The price of Bitcoin has been trending towards historic lows since August, and mining machine prices have also hit historic lows in sync.

Authors: Colin Harper, Jaran Mellerud, Balmy Investor, Hashrate Index

Translation: Frank, Foresight News

Hashrate Index has released its latest Bitcoin mining report for the third quarter of 2023, covering hash prices, common network data (hash rate/difficulty/transaction fees), inscriptions, ASIC market, energy market, and the stock prices of listed Bitcoin mining companies, among other multidimensional data.

Hash price at historic lows

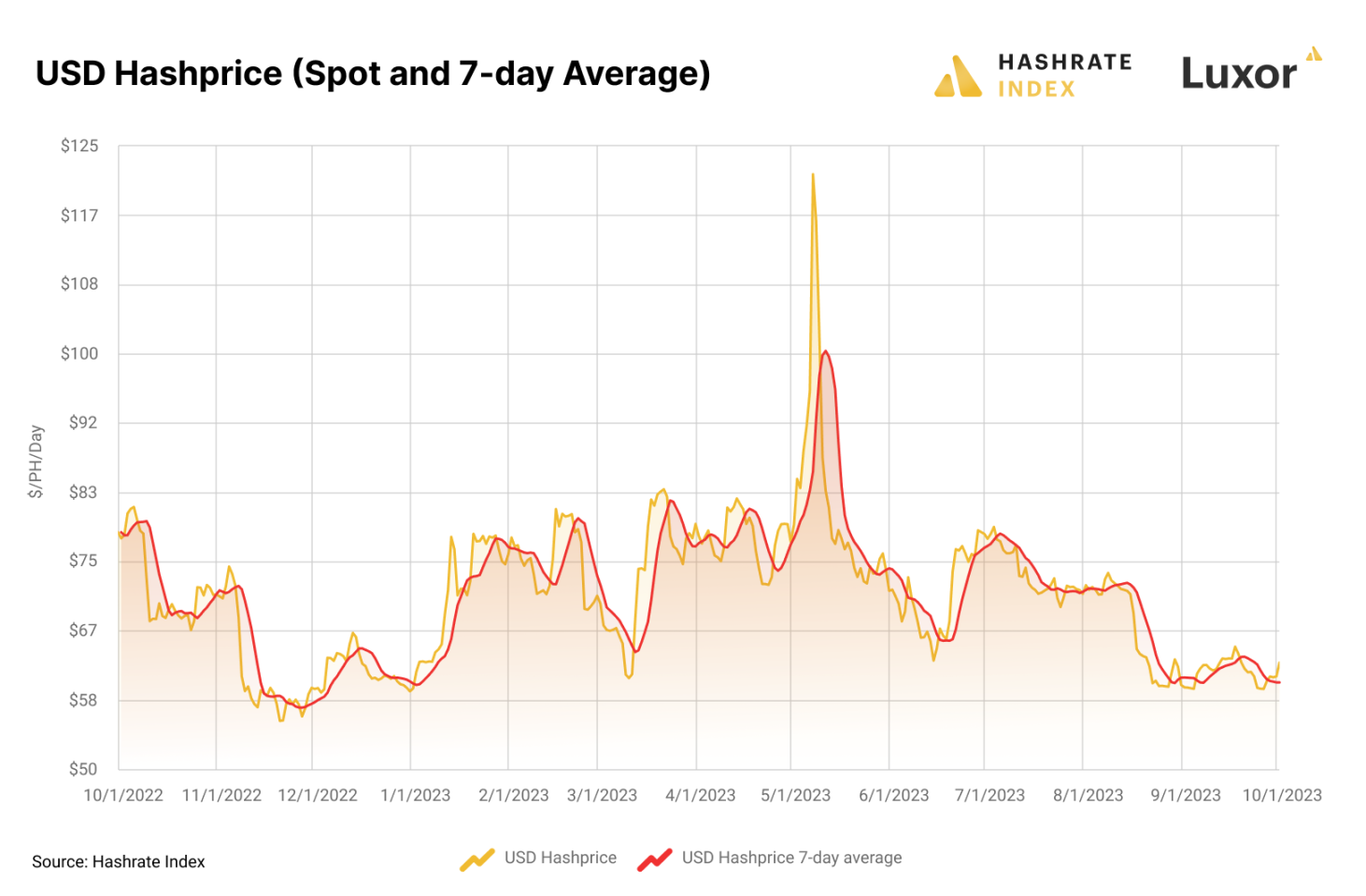

Fortunately, the price of Bitcoin hash, measured in USD (Foresight News note: an indicator of profit earned per TH/s per day), continued to rise in the third quarter of 2023, with Bitcoin reaching a year-high of slightly over $30,000, resulting in an average price of $28,100 for the quarter (compared to $26,350 for the first three quarters of 2023). This has provided support for the USD-priced Bitcoin hash price to prevent a significant drop due to the increasing mining difficulty.

However, despite the USD-priced Bitcoin hash price being above $70/PH/day in the first half of the third quarter, it dropped below $70/PH/day in August and has since been trending towards historic lows (in fact, at the time of writing, it is slightly below $60/PH/day, approaching the historic low of $55/PH/day).

In September, the USD-priced Bitcoin hash price was $61.71/PH/day, similar to the average prices in December 2022 ($61.94/PH/day) and November 2022 ($61.90/PH/day), despite Bitcoin's price fluctuating between $16,000 and $17,000 at that time.

