Seemingly calm, the blockchain always has something new.

Recently, JPMorgan Chase launched the first collateral settlement service using blockchain technology. This is a new experiment in the application of blockchain by traditional Wall Street institutions. In the midst of the hot market, this is an easily overlooked corporate news. However, amidst the continued turbulent market and inexplicable expectations this year, the development of digital assets has once again caught the attention of Wall Street.

What are the institutions doing? If you observe carefully, traditional institutions such as JPMorgan, Fidelity, and Citigroup are all using blockchain applications in internal corporate processes or financial transactions. However, these developments unrelated to trading are largely ignored by most users.

In terms of the industry, there is a disconnect between Wall Street institutions and the underlying users. The distant institutions are either advancing technological development or experimenting with emerging applications. However, for the underlying users, these actions are ineffective in converting into foreseeable value benefits, and are even less appealing than the blood-red stage nurtured by Ponzi.

In the midst of such a profound consensus divergence, the blockchain continues to forge ahead alone.

01. What are the institutions doing?

On October 10, global banking giant JPMorgan Chase announced that it had launched the first blockchain-based client collateral settlement network TCN. The initial trading parties were BlackRock and Barclays Bank. BlackRock tokenized shares in money market funds (MMFs) on TCN and used the tokens as collateral to transfer over-the-counter derivative trades to Barclays Bank for settlement.

Although the actual application has just been implemented, in September of this year, JPMorgan Chase was rumored to be exploring a blockchain-based digital payment and settlement system. According to insiders, JPMorgan Chase has designed and developed a relatively complete infrastructure for the system, but the project is currently facing difficulties due to the turmoil in U.S. regulation, hindering its progress.

JPMorgan Chase's involvement in blockchain runs deep. It was one of the first traditional institutions to recognize the effectiveness of blockchain technology. As early as 2015, JPMorgan Chase established a new product department and evaluated potential technology suppliers for the bank, from cloud to big data solutions. During the evaluation process, blockchain caught its attention. After surveying well-known blockchains in the industry, JPMorgan found that none of the projects, from the general Ethereum to the formation of digital assets, from the then-prominent Ripple to the most user-friendly Hyperledger, truly met the complex financial conditions and requirements of the banking industry.

Within 6 months of the evaluation, JPMorgan Chase decided to build an internal blockchain. The demo product, Juno, was born to improve efficiency. At that time, Juno was just a private chain completely controlled by JPMorgan Chase. However, due to the immaturity of the technology, JPMorgan abandoned this pilot in 2016 and open-sourced Juno, submitting it to the Hyperledger Foundation for industry collaboration.

The second major product was Quorum, a permissioned blockchain. After the pilot of Juno, JPMorgan Chase adjusted the private chain architecture to a permissioned chain, or consortium chain, giving the product initial industry attributes. As a project integrating the Ethereum Virtual Machine (EVM) and sidechains, Quorum's architecture and technology heavily rely on Ethereum EVM and the Solidity smart contract language, inevitably being constrained by Ethereum. For bank developers, the technical complexity is also difficult to keep up with. Therefore, although Quorum is still running, it is only embedded in the bottom layer of JPMorgan's blockchain landscape and is not well known to the public.

In 2019, JPMorgan once again launched JPM Coin, a stablecoin pegged to the U.S. dollar, for wholesale payments between institutional clients. The system can provide transactions denominated in U.S. dollars and euros and has processed approximately $300 billion in transactions.

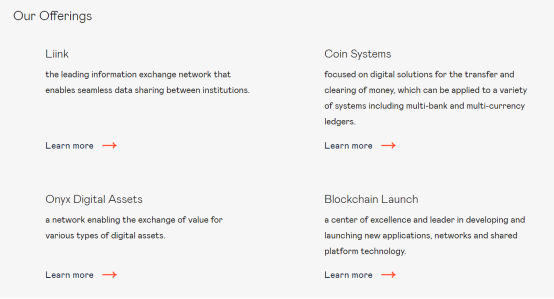

After laying the groundwork for underlying infrastructure and payment systems, JPMorgan continued to oscillate between exploring blockchain strategies and protecting its brand. It wasn't until 2020 that JPMorgan finally made a bet on blockchain. In October 2020, JPMorgan officially established the blockchain subsidiary Onyx, with Quorum as the core technology, and launched blockchain payment-related information exchange services Link, DLT clearing system Coin Systems, Onyx digital asset platform, and shared platform technology development Blockchain Launch. With this, JPMorgan's blockchain landscape officially took shape, marking the beginning of its full-scale development of blockchain.

