1. Introduction: What is DePIN

DePIN stands for Decentralized Physical Infrastructure Network. It encourages users to share personal resources through token incentives to build infrastructure networks, including storage space, communication bandwidth, cloud computing, and energy.

In simple terms, DePIN distributes the infrastructure originally provided by centralized companies to users worldwide in a crowdsourcing manner.

According to CoinGecko, the market value of the DePIN field has reached $5.2 billion, surpassing the oracle field's $5 billion and showing a continuous upward trend. Whether it's the early emergence of Arweave and Filecoin, the takeoff during the last bull market of Helium, or the recent highly anticipated Render Network, they all belong to this field.

Some readers may be curious why DePIN has recently attracted attention and enthusiasm, even though these projects have existed before. Helium also attracted a lot of attention during the last bull market. The reasons can be summarized in three aspects:

The construction of infrastructure has been greatly improved compared to a few years ago, paving the way and empowering the DePIN track.

At the end of 2022, Messari first proposed the new concept of DePIN, believing it to be "one of the most important areas for crypto investment in the next decade." The new definition and expectations have reignited the narrative of this track.

In addition, people used to place the new narrative of breaking the circle of web3 on social and gaming, but with the arrival of the bear market, people began to explore more possibilities in other directions. The DePIN track, closely linked to web2 users, has gradually become an important choice for web3 builders.

So, is the DePIN track just old wine in a new bottle, or is it a new opportunity for breaking the circle of Web3? This article will deeply analyze DePIN from five perspectives: why DePIN is needed, DePIN's token economic model, industry status, representative projects, advantages analysis, and limitations and challenges.

2. Why Do We Need DePIN?

So why do we need DePIN? What problems does DePIN solve compared to traditional ICT infrastructure?

2.1 Current Situation of Traditional ICT Industry

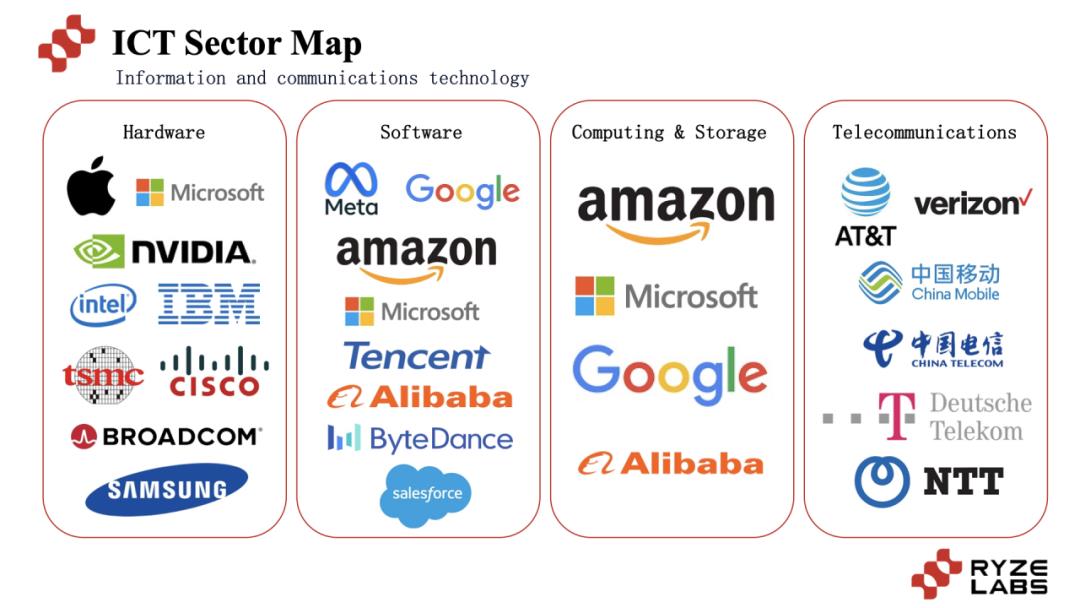

In the traditional ICT industry, infrastructure can mainly be divided into the following categories: hardware, software, cloud computing and data storage, and communication technology.

Among the top ten companies in the global market value rankings, six belong to the ICT industry (Apple, Microsoft, Google, Amazon, NVIDIA, Meta), dominating the market.

According to Gartner's data, the global market size of ICT reached $4,390 billion in 2022, and data centers and software have shown a growth trend in the past two years, influencing various aspects of our lives.

2.2 Challenges of the Traditional ICT Industry

However, the current ICT industry faces two significant challenges:

1) High entry barriers in the industry limit full competition, leading to pricing monopolized by giants.

In fields such as data storage and communication services, enterprises need to invest a large amount of capital in hardware purchase, land leasing for deployment, and hiring maintenance personnel. These high costs mean that only giant enterprises can participate, such as AWS, Microsoft Azure, Google Cloud, and Alibaba Cloud, which collectively hold nearly 70% of the market share in cloud computing and data storage. This monopolization of pricing by giants ultimately transfers the high costs to consumers.