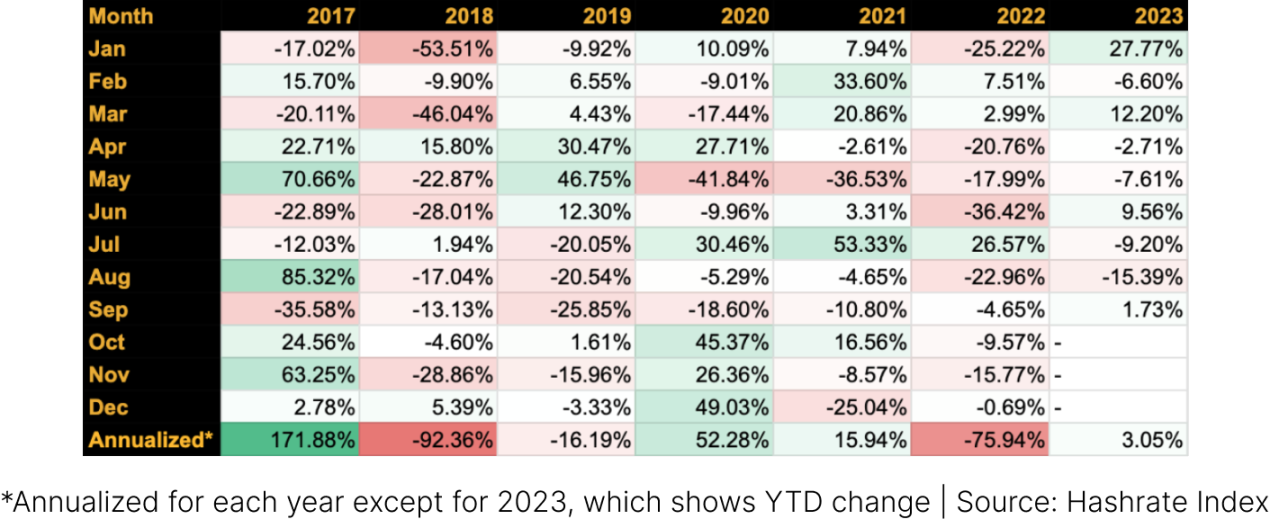

In general, the hash price of 2023 (at least so far) is more advantageous than in other years, with less volatility in monthly and annualized returns compared to other years since 2017.

The price of Bitcoin has risen by 63% in the first three quarters of 2023, enough to offset the 59% increase in Bitcoin's 7-day average hash rate during the same period. Of course, in addition to the recovery in Bitcoin prices, changes in Bitcoin transaction fees have also supported the hash price.

Looking at the time range included below, 2018 was the worst year for hash prices to date, followed by last year's bear market. The best year was during the unprecedented bull market in 2017, followed by 2020—this may come as a surprise to some readers, as it was the year of Bitcoin's third halving, reducing block rewards from 12.5 BTC to 6.25 BTC per block.

The annualized data for each year, except for 2023, shows the current situation.

Transaction fees remain relatively high but are starting to decline

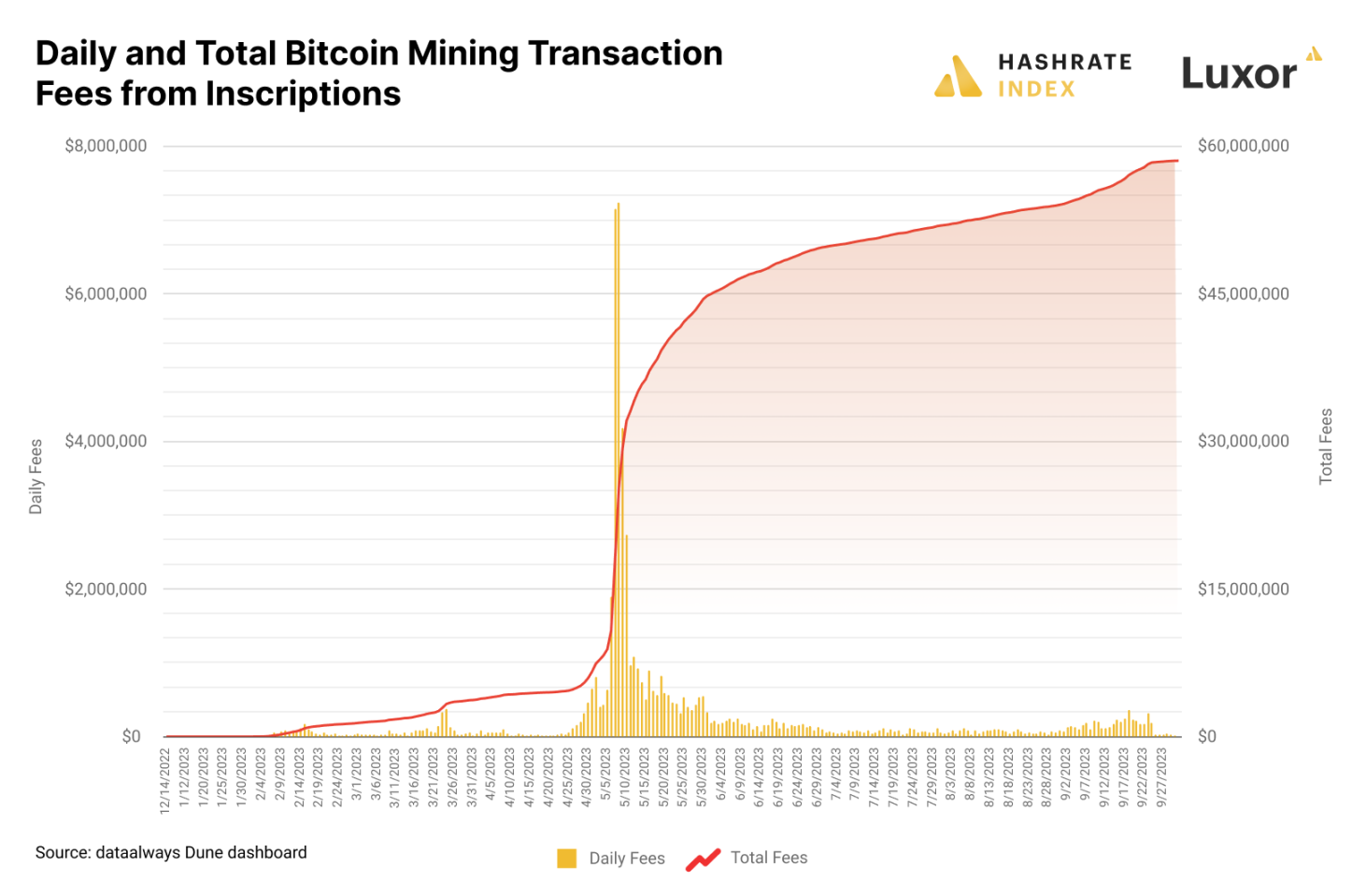

In the third quarter of 2023, transaction fee income accounted for 2.7% of total block reward income, significantly lower than the 8.17% in the second quarter, but still higher than the 2.3% in the first quarter.

Despite the decrease in transaction fee income in the second quarter, miners are still making money compared to last year, considering that in the third quarter of 2022, transaction fee income accounted for only 1.7% of total block reward income, with an average of 1.64% for 2022. So far in 2023, transaction fee income has accounted for 4.38% of total block reward income.

As discussed in our second quarter report for 2023, the growth in transaction fee income in 2023 is due to the market dynamics of Bitcoin block space shifting from inscriptions/ordinals to a paradigm change, which is a new standard for creating NFTs on Bitcoin.

As shown in the graph below, the majority of this transaction fee income was generated during a brief surge in May, in fact, miners netted 1,390.89 BTC (approximately $38.15 million) in May alone, accounting for 66% of the historical inscription fees as of the third quarter of 2023.

