Source: Dolphin Research

Image Source: Generated by Wujie AI

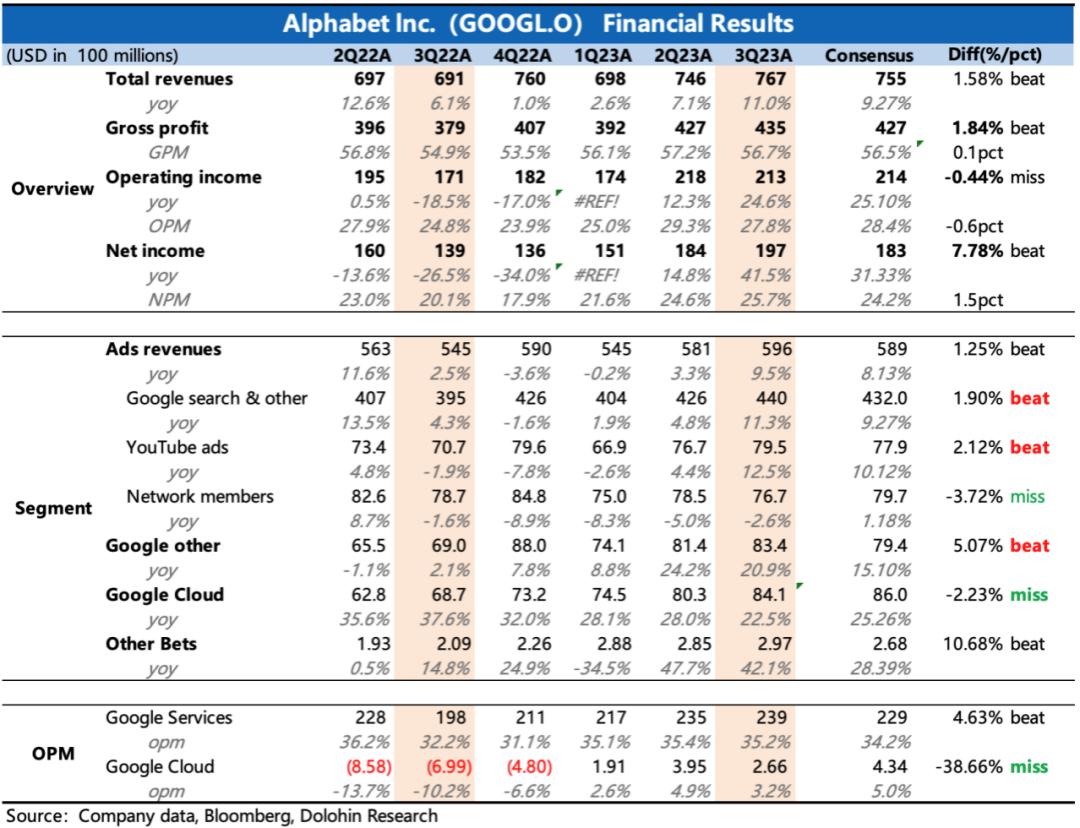

In the morning of October 25th, Beijing time, Alphabet, Google's parent company, released its financial report for the third quarter of 2023. Overall, both total revenue and profit slightly exceeded market expectations, but the performance of its two core businesses, advertising and cloud services, was unbalanced:

Advertising performed better than expected, but the cloud services showed a slowdown beyond market expectations, especially when compared to the significant acceleration in growth trend seen in Microsoft Azure during the same period, which further highlighted the dim performance of Google Cloud.

Key points of the financial report:

- Advertising to the left, cloud to the right

The growth trends of Google's advertising and cloud services have shown two different directions this year due to changes in the growth cycle and overall demand. Advertising has accelerated improvement, while cloud services have gradually slowed down.

Actual situation in the third quarter:

Advertising exceeded expectations (actual +9.5% vs expected +8.1%), with both search and YouTube performing better than expected. Both are indicating good growth, with YouTube surpassing Netflix in terms of Shorts commercialization and Nielsen's TV share data. However, what surprised Dolphin is the 11% year-on-year growth of search advertising, maintaining double-digit growth despite industry slowdown and the encroachment of New Bing.

