The main purpose of this article is to analyze the current operation and investment risks of Marathon Digital (MARA), compare it with other mining companies, and determine whether Mara is the strongest target for short selling.

Author: Yilan

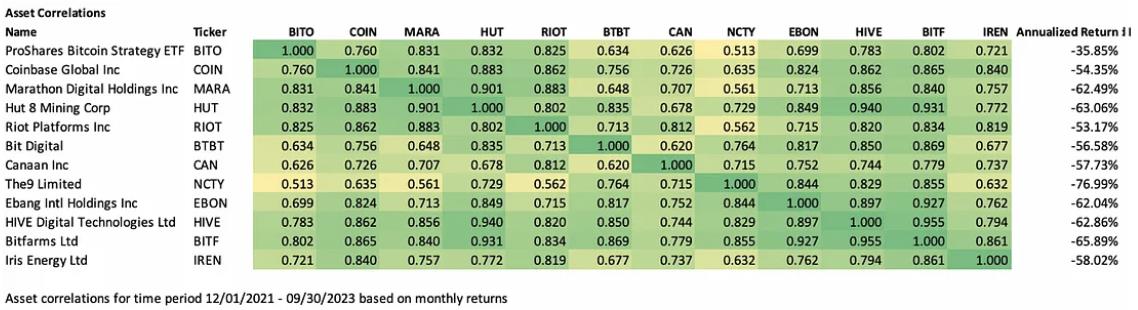

Listed blockchain concept stocks are mainly engaged in mining, mining machine sales, chip manufacturing, digital asset management, blockchain technology provision, payment and trading platforms, etc. Due to differences in business models, they have different degrees of BTC leverage effect, which means that their stock price fluctuations are usually more intense than the Bitcoin spot market and have different amplification factors. Among them, mining stocks (Mara, Riot, BTBT, etc.) are more effective BTC price amplifiers compared to mining machine stocks or stocks with other business models. For example, compared to COIN, MARA has a higher correlation and price elasticity with BTC prices (COIN vs. MARA correlation 0.76 vs. 0.83, annualized standard deviation 92% vs. 170%).

Correlation and standard deviation of various mining stocks and BITO prices (BITO fits BTC prices)

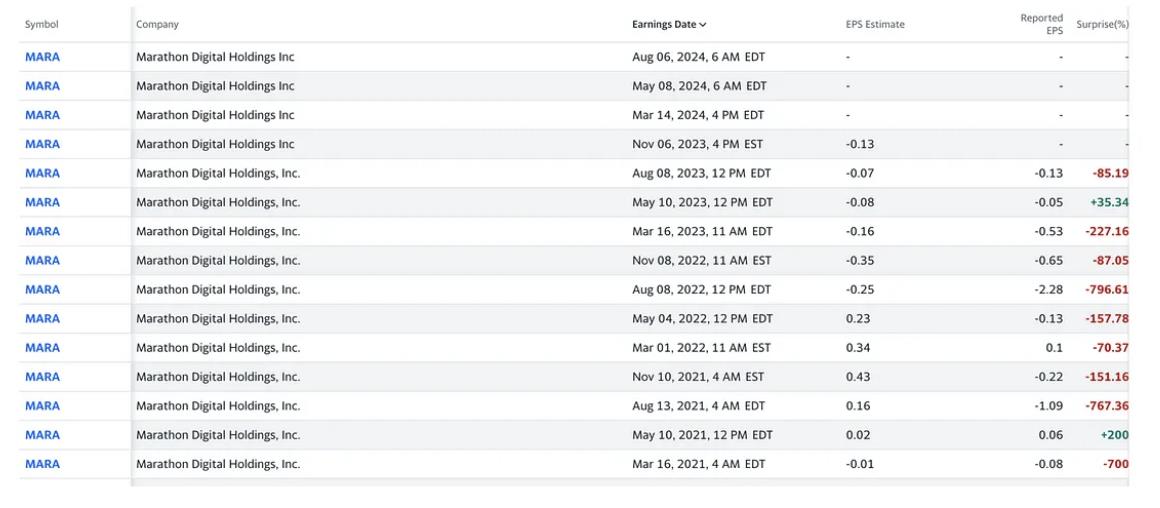

During the rebound market from June 15th to July 13th, Mara's price rose by 100%, while BTC only rose by 30%. However, during BTC's subsequent pullback, Mara also fell by 55% (in addition to the reason for BTC's decline, the announcement of the second-quarter financial report on August 8 with an EPS of -0.13, far below the expected -0.07, was also a driving force for the price decline), while BTC fell by 12%. From this perspective, Mara's amplification factor to BTC prices in this year's market is close to 300%, although the annualized standard deviation is only 170%.

MARA vs. BTC price fluctuations

Mara EPS history

This article mainly analyzes the current operation and investment risks of Marathon Digital (MARA), compares it with other mining companies, and determines whether Mara is the strongest target for short selling.

I. Investment Logic

1. Business Model and Operational Status

Marathon's main business is self-operated Bitcoin mining. The strategy is to (finance) purchase mining machines, deploy mining farms, pay for production cash operating costs, and hold Bitcoin as a long-term investment. The difference in business models between purchasing mining machines for mining and hoarding coins (Mara, Hut 8, Riot) and producing and selling mining machines (Cannan) lies in the lower research and development expenses, but higher capital expenditures, and the income lacks resilience, relying only on increasing BTC mining efficiency and profiting from BTC appreciation. The high debt ratio and leverage make the revenue of listed mining companies more closely related to the price of Bitcoin, and the price fluctuations are more intense. They also face the potential threat of insolvency in a bear market.

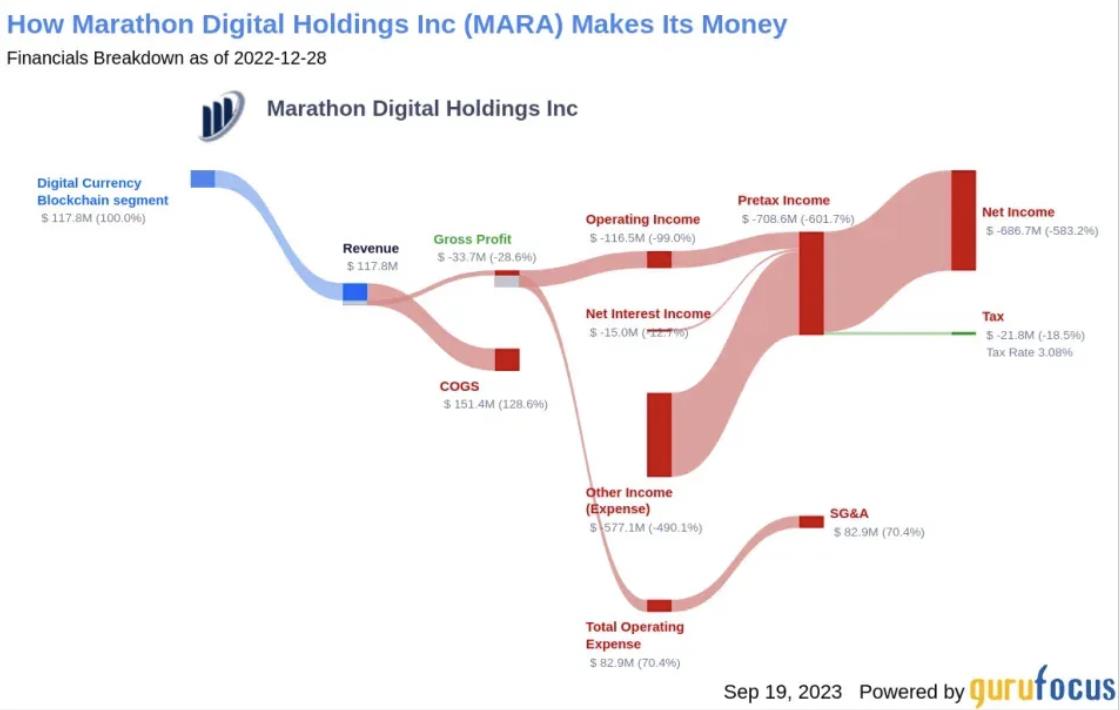

Marathon's 2022 fiscal year financial situation diagram

In terms of revenue, in the 2022 fiscal year, Marathon produced 4,144 BTC, generating revenue of 117 million, but the revenue completely failed to cover expenses. The total annual mining expenses for energy and other costs were 72 million, mining machine depreciation and amortization were 78 million, and operating expenses including personnel and maintenance were 630 million, resulting in a net loss of 687 million. Therefore, the business model of financing the purchase of Bitcoin mining machines for mining is very challenging for the company's cash flow management in a bear market.