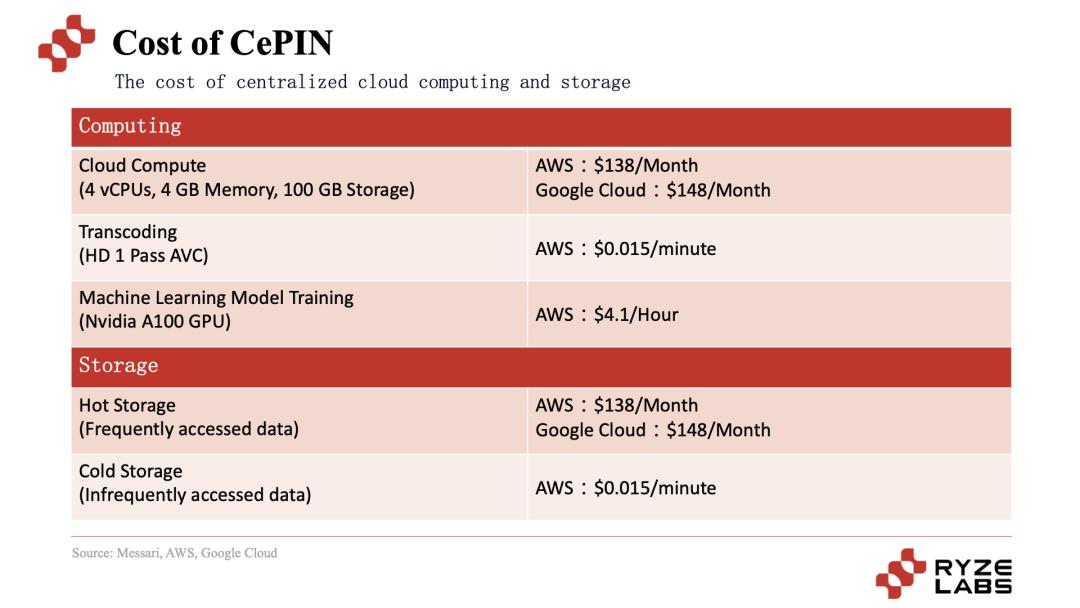

For example, the cost of cloud computing and data storage is quite high:

According to Gartner's data, in 2022, the total spending on cloud services by enterprises and individuals reached $490 billion, and it is expected to continue growing in the coming years, exceeding $720 billion by 2024. Among these, 31% of large enterprises spend over $12 million annually on cloud services, and 54% of small and medium-sized enterprises spend over $1.2 million annually on cloud services. As enterprise investment in cloud services increases, 60% of enterprises report that their cloud costs exceed expectations.

The monopolization of pricing by giants leads to increasing pressure on user and enterprise spending. Additionally, the capital-intensive nature limits full competition in the market and affects the innovation and development of the field.

2) Low utilization of centralized infrastructure resources.

The low utilization of centralized infrastructure resources is a major challenge in today's business operations. This issue is particularly prominent in the cloud computing environment, where companies often allocate a large budget for cloud services.

According to a recent report by Flexera (2022), there is a concerning trend where, on average, 32% of a company's cloud budget is wasted, meaning that one-third of resources are idle after cloud spending, resulting in significant financial losses.

This misallocation of resources can be attributed to various factors. For example, in terms of resource supply, companies often overestimate their demand to ensure continuous service availability. Additionally, according to Anodot's data, over half of cloud waste is due to a lack of understanding of cloud costs, leading to confusion in complex cloud pricing and a variety of packages.

On one hand, the monopolization by giants leads to high prices, and on the other hand, a considerable portion of a company's cloud spending is wasted, resulting in a double dilemma of IT costs and utilization rates. However, this also provides fertile ground for the development of DePIN.

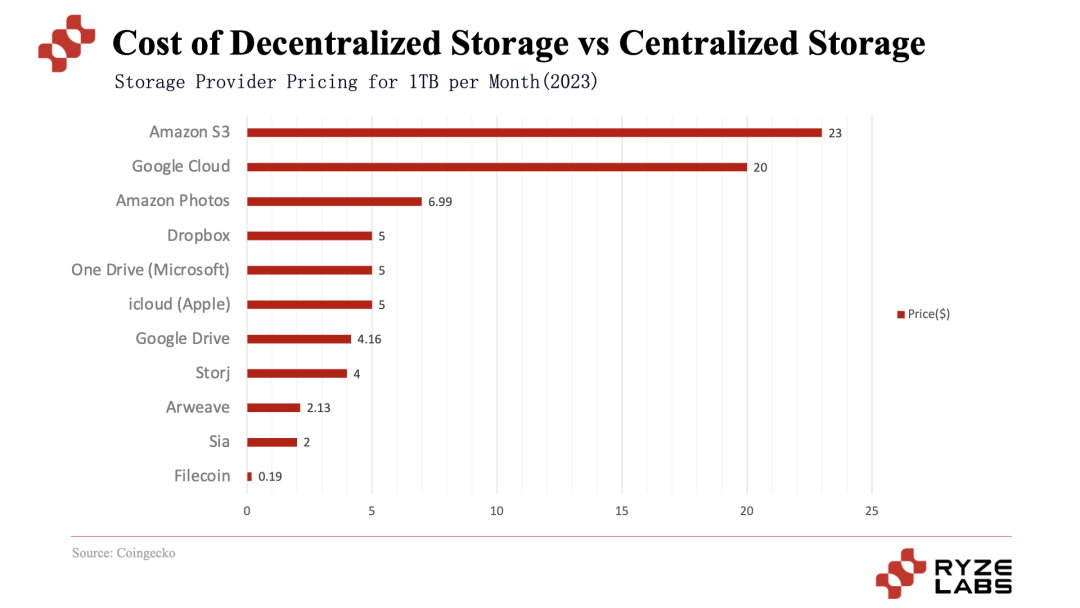

Faced with the high prices of cloud computing and storage and the dilemma of cloud waste, the DePIN track can effectively address these needs. In terms of pricing, decentralized storage (such as Filecoin, Arweave) is several times cheaper than centralized storage. In terms of the dilemma of cloud waste, some decentralized infrastructure projects have begun to adopt a tiered pricing approach to differentiate different demands. For example, the Render Network in the decentralized computing track efficiently matches GPU supply and demand through a multi-tiered pricing strategy. The advantages of decentralized infrastructure in addressing these two challenges will be detailed in the subsequent project analysis section.

3. DePIN's Token Economic Model

Before understanding the current status of the DePIN track, let's first understand the operational logic of the DePIN track. The core question is: why are users willing to provide their resources to join DePIN projects?