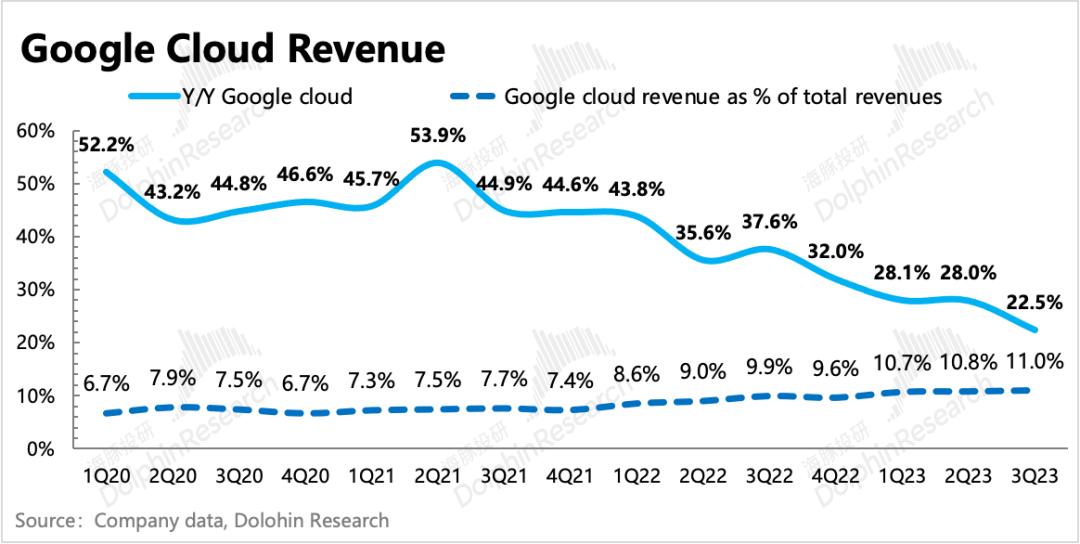

However, Google Cloud's slowdown was more significant than expected (actual +22.5% vs expected +25.3%), especially when compared to the accelerated growth of Azure during the same period, further highlighting the embarrassment of Google Cloud. While the market had certain expectations for the slowdown of cloud services (high base + enterprise capital expenditure reduction), it also expected AI's incremental demand to offset the impact of enterprise Capex reduction, as seen in the second quarter. The difference in growth direction between Google and Microsoft this quarter requires attention to whether there are internal factors affecting Google Cloud's performance, especially in terms of product performance evaluation.

However, Dolphin believes that there should be no problem with Google Cloud's products. In the third quarter, AI showed a significant cooling, and during the industry's capital expenditure contraction, leading products with competitive advantages are more likely to gain market share concentration, squeezing the short-term growth space of followers. However, in the medium to long term, as enterprises continue to invest in digitalization and AI, Google Cloud still has certain competitiveness and can reap the benefits.

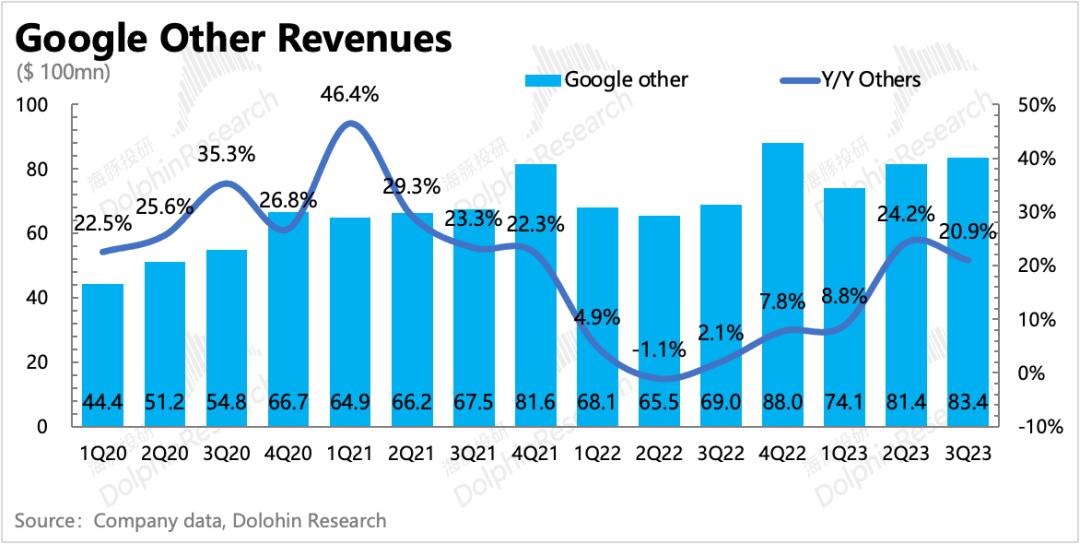

Other business revenues also performed well, with growth significantly higher than expected, mainly benefiting from YouTube subscriptions and Pixel phone revenue. With the gradual recovery of the consumer smartphone market, it is expected that Google Play's revenue will also have a certain growth support in the future.

2. Incremental investment in AI may have been reflected

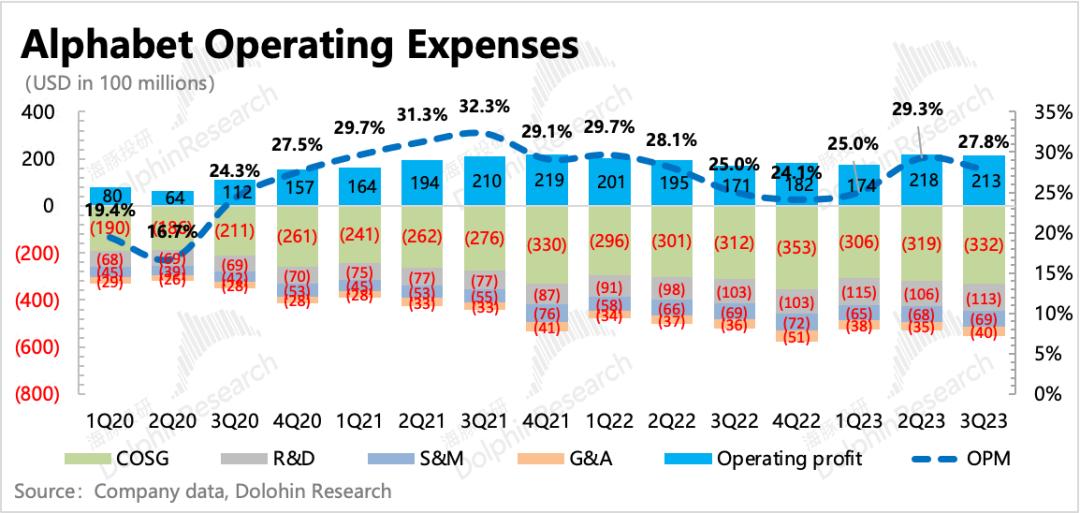

The question of when the current AI large model arms race will have an impact on costs and how much impact it will have has been on Dolphin's mind since the popularity of ChatGPT. From Google's third-quarter report, some incremental changes in expenditure can be seen.