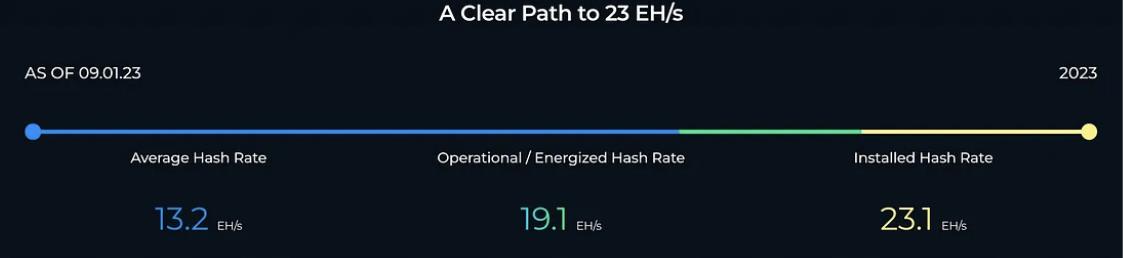

In terms of mining efficiency and operations, Marathon's hash rate in the second quarter increased by 54% from the end of last year to 11.5 EH/s, reaching 17.7 EH/s. By increasing the hash rate faster and increasing operating time, the Bitcoin production increased (producing a total of 2,926 bitcoins in the second quarter, accounting for about 3.3% of the Bitcoin network rewards during that period). In terms of operations, the company's high debt situation (insolvency in Q4 2022) has already affected the health of the balance sheet. Although Q1 and Q2 performed well due to the rise in coin prices and the increase in production hash rate, BTC prices have continued to be low in Q3 2023 and are expected to remain low until at least next year. Therefore, in September of this year, Marathon repaid most of the convertible bonds early to reduce the adverse impact of loan interest on cash flow. The remaining principal amount of the notes is still $331 million.

Although the increase in hash rate has improved the income situation by increasing BTC mining efficiency, Marathon recorded a loss of $21.3 million, or $0.13 per share, in the three months ended June 30, 2023, compared to a net loss of $212.6 million, or $1.94 per share, for the same period last year. However, it still cannot make a profit, and the substantial electricity and deployment costs continue to weaken Marathon's balance sheet in the case of a shortage of cash flow.

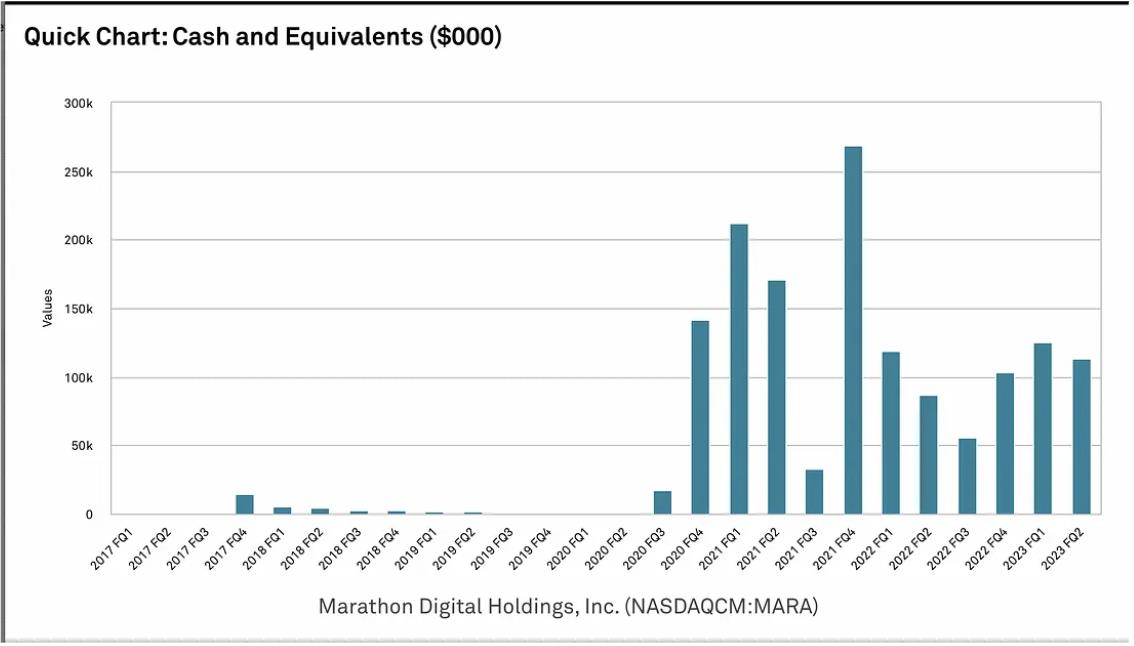

2. Cash Flow and Cash Burn Situation

From Marathon's cash flow, it can be seen that the source of cash comes entirely from financing. In Q4 2022, the company's operating cash flow was -92 million, investment cash flow was -22 million, and financing cash flow was 163 million, resulting in a net cash flow of 48 million to cover the next quarter's interest and taxes. The cash flow brought by financing comes entirely from the issuance of common stock, continuously issuing shares, which may lower the company's valuation in the market, leading to higher capital costs when Marathon raises funds in the future. Issuing more common stock may also lead to a decrease in earnings per share (EPS) because profits need to be distributed to more shareholders, which will also have a negative impact on Marathon's valuation.

As of the end of the second quarter of 2023, Marathon still holds cash and cash equivalents worth 113 million, including 12,538 BTC. In Q2 2023, Marathon's interest cash outflow reached 3 million, which is almost the same as its available net cash flow (Marathon's available net cash flow is only 3 million, which is the remaining net cash flow after issuing common stock worth 163 million and 65 million in Q1 and Q2, respectively). It can be seen that operations and investments have used too much cash, and there is no new cash generation. Therefore, in addition to actively repaying to reduce interest burden, Marathon also needs to continue selling BTC to pay for operating expenses. Indeed, in Q2 2023, Marathon sold 63% of the BTC produced, totaling $23.4 million.

3. The Crazy Expansion in the Bull Market Becomes a Concern in the Bear Market - Acquisitions and Mining Farm Deployment

In early August, Marathon deployed and installed new S19 mining machines, and the installed hash rate domestically has reached the target of 23 EH/s. The newly installed mining farm in City Garden, Texas, is close to being operational, according to the hosting provider. Marathon's joint venture in Abu Dhabi has started calculating hash rates and generating Bitcoin. However, with electricity costs of $0.12/kWh, the currently deployed mining machines would only break even at the current BTC price, and may even incur some losses (considering only variable costs such as electricity).

Furthermore, the overall investment cost of mining farm construction remains high. In 2021, the valuation of acquired mining farms could even reach $1 million/MW, and the unit price of purchased mining machines is between 55–105 USD/T. Under the double pressure of falling coin prices and rising electricity costs, the depreciation of previous asset investments and a significant reduction in income have made it difficult for many mining companies to continue.

Marathon plans to continue expanding its leadership position in the Bitcoin mining field in the coming quarters. However, such expansion in a bear market raises more concerns about its cash flow situation. Whether it can continue to finance will determine whether its expansion plans can proceed smoothly (issuing new shares will lower its per-share value).

4. Marathon's Debt Situation and Operational Status

The market downturn will have a negative impact on companies with significant debt, especially in a high-interest rate environment. Marathon's debt adds additional interest burden to its cash flow. Therefore, Marathon chose to repay most of its convertible bonds early to cope with the current low coin price and the operational pressure caused by next year's BTC halving (Marathon's $417 million convertible notes were exchanged at a discount of approximately 21%, saving Marathon about $101 million in cash, excluding transaction costs. The transaction added value to existing shareholders of approximately $0.55 per share). This transaction also increased Marathon's financial/financing selectivity. With the reduction of debt burden, the company is better able to cope with short-term volatility.

In a bear market, with the decline in coin prices, mining equipment orders, mining farm capital expenditures, and debt have put tremendous pressure on the company's operations. In addition, intense competition among miners and rising energy prices have further exacerbated the survival crisis of mining companies. Even after selling 63% of the BTC produced in Q2, Marathon's CEO revealed in the Q2 conference call that they will continue to sell BTC to maintain the company's operations.