This income comes from the rapid growth in demand from BRC-20 token collectors and inscribers to use Bitcoin's OP_CODE functionality to create a series of text-based inscriptions.

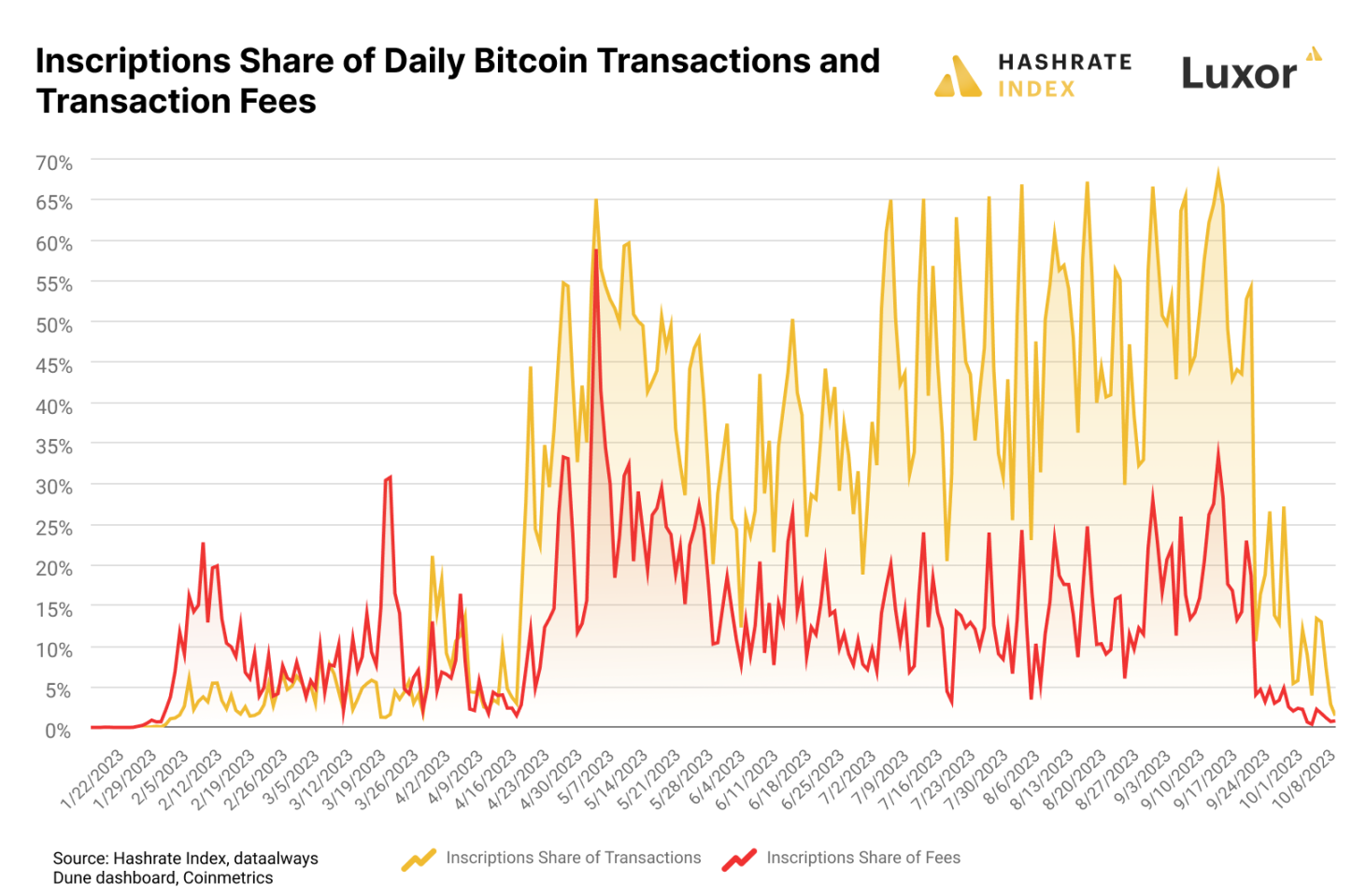

The graph below further confirms that the number of inscriptions is significantly decreasing, with inscriptions accounting for the lowest share of transaction fees and transaction volume since the first quarter of this year.

On average, in the third quarter of 2023, inscriptions accounted for 45% of daily transaction volume and 14% of daily transaction fees; the averages for the second quarter were 32% and 16%, and for the first quarter, they were 3% and 8%.