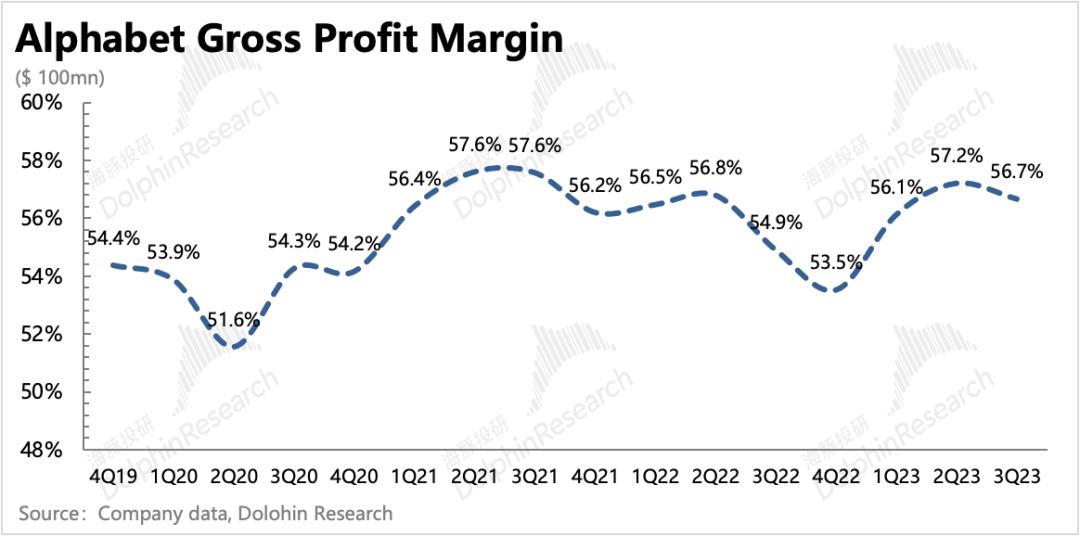

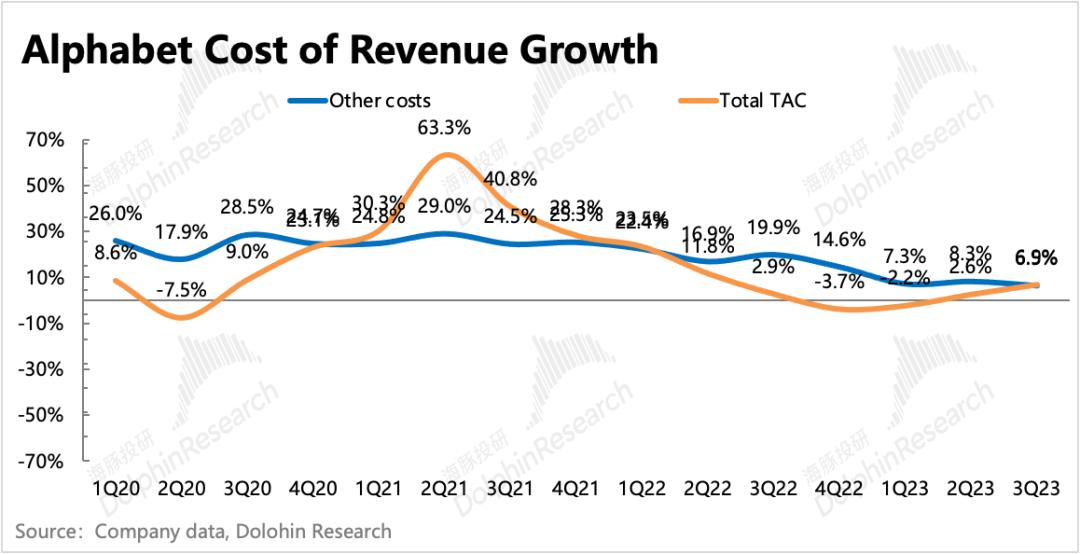

(1) Although Google's gross margin increased by 2 percentage points year-on-year, the cost details show that the traffic cost did not increase much, but the amortization and depreciation costs of other servers increased more than the traffic cost, even though the depreciation period had been reduced, indicating that Google has made some incremental investments in servers, network equipment, and other infrastructure.

(2) R&D expenses accelerated year-on-year growth in a high base scenario. Google's R&D expenses in the third quarter increased by 9.6% year-on-year, compared to 7.6% in the second quarter.