As mentioned in the introduction, the core logic of DePIN is to encourage users to provide resources, including GPU computing power, deploying hotspots, storage space, etc., to contribute to the entire DePIN network through token incentives.

Since tokens often have no actual value in the early stages of DePIN projects, the behavior of users participating in network resource provision is somewhat similar to venture capitalists. The supply side selects promising projects from numerous DePIN projects and invests resources to become "risk miners," profiting from the increase in token quantity and the potential appreciation of token prices.

These providers are different from traditional miners in that the resources they provide may involve hardware, bandwidth, computing power, and their income in tokens is often related to network usage, market demand, and other factors. For example, low network usage leads to reduced rewards, or network attacks or instability result in the waste of their resources. Therefore, risk miners in the DePIN track need to be willing to bear these potential risks and provide resources for the stability of the network, playing a crucial role in the stable operation and development of the project.

This incentive mechanism creates a flywheel effect, forming a positive feedback loop during good development; conversely, it can also lead to a withdrawal loop during downturns.

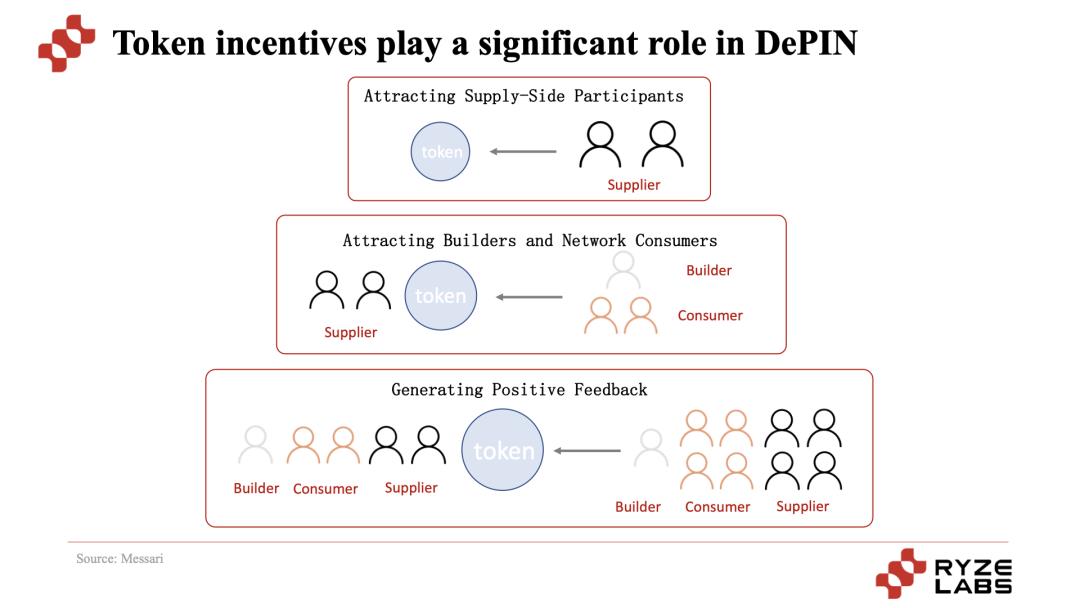

Attracting Supply-Side Participants through Tokens: By employing a sound token economic model, early participants are incentivized to contribute to network construction and provide resources in exchange for tokens.

Attracting Builders and Network Users: With an increase in resource providers, some developers begin to join the ecosystem to build products. Additionally, due to DePIN offering lower prices compared to centralized infrastructure, consumers are also attracted to join.

Creating Positive Feedback: With an increase in consumer users, this incentive for demand brings more income to supply-side participants, creating positive feedback and attracting more participants on both sides.

Under this cycle, the supply side receives more valuable token rewards, and the demand side receives more cost-effective services. The project's token value and the growth of participants on both sides remain consistent. As the token price rises, more participants and speculators are attracted, creating value capture.

Through the token incentive mechanism, DePIN first attracts suppliers and then users, thereby achieving the cold start and core operation of the project, leading to further expansion and development.

4. Current Status of the DePIN Industry

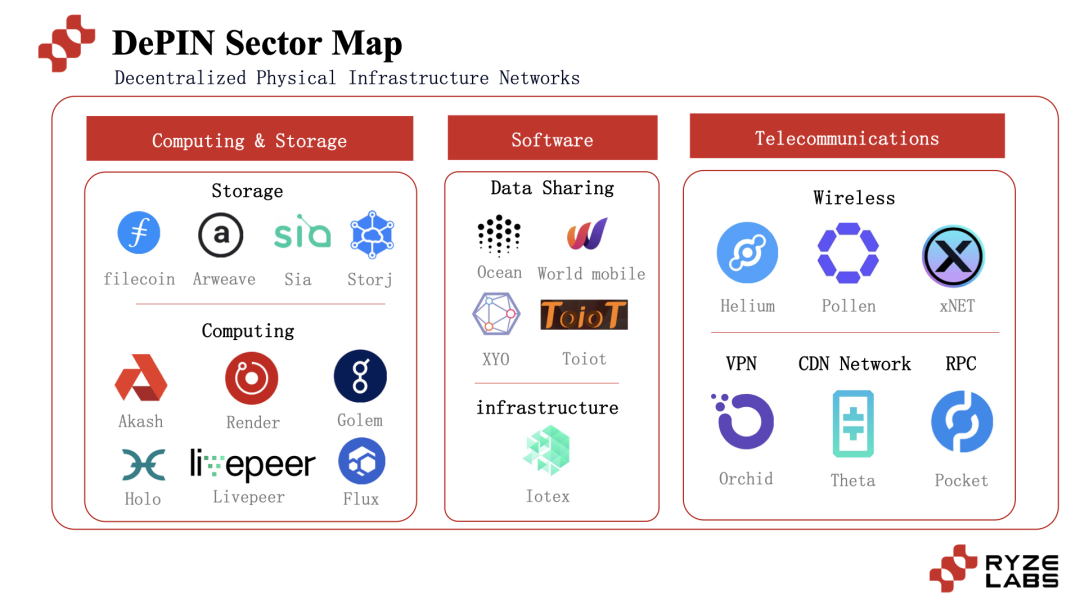

From the earliest established projects, such as the decentralized network Helium (2013), decentralized storage projects Storj (2014) and Sia (2015), it can be seen that the earliest DePIN projects were mainly focused on storage and communication technologies.