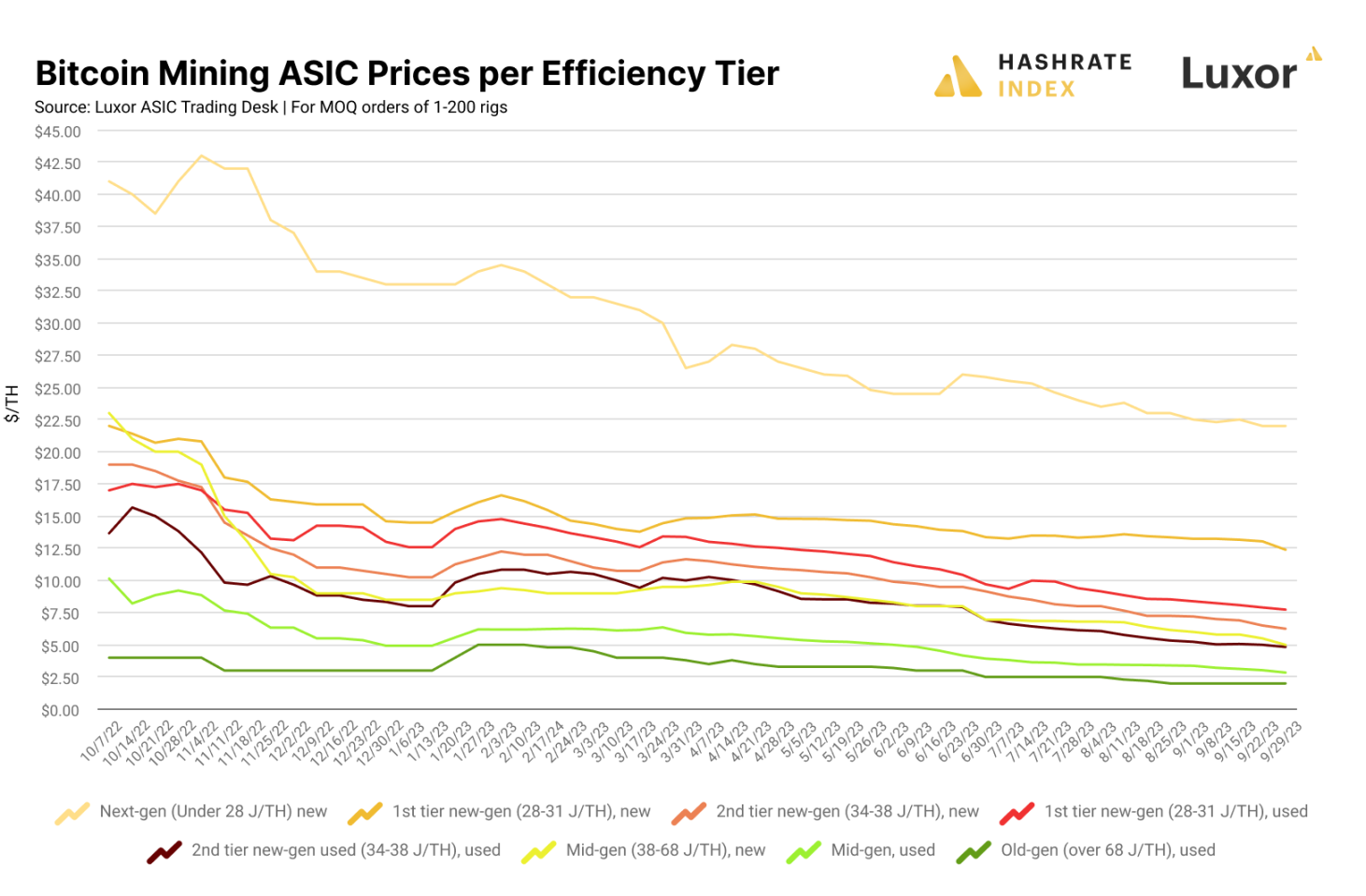

ASIC mining machine prices hit historic lows repeatedly

Bitcoin ASIC mining machines continued to decline in 2023, with prices for all models hitting historic lows in the third quarter as mining profits continued to decline.

As shown in the graph below, the new generation ASIC mining machines classified as the first tier (efficiency of 28-31 J/TH) have gradually separated from the pack over the year, with their premium relative to older and second-tier models increasing since April, and this gap has been widening since then.

With the rise in hash prices, prices for all levels of mining machines briefly increased at the beginning of 2023 and again in the second quarter, in response to the improved hash price economy driven by inscription-induced transaction fee income.

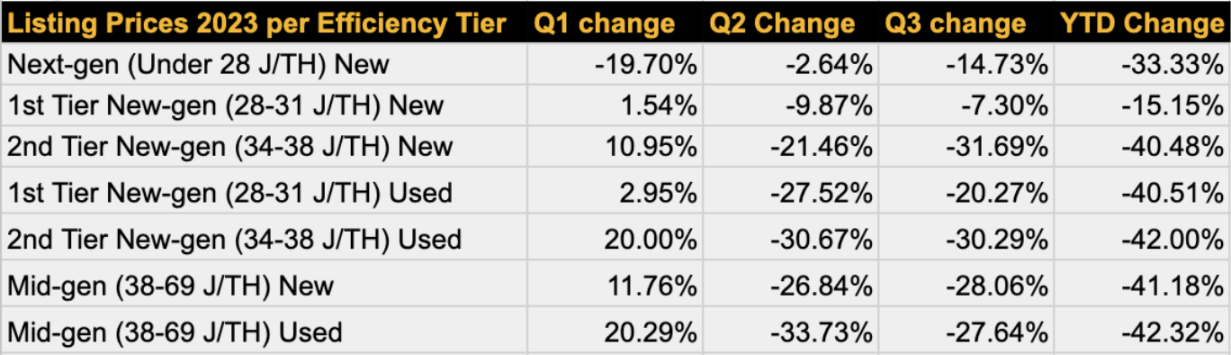

When we observe the listing price changes for ASIC mining machines of different efficiency levels in 2023, the first quarter stands out.

Due to the rebound in hash prices, every efficiency level of mining machine, except for the next-generation models, appreciated in the first quarter, while conversely, models like the S19 XP, the next-generation models, appeared somewhat oversold in the first quarter as the recovery in hash prices made less efficient machines more attractive.

The situation in the second and third quarters is completely different, with accelerated sales of mining machines, especially for older and less efficient models. The table below illustrates how miners are starting to differentiate between the first tier (28-31 J/TH) and the second tier (34-38 J/TH) of new generation ASIC mining machines.

Antminer S21 Model

Bitmain unveiled its latest ASIC mining machine model, the Antminer S21, at the World Digital Mining Summit in September. The model will have two versions, air-cooled and water-cooled, and is also the first Bitcoin ASIC mining machine to operate at an efficiency of less than 20 J/TH in history.

Bitmain is expected to start shipping the S21 model in December, although a January shipping date seems more reasonable. According to sources at Bitmain, the company plans to produce at least 50,000 units of this model per month over an 18-month period, with half being air-cooled and half being water-cooled. However, if there is enough demand, they can produce up to 100,000 units of this model per month.

At the World Digital Mining Summit, Bitmain also announced discounted prices for bulk orders of the S21 model. For the first phase of pre-orders, a minimum purchase of 1.2 EH/s is required (equivalent to 6000 units for the air-cooled model and 3380 units for the water-cooled model), with Bitmain's price set at $14/TH, meaning the price for the air-cooled model is $2800 per unit and the price for the water-cooled model is $4690 per unit.

The cost for the second phase of pre-orders is $19.6/TH (the price for the air-cooled model is $3920 per unit and the price for the water-cooled model is $6566 per unit), and a minimum order size of 1.2 EH/s is also required.

It's important to note that these are the promotional prices at the release of the Antminer S21 model, and subsequent orders will be at higher prices. Additionally, secondary market sellers have priced their models close to the promotional prices, with many suppliers selling models between $14 and $15 per TH.

