TL;DR

This report provides a preliminary analysis of Frax Finance, offering an overview of its current ecosystem, describing its product suite, and discussing its future potential.

During the last bull market, key events such as exchange listings, halving emissions, and airdrops led to $FXS outperforming Bitcoin. Despite the late issuance of frxETH, it did not reflect price surges like leading liquidity staking derivative tokens $LDO and $RPL. Meanwhile, $FRAX demonstrated strong resilience in the face of market volatility, mainly due to its advanced AMO strategy and robust $FXS collateral.

Frax Finance is rolling out a series of major upgrades in line with major DeFi trends: FRAX V3 aims to strengthen its stablecoin mechanism and reduce reliance on $USDC; FinresPBC will enter physical assets through Fraxbond (FXB); frxETH V2 focuses on decentralization and yield optimization; the upcoming EVM-compatible Layer 2 solution FraxChain aims to improve scalability and security, potentially providing a boost for the protocol and $FXS's future growth.

Driven by a focused team and innovative mechanisms, Frax Finance is evolving into a comprehensive DeFi ecosystem with strong synergies. The upcoming developments such as FRAX V3, frxETH V2, and FraxChain are expected to significantly drive its growth and create value for $FXS token holders.

1. Background

Frax Finance, despite being one of the OG DeFi protocols, has been a complex protocol for many newcomers. Due to its diverse product lines and intricate mechanisms, the initial encounter may seem daunting. However, it is a protocol that everyone should understand as it is one of the most innovative protocols and has garnered attention through its active sector expansion. This report serves as a beginner's guide to Frax Finance, reviewing its current state, introducing its products, and examining its potential. As a beginner, not all aspects of the protocol are covered in this report, but its purpose is to help readers quickly gain a basic understanding of the protocol and its future direction. Readers are encouraged to conduct thorough due diligence to fully understand the protocol and its associated risks.

2. Introduction

Frax Finance was launched in May 2019 as an algorithmic stablecoin protocol and has since evolved into a complex DeFi tech stack. Frax Finance now operates multiple business sectors, including three types of stablecoins, backed by support from three major infrastructures. Frax's operations span multiple sectors, including stablecoins, DEX, money markets, liquidity staking, and RWA is also on the horizon. Therefore, Frax is one of the most innovative protocols in DeFi, but also one of the most complex.

3. Performance Overview

Comparing token prices to $BTC, which is typically seen as the beta of the crypto market, can provide a clearer view of token performance. Additionally, the addition of key events allows us to gauge how the market views a protocol, i.e., if positive news fails to trigger any positive price action, the market may be shifting its attention, making it a less attractive investment target.

From the charts, we can see that during the last bull market, $FXS followed the overall market, experiencing significant price increases. Then, from December 2021 to March 2022, $FXS outperformed $BTC, undergoing two significant price surges. These surges may be attributed to several favorable events during that time, including the Binance listing on 12/10, $FXS emission halving on 12/20, $FPI airdrop distribution announcement on 2/19, and FTX listing on 3/24. Subsequently, $FXS followed the overall market without any significant deviation. Recently, despite the Frax team releasing news about future plans, the reaction of $FXS has not been as pronounced as before. This may be due to the prevailing bearish sentiment in the market, requiring further observation when those catalysts actually materialize.

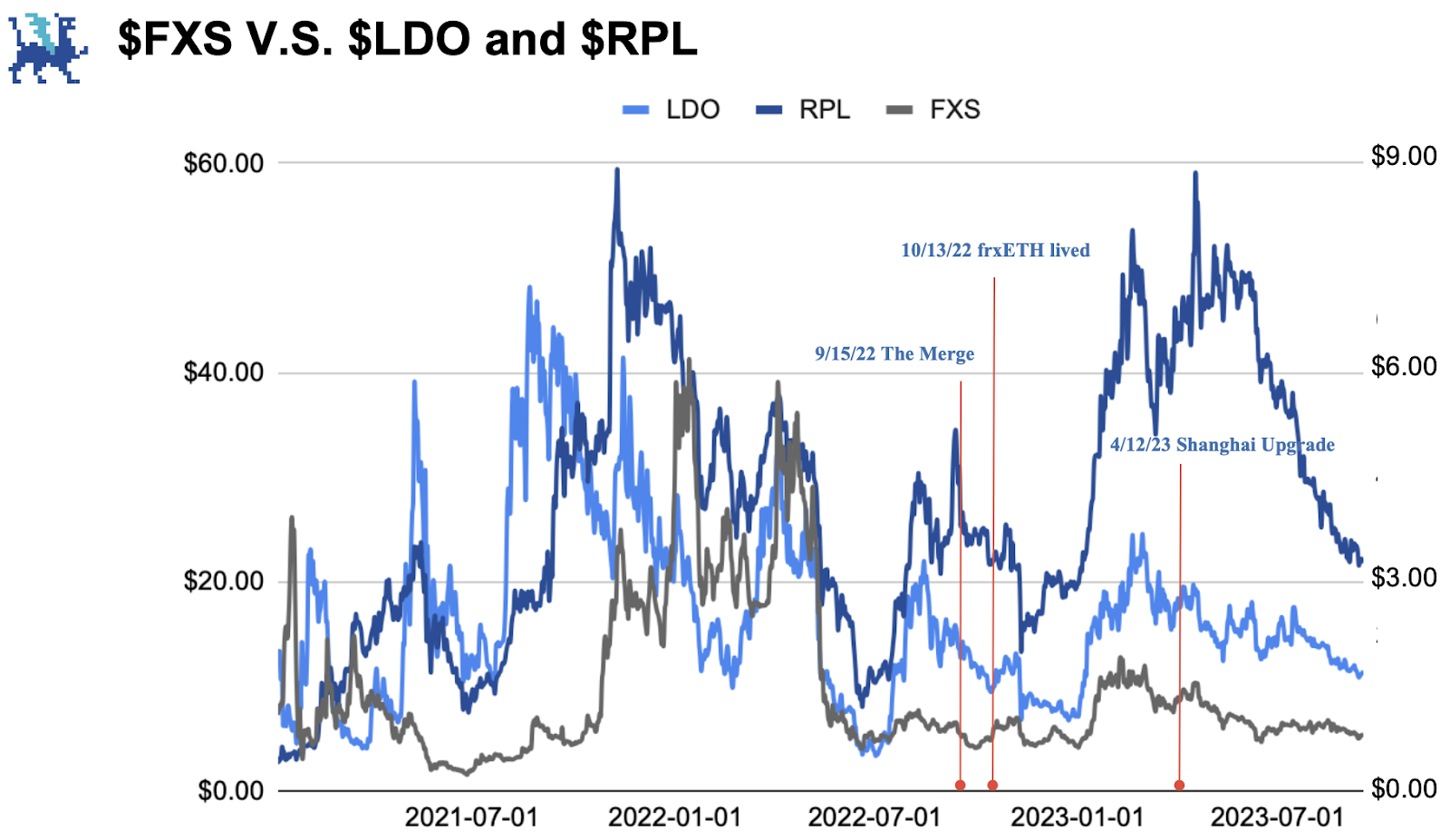

Compared to the two leading LSD narrative tokens $LDO and $RPL, we can see that $FXS, due to entering this space later, did not experience the same price surge as the other two around the Merge, but did experience a pump during the Shanghai Upgrade. With the upcoming frxETH v2 launch, the performance of $FXS compared to $LDO and $RPL will be interesting.