However, with the continuous development of the internet, IoT, and AI, there is an increasing demand for infrastructure and innovative solutions. From the current development status of DePIN, DePIN projects are mainly focused on computing, storage, communication technologies, and data collection and sharing.

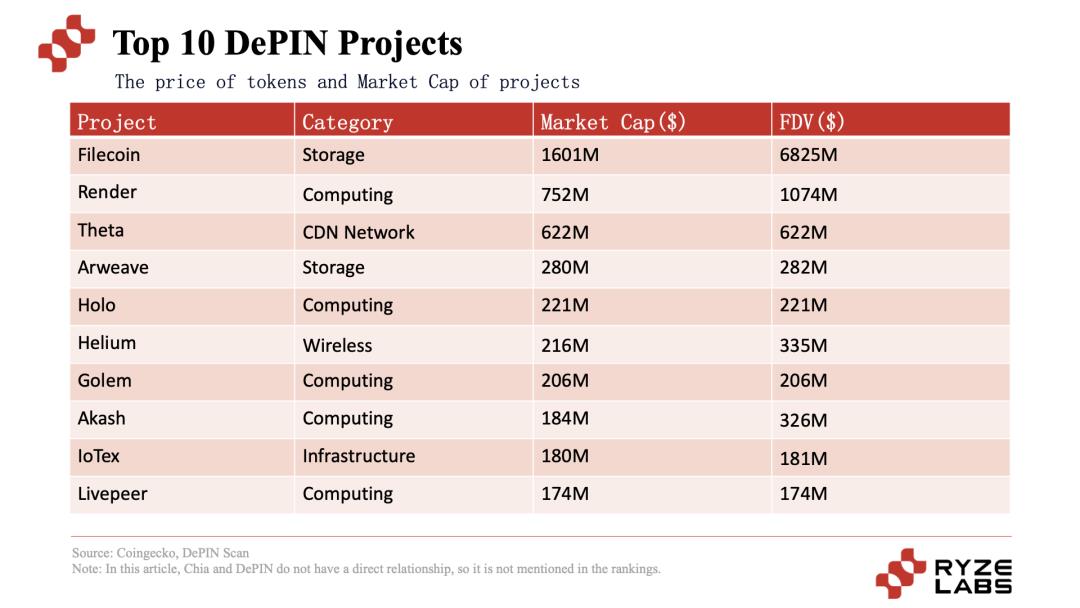

Looking at the top 10 projects in the DePIN field based on market value, most of them belong to the Storage and Computing domains. Additionally, there are some good projects in the telecommunications domain, including industry pioneers like Helium and later performers like Theta, which will be further discussed in the project analysis section.

5. Representative Projects in the DePIN Industry

Based on the market value ranking on Coingecko, this article will focus on analyzing the top five projects: Filecoin, Render, Theta, Helium, and Arweave.

First, let's take a look at the decentralized storage track projects Filecoin and Arweave, which are two well-known projects.

5.1 Filecoin & Arweave - Decentralized Storage Track

As mentioned earlier in the challenges of the traditional ICT industry, the high pricing of centralized cloud storage on the supply side and the low resource utilization on the demand side have created difficulties for users and enterprises. Additionally, there are risks such as data leaks. In response to this, Filecoin and Arweave disrupt the industry by providing lower prices through decentralized storage, offering a different kind of service to users.

Let's start with Filecoin. From the supply side, Filecoin is a decentralized distributed storage network that incentivizes users to provide storage space through token incentives (more storage space provided is directly related to receiving more block rewards). In about a month after the launch of the testnet, its storage space reached 4PB, with Chinese miners (storage space providers) playing a significant role. Currently, the storage space has reached 24EiB.

It's worth noting that Filecoin is built on the IPFS protocol, which is already a widely recognized distributed file system. Filecoin achieves decentralized and secure data storage by storing user data on nodes in the network. Additionally, Filecoin leverages the advantages of IPFS, giving it strong technical capabilities in the decentralized storage domain. It also supports smart contracts, allowing developers to build various storage-based applications.

In terms of consensus mechanism, Filecoin uses Proof of Storage, including advanced consensus algorithms like Proof of Replication (PoRep) and Proof of Spacetime (PoSt), to ensure data security and reliability. In simple terms, Proof of Replication ensures that nodes replicate client data, while Proof of Spacetime ensures that nodes maintain storage space.

Currently, Filecoin has established partnerships with many well-known blockchain projects and enterprises. For example, NFT.Storage uses Filecoin to provide a simple decentralized storage solution for NFT content and metadata, while the Shoah Foundation and Internet Archive use Filecoin for content backup. Notably, the world's largest NFT marketplace, OpenSea, also uses Filecoin for NFT metadata storage, further promoting the development of its ecosystem.

Next, let's take a look at Arweave, which has some similarities with Filecoin in incentivizing the supply side. Through token incentives, users are encouraged to provide storage space, and the reward amount depends on the amount of stored data and the frequency of data access.

However, Arweave is a decentralized permanent storage network. Once data is uploaded to the Arweave network, it is permanently stored on the blockchain.

So, how does Arweave incentivize users to provide storage space? Its core mechanism is a proof-of-work mechanism called "Proof of Access," which aims to prove the accessibility of data on the network. In simple terms, miners are required to provide a randomly selected previously stored data block as "access proof" during the block creation process.