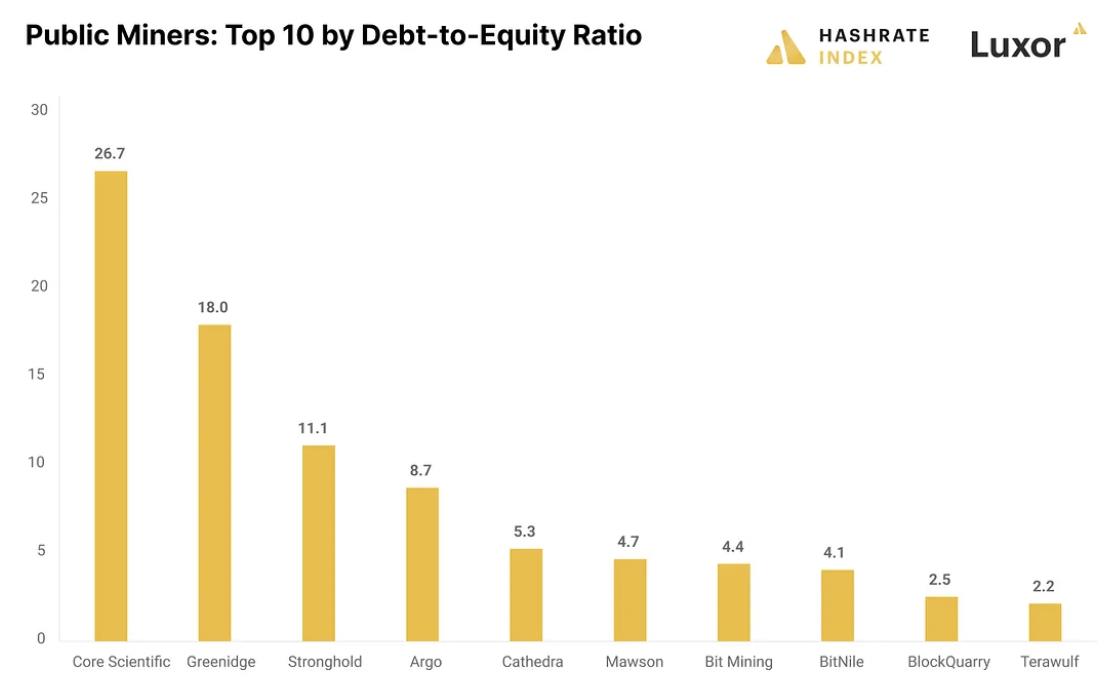

5. Current Situation of Miners in the Bear Market

Mining stocks face severe challenges in a bear market, and their strong correlation and high elasticity with BTC prices also make their prices more susceptible to downward pressure in a bear market. Due to the high-leverage operating model and the single source of income, many publicly traded mining companies also face the threat of bankruptcy. Many Bitcoin mining companies borrowed heavily during the bull market in 2021, resulting in very negative effects on their profitability during the subsequent bear market. In fact, Core Scientific, which had the highest borrowing amount and debt-to-asset ratio, sought bankruptcy protection and debt restructuring at the end of 2022. Throughout 2022, before bankruptcy, Core Scientific sold BTC to cope with its mining machine purchase costs, self-operated mining farm construction expenses, large-scale deployment of mining machine electricity costs, and loan interest, but ultimately declared bankruptcy due to its aggressive expansion plan in late 2022 (deploying over 320,000 mining machines by the end of 2022, with a daily electricity cost loss of $53,000).

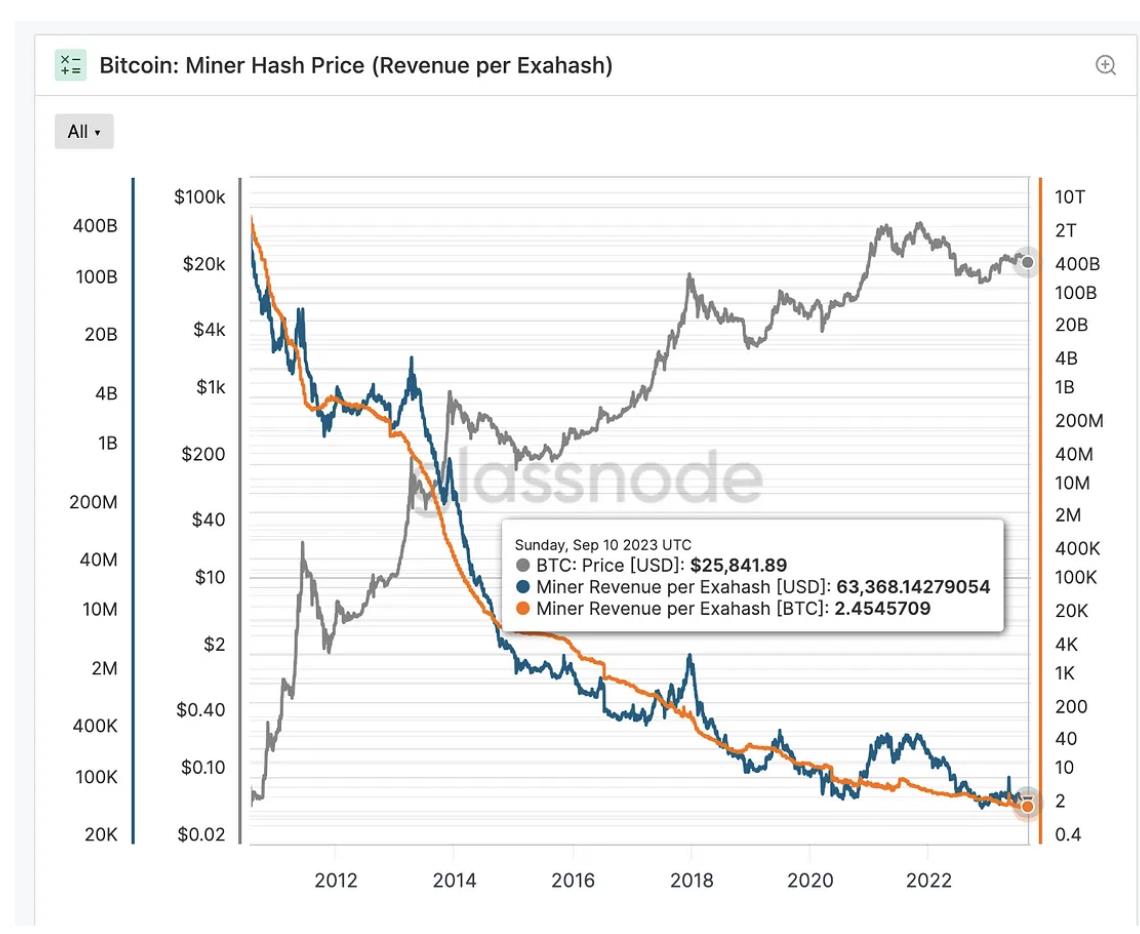

There is a significant divergence between Bitcoin prices and network difficulty. In the bull market, market rewards for miners' future hash power became an important narrative for miners to raise funds in the bull market. However, in the bear market, with the decline in Bitcoin prices, the growth in hash power has made the economic situation for miners very challenging, as miners must continue to purchase the mining equipment they previously ordered even as BTC prices fall significantly and hash power continues to grow. Miners have already paid for the capital expenditures of the mining machines, so from their perspective, as long as their marginal mining costs remain positive, continuing with the growth plan makes sense. This trend has further exacerbated the significant decline in hash prices since the beginning of this year.

With the sharp drop in Bitcoin prices, the valuations of most mining stocks have plummeted. Some mining companies are raising funds by selling BTC, issuing common stock, significantly diluting existing shareholders' equity, and raising debt capital at a high cost. In a cash-strapped situation, miners are also seeking alternative solutions, such as providing hosting services to generate higher income, selling equipment to generate more cash, and even considering mergers and acquisitions. Conservative mining companies that did not over-leverage during the bull market now have the opportunity to take an opportunistic approach, such as excellent cash flow management or the opportunity to acquire distressed competitors at a low price.

Given MARA's poor debt-to-equity ratio (increasing the likelihood of bankruptcy) and its reduced correlation with BTC's upward movement, the investment recommendation is a strong sell within 12 months, with a target price of around $3 based on a PB of 1 as the bearish target. At the current price of $8, it is overvalued by 166%. However, based on its high price elasticity, it may be possible to profit from short-term rebounds in the market, achieving better returns than buying BTC. There are two scenarios that could lead to a rise in stock prices: acquisitions and short-term rebounds in the BTC bear market.

