past few days, BlackRock's BTC spot ETF appeared on the DTCC website, and after being briefly removed, it was added back, which is also considered one of the reasons for this surge. In addition, there are other more influential factors:

BTC Halving Approaching

The BTC halving is less than 6 months away. The cryptocurrency community expects this event to kick off the next bull market cycle. According to analysts like Michaël van de Poppe, now (6 to 10 months before the BTC halving) is the best time to invest in altcoins, and venture capitalists are eager to start receiving funding.

While investors are counting the days for their investments to appreciate, BTC miners are concerned about this event. Miners' concern stems from the fact that this event will lead to a halving of mining rewards, from 6.25 BTC per block to 3.125 BTC. However, for investors, the halving event is valuable because it reduces the growth of newly mined BTC. Over time, the operating costs of miners are also increasing. Specifically, mining infrastructure is becoming more complex and expensive. Others complain about rising electricity costs, and U.S. miners may face a 30% tax, causing more anxiety. This is because BTC hash power (the computing power required for computer or hardware operations to solve different hash algorithms) is mainly concentrated in the United States.

U.S. Banking Crisis and BTC

The U.S. banking crisis in March of this year has become a boon for BTC and the crypto market. One of the most important reasons is the lack of correlation between cryptocurrencies and the U.S. stock market. Although the banking system has relatively stabilized since then, the current market conditions again suggest a similar scenario is forming.

U.S. Banks Under Pressure Again

The four major banks on Wall Street—Citigroup (C), Morgan Stanley (MS), Goldman Sachs (GS), and Bank of America (BAC)—are currently at their lowest levels since the banking crisis. Their performance since the beginning of the year shows that their stock prices are at their lowest, even lower than in March of this year. Citigroup's stock has fallen by 14% since the beginning of the year, and Goldman Sachs' decline is also close to 13%. Morgan Stanley's losses exceed both, having fallen by 16% since the beginning of the year, while Bank of America leads with a 23% decline.

Negative Correlation between Cryptocurrencies and U.S. Banks

Although the current state of the U.S. economy does not support a bullish narrative for banks or the stock market, the situation in the crypto market is completely different. Currently, BTC shows a clear negative correlation with the S&P 500 and Nasdaq indices, at -0.8 and -0.78, respectively.

In March, as banks faced immense pressure, BTC prices rose along with other cryptocurrencies, and coincidentally, BTC is now also rising. This has led to a rise in other alternative coins, pushing the total market capitalization of the entire crypto market to $1.244 trillion.

From this perspective, the losses of U.S. banking institutions are being transformed into profits for cryptocurrency investors, indicating that capital inflows into this area are not only influenced by the United States. However, the continued losses of banking institutions may not be the only reason for the rise in BTC.

Behind the Israel-Palestine Conflict, U.S. Treasury Bonds and BTC

Arthur Hayes, co-founder of BitMEX, recently stated that the current economy is being affected by a "global war," which has catalyzed the recent selling of U.S. Treasury bonds. As bonds are no longer considered safe, investors are choosing BTC and gold as alternative investment commodities.