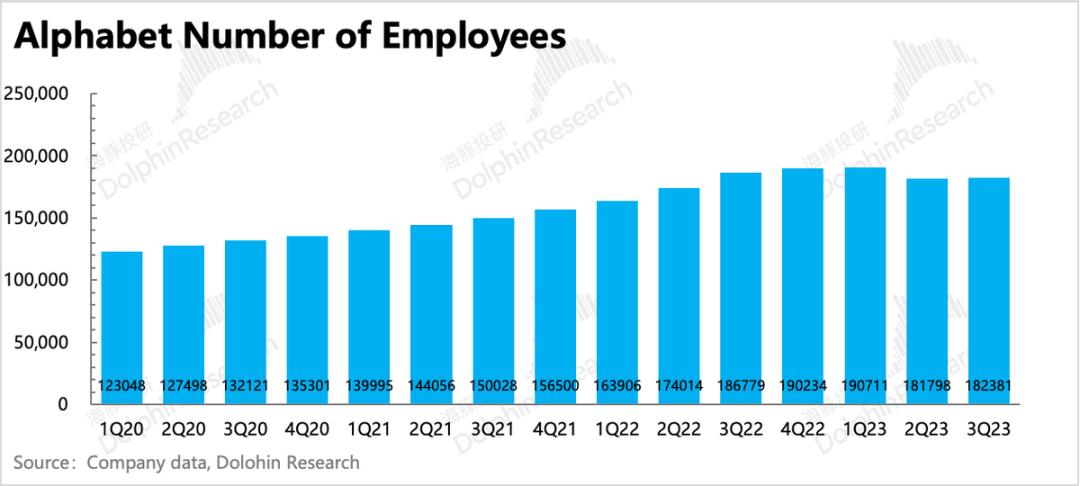

(3) The number of employees decreased by 4,400 year-on-year, but both the average employee cost and the average employee stock incentive cost increased year-on-year, indicating that the proportion of high-salary employees in the employee structure has increased.

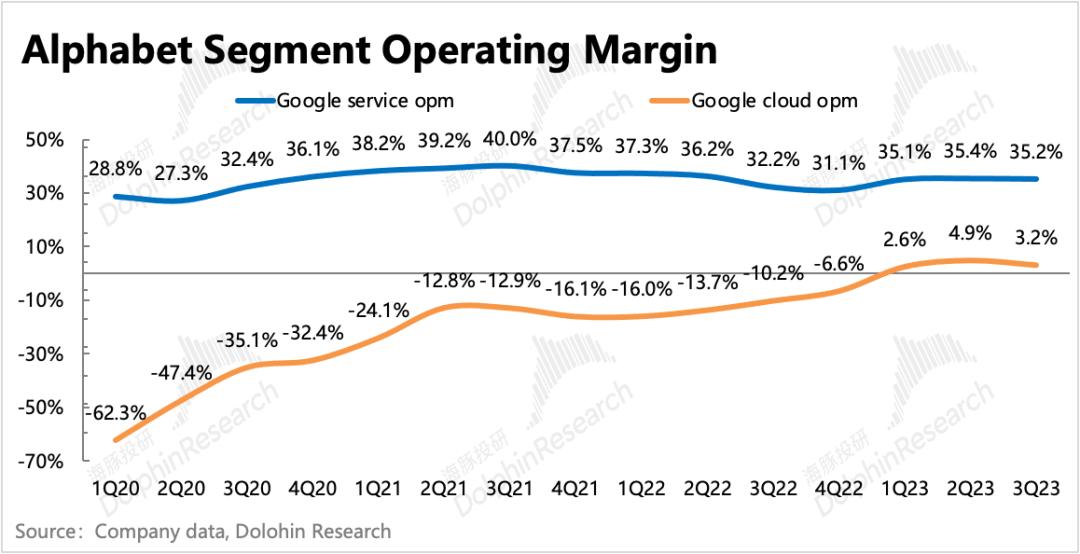

However, despite the increase in costs, due to the strong growth in high-margin advertising revenue, there was no impact on the profit margin, and it improved year-on-year. Looking at the business level, Google's service operating profit margin, mainly driven by advertising, remained above 35%, while the cloud service's operating profit margin showed a significant weakening compared to the previous quarter (3Q 3.2% vs 2Q 4.9%), falling short of the market's expectation of sequential improvement (3Qe 5%).

3. Focus on management outlook

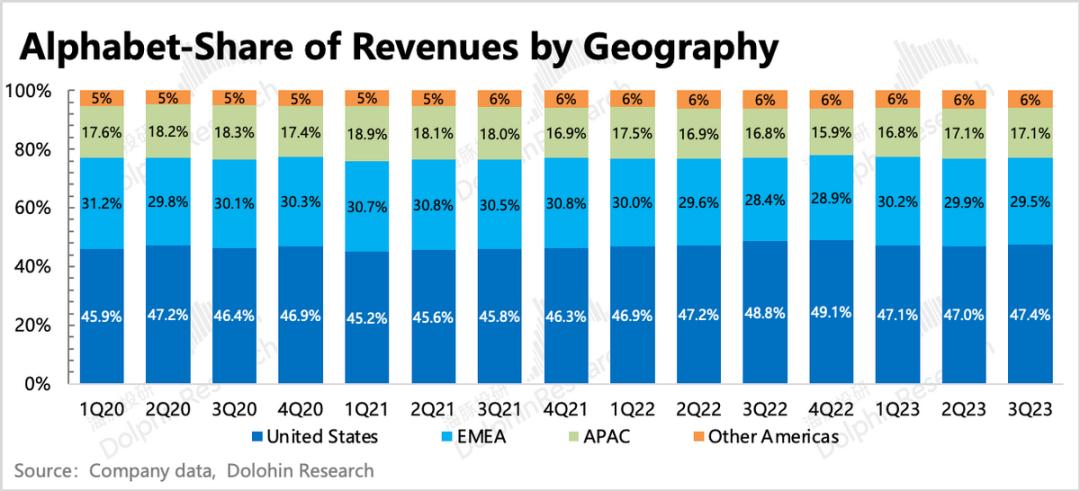

In the third quarter, under neutral exchange rates, the revenue growth rates in various regions accelerated compared to the previous quarter, with the Asia-Pacific region showing the highest growth rate. If exchange rate effects are considered, then the European region had the highest growth rate. Although the growth rate in the core contributing revenue of the United States was relatively low compared to other regions, it still showed close to double-digit growth, serving as the main force supporting Google's advertising revenue.