II. Company Background and Business Introduction

Marathon Digital Holdings, Inc. and its subsidiaries (hereinafter referred to as the "Company" or "Marathon") is a digital asset technology company focused on the blockchain ecosystem and the generation or "mining" of digital assets. The company was incorporated in Nevada on February 23, 2010, under the name Verve Ventures, Inc. In October 2012, the company began operating under a knowledge licensing model and was renamed Marathon Patent Group, Inc. In 2017, the company purchased digital asset mining equipment and established data centers in Canada for the mining of digital assets. However, the company ceased operations in Canada in 2020 and consolidated all operations in the United States. Since then, the company has expanded its Bitcoin mining activities in the United States and internationally. The company was renamed Marathon Digital Holdings, Inc. on March 1, 2021. As of June 30, 2023, the company's primary business is focused on Bitcoin mining and related opportunities within the Bitcoin ecosystem. The strategy is to hold Bitcoin as a long-term investment after paying for production cash operating costs. Holding Bitcoin is a strategy for storing value, supported by a strong and open-source architecture, not tied to the monetary policies of any country, and can serve as a value store outside of government control. Marathon believes that, due to the limited supply of Bitcoin and its increasing adoption, it also provides additional opportunities for appreciation. The company may also explore opportunities to participate in other businesses related to Bitcoin mining when favorable market conditions and opportunities arise.

Development History

- February 23, 2010: The company was incorporated in Nevada under the name Verve Ventures, Inc.

- December 7, 2011: The company was renamed American Strategic Minerals Corporation and engaged in the exploration and potential development of uranium and vanadium mines.

2012.6, the company terminated its mining business and began investing in real estate in Southern California;

2012.10, the company was renamed Marathon Patent Group, Inc. and began operating under a knowledge licensing model;

2017.11.1, the company signed a merger agreement with Global Bit Ventures, Inc. ("GBV"), focusing on mining in the blockchain industry; this was an important milestone for Marathon Digital, as it transitioned from near bankruptcy to gradually becoming a leading mining company. Marathon acquired 1,300 Bitmain S9 mining machines and 1,000 GPU mining machines owned by GBV. After becoming familiar with the process, Marathon purchased an additional 1,400 S9 machines and leased a 2 MW facility for mining operations. Shortly thereafter, the crypto market entered a bear market, and Marathon terminated its partnership with GBV.

2019.9.30–2020.12.23, the company acquired mining assets in the blockchain industry through contract agreements;

As of March 1, 2021, the company was renamed Marathon Digital Holdings, Inc.

Key Events in 2022

Significant developments in the crypto market and their impact on the company: 2022 was a challenging year for the entire crypto industry due to macroeconomic conditions (including a weak stock market due to "flight to safety" sentiment in the face of relatively high inflation and rising interest rates in recent years), which negatively affected Bitcoin prices. Additionally, the macro challenges in 2022 were further impacted by a series of unexpected black swan events, including:

- The collapse of $LUNA-UST in the second quarter of 2022, leading to the bankruptcy of significant participants in the digital asset space, including Three Arrows Capital, Voyager, and Celsius;

- The collapse of FTX in the fourth quarter of 2022, resulting in additional credit-related bankruptcies and a significant decline in Bitcoin prices and mining equipment prices. These black swan events had an impact on Marathon's operational performance, including impairments of prepayments.

Impairment of Bitcoin mining equipment and prepayments to suppliers: In the fourth quarter of 2022, the fair value of Bitcoin mining equipment significantly declined. As a result, the company assessed the need to make impairment provisions for Bitcoin mining equipment (held as fixed assets) and prepayments to suppliers (held as current assets, representing deposits for future delivery of mining equipment). Marathon made impairment provisions for both Bitcoin mining equipment and prepayments to suppliers, totaling approximately $332,933,000.

Digital assets - impairments and decreases in book value: Marathon experienced impairments of $173,215,000, realized and unrealized losses on digital assets in investment funds of $85,017,000, and unrealized losses on digital assets held on the consolidated balance sheet of $14,460,000 during the year 2022.

Decrease in total profits: Due to the decline in Bitcoin prices and delays in expanding operations, Marathon's operating profitability decreased. The total profit for the year was a loss of $33,673,000, compared to a profit of $116,768,000 in the same period last year, a decrease of $150,441,000.

Direct impact of supplier bankruptcy filings: On September 22, 2022, Compute North filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code. As a result, the company recorded an impairment provision of $39,000,000 in the third quarter of 2022. In the fourth quarter of 2022, the company estimated that an additional $16,674,000 in deposits may have been impaired, and therefore recorded additional impairment provisions.

Digital assets used as collateral - decrease in fair value and additional collateral requirements: On November 9, 2022, due to concerns about industry financial instability resulting from the collapse of FTX and a drop in Bitcoin prices to new annual lows, the company was required to provide an additional 1,669 Bitcoins (valued at $16,213 each) as collateral for its outstanding loans under the Term Loan and Revolving Line of Credit (RLOC) facilities at Silvergate Bank, bringing the total collateral balance to 9,490 Bitcoins (or approximately $153,861,000 in fair value). As of November 9, 2022, the company held a total of 11,440 Bitcoins, of which 1,950 (approximately $31,615,000) were unrestricted. In November and December 2022, the company repaid $50,000,000 of the RLOC loan. These repayments allowed the company to reduce the Bitcoins used as collateral to approximately 4,416 Bitcoins (fair value of approximately $73,074,000) as of December 31, 2022.

Impact of bankruptcy and FTX collapse on Marathon's primary lenders: Before terminating the loan facilities on March 8, 2023, Silvergate Bank was the lender for Marathon's Term Loan and RLOC facilities, under which Marathon had the right to borrow up to $200,000,000, provided sufficient Bitcoins were used as collateral. On March 1, 2023, Silvergate Bank submitted disclosures to the SEC regarding its distressed financial condition, including doubts about its ability to continue as a going concern, and notified a delay in submitting its 10-K form due to a significant reduction in customer deposits and insufficient capital. This led to crypto business clients abandoning the bank, creating both a credit void and reputational risk for crypto clients. On March 8, 2023, Silvergate announced its intention to cease operations and voluntarily liquidate the bank. On February 6, 2023, Marathon provided the required 30-day notice to Silvergate Bank, outlining its intention to repay the outstanding balance of its Term Loan facility and its intent to terminate the Term Loan facility. Marathon and Silvergate Bank later agreed to terminate the RLOC facility. On March 8, 2023, the company repaid the Term Loan and terminated the RLOC facility with Silvergate Bank.

Closure of Signature Bank: On March 12, 2023, Signature Bank was closed by its state-chartered regulatory agency, the New York State Department of Financial Services. On the same day, the FDIC was appointed as the receiver and transferred all deposits and almost all assets of Signature Bank to Signature Bridge Bank, a full-service bank operated by the FDIC. The company automatically became a client of Signature Bridge Bank in this action. As of March 12, 2023, the company held approximately $142,000,000 in cash deposits at Signature Bridge Bank. Normal banking operations resumed on March 13, 2023.

Key Events in 2023

On January 27, 2023, the company signed a shareholder agreement with FS Innovation, LLC ("FSI") to establish the Abu Dhabi Global Market Company (referred to as "ADGM Entity") for the purpose of jointly (a) establishing and operating one or more digital asset mining facilities; and (b) mining digital assets (collectively referred to as the "Business"). The initial project of the ADGM Entity will include two digital asset mining sites in Abu Dhabi with a total capacity of 250 megawatts. The initial ownership of the ADGM Entity will be 80% for FSI and 20% for Marathon, and capital contributions will be made in cash and kind in 2023, totaling approximately $40.6 million. FSI will appoint four directors to the board of the ADGM Entity, while the company will appoint one director. Unless otherwise provided by applicable law, the digital assets mined by the ADGM Entity will be distributed monthly to the company and FSI in proportion to their ownership interests in the ADGM Entity. The agreement includes provisions on financial and tax matters. The agreement will be terminated early in the event of the parties' written unanimous consent, liquidation of the ADGM Entity, or a shareholder owning all the outstanding equity interests of the ADGM Entity. The agreement also includes market terms regarding the transfer of shares, preemptive rights, and certain ancillary and incidental rights in the event of the sale of the ADGM Entity. Additionally, the agreement includes a five-year restrictive covenant, which includes provisions prohibiting Marathon from competing with the Business or FSI or certain related parties in the UAE, and prohibiting FSI from competing with Marathon's business in the United States.