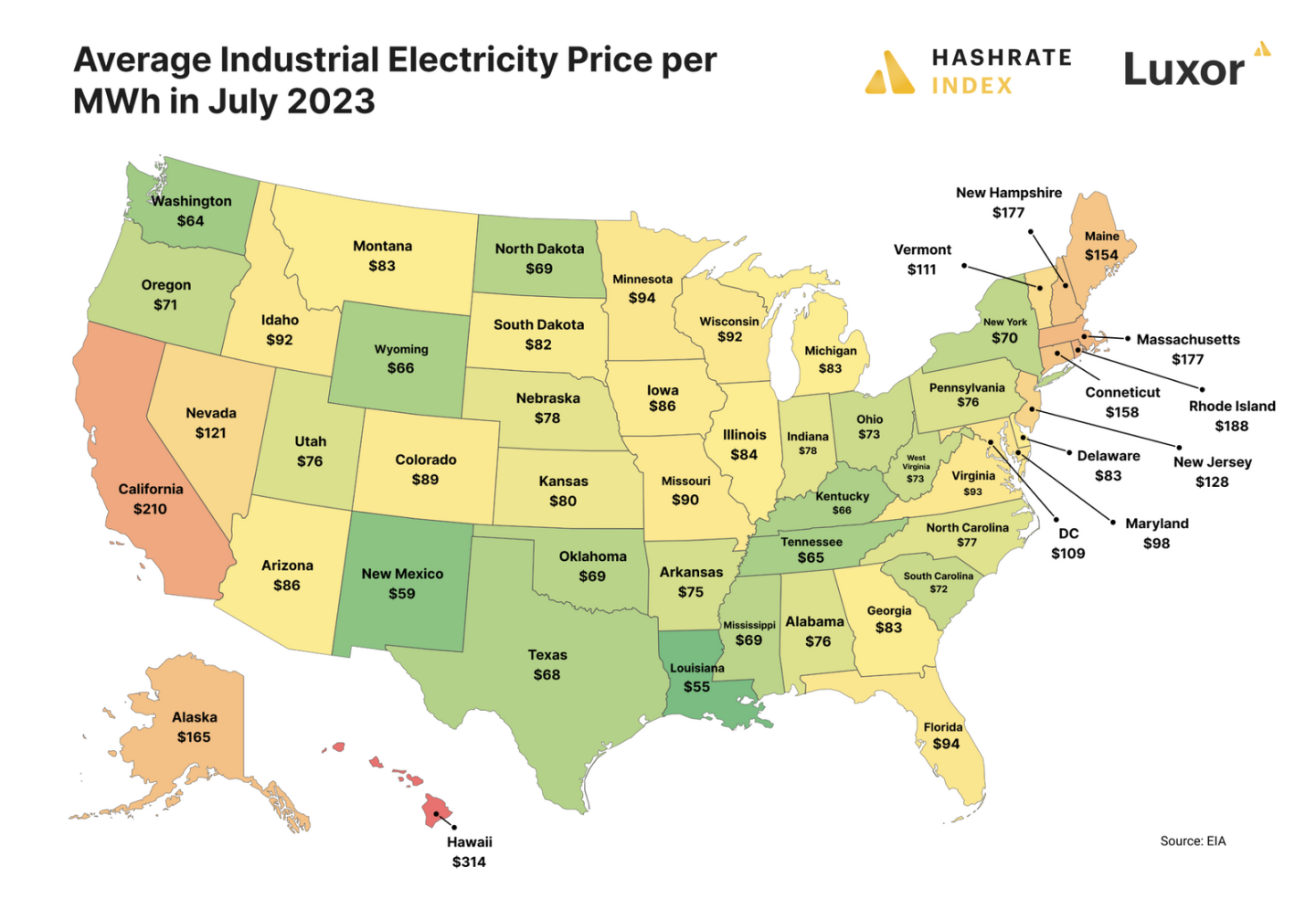

Stable Electricity Prices in the United States

At this time last year, many miners operating in the United States were struggling in a terrible market environment with low hash prices and a significant increase in electricity prices. In the third quarter of 2022, the average industrial electricity price in the United States reached a historical peak of $94 per megawatt-hour (MWh), leading to the bankruptcy of some of the largest players in the mining field, such as Compute North and Core Scientific.

By October 2023, electricity prices had returned to normal. As shown in the graph above, electricity prices in mining centers such as Texas, the Southeastern United States, New York, and the Rust Belt (Ohio and Pennsylvania) have returned to manageable levels, although there are some outliers (such as Georgia, where electricity costs were high in July 2023).

In the third quarter of 2023, the average industrial electricity price in the United States was $86 per MWh, an 8.5% decrease from the same period last year. Electricity prices in the United States typically peak in the third quarter, as demand for summer air conditioning and other cooling equipment is highest during this time.