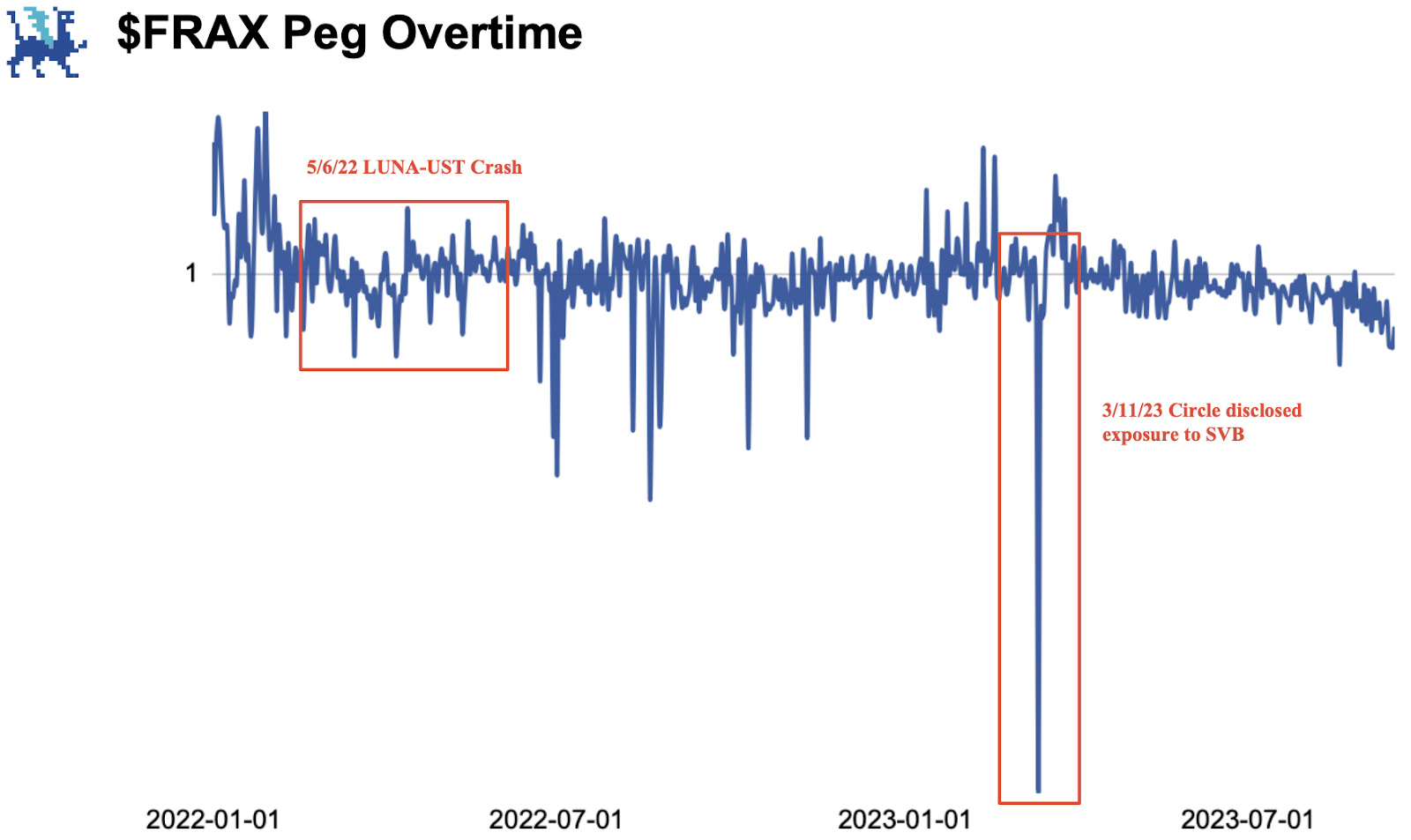

As an algorithmic stablecoin, $FRAX has maintained a fairly tight peg over the long term. During the LUNA-UST crash, $FRAX maintained a close peg range. While there were occasional minor deviations, there was always a quick rebound to prevent further ruptures. The most severe deviation occurred when Circle disclosed its risk exposure to SVB. As $FRAX is primarily backed by $USDC, it was affected. However, given the relatively small risk exposure, the peg quickly normalized in a short time. The stability of $FRAX can largely be attributed to the protocol's complex AMO strategy and the high lock-up rate of $FXS, shielding Frax from the death spirals that other algorithmic stablecoins have experienced.

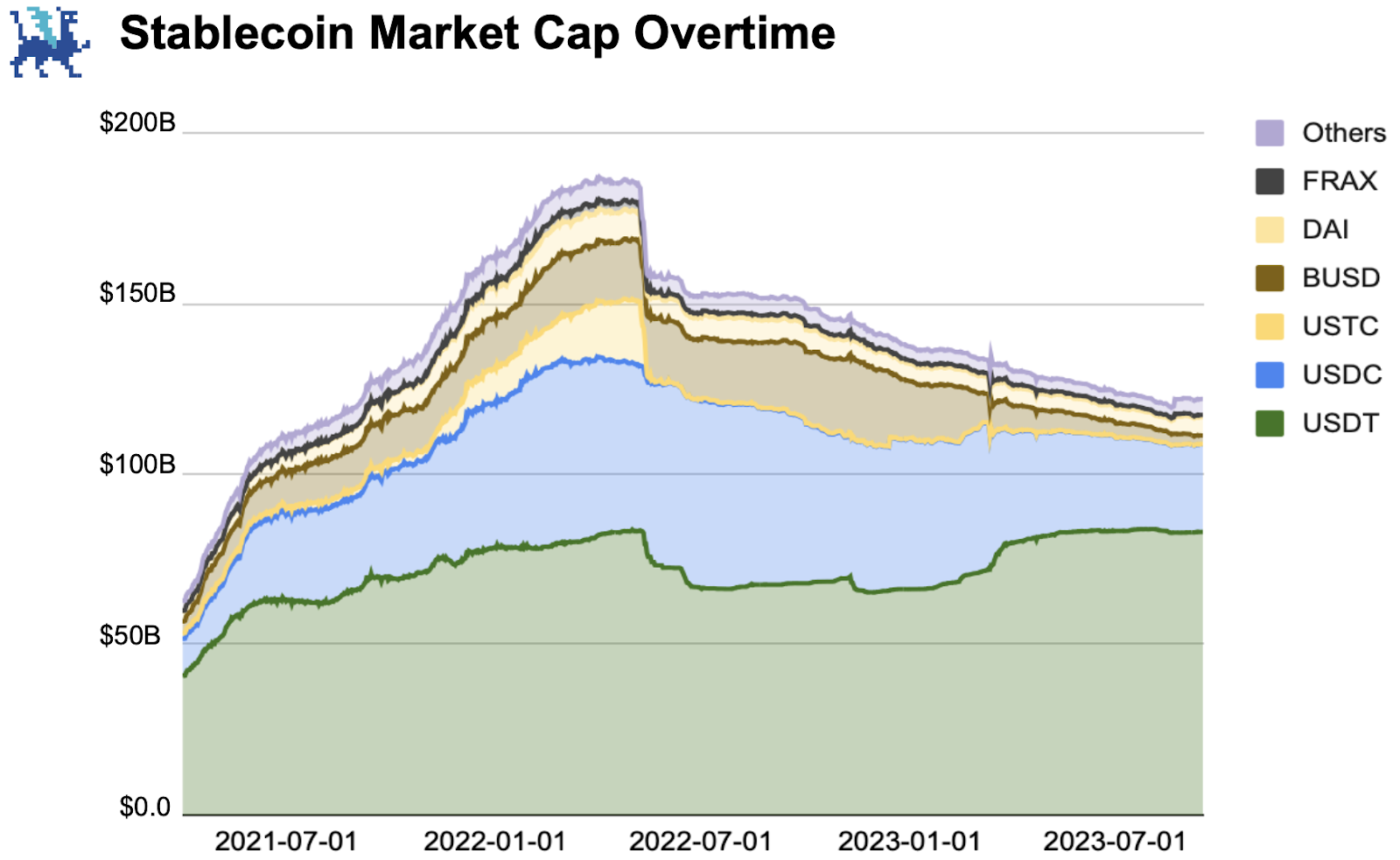

Although the LUNA-UST crash did not disrupt Frax's peg, it triggered a significant outflow of liquidity, leading to a sharp decline in stablecoin market cap, especially for decentralized stablecoins like $DAI and $FRAX. The subsequent SVB event further reduced $USDC's market share, with liquidity shifting to $USDT, which has been the only stablecoin with sustained market cap growth since 2023.