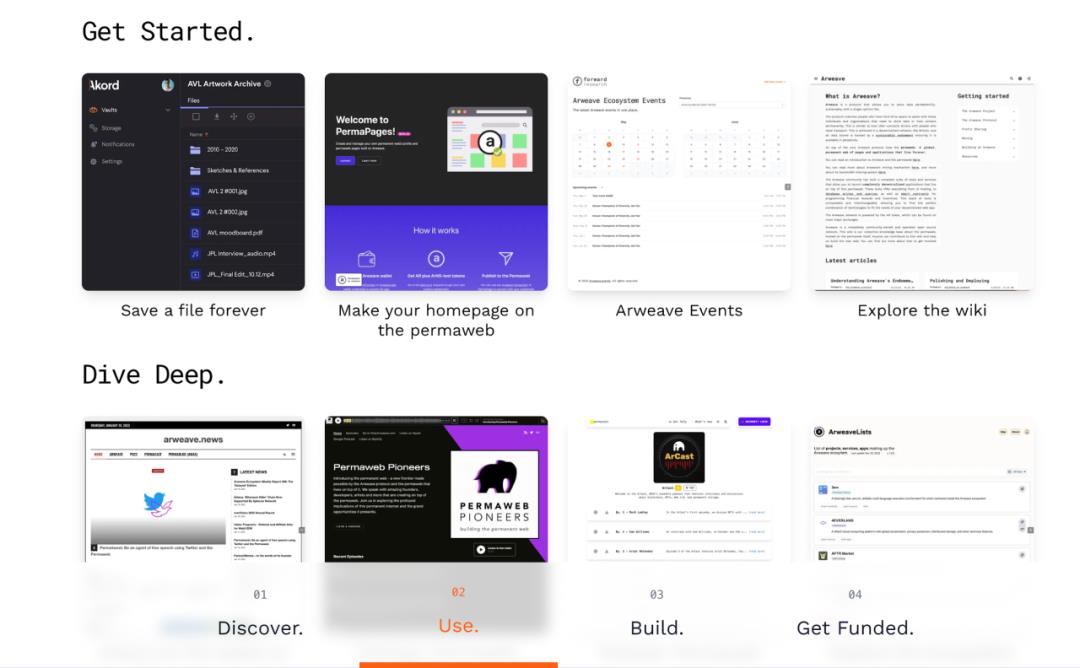

The official website provides various solutions, including permanent storage of files, creating permanent personal profiles, and web pages.

(Source: Arweave official Website)

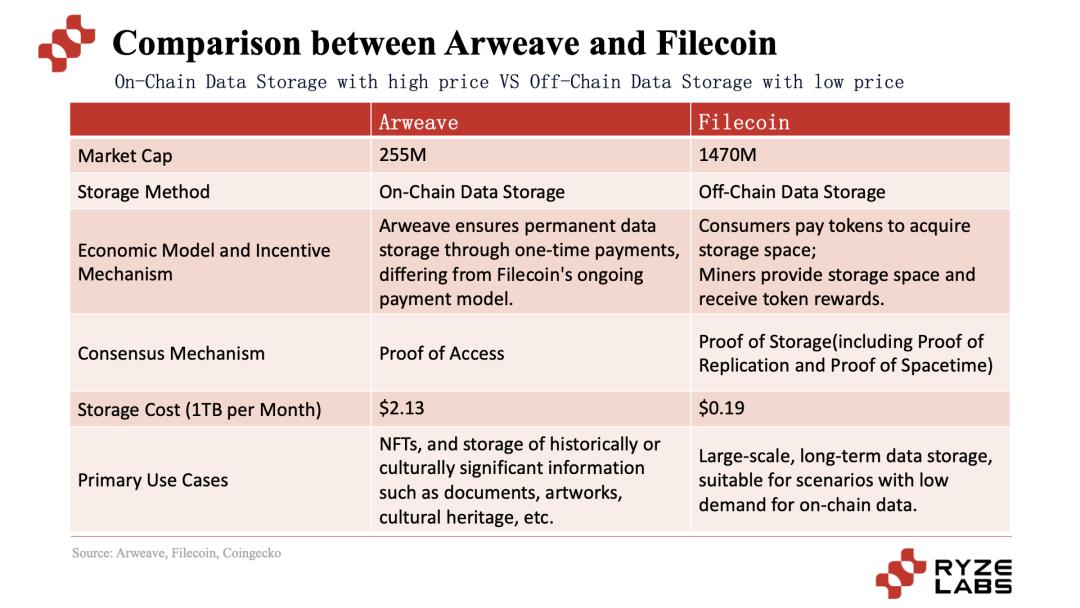

To help understand the differences between Arweave and Filecoin, a table has been created for quick reference.

From the table above, it can be seen that Filecoin and Arweave have significant differences in storage methods, economic models, and consensus mechanisms, giving them respective advantages in different application scenarios. However, due to lower storage prices, Filecoin currently holds a leading position in the market performance.

In summary, with the widespread use of big data and AI applications, the volume of data generated is growing exponentially, leading to an increasing demand for data storage. In the context of high pricing for centralized storage, the demand for decentralized storage is also increasing. The following graph shows a significant difference in pricing between decentralized and centralized storage.

Under the condition of storing 1TB for one month, the average price of decentralized storage is less than half of Google Drive and one-tenth of Amazon S3.

In addition to the price advantage, decentralized storage offers higher security as data is distributed and stored across multiple nodes, reducing the risk of single point of failure and providing higher resistance to censorship.

In terms of data privacy, users retain absolute ownership and control of their data in decentralized storage. Users can access, modify, or delete their data stored on the network at any time. In centralized storage, users entrust their data to service providers, who may have some control over the data, and users are required to comply with the service provider's terms of use and privacy policies.