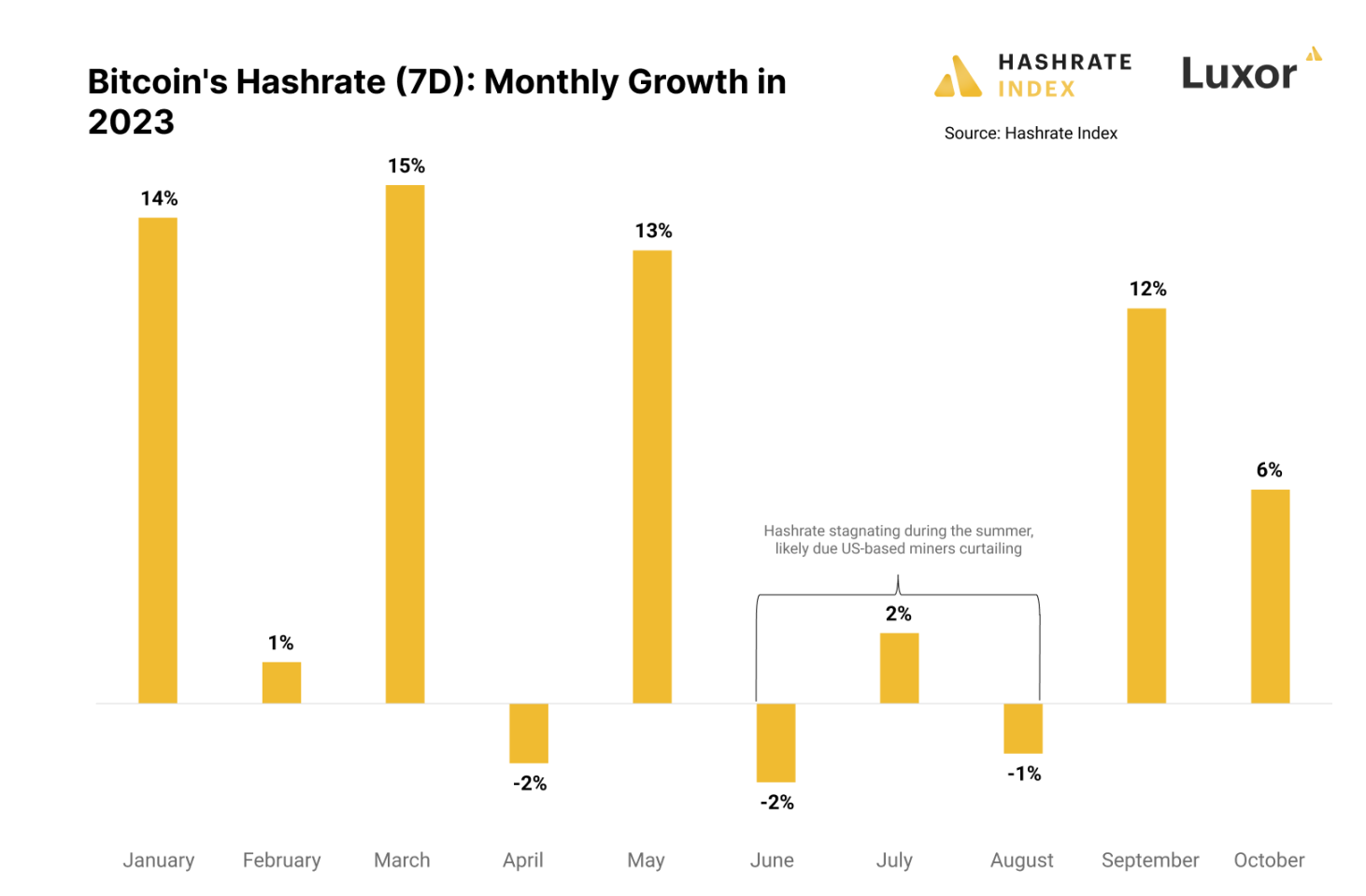

Bitcoin Hash Rate Continues to Show Seasonal Changes

Anyone following the Bitcoin mining industry may have noticed a new seasonal pattern in Bitcoin's hash rate over the past three years.

From October to May of the following year, Bitcoin's hash rate tends to grow almost uncontrollably, but this growth often slows down or even declines in the summer. The mining industry once again confirmed this pattern in the third quarter of this year, and such seasonal changes are most likely due to U.S. miners significantly reducing their hash rate deployments in the summer.

In the first five months of this year, Bitcoin's 7-day average hash rate increased by 56%, then declined by 1.3% in the summer months of June, July, and August.

In September, there was a sudden 12% increase, and with a 6% increase so far this month, it ultimately reached a historic high in mid-October.

We are relatively certain that this seasonal change pattern is caused by U.S. miners reducing their hash rate deployments in the summer, especially in areas like Texas.

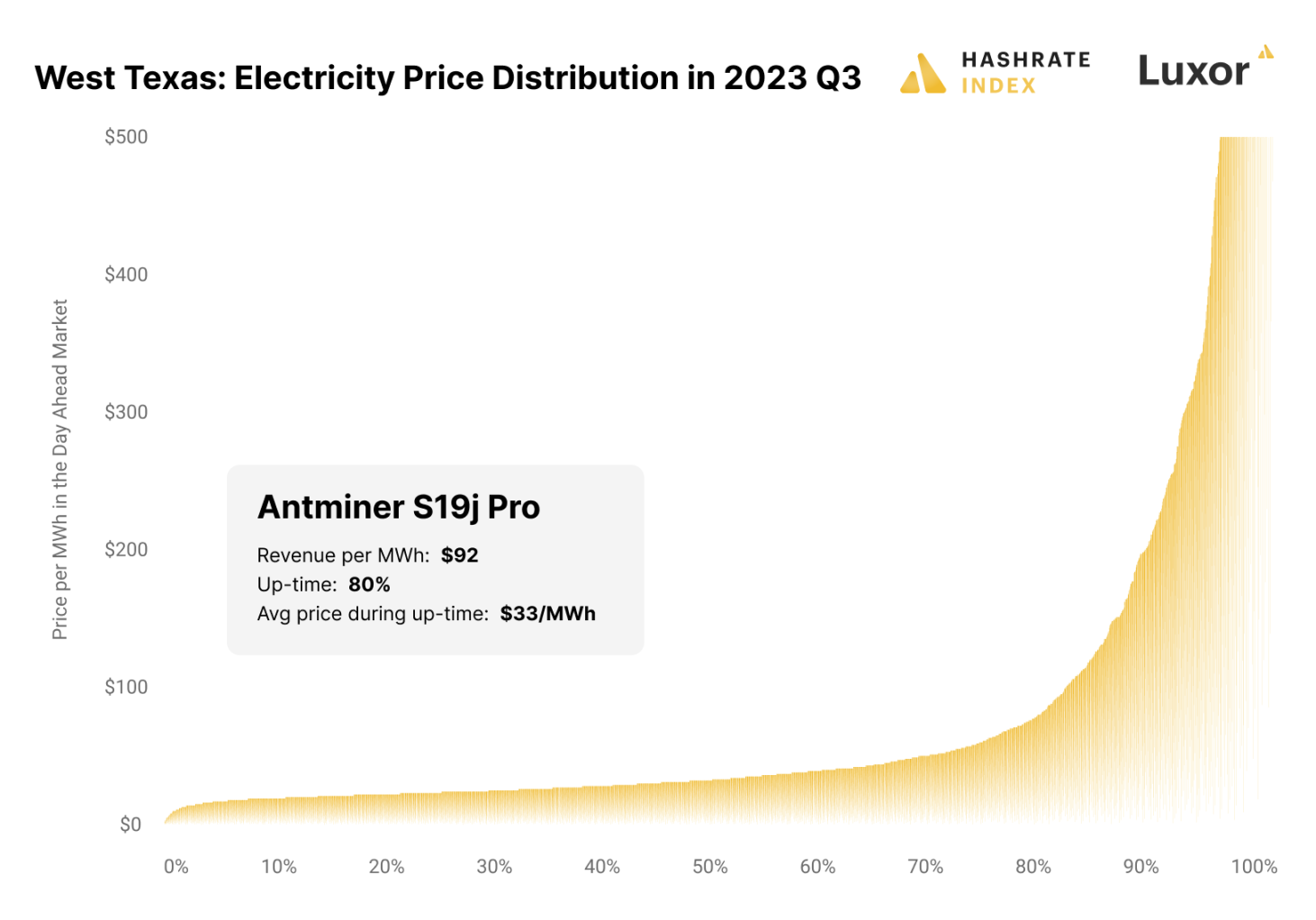

The graph above shows the distribution of electricity prices in West Texas in the third quarter of 2023. As seen, most hourly electricity prices are higher than $92 per MWh, which is also the average income for S19j Pro model mining machines in the third quarter. Therefore, miners in Texas typically reduce their hash rate deployments during these times.

Based on this data, we can imagine that a miner located in West Texas and operating a batch of S19j Pro model mining equipment theoretically has 80% of normal operating time, with the time when electricity prices exceed their S19j Pro equipment breakeven point accounting for about 20%, and the average electricity price during normal operation is $33 per MWh.