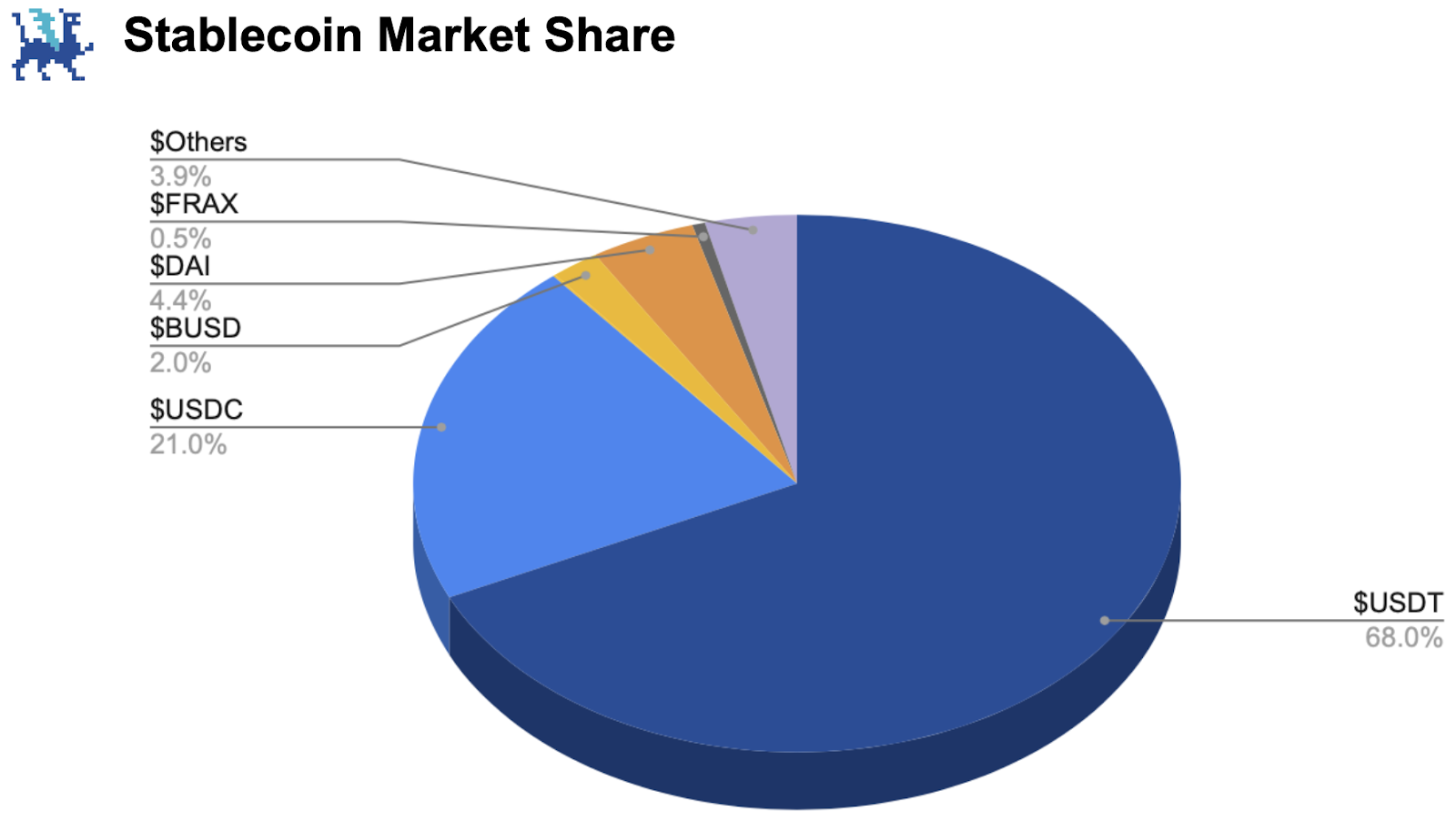

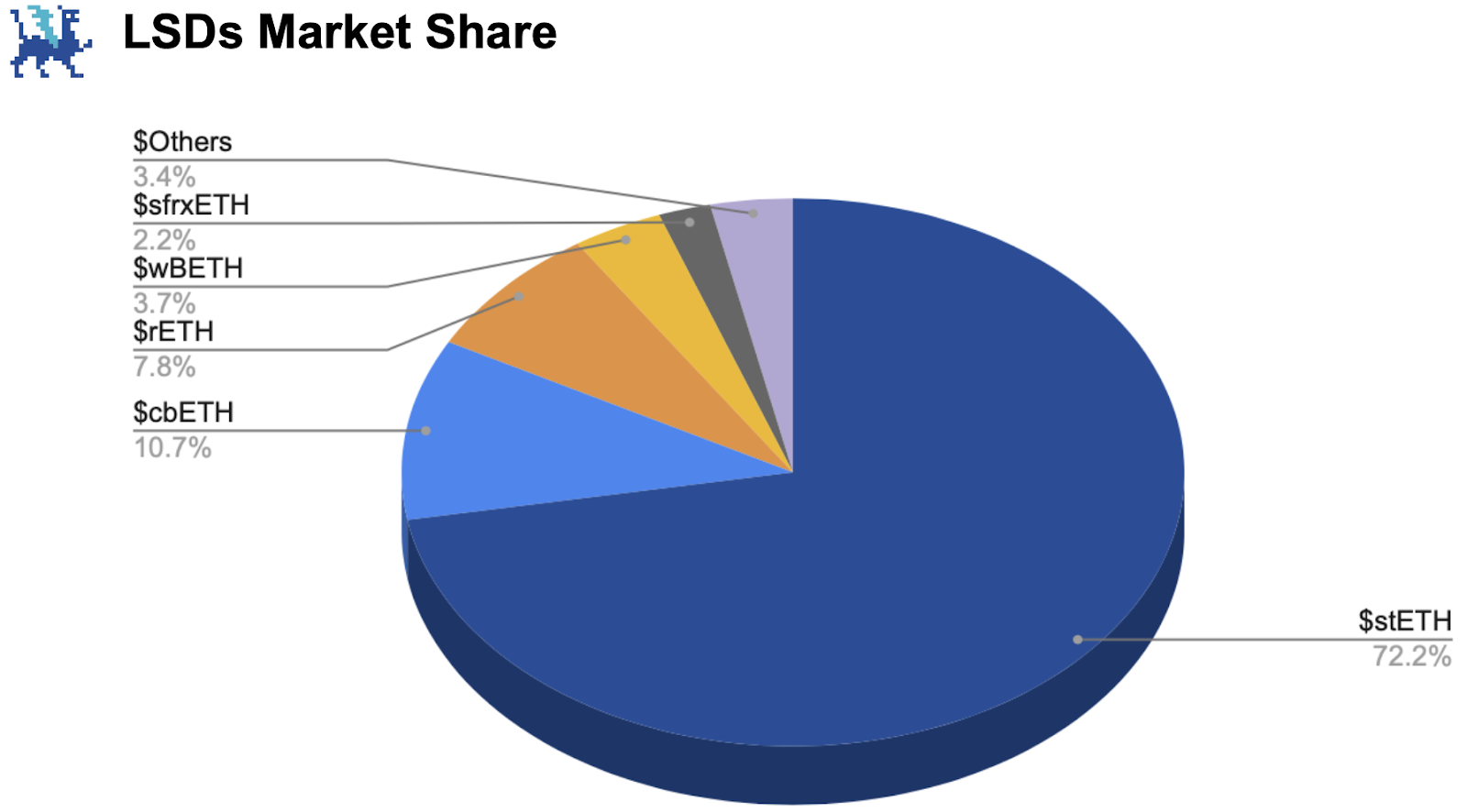

Two other key performance indicators for Frax are stablecoin market share and LSD market share. While $FRAX is the second-largest decentralized stablecoin, its market share is only 0.5%, 8.8 times less than $DAI and 136 times less than $USDT. This gap is due to various factors, with the most significant being that centralized stablecoins serve as a critical entry point for new crypto users, as new users primarily use CEX initially. The huge liquidity gap and adoption rates also contribute to this significant difference. As long as there are no major factors driving users away from centralized stablecoins, this gap is likely to persist for quite some time.