JPMorgan Chase's blockchain layout, source: JPMorgan Chase official website

According to Tyrone Lobban, head of the Onyx blockchain department, as of now, other financial institutions running nodes and tokenized assets on Onyx include Goldman Sachs, DBS Bank, and BNP Paribas. He also described how JPMorgan Chase can provide credit and repurchase services to institutional clients through Onyx, using tokenized government bonds as collateral for lending, significantly improving efficiency, and even completing $1 billion in loans within 3 hours.

Overall, as a distributed permissioned ledger, blockchain has significant effects on efficiency improvement in finance due to its low friction, divisible trust, and liquidity creation. It is widely used for process optimization, especially in the current trend of tokenization in the RWA.

According to Gyro statistics, apart from JPMorgan, many traditional institutions such as Goldman Sachs, DBS Bank, UBS Group, Santander Bank, and Societe Generale have already begun exploring this track. For example, UBS Group conducted a RAW pilot on Ethereum in 2021 and successfully issued $50 million in tokenized debt securities in December last year.

RWA layout of some mainstream institutions, source: public information

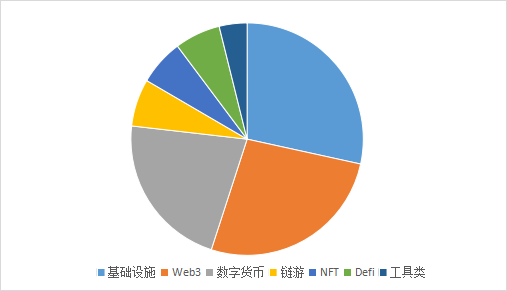

In terms of investment and financing, institutional concerns are more apparent. As of the end of September this year, there have been a total of 93 blockchain financing events worldwide with a single amount exceeding 100 million yuan, totaling 23.642 billion yuan. The infrastructure track has shown its advantage, with an amount of 6.722 billion yuan, accounting for 28.43%, ranking first in all tracks.

Proportion of global blockchain financing events exceeding 100 million yuan since 2023, source: Gyro Research Institute

It can be seen that large institutions, seemingly far from underlying applications, are actually most concerned about underlying technology and tokenization applications. However, this view is completely opposite in the minds of industry users.

02. What do market users care about?

Returning to the cryptocurrency field, this year's market has been more appropriately described as "lifeless" rather than tumultuous and grand.

From an external perspective, wars have been frequent, and inflation has been difficult to contain. After several tough measures, the effective federal funds rate in the United States has soared to the range of 5.25% to 5.50%, reaching a new high since 2006. The liquidity of risk assets has significantly decreased, and the prices of inflation-resistant assets have risen sharply. The price of gold once jumped to $2085.4 per ounce, and the Tanaka Kikinzoku Kogyo gold counter sales price, considered a retail gold price indicator in Japan, broke through the 10,000 yen per gram mark, reaching 10,100 yen per gram on September 5. In the field of technology, AI has made a strong comeback, with large models dominating and once again seizing the financing survival space of Web3 projects.

From an internal perspective, there are no representative applications emerging, and the hotspots are extremely limited. The Hong Kong and Xinjiang dispute is gradually subsiding, and the topic of BlackRock ETF speculation has been lingering for at least 3 months, with continuous false news in the market. According to incomplete calculations by BlockBeats, there were 9 projects, exchanges, and communities in the cryptocurrency industry that ceased operations in 2021, 17 in 2022, and the number increased to 27 in 2023. In 2023, the number of projects ceasing operations is increasing rapidly, from an average of 1 per month to a peak of 5 per month.