In a situation where the market has relatively high expectations for advertising, how does the management view next year's growth? How much potential risk is there for future macroeconomic weakening? What further actions will Google take in AI? When will the Gemini product launch event take place? These core questions need to be addressed and answered during the conference call.

4. Key indicators and comparison with expectations

Dolphin's viewpoint on the third quarter

With the release of the third-quarter report, Google's stock price immediately dropped by 5 points, compared to Microsoft's 5-point increase after its earnings report, indicating that the market is "disappointed" with Google Cloud's performance. Considering the valuation, Dolphin can partially understand the market's reaction:

Despite the strong advertising performance, the market's expectations are not weak, and they have been further raising their expectations for advertising growth over the past month. With the current neutral valuation range, a breakthrough requires a surprise from Google Cloud. At the same time, the incremental impact of AI mentioned by the management in the previous quarter has also led the market to hold relatively high expectations this quarter, hoping to buffer the impact of the previously reduced enterprise capital expenditure. However, the surprise did not materialize, but a small "scare" was encountered.

However, on the other hand, Dolphin believes that there is no need for excessive panic. Google's advertising revenue is expected to continue to improve for some time. On one hand, there are no significant signs of economic downturn in the United States, and on the other hand, the low base effect will still exist in the fourth quarter and the first quarter of next year. Advertising is still the basis for Google's valuation, and the short-term pressure on cloud services has only squeezed out some of the growth premium. It is recommended to pay attention to the management's explanation and outlook for the third-quarter slowdown in cloud business during the conference call.

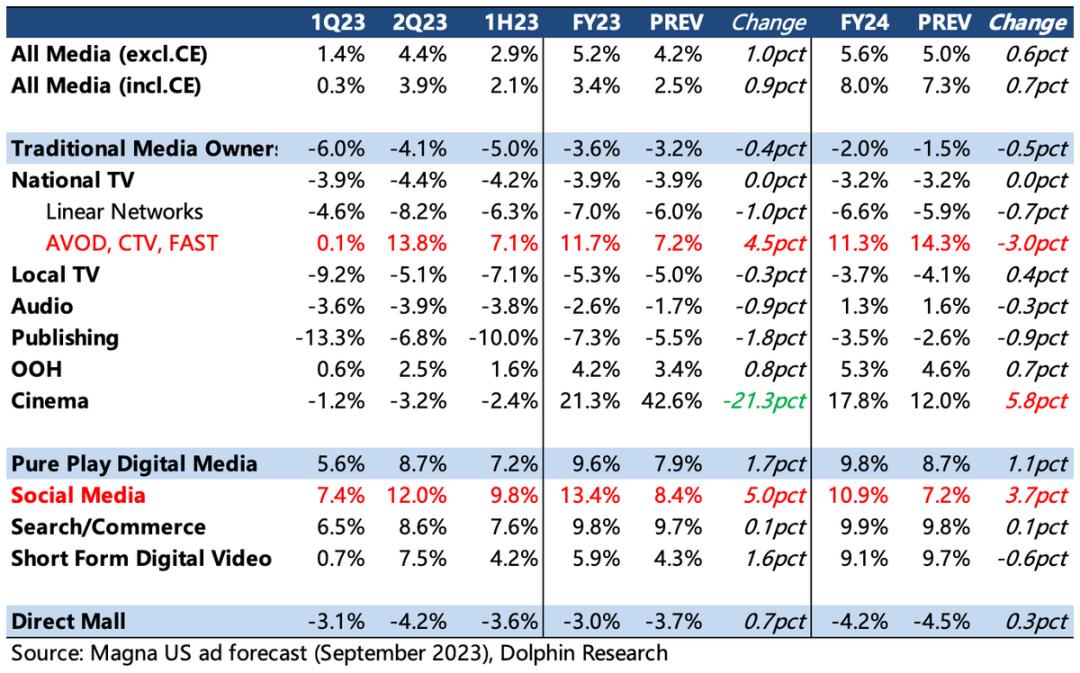

Last month, global media intelligence company Magna once again raised its forecast for the growth rate of digital advertising in the United States in 2024, which has provided some confidence boost for the three advertising giants Google, Meta, and Amazon. However, compared to this, Magna has given a more optimistic growth forecast for social media advertising, with steady growth expected for search advertising, and although short video advertising will accelerate overall next year, there has not been a significant adjustment compared to previous forecasts.

From this perspective, the slight decline in Meta's stock price after hours seems somewhat strange. Currently, Meta's valuation still has room to reach our neutral expectations, and the commercialization progress of Reels will also reduce the pressure on Meta's future growth. Tomorrow's Meta earnings report will be a key focus on the management's guidance.

The following is a detailed interpretation of the financial report

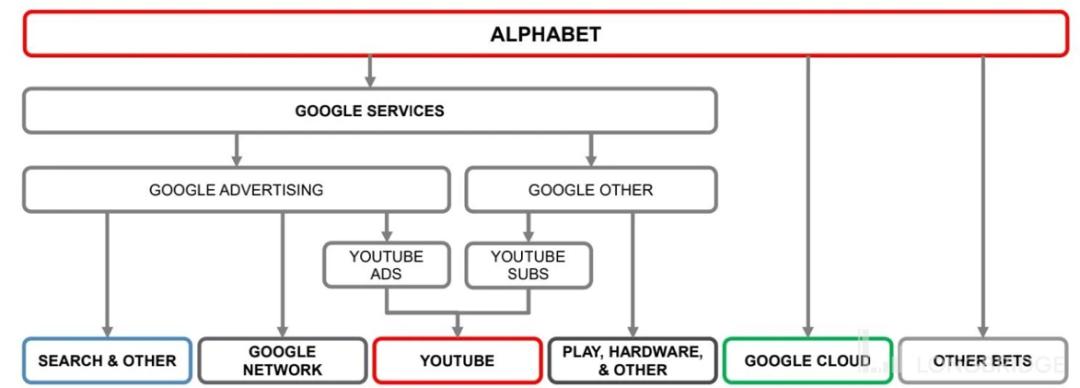

I. Basic Introduction of Google

Alphabet, Google's parent company, has a wide range of businesses, and its financial report structure has changed multiple times. For those unfamiliar with Alphabet, it is recommended to first take a look at its business structure.