In terms of LSD market share, Frax has performed well. Except for Lido, the market share gap of sfrxETH with the other three major LSDs is small. The main reasons are its higher yield and the regulatory pressure faced by CEX. With the arrival of frxETH V2, it is expected that Frax's growth in the LSD field will continue to outpace its growth in the stablecoin field.

4. Protocol Mechanisms

Frax Finance is one of the most complex protocols in the DeFi space. Its expanding product lines and business sectors essentially form its own ecosystem consisting of various stablecoins and DeFi infrastructure supporting stablecoin growth. In this report, we classify the three stablecoins released by Frax as flagship products and consider the supporting mechanisms as core infrastructure. The concept and importance of each stablecoin are presented, along with how these infrastructures contribute to business operations.

4.1 Flagship Products

4.1.1 Frax

FRAX is the first USD-pegged stablecoin issued by Frax. Unlike the largest decentralized stablecoin DAI, which is overcollateralized, Frax is a partially algorithmic stablecoin supported by USDC and Frax's native token FXS. The design goal of FRAX has always been to be equal to 1 USD, and how 1 FRAX is collateralized is determined by market dynamics. Initially, FRAX was 100% collateralized by USDC, and the protocol's algorithm gradually reduces the collateralization ratio (CR) based on market demand. For example, an 85% CR means 1 Frax is supported by 0.85 USD of USDC and 0.15 USD of FXS. The higher the demand, the lower the CR, and vice versa. As Frax is always pegged to 1 USD, when the peg is imbalanced, arbitrageurs intervene, along with the protocol's algorithm.

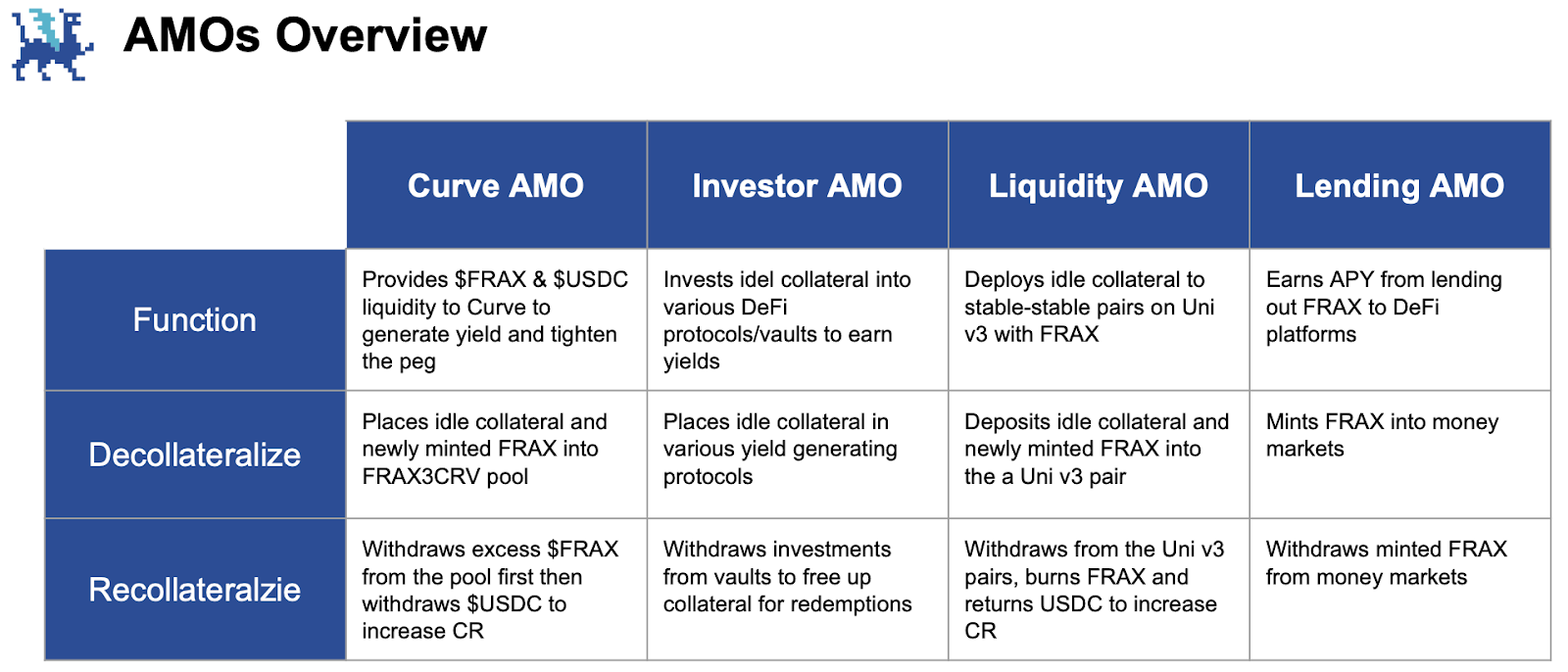

FRAX is currently in its V2 version, which utilizes multiple Automatic Market Operations (AMOs). Essentially, AMOs are smart contracts that execute open market operations (i.e., minting, burning, deploying FRAX) to maintain FRAX's peg to 1 USD. In V1, the protocol only used a single AMO, the Core Stability Module, to dynamically adjust the CR to maintain the peg to 1 USD. AMOs are one of the core mechanisms that have led to Frax's success. A deeper explanation of the underlying concepts will be provided in the next section.

It is worth noting that in 2023, the DAO has voted to increase the CR to 100% as the safest way to continue the expansion of FRAX. Although the CR provides greater flexibility and capital efficiency, the DAO has decided that it is no longer necessary given the maturity of Frax, and the use of AMOs can still make FRAX highly capital efficient.

4.1.2 FPI

The Frax Price Index (FPI) is the second stablecoin released by the protocol. Its design purpose is to maintain purchasing power by pegging it to real inflation, as defined by the Consumer Price Index for All Urban Consumers (CPI-U) in the United States. Frax uses a dedicated Chainlink oracle to fetch and report the inflation rate of the US federal government and applies that rate to the redemption price of FPI. As the anchoring of FPI is closely tied to the inflation rate, the redemption price of FPI will rise (or fall) with inflation (or deflation), meaning that users swapping other assets for FPI are speculating that the purchasing power of CPI will grow faster than the assets they are selling.

The motivation behind FPI is to create the first on-chain stablecoin that can be used to represent trade, value, and debt. Using FPI as a benchmark measurement helps determine whether the value of treasuries or income is growing or declining relative to the ever-increasing inflation, which can be very useful for DAO operations or similar activities.