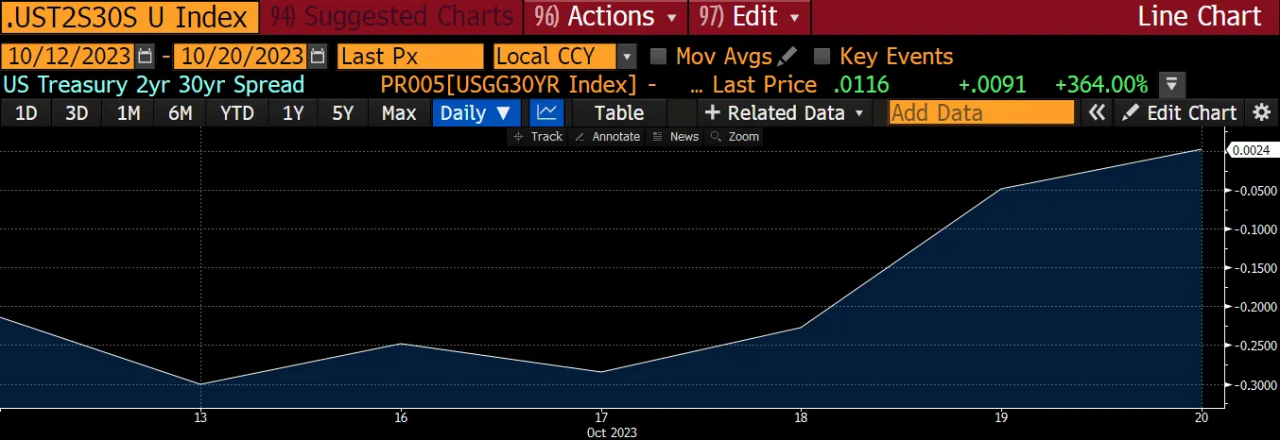

Since mid-2022, the yield spread between 2-year and 30-year U.S. Treasury bonds has turned positive for the first time.

Arthur Hayes explained the impact of the tense situation in the Middle East on the financial markets, pointing out that with the U.S. government continuing military aid to Israel, this will lead to the selling of U.S. Treasury bonds. He explained, "If you are a long-term holder of U.S. Treasury bonds, the most worrying thing is that the U.S. government does not think it is spending too much. If U.S. defense spending enters a ridiculous mode, it will involve borrowing tens of trillions of dollars to support the war machine, which will require the government to sell more long-term bonds to investors to absorb funds, and global distrust of U.S. Treasury bonds will further increase. This is why bonds are being sold, and yields are rising."

With the "Israel-Palestine conflict" and the "Federal Reserve (FED) pausing rate hikes" pushing U.S. Treasury bond yields to a 16-year high, Arthur Hayes believes that when long-term U.S. Treasury bonds no longer provide security to investors, they will seek alternative assets, and the preferred assets in this background are gold and BTC. Arthur Hayes believes that the rise in BTC and gold is due to the sharp decline in long-term U.S. bonds, not about whether ETFs are approved for speculation, but a reaction of BTC to future dollar devaluation and high inflation caused by war. Arthur Hayes also mentioned another reason for the sharp drop in bonds, when the Fed's rate hike cycle comes to an end and the U.S. economy remains normal, investors no longer have the motivation to hold long, which will also lead to the selling of U.S. Treasury bonds.

BTC Price May Rise Due to Other Factors

A group of key investors may also be one of the reasons for this surge. Since September 21, whale addresses holding 100 to 1000 BTC have been accumulating BTC. In one month, the BTC holdings of this group increased by 50,000 BTC, worth $1.7 billion, increasing their holdings from 3.85 million BTC to 3.9 million BTC.

BTC Trend

At the time of writing this article, the BTC price is $34,572, and it may continue to rise due to strong market momentum. It remains at the mid-to-high range of the market, and the chart above shows an evaluation from the low point in early 2023 to the high point this year of $35,184.

The price of BTC has doubled from the closing price of $16,542 on December 31, breaking through the key retracement level of 61.8% Fibonacci at $28,067 during the rise. The strong momentum of this rebound also broke through the 78.6% Fibonacci level to $31,197.

The pressure from increased buying volume may continue to drive the BTC price higher, with a bullish target of $35,000. In this case, the most reasonable target would be the $35,184 level at the top of the Fibonacci chart.

However, if profit-taking begins, the BTC price may still experience a downward trend. In this case, the support level for BTC may be around $31,197, or more likely around $28,067. In the most severe case, the price may drop to the $25,869 level.

Conclusion

With the continuous rise in BTC price, market sentiment is clearly bullish. It can be said that multiple factors such as the approaching BTC halving, pressure on the U.S. banking industry, and the rise in U.S. Treasury bond yields have driven this round of price increases. Although there may still be fluctuations in the short term, from a medium to long-term perspective, the BTC price is in an upward trend. For investors, now is still a good opportunity to position themselves in BTC. With the gradual release of the halving effect, BTC may open a new bull market cycle, which is worth looking forward to.

Citation: https://cryptohayes.substack.com/p/the-periphery

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。