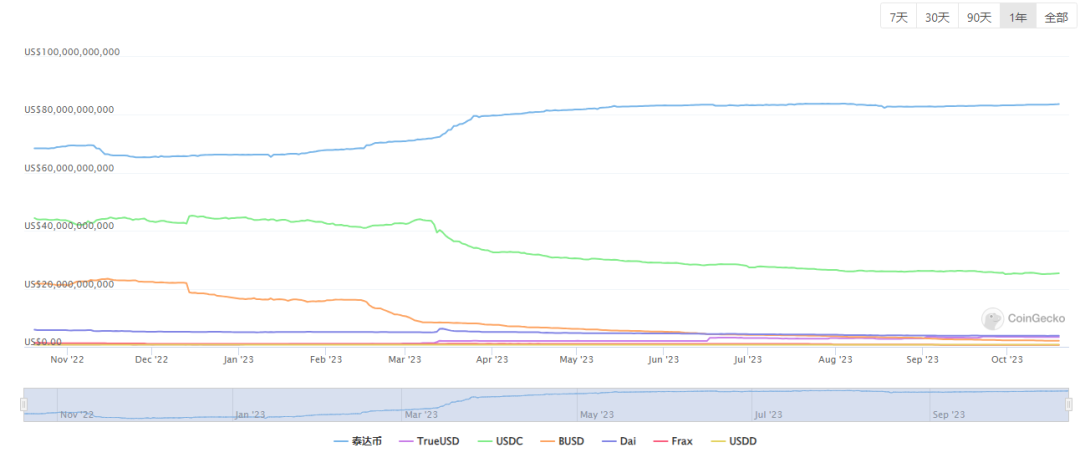

With the combination of internal and external negative factors, the market naturally doesn't look good. After bottoming out and recovering at the end of 2022, BTC has been hovering around $26,000, and even with the positive news of institutional ETFs, it quickly fell back after breaking through $30,000, currently trading at $27,261, a 58% decrease from last year's peak. In terms of stablecoin market capitalization, as of October 16, the total market capitalization of stablecoins has been declining for 19 consecutive months, falling to a new low of $120.9 billion, the lowest level since September 2021. In the past week, apart from a slight increase in USDT, the market capitalization of the three major centralized stablecoins USDC, BUSD, and TUSD has continued to decrease, with a total devaluation of over $500 million in a week, indicating a worrying level of market purchasing power.

Changes in the market capitalization of mainstream stablecoins, source: Coingecko

In this context, the market is filled with emotions, meme coins are prevalent, and for cryptocurrency users, the biggest trend this year is Bitcoin-themed NFTs, which have driven unilateral market increases. The hottest application is Friend.Tech, because anyone can create coins. Regardless of the technical terms such as Layer2, ZKP, abstract accounts, etc., users seem to only see the constantly changing price trends and coin prices, and the fluctuating overall market drives the users' wavering hearts, almost blinding them with the hormones of gambling.

There are also discussions in the industry.

03. Profound Industry Consensus and Differences

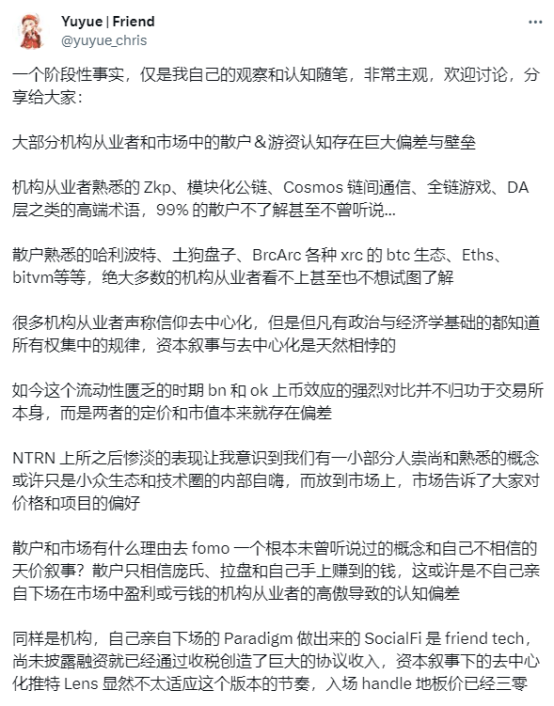

In a statement by the prominent Twitter user Yuyue, there is a significant cognitive gap between most institutional practitioners and retail investors in the market. Institutional practitioners focus on underlying technology with a sense of arrogance, while retail investors, due to their lack of understanding, do not believe in the so-called unrealized technological narratives and are more concerned about actual price fluctuations. This has led to a disconnect in the market. Institutions do not participate in the market, so the projects they launch have no takers, and retail investors do not focus on technology, leading to the prevalence of speculative and gambling activities, exacerbating the information asymmetry in the industry, resulting in the current hierarchical situation.