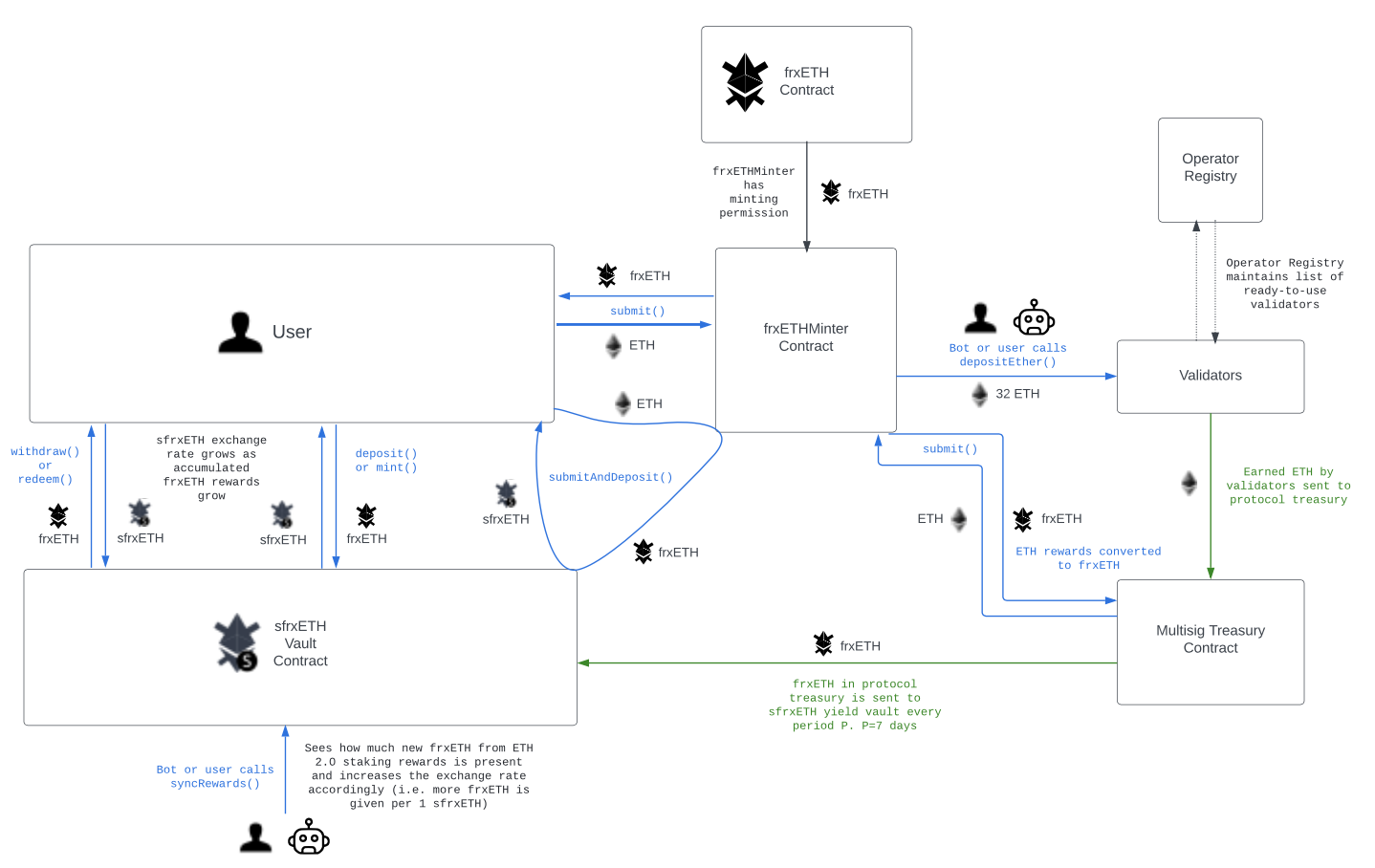

4.1.3 frxETH

Frax Ether (frxETH) is the third stablecoin released by Frax. It is pegged to ETH and earns zero-collateral rewards. Users can collateralize frxETH to receive sfrxETH, thereby earning all collateral rewards. Each uncollateralized frxETH contributes to the yield of sfrxETH. Therefore, each sfrxETH earns higher collateral rewards than ETH, which is why the yield of sfrxETH is higher than all other LSDs. Users can provide fexETH-ETH liquidity to the Curve pool and earn trading fees and emission rewards. As Frax holds a significant amount of $CRV and $CVX, it can guide a significant amount of rewards to the pool, incentivizing liquidity provision.

The launch of frxETH/sfrxETH represents Frax's strategic expansion into the LSD narrative and deepens its impact in the DeFi ecosystem. Frax cleverly leverages its significant position in the Curve War to successfully erode the market share of blue-chip LSDs like stETH and rETH. With the upcoming launch of Frax Ether's V2 version, another wave of adoption growth is expected.

4.2 Core Infrastructure

4.2.1 AMOs

For stablecoin protocols like Frax, maintaining stability is crucial. Unpegging not only weakens user confidence but can also lead to a chain reaction that tears the protocol apart. Automatic Market Operations (AMOs) are smart contracts that execute different currency operations to maintain the stability of FRAX. Frax Finance has evolved from a single AMO in V1 to four main AMOs in V2. While each has slightly different operations, AMOs share three common attributes: de-collateralization - reducing the CR strategy portion, market operations - running in balance without changing the CR strategy portion, and re-collateralization - increasing the CR strategy portion.

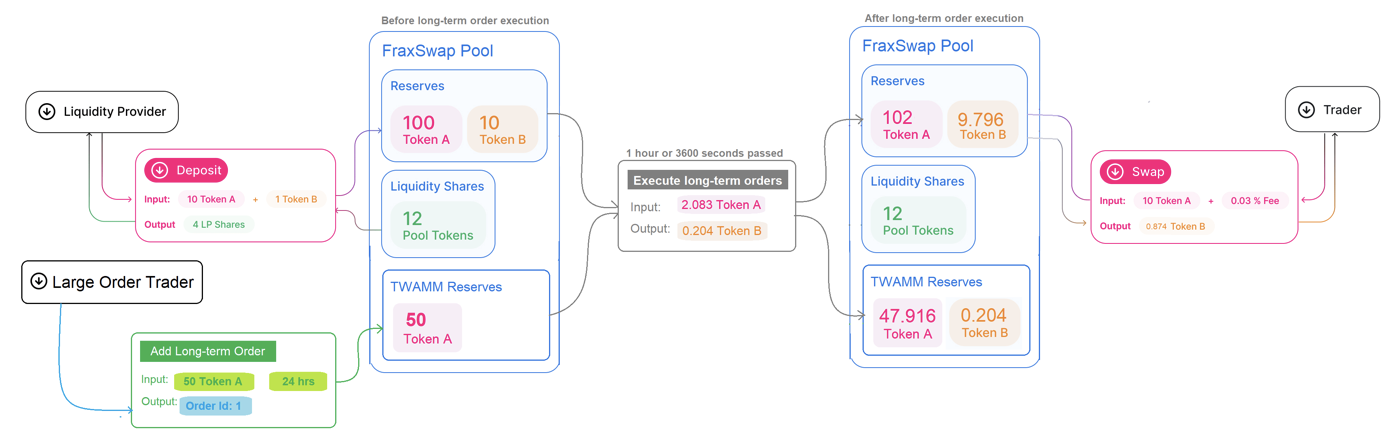

4.2.2 Fraxswap

Fraxswap is a Constant Product Market Maker (CPMM) combined with a Time-Weighted Average Market Maker (TWAMM) for optimizing the execution of long-term orders, such as order pools and aligning order expirations, and efficiently handling large orders. The purpose of Fraxswap is to enable the protocol to effectively execute its stablecoin monetary policy. Specifically, Frax will use Fraxswap for the following operations:

- Using AMO profits to buy back and burn FXS

- Minting new FXS to buy back and burn Frax

- Minting Frax to purchase hard assets through a minting tax

Fraxswap is entirely permissionless, allowing other protocols and DAOs to utilize it for monetary policy. Fraxswap V2 is also in development, which will support centralized liquidity (the current version is based on Uniswap V2) and integrate with related asset liquidity, further expanding its functionality.