On the downside, decentralized storage faces many technical challenges, including storage and retrieval efficiency, node reliability, and other issues that need to be addressed. Compared to the high availability and performance guarantees of centralized storage, the availability and performance of decentralized storage may be affected by the participants in the network, leading to potential fluctuations that impact user experience.

5.2 Helium - Decentralized Wireless Network

After understanding the decentralized storage track, let's take a look at the highly anticipated decentralized wireless network project, Helium. Established in 2013, Helium is also a veteran and pioneer in the DePIN track.

Why is a decentralized wireless network so important? In the traditional IoT industry, the difficulty of covering infrastructure costs with revenue has prevented the emergence of major players in the network supply for IoT devices, leaving the market without an integrated solution. The demand without supply has provided fertile ground for Helium's development in the IoT sector.

Since the most challenging aspect is the infrastructure cost, DePIN has a natural advantage in this area by allowing users to participate in crowdfunding on the supply side to share the costs. By incentivizing users globally through token incentives to purchase Helium's network devices and form a network, Helium achieves network supply. Its technical strength gives it a significant advantage in the Internet of Things (IoT) domain. In August last year, the number of hotspots exceeded 900,000, and the monthly active hotspots for IoT reached 600,000, which is 20 times the 30,000 hotspots of the leading player in traditional IoT networks, The Things Network. (Even though the current active hotspot count has dropped to 370,000, it still maintains a significant advantage.)

After making progress in the IoT domain, Helium aims to further expand its network business and enter the 5G and Wi-Fi markets. However, the data in the following chart shows that currently, Helium's performance is mainly outstanding in the IoT domain, while it is somewhat weak in the 5G domain.

Why does Helium perform exceptionally well in the IoT domain but appear somewhat weak in the 5G domain? Let's analyze this from the perspectives of market and compliance.

In the IoT domain, Helium uses LoRaWAN technology, a low-power wide-area network technology known for its low power consumption, long transmission distance, and excellent indoor penetration. This network usually does not require specific authorization, making it an economical choice for large-scale IoT deployments.

For example, in agricultural scenarios, farmers only need to monitor soil moisture and whether the temperature exceeds a certain threshold to implement smart irrigation and crop management. Similarly, in smart city scenarios such as smart streetlights, trash bins, and parking sensors, there are many promising prospects.

Additionally, the IoT network market is difficult to monetize due to its wide coverage but low data transmission volume, and no industry giants have emerged. Helium seized this opportunity by combining web3 technology with IoT networks, cleverly solving the problem of high capital barriers through widespread participation. By sharing the high upfront costs of IoT construction among users, a lightweight start was achieved. Currently, some location devices for indoor and outdoor use, as well as smart farms such as Abeeway and Agulus, have started using Helium, and as of August last year, the number of hotspots exceeded 900,000.

On the other hand, Helium's entry into the 5G market a year ago has not been as successful, primarily due to the dual challenges of compliance and market ceiling.

In terms of compliance, the allocation and licensing of frequency bands in the United States are strictly regulated by the Federal Communications Commission (FCC). Low-frequency bands such as 600MHz and 700MHz, mid-frequency bands such as 2.5GHz and 3.5GHz, and high-frequency bands such as 28GHz and 39GHz all require rigorous scrutiny for authorization. For example, T-Mobile, which has been authorized, uses the 600MHz band for 5G deployment, and Verizon uses the 700MHz band for 5G deployment. As a latecomer, to reduce deployment costs and address compliance challenges, Helium chose the unlicensed CBRS GAA band, which, compared to mid-frequency bands, has slightly smaller coverage and does not show significant advantages compared to US carriers.

In terms of market ceiling, it is worth noting that 5G is a sector subject to strict regulation by national policies, with most network operators worldwide being state-owned, and only a few being private enterprises with close ties to the government. Therefore, from the perspective of a large market, it is difficult for Helium to replicate its 5G market experience in the United States overseas.

Additionally, the lack of transparency in the equipment used for collaboration is also an experiential issue on the supply side. Since Helium's equipment is open-source, the performance, price, and installation process vary among different collaborating manufacturers. The lack of transparency in performance and pricing is a significant concern for providers participating in Helium, and there is also the issue of vendors passing off second-hand equipment as new. Balancing transparency in equipment performance and pricing with open-source principles is a challenge that the Helium project needs to address.

It is worth noting that on March 27th of this year, Helium began migrating from its Layer1 blockchain to Solana. The reasons for the migration can be summarized as follows:

The core Helium team's focus is on the network, and after evaluating the importance of maintaining Layer1, they decided to entrust the maintenance of the underlying blockchain to those who are skilled in this area. This allows the team to focus on building the Helium network.

The choice of Solana is mainly due to its ecosystem. Solana has many high-quality ecosystem projects and developers, and Helium's native token HNT is compatible with other innovative projects in the Solana ecosystem, providing token holders with more use cases.

Furthermore, Solana's latest state compression feature allows for the low-cost minting of a large number of NFTs, reducing the cost of minting nearly 1 million NFTs on Solana to just $113, saving a significant amount of fees. These NFTs can serve as network credentials for Helium and verify hotspots, and can also integrate the entire ecosystem's functionality, including token gating and hotspot owner access, making it highly efficient and convenient.

In terms of future planning, there are many opportunities for collaboration between Helium and Solana in projects such as Solana Mobile Stack and the Saga phone that Solana wants to launch. This is a win-win situation for Solana, which wants to develop phones, and Helium, which wants to become a 5G service provider.

In the long run, Helium's exploration in the IoT domain is an innovative endeavor from 0 to 1, with high value in addressing the needs of the Internet of Things. Although it will face many challenges in this process, as IoT devices become more widespread and application scenarios continue to expand, Helium's decentralized network solution may find broader applications. It is believed that in the future, in fields such as smart agriculture and smart cities, it will unleash tremendous potential.