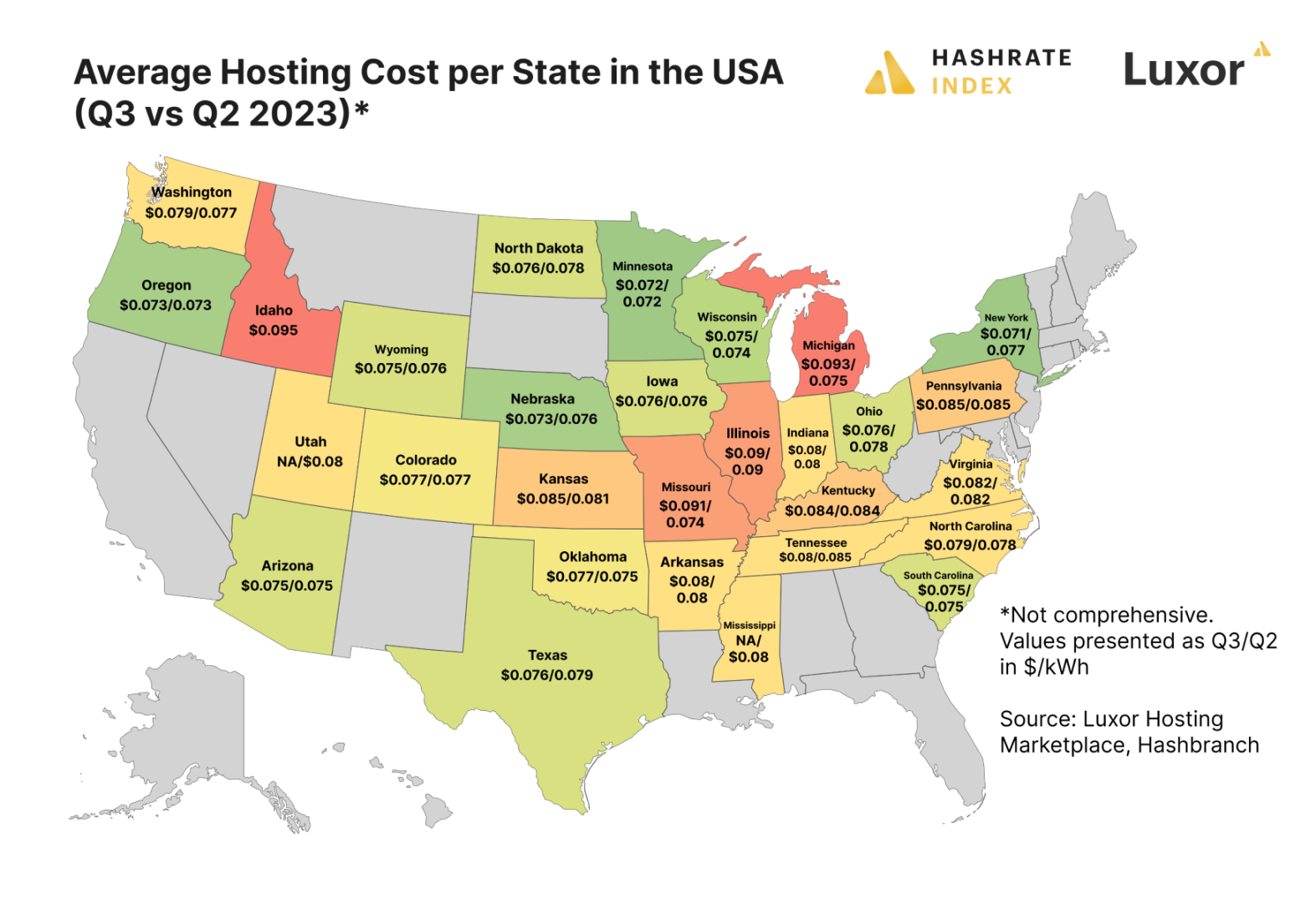

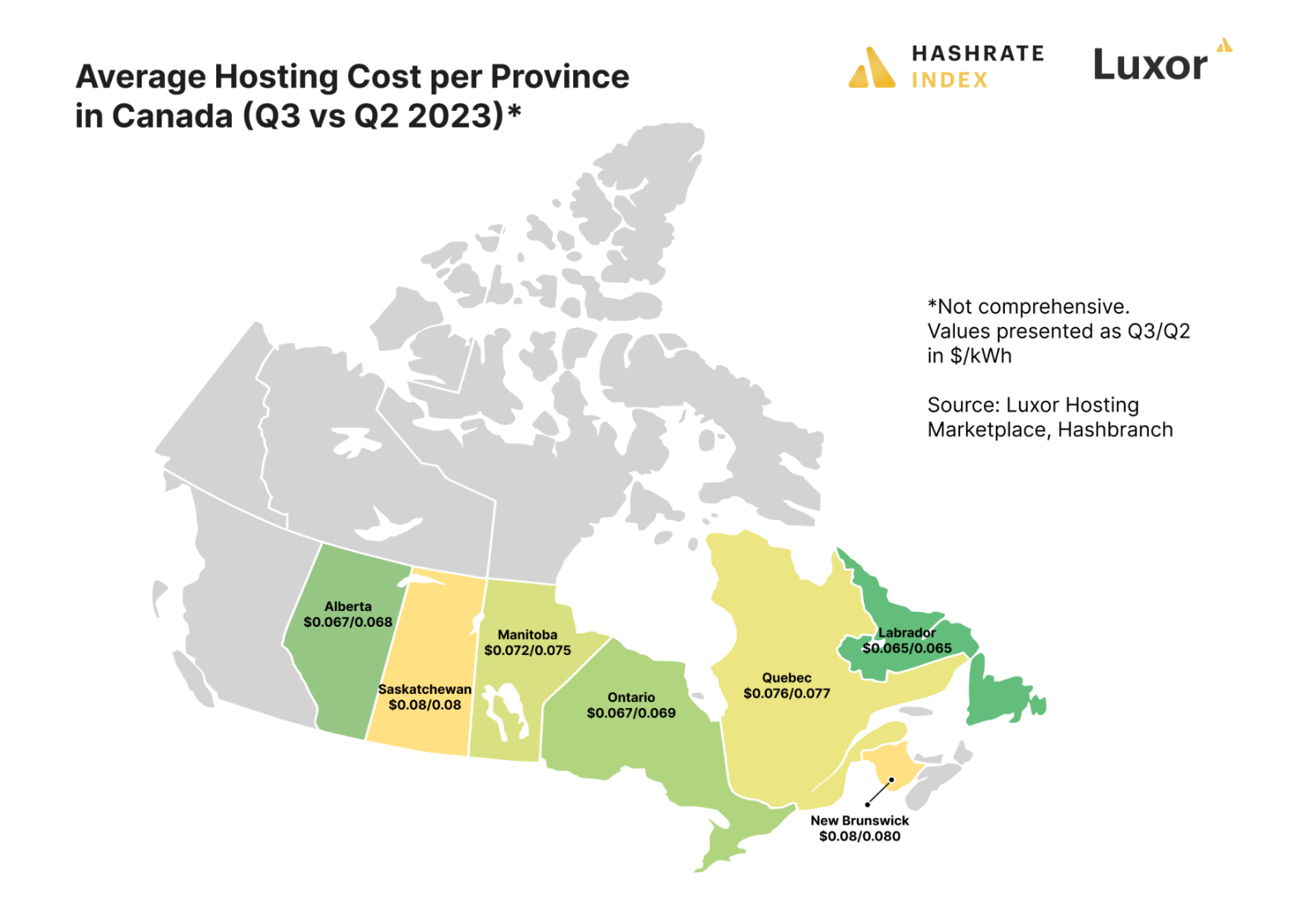

Relatively Stable Hosting Rates in the United States and Canada

Between the second and third quarters of 2023, there were no substantial changes in hosting rates in the United States and Canada.

According to information obtained from Luxor business data and Hashbranch data, the national average hosting fee level in the United States in the third quarter of 2023 (applicable to all scales) was $0.0790 per kilowatt-hour, compared to $0.0787 per kilowatt-hour in the second quarter of 2023.

The average hosting fee level in Canada in the third quarter of 2023 was $0.0725 per kilowatt-hour, compared to $0.0722 per kilowatt-hour in the second quarter of 2023 (all prices are in USD).

In the United States, the average discount for large-scale hosting agreements (over 200 ASIC mining machines) compared to small-scale agreements (1-99 ASIC mining machines) was 8% in the third quarter of 2023, compared to 7.5% in the second quarter of 2023; the relative discount for large hosting agreements compared to medium-sized agreements (100-200 ASIC) was 6.6% in the third quarter of 2023, compared to 5.3% in the second quarter of 2023.