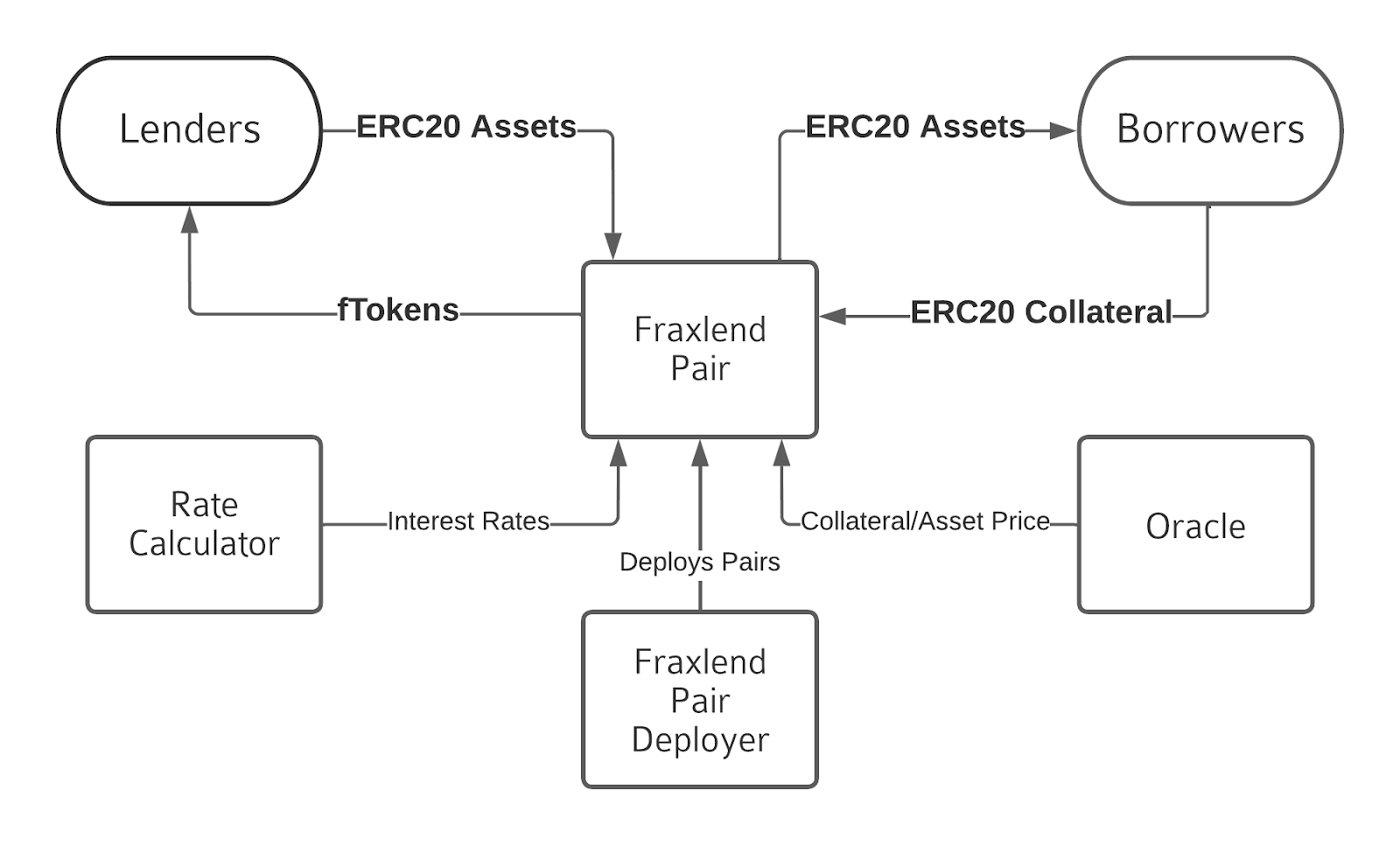

4.2.3 Fraxlend

Fraxlend is the native money market of Frax Finance, supporting lending activities using ERC-20 pairs. Each pool is overcollateralized and independent, protecting the protocol from counterparty risk and bankruptcy threats. As a stablecoin protocol, Frax's primary mission is to naturally expand the use and adoption of its stablecoin, and Fraxlend is an integral part of achieving this goal. By allowing users to have CDPs (debt positions) on FRAX, it increases the use of FRAX as currency in DeFi. It is worth noting that Fraxlend adopts a feeless model as an incentive for adoption. Like other infrastructure, Fraxlend also has v2 plans, which may introduce low collateral loans to the platform.

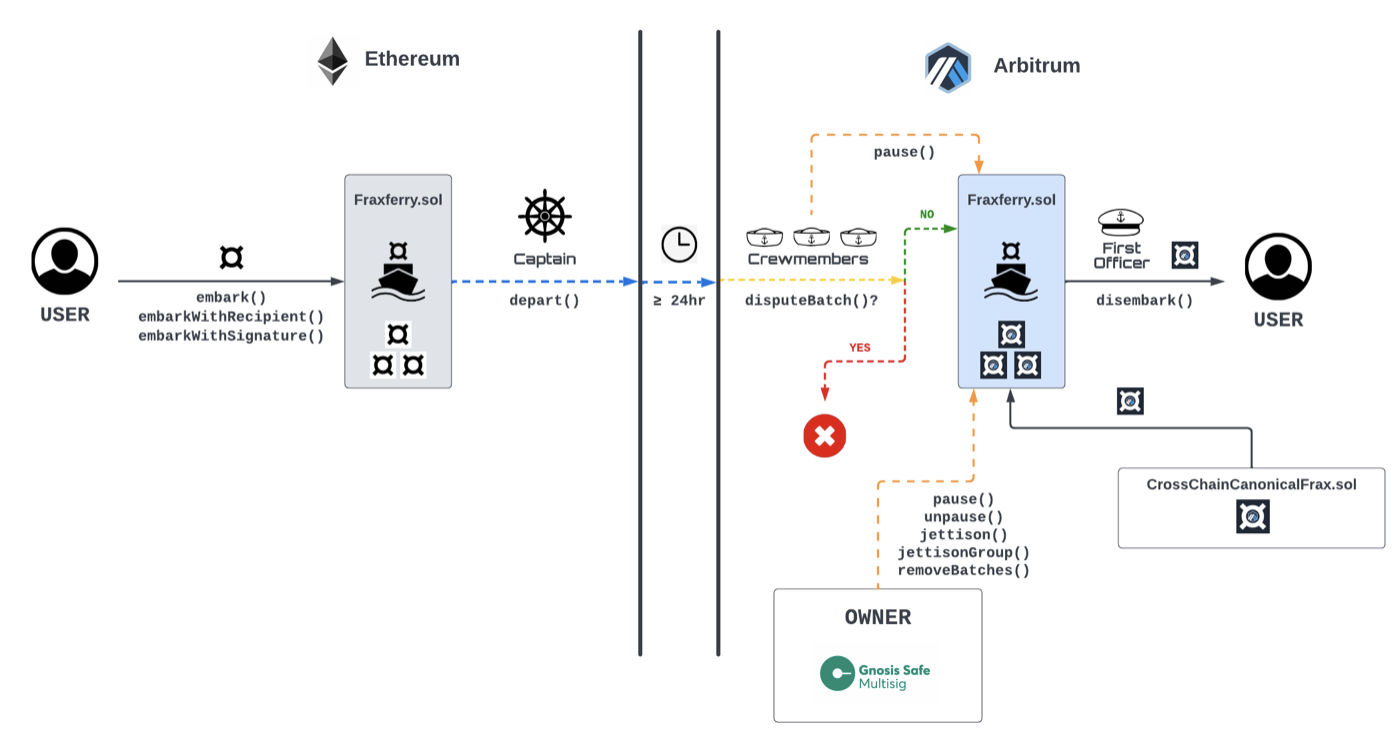

4.2.4 Fraxferry

Frax Finance has introduced Fraxferry to achieve seamless bridging mechanisms for multi-chain expansion of the protocol. Fraxferry bridges user assets in a slower but more secure manner, aiming to maximize security. The v2 version is also set to be released, making the mechanism more decentralized.