5.3 Render Network - Decentralized Computing

Render Network is a decentralized GPU rendering platform. Rendering refers to the process of transforming two-dimensional or three-dimensional computer models into realistic images and scenes. Render Network has attracted attention during the Apple Vision Pro launch event and the rise of the metaverse and AR/VR trends.

Some readers may wonder why Render Network is needed for video editing and animation when personal computers seem insufficient. The reason is that for small projects such as short videos or microfilms, the demand for computing power is relatively low. However, for many large projects, the computational resources required for rendering are significant and often rely on centralized cloud service providers such as AWS, Google Cloud, and Microsoft Azure, which can be expensive.

In terms of pricing, Render Network uses a multi-tiered pricing strategy to efficiently match GPU supply and demand, focusing on the most important aspect for customers.

Rendering services are quantified in OctaneBench units and time, adjusted based on OctaneBench4, and standardized to 1 euro. This pricing model is based on the current cost of GPU cloud rendering services on centralized platforms such as Amazon Web Services (AWS). Specifically, 1 euro worth of RNDR is equivalent to 100 times OctaneBench4 per hour.

Compared to Tier1, Tier2 provides 2 to 4 times the total workload of OctaneBench and 200-400% more computational power. Tier 2 rendering jobs have a higher priority in the rendering queue than Tier 3, allowing for accelerated parallel rendering services. Tier3 provides 8 to 16 times the workload of OctaneBench. However, Tier 3 services have the lowest priority in the rendering queue and are not recommended for time-sensitive rendering tasks.

In summary, the pricing formula for each tier is fixed, but the pricing unit OctaneBench fluctuates based on market performance. Tier1's cost and effectiveness are comparable to centralized cloud rendering services such as AWS, while Tier2 and Tier3 achieve lower prices by imposing lower speed requirements. For price-sensitive users, Tier3 is an option, while Tier1 is a priority for those seeking efficiency, and Tier2 is suitable for those in between.

Additionally, Render Network emphasizes the efficient utilization of idle GPU resources. Most GPUs are underutilized locally when idle, while artists and developers are expanding the scale of cloud rendering and computing work. The decentralized rendering network provides an efficient two-way market for global GPU computing supply and demand, which is a highly effective resource allocation method.

5.4 Theta Network - Decentralized Video Network

Theta Network's co-founder Steve Chen was a co-founder of YouTube, bringing strong industry background to the project. The core function of the project is to use a blockchain-based optimized content delivery network, significantly reducing the cost of video content transmission and improving content distribution efficiency.

To better understand, let's compare it to traditional content delivery networks (CDNs):

In traditional distribution networks, all video viewers directly connect to POP servers (network nodes distributed globally) to watch videos. Currently, most platforms such as Netflix and Facebook obtain services through centralized CDNs. However, for those in geographically distant locations from the POP servers, video streaming is often affected. The Theta Network model allows users to contribute their bandwidth and computing power, becoming caching nodes to distribute videos closer to viewers' locations.

This provides a better experience for video viewers, rewards users providing bandwidth and computing power with tokens, and reduces the costs for video platforms. With the continued increase in video content consumption and the rise of online streaming and gaming industries, Theta Network is expected to be applied in more scenarios. Currently, in the decentralized video streaming field, Theta Network will also face competition from projects such as Livepeer and VideoCoin.

In addition to the top 5 projects mentioned above, there are many other noteworthy projects, such as IoTeX, which provides underlying infrastructure for IoT projects, offers SDKs for developers in the DePIN track, and recently launched the beta version of the data platform DePINscan to help analyze data in the DePIN track.

Furthermore, this year's Wanxiang Blockchain Week hackathon champion project, Ketchup Republic, aims to create a web3-based Yelp, directly giving the traffic fees paid by businesses to users, providing businesses and consumers with better traffic and experiences…

These emerging projects from the DePIN track are like mushrooms after the rain, and the long-awaited breakthroughs may give birth to a new summer in the DePIN track. However, due to the cost requirements of hardware and software integration, the summer may come more slowly. But believe that the late arrival of spring is still spring.

6. Advantages of DePIN

Looking at the mechanisms of various DePIN projects, the fundamental core is resource integration: by incentivizing users to share resources with tokens, resources can flow efficiently to the demand side. Compared to centralized traditional infrastructure, DePIN, like DeFi compared to CeFi, to some extent weakens the role of intermediaries, making resources flow more smoothly between the supply and demand sides.

6.1 Transition from Capital-Intensive Industries to P2P/P2B Models

The mechanisms presented by DePIN projects represent a revolutionary market transformation at its core. Its decentralized nature means that the barriers to enterprise participation will be significantly lowered, no longer subject to the monopoly of a few centralized giants. This breakthrough change will give small and medium-sized enterprises and startups greater participation rights and provide an opportunity for equal competition with industry leaders.

In the field of infrastructure construction, the oligopoly problem in centralized markets has been significant. Especially in traditional storage and computing fields, which are clearly capital-intensive industries, AWS, Azure, Google Cloud, and other giants hold the prices, and users often lack bargaining power, being forced to accept high prices or even lacking real choice.

However, the emergence of DePIN brings new vitality to this situation. Whether it's Filecoin, Arweave, or Render Network, by incentivizing users with tokens to provide resources and form networks, it achieves a transition from capital-intensive industries to P2P or P2B models. This significantly lowers the barriers to enterprise participation, breaks price monopolies, and gives users more affordable choices. By incentivizing users to share resources and establishing a free competitive ecosystem, DePIN makes the market more open, transparent, and competitive.

6.2 Reusing Idle Resources to Promote Better Social Development

In traditional economic models, many resources remain idle and fail to realize their potential value. This waste of resources not only has a negative impact on the economy but also creates significant pressure on the environment and society, including idle computing power, storage, and energy. For example, according to Flexera's report, the effective utilization rate of cloud purchases by enterprises in 2022 was only 68%, meaning that 32% of cloud resources were wasted. Considering Gartner's forecast of nearly $500 billion in cloud spending in 2022, this roughly translates to $160 billion in wasted cloud spending.