On September 20, 2023, Marathon completed a transaction agreement with certain holders through private negotiations to settle the previously announced 1.00% convertible senior notes due in 2026. On average, these transactions resulted in a discount of approximately 21% to face value, saving the company approximately $101 million in cash before transaction costs. Marathon exchanged a total of $417 million in principal amount of notes held by the holders for a total of 31.7 million newly issued shares of Marathon common stock. As a result, the company reduced its long-term convertible debt by approximately 56% and saved approximately $101 million in cash before transaction costs. The remaining principal amount of the notes is $331 million.

Financial Analysis

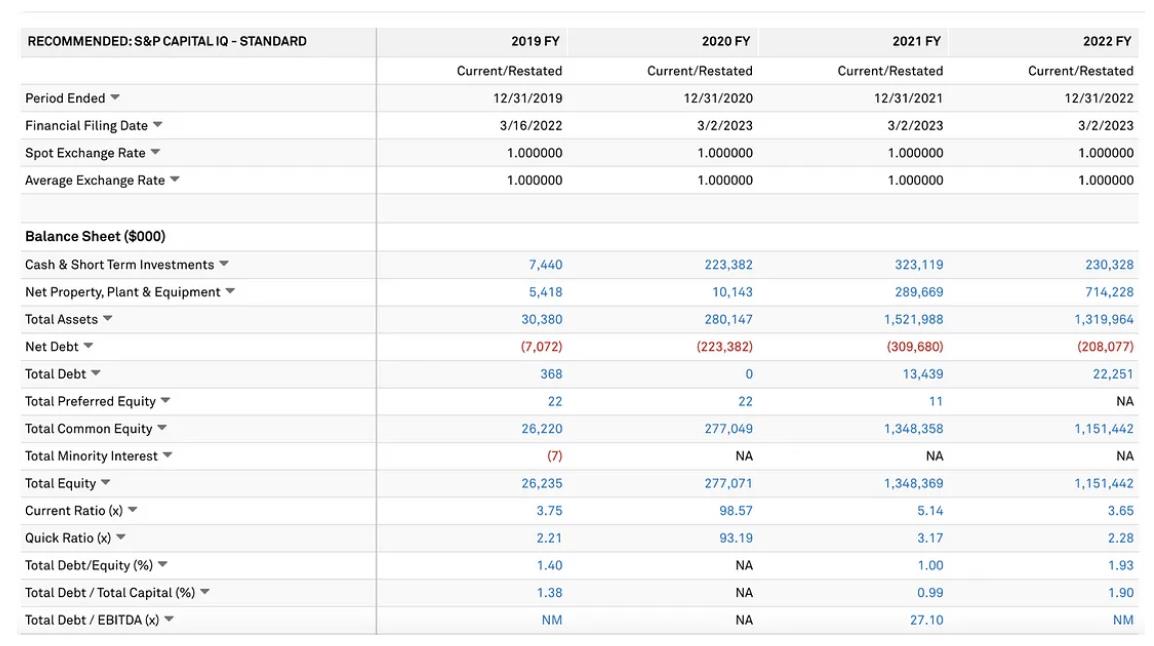

- Revenue Growth Based on the appreciation of BTC and the improved mining efficiency, Marathon experienced negative revenue growth after the crypto market entered a bear market in 2021.

In 2022, Marathon's operating revenue was $117,753,000, compared to $159,163,000 in 2021, representing a decrease of $41,410,000. The main reasons for the decrease were a reduction in revenue of $77,286,000 due to the decline in Bitcoin prices in 2022, partially offset by an increase in revenue of $44,570,000 due to increased annual production. Additionally, the company experienced a decrease in revenue of $8,694,000 in 2022 due to the cessation of operations, including third-party mining pools. Despite an overall increase in annual production, the company experienced significant production stagnation in the second and third quarters due to the aforementioned delays in exiting the Hardin and King Mountain facilities. Production in the third quarter decreased by 50% compared to the same period last year. The best production quarters for Marathon in 2022 were the first and fourth quarters.

As of December 31, 2022, the company held approximately 12,232 Bitcoins on its balance sheet, with a book value of $190,717,000. Approximately 4,416 Bitcoins (with a book value of $68,875,000) were used as collateral for loans and classified as restricted digital assets. The remaining 7,816 Bitcoins, with a book value of $121,842,000, were unrestricted holdings classified as digital assets.

In the first quarter of 2023, Marathon's BTC balance decreased for the first time by 766 coins to address the deteriorating balance sheet.

In the second quarter of 2023, due to a 314% increase in Bitcoin production, which significantly offset the 14% average decrease in Bitcoin prices compared to the same period last year, the revenue was $81.8 million, far exceeding the $24.9 million in the second quarter of 2022. However, the company's operational situation remains challenging. In the second quarter, Marathon sold 63% (1,843 BTC) of the BTC produced, resulting in a loss of $21.3 million for the three months ending June 30, 2023, or $0.13 per share, compared to a net loss of $212.6 million, or $1.94 per share, in the same period last year.

Bitcoin sales revenue was $23.4 million, as the company sold 63% of the BTC produced in the quarter to cover operating costs. Additionally, the impairment of digital assets decreased by $8.4 million due to the general increase in Bitcoin prices during the current year. Furthermore, the absence of a $79 million loss in digital asset investment funds and a $54 million gain from equipment sales, compared to the same period last year, also contributed to the comparison for the year.

Adjusted EBITDA was $25.6 million, compared to a loss of $167.1 million in the same period last year. In addition to the aforementioned revenue and lower impairments, the total gross profit, excluding depreciation and amortization, increased to $26.5 million, compared to $8.2 million in the same period last year.

Highlights of Production in the Second Quarter of 2023

Bitcoin production: Q2-23 2,926 coins, Q2-22 707 coins, an increase of 314%; Q2-23 2,926 coins, Q1-23 2,195 coins, an increase of 33%.

Average daily Bitcoin production: Q2-23 32.2 coins, Q2-22 7.8 coins, an increase of 314%; Q2-23 32.2 coins, Q1-23 24.4 coins, an increase of 32%.

Operating/installed hash rate (EH/s)1: Q2-23 17.7 EH/s, Q2-22 0.7 EH/s, an increase of 2,429%; Q2-23 17.7 EH/s, Q1-23 11.5 EH/s, an increase of 54%.

Average operating hash rate (EH/s)1: Q2-23 12.1 EH/s, not applicable in the same period last year; Q2-23 12.1 EH/s, Q1-23 6.9 EH/s, an increase of 75%.

Installed hash rate (EH/s)1: Q2-23 21.8 EH/s, not applicable in the same period last year; Q2-23 21.8 EH/s, Q1-23 15.4 EH/s, an increase of 42%.

Although the production of mining equipment significantly improved mining efficiency compared to the same period last year, the low BTC prices and aggressive expansion led to high operating expenses for Marathon, which remains on the brink of danger.

- Profit and Cost Breakdown Marathon's total profit for the 2022 fiscal year was -$33.67 million, compared to $117 million in the same period in 2021, a decrease of $150.44 million.

Marathon's operating revenue costs, including energy, hosting, and other costs, totaled $72.71 million in the 2022 fiscal year, compared to $27.49 million in the same period in 2021, an increase of $45.23 million. The increase was mainly due to higher production costs, with an increase of $30 million in production costs per Bitcoin mined, an accelerated cost of $18.21 million due to the early exit from Hardin, and the impact of higher Bitcoin production on costs, which increased by $5.56 million. Partly offsetting these increased costs was a decrease of $8.69 million in revenue costs from the cessation of third-party mining pools in 2022. Revenue costs - depreciation and amortization in 2022 were $78.71 million, compared to $14.90 million in the same period in 2021, an increase of $63.81 million. This was mainly due to accelerated depreciation related to Marathon's exit from Hardin and MT facilities, which increased by $36.03 million, and an increase of $27.77 million in depreciation costs related to more mining equipment in operation.

I hope this helps!

In 2022, Marathon recorded a net loss of $687 million, compared to a net loss of $37.09 million in the same period in 2021. The increase in the loss was $649 million, primarily due to a total decrease in the book value of Marathon's digital assets of $318 million, and impairments totaling $333 million for Bitcoin mining equipment and prepayments to suppliers.

The adjusted EBITDA was -$534 million, compared to $162 million in the same period in 2021. Depreciation and amortization were $86.64 million, legal reserves were $26.13 million, and general and administrative expenses, excluding non-cash stock compensation costs, increased by $18.57 million. Partially offsetting these unfavorable figures were gains of $83.88 million from the sale of mining equipment and an increase in non-operating income of $1.57 million.