The functionalities bridged through Fraxferry are as follows:

- Users initiate the process by sending tokens to the ferry contract.

- A designated "captain" checks and batch processes the transactions.

- There is a 24-hour waiting period before the transfer occurs, allowing for further verification.

- Upon execution, the system ensures the validity of the transaction by comparing hashes.

5. Token Economics

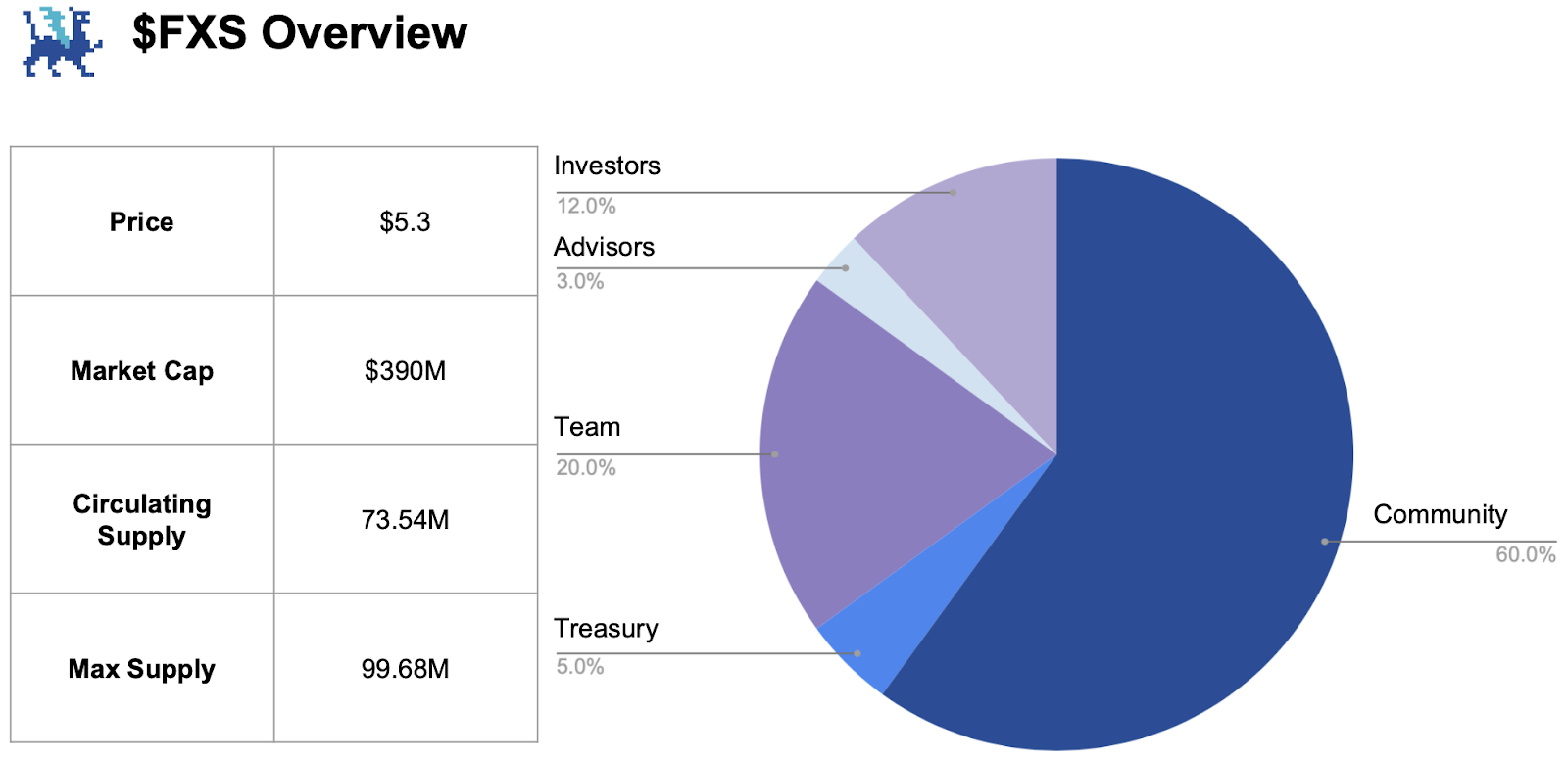

Frax Share ($FXS) is the staking and governance token of Frax Finance, with all rewards and utilities centralized around $FXS. Specifically, to enjoy all benefits, users are encouraged to lock their $FXS to receive $veFXS, similar to the veToken model of Curve. $veFXS holders have voting rights, scaling farming boosts, and cash flows from AMOs, Fraxlend loans, and Fraxswap fees. Currently, 37.484M $FXS is locked, accounting for 50.88% of the circulating supply and 37.6% of the total supply. It is worth noting that after FIP-256, whenever $FXS falls below $5 and $4, the protocol will conduct buybacks, signaling a consolidation of token economics based on implied valuations for the token.

6. Growth Drivers

Due to its diverse business areas, Frax Finance has several upcoming upgrades, making it well-suited for different major narratives that could be significant catalysts for its future growth. This section will review and discuss their prospects.

6.1 FRAX V3

Although not many details have been disclosed yet, FRAX V3 aims to eliminate reliance on $USDC and create a new decentralized stablecoin mechanism, with the goal of significantly improving the protocol's robustness. According to Frax co-founder Sam Kazmien, FRAX V3 will abandon the current pegging mechanism and not rely on fiat currency. However, more details are still pending release by the Frax team. Another highlight of v3 is the expansion into the realm of RWA. A non-profit entity named FinresPBC has been launched to leverage attractive yields on US government bonds. FinresPBC can facilitate off-chain transactions of US government bonds, in which users can participate through Fraxbond (FXB), which can be exchanged for $FXS. RWA is a major narrative in the current DeFi market, and this expansion may reflect the success of MakerDAO, whose token price has recently performed quite well due to its RWA operations. Combined with a more robust stablecoin mechanism, this expansion could drive FRAX adoption to new heights.