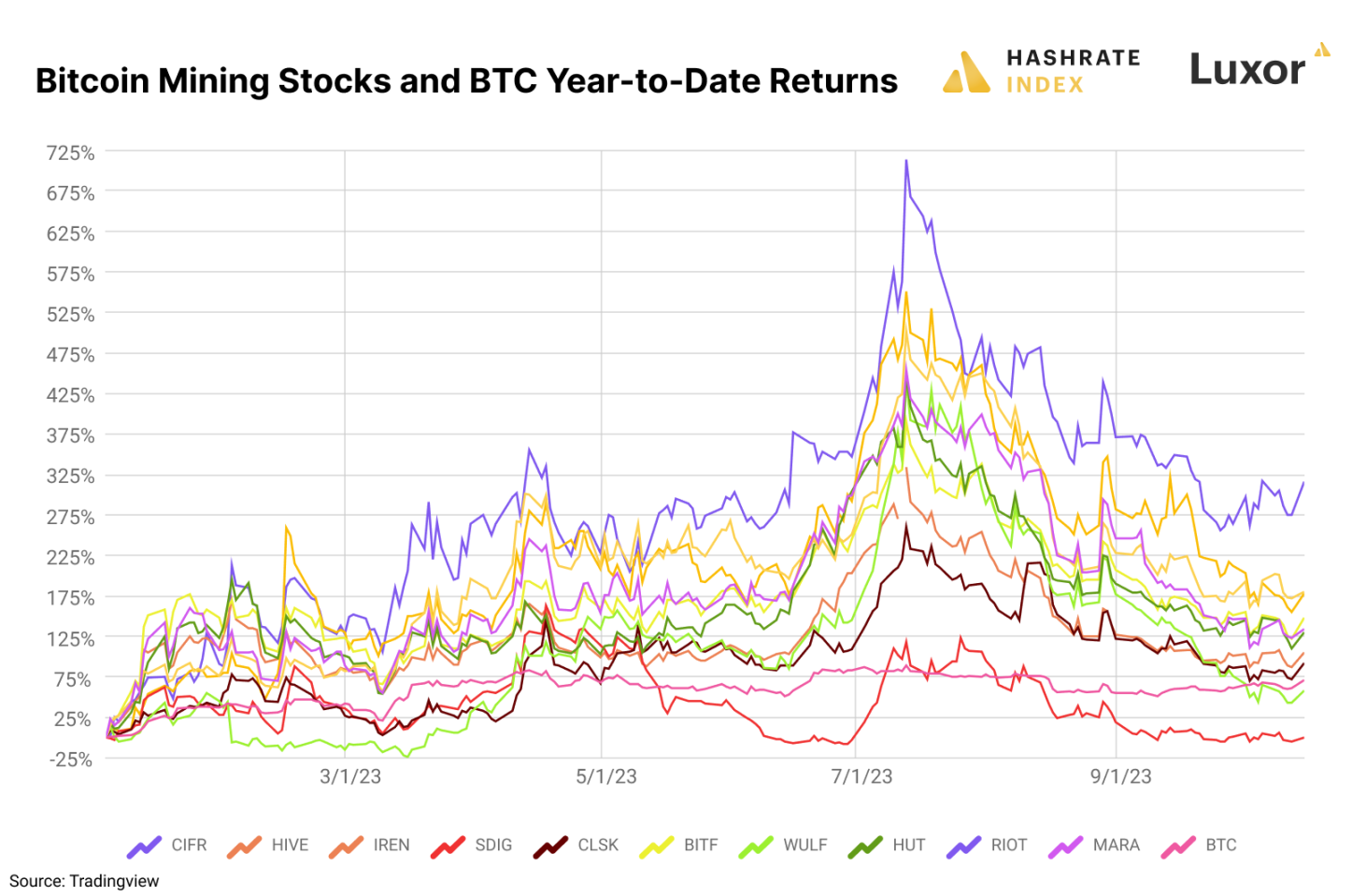

Bitcoin Mining Company Stock Prices Rise and Fall

The stock prices of listed Bitcoin mining companies started the third quarter of 2023 strong, riding the wave of Bitcoin rising to $30,000. Their stock prices surged in July but then declined significantly, erasing all gains from the first month of the third quarter.

Such price trends are also a good reminder that, overall, the stocks of Bitcoin mining companies are still high-beta trades relative to the price of Bitcoin.

The market typically evaluates the stock prices of Bitcoin mining companies based on the price movements of Bitcoin itself, rather than on fundamental factors such as mining efficiency, electricity prices/power trading strategies, and operational execution. So when the price of Bitcoin rises, the stock prices of Bitcoin mining companies rise higher and faster, and vice versa.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。