In the second quarter of 2023, Marathon recorded a net loss of $19.13 million, compared to a net loss of $21.26 million in the same period last year. The approximately 91% improvement in net loss was mainly due to favorable differences from gains on the sale of digital assets and impairments, as well as favorable differences related to impairments and losses on digital assets within investment funds, partially offsetting the lower overall profit margin.

In the second quarter of 2023, Marathon's adjusted EBITDA was $25.63 million, compared to -$167 million in the same period last year. The increase in adjusted EBITDA was mainly due to the positive impact of gains on the sale of digital assets ($23.35 million) and a reduction in impairments on digital assets ($12.32 million). The adjusted EBITDA also benefited from the absence of several expenses recorded in the same period last year, including losses on digital assets within investment funds and gains on the sale of digital assets, partially offsetting the lower overall profit margin (excluding depreciation and amortization) and higher non-equity-based management and administrative expenses.

Reanalysis of the Impact of Marathon's Mining Machine Deployment on Costs and Profits. Currently, the mining machines are hosted by third parties, and Marathon pays fees to them.

McCamey, TX - Approximately 63,000 S19j Pros are currently deployed and operated at this location, with an additional 4,000 S19j Pros planned for delivery and deployment in 2023. Marathon's contract for this facility will expire in August 2027.

Garden City, TX - Approximately 28,000 S19 XPs have been installed at this location, and the facility is currently awaiting final regulatory approval for electrification. Marathon's current expansion plans include deploying 19 megawatts of immersion equipment in 2023, provided by new capacity and replacing air-cooled units with immersion. The contract for this facility will expire in July 2027.

Ellendale, ND - It is expected that approximately 57,000 S19 XPs will be deployed at this location in the first half of 2023, with electrification expected to begin at the end of the first quarter of 2023. The contract for this location will expire in July 2027.

Jamestown, ND - Approximately 5,600 S19 XPs are currently deployed and operated at this location, with plans to deploy an additional 10,400 air-cooled units in the first quarter of 2023. In addition to the installation of these air-cooled units, the company plans to deploy 768 immersion units at this location in the second quarter of 2023. The contract for immersion deployment will expire in August 2026, and the contract for air-cooled units will expire in December 2027.

Granbury, TX - Approximately 12,500 S19j Pros and 4,400 XPs are currently deployed and electrified at this facility. There are currently no plans to expand this facility.

Coshocton, OH - Approximately 2,800 S19 Pros are currently deployed and operated at this facility. Marathon's contract for this facility will expire in June 2023, and the company does not intend to extend the termination date of the contract.

Plano, TX - Approximately 345 S19 Pros are currently deployed and operated at this facility. There are currently no plans to expand this facility, and the contract for this facility will expire in June 2027.

Kearney, NE - Approximately 2,300 S19 J Pros are currently deployed and operated at this location. The company plans to deploy an additional 1,300 MicroBT devices at this location in 2023.

South Sioux City, SD - Approximately 660 S19 Pros are currently deployed at this location. The contract for this facility expired in early 2023, and the company has exited the facility.

On January 27, 2023, Marathon and FSI signed an agreement to establish an Abu Dhabi Global Market Company, with the purpose of jointly (a) establishing and operating one or more digital asset mining facilities; and (b) mining digital assets. The initial project of the ADGM Entity will include two digital asset mining stations in Abu Dhabi with a total capacity of 250 megawatts of immersion equipment, with an initial ownership ratio of 80% belonging to FSI and 20% belonging to Marathon. The facility is expected to be operational in the second half of 2023.

In the first quarter of 2023, most of the production by Marathon was S19 XPs. Based on the profitability of each mining machine, the current profit margin for S19 XPs is minimal, at $0.08 per day. Therefore, an increase in hash rate may not fundamentally improve Marathon's profitability this year.

As for the profitability of miners, Profitability = Bitcoin rewards x BTC price - electricity cost - hash rate price. Therefore, Bitcoin market prices, electricity costs, and hash rate prices are crucial to Marathon's profitability.

- Bitcoin Rewards

Bitcoin rewards are greatly affected by the halving event. Bitcoin halving is a phenomenon that occurs in the Bitcoin network approximately every four years. It is an important part of the Bitcoin protocol, used to control the overall supply and reduce the risk of inflation of the digital asset using the proof-of-work consensus algorithm. At a scheduled block height, mining rewards are halved, hence the term "halving." For Bitcoin, the reward was initially set at 50 Bitcoins per block. Since its inception, the Bitcoin blockchain has undergone three halving events as follows: (1) on November 28, 2012, at block height 210,000; (2) on July 9, 2016, at block height 420,000; (3) on May 11, 2020, at block height 630,000, when the reward decreased to the current 6.25 Bitcoins per block. The next halving event for the Bitcoin blockchain is expected to occur around March 2024, near block height 840,000. This process will repeat until the total amount of Bitcoin rewards issued reaches 21 million, and the theoretical supply of new Bitcoins is exhausted, expected to occur around 2140. The 2024 Bitcoin halving will reduce mining rewards, posing a threat to the profitability of miners with minimal profits. Significant improvement in profitability can only be seen if the BTC price significantly increases.

- Electricity Costs

In terms of electricity costs, there is a significant difference in mining costs between countries, with European countries facing the highest costs due to rising electricity prices. The impact of rising energy prices on U.S. mining companies is relatively smaller compared to Europe, but it also exacerbates the pressure on electricity costs for U.S. mining companies. The electricity price in Texas is $0.12 per kWh, which is 34% lower than the U.S. average of $0.18 per kWh. Even so, under the current electricity prices and coin prices, most models of mining machines are struggling to break even (this is without considering subsidies, and some mining farms may still be profitable under the advantage of subsidies).

- Network Hash Rate and Difficulty

Generally, the opportunity for Bitcoin mining equipment to solve blocks on the Bitcoin blockchain and receive Bitcoin rewards is a function of the hash rate of the mining equipment relative to the global network hash rate (i.e., the total computational power used to support the Bitcoin blockchain at a specific time). As demand for Bitcoin increases, the global network hash rate rapidly increases. Additionally, with the deployment of more and more powerful mining equipment, the network difficulty of Bitcoin has also increased. Network difficulty is a measure of the difficulty of solving a block on the Bitcoin blockchain, and it is adjusted every 2016 blocks (approximately every two weeks) to ensure that the average time between blocks remains around ten minutes. High difficulty means that more computational power is required to solve blocks and receive new Bitcoin rewards, which in turn makes the Bitcoin network more secure and limits the possibility of a single miner or mining pool controlling the network. Therefore, as new and existing miners deploy additional hash rate, the global network hash rate will continue to increase, which means that if miners fail to deploy additional hash rate at a pace synchronized with the industry, their share in the global network hash rate (and thus the opportunity to earn Bitcoin rewards) will decrease. It can be seen that due to intense competition among miners, at the beginning of 2022, the income per TH was $0.25/TH, which has now decreased to approximately $0.06/TH.

As the miner with the largest share of network hash rate, Marathon has been continuously increasing its EH/s to maintain mining competitiveness. Its operational hash rate has increased from 13.2 EH/s in 22Q3 to 17.7 EH/s in 23Q2, with a target of reaching 23.1 EH/s this year.

Combining Bitcoin rewards, BTC price, electricity costs, and hash rate prices, the halving event, if not accompanied by an increase in BTC price, will challenge the operations of miners with higher hash rates and more aggressive expansion, as reduced electricity costs and rewards will not be a good thing for them.