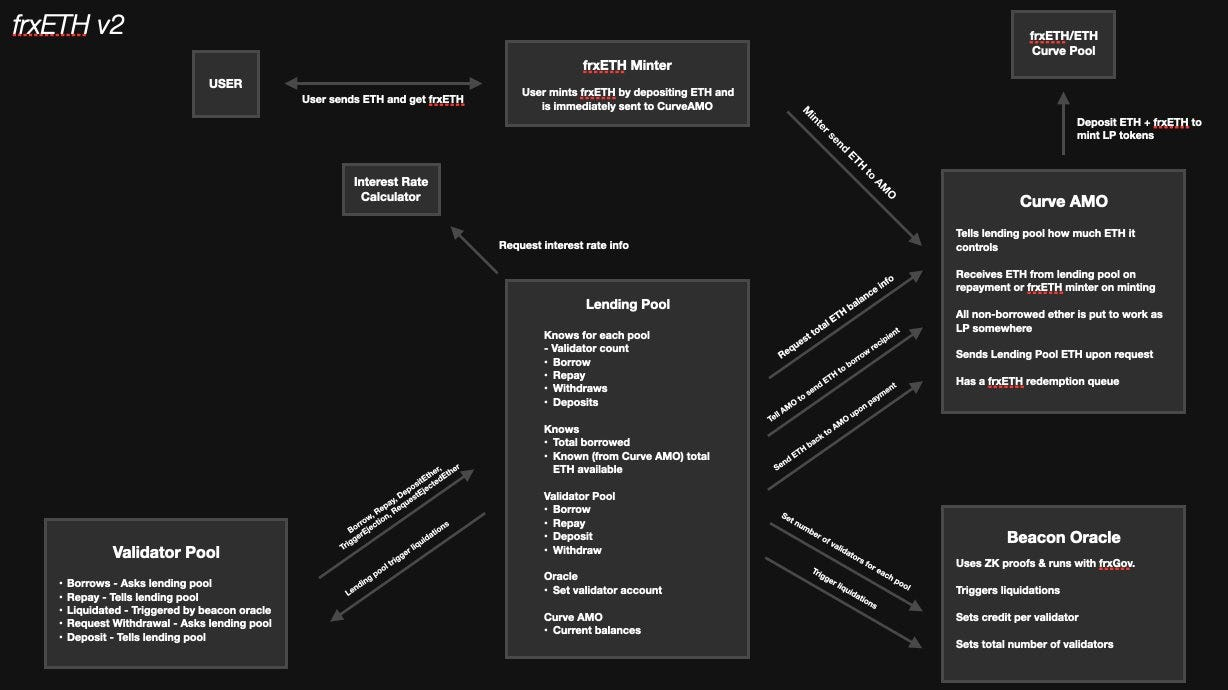

6.2 frxETH V2

Regarding frxETH, ongoing complaints from users revolve around the centralization of the mechanism, where the protocol relies on its internal validators. In response, the upcoming frxETH V2 is aimed at decentralizing the mechanism while providing users with the same or higher yields. At its core, frxETH V2 includes two innovations: utilization-based interest rates and a decentralized lending market. Frax views the LSD market as a market for lenders (stakers) and borrowers (validators), prompting these modifications.

Through the pool-to-pool model, anyone can provide collateral and borrow ETH from the stakers to become a validator. Interest rates are determined dynamically based on utilization. Ultimately, LSD borrowers and lenders will have a dynamic market, fostering the growth of Frax LSD.

6.3 FraxChain

Three months ago, in a podcast with FlyWheel DeFi, Sam revealed that the protocol will launch its own EVM-compatible L2, called Fraxchain. Although not many details have been disclosed yet, this upcoming L2 has two highlights. Firstly, it will be a hybrid rollup, using an Optimistic architecture but also integrating ZK technology to enhance security. Secondly, frxETH will be used as gas fees. The significance of frxETH as a gas token lies in the fact that as demand increases, the supply of frxETH will decrease, thereby increasing the yield of sfrxETH and further expanding its LSD market share. Fees will flow to $veFXS holders, coupled with other income sources already flowing to $veFXS, the value accumulation of $FXS will be significantly boosted. The release of Fraxchain is scheduled for the end of this year, and with the L2 narrative brought by the Cancun Upgrade, market interest may surge.

7. Growth Potential

The aforementioned growth drivers could significantly boost performance in their respective areas. To further demonstrate the potential of Frax, this section will provide a simple comparative analysis of the LSD market (one of Frax's main business areas) to offer some insights into the growth prospects of the protocol.

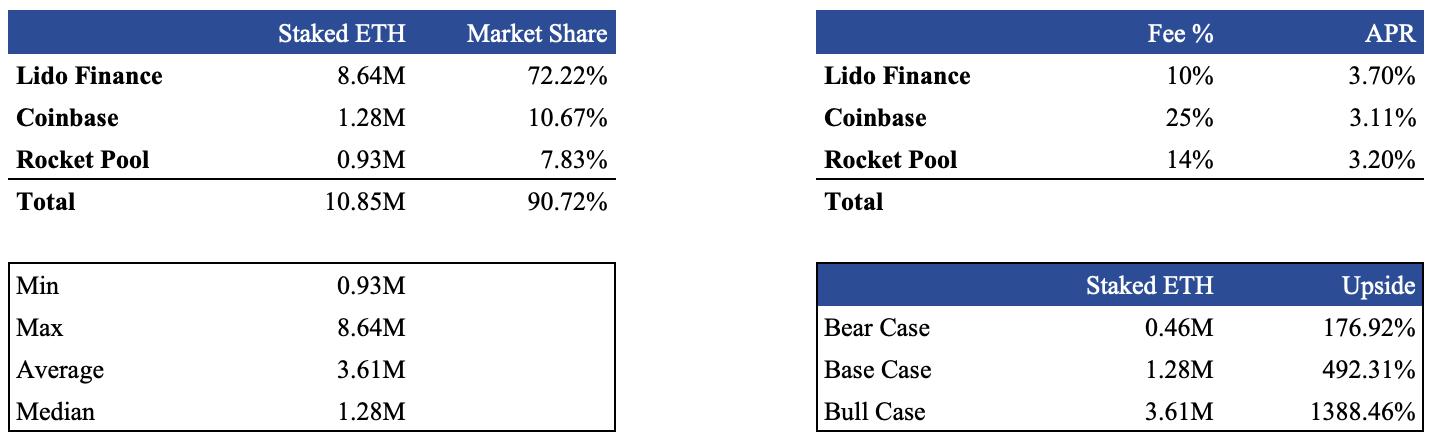

In terms of LSD market share, Lido, Coinbase, and Rocket Pool are in leading positions. For this analysis, we will use the top three LSDs as representative samples. Currently, the top three LSD protocols have approximately 10.85M staked ETH, collectively occupying 90.72% of the market share. Frax's current staked ETH amount is approximately 0.26M. Assuming conservatively that the current numbers of the top 3 LSD protocols represent the target for Frax, and setting the quantity of Rocket at 50% of the top three, the median of the top three, and the average trading volume of the top three as our bear, baseline, and bull market scenarios, we can roughly estimate the potential growth upside for Frax LSD.

While this basic comparison highlights the potential of Frax LSD, it must be recognized that reaching the staked amount of the top 3 protocols is not necessarily a straightforward process, and this process is influenced by multiple factors. However, this analysis clearly underscores the potential of Frax, and combined with the upcoming V2 updates, the future is undoubtedly bright.

(This analysis is a simplified approach to estimate the potential growth of Frax LSD, using top protocols as a baseline and their staked ETH amounts as targets. For a more detailed forecast, several additional factors need to be considered, meaning that this analysis should only be viewed as a rough measure of Frax Ether's potential.)

8. Conclusion

Starting as an algorithmic stablecoin protocol, Frax Finance has successfully transformed into a robust DeFi stack, encompassing every core area in the ecosystem. The team's continuous efforts are the primary reason for Frax's success today and underpin its future growth. Its mechanisms and products have been cleverly designed to create a strong synergistic effect, which could trigger a positive feedback loop for the protocol's growth and the value accumulation of $FXS. Looking ahead, it is advisable to closely monitor FRAX V3, frxETH V2, and Fraxchain, as these will be crucial developments determining Frax's future.

References

https://docs.frax.finance/?source=post_page-----9c23b056d46c--------------------------------

Disclaimer: This report is an original work completed by a contributor from @GryphsisAcademy, @BC082559. The author is solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy or the organization commissioning the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be considered as a basis for investment decisions. It is strongly recommended that you conduct your own research and consult with an independent financial, tax, or legal advisor before making investment decisions. Please remember that past performance of any asset is not indicative of future returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。