Briefly explain the long-term logic of Google's fundamentals:

a. Advertising business, as the main source of revenue, contributes to the company's main profit. Search advertising faces the long-term crisis of being eroded by feed advertising, and high-growth streaming media YouTube is used to make up for it.

b. Cloud business is the company's second growth curve, has turned losses into profits, and has shown strong recent momentum in signing contracts. As advertising continues to be affected by weak consumer demand, the development of cloud business is becoming increasingly important in supporting the company's performance and valuation imagination.

II. Advertising to the left, cloud services to the right? No need to panic excessively

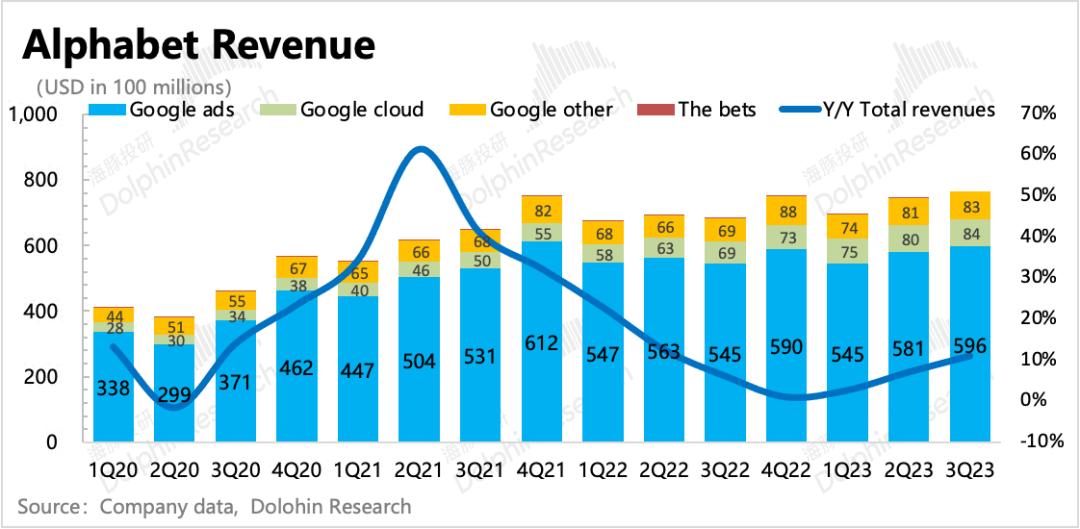

In the third quarter, Google's overall revenue was 76.7 billion, an 11% year-on-year increase, exceeding the market's consensus of 75.5 billion, and continuing to improve on a quarter-on-quarter basis due to the low base effect.

(1) The highest growth rate among the core businesses is Google Cloud, but the slowdown in cloud business is greater than the market's expectations, and it did not offset the impact of technology companies reducing Capex and thereby reducing the demand for cloud services with the incremental demand from AI, which is the main dissatisfaction of the market with this third-quarter report.