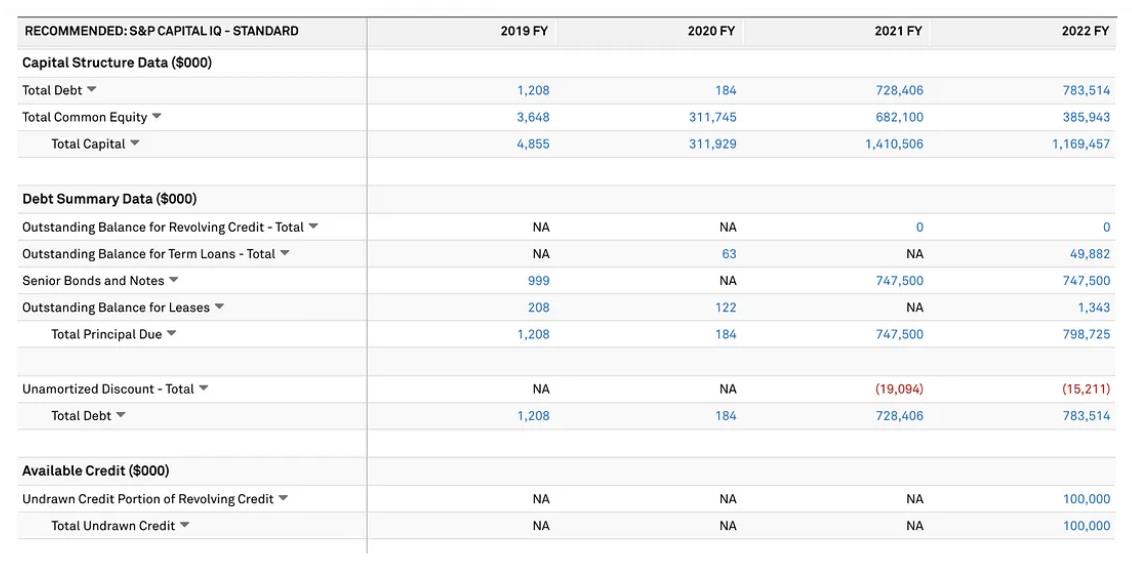

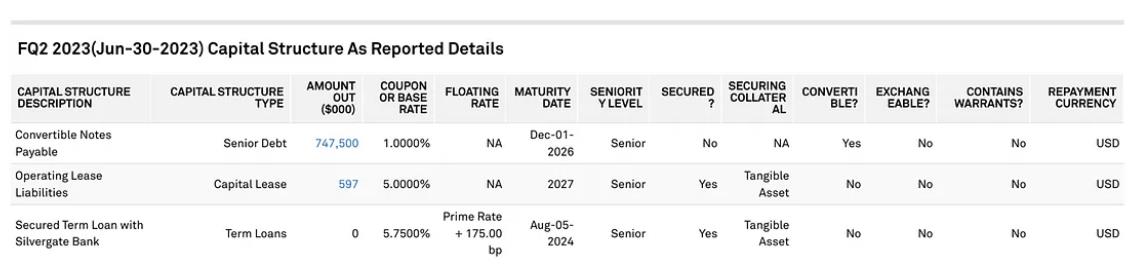

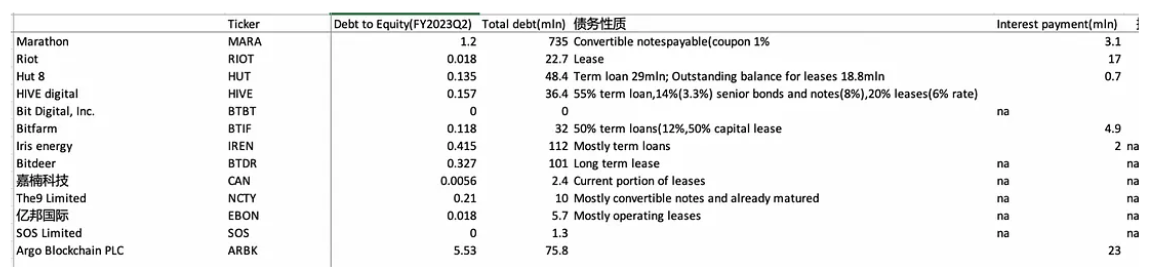

- Capital Structure, Financing Situation, and Borrowing Costs (as of FY2022 data)

Here, we focus on four dimensions: capital structure (debt-to-equity ratio), financing situation, and capital expenditures (Capex) situation.

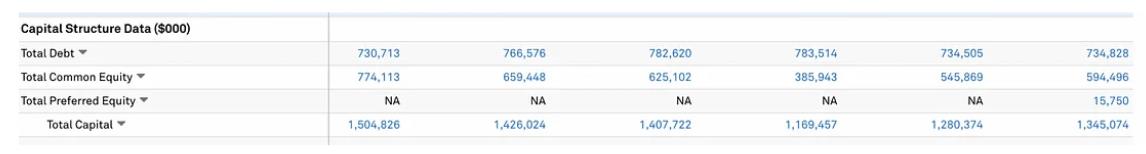

Marathon's debt-to-equity ratio: total debt/common equity = $783 million / $386 million = 2.03 (FY2022); total debt/common equity = $735 million / $594 million = 1.23 (2023Q2)

Even after deducting the early redemption value of $414 million for convertible bonds this month, Marathon's latest debt-to-equity ratio is 0.54.

Financing situation: Total debt recorded at the end of 2022 was $783 million, with the majority being $747 million in convertible bonds issued in 2021, and $414 million repaid in September 2023.

Cash flow generated from financing activities in 2023Q2 was $410,655,000, mainly from the issuance of common stock under the company's market price trading plan, resulting in $361,486,000, and borrowings issued under long-term loan agreements, resulting in $49,250,000.

Marathon's maximum borrowable amount as of December 31, 2022, was $70,000,000. Total borrowings and repayments under the revolving credit agreement for the year ended December 31, 2022, were $120,000,000, and as of December 31, 2022, there were no outstanding borrowings under the revolving credit agreement.

Cash flow generated from financing activities was $1,037,333,000, with funds primarily coming from proceeds from the issuance of convertible bonds totaling $728,406,000 and the issuance of common stock totaling $312,196,000. As of December 31, 2021, total borrowings and repayments under the company's 2021 revolving credit agreement were $77,500,000, and as of December 31, 2021, there were no outstanding borrowings under the revolving credit agreement.

Interest expense: The interest expense increased by $13,410,000 due to the issuance of convertible bonds in November 2021, including $6,633,000 related to higher interest, and $3,664,000 in debt issuance costs amortization and other interest expenses primarily related to the company's term loans and revolving line of credit ("RLOC") facilities. Based on current cash and cash equivalents, Marathon has no pressure to repay interest expenses.

Marathon's capital expenditures experienced significant changes from 2018 to 2022, increasing from $5 million, $5 thousand, $83 million, $708 million to $525 million. In particular, capital expenditures increased significantly from 2021, corresponding to the large-scale financing conducted by the company that year. Moderate capital expenditures can improve production efficiency, drive innovation, and enhance market competitiveness for the company. However, in periods of market downturn, the increase in fixed expenses for the company, especially accompanied by a significant decrease in revenue, often leads to significant pressure on cash flow.

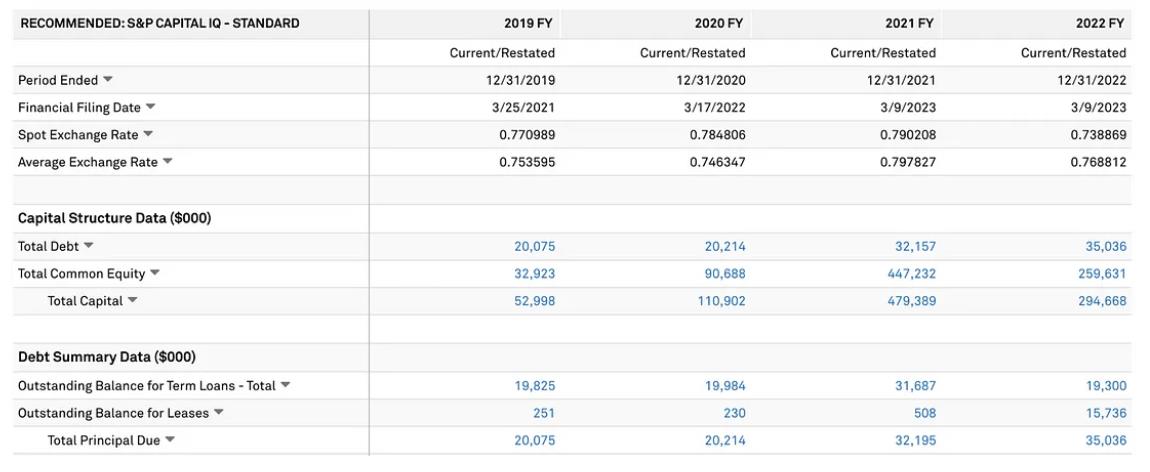

Competitor Situation (see valuation section for details, here we mainly look at debt-to-equity ratio and Capex)

Riot's debt-to-equity ratio = $22 million / $1240 million = 0.017 (2023Q2), far lower than Marathon's 1.23 (Marathon's debt-to-equity ratio is 0.54 after deducting the already repaid convertible bonds, which is not reflected in the latest financial report).