Discussion from Twitter, source: @yuyue_chris

In reality, this is indeed the case. Apart from traditional investment institutions such as Paradigm and a16z delving into application categories, many traditional institutions still have many biases towards the cryptocurrency field. Jamie Dimon, CEO of JPMorgan Chase, who has been studying blockchain for years, criticized cryptocurrencies such as Bitcoin during his testimony to the U.S. Congress in 2022, likening them to Ponzi schemes, and stating that "blockchain must be separated, this is real, DeFi is a real ledger, tokenization can be used for real things." He personally believes that Bitcoin is worthless. Tyrone Lobban, head of the department, also admitted that "99.9%" of conversations with clients are about tokenized forms of traditional financial instruments, not cryptocurrencies. According to the latest news, starting from October 16, JPMorgan Chase's UK retail bank, Chase, will prohibit customers from trading cryptocurrencies due to the continuous increase in fraud and scams.

Even though institutions such as BlackRock and Proshare are actively applying for ETFs, they are only including consensus-based currencies such as Bitcoin and Ethereum in their portfolios to benefit from intermediation and meet the diversified needs of their clients, without delving into the actual cryptocurrency ecosystem. Their main purpose is to make profitable trades without losses, and they only consider high-quality applications and projects. Retail investors are not within their consideration.

Even more absurd are entities like FTX. The cryptocurrency celebrities who once frequented the White House and loudly proclaimed "cryptocurrency is the future" have finally confessed under strict regulation. The descriptions at the hearing were shocking, with the company borrowing cash in its name, generating insurance funds at will, misappropriating client assets, selling and manipulating the market as if it were commonplace. The interests of users? Unclear and not understood.

All of this constitutes the unique ecosystem of the blockchain industry. As part of financial technology, with the foresight of trends, Wall Street elites collectively enter the field, and it is not uncommon to see Ivy League graduates in the industry. Risk control, quantification, and technology are daily topics of discussion. As part of the decentralized vision, cryptocurrency is open to everyone, and the contrast between the complexity of the technology and its accessibility is stark. Retail investors come to make money, regardless of Ponzi schemes. Even for structured products, they only focus on the TVL and returns on the surface. Institutions also come for their own interests, either with a sense of superiority or viewing users as ants, resulting in a gap that is not easily filled.

Under Yuyue's post, someone compared the current situation to that of 2018 and 2019, which evoked countless sighs. In 2019, the hot trends were Binance's launch of the IEO model, and the emergence of funding schemes such as VDS, Bell Chain, and Jushang. There was a disconnect from technological concepts, the prevalence of small circles, and a proliferation of capital manipulation methods. Apart from that, there were no other highlights, and the now commonplace concepts of DeFi, NFT, and Layer2 were just in their infancy at the time.

Someone also sarcastically remarked, "How should one answer when wearing a suit and leather shoes and asking why people in the slums don't like to eat meat?"

The innovation and implementation of technology have always been different. The appearance of technology does not necessarily mean its implementation. In the cryptocurrency field, which is adept at using narratives, the contrast is even more pronounced. Retail investors who have been deceived by many new concepts find it difficult to engage, believe, or apply them, which is understandable. For institutions and projects, it is their responsibility to adjust their attitudes, take off their long robes, and listen to the market's voice, and implement more practical applications. Perhaps only when the technological innovation is directly felt by users can it truly benefit them. But at that time, will the cryptocurrency world still be decentralized? Or will it be just another domain controlled by a wealthy group?

What is even more frustrating is that even in speculative trading, the window of opportunity for retail investors is shrinking, and the wealth effect being fought over between projects and institutions is diminishing.

References:

Stuart Popejoy, Will Martino: Understanding JPMorgan Chase's blockchain product layout in one article;

CNBC: Why big banks like JPMorgan and Citi want to put Wall Street on a blockchain;

Decrypt: JP Morgan Crypto Lead: ‘99.9% of Conversations Are About Tokenized Assets, Not Crypto’

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。