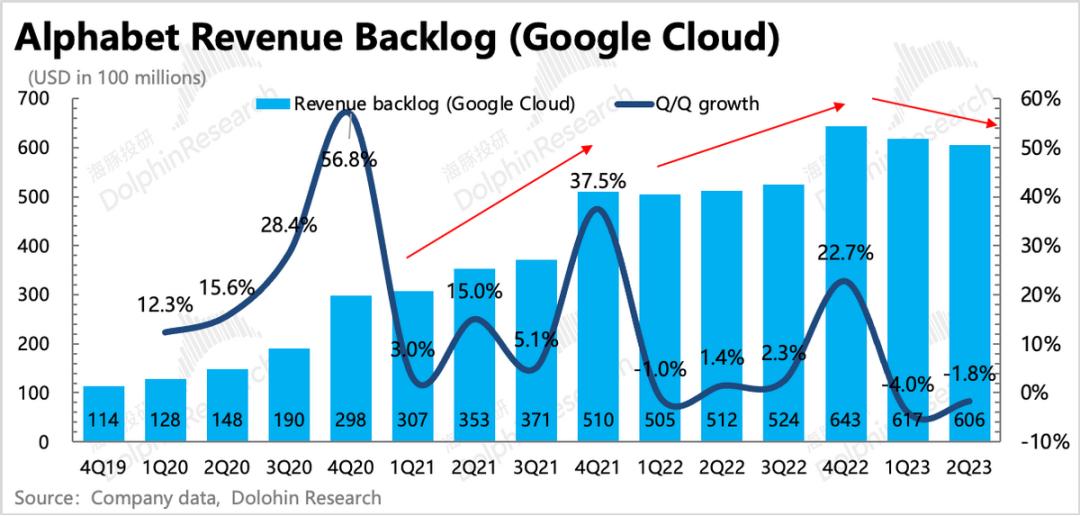

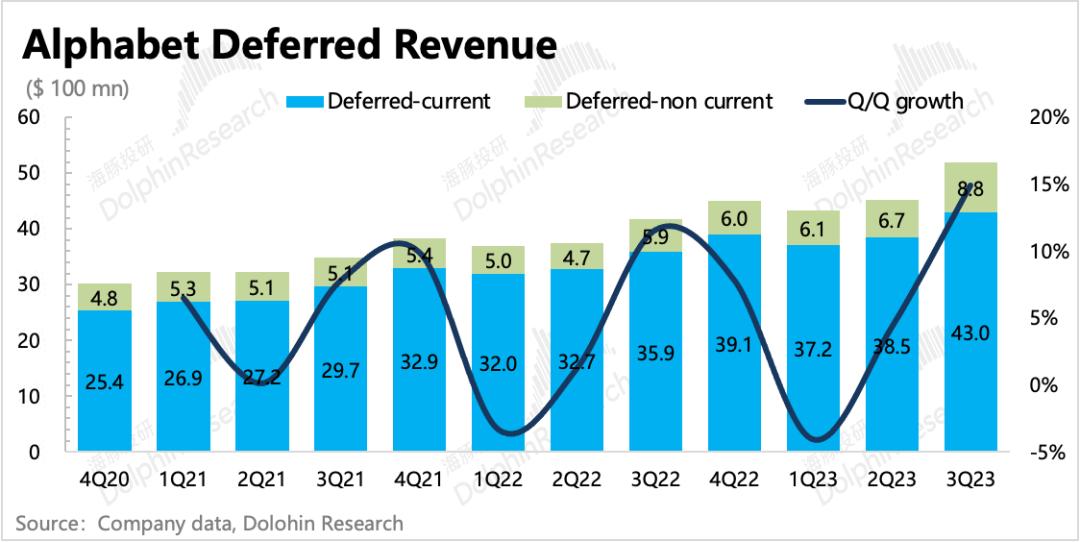

In the short to medium term, cloud business is likely to continue to face the impact of enterprise capital expenditure reduction, and the slowdown in growth will continue. AI is still the key factor in breaking the trend. The amount of remaining revenue can be seen from Google's Revenue Backlog indicator, most of which is composed of cloud business. Therefore, its trend of change can also be seen as the trend of change in the unfulfilled contract volume of cloud business.

As of the second quarter (third-quarter data needs to be found in the complete quarterly report from the SEC), Google's future confirmed contract revenue was 60.6 billion, which has declined for two consecutive quarters on a quarter-on-quarter basis. Although the absolute value of the remaining revenue is still very high, if it continues to decline without enough new contracts, there will still be pressure on short-term growth.

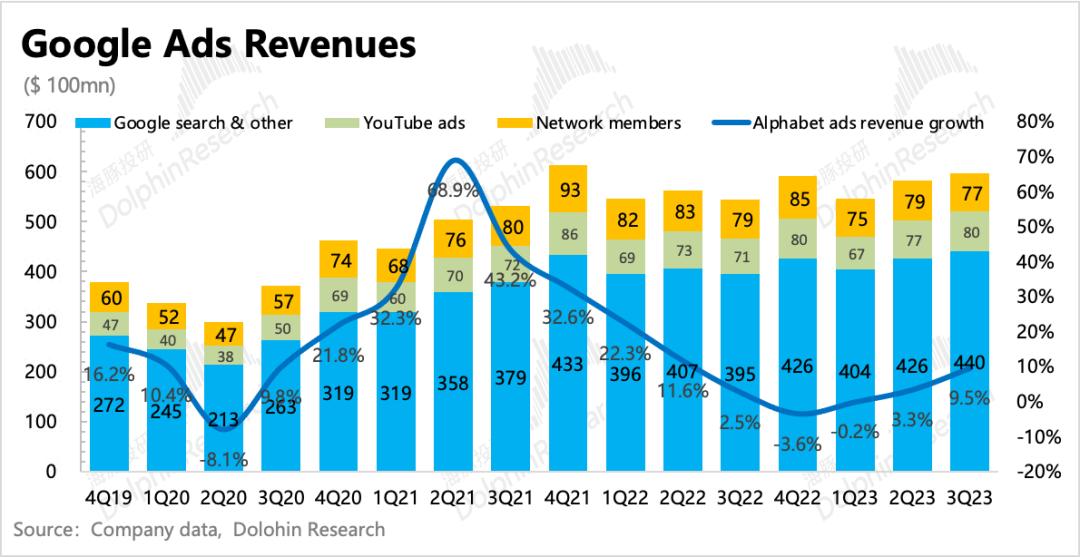

(2) Advertising is still the main pillar of revenue (accounting for 78% of revenue), and in the third quarter, driven by the strong macro background of consumer demand in the United States and the low base, Google's advertising revenue accelerated on a quarter-on-quarter basis.

