Source: GenAI New World

Image Source: Generated by Wujie AI

According to foreign media reports, based on the just-released quarterly financial report, Microsoft is surpassing its biggest competitor, Google, in the field of AI.

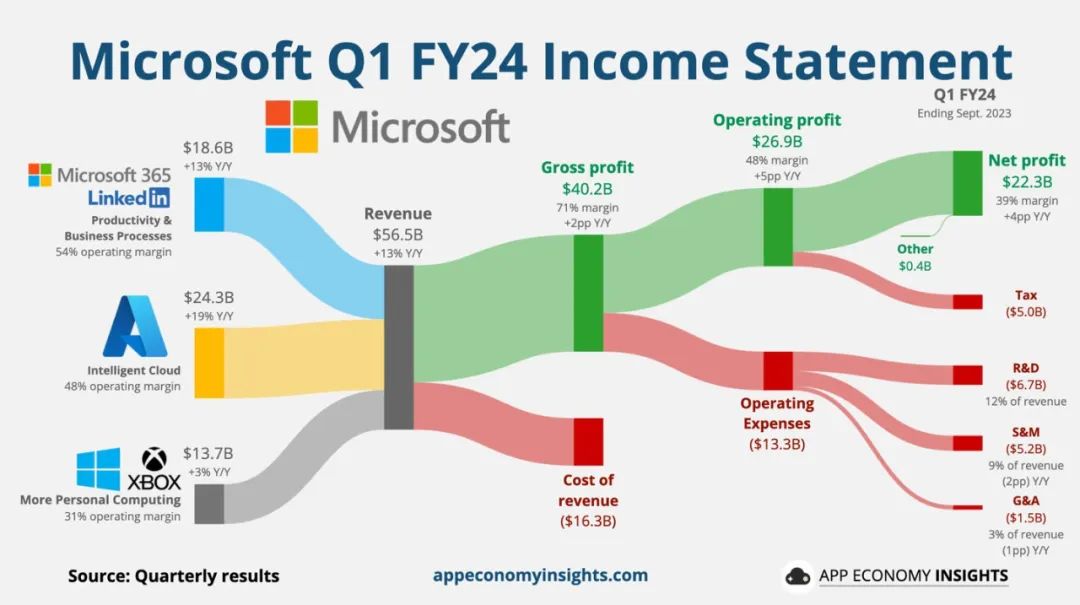

Let's first compare the quarterly financial reports of Microsoft and Google's parent company, Alphabet. In terms of revenue, Microsoft's revenue reached $56.5 billion, a 13% year-on-year increase. Meanwhile, Alphabet's revenue was $76.7 billion, an 11% year-on-year increase. In terms of profit, Microsoft's net profit for the last quarter was $22.3 billion, a 27% increase. Alphabet's net profit was $19.689 billion, a 42% year-on-year increase. Purely in terms of revenue, Alphabet's situation seems to be better.

However, when we look at the AI-related business separately, the situation is quite different. Microsoft's Intelligent Cloud division had a revenue of $24.3 billion, a 19% year-on-year increase, with Azure server products and cloud services growing by 21%, and all other cloud services growing by 28%. On the other hand, Google's revenue mainly comes from Google's ad search and YouTube's ad business. Google Cloud's revenue was $8.411 billion, lower than the market's expectation of $8.6 billion.

It is worth noting that Google Cloud's year-on-year growth in this quarter was 22%, while in the first two quarters of this year, Google Cloud's revenue growth was around 28%. The slowdown of Google Cloud seems to have disappointed investors, as evidenced by a 6% plunge in Alphabet's stock price in after-hours trading, while Microsoft's stock price rose nearly 4%.

Microsoft's fourth-quarter financial report

In the last quarter, the growth rate of Microsoft's Azure cloud computing division and the entire company accelerated, which executives attributed to higher-than-expected consumption of AI-related services. Meanwhile, Google Cloud's growth slowed by nearly 6 percentage points during the same period. From this data, it seems that Google Cloud has not benefited much from various AI-related services. Google executives stated that the Google Cloud computing division is suffering losses due to many customers cutting expenses, a trend that has persisted in the industry for several quarters.

Many people feel regretful for Sundar Pichai, the CEO of Google's parent company, Alphabet. During Google's earnings conference call, he mentioned that Google has seen strong interest in AI, while Microsoft CEO Satya Nadella spent a lot of time at the beginning of the earnings conference call listing various ways in which customers are using Microsoft's AI services.

Considering Microsoft's partnership with OpenAI, Microsoft's outstanding performance is not surprising.

OpenAI ignited the trend of generative AI a year ago, and this partnership provides support for various Microsoft products, giving Microsoft an advantage in the competition against Google, OpenAI, and other competitors. Although Microsoft and OpenAI are partners, there is also competition between them, and OpenAI's business has shown a trend of losing to Microsoft.

Alphabet's stock performance is particularly noteworthy, as the company's overall business growth rate actually exceeded expectations, indicating a recovery in the digital advertising market from the slump of the past 18 months.

Google's financial report shows that search ad revenue grew by 11%, and YouTube ad revenue grew by 12%, a significant improvement compared to the 4% to 5% growth in the second quarter.

Snap also showed a recovery. Despite appearing insignificant in the advertising market recently, according to their financial report released on Tuesday, Snap's revenue grew by 5% in this quarter. Three months ago, Snap expected its third-quarter revenue to remain flat at best. The performances of Google and Snap lay the foundation for the strong performance that Meta Platforms is about to announce.

Compared to digital advertising, investors are now more concerned about artificial intelligence. The outlook defined by Microsoft executives seems positive. Chief Financial Officer Amy Hood stated that AI consumption is expected to continue to grow in the coming quarters, which will help offset the generally more cautious spending of cloud computing customers.

However, Hood also mentioned that the cost of expanding AI infrastructure has damaged this quarter's gross margin. Nevertheless, such a cost is worth it to maintain a leading position in the most exciting technology product competition of recent years. (Translated by Lv Ke)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。