However, the emergence of DePIN provides a new solution to this dilemma. Many users hold a significant amount of idle resources, whether it's storage, computing power, or data. The key is how to mobilize these resources. Through incentive mechanisms, DePIN encourages users to share and utilize their resources, maximizing resource utilization. This includes not only data storage, computing power, and other resources but also environmental resources. For example, React Protocol connects batteries to the power market to stabilize the grid by sharing surplus power, contributing to clean energy supply and providing an additional revenue stream for users with limited resources, creating a win-win situation. This initiative not only reduces resource waste but also promotes a more sustainable development for society.

6.3 Eliminating Intermediaries for More Efficient Money Flow

In addition to the transformation of decentralized storage, computing, and networking models and the reuse of idle resources, some emerging DePIN projects aim to become the "web3" versions of O2O platforms such as Meituan, Dianping, and Didi.

For example, Ketchup Republic aims to use the location relationship between consumers and businesses (using Bluetooth) to help businesses attract offline traffic. Businesses can configure token incentives for users, allowing marketing settings based on location, frequency, distance, and more. In contrast to the web2 models of Meituan and Dianping, where the platform mediates incentives between businesses and users, Ketchup Republic directly allocates marketing fees to users, reducing marketing costs.

These emerging DePIN projects aim to replace web2 infrastructure projects, allowing users providing data to directly receive payments from businesses, eliminating intermediaries.

This means that DePIN establishes a decentralized ecosystem that directly connects supply and demand, enabling the direct transfer of value and facilitating faster money and resource flow, thereby improving transaction efficiency and transparency. This mechanism not only reduces transaction costs but also provides more opportunities and flexibility for market participants.

7. Limitations and Challenges of DePIN

The DePIN track covers a wide range of categories, including storage, computing, data collection and sharing, communication technology, and more, all of which present varying degrees of competition in existing markets. The development of DePIN also faces many limitations and challenges:

7.1 Experience: Lack of Standards in the Early Stage, Poor Developer and User Experience

The DePIN industry is still in its early stages and lacks complete infrastructure, with each project needing to be developed independently. Additionally, there is a relatively high barrier for user participation and understanding, as users need to learn and hold tokens, as well as purchase and configure hardware. These factors have led to a generally average user experience for DePIN projects in the current market. Companies need to aggregate and simplify the barriers to user participation and usage to improve network availability and potentially break through existing limitations.

It is worth noting that some companies are beginning to develop infrastructure for the DePIN track. For example, Filecoin announced the launch of Filecoin Data Tools, a set of computing and storage technologies based on its network, to enhance developer experience and provide comprehensive solutions for data services demand. In terms of infrastructure, IoTeX is also developing tools such as "move to earn" SDK, hoping to establish standards and consensus in the DePIN field to drive industry development.

7.2 Competition: Lack of Competitive Moats

The lack of competitive moats poses a challenge to the long-term stable development of networks. As resource providers, users may easily switch to other networks once more choices become available in the market. For example, in the 5G track, the entry of Pollen has led some miners from the Helium community to start deploying Pollen's miners. Similarly, as a decentralized mobile network provider, how to enhance its irreplaceability and competitive barriers is a long-term exploration process.

Additionally, preventing cheating is crucial for sustainable development. For example, the Helium project has encountered cluster mining cheating and GPS location modification cheating in geographic data-related projects. How to avoid these behaviors is also crucial. For example, Helium has seen a decrease from a peak of 600,000 active hotspots to the current 370,000 active hotspots. Addressing this decline and providing better services is an urgent issue.

Currently, projects are primarily attracting users through token incentive methods, adjusting token incentive levels based on coverage, availability, and other dimensions. However, there has yet to be a consistently effective solution. How to continuously attract user participation and create a positive flywheel effect is still an area of exploration.

7.3 Expansion: Regulatory Constraints on Legal Compliance

Due to the impact of the DePIN field on infrastructure and its implications for web2 users, legal compliance becomes an unavoidable issue. For example, in the communication field, 5G technology is subject to strict regulatory requirements. Many countries' network operators are state-owned enterprises, and private enterprises maintain close ties with the government, making authorization potentially challenging. Even in countries that have opened up some frequency bands, such as the CBRS GAA band in the United States, there are no significant advantages compared to other operators due to frequency restrictions.

Conversely, in the IoT field, the lack of mature giant solutions has left ample room for Helium to operate. Currently, DePIN is still in its early stages. On one hand, in areas where web2 has not yet been addressed, such as IoT networks, there is room for new approaches. On the other hand, in tracks where web2 has relatively mature solutions, such as 5G and data security, growth needs to be aligned with regulatory development, which is an unknown and constantly changing process.

7.4 Development: Talent Barriers

In conversations with some DePIN track project teams, a common pain point and challenge is the scarcity of talent.

The DePIN field requires talent with comprehensive skills, understanding both IoT and the operation of the web3 market. However, such talent is relatively scarce in the industry.

To some extent, the steady development of IoT and the innovative style of web3 present a somewhat contradictory quality in talent. Most talent with IoT experience may prefer to develop in traditional industries, while those who understand IoT and the operation of the web3 market are even scarcer. The difference between these two makes team recruitment and collaboration a challenge.

In summary, in the short term, the DePIN field faces challenges in product experience, establishing competitive moats, legal compliance, and talent scarcity. However, in the long run, whether it's from the perspective of lowering barriers, innovation, or utilizing idle resources and money flow, the emergence of DePIN will have a profound impact on the market. The market transformation it brings will affect the supply chain, industry landscape, and the evolution of the entire economic ecosystem. With the continuous development and maturation of DePIN, we have reason to believe that it will become a key force for bringing real change to society, businesses, and individuals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。