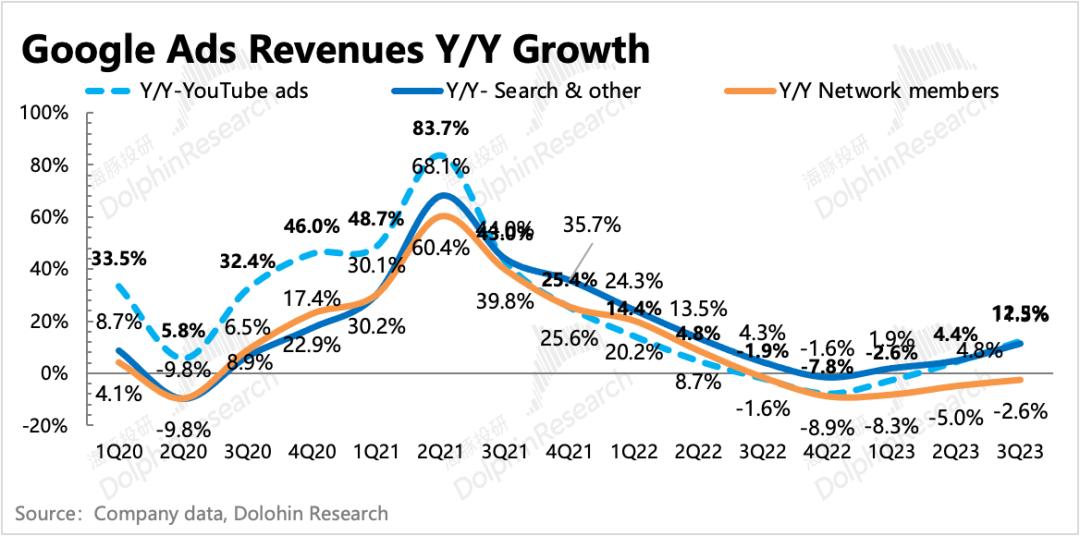

What is particularly surprising compared to Dolphin's expectations is search advertising. On one hand, due to the increase in demand for cultural and tourism activities last year due to the pandemic, search advertising naturally benefited, so the base is not low. However, looking at the growth trends of different categories of advertising, the share of search advertising has been consistently squeezed, indicating a tendency towards mature, low-growth trends in the industry. On the other hand, the potential competitive threat from New Bing has increased after the empowerment of ChatGPT.

Although Dolphin has always believed that Google's search landscape will not be easily overturned, and we are more concerned about the mismatch between AI investment and output, and the short-term potential pressure of AI on the profit side, the 11% growth of Google's search advertising in the third quarter is indeed significantly higher than our original expectations.

In addition, YouTube advertising performed well, with a growth rate of 12.5% in the third quarter, which is in line with Dolphin's expectations. Whether it is Nielsen's streaming media share data or the official commercialization of YouTube Shorts this year, both indicate that YouTube's growth will be strong.

Alliance advertising is still adjusting and optimizing the conversion rate due to the impact of privacy policies, so it has not truly rebounded in terms of revenue.

In the next 1-2 quarters, Dolphin believes that the steady growth of advertising will continue, and it can even accelerate on a quarter-on-quarter basis, given the low base. Last month, global media intelligence company Magna once again raised its forecast for the growth rate of digital advertising in the United States in 2024, which has provided some confidence boost for the three advertising giants Google, Meta, and Amazon. However, compared to this, Magna has given a more optimistic growth forecast for social media advertising, with steady growth expected for search advertising, and although short video advertising will accelerate overall next year, there has not been a significant adjustment compared to previous forecasts.

(3) The growth rate of other businesses in the third quarter was also good, with a year-on-year increase of 20.9%. This part of the revenue is mainly composed of Google Play, YouTube membership fees, hardware (Pixel phones and smart home appliances such as Nest). In the third quarter, in addition to the good revenue from YouTube subscriptions, the sales of Pixel and the revenue from Google Play were driven by the recovery of global smartphone sales.

Looking at deferred revenue, the short-term growth trend of other business revenue should not have too many problems, especially short-term deferred revenue, which should basically consist of Google Play revenue and YouTube membership subscriptions. This part of the deferred revenue increased by 500 million in the third quarter, a 15% increase on a quarter-on-quarter basis, laying the foundation for short-term growth in the future.

Looking at the comprehensive revenue by region, all markets have shown significant rebounds. The core supporting revenue in the United States also saw a nearly 10% year-on-year increase in the third quarter.

III. Profit margin improved year-on-year, but AI costs are reflected to some extent

In the third quarter, driven by revenue, Google's gross margin and operating profit margin continued to improve year-on-year, but weakened on a quarter-on-quarter basis to some extent. Although this year is still considered a period of cost reduction and efficiency improvement overall, some indicators already show the trend of increased costs brought about by AI.

Google's cost reduction and efficiency improvement measures in this round mainly include two initiatives. One is layoffs and office space reduction, with an announcement of 12,000 job cuts at the beginning of the year. The other is a financial and technical cost reduction, extending the depreciation period for servers and network equipment.

Looking at it year-on-year, there will be profit improvement for the entire year. But on a quarter-on-quarter basis, the number of employees has increased rather than decreased by the third quarter (an increase of 583 employees compared to the previous quarter). Does this mean there is no more room for optimization?

Not quite. Looking at the value of revenue created per employee on average, although this number continues to increase in the third quarter, it is still lower than in 2021. At this point, the increase in personnel can only be used to enhance the research and development capabilities of the AI team. In addition, while the depreciation period for servers and network equipment has been extended, the absolute value of other costs excluding traffic acquisition costs (TAC) still maintained a nearly 7% year-on-year growth under the high base of last year, indicating that the infrastructure itself continues to expand.

Of course, in terms of the numerical value of profit margin, there is still theoretical room for optimization, especially since the expenses for the first three quarters of this year include one-time severance and office building disposal costs. In the third quarter alone, confirmed expenses amounted to 86 million (severance costs) + 16 million (related office disposal costs) = 102 million in one-time expenses.

However, the exclusion of these one-time disposal costs clearly cannot offset the potential profit pressure brought about by the continuous investment in AI research and development. It is recommended to look at the management's spending guidance for next year, especially considering the sustained incremental costs brought about by AI.

Of course, the best way to cover these incremental costs is undoubtedly the optimization of AI's own profit model, but it seems difficult in the short term based on the current situation. As for new products, it is worth paying attention to when the flagship product Gemini will be open to the public, which the Google management may reveal during the upcoming conference call.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。