For the fiscal years 2018–2022, Riot's Capex was $20 million, $6.4 million, $41 million, $421 million, and $343 million, respectively. Riot's Capex for 23Q2 was $56 million.

Hut 8's debt-to-equity ratio = $35 million / $259 million = 0.135 (FY2022), also much lower than Marathon's 1.23 (Marathon's debt-to-equity ratio is 0.54 after deducting the already repaid debt, which is not reflected in the latest financial report).

Jiangzhi Technology Capex for the fiscal years 2018–2022

BTBT Capex for the fiscal years 2018–2022

It can be seen that the level of the debt-to-equity ratio has a decisive impact on the survival of companies in a poor income environment. Historically high Capex often means that the debt-to-equity ratio will also be high without actively repaying debt. If Capex spending has not contributed positively to the balance sheet's cash flow, it is considered a negative signal in such an external environment. Core Scientific, as the top-ranked miner in terms of the debt-to-equity ratio, announced bankruptcy at the end of 2022 and is currently undergoing bankruptcy reorganization.

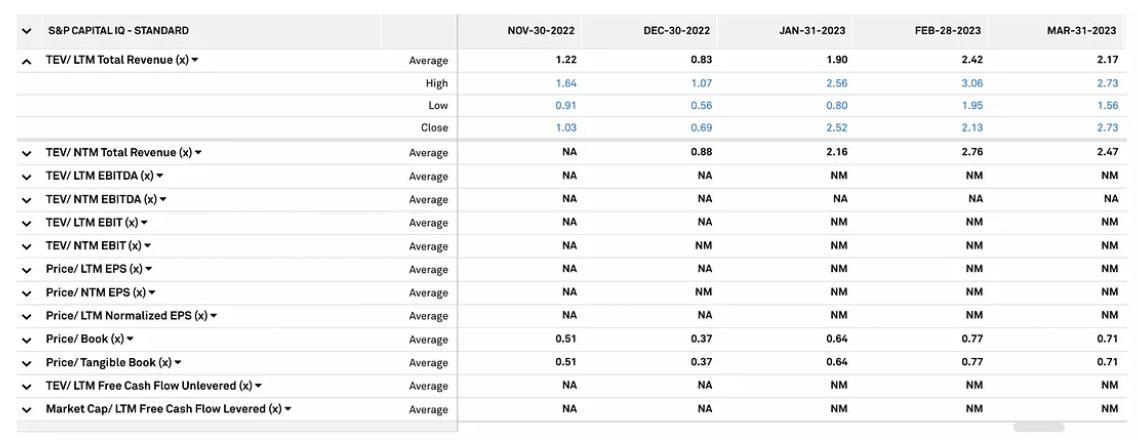

IV. Valuation

Considering the financial debt situation of each company, the best-performing in terms of the debt-to-equity ratio are Jiangzhi Technology, Yibang International, and Riot, with debt-to-equity ratios of 0.0056, 0.018, and 0.018, respectively; Marathon and Argo have debt greater than equity, with debt-to-equity ratios of 1.2 and 5.5.

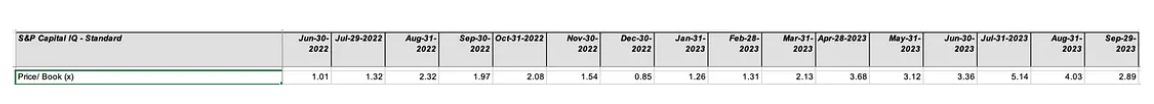

In terms of P/B, the most undervalued are SOS Limited (0.08), Yibang International (0.14), Jiangzhi Technology (0.73), Iris Energy (0.68), Bitdeer (0.98), and HUT8 (1.22). However, a P/B ratio greater than 0.5 can be considered as indicating stable operations, without the threat of bankruptcy.

A P/B ratio below 1 reveals the market's negative expectations for the company's future prospects (such as bankruptcy or a significant discount on equity value). Investors may have a negative view of the company's future performance, believing that the company's net assets (i.e., book value) may be impaired in the future. Therefore, they purchase the company's stock at a price below book value. However, it also means that if the company's performance exceeds expectations, the rebound will be much greater than similar benchmarks.

Looking at mining targets alone, considering the debt-to-equity ratio and P/B value, the order from highest to lowest debt-to-equity ratio is Mara (1.2) > Hut 8 (0.135) > Riot (0.018) > BTBT (0); and the order from highest to lowest P/B value is BTBT (2.24) > Mara (2.21) > Riot (1.33) > Hut 8 (1.22). Hut 8 performs the best, with a healthy debt level and the lowest P/B value. Next is Riot.

Marathon P/B comparison

Based on Marathon's historical P/B data, the current 2.21 is still overvalued, with significant room for decline (but it has already decreased by half compared to 5.15 at the end of July).

Hut 8 P/B comparison

Riot P/B 1.5

BTBT P/B 2.24

ARGO P/B 10.95, overvalued

Valuation Recommendation

Based on the high P/B, unprofitable hash rate growth, and high debt-to-equity ratio, the investment recommendation for Marathon is a strong sell within 12 months. During this period, it is advisable to go long on Mara only if there is a clear rebound in BTC to gain greater leverage.

Given Mara's poor debt-to-capital ratio (increasing the likelihood of bankruptcy) and the reduced correlation with BTC's upward movement, if Mara's recent debt restructuring allows it to sustain its balance sheet health into the BTC bull market, in the current market conditions (continuing downward), considering Marathon's debt situation (excessively high debt-to-equity ratio), valuation situation (significant room for P/B to decline, MC/hashrate higher than peers), the investment recommendation is a strong sell within 12 months, with a bearish target of a P/B of 1, with a target stock price of around $3. At the current price of $8, it is overvalued by 166%. However, based on its highest price elasticity, it can be traded for short-term gains during a rebound, potentially yielding better returns than buying BTC.

V. Risks

The Altman Z-Score is used to assess a company's financial health and bankruptcy risk, mainly to evaluate the likelihood of a company going bankrupt within the next two years. The Z-Score considers various financial ratios and provides a single numerical score, divided into three different categories, each reflecting a different degree of bankruptcy risk.

Based on Marathon's Altman Z-Score, which has dropped to -0.47, it is already in the "likely bankruptcy" zone (Z-Score 1.8 — likely bankruptcy; Z-Score 1.81 to 3 — indeterminate zone; Z-Score > 3 — healthy). The company's Z-Score has been below 3 for many times in the past four years and has recently dropped to -0.47.

VI. Conclusion

Mining stocks have the greatest price elasticity among publicly traded stocks related to cryptocurrencies, which means that their prices will continue to decline significantly in the upcoming bear market, but temporary rebounds will also be more significant in these targets.

The bear market and low coin prices have led to impairment of digital assets on the balance sheet, reduced income, and an inability to reduce operating expenses, which is a common situation for miners in a bear market. The aggressive expansion plans in 2021 have led to a significant increase in Capex and debt for mining companies, resulting in many miners being unable to cover their operating expenses and having to sell BTC. The conclusion drawn from monitoring the financial situation of mining companies like Marathon is that the market is pricing the current unprofitable situation and investing at a low P/B, but Marathon's financial situation is worse than Riot's, and its P/B is still relatively high, with room for further decline.

It is undeniable that the growth in hashrate has indeed brought significant improvements in mining efficiency for Marathon. If the financial situation can be maintained, companies like Marathon will reap the rewards of their mining layout during the bull market. Additionally, given the most significant decline in stock prices compared to similar benchmarks during the bear market, a reversal of the difficult situation can be achieved, resulting in double gains. However, based on its Altman Z-Score being in the likely bankruptcy zone, although debt-to-equity conversion has reduced leverage to some extent, high Capex and significant unprofitability of previously deployed mining machines indicate a need to short Mara in the bear market, but it can also be traded for temporary rebounds.

The question of whether Mara is the strongest short trend target, Argo seems to be more overvalued than Mara. However, compared to Riot and Hut 8, Mara is indeed the strongest short trend target. Compared to BTBT, BTBT has less debt risk but a higher P/B value.

For mining companies, 2024 will be a more difficult year, as maintaining prices and halving production will lead to deeper losses for mining companies (low coin prices leading to impairment of digital assets on the balance sheet, reduced income, and an inability to reduce operating expenses), which is a common situation for miners in a bear market. Generally, the liquidation of miners is an important signal at the beginning of a bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。